|

市場調查報告書

商品編碼

1444577

視訊點播 - 市場佔有率分析、產業趨勢與統計、成長預測(2024 - 2029 年)Video-on-Demand - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

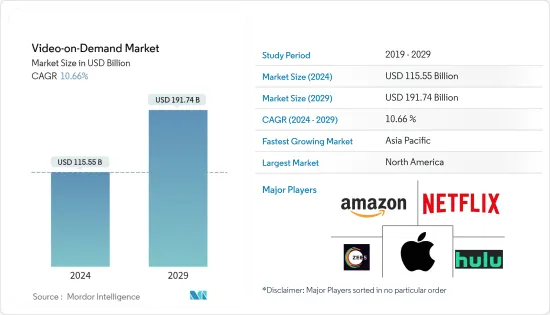

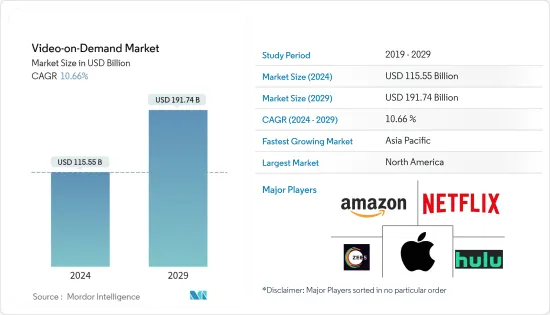

視訊點播市場規模預計到 2024 年為 1155.5 億美元,預計到 2029 年將達到 1917.4 億美元,在預測期內(2024-2029 年)CAGR為 10.66%。

主要亮點

- 不間斷的連接、作為內容消費主要來源的行動裝置以及智慧型手機的先進功能等基本因素可能會推動視訊點播市場的發展。

- 由於 Netflix、Amazon Prime 等 OTT 平台的使用不斷增加,隨選視訊服務在過去幾年中越來越受歡迎。這些企業的存在以及雲端平台的廣泛使用為市場的成長做出了重大貢獻。

- 由於社群媒體平台的日益普及,對數位媒體設備的需求激增,可以透過更快的網路遠端存取媒體內容,再加上行動電話的迅速普及,推動了視訊點播市場的成長。最近的技術發展和網際網路在全球多個國家的日益普及使視訊點播服務提供商能夠提供高品質的內容。同時,疫情期間這些平台上新節目和電影的推出也促進了 SVoD 服務的成長。

- 數位影片領域的發展,尤其是優質影片廣告,隨著串流服務上的廣告觀看次數而持續成長。由於觀眾接受廣告支援的數位影片內容,廣告觀看次數增加了 45%。最近的一項研究發現,美國觀眾透過有廣告和無廣告的訂閱使用七種以上的視訊串流服務,這推動了視訊點播服務的發展。業界已將關注點從內容轉向用戶體驗。然而,在印度等國家,特定的客製化區域內容將在推動視訊需求市場方面發揮至關重要的作用。

- 市場參與者對視訊內容盜版和保護的日益擔憂預計將阻礙視訊點播市場的成長,並可能導致大幅收入損失。因此,觀看內容的觀眾數量可能會下降。例如,根據數位公民聯盟與 NAGRA 的聯合研究,美國約有 900 萬用戶正在使用盜版訂閱 IPTV 服務。

- COVID-19 大流行導致世界各地實施封鎖。由於疫情期間旅行受到限制,封鎖對隨選視訊業務產生了有利影響。世界各地的消費者擴大使用串流媒體娛樂。根據Rapid TV News預測,COVID-19大流行危機將使全球SVoD用戶數量增加5%,達到9.49億。疫情過後,先進網路技術的日益普及將支持產業擴張。

視訊點播市場趨勢

行動網際網路用戶激增推動市場發展

- 串流平台上的追劇盛行增強了顧客的觀看體驗。行動裝置在豐富體驗方面發揮了關鍵作用。它們提供了急需的觀看體驗和某種便利。此外,跨行動裝置與高速網路的各種內容的持續整合使用戶能夠隨時隨地觀看內容。

- 網路存取的增加和行動裝置的廣泛使用等因素可協助客戶無需等待即可了解數位世界的最新動態。因此,隨著用戶採用智慧型手機、平板電腦和個人電腦等行動設備,即時滿足感逐漸成為消費世界的一股強大力量。

- 支援數據的裝置和遊戲和視訊串流等高頻寬應用程式是行動資料流量呈指數成長的主要驅動力。根據 GSMA 2022 年報告,全球超過 55% 的人使用行動網路。 Around 4.3 billion people were using mobile internet by the end of 2021, an increase of about 300 million since the end of 2020. People in low- and middle-income nations (LMICs) have largely been responsible for the growth in the use of mobile網際網路.結果,中低收入國家的一半人口首次使用行動網路。

- 此外,Erricson 預計,到 2025 年,5G 用戶數量將達到 26 億,覆蓋全球 65% 的人口,產生全球行動資料總流量的 45%。世界廣告研究中心 (WARC) 發布的另一份報告顯示,行動貿易機構GSMA 的資料表明,到 2025 年,預計將有超過 13 億人透過智慧型手機和 PC 存取網路。

- 行動網際網路用戶的成長也歸因於內容和相關服務的消費,營運商擴大採用 5G 網路,這需要 4G LTE 資源。印度和中國等國家的行動網際網路月使用率最高。服務提供者提供的有吸引力的資料計劃以及千禧世代不斷變化的視訊觀看習慣推動了每月用戶的成長。

- 因此,智慧型手機訂閱數量的不斷成長以及每次訂閱對更多資料的需求(進而促使影片內容觀看量的增加)都是網路流量成長的促進因素。

北美將佔據最大市場佔有率

- 該地區包括美國和加拿大。美國是世界上最大的經濟體,一直是北美地區視訊點播的重要市場。靈活性、舒適性和內容個人化,以及多樣化內容的可用性和內容量,在很大程度上推動了 VoD 服務的採用。

- 據 nScreenMedia 稱,在過去 9 年裡,該國的視訊串流市場已發展成為價值 160 億美元的產業。交易和租賃視訊市場對這種成長產生了重大影響。

- 隨著智慧型手機傳輸速度的大幅提升,中國正在經歷從 4G 到 5G 的早期過渡。隨著 5G 速度的提高,更高解析度的影片預計將使消費者的體驗更加難忘。這種體驗促使消費者大力採用數位內容。

- 在 COVID-19 大流行期間,大部分人都待在家裡以阻止病毒的傳播。因此,許多內容製作商正在選擇視訊串流平台來應對影院關閉的情況。

- 例如,美國軍隊網路 (AFN) 於 2022 年 11 月推出了新的串流媒體服務 AFN Now。AFN Now 應用程式允許駐紮在國外的軍人、家庭和退休人員隨時隨地觀看收視率最高的 AFN 電視節目他們想要使用他們使用的常規設備。國防媒體活動 (DMA) 邀請授權觀眾立即下載新的隨選視訊和直播應用程式。

- 由於各種因素,包括加拿大行動趨勢的增強、網際網路的日益普及、線上串流媒體服務的興起以及內容製作商和串流媒體合作夥伴之間前所未有的聯盟,加拿大對視訊點播服務的需求發現了令人興奮的成長機會。

視訊點播行業概覽

VoD 市場由多家全球和地區參與者組成,它們在競爭相當激烈的市場空間中爭奪注意力。然而,Netflix、亞馬遜、迪士尼+和蘋果等公司在研究的市場中佔據主導地位。市場主要參與者正在採取各種策略,例如製作原創內容,以利用其競爭優勢。預計公司集中度在預測期內將錄得更高成長。在封鎖協議後出現巨大成長之後,一些參與者將市場視為鞏固其服務產品的有利可圖的機會。

2022 年 7 月,Netflix 宣布與微軟合作開發廣告工具和銷售,將廣告帶到該平台。它將推出一項新的基於廣告的計劃,名為“基本標準高級計劃”。新計劃旨在從人們有時需要付費訂閱的各個地區和國家帶來新的訂閱。

2022 年 5 月,Amazon Prime Video 宣布與 Sajid Nadiadwala 旗下的 Nadiadwala Grandson Entertainment (NGE) 達成多部電影授權協議。作為協議的一部分,串流媒體服務將在 NGE 即將上映的電影上映後不久託管這些電影。此外,這些電影在院線上映後,所有 Prime 會員都可以透過 Amazon Prime Video 觀看。此外,所有亞馬遜客戶(Prime 或其他)都可以在 Amazon Prime Video 上的「搶先體驗租賃」視窗中租借這些影片。

額外的好處:

- Excel 格式的市場估算 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章:簡介

- 研究假設和市場定義

- 研究範圍

第 2 章:研究方法

第 3 章:執行摘要

第 4 章:市場洞察

- 市場概況

- 產業價值鏈分析

- 產業吸引力-波特五力分析

- 買家的議價能力

- 供應商的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭激烈程度

- COVID-19 對市場的影響

- 關鍵指標

- 使用者滲透率

- 每個用戶的平均收入

第 5 章:市場動態

- 市場促進因素

- 數位視訊領域的發展

- 行動網路使用者激增

- 市場限制

- 影片內容盜版的威脅日益嚴重

第 6 章:技術概覽

- 付費電視點播

- 頂級 (OTT)

- 網際網路通訊協定電視 (IPTV)

第 7 章:市場區隔

- 依商業模式

- 訂閱視訊點播 (SVoD)

- 交易視訊點播 (TVoD)

- 其他商業模式

- 依地理

- 北美洲

- 歐洲

- 亞太地區

- 中東和非洲

- 世界其他地區

第 8 章:競爭格局

- 公司簡介

- Amazon.com Inc. (Amazon Prime Video)

- Netflix Inc.

- Apple Inc.

- Zee Entertainment Enterprises Ltd (Zee5)

- Hulu LLC

- Warner Bros. Discovery Inc.

- The Walt Disney Company (Disney+)

- Popcornflix LLC

- Novi Digital Entertainment Private Limited (Hotstar)

- Comcast Xfinity

- DirecTV

- DISH Network LLC

- Fujitsu

- Midwest Tape LLC (Hoopla Digital)

- Vubiquity Inc.

- Fandango Media LLC (Vudu)

- Edgio

- Dacast Inc.

- Kaltura

- Wistia Inc.

第 9 章:投資分析

第 10 章:市場機會與未來趨勢

The Video-on-Demand Market size is estimated at USD 115.55 billion in 2024, and is expected to reach USD 191.74 billion by 2029, growing at a CAGR of 10.66% during the forecast period (2024-2029).

Key Highlights

- Fundamental factors, such as uninterrupted connectivity, mobile devices as a primary source of content consumption, and advanced capabilities of smartphones are likely propelling the video-on-demand market.

- Video-on-demand services gained popularity in the past few years due to the increasing use of OTT platforms, such as Netflix, Amazon Prime, and others. The presence of these businesses and the widespread accessibility of cloud platforms contributed significantly to the market's growth.

- The surging demand for digital media devices and the availability of faster internet to access media content remotely, along with the rapid adoption of mobile phones, owing to the growing popularity of social media platforms, drive the growth of the video-on-demand market. Recent technological developments and increasing penetration of the internet in several countries over the globe allow video-on-demand service providers to offer high-quality content. At the same time, the launch of new shows and movies on these platforms during the pandemic contributed to the growth of SVoD services.

- Developments in the digital video landscape, especially with premium video advertising, continue to grow with the ad views on streaming services. Ad views increased by 45% because viewers embraced ad-supported digital video content. A recent study found that U.S. audiences use upwards of seven video streaming services via ad-supported and ad-free subscriptions, which drives the Video-on -demand services. The industry has shifted its focus on user experience from content. However, in countries like India, specific customized regional content will play an essential role in driving the video demand market.

- Increasing concerns among market players about video content piracy and protection are expected to hinder the video-on-demand market growth and may lead to substantial revenue loss. As a result, the number of viewers watching content may decline. For instance, according to a joint Digital Citizens Alliance-NAGRA study, the pirate subscription IPTV service is being used by around 9 million subscribers in the United States.

- The COVID-19 pandemic led to the lockdown all over the world. Due to the limits on travel during the pandemic, there has been a beneficial effect on the video-on-demand business due to the lockdown. Consumers all around the world are increasingly streaming entertainment. According to predictions made by Rapid TV News, the COVID-19 pandemic crisis would increase the number of SVoD users worldwide by 5% and reach 949 million. Following the pandemic, the growing popularity of advanced networking technologies would support industry expansion.

Video on Demand Market Trends

Surge in Mobile-based Internet Users to Drive the Market

- The popularity of binge-watching on streaming platforms enhanced the customer's viewing experience. Mobile devices have played a key role in enriching the experience. They provide a much-needed viewing experience with a kind of convenience. Further, the continuous integration of various contents across mobile devices with high-speed internet enabled the users to watch the content anywhere and anytime.

- Factors such as increasing access to the internet and widespread usage of mobile devices helped customers stay up-to-date with the digital world without having to wait. Hence, instant satisfaction evolved as a powerful force in the consumer world, with users adopting mobile devices like smartphones, tablets, and PCs.

- Data-capable devices and high-bandwidth applications like gaming and video streaming are the main drivers of exponential growth in mobile data traffic. According to the GSMA Report 2022, more than 55% of people worldwide used mobile internet. Around 4.3 billion people were using mobile internet by the end of 2021, an increase of about 300 million since the end of 2020. People in low- and middle-income nations (LMICs) have largely been responsible for the growth in the use of mobile internet. As a result, for the first time, mobile internet is being used by half of the population in LMICs.

- Further, Erricson expects that there will be 2.6 billion 5G subscriptions, covering up to 65% of the world's population and generating 45% of the world's total mobile data traffic by 2025. Another report published by the World Advertising Research Centre (WARC), based on data from mobile trade body GSMA, indicated that over 1.3 billion people are anticipated to access the internet via smartphone and PC by 2025.

- The growth of mobile-based internet users is also attributed to the operators' rising adoption of 5G networks due to the consumption of content and related services, which requires 4G LTE resources. Countries like India and China have the highest mobile internet monthly usage. Attractive data plans offered by service providers and millennials' changing video viewing habits drive monthly user growth.

- As a result, both the growing number of smartphone subscriptions and the need for more data per subscription, which in turn leads to increased viewing of video content, are driving factors in internet traffic growth.

North America to Hold the Largest Market Share

- The region comprises the United States and Canada. The United States is the largest economy in the world and has been a significant market for VoD in the North American region. Flexibility, comfort, and content personalisation, as well as the availability of diverse content and the volume of content, have largely driven the adoption of VoD services.

- According to nScreenMedia, the video streaming market in the country has grown into a USD 16 billion industry over the last nine years. The transactional and rental video markets have significantly impacted such growth.

- With smartphone transmission speeds increasing dramatically, the country is witnessing an early transition from 4G to 5G. With the increased speeds of 5G, higher-resolution videos are expected to make consumers' experiences more memorable. Such experiences drive consumers to significantly adopt digital content.

- Amid the COVID-19 pandemic, a major share of the population was staying at home to stop the spread of the virus. Due to this, a number of content producers are selecting video streaming platforms to cope with theater closures.

- For instance, the American Forces Network (AFN) launched its new streaming service, AFN Now, in November 2022. The AFN Now app allows military members, families, and retirees who are stationed abroad to watch top-rated AFN television shows whenever and wherever they want on the regular devices they use. Authorized viewers are invited to download the new video-on-demand and live-streaming app straight away by the Defence Media Activity (DMA).

- The demand for VoD services in Canada finds exciting growth opportunities owing to various factors that include increased mobility trends in Canada, the increasing proliferation of the internet, the rise of online streaming services, and an unprecedented alliance among content producers and streaming partners.

Video on Demand Industry Overview

The VoD market comprises several global and regional players vying for attention in a fairly contested market space. However, players like Netflix, Amazon, Disney+, and Apple Inc. have dominated the market studied. Major players in the market are adopting various strategies, such as the production of original content, to leverage their competitive advantage. The firm concentration ratio is expected to record higher growth during the forecast period. Several players are looking at the market as a lucrative opportunity to consolidate their service offerings, following the tremendous growth after the lockdown protocols.

In July 2022, Netflix announced a partnership with Microsoft to develop ad tools and sales to bring advertisements to the platform. It was to launch a new advertising-based plan, titled the Basic Standard Premium plan. The new plan aimed to bring new subscriptions from various regions and countries where people sometimes pay for premium subscriptions.

In May 2022, Amazon Prime Video announced a multi-film licencing deal with Sajid Nadiadwala's Nadiadwala Grandson Entertainment (NGE). As part of the agreement, the streaming service hosted NGE's upcoming schedule of films shortly after their theatrical release. Furthermore, the films are available to all Prime members on Amazon Prime Video following their theatrical release. Additionally, the films can be rented on Amazon Prime Video for all Amazon customers (Prime or otherwise) in the 'Early Access Rental' window.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Buyers

- 4.3.2 Bargaining Power of Suppliers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitutes

- 4.3.5 Intensity of Competitive Rivalry

- 4.4 Impact of COVID-19 on the Market

- 4.5 Key Metrices

- 4.5.1 User Penetration Rate

- 4.5.2 Average Revenue Per User

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Developments in Digital Video Landscape

- 5.1.2 Surge in Mobile Based Internet Users

- 5.2 Market Restraints

- 5.2.1 Growing Threat of Video Content Piracy

6 TECHNOLOGY SNAPSHOT

- 6.1 Pay-TV VOD

- 6.2 Over-the-top (OTT)

- 6.3 Internet Protocol Television (IPTV)

7 MARKET SEGMENTATION

- 7.1 By Business Model

- 7.1.1 Subscription Video-on-demand (SVoD)

- 7.1.2 Transactional Video-on-demand (TVoD)

- 7.1.3 Other Business Models

- 7.2 By Geography

- 7.2.1 North America

- 7.2.2 Europe

- 7.2.3 Asia Pacific

- 7.2.4 Middle East and Africa

- 7.2.5 Rest of the World

8 COMPETITIVE LANDSCAPE

- 8.1 Company Profiles

- 8.1.1 Amazon.com Inc. (Amazon Prime Video)

- 8.1.2 Netflix Inc.

- 8.1.3 Apple Inc.

- 8.1.4 Zee Entertainment Enterprises Ltd (Zee5)

- 8.1.5 Hulu LLC

- 8.1.6 Warner Bros. Discovery Inc.

- 8.1.7 The Walt Disney Company (Disney+)

- 8.1.8 Popcornflix LLC

- 8.1.9 Novi Digital Entertainment Private Limited (Hotstar)

- 8.1.10 Comcast Xfinity

- 8.1.11 DirecTV

- 8.1.12 DISH Network LLC

- 8.1.13 Fujitsu

- 8.1.14 Midwest Tape LLC (Hoopla Digital)

- 8.1.15 Vubiquity Inc.

- 8.1.16 Fandango Media LLC (Vudu)

- 8.1.17 Edgio

- 8.1.18 Dacast Inc.

- 8.1.19 Kaltura

- 8.1.20 Wistia Inc.