|

市場調查報告書

商品編碼

1408239

mPOS終端-市場佔有率分析、產業趨勢/統計、2024年至2029年成長預測mPOS Terminals - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts 2024 - 2029 |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

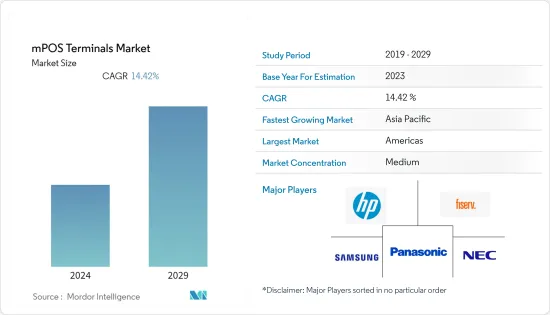

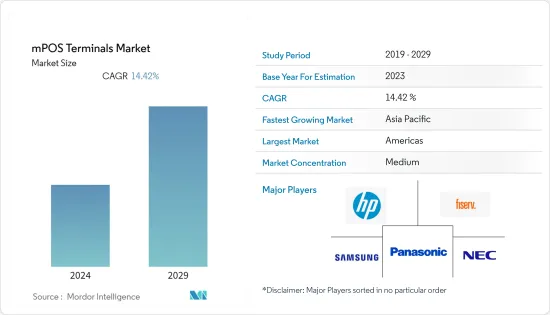

本會計年度全球mPOS終端市場規模為411.7億美元,預計到預測期結束時將達到807.3億美元,複合年成長率為14.42%。

主要亮點

- 行動 POS (mPOS) 終端機和市場是指用於銷售點付款的行動設備,例如智慧型手機、平板電腦和專用付款設備。

- 在這種情況下,可以透過掃描2D碼、簽帳金融卡或信用卡、現金或 UPI 轉帳的方式進行付款。 mPOS系統提供企業多種支付型態,讓客戶輕鬆便捷地進行支付。這些系統可以處理所有支付模式並追蹤交易,有助於降低整體成本並提高效率。

- 行動 POS 系統越來越受歡迎,因為它們允許銷售和服務企業在客戶所在的地方進行交易,從而增加了整個流程的彈性並改善了客戶體驗。全球電子商務的成長以及實體零售和線上零售的融合預計也將影響終端的未來成長。事實上,由於主要電子商務平台提供貨到付款選項,行動 POS 終端機的採用率激增。

- 資料保護至關重要,因為 mPOS 終端可能沒有像 POS 終端那樣強大的安全協議,尤其是在使用 Apple 或 Android 智慧型手機和平板電腦等商用現成 (COTS) 終端時。

- 在預測期結束時,隨著商家增加相關服務,以滿足對非接觸式和易於使用的支付方式不斷成長的需求,市場預計將會成長。由於 mPOS 解決方案是專門為手持設備而不是桌上型電腦設計的,因此更小、更攜帶的設備的趨勢預計將推動市場成長。

mPOS終端市場趨勢

卡片付款和線上付款的採用率增加

- 金融科技公司和專用數位銀行的成長預計將加劇全球銀行業的競爭並增加簽帳金融卡的使用。在信用卡普及的美國,拉丁美洲等地區,尤其是收入較低的地區,傳統上都是用現金支付。近年來,這些地區發生了變化,隨著數位化的進步,越來越多的人願意使用信用卡進行購物。

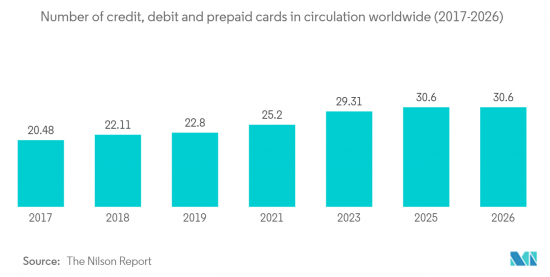

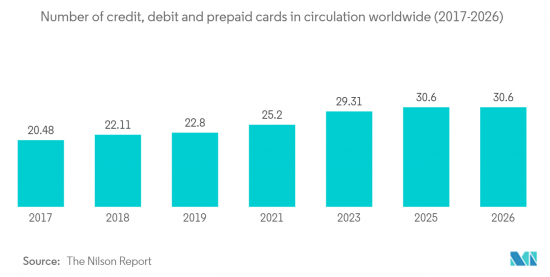

- 世界各地商店的卡片付款包括簽帳金融卡、信用卡和銀行融資的預付卡。近年來,POS上的簽帳金融卡和信用卡卡片付款交易已在各地區普及。 POS卡片付款的成長主要得益於各種政府措施的支持,例如限制交換費和增加 POS 基礎設施的普及。

- 2023 年 6 月,iPhone 上的 Tap to Pay 將支援使用 iPhone 以簡單、安全和私密的方式在 LVMH 門市進行面對面非接觸式付款,無需任何額外硬體。在今年的 Viva 科技展上,LVMH 宣布從今年稍後開始,iPhone 上的 Tap to Pay 將在美國部分 LVMH 集團商店推出,提供無縫且安全的付款體驗。 iPhone 上的 Tap to Pay 允許 LVMH 集團客戶顧問使用 Apple Pay、非接觸式簽帳金融卡支付以及店內數位錢包,只需使用他們的 iPhone 和合作夥伴支援的 iOS 應用程式即可。

- 此外,過去兩年澳洲的 EFTPOS 終端數量有所增加。隨著EFTPOS被證明是一種安全的付款方式,預計將增加國內機場的數量,並鼓勵全國各地的實體店接受卡片付款。例如,2021年11月,為了促進澳洲數位經濟的付款競爭,EFTPOS宣布其下一代數位安全技術的最新階段將被多家澳洲銀行成員使用,包括Fat Zebra、Till Payments宣佈在商店和FinTech運作。

- 此外,隨著更多經濟領域的開放,全球各 POS 公司都在增加產量,以滿足各個實體店對 POS 系統的需求。預計這些發展將在研究期間進一步加速卡片卡片付款的成長。

零售業預計將大幅成長

- 零售業是mPOS終端機的主要用戶之一。預計該細分市場將在全球佔據顯著佔有率。隨著世界各地實體店日益數位化,零售業也逐漸復甦。精通技術和不懂技術的客戶都希望在他們最喜歡的零售商處獲得順暢的交易體驗。

- 在超級市場、大型零售商、百貨公司等,對多個mPOS系統的需求如滾雪球般成長,活躍且集中的系統正在支援mPOS終端市場零售業的穩定開拓。對於客戶地圖應用程式,人們越來越關注客戶行為,並且 mPOS 的採用率也在不斷成長。

- 零售商正在採用行動 POS 軟體程式遠端存取其設施,減少因員工缺勤造成的收益損失。這使得業主能夠頻繁地收到有關其零售店內正在進行的工作的資訊。它還允許您追蹤和組織實體店和線上市場中的產品。市場領導正在推出支援 NFC 和 EMV 合規性的零售 POS 終端軟體,以幫助客戶更快、更安全地進行支付。

- 每個地區的零售店數量不斷增加,透過大型售貨亭和其他服務吸引顧客。此外,美國商務部預測,到2025年,美國本土零售額將達到約5.35兆美元。然而,客戶維繫已成為維持市場的主要挑戰。這種競爭增加了重塑經營模式的義務,以避免價值競爭,並在尖端技術投資和收入之間找到平衡。

- 此外,數位經濟預計將迅速擴張並創造巨大的需求。淡馬錫和Google預測,到 2023 年,前六大國家的線上消費者支出將達到近 25 兆美元。可支配收入增加、網際網路使用增加、物流網路改善和替代付款方式推動了電子商務的興起。

mPOS終端產業概況

全球行動POS終端市場包括Fiserv, Inc.、Hewlett Packard Enterprise Development LP、Ingenico、NEC、Oracle、Panasonic Holdings Corporation、PAX Technology、Posiflex Technology, Inc.、QVS Software、Samsung Spectra Technologies、Toshiba Corp.等主要企業VeriFone , Inc. 和Zebra Technologies Corp. 等公司正進入該市場。

- 2023 年 4 月,全球付款技術公司和行動 POS 領先者 Miura Systems 宣布推出全新 Miura Android 智慧 POS付款設備 (MASP)。 Miura Android智慧型POS付款設備不僅完美改善了行動付款,還可以讓您在沒有任何困難或註冊知識的情況下融入付加,以更少的部署、更快的上市時間、維護價格,為經銷商獲得更有意義的價值打開大門獲取即時交易資訊以促進更健康的業務理解和政策制定。

- 2023年4月,美國支付論壇發布了兩份與銷售資訊(POS)相關的新白皮書。初始材料旨在讓行業利益相關者了解 mPOS、TapToMobile 和傳統 POS 解決方案之間的差異。第二份文件為使用者驗收測試 (UAT) 提供了指導,以減少部署資訊點 (POS) 解決方案後的生產和驗收問題。

- 2023 年 1 月,IPCMobile 推出了行動 POS 平台,該平台在一個地方提供硬體、軟體和定價選項。新的 QuantumPay 旨在簡化和加速行動付款解決方案的部署,同時讓客戶可以選擇攜帶自己的處理器。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場洞察

- 市場概況

- 產業吸引力-波特五力分析

- 買方議價能力

- 供應商的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭公司之間敵對關係的強度

- COVID-19 市場影響評估

第5章市場動態

- 市場促進因素

- 降低整個付款流程和庫存管理的成本

- 卡片付款和線上付款的採用率增加

- 市場抑制因素

- 農村地區缺乏數位基礎設施

第6章 市場細分

- 按類型

- 智慧型手機/平板電腦

- 行動POS設備

- 按行業分類

- 零售

- 款待

- 醫療保健

- 其他行業

- 按地區

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 中東/非洲

第7章 競爭環境

- 公司簡介

- HP Development Company, LP

- Fiserv, Inc

- NEC Corporation

- Ingenico

- Panasonic Corporation

- PAX Technology

- SAMSUNG ELECTRONICS

- Posiflex Technology, Inc.

- SPECTRA Technologies

- VeriFone, Inc.

第8章投資分析

第9章 市場未來展望

The global mPOS terminals market was valued at USD 41.17 billion in the current year, and it is anticipated to register a CAGR of 14.42% to reach USD 80.73 billion by the end of the forecast period.

Key Highlights

- The mobile POS or mPOS terminals or market denotes the mobile devices used to make transactions, including smartphones or tablets and dedicated payment devices, to make payments at the point of sale.

- In this case, the payment is made by scanning a QR code, debit and credit cards, cash, or UPI transfers. The mPOS systems make it accessible for businesses to accept payment in different forms, making it easy for customers to pay conveniently. Since these systems can process all the payment modes and keep track of the transactions, they help reduce the overall cost and improve efficiency.

- Mobile POS systems are gaining traction as they allow sales and service industries to conduct the transaction at the customer's location, adding flexibility to the whole process and improving customer experience. The growth in e-commerce globally and the entangling of brick-and-mortar and online retail practices are also expected to affect the future growth of the terminals. In fact, with the option of cash on delivery provided by major e-commerce platforms, a sudden surge in the adoption of mobile POS terminals has been recognized.

- Data protection is paramount as mPOS devices may not have security protocols as robust as their POS counterparts, especially if using commercial-off-the-shelf (COTS) devices such as Apple or Android smartphones and tablets.

- Towards the end of the forecast period, the market is anticipated to grow as vends increase their relevant offerings in response to the increased demand for contactless ease-of-use payment methods. As mPOS solutions are specially designed for handheld devices instead of desktop computers, the trend of smaller and more portable devices will augment the market's growth.

mPOS Terminals Market Trends

Increase in Adoption of Card and Online payment

- The growth of fintech companies and digital-only banks is anticipated to increase competition in the global banking industry and increase the use of debit cards. In the United States, where credit cards are widely used, people in regions such as Latin America, particularly those with lower incomes, have traditionally made payments using cash. In recent years, there has been a transition in these regions as well, and more people are becoming comfortable with using credit cards to make purchases due to growing digital adoption.

- The card-based payments at the point of sale worldwide include debit cards, credit cards, and bank-financing prepaid cards. Over the past few years, card-payment transactions through debit cards and credit cards at the point of sale are gaining popularity in all regions. The growth in card payments at the point of sale is primarily supported by various government initiatives, including the cap on interchange fees and the widespread expansion of POS infrastructure.

- In June 2023, Tap to Pay on iPhone provides an easy, secure, and private way to accept in-person contactless payments at LVMH stores using iPhone - no additional hardware needed. At this year's Viva Technology show, LVMH announced that it would begin rolling out Tap to Pay on iPhone to select LVMH Group stores in the U.S. later this year, offering a seamless and secure payment experience. With Tap to Pay on iPhone, the LVMH Group client advisors can accept Apple Pay, contactless debit and credit cards payments, and various digital wallets in the store simply by using their iPhone and a partner-enabled iOS app - no additional hardware needed, regardless of the purchase amount.

- Additionally, Australia has witnessed an upward swing in the number of EFTPOS terminals in the past two years. An increased number of airports across the country, as it has been proven to be the secure option of payment, it is expected to boost card payment acceptance at the physical stores in the country. For instance, in November 2021, In a movement to boost payments competition in the Digital Economy of Australia, EFTPOS proclaimed that the newest phase of its next-generation digital security technology had gone live with numerous banks in Australia merchants and FinTechs, that included Fat Zebra, Till Payments, as well as EFTEX.

- Further, with the opening of more economic sectors, various POS companies globally are increasing their production to cater to the demand for the POS system at various physical stores. Such development is anticipated to further augment the growth of card-based payments during the study period.

Retail Segment is Projected to Showcase a Significant Growth

- The retail sector is one of the main users of mPOS terminals. The segment is anticipated to hold a noteworthy share globally. The retail segment is gradually picking up with the digitalization of brick-and-mortar stores in different parts of the world. Tech and non-tech-savvy customers are similarly demanding in desiring a smooth transaction experience at their favored retailers.

- The snowballing need for multiple mPOS systems among supermarkets, big retailers, and departmental stores with a vigorous and centralized system has pushed the retail sector's steady development in the mPOS terminal market. Due to its customer mapping application, the augmented emphasis on customer behavior has directed to amplified mPOS adoption.

- Retailers are employing mobile POS software programs to remotely access their establishments and reduce the factors contributing to decreased revenues owing to the non-availability of staff. This gives the owners frequent updates on the work done within retail locations. It also makes tracking and organizing the products in physical and online marketplaces possible. Market leaders have introduced retail POS terminal software compatible with NFC and EMV compliance, enabling customers to make payments more quickly and securely.

- The increasing number of retail stores across regions attracts customers because of the significant concessions and other services. Additionally, the Department of Commerce in the United States has projected the retail revenue to touch about USD 5.35 trillion in the United States itself by 2025. Nevertheless, customer retention has become the principal challenge to sustaining in the market. This competition upsurges the obligation to reinvent their business models to sidestep competition concerning the value and find the balance between investment in the latest technologies and income.

- Furthermore, the digital economy is projected to expand rapidly, in that way creating significant demand. Temasek and Google predict that by the year 2023, online consumer spending across the top 6 economies will witness almost a quarter of a trillion dollars. The rise of e-commerce is fueled by rising disposable incomes, increased internet usage, improved logistical networks, and alternative payment methods.

mPOS Terminals Industry Overview

The global mobile POS terminals market featured several prominent players, such as Fiserv, Inc., Hewlett Packard Enterprise Development LP, Ingenico, NEC Corporation, Oracle, Panasonic Holdings Corporation, PAX Technology, Posiflex Technology, Inc., QVS Software, Samsung Spectra Technologies, Toshiba Corp., VeriFone, Inc., and Zebra Technologies Corp.

- In April 2023, a global payment technology company, in addition to a mobile point-of-sale front-runner, Miura Systems, proclaimed the introduction of its new Miura Android Smart POS payment device (MASP). Miura Android Smart POS payment device flawlessly improves mobile payments as well as value-added incorporations without difficulty or registered knowledge, opening the door to dealers deriving more value meaningfully in terms of lesser deployment, faster time-to-market, and maintenance prices, and access to real-time transactional information for healthier business understandings and policymaking.

- In April 2023, The US Payments Forum published two new white papers related to the Point of Sale (POS). The first resource pursues to instruct industry shareholders on the differences between mPOS, TapToMobile, and traditional POS solutions. The second resource provides direction for user acceptance testing (UAT) to decrease production and acceptance problems following the deployment of Point of Sales Solutions.

- In January 2023, IPCMobile launched a mobile point-of-sale (POS) platform that includes hardware, software, and pricing options from a single source. The new QuantumPay is designed to simplify and accelerate the deployment of mobile payment solutions while offering customers the option of bringing their processors.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Buyers

- 4.2.2 Bargaining Power of Suppliers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitutes

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Assessment of the Impact of COVID-19 on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Reduced Cost of overall payment process and inventory management

- 5.1.2 Increase in Adoption of Card and Online payment

- 5.2 Market Restrains

- 5.2.1 Lack of Digital Infrastructure in Rural Areas

6 MARKET SEGEMENTATION

- 6.1 By Type

- 6.1.1 Smartphone/Tablet

- 6.1.2 mPOS Device

- 6.2 By End-Use Verticals

- 6.2.1 Retail

- 6.2.2 Hospitality

- 6.2.3 Healthcare

- 6.2.4 Other End-Use Verticals

- 6.3 By Geography

- 6.3.1 North America

- 6.3.2 Europe

- 6.3.3 Asia-Pacific

- 6.3.4 Latin America

- 6.3.5 Middle East and Africa

7 COMPETETIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 HP Development Company, L.P

- 7.1.2 Fiserv, Inc

- 7.1.3 NEC Corporation

- 7.1.4 Ingenico

- 7.1.5 Panasonic Corporation

- 7.1.6 PAX Technology

- 7.1.7 SAMSUNG ELECTRONICS

- 7.1.8 Posiflex Technology, Inc.

- 7.1.9 SPECTRA Technologies

- 7.1.10 VeriFone, Inc.