|

市場調查報告書

商品編碼

1435866

智慧顧問 - 市場佔有率分析、產業趨勢與統計、成長預測(2024 - 2029)Smart Advisor - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

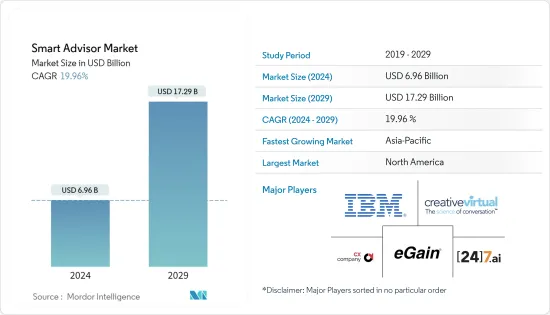

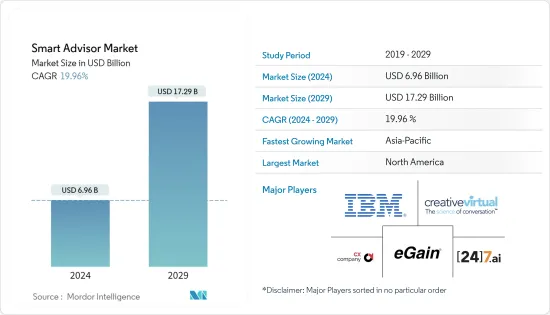

智慧顧問市場規模預計到2024年將達到 69.6 億美元,預計到2029年將達到 172.9 億美元,在預測期內(2024-2029年)CAGR為 19.96%。

用於理解自然語言並為最終用戶完成所有電子任務的應用程式稱為智慧顧問程式。智慧顧問提供營運資料以幫助做出更好的決策。智慧顧問是一種智慧搜尋引擎,使代理商能夠存取多個企業的知識庫。此外,還可讓知識庫管理員和聊天機器人內容創建者在代理與客戶聊天時進行協作。

主要亮點

- 在 COVID-19 大流行期間,報告了許多金融詐欺事件,導致全球各國政府因詐欺索賠而損失了數十億美元。金融科技公司開始轉向創新工具來處理這些詐欺行為。英國政府與金融科技公司 Quantexa 合作推出了「Spotlight」,一種自動化盡職調查工具。使用 Spotlight,可以收集大量資料,並可以根據這些資料點提供風險指標,做出更明智、更及時的獎勵決策。

- 日益增加的網路犯罪為智慧顧問市場帶來了挑戰。KPMG最近的一項調查發現,網路安全風險是該組織近期發展面臨的最大威脅。這將影響根據訪客在聊天中提出的問題即時幫助代理的軟體的安全性。一項調查顯示,由於消費者資料外洩、金融犯罪、市場操縱和智慧財產權盜竊,網路犯罪每年對全球經濟造成 4,700 億美元的損失。

- 財務顧問對於各領域的成功業務運作都是必要的。醫療保健產業是一個實施智慧建議以提高績效的產業。具有分析能力的公司可以處理最迫切的醫療保健需求。由於需要更多的資料整合,臨床資料的儲存、查詢和分析目前很棘手。這些商業智慧公司為決策者提供正確的工具來評估資源的使用情況並尋找規模經濟。

- 2023年 1月,Creative Virtual(客戶和員工參與對話式 AI 領域的全球領導者之一)發布了一份買家指南,目的是協助當年的聊天機器人購買決策。這本深入指南包括一個評估對話式人工智慧解決方案功能的比較圖表。對話式人工智慧專家與附加機器人供應商不同,他們的核心產品是對話式人工智慧平台以及提供非常成功的虛擬代理和聊天機器人解決方案的悠久歷史。

- 房地產公司也期待技術進步,以獲得對買家投資組合的寶貴見解。諸如合適的智慧型文件處理器(IDP)之類的工具用來將更多資料輸入所需的終端系統,而幾乎不需要人工干預。人工智慧對各種文件類型的深入了解將使公司能夠做出有利的交易和財務決策。

智慧顧問市場趨勢

預計零售領域將大量採用智慧顧問解決方案。

- 機器人顧問和被動投資等自動化工具吸引投資者。因此,顧問們轉向資料分析來改善客戶體驗。 Live Connections 等智慧顧問應用程式可協助顧問在數位時代進行行銷、業務開發和潛在客戶開發。

- 財務顧問(FA)通常需要協助來跟上即時市場變化和客戶需求。為了克服這一差距,下一代人工智慧/機器學習技術在開發智慧解決方案中變得非常重要。這些人工智慧驅動的智慧顧問工具可以掃描多個資料來源以獲取市場資料、事件和新聞。這些工具還同時管理大量客戶組合(例如社交媒體足跡),以確定他們的生活事件。因此,FA 可以更快地分析關鍵的市場洞察,並及時採取行動來降低風險或提高投資回報。

- 諮詢公司跨國合作以擴大業務。2022年 12月,全國軟體和服務公司協會(NASSCOM)與新南威爾斯州政府經濟發展局(NSW)合作,為印度科技公司組織路演,以突顯澳洲的商業和投資機會。

- 2022年 10月 - AccessFintech 與德勤攜手協助金融機構遵守即將訂定的綜合審計追蹤法規(CAT)。透過使用 AccesssFintech 的 CAT 錯誤解決工作流程,客戶將免受罰款,因為可以輕鬆調查錯誤並以結構化方式進行協作。

- 在埃森哲進行的一項調查中,十分之八的顧問認為使用一站式平台或將應用程式數位化到單一螢幕中將有助於提高他們的效率。研究指出,這將在未來三年內將顧問的生產力提高三到七倍。

歐洲市場預計將大幅成長

- 金融科技活動整個歐洲擴展。根據Mckinsey的報告,調查顯示,對消費者來說,定價和客戶體驗是金融科技銀行業務的首要原因。歐洲銀行依賴主要領域的各種金融科技合作,包括營運和支付。金融科技業在歐洲創造了超過100萬個就業機會,成長潛力巨大。截至2022年 6月,歐洲金融科技公司的總估值接近 4,530 億美元。

- 根據Finch Capital的見解,歐洲有超過 250 家金融科技企業致力於 KYC 合規性,而超過 300 家提供成本管理軟體。西班牙政府通過了《創業法》,以鼓勵創業,使該國對外國投資者和創意思想家更具吸引力。儘管西班牙的金融科技市場不如其歐洲鄰國法國和德國發達,但歐盟為西班牙金融科技公司提供了誘人的潛力。

- 2022年 1月,荷蘭銀行投資了為零售和商業客戶提供自行車保險的 Laka。對電動車日益成長的需求促使荷蘭銀行創投公司進行投資。這將有助於 Laka 實現成為歐洲頂級綠色旅遊保險科技的使命。另一方面,ABM AMRO 將透過提供世界一流的數位服務並協助他們轉向更永續的生活方式來增加客戶群。

智慧顧問產業概況

由於參與者眾多,智慧顧問市場競爭非常激烈。一些著名的智慧諮詢公司憑藉客戶的信任在市場上佔據主導地位。顧問必須在資料驅動的分析和同理心驅動的討論之間找到適當的平衡,才能在業務中取得成功。資料保護是一個問題,因為智慧顧問解決方案處理公司的敏感資料。因此,客戶青睞成熟公司的智慧顧問解決方案。這項服務的一些知名參與者包括 eGain、IBM、Cisco 等。

- 2023年5月- Creative Virtual 是領先的對話式AI 公司之一,致力於幫助企業向客戶、員工和聯絡中心代理提供無縫、個性化的數位支持,發布了Gluon,這是其V-PersonTM 技術的新版本。 Gluon 版本為 Creative Virtual 的 V-PortalTM 和 V-Person 產品套件提供支持,具有新的技術功能並提供更好的使用者體驗。

- 2022年 9月 - eGain 與 Feet Management 公司合作,提供集中式全通路知識中心,以轉變他們的客戶服務體驗。憑藉其知識管理專業知識以及與領先 CRM 系統的便捷連接,eGain Knowledge Hub 將為這家車隊管理公司在全球服務聯絡中心的 19 種語言的代理提供支援。

附加優惠:

- Excel 格式的市場估算(ME)表

- 3 個月的分析師支持

目錄

第1章 簡介

- 研究假設和市場定義

- 研究範圍

第2章 研究方法

第3章 執行摘要

第4章 市場動態

- 市場概況

- 市場促進因素

- 對智慧客戶互動的需求不斷成長

- 醫療保健成本管理自動化的需求

- 與雲端運算整合的網站和行動應用程式的滲透率不斷提高

- 市場限制

- 缺乏意識、資訊和可用性作為分析下的加載項

- 產業價值鏈分析

- 產業吸引力-波特五力分析

- 新進入者的威脅

- 買家/消費者的議價能力

- 供應商的議價能力

- 替代產品的威脅

- 競爭激烈程度

- COVID-19 對市場的影響評估

第5章 新興科技趨勢

第6章 市場細分

- 依產品分類

- 軟體

- 服務

- 依最終用戶垂直領域

- BFSI

- 零售

- 旅遊和飯店業

- 政府

- 其他最終用戶垂直領域(醫療保健和消費性電子產品)

- 地理

- 北美洲

- 歐洲

- 亞太地區

- 世界其他地區

第7章 競爭格局

- 公司簡介

- IBM Corporation

- eGain Corporation

- Creative Virtual Pvt. Ltd

- CX Company Limited

- 24/7 Customer Inc.

- Nuance Communications Inc.

- Artificial Solutions International AB

- Next IT Corporation

- Speakoit Inc.

- Codebaby Corporation

第8章 投資分析

第9章 市場機會與未來趨勢

The Smart Advisor Market size is estimated at USD 6.96 billion in 2024, and is expected to reach USD 17.29 billion by 2029, growing at a CAGR of 19.96% during the forecast period (2024-2029).

An application program that is used to understand the natural language and complete all the electronic tasks for an end user is called the smart advisor program. A smart advisor provides operational data for better decision-making. A smart advisor is an intelligent search engine that gives agents access to the knowledge bases of multiple businesses. Additionally, it allows knowledge base managers and chatbot content creators to collaborate while agents chat with clients.

Key Highlights

- Many instances of financial fraud were reported during the COVID-19 pandemic, resulting in fraud claims costing governments worldwide billions of dollars. The Fintech companies started to move towards innovative tools to handle these frauds. UK Govt., in collaboration with fintech company Quantexa, launched "Spotlight," an automated due-diligence tool. Using Spotlight, a lot of data can be collected, and risk indicators can be provided against those data points, resulting in a better informed and timely award decision.

- Increasing cybercrimes are posing challenges to the smart advisor market. A recent KPMG survey identified cyber security risk as the biggest threat to the organization's growth in the near future. This will impact the security of software that help agents in real time based on what the visitor is asking in the chat. A survey revealed cybercrime costs the global economy USD 470 billion in annual losses due to consumer data breaches, financial crimes, market manipulation, and intellectual property theft.

- A financial counselor is necessary for successful business operations in every area. The healthcare sector is one industry implementing smart advice for improved performance. Companies that have analytical capacity handle the most urgent healthcare demands. Storage, query, and analysis of clinical data are currently tricky due to the need for more data consolidation. These Business Intelligence companies provide decision-makers with the right tools to assess the use of resources and find economies of scale.

- In January 2023, Creative Virtual, one of the global leaders in conversational AI for customer and employee engagement, published a buyer's guide written to assist with chatbot purchasing decisions in the current year. The in-depth guide includes a comparison chart that evaluates the capabilities of conversational AI solutions. A conversational AI specialist differs from an add-on bot vendor, and their core product is their conversational AI platform and established history of delivering highly successful virtual agent and chatbot solutions.

- Real estate companies also look forward to technological advancements to gain valuable insights into buyer portfolios. Tools like the suitable intelligent document processor (IDP) are being used to feed more data into desired end systems with little to no manual intervention. AI's in-depth knowledge of various document types will equip the company to make profitable deals and financial decisions.

Smart Advisor Market Trends

The Retail Segment is Expected to Witness Significant Adoption for Smart Advisor Solutions.

- Automated tools like robo-advisors and passive investing are attracting investors. Therefore advisors are switching to data analytics to improve the client experience. Smart advisor applications like Live Connections help advisors to approach marketing, business development, and lead generation in the digital age.

- Financial Advisors (FA) often need help to keep up with real-time market changes and client needs. To overcome this gap, next-gen AI/ML technologies are becoming essential in developing intelligent solutions. These AI-powered smart advisor tools can scan multiple data sources for market data, events, and news. These tools also manage numerous client portfolios simultaneously, like social media footprints, to determine their life events. Thus, FA can analyze critical market insights more quickly and take timely action to reduce risk or improve returns on investment.

- Advisory firms are collaborating across borders for business expansion. In December 2022, the National Association of Software and Services Companies (NASSCOM) partnered with New South Wales Government's economic development, called NSW, to organize roadshows for Indian technology companies to highlight business and investment opportunities in Australia.

- October 2022 - AccessFintech joined hands with Deloitte to assist financial institutions in their struggle to comply with the impending Consolidated Audit Trail regulation (CAT). By using AccesssFintech's CAT Error Resolution workflow, Clients will be saved from monetary penalties as it will be easy to investigate errors and collaborate in a structured manner.

- In a survey conducted by Accenture, eight in ten advisors accepted that using a one-stop platform or digitalizing applications into a single screen would help improve their efficiency. The research pointed out that this would boost advisor productivity three to seven times in the next three years.

European Market is Expected to Grow Significantly

- Fintech activity is expanding throughout Europe. According to a report by Mckinsey, pricing and customer experience are the top reasons for banking with fintech, for consumers, as per the survey. European banks rely on various fintech collaborations in major sectors, including operations and payments. Fintech Sector creates more than 1 million jobs across Europe, with huge potential for growth. Fintechs in Europe represented a total valuation of almost 453 billion USD as of June 2022.

- According to Finch Capital insights, more than 250 fintech businesses specialize in KYC compliance in Europe, while more than 300 provide cost management software. Spain's government passed the Startups Law to encourage entrepreneurship and make the country more appealing to foreign investors and creative thinkers. Although Spain's Fintech market is less developed than its European neighbors France and Germany, the EU offers intriguing potential for Spanish Fintechs.

- In January 2022, ABN Amro invested in Laka, a bicycle insurance provider for retail and commercial customers. The growing demand for e-mobility prompted ABN AMRO Ventures to invest. This will assist Laka in its mission to become the top green mobility insurtech in Europe. On the other side, ABM AMRO will increase its clientele by providing world-class digital services and assisting them in making the switch to a more sustainable way of life.

Smart Advisor Industry Overview

The smart advisor market is highly competitive because of many players. Some prominent smart advisory companies are dominating the market with their trust among customers. The advisors must find the appropriate balance of data-driven analytics and empathetically-driven discussions to be successful in the business. Data protection is a problem as smart advisor solutions handle the firm's sensitive data. Customers, therefore, favor well-established companies for smart adviser solutions. Some of the known players in this service are eGain, IBM, Cisco, and more.

- May 2023 - Creative Virtual, one of the leading conversational AI companies that enables businesses to deliver seamless, personalized digital support to customers, employees, and contact center agents, released Gluon, a new version of its V-PersonTM technology. Powering Creative Virtual's V-PortalTM and V-Person product suites, the Gluon release has new technical capabilities and provides a better user experience.

- September 2022 - eGain partners with Feet Management company to provide a centralized omnichannel knowledge hub to transform their customer service experience. With its knowledge management expertise and ease of connection with leading CRM systems, eGain Knowledge Hub will support agents in 19 languages in service contact centers across the globe for this fleet management company.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Burgeoning Demand for Intelligent Customer Engagement

- 4.2.2 Demand for Automation for Cost Management in the Healthcare

- 4.2.3 Increasing Penetration of Websites and Mobile Applications Integrated with Cloud Computing

- 4.3 Market Restraints

- 4.3.1 Lack of Awareness and Information and Availability as add-in Under Analytics

- 4.4 Industry Value Chain Analysis

- 4.5 Industry Attractiveness - Porter's Five Forces Analysis

- 4.5.1 Threat of New Entrants

- 4.5.2 Bargaining Power of Buyers/Consumers

- 4.5.3 Bargaining Power of Suppliers

- 4.5.4 Threat of Substitute Products

- 4.5.5 Intensity of Competitive Rivalry

- 4.6 Assessment on the Impact of COVID-19 on the Market

5 EMERGING TECHNOLOGY TRENDS

6 MARKET SEGMENTATION

- 6.1 By Offerings

- 6.1.1 Software

- 6.1.2 Services

- 6.2 By End-user Verticals

- 6.2.1 BFSI

- 6.2.2 Retail

- 6.2.3 Travel and Hospitality

- 6.2.4 Government

- 6.2.5 Other End-user Verticals (Healthcare and Consumer Electronics)

- 6.3 Geography

- 6.3.1 North America

- 6.3.2 Europe

- 6.3.3 Asia Pacific

- 6.3.4 Rest of the World

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles*

- 7.1.1 IBM Corporation

- 7.1.2 eGain Corporation

- 7.1.3 Creative Virtual Pvt. Ltd

- 7.1.4 CX Company Limited

- 7.1.5 24/7 Customer Inc.

- 7.1.6 Nuance Communications Inc.

- 7.1.7 Artificial Solutions International AB

- 7.1.8 Next IT Corporation

- 7.1.9 Speakoit Inc.

- 7.1.10 Codebaby Corporation