|

市場調查報告書

商品編碼

1440304

包裝:市場佔有率分析、產業趨勢與統計、成長預測(2024-2029)Packaging - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

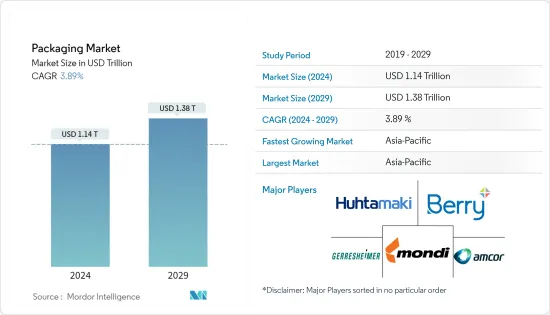

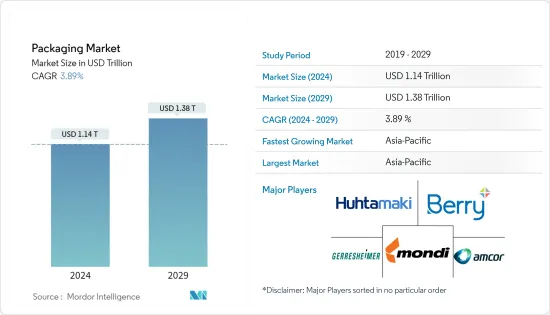

2024年包裝市場規模預計為1.14兆美元,預計到2029年將達到1.38兆美元,在預測期內(2024-2029年)年複合成長率為3.89%成長。

由於基材選擇的變化、新市場的擴張以及所有權關係的變化,全球包裝業務在過去十年中經歷了持續成長。傳統包裝可能會繼續被軟包裝和高阻隔薄膜所取代,而立式殺菌袋有潛力與金屬罐和玻璃瓶等硬包裝形式競爭,適用於各種食品。

主要亮點

- 隨著糖果零食和糖果零食產品消費量的增加,一些軟質塑膠包裝供應商正在提供專門滿足這項需求的包裝解決方案,進一步提高銷售額和收益。例如,根據美國人口普查局的數據,到 2023 會計年度,美國糖果零食業收益預計將達到 108.9 億美元。

- 根據軟質包裝協會統計,軟質包裝主要用於食品,佔整個市場的60%以上。由於能夠針對各種包裝問題採用新的解決方案,軟包裝產業正在穩步成長。此外,根據 IBEF 的數據,印度的食品和雜貨市場是全球第六大市場,零售額佔銷售額的 70%。印度食品加工業是該國最重要的產業之一,佔全國食品市場總量的32%,在產量、消費和出口方面排名第五。

- 永續性趨勢,包括 PET 的回收和生物分解性型態的使用,預計在預測期內將會增加。在某些方面,其生產的性質意味著它將始終面臨永續性問題。然而,回收流和發展可以幫助解決此類永續性問題。例如,可口可樂的歐洲合作夥伴承諾到 2025 年在西歐收集 100% 的包裝,並在寶特瓶使用 50% 的再生塑膠。百事可樂的目標是到 2025 年在歐洲生產的瓶子中使用 50% 的再生塑膠。 2030年,中期目標是到2025年約45%。各大食品製造商也面臨來自活動人士和消費者的壓力,現在他們的使命是重新思考塑膠包裝並轉向循環經濟。例如,雀巢和億滋最近簽署了歐洲塑膠協議。該計劃的目標是到 2025 年使包裝材料 100% 可回收或可重複使用,並減少原生塑膠的使用。

- 不同的公司都專注於產品創新,以便在所研究的市場中佔有重要地位。例如,2021年2月,ConstantiaFlexibles推出了新產品Perpetua,這是一種用於藥品的可回收阻隔性聚合物單材料包裝解決方案。該公司表示,該解決方案與廣泛的藥品包裝應用相容,目前在全球範圍內銷售。

- 許多供應商都致力於透過建造新的紙包裝生產設施來擴大其市場佔有率。例如,2021年12月,羅馬尼亞工業包裝公司Promateris宣布將在該國建造生產設施,並於2022年進入紙包裝領域。該計劃預計將於2023年完工。此外,該公司計劃於 2022 年開始生產以玉米粉為基礎的生物分解性和可堆肥原料,成為東歐第一家這樣做的公司。

- 然而,另一方面,不可回收和不可生物分解性的塑膠包裝解決方案的整體使用正在增加,導致環境中的碳排放增加。這可能是限制市場成長的因素。因此,亞馬遜、谷歌和利樂等許多大公司都以淨零碳排放為目標,預計將轉化為資本支出。

- 在COVID-19的影響下,無接觸配送也成為新趨勢。 Garcon Wines 等永續包裝先驅有潛力適應這些新標準。 Garcon Wines 順利供應信箱和平底酒瓶,需求量大。此外,COVID-19感染疾病的快速生產也增加了對玻璃容器和管瓶儲存的需求。德國著名玻璃公司 Schott AG 到 2021 年 3 月已生產足夠 10 億劑 COVID-19感染疾病的管瓶,並且預計將生產超過 20 億劑。該公司表示,大約 90% 的批准疫苗使用其硼矽酸管瓶,因為它們能夠抵抗衝擊和極端溫度。

包裝市場趨勢

紙和紙板包裝產品將經歷最高成長

- 包裝中擴大使用環保材料推動了市場的發展。環保包裝可回收、生物分解性分解、可重複使用、無毒且對環境影響較小。紙袋、小袋和紙箱等紙包裝產品是成長最快的永續包裝材料。線上零售和有關非生物分解和不可回收包裝解決方案的環境法規的日益成長的趨勢正在逐漸創造對環保紙包裝解決方案的巨大需求。

- 2021 年 2 月,可口可樂使用紙瓶測試了第一個試點,該紙瓶由非常堅固的紙殼和薄塑膠內襯組成。我們對 2,000 個瓶子進行了初步測試,看看它的耐用性。該公司的目標是製造 100% 可回收的無塑膠瓶,以防止氣體從碳酸飲料中逸出。

- 此外,Smarties 等公司正在全球糖果零食業為糖果零食產品部署可回收紙包裝。這意味著 Smarties 系列已完成 90% 的遷移。 10% 已採用可回收紙包裝。此外,實現雀巢宏偉目標的重要一步是到 2025 年所有包裝均採用紙質且可回收或可重複使用,從而將原始塑膠的使用量在同一時期減少三分之一。

- 紙包裝市場的公司越來越重視永續包裝解決方案,以滿足消費者的需求。例如,芬蘭食品包裝專家 Huhtamaki Oyj 開發了 Huhtamaki Blue Loop,這是一個新平台,合作夥伴可以在該平台上進行協作並集思廣益,討論永續紙質包裝。此類創新平台的引入正在導致市場擴張。

- 此外,各供應商正在採用並創新使用紙質包裝材料的新包裝,以減少包裝對環境的影響並發起多項回收措施。例如,2021 年 2 月,利樂宣布與吉達穆罕默德迪亞區模型中心合作在吉達實施一項新措施。收集並回收用過的紙盒,以支持永續的消費習慣。

亞太包裝市場顯著擴張

- 塑膠包裝在亞洲已被廣泛使用,印度和中國等國家透過其食品和飲料市場做出了巨大貢獻。中國的包裝產業深受人口變數的影響,例如人均收入的增加、社會氛圍的變化以及旨在最大限度地減少塑膠排放的禁塑措施。這對包裝業務有重大影響。

- 中國在2021-2025年「五年計畫」中宣布增加塑膠回收和焚燒能力,推廣「綠色」塑膠產品,打擊包裝和農業領域的塑膠濫用。新的五年計畫要求商店和快遞公司減少「不合理」的塑膠包裝,到2025年將都市區焚燒的垃圾量減少到每天80萬噸左右(去年為58萬噸)。數量增加。這些發展預計將增加國內對可回收軟質塑膠包裝的需求。阿里巴巴等電子商務巨頭的崛起預計將在預測期內刺激包裝市場。例如,在持續10天的阿里巴巴雙11購物活動期間,中國消費者收到了約19億件包裹。

- 包裝是印度第五大產業,也是印度成長最快的產業之一。近年來,包裝產業已成為該國技術和創新的主要推動力,為包括農業和日常消費品(日常消費品)產業在內的各個製造業領域創造價值。

- 印度包裝研究所(IIP)的數據顯示,過去十年,印度的包裝消費量激增了200%,從2010年的每人每年4.3公斤pppa(pppa)增加到2020年的8.6公斤pppa。儘管過去十年快速成長,但與世界其他已開發地區相比,該行業仍存在巨大的成長空間。

- 日本是各種行業紙質產品的主要用戶,包括報紙、包裝、印刷和通訊、衛生產品以及各種其他應用。此外,由於消費者對永續包裝的認知、對森林砍伐的擔憂以及原料的可用性,包裝行業最近已轉向使用紙張。

包裝行業概況

主導全球包裝市場的關鍵因素是透過創新實現的永續競爭優勢、市場滲透水平、退出障礙、競爭策略廣告支出的力量以及公司的集中度。這個市場的參與者透過創新擁有競爭優勢。包裝材料,特別是塑膠包裝,規格不同,產品差異化的可能性很高。

- 2022 年 7 月 - Mondi 和 Fiorini International 合作,為義大利優質義式麵食產品製造商 Antico Pastificio Umbro 創建新的紙質包裝解決方案。新包裝完全可回收,在所有義式麵食產品中推廣後,每年可節省多達 20 噸塑膠。

- 2022 年 6 月 - Coveris 擴大庫夫施泰因工廠的產能。新的擠壓設備最近全面運作,繼續推進工廠的現代化工作,並顯著提高青貯飼料包拉伸膜的生產率。

- 2022 年 6 月 - Ardagh Metal Packaging 宣布計劃透過位於法國拉西約塔的新工廠擴大產能。該支出將得到 Sud Attractivite 和 Bpifrance 的支持,並將滿足中東非洲 (MEA) 和西南部現有客戶和新客戶對長期合作夥伴關係不斷成長的需求。

- 2022 年 4 月 - Sealed Air 推出數位包裝品牌 PRISTIQ,提供設計服務、數位印刷和智慧包裝解決方案組合,旨在消除浪費和過度包裝,同時增強產品和客戶參與。Masu。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章 簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場洞察

- 市場概況

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 競爭對手之間存在敵對威脅

- 替代品的威脅

- 產業價值鏈分析

- 市場促進因素(紙張和玻璃)

- 市場挑戰(塑膠)

- 評估 COVID-19 對包裝產業的感染疾病

- 全球主要國家人均包裝消費量覆蓋率

- 市場機會

第5章市場區隔

- 按包裝類型

- 塑膠包裝

- 單獨的硬質塑膠包裝

- 依材料類型- (PE-HDPE &LDPE, PP, PET, PVC, PS, EPS)

- 按產品類型 - (瓶子和罐子(容器)、瓶蓋和蓋子、散裝級產品 - IBC、板條箱和托盤、其他)

- 按最終用戶行業 -(食品、飲料、工業和建築、汽車、化妝品和個人護理、其他最終用戶行業)

- 獨立軟質塑膠包裝

- 依材料類型-(PE、BOPP、CPP 等)

- 依產品類型 -(袋、袋、薄膜、包裝紙)

- 按最終用戶行業 -(食品、飲料、藥品、化妝品、個人護理)

- 按地區 -(北美、歐洲、亞太地區、中東和非洲(海灣合作理事會、阿拉伯聯合大公國、沙烏地阿拉伯、海灣合作理事會其他地區、中東其他地區)、拉丁美洲)

- 紙和紙板

- 依產品類型 -(折疊紙盒、瓦楞紙箱、免洗紙產品(袋子、杯子等))

- 依最終使用者(食品、飲料、工業和電子、化妝品和個人護理、醫療保健、其他(家庭用品、汽車零件、機械等的運輸))

- 按地區 -(北美、歐洲、亞太地區、中東和非洲(海灣合作理事會、阿拉伯聯合大公國、沙烏地阿拉伯、海灣合作理事會其他地區、中東其他地區)、拉丁美洲)

- 金屬包裝

- 依產品類型 -(罐頭(食品、飲料、氣霧劑、其他)、瓶蓋和蓋子、其他產品類型)

- 按地區 -(北美、歐洲、亞太地區、中東和非洲(海灣合作理事會、阿拉伯聯合大公國、沙烏地阿拉伯、海灣合作理事會其他地區、中東其他地區)、拉丁美洲)

- 容器玻璃

- 按最終用戶 -(食品、飲料(酒精、非酒精)、個人護理和化妝品、藥品)

- 按地區 -(北美、歐洲、亞太地區、中東和非洲(海灣合作理事會、阿拉伯聯合大公國、沙烏地阿拉伯、海灣合作理事會其他地區、中東其他地區)、拉丁美洲)

- 塑膠包裝

第6章 競爭形勢

- 公司簡介-主要紙包裝廠商分析

- International Paper Company

- Mondi Group

- Smurfit Kappa Group

- DS Smith PLC

- WestRock Company

- 公司簡介-主要軟質塑膠包裝廠商分析

- UFlex Limited

- Huhtamaki OYJ

- Amcor PLC

- Coveris Holding SA

- Sealed Air Corporation

- 公司簡介-主要硬質塑膠包裝廠商分析

- Greif, Inc.

- Sonoco Products Company

- Aptar Group Inc.

- Berry Global Inc.

- Alpla Group

- 公司簡介-主要容器玻璃製造商分析

- Owens-illinois, Inc.

- Vidrala, SA

- Verallia SA

- Gerresheimer AG

- Vitro, SAB De CV

- 公司簡介-主要金屬包裝廠商分析

- Ball Corporation

- Crown Holdings, Inc.

- Ardagh Group SA

- Can Pack SA

- Silgan Holdings Inc.

第7章 投資分析

第8章 市場未來展望

The Packaging Market size is estimated at USD 1.14 trillion in 2024, and is expected to reach USD 1.38 trillion by 2029, growing at a CAGR of 3.89% during the forecast period (2024-2029).

The global packaging business has experienced consistent growth over the last decade due to substrate choice changes, expansion of new markets, and changing ownership dynamics. Traditional packaging may continue to be replaced by flexible packaging, high-barrier films, and stand-up retort pouches may challenge rigid pack formats like metal tins and glass jars for a wide range of food products.

Key Highlights

- With the rising consumption of sweets and confectionery, several flexible plastic packaging providers are offering packaging solutions, specifically catering to this demand, and are further driving their sales and revenues. For instance, according to the US Census Bureau, confectionery manufacturing industry revenue in the United States is expected to reach USD 10.89 billion by FY 2023.

- According to the Flexible Packaging Association, flexible packaging is mainly used for food, which accounts for more than 60% of the total market. Since it could incorporate new solutions for various packaging issues, the flexible packaging industry is experiencing robust growth. In addition, the Indian food and grocery market is the world's sixth-largest, according to IBEF, with retail accounting for 70% of sales. The Indian food processing industry, which contributes to 32% of the country's overall food market, ranks fifth in production, consumption, and export and is one of the country's most important industries.

- The sustainability trends, including recycling and using bio-degradable forms of PET, are expected to rise over the forecast period. In some regards, it will always face sustainability issues due to the nature of its production. However, the recycling streams and development will help neutralize such sustainability issues. For instance, the Coca-Cola European partners pledged to collect 100% of the packaging and use 50% recycled plastic in plastic PET bottles in Western Europe by 2025. PepsiCo aims to use 50% of recycled plastic in its bottles across the European region by 2030, with an interim target of around 45% by 2025. Also, various large food manufacturers are under pressure from campaigners and consumers and are currently on a mission to rethink their plastic packaging and move towards a circular economy. For instance, Nestle and Mondelez recently signed the European Plastics Pact. This initiative is committed to making 100% of packaging recyclable or reusable and reducing virgin plastic usage by 2025.

- Various companies focus on product innovations to hold a significant position in the studied market. For instance, in February 2021, Constantia Flexibles announced its new product, Perpetua, a recyclable, high-barrier, polymeric mono-material packaging solution for pharmaceutical products. According to the company, the solution has a wide range of pharmaceutical packaging applications and is now available worldwide.

- Various vendors have been focusing on expanding their market presence by constructing new production facilities for paper packaging. For instance, in December 2021, Promateris, a Romanian industrial packaging company, announced entering the paper packaging area in 2022 by building a production facility in the country. This project will be completed in 2023. Furthermore, in 2022, the firm expects to begin producing biodegradable and compostable raw materials based on corn starch, making it the first company to do so in Eastern Europe.

- However, on the other hand, the overall usage of non-recyclable, non-biodegradable plastic packaging solutions is expanding, resulting in increased carbon emissions in the environment. This might be a factor that could restrain the market growth. As a result, numerous large firms such as Amazon, Google, and Tetrapak, among others, are aiming toward net-zero carbon emissions, which is predicted to be their capital expenditure.

- During COVID-19, contactless delivery has also emerged as a new trend. Pioneers in sustainable packaging could adjust to these new standards, such as Garcon Wines, whose frictionless supply of letterbox- and climate-friendly flat wine bottles has witnessed a great demand. In addition, the rapid production of COVID-19 vaccines has also increased the need for glass containers or vials for storage purposes. By March 2021, Schott AG, a prominent German glass company, had produced enough vials for one billion COVID-19 vaccine doses, and it is on schedule to produce over two billion doses. According to the company, their borosilicate glass vials are used in roughly 90% of licensed vaccinations because they are resistant to shocks and temperature extremes.

Packaging Market Trends

Paper and Paperboard Packaging Products to Witness the Highest Growth

- The market is driven by the increased usage of environmentally friendly materials in packaging. Eco-friendly packaging is recyclable, biodegradable, reused, and non-toxic, with a low environmental impact. Paper packaging products, such as paper bags, pouches, and cartons, are the fastest-growing sustainable packaging materials. The increasing trend of online retail and environmental regulations on non-biodegradable and non-recyclable packaging solutions is progressively creating a massive demand for eco-friendly paper packaging solutions.

- In February 2021, Coca-Cola tested its first test run on paper bottles from an extra-strong paper shell containing a thin plastic liner. It ran its first test with 2,000 bottles to see how it held up. The company aims to create a 100% recyclable, plastic-free bottle to prevent gas from escaping from carbonated drinks.

- Moreover, companies such as Smarties have rolled out recyclable paper packaging for confectionery products worldwide in the confectionaries category. This would represent a transition of 90% of the Smarties range, as 10% was already packed in recyclable paper packaging. Further, Nestle's major step toward its ambition is to make all of its packaging paper-based and recyclable or reusable by 2025 and reduce the usage of virgin plastics by one-third in the same period.

- Companies in the paper packaging market are increasing their focus on sustainable packaging solutions that meet consumer demands. For instance, Huhtamaki Oyj, a Finland-based food packaging specialist, developed the Huhtamaki blue loop, a novel platform where partners can collaborate to brainstorm sustainable paper packaging. The introduction of such innovative platforms is leading to market expansion.

- Moreover, various vendors are adapting and innovating new packaging with paper packaging material to reduce the environmental impact of packaging and launch multiple recycling initiatives. For instance, in February 2021, TetraPak announced a new initiative in Jeddah in partnership with the District Model Center of Muhammadiyah in Jeddah. It will collect used carton packages and recycles them to support sustainable consumption practices.

Asia Pacific Packaging Market to Expand Significantly

- Plastic packaging has observed wide-scale utilization in Asia, with countries like India and China contributing significantly through their food and beverages market. The Chinese packaging sector is heavily influenced by variables such as rising per capita income, changing social atmosphere, and demographics, including ban enforcement on plastics to minimize its plastic footprint. This results in significant impacts on the packaging business.

- In a 2021-2025 "five-year plan," China announced it would improve its plastic recycling and incineration capacities, promote "green" plastic products, and combat the misuse of plastic in packaging and agriculture. The new five-year plan would push merchants and delivery companies to reduce "unreasonable" plastic wrapping and increase garbage incineration rates in cities to about 800,000 tons per day by 2025, up from 580,000 tons last year. Such developments are expected to increase the country's demand for recyclable flexible plastic packaging. Over the projection period, the rise of e-commerce giants like Alibaba is expected to fuel the packaging market. For example, Chinese shoppers received approximately 1.9 billion shipments during Alibaba's Double 11 shopping event, which lasted 10 days.

- Packaging is India's fifth-largest industry and one of the country's fastest-growing sectors. Over the last few years, the packaging industry has been a key driver of technology and innovation in the country, contributing value to various manufacturing sectors, including agriculture and the fast-moving consumer goods (FMCG) segments.

- According to the Indian Institute of Packaging (IIP), packaging consumption in India has surged by 200% over the last decade, from 4.3 kilograms per person per annum (pppa) in FY10 to 8.6 kg pppa in FY20. Despite the sharp increase over the last decade, there remains tremendous space for growth in this industry compared to other developed regions throughout the world.

- Japan is a major user of paper-based products in various industries, including newspaper, packaging, printing and communication, sanitary products, and other miscellaneous uses. Moreover, due to consumer awareness about sustainable packaging, worries about deforestation, and raw material availability, there has been a recent movement in the packaging sector to utilize paper.

Packaging Industry Overview

The significant factors governing the Global Packaging Market are sustainable competitive advantages through innovation, levels of market penetration, barriers to exit, advertising expense power of competitive strategy, and firm concentration ratio. The players in this market possess a competitive advantage through innovation. The specification of the packaging material is different, mostly in plastic packaging, leaving a high possibility of product differentiation.

- July 2022 - Mondi and Fiorini International teamed up to create a new paper packaging solution for Italian premium pasta product manufacturer Antico Pastificio Umbro. The new packaging is fully recyclable and, when rolled out across all pasta products, it could save up to 20 tons of plastic each year.

- June 2022 - Coveris expanded capacity at its Kufstein site. The new extrusion facility, which was recently put into full operation, continues the modernization efforts at the plant and significantly increases the production speed of stretch film for silage bales.

- June 2022- Ardagh Metal Packaging announced plans to expand its production capacity through a new facility at La Ciotat, France. The expenditure will be supported by Sud Attractivite and Bpifrance, catering to the increasing demands from existing and new customers for long-term partnerships in Middle East Africa (MEA) and Southwestern Europe.

- April 2022 - Sealed Air introduced PRISTIQ, a digital packaging brand with a portfolio of solutions for design services, digital printing, and smart packaging, eliminating waste and excess packaging while enhancing products and customer engagement.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Consumers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Competitive Rivalry

- 4.2.5 Threat of Substitutes

- 4.3 Industry Value Chain Analysis

- 4.4 Market Drivers (Paper and Glass)

- 4.5 Market Challenges (Plastic)

- 4.6 Assessment of the Impact of COVID-19 on the Packaging Industry

- 4.7 Coverage of Per Capita Packaging Consumption in Major Countries Across the World

- 4.8 Market Opportunities

5 MARKET SEGMENTATION

- 5.1 By Packaging Type

- 5.1.1 Plastic Packaging

- 5.1.1.1 By Rigid Plastic Packaging

- 5.1.1.1.1 By Material Type - (PE - HDPE & LDPE, PP, PET, PVC, PS and EPS)

- 5.1.1.1.2 By Product Type - (Bottles and Jars (Containers), Caps and Closures, Bulk-Grade Products - IBC, Crates & Pallets, Others)

- 5.1.1.1.3 By End-User Industry - (Food, Beverage, Industrial and Construction, Automotive, Cosmetics and Personal Care, Other End-user Industries)

- 5.1.1.2 By Flexible Plastic Packaging

- 5.1.1.2.1 By Material Type - (PE, BOPP, CPP, Others)

- 5.1.1.2.2 By Product Type - (Pouches, Bags, Films and Wraps)

- 5.1.1.2.3 By End User Industry - (Food, Beverage, Pharmaceutical, Cosmetics and Personal Care)

- 5.1.1.3 By Region - (North America, Europe, Asia Pacific, Middle East and Africa (GCC, United Arab Emirates, KSA, Rest of GCC, Rest of Middle East and Africa), Latin America)

- 5.1.2 Paper and Paperboard

- 5.1.2.1 By Product Type - (Folding Carton, Corrugated Boxes, Single-use Paper Products (Bags, Cups, Others))

- 5.1.2.2 By End-user (Food, Beverage, Industrial & Electronic, Cosmetics & Personal Care, Healthcare, Others (Household Care, Transit (Transportation of Automobile Components, Machinery, etc.))

- 5.1.2.3 By Region - (North America, Europe, Asia Pacific, Middle East and Africa (GCC, United Arab Emirates, KSA, Rest of GCC, Rest of Middle East and Africa), Latin America)

- 5.1.3 Metal Packaging

- 5.1.3.1 By Product Type - (Cans (Food, Beverage, Aerosols, Others), Caps and Closures, Other Product Types)

- 5.1.3.2 By Region - (North America, Europe, Asia Pacific, Middle East and Africa (GCC, United Arab Emirates, KSA, Rest of GCC, Rest of Middle East and Africa), Latin America)

- 5.1.4 Container Glass

- 5.1.4.1 By End-user - (Food, Beverage (Alcoholic, Non-Alcoholic), Personal Care and Cosmetics, Pharmaceuticals)

- 5.1.4.2 By Region - (North America, Europe, Asia Pacific, Middle East and Africa (GCC, United Arab Emirates, KSA, Rest of GCC, Rest of Middle East and Africa), Latin America)

- 5.1.1 Plastic Packaging

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles - Analysis of the Major Paper Packaging Manufacturers

- 6.1.1 International Paper Company

- 6.1.2 Mondi Group

- 6.1.3 Smurfit Kappa Group

- 6.1.4 DS Smith PLC

- 6.1.5 WestRock Company

- 6.2 Company Profiles - Analysis of the Major Flexible Plastic Packaging Manufacturers

- 6.2.1 UFlex Limited

- 6.2.2 Huhtamaki OYJ

- 6.2.3 Amcor PLC

- 6.2.4 Coveris Holding SA

- 6.2.5 Sealed Air Corporation

- 6.3 Company Profiles - Analysis of the Major Rigid Plastic Packaging Manufacturers

- 6.3.1 Greif, Inc.

- 6.3.2 Sonoco Products Company

- 6.3.3 Aptar Group Inc.

- 6.3.4 Berry Global Inc.

- 6.3.5 Alpla Group

- 6.4 Company Profiles - Analysis of the Major Container Glass Manufacturers

- 6.4.1 Owens-illinois, Inc.

- 6.4.2 Vidrala, S.A.

- 6.4.3 Verallia SA

- 6.4.4 Gerresheimer AG

- 6.4.5 Vitro, S.A.B. De C.V.

- 6.5 Company Profiles - Analysis of the Major Metal Packaging Manufacturers

- 6.5.1 Ball Corporation

- 6.5.2 Crown Holdings, Inc.

- 6.5.3 Ardagh Group S.A.

- 6.5.4 Can Pack SA

- 6.5.5 Silgan Holdings Inc.