|

市場調查報告書

商品編碼

1441661

POS 終端:市場佔有率分析、產業趨勢與統計、成長預測(2024-2029)POS Terminal - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

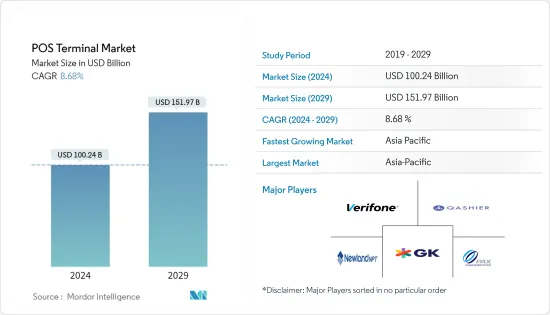

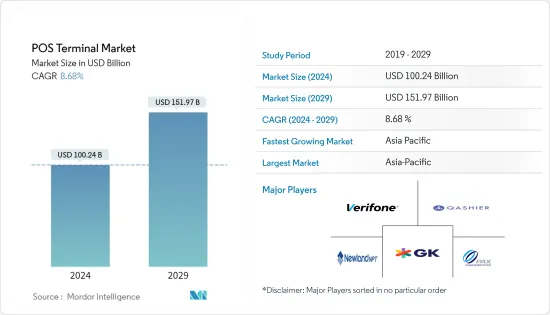

POS終端市場規模預計2024年為1002.4億美元,預計到2029年將達到1519.7億美元,在預測期內(2024-2029年)將以複合年成長率8.68%成長。

由於收益回報率 (ROI) 的提高和易於訪問性,POS 終端市場在過去幾年中出現了顯著成長。 POS 終端系統促進零售、酒店、運輸和銀行等各行業企業核心組件的交易,多年來在中小型企業和大型企業中越來越重要。

主要亮點

- POS終端系統已經從交易導向的終端/設備發展成為與公司的金融解決方案和CRM整合的系統。這種演變使最終用戶能夠利用商業智慧(BI) 來更好地管理收益流和庫存。準確的交易、降低的維護成本和即時庫存是 POS 系統的主要優勢。先進的銷售點系統提供的多種功能優勢正在引導企業以 POS 系統取代傳統的申請軟體,確保銷售點 (POS) 系統市場的成長。

- 隨著時間的推移,現代 POS 終端可降低安裝、設定、電力消耗和維護成本,從而降低擁有成本。多家供應商提供模組化 POS 終端,具有低功耗和觸控螢幕顯示器等特性,有助於降低擁有成本。 Aures Technologies 和 Sharp Electronics 等公司提供固定 POS 解決方案,配備堅固耐用的處理器和觸控螢幕顯示器,有助於改善業務並減少停機。為了最大限度地減少終端內移動部件的數量,Aures 提供的 POS 解決方案配備了無風扇溫度控制。

- 此外,COVID-19感染疾病極大地改變了消費者的購物方式,影響了多個垂直市場。由於 COVID-19 大流行,零售業發生了巨大變化。此外,世界各地的一些消費者擴大使用不同的銷售方式,例如虛擬諮詢、非接觸式付款、路邊取貨和社交商務,其中包括透過多個社交媒體網站購物。這些趨勢正在影響全球 POS 終端的需求。

- 然而,由於使用敏感訊息,安全性仍然是 POS 市場成長的課題。 POS 終端連接到網路和網際網路,這使得它們很容易受到訪問操縱的攻擊,就像任何其他不安全的機器一樣。終端與網路其餘部分的通訊方式意味著攻擊者可以存取未加密的卡片資料,包括 Track2 和 PIN 訊息,這些數據可用於竊盜或克隆支付卡。

POS終端市場趨勢

硬體領域佔據最大市場佔有率

- 此系列硬體組件主要構成具有附加交易功能的整合 POS 系統和獨立 POS 終端(交易支援單元)。雖然許多傳統硬體通常是模組化的,但一體式設備的推出為固定設備和內建付款終端、掃描器和印表機的可攜式POS 平板電腦打開了大門。

- 在一些國家/地區,信用卡和簽帳金融卡卡僅透過支付終端進行處理,因為物理屬性被認為可以提供真實性。這項傳統使得人們可以超越櫃檯,通常是在商店內的終端機上。信用卡和簽帳金融卡資料相對容易受到駭客攻擊,這一事實進一步加劇了這種需求,這與透過 POS 系統處理支付卡時不同,在 POS 系統中,安全措施取決於最終用戶或開發人員。

- 由於存在多種安全威脅,大多數為市場製造的新硬體都是為了讓交易更順暢而設計的。然而,大流行造成的強制疏遠刺激了具有專用身份驗證功能的非接觸式付款的發展。攝影機和指紋感應器的添加正在推動表單尺寸的增加。儘管如此,產業發展也阻礙了製造商在微電子領域的小型化進程。例如,VisionLabs 推出了經過 Visa PayWave 認證的 LUNA POS 終端機和 Mastercard Contactless,旨在支援傳統信用卡交易和非接觸式臉部認證交易。作為臉部認證的替代方案,也支援 NFC、RFID、晶片和磁條卡交易。

- 超級市場零售商的成長增加了對 mPOS 解決方案的需求。 Visa 交易資料進一步支持了這一觀察結果,與成熟和新興電子商務市場相比,多個國家的平均交易規模繼續保持領先地位。

- 隨著疫情期間線上市場取代了購物體驗,電子商務也需要更多的關注。 Shopify 推出了適用於紐西蘭面對面交易的 Shopify 銷售點 (POS) 和 Shopify Payments 的整合式零售硬體。該機器專門用於允許零售商使用完整的行動 POS 及其各自的硬體來處理交易並接受各種付款方式。

亞太地區將經歷顯著成長

- 亞太地區是技術採用最前沿的地區,這也影響著 POS 終端市場的成長。無現金付款在各國的興起也為市場創造了新的機會。

- 使用信用卡和簽帳金融卡進行 POS付款也推動了對 POS 終端的需求。此外,該地區供應商透過創新、戰略合作夥伴關係和併購的投資正在推動該地區的市場成長。根據印度儲備銀行統計,目前印度 PoS 終端數量已超過 470 萬台。 PoS終端在餐廳、雜貨店、加油站和加油站等商業領域穩步成長。

- 類似地,PCI 認證付款軟體解決方案的主要企業MYPINPAD 最近與付款解決方案供應商SPECTRA Technologies 和香港領先的付款終端製造商合作,為智慧型手機推出基於軟體的非接觸式解決方案。付款解決方案。萬事達卡也與兩家公司合作推出了新的 SoePay 解決方案,進一步擴大了萬事達卡 Tap on Phone 受理網路。

- 此外,該地區電子商務的成長也為POS終端市場創造了新的機會。 Reprise 和 Google 最近的一項研究發現,“每月幾次”網上購物的人數比線下消費者多出42%,而線下購物者則多出31%,而“每隔幾個月一次”網上購物的人數比線下消費者多出 66% 。研究還表明,該地區已實現五次跨越,並已實現 2025 年的預測 (n=13,000)。

POS終端產業概況

由於 iMetrics Pte Ltd、三星電子、松下公司、卡西歐電腦、NEC 公司和 PAX Technology 等眾多參與者的存在,POS 終端市場高度分散。此外,這些參與者正在研發活動中投入大量資金,以將創新的付款技術推向市場。一些國家嚴格的政府法規和政策將推動市場,進一步提高其吸引力和競爭力。

2022 年 6 月,Qasher 為 GastroBeats 2022食品音樂節提供官方 POS。此舉標誌著這家新加坡金融科技Start-Ups向活動付款解決方案領域的擴張。 Qasher 與 GastroBeats 合作,在整個活動期間實現非接觸式訂購和支付,確保每個人都能獲得安全、簡化的體驗。作為官方 POS 贊助商,Qasher 將在海灣舫大道 14,200平方公尺的活動空間內的約 40 個餐飲攤位引入無現金付款,零售品牌將配備 QasherPay 智慧終端,接受無限現金支付,包括信用卡/金融卡。接受付款方式。

2022年5月,Lavu與Verifone合作,為餐廳提供整合付款和POS解決方案。這項策略合作夥伴關係將更好地服務餐飲業,使 Verifone 和 Lavu 能夠為客戶提供高品質、整合的銷售點 (POS) 和支付體驗。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場洞察

- 市場概況

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭公司之間的敵意強度

- COVID-19對POS終端市場的影響

第5章市場動態

- 市場促進因素

- 零售業擴大採用 POS 終端

- 擴大採用雲端基礎的平台

- 市場課題

- 資料安全問題

- 硬體引起的問題

第6章市場區隔

- 依成分

- 硬體

- 軟體

- 服務

- 依類型

- 固定POS終端

- 行動/可攜式POS 終端

- 依最終用戶產業

- 娛樂

- 款待

- 衛生保健

- 零售

- 其他

- 依地區

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 中東和非洲

第7章 競爭形勢

- 公司簡介

- iMetrics Pte Ltd

- Samsung Electronics Co. Ltd

- Ingenico SA

- VeriFone System Inc.

- Micros Retail Systems Inc.(Oracle)

- HP Development Company LP

- Panasonic Corporation

- Bindo Labs Inc.

- NEC Corporation

- PAX Technology

- Casio Computer Co. Ltd

- NCR Corporation

- Newland Payment Technology

- NEXGO(Shenzhen Xinguodu Technology Co. Ltd.)

- Toshiba Global Commerce Solutions

- Fujitsu Ltd

- Qashier PTE Ltd

- Diebold Nixdorf

- NCR Corporation

- Cow Hills Retail BV

- Ctac NV

- Agilysys Inc.

- GK Software SE

- Infor Inc.

- Aptos Inc.

- PCMS Group Ltd

- Cegid Group

- Toshiba Tec Corporation

第8章投資分析

第9章市場的未來

The POS Terminal Market size is estimated at USD 100.24 billion in 2024, and is expected to reach USD 151.97 billion by 2029, growing at a CAGR of 8.68% during the forecast period (2024-2029).

The POS terminal market has witnessed significant growth over the past few years, owing to its ability to offer an increased return on investment (ROI) and ease of access. POS terminal systems that facilitate transactions from the central component of businesses across industries, like retail, hospitality, transportation, and banking, have gained importance in small and big-sized companies over the years.

Key Highlights

- POS terminal systems have evolved from transaction-oriented terminals/devices to systems that integrate with the company's financial solutions and CRM. The evolution has empowered end-users with business intelligence (BI) to better manage their revenue streams and inventory. Accurate transactions, lower maintenance costs, and real-time inventory are critical advantages of point-of-sale systems. With the several functional benefits that the advanced point-of-sale systems offer, companies have replaced traditional billing software with POS systems, thus securing the growth of the point-of-sale (POS) systems market.

- Modern POS terminals reduce the cost of deployment, setup, power consumption, and maintenance over time, leading to the cost of ownership. Several vendors offer modular point-of-sale terminals with attributes such as low power consumption and touchscreen displays, which helps reduce ownership costs. Companies such as Aures Technologies, Sharp Electronics, and many others offer fixed point-of-sale solutions with robust processors that help improve operations and reduce failures and touchscreen displays. To minimize the several number of moving parts in the terminal, the point-of-sale solution offered by Aures comes with fanless temperature control.

- Further, the COVID-19 pandemic has significantly transformed how consumers shop, affecting several market verticals. The retail industry witnessed a drastic difference due to the COVID-19 pandemic. Several consumers globally have also increased the use of various sales methods, such as virtual consultations, contactless payment, curbside pickup, and social commerce, which includes shopping through several social media sites. Such trends have affected the demand for point-of-sale (POS) terminals globally.

- However, security remains a challenge for the point-of-sales market's growth due to the usage of critical information. POS terminals are connected to the network and the internet, making them vulnerable to attacks for access manipulation as is the case with any other insecure machine. The way the terminal communicates with the rest of the network means attackers could access unencrypted card data, including Track2 and PIN information that can be used to steal and clone payment cards.

Point of Sale (POS) Terminal Market Trends

Hardware Segment to Account for the Largest Market Share

- The scope of hardware components primarily constitutes an integrated POS system that features additional transactional capabilities and standalone POS terminals (transaction enablement units). While a lot of legacy hardware has typically been modular, the advent of All-In-One units has allowed for the deployment of fixed units and portable POS tablets in the market that feature built-in payment terminals, scanners, and printers.

- In some countries, credit and debit cards are only processed via payment terminals, owing to a belief that physical attributes offer reliability. This tradition has allowed counters to be overridden with terminals in stores typically. The demand is further supported by the fact that credit and debit card data is comparatively less vulnerable to hackers, unlike when payment cards are processed through a POS system where the security measures depend on end-users and developers.

- Due to several security threats, most new hardware manufactured for the market is designed to enable smoother transactions. However, the forced distancing due to the pandemic has spurred the development of contactless payments with dedicated authentication features. The addition of cameras and fingerprint sensors is pushing for larger form sizes. Still, it is also being countered by industry developments that allow manufacturers to go smaller in the hunt for microelectronics. For instance, VisionLabs announced the LUNA POS terminal, a terminal certified by Visa PayWave, and Mastercard Contactless designed to permit transactions from both traditional credit card transactions and contactless face biometrics. NFC, RFID, chip, and magnetic stripe card transactions are also supported as alternatives to facial authentication.

- The growth of supermarket retailers globally has fueled the demand for mPOS solutions. Visa transaction data further supported the observation, showing that several countries continue to maintain a healthy lead in average transaction size compared to both mature and emerging e-commerce markets.

- As online marketplaces took over the shopping experience during the pandemic, e-commerce also began to demand more interest. Shopify launched integrated retail hardware for Shopify Point of Sale (POS) and Shopify Payments for in-person transactions in New Zealand. The machine was dedicated to allowing retailers to process transactions and accept various payment methods with a fully mobile POS and respective hardware.

Asia Pacific to Witness Significant Growth

- Asia Pacific is a region at the forefront of technology adoption, which is also influencing the market growth for POS terminals. The prominence of cashless payments in different countries is also a factor that creates new opportunities for the market.

- The usage of credit and debit cards in point-of-sale payments is also a factor that is driving the need for POS terminals. Further, investments by vendors in the region through innovation, strategic partnerships, and mergers and acquisitions are driving market growth in the region. According to the Reserve Bank of India, there were more than 4.7 million PoS terminals recently in India. PoS terminals saw steady growth in business sectors like restaurants, grocery shops, and gas and fuel stations.

- Along similar lines, recently, MYPINPAD, a prominent player in PCI-certified payments software solutions, together with a payment solution provider, SPECTRA Technologies, and Hong Kong's leading payment terminal manufacturer, announced the launch of a software-based contactless payments solution for smart devices that enhances customer experience for small and micro-merchants in Hong Kong. Mastercard also partnered with both companies to launch the new SoePay solution to expand the Mastercard Tap on Phone acceptance network further.

- Moreover, the growth in e-commerce in the region also presents new opportunities for the POS terminals market. According to a recent study by Reprise and Google, a 'few times a month' online shoppers are now outpacing their offline counterparts by 42% vs. 31% and those who shop online 'once every few months' leapfrog offline shoppers by 66%. Also, according to the study, the region has leapfrogged as much as five times, already meeting projections for 2025. (n=13,000).

Point of Sale (POS) Terminal Industry Overview

The Point of Sale Terminal Market is significantly fragmented with the presence of a large number of players such as iMetrics Pte Ltd, Samsung Electronics Co. Ltd, Panasonic Corporation, Casio Computer Co. Ltd, NEC Corporation, PAX Technology, and many more. Moreover, these players are investing large amounts of money in R&D activities to introduce innovative payment technologies in the market. Strict government regulations and policies in several countries will drive the market, making it more attractive and competitive.

In June 2022, Qashier offered the official point-of-sale (POS) for the food and music festival, GastroBeats 2022. This step marks the Singapore FinTech startup's foray into the events payment solutions space. Qashier partnered with GastroBeats to enable contactless ordering and payments across the entire event, ensuring a safe and streamlined experience for everyone. As the official POS sponsor, Qashier powered the 14,200 sq m event space at Bayfront Avenue with cashless payments around 40 F&B stalls, and retail brands were equipped with QashierPay smart terminals, allowing them to accept a myriad of cashless payment methods, including credit/debit cards, and e-wallets.

In May 2022 , Lavu partnered with Verifone to provide restaurants with unified payments and point-of-sale solutions. The strategic partnership helped serve the restaurant industry better, allowing Verifone and Lavu to offer customers a high-quality, unified point of sale (POS) and payment experience.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Consumers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitutes

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Impact of COVID-19 on the Point of Sale (POS) Terminal Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Growing Adoption of POS Terminals in the Retail Sector

- 5.1.2 Rising Adoption of Cloud-based Platforms

- 5.2 Market Challenges

- 5.2.1 Data Security Concerns

- 5.2.2 Problems Due to Hardware

6 MARKET SEGMENTATION

- 6.1 By Component

- 6.1.1 Hardware

- 6.1.2 Software

- 6.1.3 Services

- 6.2 By Type

- 6.2.1 Fixed Point-of-Sale Terminals

- 6.2.2 Mobile/Portable Point-of-Sale Terminals

- 6.3 By End-user Industries

- 6.3.1 Entertainment

- 6.3.2 Hospitality

- 6.3.3 Healthcare

- 6.3.4 Retail

- 6.3.5 Other End-user Industries

- 6.4 By Geography

- 6.4.1 North America

- 6.4.2 Europe

- 6.4.3 Asia Pacific

- 6.4.4 Latin America

- 6.4.5 Middle East and Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 iMetrics Pte Ltd

- 7.1.2 Samsung Electronics Co. Ltd

- 7.1.3 Ingenico SA

- 7.1.4 VeriFone System Inc.

- 7.1.5 Micros Retail Systems Inc. (Oracle)

- 7.1.6 HP Development Company LP

- 7.1.7 Panasonic Corporation

- 7.1.8 Bindo Labs Inc.

- 7.1.9 NEC Corporation

- 7.1.10 PAX Technology

- 7.1.11 Casio Computer Co. Ltd

- 7.1.12 NCR Corporation

- 7.1.13 Newland Payment Technology

- 7.1.14 NEXGO (Shenzhen Xinguodu Technology Co. Ltd.)

- 7.1.15 Toshiba Global Commerce Solutions

- 7.1.16 Fujitsu Ltd

- 7.1.17 Qashier PTE Ltd

- 7.1.18 Diebold Nixdorf

- 7.1.19 NCR Corporation

- 7.1.20 Cow Hills Retail BV

- 7.1.21 Ctac NV

- 7.1.22 Agilysys Inc.

- 7.1.23 GK Software SE

- 7.1.24 Infor Inc.

- 7.1.25 Aptos Inc.

- 7.1.26 PCMS Group Ltd

- 7.1.27 Cegid Group

- 7.1.28 Toshiba Tec Corporation