|

市場調查報告書

商品編碼

1435863

工單管理:市場佔有率分析、產業趨勢與統計、成長預測(2024-2029)Work Order Management - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

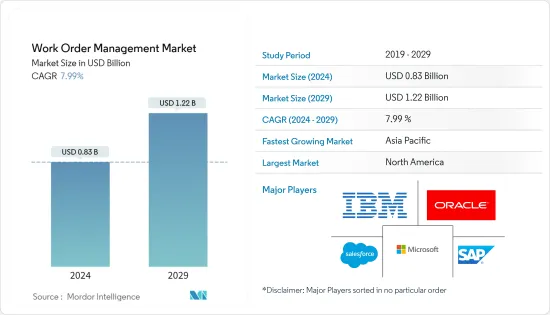

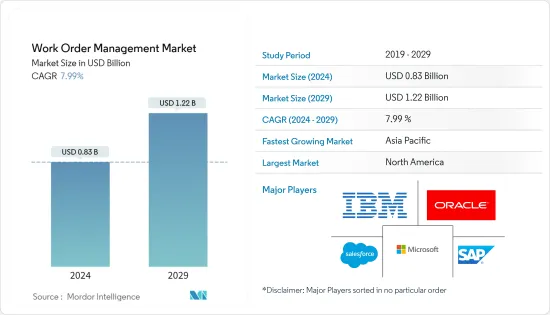

2024年工單管理市場規模估計為8.3億美元,預計到2029年將達到12.2億美元,在預測期間(2024-2029年)以7.99%的複合年增長率增長。

世界各地的企業擴大走向數位轉型,並採用各種解決方案來監控維護和管理。

主要亮點

- 客戶對智慧工廠的興趣與日俱增,根據思科預測,到年終,支援物聯網應用的機器對機器 (M2M) 連接將佔全球 285 億連接設備的一半以上。

- 工單管理是對公司維護、安裝和維修任務的工單進行排程、規劃、追蹤和管理。降低成本、減少設備停機時間和最佳化營運正在推動世界各地設施的數位化。工作訂單管理系統為公司提供了預防性保養的選擇,從而更容易提出服務請求和接收即時更新。

- 隨著中小型企業採用基於雲的管理解決方案的趨勢越來越大,預計小型供應商將越來越專注於在區域範圍內為此類企業提供服務。 預計較小的供應商將在幾個客戶中獲得優勢,而主要供應商越來越多地參與併購活動以獲得區域市場佔有率。

- 例如,2022 年 5 月,Verisk 宣布收購 Pruvan,後者為財產保護和建築專業人士提供現場到辦公室的管理解決方案。此次收購將幫助客戶節省時間並降低營運成本。預計未來幾年此類發展將會增加並再形成市場。

- COVID-19 透過增加對遠距工作和協作工具的需求而影響了所研究的市場。許多組織已轉向遠距工作,這使得管理工單變得更加困難。因此,對可從任何地方存取的工作訂單管理解決方案的需求不斷增加。

工單管理市場趨勢

預計在製造業中廣泛採用

- 工業 4.0 正在將產業從舊有系統轉變為智慧組件和機器,以促進數位工廠以及互聯工廠和企業生態系統的發展。工業 4.0 促使OEM在其業務中採用物聯網。

- 物聯網在製造業中帶來的好處將推動採用率,例如提高機器運轉率、預測性維護和生產、資料分析、監控、自動化和成本效益。

- 隨著製造業對自動化的需求不斷增加,各公司紛紛建立策略夥伴關係,以利用這種不斷成長的需求。

- 例如,2022年3月,全球首個針對現代商業的3D機器人供應鏈系統Attabotics與物流自動化公司SYNUS Tech宣佈建立獨家合作夥伴關係,為韓國市場提供綜合物流技術倉庫解決方案。在 Attabotics 等合作夥伴的幫助下,SYNUS Tech 開發了智慧工廠整體解決方案,並且是韓國第一家將人工智慧融入倉庫的公司。

- 此外,2022年11月,中國工業和資訊化部核准新設三個國家製造業研發中心。他也表示,這些中心將專注於重要非專利技術,推動這些產業的技術研發。

- 此外,工信部表示,將指導新建製造業研發中心增強技術創新能力,為製造業重點領域高品質發展提供重要支撐。

預計北美將主導市場

- 由於 IBM、Microsoft、Oracle 和 Salesforce 等該地區的多家解決方案供應商以及該地區的技術採用優勢,預計北美將主導工作訂單管理市場。

- 物聯網技術正在克服製造業的勞動力短缺問題,尤其是在美國等已開發國家。美國聯邦政府和私營部門組織正在投資工業 4.0 物聯網技術,以擴大美國的工業基礎。

- 人工智慧、物聯網、智慧型裝置和 3D 列印等多項技術已經在改善美國主要工廠的績效指標。該地區各國政府也採取措施支持機器人市場新興技術的發展,以促進機器人的採用。

- 例如,美國聯邦政府啟動了國家機器人舉措(NRI)計劃,以加強美國國內機器人建立能力並推動該領域的研究活動。工單管理透過全面檢查進出物流,降低供應鏈風險,確保運輸途中產品的品質和可靠性。

- 此外,根據美國勞工統計局的數據,截至 2023 年 2 月,美國建築業僱用了約 800 萬人,高於 2021 年的 729 萬人。對建築勞動力的需求不斷成長,也增加了現場對穿戴式裝置的需求。增加更多工人並加速市場成長。

工單管理產業概述

由於全球存在 Salesforce、IBM、Microsoft、SAP SE、Oracle 等解決方案供應商,工單管理市場的競爭形勢較為分散。市場相關人員正在進行重大的產品開發和創新,以增強其在市場中的地位。

2022年3月,亞馬遜宣布收購多通路訂單管理軟體公司Veeqo。此次收購將有助於亞馬遜將增強的銷售工具整合到其多通路履約計畫中。

2022 年 1 月,房地產軟體供應商 MRI Software 宣布收購 Angus Systems,這是一家總部位於多倫多的為商業房地產業主和營運商提供企業級建築營運管理軟體供應商。 Angus Systems 擴展了 MRI 的能力,幫助客戶在疫情期間實現數位轉型並管理不斷變化的工作環境。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場動態

- 市場概況

- 市場促進因素

- 現場工作人員採用行動和穿戴式設備

- 公司傾向於最佳化工作以更好地執行計劃

- 市場限制因素

- 現場工作人員缺乏專業知識

- 產業價值鏈分析

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 買方議價能力

- 新進入者的威脅

- 替代產品的威脅

- 競爭公司之間的敵意強度

- 評估 COVID-19 對產業的影響

第5章市場區隔

- 依成分

- 解決方案

- 服務

- 依部署方式

- 本地

- 雲

- 依最終用戶產業

- 製造業

- 運輸和物流

- 能源和公共

- 衛生保健

- BFSI

- 通訊和資訊技術

- 其他最終用戶產業

- 依地區

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 中東和非洲

第6章 競爭形勢

- 公司簡介

- Salesforce.com, Inc.

- IBM Corporation

- Microsoft Corporation

- Oracle Corporation

- SAP SE

- IFS AB

- Infor Inc.

- Hippo CMMS

- ServiceMax, Inc.

- Innovapptive Inc.

- eMaint Enterprises, LLC

第7章 投資分析

第8章市場機會及未來趨勢

The Work Order Management Market size is estimated at USD 0.83 billion in 2024, and is expected to reach USD 1.22 billion by 2029, growing at a CAGR of 7.99% during the forecast period (2024-2029).

Enterprises worldwide are increasingly moving towards digital transformation, adopting various solutions to oversee maintenance and management.

Key Highlights

- According to Cisco, customers are becoming more interested in smart factories, and by the end of 2022, machine-to-machine (M2M) connections that support IoT applications are predicted to account for more than half of the 28.5 billion connected devices worldwide.

- Work order management is scheduling, planning, tracking, and managing work orders for a business's maintenance, installation, and repair tasks. Reducing costs, equipment downtime, and optimizing operations are augmenting the digitalization of facilities across the globe. Adopting a work order management system allows enterprises to opt for preventive maintenance, making it easy to place service requests and gain real-time updates.

- Due to SMEs' growing inclination towards adopting cloud-based management solutions, smaller vendors are expected to increase their focus on catering to such enterprises regionally. Smaller vendors are expected to command dominance in several clients, and large vendors are increasingly engaging in M&A activities to gain regional market share.

- For instance, In May 2022, Verisk announced the acquisition of Pruvan, a provider of field-to-office management solutions for property preservation and construction professionals. The acquisition would help clients in saving time and reduce operating costs. Such developments are expected to increase over the coming years and reshape the market.

- COVID-19 impacted the studied market through the increased need for remote work and collaboration tools. Many organizations shifted to remote work, making managing work orders more challenging. As a result, there was an increased demand for work order management solutions accessible from anywhere.

Work Order Management Market Trends

Manufacturing Expected to Exhibit Significant Adoption

- Industry 4.0 is transforming industries, from legacy systems to smart components and machines, to promote digital factories and the development of an ecosystem of connected plants and enterprises. Industry 4.0 has persuaded OEMs to adopt IoT across their operations.

- The benefits offered by IoT in the manufacturing industry drive the adoption rates, such as increased machine utilization, predictive maintenance and production, data analytics, monitoring, automation, and cost benefits.

- With the growing demand for automation in manufacturing, companies are entering into strategic partnerships to leverage the growing demand.

- For instance, in March 2022, Attabotics, the world's first 3D robotics supply chain system for modern commerce, and SYNUS Tech, a logistics automation company, announced an exclusive partnership to provide integrated logistics technique warehouse solutions to South Korean markets. SYNUS Tech is developing smart factory total solutions and integrating AI into warehouses for the first time in Korea with the help of partners such as Attabotics.

- Moreover, in November 2022, China's Ministry of Industry and Information Technology approved three new national manufacturing innovation centers. They also stated that these centers would focus on vital generic technologies and boost technological research and development in these industries.

- In addition, the ministry stated that it would guide the new manufacturing innovation centers in strengthening their capabilities to seek technological innovation to provide critical support for the high-quality development of primary fields in manufacturing.

North America Expected to Dominate the Market

- North America is expected to dominate the Work Order Management Market owing to several solution providers in the region, such as IBM, Microsoft, Oracle, and Salesforce, amongst others, coupled with the region's dominance in technology adoption.

- IoT technologies are overcoming the labor shortage in the manufacturing sector, especially in developed countries such as the United States. The Federal Government and private sector organizations in the United States are investing in Industry 4.0 IoT technologies to expand the American industrial base.

- Several technologies like AI, IoT, smart devices, and 3D printing are already growing the performance metrics of major US-based factories. The government in the region is also promoting the adoption of robotics by taking initiatives to support the growth of modern technologies in the robotics market.

- For instance, the US federal government has initiated the National Robotics Initiative (NRI) program to strengthen the capabilities of building domestic robots in the country and boost research activities in the field. Work order management decreases supply-chain risk and ensures the quality and authenticity of in-transit products with a full survey of inbound and outbound logistics.

- Moreover, according to the Bureau of Labor Statistics, the construction sector employed around eight million people in the United States as of February 2023, which increased from 7.29 million in 2021. Such rising demand for construction labor has propelled the demand for wearable devices among field workers, thus accelerating market growth.

Work Order Management Industry Overview

The competitive landscape of the Work Order Management Market is moderately fragmented owing to the presence of several solution providers, such as Salesforce, IBM, Microsoft, SAP SE, and Oracle, amongst others, across the world. The market players are making significant product developments and innovations to enhance their market presence.

In March 2022, Amazon announced the acquisition of Veeqo, a multichannel order management software company. The acquisition would support Amazon in integrating enhanced seller tools into its Multichannel Fulfillment program.

In January 2022, MRI Software, a real estate software provider, announced the acquisition of Angus Systems, a Toronto-based enterprise-class building operations management software provider for commercial real estate owners and operators. Angus Systems expanded MRI's ability to help its clients embrace attaining digital transformation and manage the changing work environments amid the pandemic.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Adoption of Mobile and Wearable Devices Among Field Workers

- 4.2.2 Enterprise Propensity Towards Optimizing Work for Better Execution of Projects

- 4.3 Market Restraints

- 4.3.1 Lack of Expertise Among Field Workers

- 4.4 Industry Value Chain Analysis

- 4.5 Industry Attractiveness - Porter's Five Forces Analysis

- 4.5.1 Bargaining Power of Suppliers

- 4.5.2 Bargaining Power of Buyers/Consumers

- 4.5.3 Threat of New Entrants

- 4.5.4 Threat of Substitute Products

- 4.5.5 Intensity of Competitive Rivalry

- 4.6 Assessment of Impact of COVID-19 on the Industry

5 MARKET SEGMENTATION

- 5.1 By Component

- 5.1.1 Solutions

- 5.1.2 Services

- 5.2 By Deployment Mode

- 5.2.1 On-Premise

- 5.2.2 Cloud

- 5.3 By End-user Industry

- 5.3.1 Manufacturing

- 5.3.2 Transportation and Logistics

- 5.3.3 Energy & Utilities

- 5.3.4 Healthcare

- 5.3.5 BFSI

- 5.3.6 Telecom and IT

- 5.3.7 Other End-user Industries

- 5.4 Geography

- 5.4.1 North America

- 5.4.2 Europe

- 5.4.3 Asia-Pacific

- 5.4.4 Latin America

- 5.4.5 Middle-East & Africa

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 Salesforce.com, Inc.

- 6.1.2 IBM Corporation

- 6.1.3 Microsoft Corporation

- 6.1.4 Oracle Corporation

- 6.1.5 SAP SE

- 6.1.6 IFS AB

- 6.1.7 Infor Inc.

- 6.1.8 Hippo CMMS

- 6.1.9 ServiceMax, Inc.

- 6.1.10 Innovapptive Inc.

- 6.1.11 eMaint Enterprises, LLC