|

市場調查報告書

商品編碼

1347333

營運商中立者希望搭乘 GenAI 浪潮 - 2023 年 1 月更新:CNNO 收入預計在 2023 年達到 100B 美元,資本密集度 >35%,因為行業抓住生成式 AI 和 5G 緻密化的機會Carrier-neutrals Hope to Ride the GenAI Wave - 1H23 Update: CNNO Revenues on Track to Hit $100B in 2023, Capital Intensity >35% as Sector Attacks Opportunities in Generative AI and 5G Densification |

||||||

最近 12 個月(2022 年第三季至 2023 年第二季)CNNO 市場規模為營收 967 億美元(年成長 2.7%)及資本投資 348 億美元(年成長 2.7%)其中,併購投資88億美元(年減68.9%),工廠淨投資2,511億美元(年增2.3%)。截至2023年6月末,中海油擁有員工約11.37萬人,較去年同期成長4.8%。

經歷了 2022 年下半年的低迷之後,CNNO 部門在 2023 年開始有所改善,第一季和第二季的營收成長率分別為 3% 和 5%。利率上升減緩了併購速度,迫使 CNNO 更加謹慎地管理債務,但資本支出仍然很高,佔銷售額的 35% 以上。CNNO 不斷透過分拆、資產購買和不時創建新產品來優化其足跡和規模。例如,Cogent 將於 2022 年底從 Sprint 購買一系列舊交換中心,並將其中一些轉變為較小的託管中心。CNNO 正在加大永續發展力度,重點是最大限度地降低電力成本,或至少減少價格上漲的影響。

就成長而言,CNNO 預計將利用兩個重要機會。首先,它支援營運商行動網路緻密化需求。4G 需要更高的密度,但 5G 需要更高的密度才能滿足延遲和速度目標。以中國鐵塔為例,2023年第二季度,中國鐵塔樓內DAS覆蓋面積擴大至88.2億平方米,較去年同期成長48%。其次將透過建設設施和提供滿足新興需求的服務來支援技術領域,該領域對生成式人工智慧的興趣正在爆炸式增長。例如,DigitalBridge 認為人工智慧是一個“雲端規模的機會”,並且“以最低的總成本訪問數位基礎設施是成功的關鍵因素”。這對資料中心 CNNO 來說是一個巨大的機會,因為 CNNO 專門從事 "數位基礎設施的存取" 。投資 GenAI 的大型網路縮放器可能希望專門為模型訓練建立自己的設施,但像 Digital Realty 和 Equinix 這樣的 CNNO 將在模型實現(即推理)中發揮作用。

本報告檢視了 CNNO 市場,並分析了 5G 和生成式人工智慧帶來的機會。

範圍

對象經營者

|

|

目錄

- 摘要

- 2023年上半年營收年增4%,資本投入成長15%

- 自由現金流利潤率在過去幾季有所下降,淨利潤率為負值

- 生成式人工智慧為資料中心公司帶來新機遇

- 5G 需要移動 RAN 的緻密化,為 CNNO 創造機會

- 預測

- 附錄

This brief is focused on the carrier-neutral network operator (CNNO) sector. CNNOs sell independent, carrier-neutral access to network infrastructure, including bandwidth (fiber), data center and tower/small cell assets. The biggest CNNOs by revenues are China Tower, American Tower, Equinix, Crown Castle, Level 3 (a Lumen subsidiary), Digital Realty, Cellnex, NBN Australia, Indus Towers (ex-Bharti Infratel), and Zayo. In the most recent 12 months (3Q22-2Q23), the CNNO market represented $96.7 billion in revenues (+2.7% YoY), $34.8B in capex (+9.4% YoY), $8.8B in M&A spend (-68.9% YoY), and $251.1B of net plant (+2.3% YoY). CNNOs employed about 113.7K people at the end of June 2023, up 4.8% YoY.

VISUALS

After a weak second half 2022 (2H22), the CNNO sector has begun to improve in 2023 with 3% and 5% revenue growth rates in the first two quarters, respectively. Higher interest rates have slowed M&A and forced CNNOs to manage debt more carefully, but capex outlays remain high at over 35% of revenues. CNNOs continue to optimize their footprint and scale, spinning off and buying or building assets accordingly. One example: Cogent bought a portfolio of old switching centers from Sprint in late 2022 and is converting some to small colocation centers. CNNOs are increasing their focus on minimizing power costs - or at least limiting the impact of price rises - and gearing up their sustainability efforts.

For growth, we expect CNNOs to attack two important opportunities. First: support the telco need to densify their mobile networks; that means more small cell/DAS and metro fiber infra, but also more macro tower sites. Densification was required with 4G, but 5G requires even more in order to achieve its latency and speed goals. China Tower, as an example, expanded its in-building DAS coverage to 8,820 million square meters in 2Q23, up by 48% YoY. Second: support the tech sector's explosion of interest in generative AI ("GenAI"), by building facilities and offering services that match these new needs. DigitalBridge, for example, argues that AI is a "cloud-scale opportunity" and that "access to digital infra...at the lowest total cost, is a key success factor." CNNOs specialize in "access to digital infra" so this is a big opportunity for data center CNNOs. The big webscalers investing in GenAI will surely also want to build their own facilities, especially for model training, but CNNOs like Digital Realty and Equinix have roles to play with model implementation (i.e. inference).

COVERAGE:

Operators covered:

|

|

Table of Contents

- Summary

- Revenues up 4%, Capex up 15% YoY in the 1H23 period

- Free cash flow margin slides over the last few quarters; net margin is negative

- Generative AI opens up new opportunities for data center players

- 5G requires densification in the mobile RAN, creating CNNO opportunities

- Outlook

- Appendix

List of Figures and Tables

- Figure 1: YoY growth rates for single quarter revenues and capex, CNNOs

- Figure 2: CNNOs' net PP&E on the books alongside capex and M&A spending

- Figure 3: Annualized revenues ($B) and capital intensity for CNNO sector

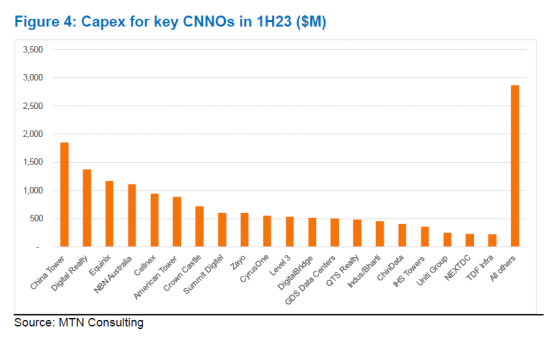

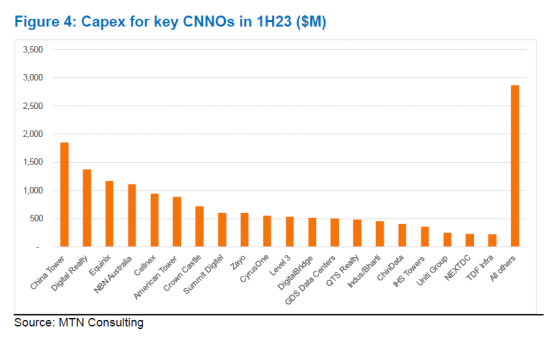

- Figure 4: Capex for key CNNOs in 1H23 ($M)

- Figure 5: Recent profitability margins for CNNO sector, annualized

- Figure 6: Top and bottom CNNOs based on annualized FCF margin in 2Q23

- Figure 7: Implications of GenAI for data center requirements in CNNO market

- Figure 8: Densification solutions for improved coverage, per American Tower

- Figure 9: China Tower's in-building DAS coverage, millions of square meters