|

市場調查報告書

商品編碼

1408868

工業半導體裝置:市場佔有率分析、產業趨勢/統計、2024年至2029年成長預測Semiconductor Device For Industrial Applications - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts 2024 - 2029 |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

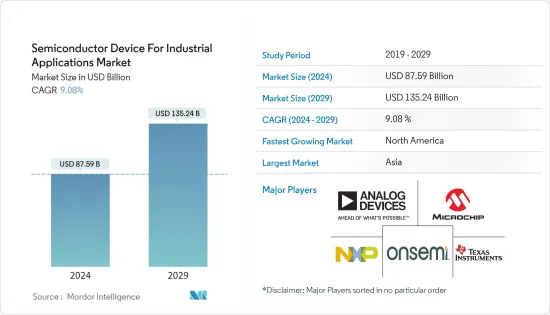

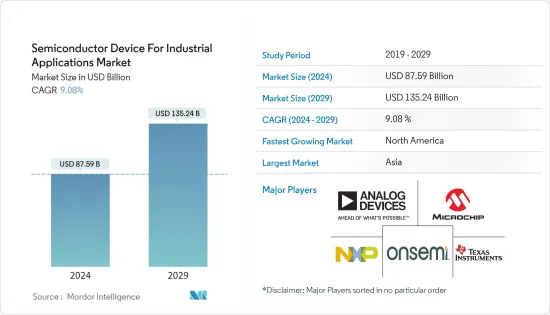

工業半導體裝置市場規模預計2024年為875.9億美元,預計2029年將達到1,352.4億美元,在預測期間(2024-2029年)複合年成長率為9.08%成長。

主要亮點

- 工業自動化的快速發展導致工業應用中擴大採用半導體裝置。工業 4.0 正在改變公司製造產品的方式。工業 4.0 是指智慧型互聯生產系統,旨在感知、預測或與物理世界交互,以做出支援生產的即時決策。工業 4.0 可以提高製造生產力、能源效率和永續性。

- 工業4.0最重要的組成部分之一是工業物聯網,它是指物聯網在工業領域和應用中的擴展和使用。工業物聯網中半導體的基本核心功能包括感測、連接和運算。例如,在工業物聯網中,感測器廣泛應用於各個行業,以監控設備、資產、系統和整體效能。

- 工業機器人是工業 4.0 的另一個關鍵推動者,也是半導體的常見應用領域,它是經過編程的機械設備,可在工業環境中自動執行與生產相關的任務。

- 為了發揮作用,工業機器人需要先進的感測器來捕獲關鍵資訊。感測器可以使用半導體處理單元來收集外部資訊,例如影像、紅外線、聲音、內部溫度、濕度、運動和位置資料。許多工業機器人現在都配備了 3D 視覺系統,通常由多個攝影機和一個或多個雷射位移感測器組成。

- 半導體產業的供需受到了 COVID-19 的顯著影響。製造地停工和政府封鎖嚴重影響了世界各地的生產和供應鏈。工業4.0意識的增強和智慧型工廠的頻繁採用加速了隨後的市場成長。

工業半導體裝置市場趨勢

感測器領域在工業應用中佔據主要佔有率

- 感測器是工廠自動化和工業 4.0 的重要組成部分。運動、環境和振動感測器透過線性和角度定位、傾斜檢測、調平以及衝擊跌落偵測來監控設備的健康狀況。

- 基於微加工感測 (MEMS) 元件的專用工業運動感測器可用於工業 4.0 應用。它們具有寬機械頻率感測頻寬、高可靠性以及高達 105°C 的精確操作。

- 工業感測器系統通常由 24V 直流電源供電,這與消費性系統中由 3V 或 5V 電源供電的感測器有很大不同。因此,工業感測器系統需要額外的電源管理來有效驅動感測器。這些系統使用 IO-Link 等數位輸出直接連接到微控制器和無線收發器。

- 被動紅外線 (PIR) 感測器或旋轉編碼器可以成為工業自動化系統中閾值測量的限位交換器。這些工業物聯網(IIoT)感測器透過有線或無線工業感測器網路連接到閘道器,而閘道器連接到物聯網進行即時分析和狀態監測。

- 這些感測器通常價格便宜,因為安裝和操作所需的時間較短。連接到現有機械的無線感測器和覆蓋解決方案具有成本效益,因為它們使用一組標準技術。

- 工業機器人的採用不斷增加,並成為實現工業 4.0 的重要元素。為了發揮作用,工業機器人需要先進的感測器來收集關鍵資料。除了溫度、濕度、運動和位置等內部資料外,感測器還採用半導體處理單元,可收集影像、紅外線輻射和聲音等外部資料。

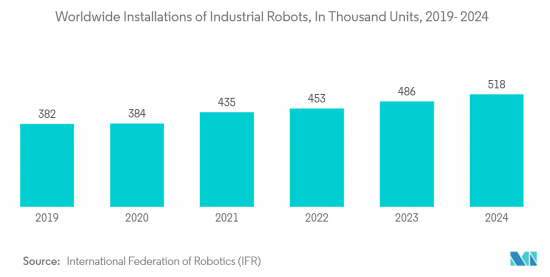

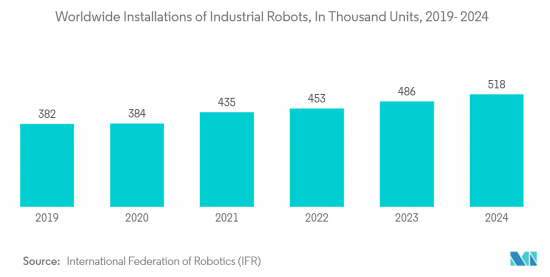

- 據國際機器人聯合會(IFR)稱,工業機器人的銷售量預計將激增。預計2024年,全球工業機器人出口量將達到518萬台。這一事實將對工業機器人製造中感測器的採用發揮重要作用,例如 2D/3D 視覺和力/扭矩感測器。

亞洲地區的市場成長顯著。

- 亞洲包括中國、日本、印度、韓國和其他亞洲地區。中國正在投資下一代技術並迅速實現工業自動化,在新技術和創新投資方面超過了西方國家。

- 例如,機器人技術在中國工業中的普及。根據《南華早報》報道,2023年上半年中國生產工業機器人222萬台,年增5.4%。據工信部數據顯示,服務機器人產量353萬台,成長9.6%。工業機器人引進的巨大成長率可能會在預測期內推動研究市場的發展。

- COVID-19的發展迫使日本工業部門重新審查既定的生產程序。日本在工業經濟自動化方面處於領先地位。日本現在可以透過工業中心向其他地區提供工廠自動化產品。此外,我們也向其他國家出口工廠自動化和工業控制設備。機器人的普及以及具有人工智慧功能的機器人的興起引發了新技術的誕生,以幫助企業提高生產力並最大限度地減少錯誤。

- 同樣,印度也受益於自動化在推動成長和競爭形勢中的關鍵作用,其產業形勢正在發生重大轉變。過去幾年,印度製造業一直在走向自動化。對此,許多全球企業都有興趣在印度投資智慧型工廠製造。例如,2022年12月,Schneider Electric計畫投資42.5億印度盧比(約51.3億美元)在印度班加羅爾開發一座新的智慧工廠。這些趨勢可能會在預測期內推動市場成長。

工業半導體裝置產業概況

工業半導體裝置市場的特點是競爭激烈且碎片化,許多全球和本地公司積極參與。該領域的主要企業包括 Analog Devices Inc.、NXP Semiconductors NV、Microchip Technology Inc.、ON Semiconductor Corporation 和 Texas Instruments Incorporated。這些公司不斷追求技術創新並促進與其他行業領導者的合作以保持競爭力。

2023 年 3 月,恩智浦半導體宣布推出 UCODE 9xm。 UCODE 9xm 是一款突破性產品,它將擴充性、適應性強的記憶體與頂級的讀寫效能相結合。 UCODE 9xm 有助於使用更小的標籤天線,允許對更小的物品進行單獨標記並無縫整合到智慧製造流程、供應鏈管理和追蹤應用中。這項演變旨在提高系統的整體可靠性和準確性,為使用者提供標記更廣泛的物件類型的多功能性,並帶來更全面的供應鏈視圖。

2022 年 6 月,ADI 公司宣布推出 ADTF3175 模組,這是一款工業級高解析度間接飛行時間 (iToF) 解決方案,專為 3D 深度感測和視覺系統而設計。這項創新模組使相機和感光元件能夠以令人難以置信的 100 萬像素解析度感知 3D 空間,使其適合工業自動化領域的應用。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場洞察

- 市場概況

- 波特五力分析

- 供應商的議價能力

- 買方議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭公司之間敵對關係的強度

- 產業價值鏈/供應鏈分析

- 評估宏觀趨勢對市場的影響

第5章市場動態

- 市場促進因素

- 人們對工業 4.0 和智慧工廠的認知不斷增強

- 市場抑制因素

- 半導體短缺限制市場擴張

第6章市場區隔

- 設備類型

- 離散半導體

- 光電子學

- 感應器

- 積體電路

- 模擬

- 邏輯

- 記憶

- 微

- 微處理器

- 微控制器

- 數位訊號處理器

- 地區

- 美國

- 歐洲

- 日本

- 中國

- 韓國

- 台灣

- 世界其他地區

第7章 競爭形勢

- 公司簡介

- Analog Devices Inc.

- Microchip Technology Inc.

- NXP Semiconductors NV

- ON Semiconductor Corporation

- Texas Instruments Incorporated

- Infineon Technologies AG

- AMS Technologies AG

- STMicroelectronics

- Renesas Electronics Corporation

- Rohm Co. Ltd

第8章投資分析

第9章 市場未來展望

The Semiconductor Device For Industrial Applications Market size is estimated at USD 87.59 billion in 2024, and is expected to reach USD 135.24 billion by 2029, growing at a CAGR of 9.08% during the forecast period (2024-2029).

Key Highlights

- Semiconductor devices are increasingly adopted in industrial applications owing to the rapid growth in industrial automation. Industry 4.0 is transforming the way companies manufacture their products. Industry 4.0 refers to intelligent and connected production systems designed to sense, predict, or interact with the physical world, making real-time decisions that support production. It can increase productivity, energy efficiency, and sustainability in manufacturing.

- One of the most critical components of Industry 4.0 is the Industrial Internet of Things, which indicates the extension and use of the IoT in industrial sectors and applications. Semiconductors' underlying core capabilities for IIoT include sensing, connectivity, and computing. For instance, in IIoT, sensors are widely used in different industries to monitor equipment, assets, systems, and overall performance.

- Another critical enabler of Industry 4.0 and a common area of application of semiconductors is industrial robots, which are mechanical machines programmed to automatically perform production-related tasks in industrial environments.

- For their functioning, industrial robots require sophisticated sensors that obtain essential information. Sensors can use semiconductor processing units to gather external information like images, infrared light, sound, internal temperature, moisture, movement, and position data. Currently, many industrial robots are equipped with 3D vision systems, usually comprised of multiple cameras or one or more laser displacement sensors.

- The semiconductor industry's supply and demand were both significantly impacted by COVID-19. The shutdown of manufacturing sites and government-induced lockdowns severely affected the production and supply chain of the entire globe. The growing awareness of Industry 4.0 and the frequent adoption of intelligent factories accelerated market growth in the following years.

Semiconductor Device For Industrial Applications Market Trends

Sensor Segment to Hold a Significant Share in Industrial Applications

- Sensors are a vital part of factory automation and Industry 4.0. Motion, environmental, and vibration sensors monitor equipment health, ranging from linear or angular positioning, tilt sensing, leveling, and shock to fall detection.

- Dedicated industrial motion sensors based on micromachined sensing (MEMS) elements are available for Industry 4.0 applications. These have a wide mechanical frequency sensing bandwidth, high reliability, and accurate operation up to 105°C.

- An industrial sensor system is often powered by a 24V DC source, which is very different from a sensor in a consumer system powered by a 3V or 5V source. As a result, industrial sensor systems require additional power management to drive the sensors effectively. These use digital outputs, such as IO-Link direct to a microcontroller or the wireless transceiver.

- Passive infrared (PIR) sensors and rotary encoders can be limit switches for threshold measurements in industrial automation systems. Such industrial Internet of Things (IIoT) sensors are linked through industrial sensor networks, either wired or wireless, back to a gateway and then back to the Internet of Things to provide real-time analysis and conditional monitoring.

- These sensors are generally cheaper because they take less time to install and run. A wireless sensor or overlay solution attached to an existing machine is cost-effective, as it uses a standard technology set.

- Industrial robotics adoption is increasing, an essential enabler of Industry 4.0. Industrial robots need sophisticated sensors to gather crucial data for them to function. In addition to internal data on temperature, moisture, movement, and position, sensors can employ semiconductor processing units to collect external data from sources, including pictures, infrared light, and sound.

- According to the International Federation of Robotics (IFR), industrial robot sales are anticipated to rise sharply. Global exports of industrial robots are predicted to reach 5,18,000 units in 2024. This fact will play a significant role in adopting sensors in manufacturing industrial robots such as 2D and 3D vision and force or torque sensors; collision sensors are widely used in it.

Asia Region to Grow Significantly in this Market

- Asia includes China, Japan, India, Korea, and the rest of Asia. China is investing in next-generation technologies, quickly automating the industry, and even positioned to surpass the Western countries in terms of new technology investment and innovation.

- For instance, in the widespread use of robotics in the Chinese industry. According to the South China Morning Post, China produced 2,22,000 industrial robotic units in the first half of 2023, an increase of 5.4% compared to the same period last in 2022. According to Ministry figures, it also generated 3.53 million service robot units, a 9.6% increase. This tremendous growth rate in installing industrial robots will drive the studied market during the forecast period.

- The development of COVID-19 forced the Japanese industrial sector to reexamine its established production procedures. Japan has led the automation of the industrial economy. The nation can now provide factory automation products to other regions through its industrial center. Additionally, it exports factory automation and industrial controls to other countries. Robot proliferation and the rise of robots with AI capabilities have sparked the creation of new technologies that may aid businesses in enhancing productivity and minimizing errors.

- Similarly, India is benefiting from the critical role of automation in driving growth and competitiveness, which has seen a remarkable transformation of its industrial landscape. Over the last few years, India's manufacturing sector has been moving towards automation. Regarding this, many global companies are interested in investing in the manufacturing of intelligent factories in India. For instance, in December 2022, Schneider Electric plans to invest INR 425 crore (around USD 5.13 billion) to develop a new smart factory in Bangalore, India. These trends will drive the studied market growth during the projected period.

Semiconductor Device For Industrial Applications Industry Overview

The semiconductor device market for industrial applications is characterized by fierce competition and fragmentation, with a multitude of global and local players actively participating in the industry. Key companies in this domain include Analog Devices Inc., NXP Semiconductors NV, Microchip Technology Inc., ON Semiconductor Corporation, and Texas Instruments Incorporated, among others. These players continually pursue innovation and foster collaborations with other industry leaders to remain competitive.

In March 2023, NXP Semiconductors unveiled the UCODE 9xm, a revolutionary product that combines expansive, adaptable memory with top-tier read/write performance. The UCODE 9xm facilitates the utilization of smaller tag antennas, making it possible to individually tag smaller items and seamlessly integrate them into smart manufacturing processes, supply chain management, and tracking applications. This advancement is aimed at enhancing the overall reliability and precision of the system, offering users greater versatility in tagging a wider variety of object types, thus leading to a more comprehensive understanding of the supply chain.

In June 2022, Analog Devices made an exciting announcement about the launch of the ADTF3175 module, an industrial-grade, high-resolution indirect Time-of-Flight (iToF) solution designed for 3D depth sensing and vision systems. This innovative module empowers cameras and sensors to perceive 3D space with an impressive one-megapixel resolution, rendering it suitable for applications within the realm of industrial automation.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitutes

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Value Chain/Supply Chain Analysis

- 4.4 Impact Assessment of Macro Trends on the market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Growing Awareness for Industry 4.0 and Smart factories

- 5.2 Market Restraints

- 5.2.1 Shortage of Semiconductors Limits Market Expansion

6 MARKET SEGMENTATION

- 6.1 Device Type

- 6.1.1 Discrete Semiconductors

- 6.1.2 Optoelectronics

- 6.1.3 Sensors

- 6.1.4 Integrated Circuits

- 6.1.4.1 Analog

- 6.1.4.2 Logic

- 6.1.4.3 Memory

- 6.1.4.4 Micro

- 6.1.4.4.1 Microprocessor

- 6.1.4.4.2 Microcontroller

- 6.1.4.4.3 Digital Signal Processors

- 6.2 Geography

- 6.2.1 United States

- 6.2.2 Europe

- 6.2.3 Japan

- 6.2.4 China

- 6.2.5 Korea

- 6.2.6 Taiwan

- 6.2.7 Rest of the World

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Analog Devices Inc.

- 7.1.2 Microchip Technology Inc.

- 7.1.3 NXP Semiconductors NV

- 7.1.4 ON Semiconductor Corporation

- 7.1.5 Texas Instruments Incorporated

- 7.1.6 Infineon Technologies AG

- 7.1.7 AMS Technologies AG

- 7.1.8 STMicroelectronics

- 7.1.9 Renesas Electronics Corporation

- 7.1.10 Rohm Co. Ltd