|

市場調查報告書

商品編碼

1413689

全球電子材料氣體(含氖、氙)市場分析(2023-2024年)Electronic Gases including Ne & Xe Market Report (a Critical Materials Report) 2023-2024 |

||||||

本報告分析了用於半導體裝置製造的電子材料氣體的全球市場及其供應鏈。由於產業低迷,天然氣公司面臨的挑戰之一是大型設備投資的時機和獲利能力,例如空氣分離裝置(ASU)和半導體鑄造廠。同時,中國市場上不斷出現新的供應商來支持政府支持的 "中國製造" 計畫。隨著這些供應商能力的增強,他們的影響力可能會在未來三年或更長時間內極大地影響天然氣供應鏈。

有關電子材料氣體市場最新資訊和報告亮點的專題新聞稿:

目錄

第一章執行摘要

第二章 研究範圍、目的與研究方法

第三章 半導體產業市場現況與展望

- 世界經濟

- 連結半導體產業與全球經濟

- 半導體銷售額成長率

- 台灣月度銷售趨勢

- 2023年高度不確定性-半導體收入成長預計將放緩至負值

- 晶片銷售趨勢:按電子設備細分市場

- 手機

- PC 出貨量

- 伺服器/IT市場

- 半導體製造業的成長與擴張

- 鑄造廠擴建公告:概述

- 透過在世界各地擴大鑄造廠來加速成長

- 資本支出趨勢

- 技術路線圖

- 代工投資評估

- 政策和貿易趨勢及影響

- 半導體材料概述

- 晶片生產進度可能受到材料產能限制

- 緩解物流問題

- TECHCET:晶圓市場趨勢預測(至2027年)

- TECHCET:材料市場預測

第四章 電子材料氣體市場趨勢

- 推動電子材料氣體業務的市場趨勢

- 供給能力、需求和投資

- WF6 的需求驅動因素

- WF6的市場需求

- WF6市場需求:MO ALD IP應用

- WF6的市場需求

- 技術驅動/材料變化與轉變

- 過去10年整體趨勢:從PVD/LPCVD到PECVD/ALD

- 市場趨勢:按設備類型/節點 - 高級設備

- 市場趨勢:高階邏輯

- 市場趨勢:引入晶圓數量(DRAM)

- 市場趨勢:引入晶圓數量(NAND)

- 氣相沉積製程:按設備類型/材料劃分 - 概述

- 蝕刻製程:依設備類型 - 電子層蝕刻 (ALE)

- 科技趨勢與機會:概述

- 按地區劃分的趨勢

- 區域趨勢:林德

- 地區趨勢:液化空氣集團

- 地區趨勢:空氣產品公司

- 各地區趨勢:太陽日本佐野

- 按地區劃分的趨勢:韓國

- 地區趨勢:日本

- 按地區劃分的趨勢:日本/韓國

- 地區趨勢:中國

- 地區趨勢:俄羅斯

- 地區趨勢:美國

- 關於規格和純度的一般評論

- 電子材料氣體供應鏈風險因素

- 地緣政治風險

- 俄羅斯風險

- 供應鏈風險:原物料價格

- 後勤

- 市場趨勢評估

第五章 EHS(環境、健康與安全)與永續發展議題

- EHS 和物流問題 - 半導體製造產生的溫室氣體

- EHS 和物流問題

- EHS 和物流問題 - 半導體製造產生的溫室氣體

- EHS 和物流問題 - 空氣中的溫室氣體(氖氣)

- 空分單位能源消耗 - 溫室氣體排放

- 空分單位能源消耗 - 溫室氣體排放

- 霓虹燈供應從烏克蘭轉向中國造成的碳排放

- 氖氣生產產生的碳足跡

- ISO 氣體容器中氖氣運輸的碳足跡

- 計算運輸草案:中國 vs 烏克蘭

- 永續半導體製程和製造技術

- 氦氣:永續生產 - 綠色氦氣

- 氦氣:永續生產 - 綠色氦氣

- NF3替代品:F2氣體

- 氟氣法規

- Linde含氟氣體安裝

- 考慮環境監管風險的公約和協議

第六章 電子材料氣體市場統計及預測

- 電子材料氣體市場-實際結果與預測(5年)

- 工業氣體市場

- 電子材料氣體市場

- 供應商名單/財務資訊/簡介

- 特種氣體市場的驅動因素

- 特種氣體市場:需求、供給、市佔率(5年)

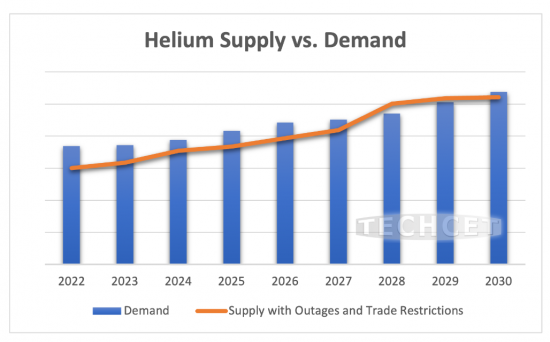

- 氦氣 (He):5 年的供需

- 氖氣(Ne)5年供需狀況

- 氖

- 氙氣(XE)5年供需狀況

- 三氟化氮(NF3)5年供需狀況

- 六氟化鎢(WF6)五年供需狀況

- 併購 (M&A) 活動

- 新工廠

- 新工廠:LINDE擴建(2023年)

- 新工廠:AIR LIQUIDE擴建(2022/2023)

- NIHON SUO HOLDING CO., LTD.:擴大乙硼烷產能

- 供應商工廠關閉

- 新進入者:K MATERIALS 和 SHOWA DENKO 尋求聯合進入美國半導體氣體市場

- 新加入者:RESONAC

- 新加入者:NEON(中國)

- 價格趨勢

- 供氣評估

第七章 下層材料供應鏈

- 銷售渠道

- 物流要求

- 次級供應鏈:鎢的顛覆

- 供應鏈下游:併購活動

- 下游供應鏈:EHS 與物流問題

- 下游供應鏈:價格趨勢

- 下游供應鏈:TECHCET 分析師評估

第八章 供應商簡介

- ADEKA CORPORATION

- AIR LIQUIDE

- AZMAX CO., LTD

- DNF CO., LTD

- ENTEGRIS

- 其他20多家企業

第9章附錄

This report covers the electronic gas materials market and supply-chain for these materials used in semiconductor device fabrication. One of the challenges that the gas companies encounter is profitability due to the timing of investments and industry downturns for large installations like Air Separation Units (ASUs) and Semiconductor fabs. In the meantime, new suppliers are emerging in the China market to support the "Made in China" program backed by the government. When these suppliers gain in capability and capacity, their influence could dramatically impact the gas supply chain in the next 3+ years.

This report comes with 3 Quarterly Updates featuring updated market information and forecasting from the report analyst.

TABLE OF CONTENTS

1. EXECUTIVE SUMMARY

- 1.1. ELECTRONIC GAS MARKET-HISTORICAL AND 5-YEAR FORECAST

- 1.2. MARKET DRIVERS FOR THE SPECIALTY GAS MARKET

- 1.2.1. SPECIALTY GAS MARKET: 5-YEAR SUPPLY & DEMAND

- 1.3. MARKET TRENDS

- 1.4. TECHNOLOGY TRENDS-DEVICE ROADMAP

- 1.4.1. TECHNOLOGY TRENDS-DEVICE SEGMENT OPPORTUNITIES

- 1.5. COMPETITIVE LANDSCAPE-ELECTRONIC GAS MARKET SHARE

- 1.6. SUPPLY CAPACITY AND DEMAND, INVESTMENTS

- 1.7. EHS AND LOGISTIC ISSUES-GREEN HOUSE GASES FROM LOGIC PRODUCTION

- 1.8. MARKET ASSESSMENT SUMMARY

2. SCOPE, PURPOSE AND METHODOLOGY

- 2.1. SCOPE

- 2.2. PURPOSE

- 2.3. METHODOLOGY

- 2.4. OVERVIEW OF OTHER TECHCET CMR™ REPORTS

3. SEMICONDUCTOR INDUSTRY MARKET STATUS & OUTLOOK

- 3.1. WORLDWIDE ECONOMY

- 3.1.1. SEMICONDUCTOR INDUSTRIES TIES TO THE GLOBAL ECONOMY

- 3.1.2. SEMICONDUCTOR SALES GROWTH

- 3.1.3. TAIWAN MONTHLY SALES TRENDS

- 3.1.4. UNCERTAINTY ABOUNDS ESPECIALLY FOR 2023-SLOWER TO NEGATIVE SEMICONDUCTOR REVENUE GROWTH EXPECTED

- 3.2. CHIPS SALES BY ELECTRONIC GOODS SEGMENT

- 3.2.1. SMARTPHONES

- 3.2.2. PC UNIT SHIPMENTS

- 3.2.3. SERVERS / IT MARKET

- 3.3. SEMICONDUCTOR FABRICATION GROWTH & EXPANSION

- 3.3.1. FAB EXPANSION ANNOUNCEMENT SUMMARY

- 3.3.2. WW FAB EXPANSION DRIVING GROWTH

- 3.3.3. EQUIPMENT SPENDING TRENDS

- 3.3.4. TECHNOLOGY ROADMAPS

- 3.3.5. FAB INVESTMENT ASSESSMENT

- 3.4. POLICY & TRADE TRENDS AND IMPACT

- 3.5. SEMICONDUCTOR MATERIALS OVERVIEW

- 3.5.1. COULD MATERIALS CAPACITY LIMIT CHIP PRODUCTION SCHEDULES?

- 3.5.2. LOGISTICS ISSUES EASED DOWN

- 3.5.3. TECHCET WAFER STARTS FORECAST THROUGH 2027

- 3.5.4. TECHCET'S MATERIAL FORECAST

4. ELECTRONIC GASES MARKET TRENDS

- 4.1. MARKET TRENDS DRIVING THE ELECTRONIC GAS BUSINESS

- 4.2. SUPPLY CAPACITY AND DEMAND, INVESTMENTS

- 4.2.1. WF6 DEMAND DRIVERS

- 4.2.2. WF6 MARKET DEMAND

- 4.2.3. WF6 MARKET DEMAND-MO ALD IP FILING

- 4.2.4. WF6 MARKET DEMAND

- 4.3. TECHNICAL DRIVERS / MATERIAL CHANGES AND TRANSITIONS

- 4.3.1. GENERAL TREND LAST DECADE GOING FROM PVD & LPCVD TO PECVD

- 4.3.2. MARKET TRENDS BY DEVICE TYPE AND NODE-ADVANCED DEVICES

- 4.3.3. MARKET TRENDS-ADVANCED LOGIC

- 4.3.4. MARKET TRENDS-WAFER STARTS DRAM

- 4.3.5. MARKET TRENDS-WAFER STARTS NAND

- 4.3.6. DEPOSITION PROCESS BY DEVICE TYPE AND MATERIAL-AN OVERVIEW

- 4.3.7. ETCH PROCESS BY DEVICE TYPE-ATOMIC LAYER ETCHING ALE

- 4.3.8. SUMMARY OF TECHNICAL TRENDS AND OPPORTUNITIES

- 4.4. REGIONAL TRENDS

- 4.4.1. REGIONAL TRENDS-LINDE

- 4.4.2. REGIONAL TRENDS-AIR LIQUIDE

- 4.4.3. REGIONAL TRENDS-AIR PRODUCTS

- 4.4.5. REGIONAL TRENDS-TAIYO NIPPON SANO

- 4.4.6. REGIONAL TRENDS-KOREA

- 4.4.7. REGIONAL TRENDS-JAPAN

- 4.4.8. REGIONAL TRENDS-JAPAN & KOREA

- 4.3.15. REGIONAL TRENDS-CHINA

- 4.4.9. REGIONAL TRENDS-RUSSIA

- 4.4.10. REGIONAL TRENDS-USA

- 4.5. GENERAL COMMENTS ON SPECIFICATIONS AND PURITY

- 4.6. ELECTRONIC GAS SUPPLY CHAIN RISK FACTORS

- 4.6.1. GEOPOLITICAL RISKS

- 4.6.2. RUSSIA RISKS

- 4.6.3. SUPPLY CHAIN RISKS-RAW MATERIAL PRICING

- 4.6.4. LOGISTICS

- 4.7. MARKET TRENDS ASSESSMENT

5. EHS AND SUSTAINABILITY ISSUES

- 5.1. EHS AND LOGISTIC ISSUES-GREEN HOUSE GASES FROM SEMICONDUCTOR PRODUCTION

- 5.2. EHS AND LOGISTICS ISSUES

- 5.3. EHS AND LOGISTIC ISSUE-GREEN HOUSE GASES FROM SEMICONDUCTOR PRODUCTION

- 5.4. EHS AND LOGISTIC ISSUES-GREEN HOUSE GASES FROM AIR GASES (NEON)

- 5.4.1. ASU ENERGY CONSUMPTION-GHG EMISSIONS

- 5.4.2. ASU ENERGY CONSUMPTION-GHG EMISSIONS

- 5.4.3. CARBON FOOTPRINT OF SHIFTING NEON SUPPLY FROM UKRAINE TO CHINA

- 5.4.4. CARBON FOOTPRINT OF NEON PRODUCTION

- 5.4.5. CARBON FOOTPRINT OF NEON SHIPPING IN GAS ISO CONTAINER

- 5.4.6. DRAFT CALCULATION TRANSPORT: CHINA VS UKRAINE

- 5.5. SUSTAINABLE SEMICONDUCTOR PROCESSES AND MANUFACTURING TECHNOLOGIES

- 5.6. HELIUM-SUSTAINABLE PRODUCTION-GREEN HELIUM

- 5.7. HELIUM-SUSTAINABLE PRODUCTION-GREEN HELIUM

- 5.8. NF3 REPLACEMENT: F2 GAS

- 5.8.1. FLUORINATED GAS REGULATIONS

- 5.8.3. LINDE F-GAS INSTALLATION

- 5.8.4. ENVIRONMENT REGULATION RISK-IMPLEMENTED TREATIES AND PROTOCOLS

6. ELECTRONIC GASES MARKET STATISTICS & FORECASTS

- 6.1. ELECTRONIC GAS MARKET-HISTORICAL AND 5-YEAR FORECAST

- 6.1.1. INDUSTRIAL GAS MARKET

- 6.1.2. ELECTRONIC GAS MA

- 6.1.3. SUPPLIER LIST, FINANCIALS AND PROFILES

- 6.1.4. MARKET DRIVERS FOR THE SPECIALTY GAS MARKET

- 6.2. SPECIALTY GAS MARKET: 5-YEAR SUPPLY & DEMAND RKET SHARE

- 6.2.1. HE 5-YEAR SUPPLY & DEMAND

- 6.2.2. NE 5-YEAR SUPPLY & DEMAND

- 6.2.3. NEON

- 6.2.4. XE 5-YEAR SUPPLY & DEMAND

- 6.2.5. NF3 5-YEAR SUPPLY & DEMAND

- 6.2.6. TUNGSTEN HEXAFLUORIDE 5-YEAR SUPPLY & DEMAND

- 6.3. M&A ACTIVITIES

- 6.4. NEW PLANTS

- 6.4.1. NEW PLANTS, LINDE EXPANSIONS 2023

- 6.4.2. NEW PLANTS, AIR LIQUIDE EXPANSIONS 2022/2023

- 6.4.3. NIHON SUO HOLDING CO., LTD. TO INCREASE DIBORANE CAPACITY

- 6.5. SUPPLIER PLANT CLOSURES

- 6.5.1. NEW ENTRANTS-SK MATERIALS, SHOWA DENKO SEEK JOINT ENTRY INTO US SEMICONDUCTOR GAS MARKET

- 6.5.2. NEW ENTRANTS-RESONAC

- 6.5.3. NEW ENTRANTS-NEON, CHINA

- 6.6. PRICING TRENDS

- 6.7. GAS SUPPLY ASSESSMENT

7. SUB TIER MATERIAL SUPPLY CHAIN

- 7.1. SALES CHANNELS

- 7.2. LOGISTICS REQUIREMENTS

- 7.2.1. SUB-TIER SUPPLY-CHAIN: TUNGSTEN DISRUPTIONS

- 7.3. SUB-TIER SUPPLY-CHAIN M&A ACTIVITY

- 7.4. SUB-TIER SUPPLY-CHAIN EHS AND LOGISTICS ISSUES

- 7.5. SUB-TIER SUPPLY-CHAIN PRICING TRENDS

- 7.6. SUB-TIER SUPPLY-CHAIN TECHCET ANALYST ASSESSMENT

8. SUPPLIER PROFILES

- ADEKA CORPORATION

- AIR LIQUIDE

- AZMAX CO., LTD

- DNF CO., LTD

- ENTEGRIS

- ...and 20+ more

9. APPENDIX

- 9.1. GASES USED BY MULTIPLE INDUSTRIES

- 9.1.1. SPECIALTY GAS INDUSTRY MATRIX

- 9.1.2. GASES USED FOR SEMICONDUCTOR DEVICE MANUFACTURING

- 9.1.3. GASES USED IN THE DISPLAY INDUSTRY

- 9.2. SUPPLIER LISTING BY GAS TYPE

- 9.2.1. HYDRIDES

- 9.2.2. SILICON PRECURSORS (SILANES)

- 9.2.3. ETCHANTS/CHAMBER CLEAN

- 9.2.4. DEPOSITION/MISC

- 9.2.5. BULK GASES

- 9.3. ETCH GAS ROADMAPS

- 9.3.1. ETCH ROADMAPS 1 OF 3

- 9.3.2. ETCH ROADMAPS 2 OF 3

- 9.3.3. ETCH ROADMAPS 3 OF 3

LIST OF FIGURES

- FIGURE 1: ELECTRONIC GAS MARKET

- FIGURE 2: ELECTRONIC GAS MARKET SEGMENTATION

- FIGURE 3: TECHCET WAFER START FORECAST BY NODE

- FIGURE 4: TECHNOLOGY ROADMAP DEVICES

- FIGURE 5: TOTAL ELECTRONIC GAS MARKET SHARE 2021, US$6,3 BILLION

- FIGURE 6: AIR GAS BOILING POINT

- FIGURE 7: COMPARISON OF CO2 EMISSIONS FROM VARIOUS TRANSPORTATION MODES

- FIGURE 8: OCEAN CONTAINER PRICE INDEX-JULY '20 TO MARCH '23

- FIGURE 9: GLOBAL ECONOMY AND THE ELECTRONICS SUPPLY CHAIN (2022)

- FIGURE 10: WORLDWIDE SEMICONDUCTOR SALES

- FIGURE 11: TECHCET'S TAIWAN SEMICONDUCTOR INDUSTRY INDEX (TTSI)*

- FIGURE 12: 2023 SEMICONDUCTOR INDUSTRY REVENUE GROWTH FORECASTS

- FIGURE 13: 2022 SEMICONDUCTOR CHIP APPLICATIONS

- FIGURE 14: MOBILE PHONE SHIPMENTS WW ESTIMATES

- FIGURE 15: WORLDWIDE PC AND TABLET FORECAST

- FIGURE 16: ELECTRIFICATION TREND BY WORLD REGION

- FIGURE 17: SEMICONDUCTOR AUTOMOTIVE PRODUCTION

- FIGURE 18: TSMC PHOENIX INVESTMENT ESTIMATED WILL BE US $40 B

- FIGURE 19: CHIP EXPANSIONS 2022-2027 US$366 B

- FIGURE 20: SEMICONDUCTOR CHIP MANUFACTURING REGIONS OF THE WORLD

- FIGURE 21: GLOBAL TOTAL EQUIPMENT SPENDING BY SEGMENT (US$ B)

- FIGURE 22: OVERVIEW OF ADVANCED LOGIC DEVICE TECHNOLOGY ROADMAP

- FIGURE 23: INTEL OHIO PLANT SITE FEB. 2023 AND ARTIST RENDERING (ON BOTTOM)

- FIGURE 24: EUROPE CHIP EXPANSION UPSIDE

- FIGURE 25: PORT OF LA

- FIGURE 26: TECHCET WAFER START FORECAST BY NODE SEGMENTS**

- FIGURE 27: GLOBAL SEMICONDUCTOR MATERIALS OUTLOOK

- FIGURE 28: 2D PHASE OF BORON AS POSSIBLE FUTURE TRANSISTOR CHANNEL

- FIGURE 29: 3DNAND MARKET SHARE 2022

- FIGURE 30: 3DNAND STRUCTURE

- FIGURE 31: MO PRECURSORS

- FIGURE 32: PATENT FAMILIES FILED FOR MOLYBDENUM ALD IN THE MEMORY SPACE

- FIGURE 33: WAFER START FORECAST SHOWING TWO TIMING SCENARIOS WHERE MO COULD BE INTRODUCED (MILLIONS OF 200 MM EQUIVALENT / YEAR)

- FIGURE 34: 3D DEVICE ARCHITECTURES

- FIGURE 35: FORECASTS--WAFER STARTS 2021 TO 2027

- FIGURE 36: FORECASTS--WAFER STARTS LOGIC 300 MM

- FIGURE 37: SAMSUNG START 3 NM PILOT RAMP USING GAA-FET TECHNOLOGY JUNE 2022

- FIGURE 38: IMEC 2022 LOGIC ROADMAP

- FIGURE 39: APPLIED MATERIALS CENTURA PATTERN SHAPING CLUSTER

- FIGURE 40: FORECASTS--WAFER STARTS DRAM 300 MM

- FIGURE 41: IP FILING IN THE FIELD OF 3DRAM IS ACCELERATING

- FIGURE 42: FORECASTS--WAFER STARTS NAND 300 MM

- FIGURE 43: PATHWAYS FOR CONTINUED 3D NAND SCALING

- FIGURE 44: 3DNAND SCALING FROM 1 STACK TO 4 STACKS

- FIGURE 45: SELECTIVE W LOWERS RESISTANCE

- FIGURE 46: FINFET/GAA TRANSITION

- FIGURE 47: SELECTIVITY IMPROVEMENT WITH ALE

- FIGURE 48: ALD AND ALE ROADMAPS OF INTEL, TSMC AND SAMSUNG

- FIGURE 49: DEP-ALE STI FILL AND RECESS ETCH

- FIGURE 50: PLASMA AND THERMAL ALE PROCESSES

- FIGURE 51: AIR LIQUIDE FINANCIALS (ANNUAL REPORT 2022 PENDING)

- FIGURE 52: KOREA 2021 NEON IMPORTS

- FIGURE 53: RESONAC BUSINESS SEGMENT REVENUE 2022

- FIGURE 54: TOTAL HELIUM PRODUCTION 160 MILLION M3

- FIGURE 55: FLUORSPAR PRICE IN US 2014-2022

- FIGURE 56: OCEAN CONTAINER PRICE INDEX-JULY '20 TO MARCH '23

- FIGURE 57: CO2 EMISSIONS CONTRIBUTIONS WITHIN A CHIP FAB

- FIGURE 58: GLOBAL WARMING IMPACT FROM VARIOUS PROCESS GASES

- FIGURE 59: TOTAL EMISSIONS AND ENERGY USE PROJECTION PER LOGIC NODE

- FIGURE 60: CO2EQ OUTPUT FROM ETCH GASES

- FIGURE 61: AIR SEPARATION UNIT FLOW CHART

- FIGURE 62: AIR GAS BOILING POINT

- FIGURE 63: CARBON GENERATION FROM AIR SEPARATION PROCESSES

- FIGURE 64: COMPARISON OF CO2 EMISSIONS FROM VARIOUS TRANSPORTATION MODES

- FIGURE 65: F2 AND NF3 ACTIVATION

- FIGURE 66: ELECTRONIC GAS MARKET

- FIGURE 67: TOTAL INDUSTRIAL GAS MARKET 2021, US$97 BILLION

- FIGURE 68: TOTAL ELECTRONIC GAS MARKET 2021, US$6,3 BILLION

- FIGURE 69: ELECTRONIC GAS MARKET SEGMENTATION

- FIGURE 70: HE WW SUPPLY AND DEMAND

- FIGURE 71: 2027 HELIUM SUPPLY

- FIGURE 72: TOTAL NEON DEMAND VS. SUPPLY

- FIGURE 73: KOREA 2021 NEON IMPORTS

- FIGURE 74: TOTAL XENON DEMAND VS. SUPPLY (MILLION LITERS/YR)

- FIGURE 75: TOTAL KRYPTON DEMAND VS. SUPPLY (MILLION LITERS/YR)

- FIGURE 76: NF3 SUPPLY/DEMAND

- FIGURE 77: AWF6 FORECAST

- FIGURE 78: HARDMASK SCHEMATIC

- FIGURE 79: LATEST SITUATION MAP IN UKRAINE, SHOWING TAKEN MAURIUPOL BUT ODESSA STILL FREE

- FIGURE 80: RESONAC BUSINESS SEGMENT REVENUE 2022

- FIGURE 81: RARE GAS PRICE ESCALATION

- FIGURE 65: F2 AND NF3 ACTIVATION

- FIGURE 66: ELECTRONIC GAS MARKET

- FIGURE 67: TOTAL INDUSTRIAL GAS MARKET 2021, US$97 BILLION

- FIGURE 68: TOTAL ELECTRONIC GAS MARKET 2021, US$6,3 BILLION

- FIGURE 69: ELECTRONIC GAS MARKET SEGMENTATION

- FIGURE 70: HE WW SUPPLY AND DEMAND

- FIGURE 71: 2027 HELIUM SUPPLY

- FIGURE 72: TOTAL NEON DEMAND VS. SUPPLY

- FIGURE 73: KOREA 2021 NEON IMPORTS

- FIGURE 74: TOTAL XENON DEMAND VS. SUPPLY (MILLION LITERS/YR)

- FIGURE 75: TOTAL KRYPTON DEMAND VS. SUPPLY (MILLION LITERS/YR)

- FIGURE 76: NF3 SUPPLY/DEMAND

- FIGURE 77: AWF6 FORECAST

- FIGURE 78: HARDMASK SCHEMATIC

- FIGURE 79: LATEST SITUATION MAP IN UKRAINE, SHOWING TAKEN MAURIUPOL BUT ODESSA STILL FREE

- FIGURE 80: RESONAC BUSINESS SEGMENT REVENUE 2022

- FIGURE 81: RARE GAS PRICE ESCALATION

- FIGURE 82: HE MATERIALS SUPPLIER TIER STRUCTURE

- FIGURE 83: TUNGSTEN USE BY INDUSTRY (TECHCET ESTIMATE)

- FIGURE 84: ELECTRONIC SPECIALTY GASES

- FIGURE 85: BULK GASES 177

LIST OF TABLES

- TABLE 1: SPECIALTY AND BULK GAS REVENUE 2022, 2027

- TABLE 2: ELECTRONIC GAS MARKET GROWTH RATES BY END MARKET

- TABLE 3: 5-YEAR SPECIALTY GAS SUPPLY & DEMAND

- TABLE 4: GAS TRENDS AND OPPORTUNITIES BY DEVICE TYPE & PROCESS TECHNOLOGY

- TABLE 5: GLOBAL GDP AND SEMICONDUCTOR REVENUES*

- TABLE 6: IMF ECONOMIC OUTLOOK*

- TABLE 7: DATA CENTER SYSTEMS AND COMMUNICATION SERVICES MARKET SPENDING 2022

- TABLE 8: OVERVIEW OF DEPOSITION PROCESSES BY DEVICE TYPE AND MATERIAL

- TABLE 9: ETCH GASES SUMMARY TABLE

- TABLE 10: GAS TRENDS AND OPPORTUNITIES BY DEVICE TYPE

- TABLE 11: LINDE FINANCIALS AND REGIONAL SALES

- TABLE 12: AIR PRODUCTS REGIONAL FINANCIALS

- TABLE 13: TAIYO NIPPON SANSO REGIONAL FINANCIALS

- TABLE 14: ESTIMATED SUPPLY CHAIN SUPPLIER RANKING

- TABLE 15: REGIONAL SUMMARY OF GAS MARKET

- TABLE 16: CO2 EMISSIONS PER TONS SHIPPED BY OCEAN, TRUCK OR RAIL

- TABLE 17: GAS GWP AND ATMOSPHERIC LIFETIME

- TABLE 18: ELECTRONIC GAS MARKET SIZE AND GROWTH

- TABLE 19: TOTAL REVENUE 2022 COMPARED TO 2021 OF MAJOR GAS COMPANIES AND GAS SUPPLIERS

- TABLE 20: ELECTRONIC GAS MARKET GROWTH RATES BY END MARKET

- TABLE 21: 5-YEAR SPECIALTY GAS SUPPLY & DEMAND

- TABLE 22: M&A ACTIVITIES

- TABLE 23: SPECIALTY GAS INDUSTRY MATRIX

- TABLE 24: GASES USED IN FPD MANUFACTURING

- TABLE 25: HYDRIDE GAS SUPPLIERS

- TABLE 26: SILICON PRECURSOR SUPPLIERS

- TABLE 27: ETCHANT GAS SUPPLIERS

- TABLE 28: DEPOSITION/MISC. GAS SUPPLIERS

- TABLE 29: BULK GAS SUPPLIERS

- TABLE 30: ETCH ROADMAPS

- TABLE 31: ETCH ROADMAPS

- TABLE 32: ETCH ROADMAPS