|

市場調查報告書

商品編碼

1444943

智慧虛擬助理(IVA):市場佔有率分析、產業趨勢與統計、成長預測(2024-2029)Intelligent Virtual Assistant (IVA) - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

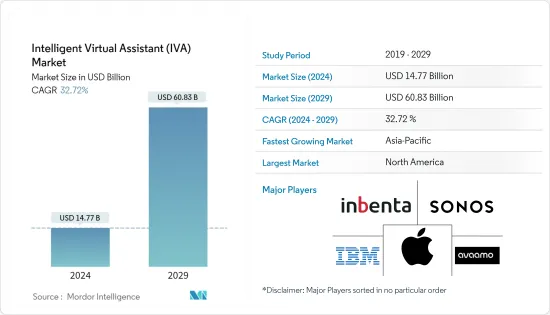

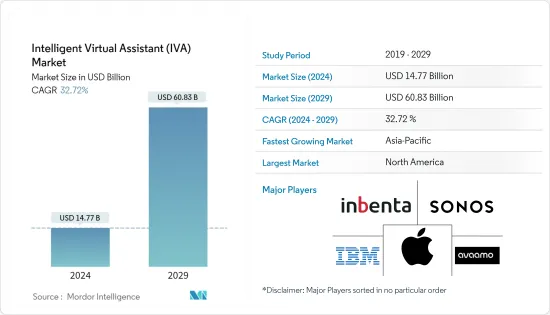

智慧虛擬助理(IVA)市場規模預計到 2024 年為 147.7 億美元,預計到 2029 年將達到 608.3 億美元,在預測期內(2024-2029 年)年複合成長率為 32.72%。

深度神經網路、機器學習和人工智慧的其他進步使更多的虛擬助理成為可能。聊天機器人和智慧揚聲器是零售、BFSI 和醫療保健等最終用戶行業中使用的虛擬助理的兩個範例。虛擬助理充當個人助理,是消費者互動的重要形式。它透過利用 Apple 的 Siri 並為連網家庭和汽車提供易於使用的介面,幫助用戶完成各種雜務。

主要亮點

- 另一個日益成長的用途是虛擬助理,他們扮演客戶服務代理的角色。對於企業而言,虛擬助理可以透過對消費者更友善的方式改善客戶和品牌體驗。例如,雲端客服中心供應商 Five9 與 Inference Solutions 合作推出 Five9 虛擬助理。該系統利用會話人工智慧來自動執行手動任務並回答常見的客服中心問題。

- 這些助手的功能還可以根據最終用戶進行修改,從而改善特定行業的客戶體驗。例如,在醫療保健行業,虛擬助理可以幫助客戶找到診所或補充藥物。您將收到處方箋和付款提醒。

- 在醫療保健領域獲得認可的虛擬個人助理包括蘋果的 Siri、微軟的 Cortana 和Google的 Assistant。中小企業也在推動智慧虛擬助理背後的技術發展,使其成為健康智慧虛擬助理的重要組成部分。例如,Next IT 的 Alme of Healthcare 是一款專注於慢性病管理並主動回答患者問題和請求的虛擬助理。目前,該技術已被醫療保健提供者大規模採用。

- 除了醫療保健之外,零售公司還在流行的通訊程式中使用聊天機器人,為客戶提供更好的體驗。 Domino's Pizza 和其他商店正在使用人工智慧和機器學習來為聊天機器人等虛擬助理提供支持,幫助顧客直接透過 Facebook Messenger 下訂單。

- 2020 年春季智慧音訊報告證實,約 77% 的美國成年人因 COVID-19感染疾病而改變了正常的生活習慣。在這些變化中,越來越多的人使用語音助手,這有利於市場成長。

- 公司也推出服務,幫助人們在這些不確定的時期保持警覺。例如,Avaamo 是一家專門從事對話式介面的深度學習軟體公司,由Wipro Ventures 提供支持,該公司推出了Project,這是一款任何人都可以使用的COVID-19 虛擬助手,可以幫助用簡單的英語快速找到答案。我們推出了COVID。

智慧虛擬助理(IVA)市場趨勢

智慧音箱推動市場成長

- 目前,智慧音箱所需的功能包括音樂播放和智慧家庭設備的控制。智慧音箱數量的增加預計將進一步提高語音助理在互聯用戶生活中的效用。在很短的時間內,聲控音箱已經成為人們日常生活的一部分。原因包括在處理多任務時使用科技的能力、人們說話的速度比打字的速度(速度)以及人機介面的增加。

- 此外,消費者通常更喜歡價格實惠且具有高階功能的產品。透過 Whole Foods 商店的促銷策略以及在網路和電視廣告上以 Alexa 為重點的廣告,Amazon Alexa 在消費者中獲得了巨大的吸引力。亞馬遜也降低了一些產品的價格以獲得競爭優勢。

- 出版商和媒體公司正在嘗試新內容以及智慧揚聲器如何與之互動。例如,NPR、路透社、紐約時報和 CNN 等出版商,以及田納西州、印地星報和德克薩斯論壇報等當地新聞提供者。 ,我們正在創建簡短的音訊簡報,供每個人在智慧揚聲器上收聽。

一些最知名的智慧揚聲器包括 Amazon Echo 和 Google Nest 產品,但也有許多內建 Alexa 和 Google Assistant 的第三方揚聲器,例如 Sonos One。這些公司正在推出新產品,以滿足不斷成長的市場需求。智慧音箱預計將推動下一波日常消費品和雜貨電子商務的浪潮。企業正在尋求將語音技術整合到更廣泛的跨通路策略中。

北美預計將佔據很大佔有率

- 由於該地區許多千禧世代更喜歡自助服務選項和通訊應用程式,該地區的企業可能會選擇 IVA 服務來滿足他們的需求,這將導致該地區的市場成長。

- 該地區強勁的銀行和醫療保健產業正在積極投資聊天機器人,以實現客戶個人化。北美是銀行業人工智慧輔助聊天機器人的早期採用者。

- 例如,市場上的知名企業 Nuance Communications 透露,10,000 名美國臨床醫生中有 80% 相信虛擬助理將在未來幾年內大幅改變醫療保健。消費者對自助服務選項的高度偏好正在導致通訊軟體的成長,這表明全部區域有利於 IVA 聊天機器人的部署環境。

- 公司也投入更多資金,借助人工智慧和機器學習來改進 IVA 技術,以支援自動化決策系統。預計這將提振全部區域的市場。最近,亞馬遜為亞馬遜語音服務 API 新增了通知功能。因此,這項最新的語音通知功能允許 Alexa 向您展示新內容,例如購物更新、即將推出的優惠、購物節詳細資訊以及許多其他更新。這些語音搜尋通知預計將成為未來幾年的最新趨勢。

- 美國仍然是智慧音箱採用的主要市場。根據 NPR 最新的智慧音訊報告,大約 24% 的美國人(18 歲及以上)擁有至少一台智慧音箱,平均每位擁有者擁有不只一台。大多數美國人都擁有 Alexa。自從亞馬遜首次推出 Echo 以來,它在美國越來越受歡迎,並且可以與其他頂級競爭對手相提並論。

智慧虛擬助理(IVA)產業概況

智慧虛擬助理 (IVA) 市場的競爭相當激烈,有幾個主要參與者。從市場佔有率來看,目前有少數幾家公司佔據市場主導地位。然而,整合語音和手勢識別技術的進步正在推動新參與企業增加其市場佔有率並擴大企業發展。市場的最新發展包括:

2022 年 9 月,開發自動化客戶互動平台的 eGain Corporation 宣布推出適用於 IBM Watson Assistant 的預先建置連接器。這是與 IBM 合作完成的。該連接器使用 eGain 獨特的 BYOBTM(自帶機器人)架構,使業務用戶可以輕鬆且無需編寫程式碼地整合 Watson Assistant 和 eGain 平台。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 調查先決條件

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場洞察

- 市場概況

- 產業相關人員分析

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代產品的威脅

- 競爭公司之間的敵意強度

- 產業價值鏈分析

- 技術簡介

- 評估 COVID-19感染疾病對智慧虛擬助理 (IVA) 市場的影響

第5章市場動態

- 市場促進因素

- 專注於改善專業服務的客戶體驗

- 智慧音箱推動市場成長

- 市場限制因素

- 對現場人際互動的偏好增加

第6章市場區隔

- 依產品

- 聊天機器人

- 智慧音箱

- 透過使用者介面

- Text-to-Text

- Text-to-Speech

- 自動語音識別

- 按最終用戶

- 聊天機器人

- 零售

- BFSI

- 衛生保健

- 電訊

- 旅行和招待

- 其他最終用戶產業

- 智慧音箱

- 個人

- 商業的

- 聊天機器人

- 地區

- 北美洲

- 美國

- 加拿大

- 北美其他地區

- 歐洲

- 德國

- 英國

- 法國

- 西班牙

- 其他歐洲國家

- 亞太地區

- 中國

- 日本

- 印度

- 其他亞太地區

- 拉丁美洲

- 巴西

- 阿根廷

- 其他拉丁美洲

- 中東和非洲

- 阿拉伯聯合大公國

- 沙烏地阿拉伯

- 南非

- 其他中東和非洲

- 北美洲

第7章 競爭訊息

- 公司簡介

- Avaamo Inc.

- EdgeVerve Systems Limited(An Infosys Company)

- SMOOCH.ai

- Inbenta Technologies Inc.

- Creative Virtual Ltd.

- Serviceaide Inc.

- Ipsoft Inc.

- Kore.ai Inc.

- IBM Corporation

- Smart Speaker Vendors

- Amazon.com Inc.

- Google LLC(Alphabet Inc.)

- Alibaba Group

- Sonos Inc.

- Harman-Kardon Inc

- Apple Inc.

- Bose Corporation

- Xiaomi Inc.

- Baidu Inc.

第8章投資分析

第9章 市場未來展望

The Intelligent Virtual Assistant Market size is estimated at USD 14.77 billion in 2024, and is expected to reach USD 60.83 billion by 2029, growing at a CAGR of 32.72% during the forecast period (2024-2029).

Deep neural networks, machine learning, and other advances in AI are making more virtual assistants possible. Chatbots and smart speakers are two examples of virtual assistants that are used in retail, BFSI, and healthcare, among other end-user industries. A virtual assistant acting as a personal assistant is a significant consumer-facing form. With the aid of Apple's Siri or by providing an easy-to-use interface for connected homes or autos, it aids users in completing various chores.

Key Highlights

- Another use on the rise is virtual assistants adopting the customer service agent role. For enterprises, virtual assistants improve customer and brand experiences with a more consumer-friendly approach. For example, Five9, a cloud contact center provider, launched Five9 Virtual Assistant in partnership with Inference Solutions. The system leverages conversational artificial intelligence to automate manual tasks and answer common questions in the contact center.

- The capabilities of these assistants can also be changed based on the end user, which makes the customer experience better in a certain industry.For example, in the healthcare industry, a virtual assistant can help a customer find a doctor's office, fill and refill a prescription, and get payment reminders.

- Some virtual personal assistants that have gained recognition across the healthcare sector are Apple's Siri, Microsoft's Cortana, and Google's Assistant. Small and medium-sized businesses also drive the technology behind intelligent virtual assistants, making them important parts of health-intelligent virtual assistants. For example, Next IT's Alme of Healthcare is a virtual assistant that focuses on managing chronic diseases and actively answers patients' questions and requests. This is currently being adopted on a massive scale by healthcare providers.

- Aside from healthcare, retail companies also use chatbots in popular messaging apps to give their customers a better experience.Domino's and other stores use AI and machine learning to power virtual assistants like chatbots, which let customers place orders directly through Facebook Messenger.

- The Spring 2020 Smart Audio Report confirmed that the COVID-19 outbreak caused about 77% of US adults to change their normal routines. During these changes, more people used voice assistants, which was good for market growth.

- Companies are also rolling out offerings that help people stay aware of these uncertain times. For example, Avaamo, a deep-learning software company that specializes in conversational interfaces and is backed by Wipro Ventures, launched Project COVID, a COVID-19 Intelligent Virtual Assistant that can be used by anyone and helps find answers quickly in plain English.

Intelligent Virtual Assistant (IVA) Market Trends

Smart Speakers to Drive the Market Growth

- The characteristics expected from a smart speaker nowadays include playing music and controlling smart home devices. An increasing number of smart speakers is believed to give voice assistants more utility in a connected user's life. In a short period of time, voice-activated speakers have become a part of people's routines. Reasons for this include the ability to use the technology while multitasking, the fact that people speak more quickly than they type (speed), and increasing human interfaces.

- Further, consumers frequently like products that are both affordable and packed with high-end features. Due to its promotional tactics at a Whole Foods store and Alexa-focused advertisements on both the web and television commercials, Amazon Alexa achieved tremendous momentum among consumers. Amazon also lowered the price of several of its products to obtain a competitive edge.

- Publishers and media companies are trying out new content and ways for smart speakers to interact with it.For instance, publishers like NPR, Reuters, the New York Times, CNN, and local news providers, such as the Tennessean, IndyStar, and Texas Tribune, are all creating short audio briefings designed to be heard on smart speakers.

Among the most well-known smart speakers are the Amazon Echo and Google Nest ranges of products, but there are plenty of third-party speakers, like the Sonos One, which come with both Alexa and Google Assistant built-in. These companies are rolling out new products to cater to the increasing market demand. Smart speakers are forecast to drive the next wave of FMCG and grocery e-commerce. Companies are thinking of integrating voice technology into a broader cross-channel strategy.

North America is Expected to Hold a Major Share

- Since many millennials in the region prefer self-service options and messaging apps, businesses in the region are likely to choose IVA services to meet their needs, which will help the market grow in the region.

- The region's robust banking and healthcare sectors have actively invested in chatbots for customer personalization. The early adopters of AI-assisted chatbots in the banking sector are from North America.

- For instance, Nuance Communications, a prominent player in the market, revealed that 80% of 10,000 US clinicians believe virtual assistants will drastically change healthcare in the next few years. Such high consumer inclination toward self-service options has led to the growth of messaging applications, indicating the favorable environment for adopting IVA chatbots across regions.

- Also, companies are putting more money into improving IVA technology with the help of AI and machine learning to support automated decision-making systems. This is expected to drive the market across the region.Recently, Amazon added a notification capability to the Amazon Voice Services API. Therefore, this latest voice notification feature allows Alexa to indicate some new content, such as shopping updates, upcoming offers, shopping festival details, and many other updates. These voice search notifications are expected to become the latest trend in the coming years.

- The US remains an important market for smart speaker adoption. According to the latest Smart Audio Report from NPR, around 24% of Americans (18+) own at least one smart speaker, and the average owner has more than one. The majority of Americans own Alexa. Since Amazon first introduced the Echo, it has become popular in the United States, challenging other top competitors.

Intelligent Virtual Assistant (IVA) Industry Overview

The intelligent virtual assistant market is moderately competitive and has several significant players. In terms of market share, some of the players currently dominate the market. However, with the advancement of integrated speech and gesture recognition technologies, new players are increasing their market presence and expanding their business footprint across emerging economies. Some of the recent developments in the market are:

In September 2022, eGain Corporation, which makes a platform for automating customer interactions, said that a pre-built connector for IBM Watson Assistant was available. This was done in partnership with IBM. The connector uses eGain's unique BYOBTM (Bring Your Own Bot) architecture to make integrating the Watson Assistant with the eGain platform easy and code-free for business users.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Stakeholder Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Consumers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

- 4.4 Industry Value Chain Analysis

- 4.5 Technology Snapshot

- 4.6 Assessment of COVID-19 Impact on the Intelligent Virtual Assistant (IVA) Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing Focus to Improve Customer Experience across Professional Services

- 5.1.2 Smart Speakers to Drive the Market Growth

- 5.2 Market Restraints

- 5.2.1 Increasing Preference for Live Person Interaction

6 MARKET SEGMENTATION

- 6.1 By Product

- 6.1.1 Chatbots

- 6.1.2 Smart Speakers

- 6.2 By User Interface

- 6.2.1 Text-to-Text

- 6.2.2 Text-to-Speech

- 6.2.3 Automatic Speech Recognition

- 6.3 By End-User

- 6.3.1 Chatbots

- 6.3.1.1 Retail

- 6.3.1.2 BFSI

- 6.3.1.3 Healthcare

- 6.3.1.4 Telecom

- 6.3.1.5 Travel and Hospitality

- 6.3.1.6 Other End-User Industries

- 6.3.2 Smart Speakers

- 6.3.2.1 Personal

- 6.3.2.2 Commercial

- 6.3.1 Chatbots

- 6.4 Geography

- 6.4.1 North America

- 6.4.1.1 United States

- 6.4.1.2 Canada

- 6.4.1.3 Rest of North America

- 6.4.2 Europe

- 6.4.2.1 Germany

- 6.4.2.2 United Kingdom

- 6.4.2.3 France

- 6.4.2.4 Spain

- 6.4.2.5 Rest of Europe

- 6.4.3 Asia-Pacific

- 6.4.3.1 China

- 6.4.3.2 Japan

- 6.4.3.3 India

- 6.4.3.4 Rest of Asia-Pacific

- 6.4.4 Latin America

- 6.4.4.1 Brazil

- 6.4.4.2 Argentina

- 6.4.4.3 Rest of Latin America

- 6.4.5 Middle East and Africa

- 6.4.5.1 UAE

- 6.4.5.2 Saudi Arabia

- 6.4.5.3 South Africa

- 6.4.5.4 Rest of Middle East and Africa

- 6.4.1 North America

7 COMPETITIVE INTELLIGENCE

- 7.1 Company Profiles

- 7.1.1 Avaamo Inc.

- 7.1.2 EdgeVerve Systems Limited (An Infosys Company)

- 7.1.3 SMOOCH.ai

- 7.1.4 Inbenta Technologies Inc.

- 7.1.5 Creative Virtual Ltd.

- 7.1.6 Serviceaide Inc.

- 7.1.7 Ipsoft Inc.

- 7.1.8 Kore.ai Inc.

- 7.1.9 IBM Corporation

- 7.2 Smart Speaker Vendors

- 7.2.1 Amazon.com Inc.

- 7.2.2 Google LLC (Alphabet Inc.)

- 7.2.3 Alibaba Group

- 7.2.4 Sonos Inc.

- 7.2.5 Harman-Kardon Inc

- 7.2.6 Apple Inc.

- 7.2.7 Bose Corporation

- 7.2.8 Xiaomi Inc.

- 7.2.9 Baidu Inc.