|

市場調查報告書

商品編碼

1408768

消費性半導體元件:市場佔有率分析、產業趨勢與統計、2024年至2029年成長預測Semiconductor Device In Consumer Industry - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts 2024 - 2029 |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

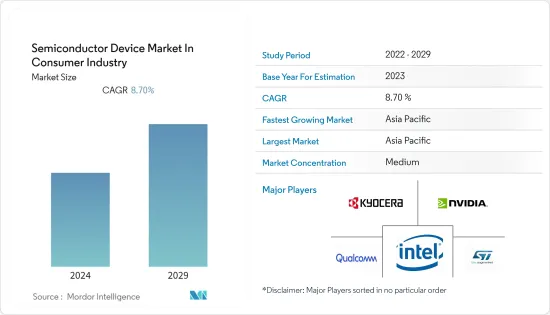

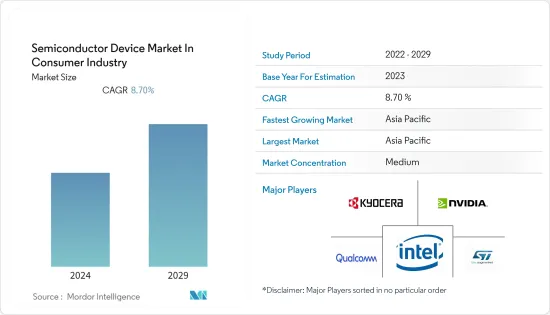

本會計年度消費性半導體元件市場價值為 834 億美元,預計將達到 1,269 億美元,預測期內複合年成長率為 8.7%。

主要亮點

- 大多數家用電子電器,例如行動電話電腦、遊戲機、微波爐和冰箱,均由整合式晶片、二極體和電晶體等半導體供電。對此類設備的高需求是推動市場成長的主要因素。

- 積體電路廣泛普及微處理器控制的家用電子電器中,從行動電話和可攜式音樂播放器到遊戲系統、個人電腦和其他數位裝置。積體電路 (IC) 或晶片是一種高度複雜的設備,它將許多電子元件(例如電容器、電晶體和電阻器)封裝到矽晶圓上幾平方公分的區域中。

- 此外,消費物聯網 (IoT) 等趨勢的出現正在推動消費半導體設備市場的需求。消費者物聯網的一個理想範例是智慧家居,其中電子設備、照明、暖通空調系統和家用電器均由中央集線器控制和監控。所有物聯網設備都需要半導體,因為物聯網應用如果沒有積體電路和感測器就無法運行,這為所研究的市場創造了巨大的成長潛力。

- 此外,近年來市場上智慧型手機和智慧家居設備的爆炸性成長正在推動消費半導體設備市場的需求。數位設備中擴大採用第五代(5G)無線技術也是連網型設備和智慧產品需求不斷成長、支持市場成長的關鍵因素之一。

- 俄羅斯和烏克蘭之間的戰爭對半導體產業的供應鏈產生了負面影響。據SEMI稱,烏克蘭和中國供應約80%的氙氣和氪氣。這些氣體大量用於半導體製造,主要用於鋼鐵製造並藉助空氣分離設備。

- 隨著戰爭的爆發以及其他地區缺乏專用空氣分離設備,半導體製造的交貨時間增加,導致所研究行業的晶片短缺。

半導體裝置市場趨勢

智慧型手機和智慧型穿戴裝置的普及提高

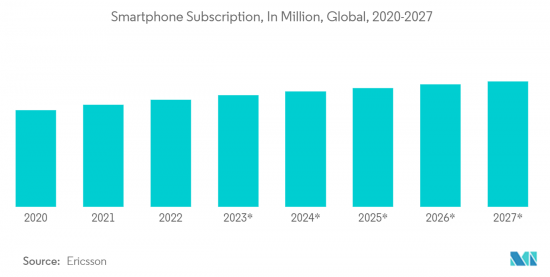

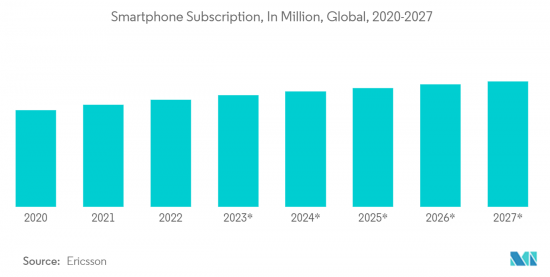

- 人口成長和都市化正在提高智慧型手機的普及,尤其是在開發中國家,這正在推動消費半導體設備市場的需求。例如,根據 GSMA 的數據,到 2025 年,智慧型手機預計將佔 5 個連線中的 4 個,高於 2019 年的 65%。

- 此外,根據BankMyCell的數據,截至2022年9月,全球智慧型手機用戶數為66.48億,這意味著全球83.04%的人口擁有智慧型手機。擁有智慧型手機或功能手機的人數為72.6億,佔全球人口的91.08%。

- 此外,隨著5G普及的普及以及相容5G的智慧型手機的需求增加,消費產業的半導體裝置市場預計將經歷高速成長。例如,根據 GSMA 的數據,到 2025 年,5G 網路可能覆蓋全球三分之一的人口。在 5G 無線蜂巢式網路中,智慧型手機電池效率和最佳電力利用率已成為促進半導體裝置成長的關鍵因素。

- 智慧型手錶環、健身追蹤器、活動追蹤器、運動手錶、虛擬實境(VR)耳機等智慧穿戴裝置與人工智慧(AI)、物聯網(IoT)等先進技術相結合。大量感測器和積體電路(IC)。例如,Fitbit、智慧型手錶和脈動式血氧監測儀系統等穿戴式系統採用光學感測器,為即時追蹤患者健康狀況提供解決方案。因此,隨著這些設備的使用不斷增加,整個消費半導體設備市場受到了積極影響,並呈現穩定成長。

- 許多供應商也專注於新產品開發,以滿足不斷成長的需求並擴大基本客群。例如,2023年1月,221e srl和意法半導體合作,基於221e的感測AI軟體和意法半導體的微控制器和智慧型感測器,為穿戴式裝置、物聯網和其他消費應用提供人工智慧解決方案。

亞太地區主導市場

- 由於領先的消費電子製造商的存在,預計消費半導體設備市場將由亞太地區主導。預計該市場將受到智慧型手機普及、5G普及和智慧家電增加的推動。

- 多家跨國公司將亞太地區視為其未來成長的關鍵市場之一。亞太地區消費市場的成長主要受到有利的人口趨勢和可支配收入增加的推動。

- 由於大型製造商的存在,該地區是最大的消費性電子市場之一。隨著多個國家消費性電子產業的擴張,消費產業對半導體元件市場的需求預計將會增加。例如,印度是世界領先的消費品和尖端技術市場之一。印度品牌資產基金會 (IBEF) 預測,印度家用電子電器(ACE) 市場將以 9% 的複合年成長率成長,到 2025 年將達到 211.8 億美元。據估計,這些數字將推動該地區產品發布的成長。

- 此外,由於能源成本不斷上升,對智慧家庭的需求不斷成長,預計將導致恆溫器、照明和智慧插座採用能源效率和節省成本的解決方案。這些市場對智慧家庭設備和智慧電源管理設備的需求不斷成長,預計將推動該地區消費產業半導體設備市場的需求成長。

- 此外,該行業的領先公司正致力於擴大其區域業務以擊敗競爭對手。例如,2023年3月,三星宣布將投資2,280億美元在韓國興建新的半導體工廠。

半導體裝置產業概況

由於持續整合、技術進步和地緣政治因素,消費產業半導體元件市場目前正在經歷顯著波動。市場競爭持續加劇,透過創新獲得永續競爭優勢至關重要。在這種動態環境下,品牌形像是一個至關重要的因素,特別是考慮到半導體製造業最終用戶對品質的高期望。

該市場由市場滲透率較高的大公司主導,例如英特爾公司、英偉達公司、京瓷公司、高通技術公司和意法半導體公司。在這種競爭形勢中,創新、上市時間和性能成為產業參與者的關鍵差異化因素。總體而言,競爭公司之間的敵對行動在預測期內穩定增加。

2023 年 4 月,瑞薩電子宣布推出首款基於先進 22 奈米製程技術的微控制器 (MCU)。這項創新產品的推出旨在為客戶提供卓越的性能,同時透過降低核心電壓來降低功耗。

2023年3月,意法半導體與華邦電子公司建立策略合作夥伴關係,將高效能記憶體整合到面向消費和智慧工業應用的STM32設備中。此次合作的目的是將華邦的DDR3動態RAM與ST的STM32M P1 MPU結合。這些 MPU 整合了多達兩個 Cortex-A7 內核,並提供先進的周邊、物聯網安全硬體和高效晶載電源轉換積體電路。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場洞察

- 市場概況

- 產業價值鏈分析

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭公司之間敵對關係的強度

- 宏觀趨勢對產業的影響

第5章市場動態

- 市場促進因素

- 智慧科技在家電領域的普及

- 5G的普及和5G智慧型手機需求的增加

- 市場挑戰

- 供應鏈中斷

第6章市場區隔

- 依設備類型

- 離散半導體

- 光電子學

- 感應器

- 積體電路

- 模擬

- 邏輯

- 記憶

- 微

- 微處理器 (MPU)

- 微控制器(MCU)

- 數位訊號處理器

- 按地區

- 美國

- 歐洲

- 日本

- 中國

- 韓國

- 台灣

- 世界其他地區

第7章 競爭形勢

- 公司簡介

- Intel Corporation

- Nvidia Corporation

- Kyocera Corporation

- Qualcomm Incorporated

- STMicroelectronics

- Micron Technology Inc.

- Xilinx Inc.

- NXP Semiconductors NV

- Toshiba Corporation

- Texas Instruments Inc.

- Taiwan Semiconductor Manufacturing Company(TSMC)Limited

- SK Hynix Inc.

- Samsung Electronics co. ltd

- Fujitsu Semiconductor Ltd

- Rohm Co. Ltd

- Infineon Technologies AG

- Renesas Electronics Corporation

- Advanced Semiconductor Engineering Inc.

- Broadcom Inc.

- ON Semiconductor Corporation

第8章投資分析

第9章市場的未來

The semiconductor device market in the consumer industry was valued at USD 83.4 billion in the current year and is expected to register a CAGR of 8.7%, reaching USD 126.9 billion over the forecast period.

Key Highlights

- Most consumer electronics, like mobile phones, laptops, game consoles, microwaves, and refrigerators, operate with semiconductors, such as integrated chips, diodes, and transistors. The high demand for these devices is a key factor contributing to the market growth.

- The use of integrated circuits is widespread in consumer electronics with microprocessor control, from cell phones and portable music players to gaming systems, PCs, and other digital devices. An integrated circuit (IC) or chip is an extremely sophisticated device that packs up many electronic components like capacitors, transistors, and resistors into an area of a few square centimeters on a silicon wafer.

- Further, the emergence of trends, such as consumer Internet of Things (IoT), has fueled the demand for the semiconductor devices market in the consumer industry. An ideal example of consumer IoT is the smart home, where electronic equipment, lighting, HVAC systems, and appliances are all controlled and monitored from a central hub. IoT applications cannot work without integrated circuits and sensors, so all IoT devices require semiconductors, which creates a huge growth potential for the market studied.

- Moreover, the explosive growth of smartphones and smart home devices in the markets in recent years has fueled the demand for the semiconductor device market in the consumer industry. The increasing adoption of the fifth-generation (5G) wireless technology for digital devices is also one of the major contributing factors to the rising demand for connected devices and smart products, thereby supporting the market's growth.

- The Russia and Ukraine war negatively impacted the supply chain in the semiconductor Industry. According to SEMI, Ukraine and China supply about 80% of Xenon and krypton gasses. These gasses are highly used in semiconductor manufacturing, and they can be obtained mainly through steel manufacturing and with the help of Air Separation units.

- With the war in place and no dedicated Air Separation Units elsewhere, the lead time for semiconductor manufacturing is increasing, leading to chip shortages across the industries studied.

Semiconductor Device Market Trends

Increase Penetration of Smartphones and Smart Wearable Devices

- Due to the increasing population and urbanization, smartphone adoption rates are increasing, particularly in developing countries, which has fueled the demand for the semiconductor device market in the consumer industry. For instance, as per GSMA, by 2025, smartphones are expected to account for four of every five connections, up from 65% in 2019.

- Moreover, as per BankMyCell, as of September 2022, smartphone users worldwide are 6.648 billion, translating to 83.04% of the world's population owning a smartphone. The number of people owning a smart and feature phone is 7.26 billion, making up 91.08% of the world's population.

- Further, the semiconductor device market in the consumer industry will witness high growth due to the growing penetration of 5G technology, which drives the demand for 5G-enabled smartphones. For instance, as per GSMA, by 2025, 5G networks will likely cover one-third of the world's population. In the 5G wireless cellular networks, smartphone battery efficiency and optimal power utilization have emerged as important factors contributing to the growth of semiconductor devices.

- Additionally, several smartphone manufacturers are focusing on launching technologically advanced phones to gain a competitive edge, further supporting the market growth. For instance, in May 2023, Poco announced the launch of Poco F5 in India and global markets. The company is also launching the Poco F5 Pro simultaneously globally.

- Smart wearable devices, such as smartwatches, smart wristbands, fitness trackers, activity trackers, sports watches, and virtual realty (VR) headsets, are integrated with advanced technologies such as artificial intelligence (AI) and the Internet of Things (IoT), which employ a huge number of sensors and integrated circuits (ICs). For instance, fit bits, smartwatches, and pulse oximeters are among the wearable systems incorporated with optical sensors to provide real-time patient health tracking solutions. Therefore, with the increased use of these devices, the overall semiconductor device market in the consumer industry is impacted positively, exhibiting steady growth.

- Many vendors are also focusing on developing new products to meet the growing demands and increase customer base. For instance, in January 2023, 221e srl and STMicroelectronics joined forces to enhance artificial intelligence solutions for wearable, IoT, and other consumer applications based on 221e's sensing AI software and STMicroelectronics's microcontrollers and intelligent sensors.

Asia-Pacific to Dominate the Market

- The semiconductor device market in the consumer industry is projected to be dominated by Asia-Pacific owing to the presence of leading consumer electronics manufacturers. The market is expected to be driven by increasing smartphone penetration, 5G penetration, and smart home appliances.

- Several global companies see the Asia-Pacific region as one of the key markets likely to generate future growth. The growth of the Asia-Pacific consumer market is mainly driven by favorable demographics and increasing disposable income.

- With the presence of significant manufacturers, the region is among the biggest consumer electronics markets. The demand for the semiconductor devices market in the consumer industry is anticipated to increase as the consumer electronics industry expands in several countries. India, for instance, is one of the major global markets for consumer goods and the newest technology. India Brand Equity Foundation (IBEF) predicted that the market for Indian appliances and consumer electronics (ACE) will grow at a 9% CAGR to reach USD 21.18 billion by 2025. Such numbers are estimated to drive the growth of product launches in the region.

- Moreover, the demand growth for smart homes is expected to be driven by rising energy costs, which has led to the adoption of energy-efficient and cost-saving solutions for thermostats, lighting, and smart outlets. Such an increase in the demand for smart home devices and smart power management devices in the market is expected to fuel the demand growth of the semiconductor device market in the consumer industry in the region.

- Furthermore, major industry players focus on expanding their regional operations to stay ahead of the competition. For instance, in March 2023, Samsung announced to build a new semiconductor facility in South Korea by investing USD 228 billion.

Semiconductor Device Industry Overview

The semiconductor device market in the consumer industry is currently experiencing significant fluctuations due to ongoing consolidation, technological advancements, and geopolitical factors. In a market where gaining a sustainable competitive advantage through innovation is of paramount importance, competition is poised to escalate. Given this dynamic environment, brand identity becomes a crucial factor, especially considering the high expectations of quality from end-users in the semiconductor manufacturing sector.

The market is dominated by established giants, including Intel Corporation, Nvidia Corporation, Kyocera Corporation, Qualcomm Technologies Inc., and STMicroelectronics NV, which have achieved substantial market penetration. In this competitive landscape, innovation, time-to-market, and performance stand out as the key differentiators for industry players. Overall, the competitive rivalry is steadily increasing over the forecast period.

April 2023 witnessed Renesas Electronics Corporation's milestone announcement, as they introduced their first microcontroller (MCU) based on advanced 22-nm process technology. This innovative product launch aims to provide customers with superior performance while reducing power consumption through lower core voltages.

In March 2023, STMicroelectronics and Winbond Electronic Corporation entered into a strategic partnership to amalgamate high-performance memory with STM32 devices for consumer and smart industrial applications. The partnership's goal is to combine Winbond's DDR3 dynamic RAM with ST's STM32M P1 MPUs. These MPUs incorporate up to two Cortex-A7 cores and offer advanced peripherals, IoT security hardware, and highly efficient on-chip power conversion integrated circuits.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Consumers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

- 4.4 Impact of Macro Trends on the Industry

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Proliferation of Smart Technologies in the Consumer Electronics Sector

- 5.1.2 Increased Deployment of 5G and Rising Demand for 5G Smartphones

- 5.2 Market Challenges

- 5.2.1 Supply Chain Disruptions

6 MARKET SEGMENTATION

- 6.1 By Device Type

- 6.1.1 Discrete Semiconductors

- 6.1.2 Optoelectronics

- 6.1.3 Sensors

- 6.1.4 Integrated Circuits

- 6.1.4.1 Analog

- 6.1.4.2 Logic

- 6.1.4.3 Memory

- 6.1.4.4 Micro

- 6.1.4.4.1 Microprocessors (MPU)

- 6.1.4.4.2 Microcontrollers (MCU)

- 6.1.4.4.3 Digital Signal Processor

- 6.2 By Geography

- 6.2.1 United States

- 6.2.2 Europe

- 6.2.3 Japan

- 6.2.4 China

- 6.2.5 Korea

- 6.2.6 Taiwan

- 6.2.7 Rest of the World

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Intel Corporation

- 7.1.2 Nvidia Corporation

- 7.1.3 Kyocera Corporation

- 7.1.4 Qualcomm Incorporated

- 7.1.5 STMicroelectronics

- 7.1.6 Micron Technology Inc.

- 7.1.7 Xilinx Inc.

- 7.1.8 NXP Semiconductors NV

- 7.1.9 Toshiba Corporation

- 7.1.10 Texas Instruments Inc.

- 7.1.11 Taiwan Semiconductor Manufacturing Company (TSMC) Limited

- 7.1.12 SK Hynix Inc.

- 7.1.13 Samsung Electronics co. ltd

- 7.1.14 Fujitsu Semiconductor Ltd

- 7.1.15 Rohm Co. Ltd

- 7.1.16 Infineon Technologies AG

- 7.1.17 Renesas Electronics Corporation

- 7.1.18 Advanced Semiconductor Engineering Inc.

- 7.1.19 Broadcom Inc.

- 7.1.20 ON Semiconductor Corporation