|

市場調查報告書

商品編碼

1273480

糖基輔料市場——增長、趨勢、COVID-19 的影響和預測 (2023-2028)Sugar-Based Excipients Market - Growth, Trends, and Forecasts (2023 - 2028) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

在預測期內,糖基輔料市場預計將以 4.6% 的複合年增長率增長。

在 COVID-19 大流行期間,藥用輔料公司面臨重大挑戰,例如藥品短缺,全球停工中斷了來自製造基地的全球原材料供應鏈。 這些限制阻礙了藥物研究和製造過程,並對依賴外包的公司產生了重大影響。 此外,在 COVID-19 疫苗中越來越多地使用糖基輔料對市場產生了積極影響。 例如,根據康涅狄格州衛生部 2021 年 4 月的審查,輝瑞-BioNTech 疫苗含有一種鹼性食糖,通常稱為蔗糖,用作疫苗穩定劑。 這種成分有助於在冷凍時保持分子的形狀。 因此,在 COVID-19 大流行期間,糖基輔料市場預計會產生初步的負面影響,但隨後 COVID-19 藥物和疫苗配方中使用糖基輔料,預計會受到影響.

市場增長的主要驅動力是共加工輔料的使用增加、仿製藥市場的快速增長以及口腔崩解片的不斷發展。 例如,根據 2022 年 12 月發表在 APhP 上的一份報告,現有輔料的新組合可用於改善輔料的功能,包括口腔崩解片中令人愉悅的味道、口感和甜味,這是一個有趣的選擇。 因此,共加工輔料的上述優勢有望增加對碳水化合物輔料(藥物成分之一)的需求,並推動市場增長。

此外,對口腔崩解片的日益偏愛及其發展正在推動市場。 口腔崩解片與傳統片劑的不同之處在於,它們被設計為在舌頭上溶解而不是整個吞嚥。 隨著老年人口和兒科患者數量的增加,對口腔崩解片的需求也在增加。 例如,根據 MDPI 於 2022 年 8 月發表的研究,糖和糖醇由於其高水溶性和改善口味的特性,長期以來一直受到口腔崩解製劑領域的關注。 因此,開髮用於生產口腔分散製劑的一些賦形劑組合包含單醣和/或相應的醇。 糖和糖醇與其他賦形劑一起使用,以確保片劑的均勻性和結構完整性。 因此,由於上述糖基輔料在口腔分散片中的優勢,預計糖基輔料市場將會增長。

然而,對糖基賦形劑產品的嚴格監管要求預計將抑制市場增長。

糖基輔料市場趨勢

預計在預測期內糖醇部分將佔據最大的市場份額

由於其無毒和高效,糖醇越來越多地用於口服處方和兒科製劑,預計將佔據全球市場的最大份額。 糖醇,也稱為多元醇,是用作甜味劑和填充劑的成分。 糖醇,也稱為多元醇,是用作甜味劑和填充劑的成分,可掩蓋活性劑的苦味並改善其適口性。

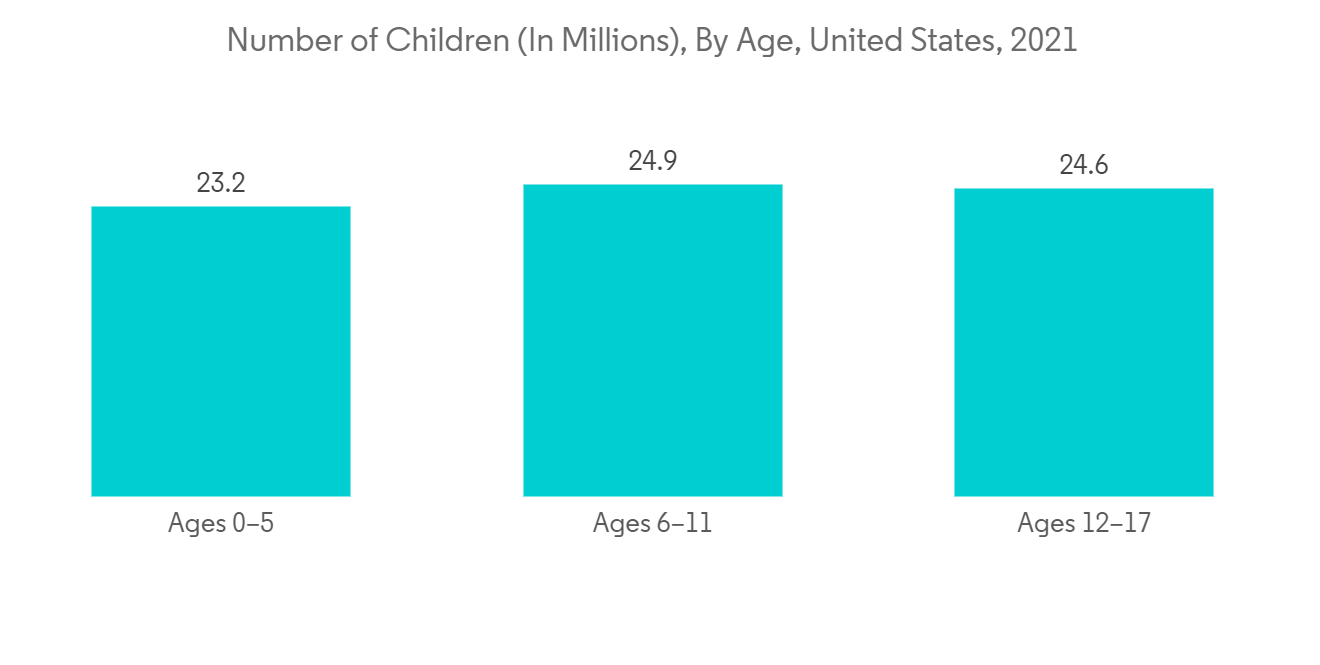

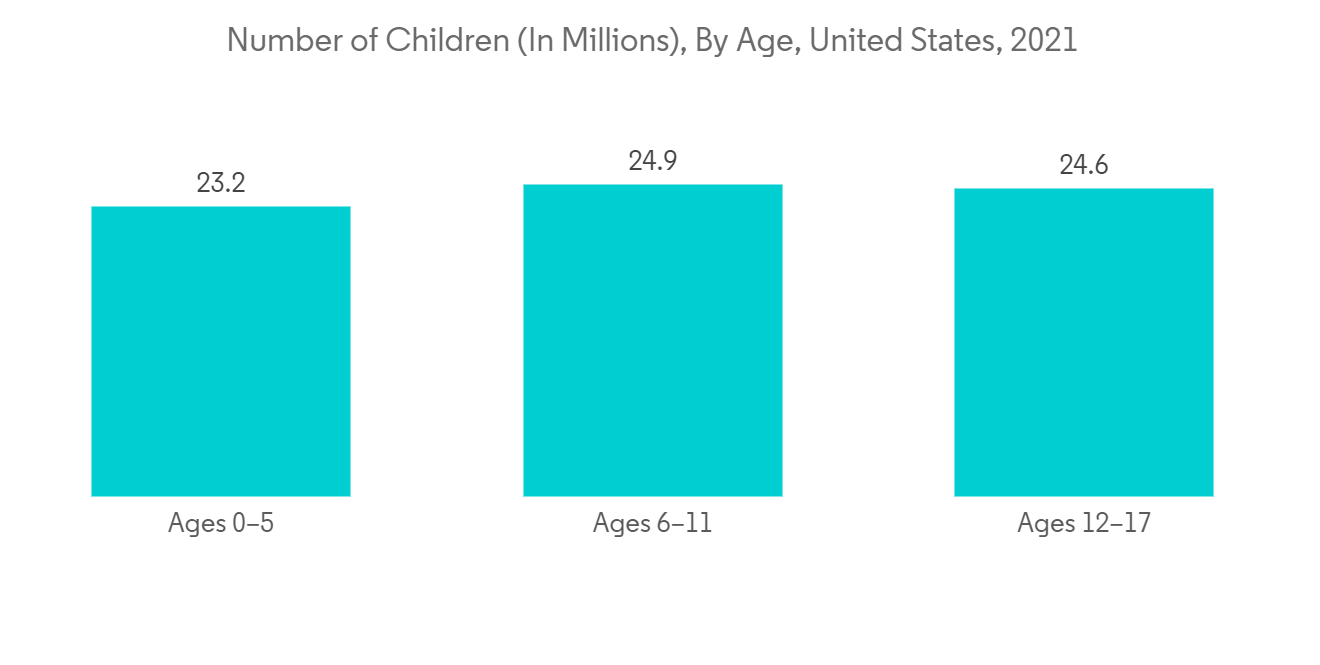

不斷上升的生育率和不斷增加的兒科患者數量是推動這一領域市場增長的主要因素。 醣類無毒,藥物反應可忽略不計,因此主要用於口服製劑。 根據 Childstats.gov 2022,2021 年美國 0-17 歲兒童人數估計為 7360 萬,預計到 2050 年將增至 7820 萬。 因此,預計不斷增長的兒科人口將推動對碳水化合物配方的需求,從而促進該領域的增長。

此外,糖醇在製藥領域的一些附加優勢幫助了該領域的增長。 例如,根據 AAPS 雜誌 2022 年 1 月發表的一份報告,已知糖醇山梨糖醇和甘露糖醇在口服時具有很強的滲透作用。 因此,糖醇被廣泛使用,預計將在預測期內推動市場。

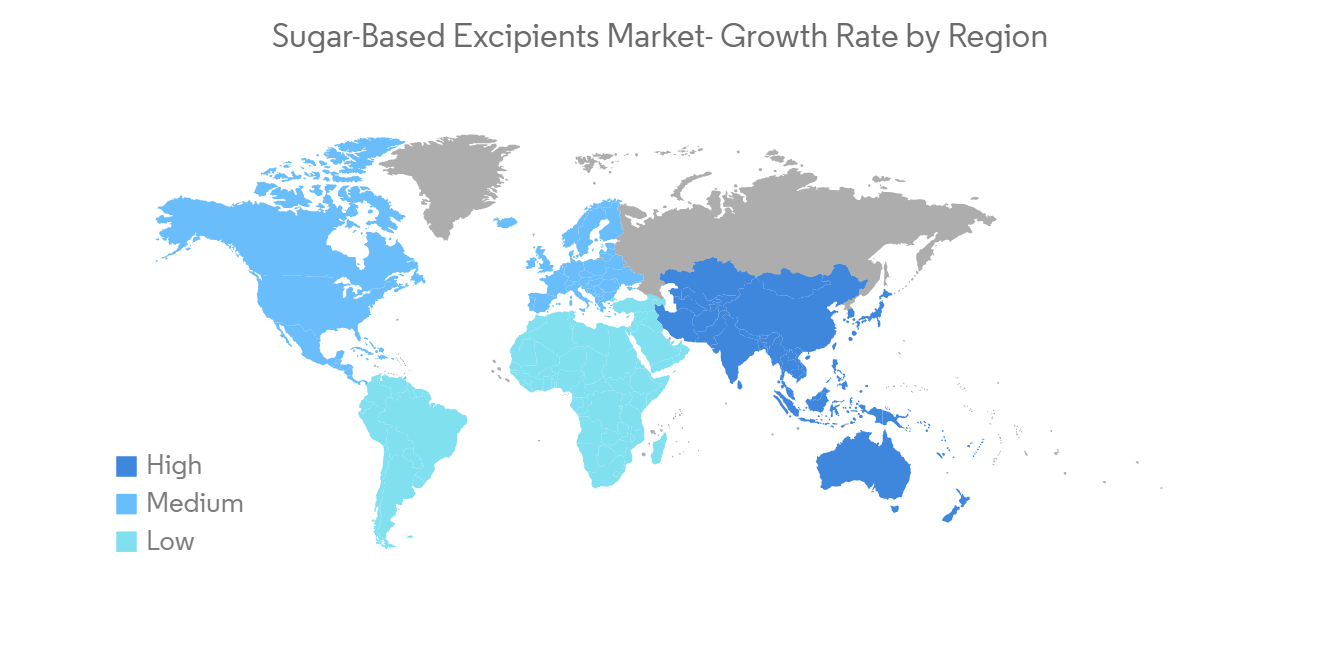

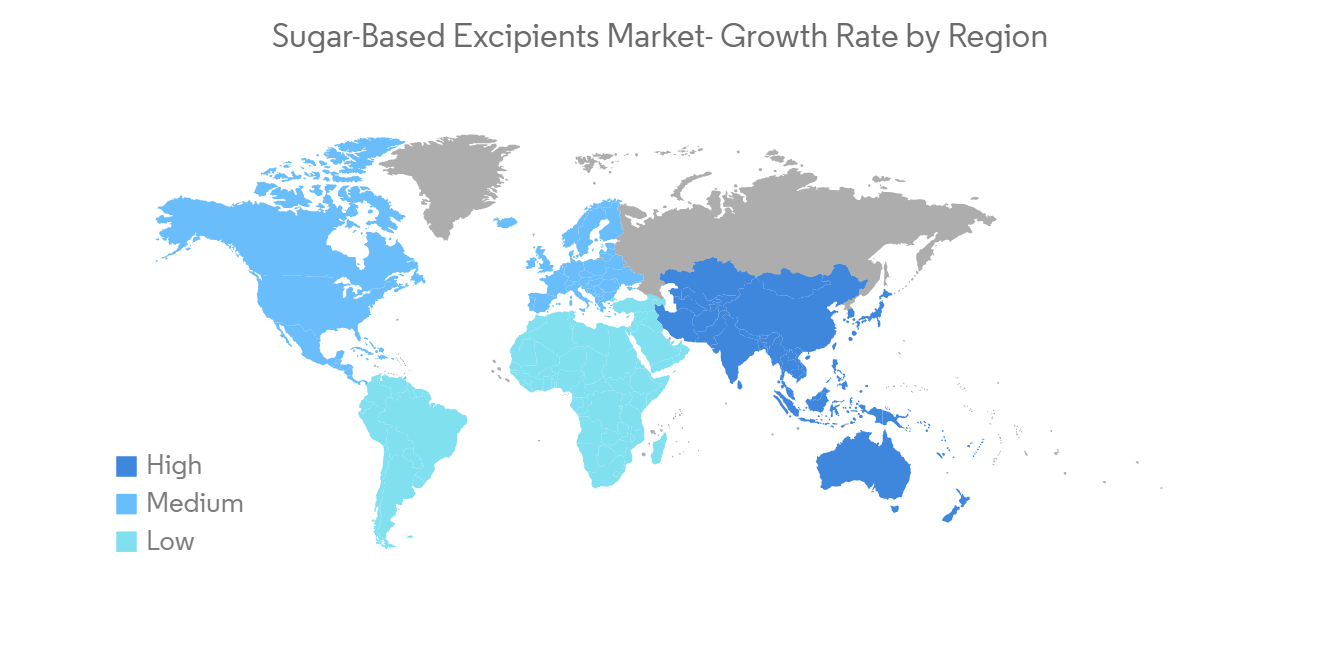

預計在預測期內北美市場將顯著增長

北美的糖基輔料市場經歷了顯著增長,預計在預測期內將保持這種增長。 製藥行業的快速擴張、對功能性賦形劑的需求不斷增長、該地區有影響力的參與者的存在以及技術進步等因素預計將在預測期內推動市場擴張。

根據 CDC 於 2021 年 11 月發布的一份報告,糖基賦形劑被用作穩定劑,以在運輸和儲存過程中保持疫苗的效力。 同樣根據上述來源,以蔗糖為賦形劑的疫苗包括流感(Afluria)四價、流感(FluMist)四價、MenB(Bexsero)、MMRV(ProQuad)、輪狀病毒(RotaTeq)等。 因此,這些糖基賦形劑在該地區被廣泛用作穩定劑,預計將在預測期內推動市場。

此外,市場進入者採取的戰略行動(例如產品發布、併購)也有助於細分市場的增長。 例如,2021 年 12 月,羅蓋特集團加強了在美洲的製藥業務擴張,以加強其全球領導地位,並突出其對以客戶為中心的創新的承諾。 因此,預計主要市場參與者的這些戰略行動將有助於促進產品在該地區的滲透,並在研究期間提振市場。

糖基輔料行業概況

糖基輔料市場由幾家大型企業組成,競爭相對激烈。 目前主導市場的公司包括 DFE Pharma、Archer Daniels Midland Company、Ashland Inc.、Roquette Group、The Lubrizol Corporation、Associated British Foods PLC、Cargill, Inc、Colorcon Inc、FMC Corporation 和 Megle AG。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

內容

第一章介紹

- 調查假設和市場定義

- 本次調查的範圍

第二章研究方法論

第 3 章執行摘要

第四章市場動態

- 市場概覽

- 市場驅動力

- 增加協同加工輔料的使用

- 仿製藥市場的快速增長

- 擴大口腔崩解片的開發

- 市場製約因素

- 嚴格的監管要求

- 波特五力

- 新進入者的威脅

- 買方/消費者議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭公司之間的敵對關係

第 5 章市場細分

- 按產品分類

- 糖

- 糖醇

- 人造甜味劑

- 按類型

- 粉末/顆粒

- 直壓糖

- 水晶

- 其他

- 通過使用

- 填料和稀釋劑

- 化妝品

- 補品

- 其他

- 按地區

- 北美

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 法國

- 意大利

- 西班牙

- 其他歐洲

- 亞太地區

- 中國

- 日本

- 印度

- 澳大利亞

- 韓國

- 其他亞太地區

- 中東和非洲

- 海灣合作委員會

- 南非

- 其他中東和非洲地區

- 南美洲

- 巴西

- 阿根廷

- 其他南美洲

- 北美

第六章競爭格局

- 公司簡介

- DFE Pharma(Royal FrieslandCampina)

- Archer Daniels Midland Company

- Ashland Inc.

- Roquette Group

- The Lubrizol Corporation

- Associated British Foods PLC

- Cargill, Inc.

- Colorcon Inc.

- MEGGLE Group GmbH

- DuPont de Nemours, Inc.

- Innophos

第7章 市場機會與未來動向

The sugar-based excipients market is projected to grow with a CAGR of 4.6% over the forecast period.

During the COVID-19 pandemic, pharmaceutical excipients companies faced significant problems, such as a shortage of medicinal items, and shutdown measures worldwide damaged the global supply chain of raw materials from manufacturing hubs. These restrictions hampered the medication research and manufacturing processes and had a significant impact on the corporations that rely on outsourcing. Moreover, the growing use of sugar-based excipients in the COVID-19 vaccines positively impacted the market. For instance, according to the review by the Connecticut Department of Health in April 2021, the Pfizer-BioNTech vaccine contains basic table sugar, generally known as sucrose, which is used as a stabilizer in vaccines. This component aids in the preservation of the molecules' form upon freezing. Thus, during the COVID-19 pandemic, the sugar-based excipients market is expected to have an adverse impact initially, later due to the use of sugar-based excipients in COVID-19 drug and vaccine formulations which is likely to gain market growth over the study period.

The major factor attributing to the growth of the market is the increasing use of co-processed excipients, the rapid growth of the generic market, and the increasing development of orally disintegrating tablets. For instance, as per the report published by the journal of APhP in December 2022, new combinations of existing excipients are an interesting option for improving excipient functionality which includes pleasant taste, mouth feel, and sweetness in orally disintegrating tablets. Thus, due to the above benefits of the co-processed excipient, the demand for sugar-based excipients is expected to grow, as it is one of the ingredients in the pharmaceutical product, thereby boosting the market growth.

Furthermore, the growing preference for orally disintegrating tablets and their development is boosting the market. Orally disintegrating tablets differ from traditional tablets in that they are designed to be dissolved on the tongue rather than swallowed whole. As the number of geriatric population and pediatric patients increases, the demand for orally disintegrating tablets is increasing. For instance, according to the study published by MDPI in August 2022, saccharides and sugar alcohols have long been of interest in the area of orodispersible formulations due to their high-water solubility and taste-improving properties. As a result, several excipient combinations developed to manufacture orally dispersible dosage forms contain monosaccharides and/or their respective alcohols. Sugars or sugar alcohols, together with other excipients, are used to ensure the tablets' uniformity and structural integrity. The market for sugar-based excipients is therefore projected to rise as a result of the aforementioned advantages of sugar-based excipients in orally dispersible tablets.

However, the stringent regulatory requirements for sugar-based excipient products are expected to restrain market growth.

Sugar-Based Excipients Market Trends

Sugar Alcohol Segment is Expected to have Largest Share in the Market Over the Forecast Period

The sugar alcohol segment is expected to account for the largest share in the global market owing to its increased utilization in oral prescription medicines and pediatric formulations due to its non-toxicity and high efficiency. Sugar alcohols, also known as polyols, are ingredients used as sweeteners and bulking agents. They can be used to conceal the bitter taste of active agents, thereby making them more palatable.

The major factors increasing the market growth of the segment are the increasing birth rate and the growing pediatric patient pool. The actual sugars are used mainly in oral formulations due to their non-toxicity and negligible reaction with drugs. According to Childstats.gov 2022, the number of children aged 0-17 years in the United States is estimated at 73.6 million in 2021 and is likely to increase to 78.2 million by 2050. Thus, increasing the pediatric population is expected to drive the demand for sugar-based formulations, thereby boosting segment growth.

Additionally, some of the additional advantages of sugar alcohols in the pharmaceutical field help in the growth of the segment. For instance, as per the report published by the AAPS Journal in January 2022, when taken orally, the sugar alcohols sorbitol and mannitol are known to provide a strong osmotic effect. Hence, widespread applications of sugar alcohols it is expected to drive the market over the forecast period.

North America is Expected to have Significant Growth in the Market Over the Forecast Period

North America is expected to have significant growth in the sugar-based excipients market and is likely to maintain this over the forecast period. Factors such as the rapidly expanding pharmaceutical sector, the rising need for functional excipients, the presence of significant players in the region, and technological advances will drive market expansion throughout the projection period.

According to the report published by CDC in November 2021, sugar-based excipients are used as stabilizers to keep the vaccine potent during transportation and storage. Also, as per the same above-mentioned source, some of the vaccines in which sucrose is used as an excipient include Influenza (Afluria)Quadrivalent, Influenza (FluMist) Quadrivalent, MenB (Bexsero), MMRV (ProQuad), and Rotavirus (RotaTeq). Hence, the wide usage of these sugar-based excipients in the region as stabilizers is expected to drive the market over the forecast period.

Furthermore, strategic actions done by market participants, such as product launches, mergers, and acquisitions, contribute to the market segment's growth. For instance, in December 2021, Roquette Group intensified its pharmaceutical business expansion in the Americas to consolidate its worldwide leadership and underline its commitment to customer-focused innovation. Hence, these strategic actions of the major market players help in the widespread of the products in the region and are expected to boost the market over the study period.

Sugar-Based Excipients Industry Overview

The Sugar-Based Excipients market is moderately competitive and consists of several major players. Some of the companies which are currently dominating the market are DFE Pharma, Archer Daniels Midland Company, Ashland Inc., Roquette Group, The Lubrizol Corporation, Associated British Foods PLC, Cargill, Inc., Colorcon Inc., FMC Corporation, and Meggle AG.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Increasing Use of Co-processed Excipients

- 4.2.2 Rapid Growth in the Generics Market

- 4.2.3 Increasing Development of Orally Disintegrating Tablets

- 4.3 Market Restraints

- 4.3.1 Stringent Regulatory Requirements

- 4.4 Porter Five Forces

- 4.4.1 Threat of New Entrants

- 4.4.2 Bargaining Power of Buyers/Consumers

- 4.4.3 Bargaining Power of Suppliers

- 4.4.4 Threat of Substitute Products

- 4.4.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION (Market Size by Value - USD million)

- 5.1 By Product

- 5.1.1 Actual Sugar

- 5.1.2 Sugar Alcohols

- 5.1.3 Artificial Sweeteners

- 5.2 By Type

- 5.2.1 Powders/Granules

- 5.2.2 Direct Compression Sugars

- 5.2.3 Crystals

- 5.2.4 Others

- 5.3 By Application

- 5.3.1 Fillers and Diluents

- 5.3.2 Flavoring Agents

- 5.3.3 Tonicity Agents

- 5.3.4 Others

- 5.4 Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.1.3 Mexico

- 5.4.2 Europe

- 5.4.2.1 Germany

- 5.4.2.2 United Kingdom

- 5.4.2.3 France

- 5.4.2.4 Italy

- 5.4.2.5 Spain

- 5.4.2.6 Rest of Europe

- 5.4.3 Asia-Pacific

- 5.4.3.1 China

- 5.4.3.2 Japan

- 5.4.3.3 India

- 5.4.3.4 Australia

- 5.4.3.5 South Korea

- 5.4.3.6 Rest of Asia-Pacific

- 5.4.4 Middle East and Africa

- 5.4.4.1 GCC

- 5.4.4.2 South Africa

- 5.4.4.3 Rest of Middle East and Africa

- 5.4.5 South America

- 5.4.5.1 Brazil

- 5.4.5.2 Argentina

- 5.4.5.3 Rest of South America

- 5.4.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 DFE Pharma (Royal FrieslandCampina)

- 6.1.2 Archer Daniels Midland Company

- 6.1.3 Ashland Inc.

- 6.1.4 Roquette Group

- 6.1.5 The Lubrizol Corporation

- 6.1.6 Associated British Foods PLC

- 6.1.7 Cargill, Inc.

- 6.1.8 Colorcon Inc.

- 6.1.9 MEGGLE Group GmbH

- 6.1.10 DuPont de Nemours, Inc.

- 6.1.11 Innophos