|

市場調查報告書

商品編碼

1128127

22年前半期運營商中立市場的資料中心投資飆升Data Center Spending Surges in Carrier-neutral Market in 1H22: Most Public CNNOs, However, are Conservative in Spending Outlook as Riskier Expansions are Pushed by Private Capital and a Hybrid Player, DigitalBridge |

||||||

CNNO,對資料中心的互相連接等,技術的投資日益增加。再加上CNNO提供客戶電力與其他的公共事業,成為運營商產業的永續性相關疑慮的中心存在。在今後2年~3年之間,將出現一批新型的基礎設施網路資產整合所有者,融合塔、資料中心和光纖網路。這個會聚實際發生著。可是,現在資料中心成為熱點。

本報告提供資料中心專門化的CNNO平台的市場方向性,2022年前半期的業績和CNNO領域的市場活動概要。

涵蓋範圍

本報告所涵蓋的公司及組織如下列。

|

|

目錄

- 概要

- 資料中心CNNO市場主要企業

- 公開CNNO的財務

- 暗示

- 關於

MTN Consulting tracks three segments of network operators: telco, webscale, and carrier-neutral (CNNO). The CNNO market is by far the smallest, accounting for 2.2% of 2017-21 combined operator revenues, and 6.1% of combined capex. However, CNNOs are essential for the efficient functioning of operator markets. CNNOs help lower the cost of building and operating networks for telcos and webscalers, and accelerate their time to market. CNNOs also do much more than simply rent out space or capacity on neutral platforms. Increasingly they are investing in technology, for instance data center interconnect. Further, they provide electricity and other utilities to their customers, and as such are central to the sustainability concerns of the operator industry.

VISUALS

Within the CNNO market, there are three types of infrastructure focus: towers, data centers, and fiber/bandwidth. Many CNNOs own and operate two or all three of these infra types. Over time this integrated approach to CNNO infrastructure is becoming more common. As we argued in a July 2021 report: "a new breed of integrated owners of infrastructure network assets will emerge over the next 2-3 years, converging towers, data centers, and fiber networks." This convergence is indeed occurring. However, data centers are the hot spot at the moment. There is significant new investment into CNNO data centers from asset management and real estate firms, and there is a lot of M&A activity in the DC market aimed at building bigger portfolios. Some of the investment targets so-called "hyperscale" facilities designed for the needs of the largest Internet companies, such as the cloud providers which we track in the webscale market; other investment is aimed at smaller facilities at the edge of the network, serving a wider range of customers including mobile operators. We have reviewed first half 2022 earnings and market activity in the CNNO space to gauge market directions for data center-focused CNNO platforms. Spending outlook is generally modest for the key public CNNOs, but private asset management companies - plus DigitalBridge, a now-public CNNO with a private equity past - continue to make splashy announcements and acquisitions in the sector.

COVERAGE:

Companies and organizations mentioned in this report include:

|

|

Table of Contents

- Summary

- Key players in data center CNNO markets

- Public CNNO financials

- Implications

- About

FIGURES

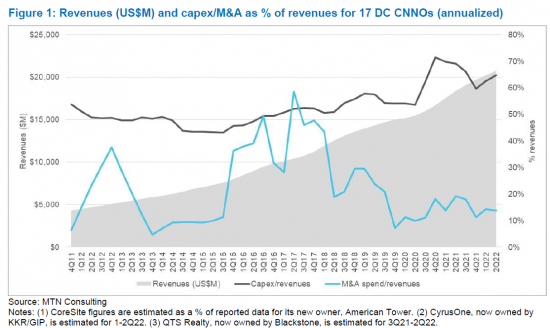

- Figure 1: Revenues (US$M) and capex/M&A as % of revenues for 17 DC CNNOs (annualized)

- Figure 2: First half capex for top data center CNNOs, 2020-22 (US$M)

- Figure 3: DigitalBridge's strategy progression