|

市場調查報告書

商品編碼

1408767

用於加工的半導體裝置-市場佔有率分析、產業趨勢與統計、2024年至2029年的成長預測Semiconductor Device For Processing Applications - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts 2024 - 2029 |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

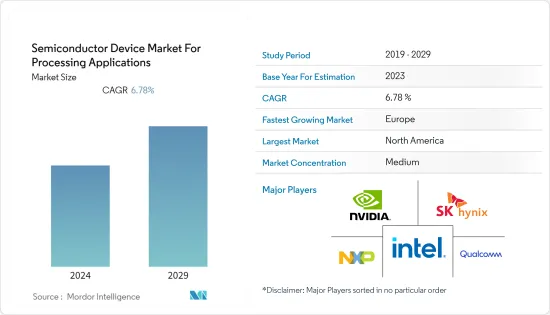

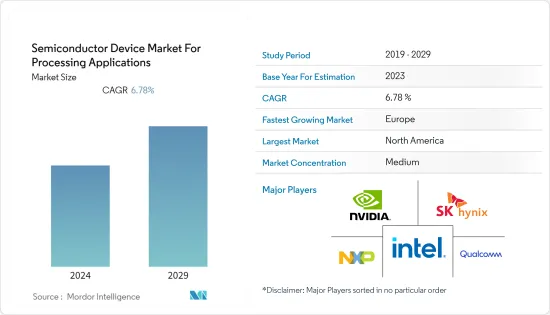

本會計年度加工半導體設備市場規模預計將達到2,011億美元,複合年成長率為6.78%,到預測期結束時將達到2,792.6億美元。

主要亮點

- 半導體產業正在經歷快速成長,半導體已成為所有現代技術的基本組成部分。該領域的進步和創新對所有下游技術產生直接影響。

- 半導體構成了所有計算設備的建構模組。例如,許多電晶體組成邏輯閘並處理二進位訊息,即電腦使用的一和零的程式碼。這些半導體元件還可以將二進位代碼儲存為儲存區塊。

- 隨著智慧型手機、個人電腦和筆記型電腦等運算設備的普及,世界各地和網路上即時產生和通訊的資料量正在迅速增加。為了適應這種成長,高效能運算 (HPC) 發揮了關鍵作用,並且正在經歷顯著成長。 HPC 是指處理資料、高速執行複雜運算、解決效能集中問題。實現HPC應用需要感測器、光電裝置等許多半導體裝置。

- 高效能運算 (HPC) 正在成為半導體產業的關鍵驅動力。

- 此外,COVID-19 的爆發加速了數位平台和雲端服務的使用,促使資料中心的發展激增。資料中心是儲存和共用應用程式和資料的設施。

- 半導體也是資料中心的關鍵組件。使用了多種設備,包括中央處理單元 (CPU)、圖形處理單元 (GPU)、記憶體、網路基礎設施晶片和電源管理。因此,半導體記憶體晶片是資料中心儲存和管理資料的重要裝置,其效能對於資料中心營運的成功至關重要。

半導體裝置市場趨勢

積體電路下的記憶體可望帶動市場需求

- 半導體記憶體是在積體電路上實現半導體電子元件的數位資料儲存裝置。記憶體有不同類型,例如 DRAM、SRAM、NOR 快閃記憶體、 NAND快閃記憶體、ROM 和 EPROM。記憶體有DRAM、SRAM、 NAND快閃記憶體、ROM、EPROM等多種類型,廣泛應用於電腦、筆記型電腦、相機、行動電話等數位家電。

- 資料中心需求的增加也推動了記憶體組件的需求。目前,北美的大型資料中心計劃正在推動對包括DRAM在內的記憶體的強勁需求。然而,以每位用戶的資料中心空間衡量,中國的網路資料中心預計將成長至少是美國規模的22倍,至少是日本目前規模的10倍。因此,DRAM擁有巨大的成長機會,正在影響半導體元件產業。

- 此外,攜帶式系統市場的成長正在推動半導體產業對用於大容量儲存應用的非揮發性記憶體(NVM)技術的興趣。對更高效率、更快記憶體存取和更低功耗的需求不斷成長是推動 NVM 市場成長的關鍵因素。資料中心應用程式越來越需要 NVM 來防止突然斷電導致的資料遺失。隨著資料中心的增加,下一代非揮發性記憶體的採用也將增加,預計將推動市場成長。

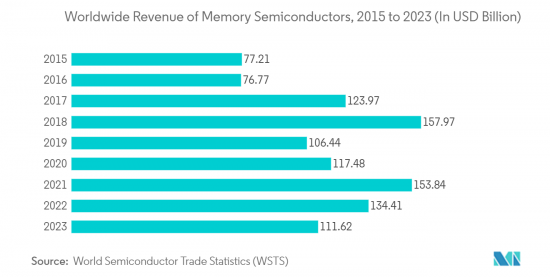

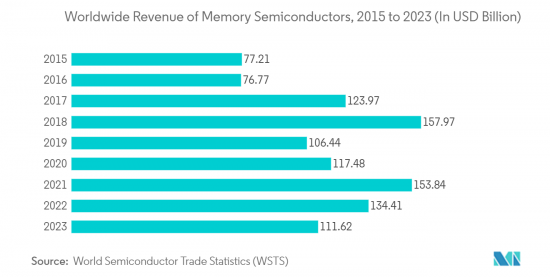

- 此外,根據 WSTS 的數據,2022 年內存組件銷售收益預計將達到 1,344.1 億美元,而 2021 年為 1,548.4 億美元。然而,內存組件銷售收入有所下降,預計為1116.2億美元,但在不久的將來可能會成長,並在年終實現良好的成長。這些因素可能會促進市場成長。

- 三星正在參與該合作夥伴關係。最終用戶可以確信,未來的儲存解決方案將得到各種設備供應商和垂直整合的硬體和軟體公司的支援。例如,2022 年 3 月,三星電子和西部資料同意合作標準化和普及下一代資料放置、處理和結構 (D2PF) 儲存技術。兩家公司希望採取這些措施將使行業能夠專注於更廣泛的應用,並最終為客戶帶來更多價值。

- 同樣在 2022 年 7 月,美光科技宣布已開始量產全球首款採用業界領先創新技術建構的 232 層 NAND,以推動儲存解決方案實現前所未有的效能。該公司的232層NAND首次證明3D NAND可以擴展到200層以上,標誌著儲存創新的分水嶺時刻。

歐洲預計將實現顯著成長

- 歐洲地區是全球最重要的技術中心,也是現代科技的重要推手和採用者。先進技術的不斷滲透和半導體的日益採用正在推動該地區的市場成長。

- 隨著物聯網(IoT)的興起,半導體裝置正在整合到各種類型的設備中,擴大了運算和資料儲存應用的範圍。對這些設備的需求也在穩定成長。材料和架構正在穩步發展,以提高尖端記憶體和邏輯裝置、功率半導體裝置以及各種感測器的性能。

- 此外,5G 部署預計將實現物聯網連接、自動化和邊緣技術。具有這種更智慧標準的新設備將要求工廠生產具有更大記憶體和儲存容量的更高效能晶圓。

- 5G 網路和技術有望透過改變現有市場領域和產業來進一步革新無線通訊。該公司表示,從2021年到2025年,5G將為歐洲經濟所有主要產業創造高達2兆歐元(2.17兆美元)的新銷售額。因此,支援 5G 的新設備將需要晶圓廠生產具有更大記憶體和儲存容量的更高效能晶圓。

- 2022年3月,英特爾宣布第一階段計劃,未來10年在歐盟投資800億歐元(868.4億美元),涵蓋整個半導體價值鏈,包括研發、製造和封裝技術。該投資還包括在德國建立半導體製造巨型基地,在法國開發新的研發和設計設施,以及在義大利、波蘭、愛爾蘭和西班牙投資約170億日圓用於研發、製造和代工服務。計劃投資184.5億歐元(184.5 億美元)。

半導體裝置產業概況

加工半導體設備市場正在經歷適度的碎片化,多個競爭對手在整合加劇、技術進步和不斷變化的地緣政治局勢中應對波動。在透過創新建立永續競爭優勢至關重要的市場中,這種競爭的加劇可能會變得更加激烈。鑑於半導體製造業最終用戶的品質期望,品牌標誌在這一形勢發揮著至關重要的作用。

市場滲透率異常高,主要是由於英特爾公司、英偉達公司、京瓷公司和高通技術公司等重要的行業領導者的存在。

2022 年 4 月,SK 海力士與其位於聖荷西的子公司 Solidigm 合作,推出了專為資料中心設計的最新固態硬碟 (SSD),稱為 P5530。 SSD利用快閃記憶體來儲存資料,這款創新設備將SK Hynix的旗艦128層4D NAND與Solidigm的SSD控制器結合。

2022 年 3 月,三星電子和西部資料同意就下一代資料放置、處理和結構 (D2PF) 儲存技術的標準化和普及進行合作。兩家公司的共同努力旨在簡化行業實踐並實現更廣泛的應用,最終為客戶帶來更大的價值。

2022 年 1 月,鎧俠宣布推出通用快閃記憶體儲存 (UFS) 3.1 版嵌入式快閃記憶體裝置。這些元件利用該公司開創性的每單元 4 位元四級單元 (QLC) 技術,能夠在單一封裝中實現最高密度。該技術特別適合高階智慧型手機等高密度應用。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場洞察

- 市場概況

- 科技趨勢

- 產業價值鏈/供應鏈分析

- 產業吸引力波特五力分析

- 供應商的議價能力

- 買方議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭公司之間的敵對關係

- 宏觀經濟走勢對市場的影響

第5章市場動態

- 市場促進因素

- 擴大物聯網和人工智慧等技術的採用

- 5G的普及和資料中心需求的增加

- 市場課題

- 供應鏈中斷導致半導體晶片短缺

第6章市場區隔

- 依設備類型

- 離散半導體

- 光電子學

- 感應器

- 積體電路

- 模擬

- 邏輯

- 記憶

- 微

- 微處理器 (MPU)

- 微控制器(MCU)

- 數位訊號處理器

- 依地區

- 北美洲

- 歐洲

- 亞太地區

- 世界其他地區

第7章 競爭形勢

- 公司簡介

- Intel Corporation

- Nvidia Corporation

- Qualcomm Incorporated

- NXP Semiconductors NV

- SK Hynix Inc.

- Kyocera Corporation

- Samsung Electronics Co., Ltd.

- Advanced Micro Devices, Inc

- ST microelectronics Nv

- Micron Technology Inc.

- Toshiba Electronic Devices And Storage Corporation

- Infineon Technologies AG

第8章投資分析

第9章市場的未來

The semiconductor device market for processing applications is estimated at USD 201.1 billion in the current year, registering a CAGR of 6.78%, to reach USD 279.26 billion by the end of the forecast period.

Key Highlights

- The semiconductor industry is witnessing rapid growth, with semiconductors emerging as the basic building blocks of all modern technology. The advancements and innovations in this field are resulting in a direct impact on all downstream technologies.

- Semiconductors form the building blocks of any computing device. For instance, many transistors make up a logic gate that processes binary information, the code of ones and zeros computers use. These semiconductor devices can also retain binary code as memory blocks.

- With the growing popularity of computing devices like smartphones, PCs, and laptops, the amount of data generated and communicated across a global network, often in real-time, has grown rapidly. To keep up with this growth, High-performance computing (HPC) has become crucial and is seeing significant growth. HPC refers to processing data and performing complex calculations at high speeds to solve performance-intensive problems. Many semiconductor devices like sensors and optoelectronics are required to enable HPC applications.

- High-performance computing (HPC) has emerged as an important growth driver for the semiconductor industry. For instance, Taiwan Semiconductor Manufacturing Co. (TSMC) expects the HPC platform to be the strongest-growing platform in 2022 and the largest contributor to the company's growth, fueled by the structural mega-trend, driving rising needs for higher computing power and energy-efficient computing.

- Further, the COVID-19 pandemic accelerated the use of digital platforms and cloud services, resulting in a surge in data center development. A data center is a facility that stores and shares applications and data.

- Also, semiconductors serve as a primary component for data centers. Different devices are used, like central processing units (CPUs), graphics processing units (GPUs), memory, chips for network infrastructure, and power management. Therefore, semiconductor memory chips are the key devices for storing and managing data in data centers, and their performance is crucial to the success of data center operations.

Semiconductor Device Market Trends

Memory Segment Under Integrated Circuits is Expected to Boost The Demand in The Market

- The semiconductor memory is a digital electronic data storage device implemented with semiconductor electronic devices on an integrated circuit. Different types of memory are available, such as DRAM, SRAM, Nor Flash, NAND Flash, ROM, and EPROM. They find widespread application in digital consumer products like PCs, laptops, cameras, and phones.

- The increasing demand for data centers is also bolstering the demand for memory components. Currently, large data center projects in North America have contributed to the strong demand for memory, such as DRAM. However, according to the measure of data center space per user, China's internet data centers are poised to grow to at least 22 times that of the United States or at least 10 times the current space of Japan. Hence, DRAM has a significant opportunity for growth and thus is impacting the semiconductor device industry.

- Further, the growth of the portable systems market attracted the semiconductor industry's interest in non-volatile memory (NVM) technologies for mass storage applications. The rise in demand for greater efficiency, faster memory access, and low power consumption are some of the significant factors driving the NVM market growth. There is an increasing need for NVM in data center applications to protect data losses from a sudden power outage. With the growth of data centers, the adoption of next-generation non-volatile memory is also expected to increase, driving market growth.

- Moreover, according to WSTS, In 2022, it is projected that revenue from memory component sales will amount to USD 134.41 billion, and in 2021 the recorded revenue of USD 154.84 billion. However, the revenue from memory component sales decreased, with an estimated amount of USD 111.62 billion, but it is likely to grow in the near future, and by the end of 2023, it will achieve good growth. Such factors are likely to boost the market growth.

- Samsung participates in partnerships; end users may be sure that various device suppliers and vertically integrated hardware and software firms will support its upcoming storage solutions. For instance, in March 2022, Samsung Electronics and Western Digital agreed to work together to standardize and promote next-generation data placement, processing, and fabrics (D2PF) storage technologies. They hope that by taking these steps, the industry will be able to concentrate on a wide range of applications that will ultimately provide customers with more value.

- Also, in July 2022, Micron Technology, Inc. announced that it had begun volume production of the world's first 232-layer NAND, built with industry-leading innovations to drive unprecedented performance for storage solutions. The company's 232-layer NAND is a watershed moment for storage innovation as the first proof of the capability to scale 3D NAND to more than 200 layers in production.

European Region Expected to Witness the Significant Growth

- The European region is home to some of the most crucial technology hubs across the globe and a critical driver and adopter of modern technology. The increasing penetration of advanced technologies and the increasing adoption of semiconductors drives market growth in the region.

- With the rise of the Internet of Things (IoT), semiconductor devices are being incorporated into all types of devices, with a wider range of computing and data storage applications. Demand for these devices is also steadily increasing. Materials and architecture are steadily evolving to improve the performance of cutting-edge memory and logic devices, power semiconductor devices, and various types of sensors.

- Furthermore, the rollout of 5G is perceived to be the enabler of IoT connectivity, automation, and edge technologies. New devices in this smarter standard will require fabs to produce higher-performing wafers with even greater capacity for memory and storage.

- 5G networks and technology are further revolutionizing wireless communications by transforming existing market sectors and industries. As per the company, between 2021 and 2025, 5G will drive up to EUR 2.0 trillion (USD 2.17 trillion) in total new sales across all major industries in the European economy. As such, new devices that enable 5G will require fabs to produce higher-performing wafers with even greater capacity for memory and storage.

- In March 2022, Intel issued the first phase of its EUR 80 billion (USD 86.84 billion) investment plan in the EU over the next decade across the semiconductor value chain, including R&D, manufacturing, and packaging technologies. Further in this investment, the company plans to invest approximately EUR 17 billion (USD 18.45 billion) in establishing a semiconductor fab mega-site in Germany, as well as the development of a new R&D and design facility in France, and to invest in R&D, manufacturing, and foundry services in Italy, Poland, Ireland, and Spain.

Semiconductor Device Industry Overview

The semiconductor device market for processing applications is experiencing moderate fragmentation, with several competitors navigating fluctuations amidst growing consolidation, technological advancements, and evolving geopolitical scenarios. This heightened competition is set to intensify in a market where establishing a sustainable competitive advantage through innovation is of paramount importance. Given the expectations of quality from end-users in the semiconductor manufacturing sector, brand identity plays a pivotal role in this landscape.

The market penetration levels are notably high, primarily due to the presence of significant market incumbents such as Intel Corporation, Nvidia Corporation, Kyocera Corporation, Qualcomm Technologies Inc., and other industry leaders.

In April 2022, SK Hynix Inc. introduced its latest solid-state drive (SSD), known as the P5530, designed for data centers in collaboration with its San-Jose-based subsidiary, Solidigm. SSDs leverage flash memory to store data, and this innovative device combines SK Hynix's 128-layer 4D NAND, a core product, with Solidigm's SSD controller.

In March 2022, Samsung Electronics and Western Digital reached an agreement to collaborate on standardizing and promoting next-generation data placement, processing, and fabrics (D2PF) storage technologies. Their joint efforts aim to streamline industry practices, allowing for a broader array of applications that ultimately deliver greater value to customers.

In January 2022, Kioxia Corporation announced the launch of Universal Flash Storage (UFS) Ver. 3.1 embedded flash memory devices. These devices harness the company's pioneering 4-bit per cell quad-level-cell (QLC) technology, which has the capability to achieve the highest densities available in a single package. This technology is particularly suited for high-density applications like high-end smartphones

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Technological Trends

- 4.3 Industry Value Chain/Supply Chain Analysis

- 4.4 Industry Attractiveness Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitutes

- 4.4.5 Intensity of Competitive Rivalry

- 4.5 Impact of the Macroeconomics Trends on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Growing Adoption of Technologies Like IoT And AI

- 5.1.2 Increased Deployment of 5G And Rising Demand For Data Centers

- 5.2 Market Challenges

- 5.2.1 Supply Chain Disruptions Resulting In Semiconductor Chip Shortage

6 MARKET SEGMENTATION

- 6.1 By Device Type

- 6.1.1 Discrete Semiconductors

- 6.1.2 Optoelectronics

- 6.1.3 Sensors

- 6.1.4 Integrated Circuits

- 6.1.4.1 Analog

- 6.1.4.2 Logic

- 6.1.4.3 Memory

- 6.1.4.4 Micro

- 6.1.4.4.1 Microprocessors (MPU)

- 6.1.4.4.2 Microcontrollers (MCU)

- 6.1.4.4.3 Digital Signal Processors

- 6.2 By Geography

- 6.2.1 North America

- 6.2.2 Europe

- 6.2.3 Asia Pacific

- 6.2.4 Rest of the World

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Intel Corporation

- 7.1.2 Nvidia Corporation

- 7.1.3 Qualcomm Incorporated

- 7.1.4 NXP Semiconductors NV

- 7.1.5 SK Hynix Inc.

- 7.1.6 Kyocera Corporation

- 7.1.7 Samsung Electronics Co., Ltd.

- 7.1.8 Advanced Micro Devices, Inc

- 7.1.9 ST microelectronics Nv

- 7.1.10 Micron Technology Inc.

- 7.1.11 Toshiba Electronic Devices And Storage Corporation

- 7.1.12 Infineon Technologies AG