|

市場調查報告書

商品編碼

1405716

抗輻射電子產品:市場佔有率分析、產業趨勢/統計、成長預測,2024-2029Radiation Hardened Electronics - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts 2024 - 2029 |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

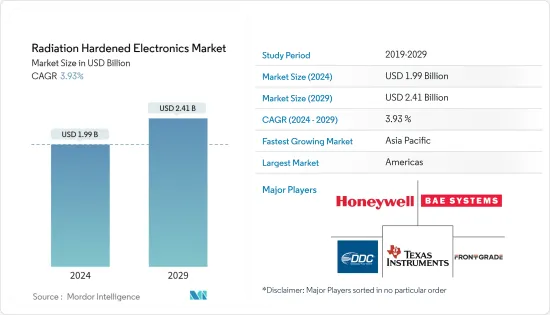

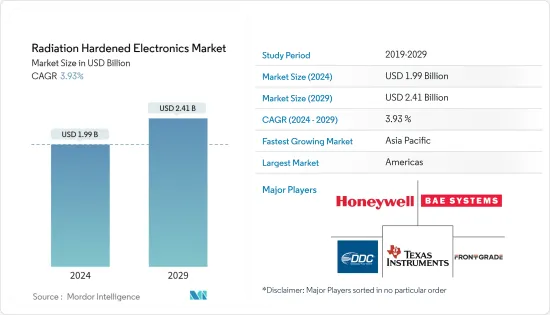

2024 年耐輻射電子市場價值為 18.1 億美元,預計到 2029 年將達到 21.8 億美元,預測期內複合年成長率為 3.87%。

抗輻射電子產品旨在承受極端輻射,用於情報、監視和偵察 (ISR) 系統。對監視、資訊收集和邊境管制等安全措施的需求不斷成長,推動了對抗輻射電子設備的需求。面對高輻射水平的挑戰,抗輻射材料需要適當的電源管理。電子設備損壞可能會導致安全隱患。因此,這些設施需要可靠、抗輻射的電源管理系統。

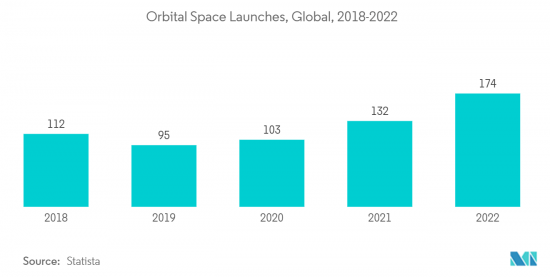

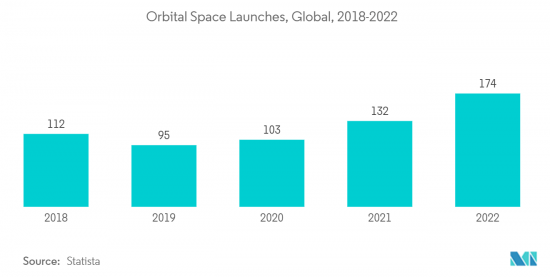

隨著我們更多地依賴衛星導航和其他基於衛星的應用,衛星發射和其他太空任務的數量在全球範圍內不斷增加。為了確保衛星上嵌入式系統的正常運行,對抗輻射電子產品的需求預計將會激增。

有限的可得性和性能限制阻礙了即時成像、國防和太空市場中的 5G/6G通訊以及核融合和 SMR 的抗輻射電子裝置對高性能半導體的需求。儘管該行業有顯著的成長動力,但組件可得性不足仍然是該行業面臨的挑戰。

然而,為了模擬太空工作環境,設計抗輻射電子測試台是很複雜的,因為需要考慮一些意想不到的因素來測試性能和可靠性,以下是步驟。隨著技術的進步和抗輻射電子產品的應用擴展,新應用的廣泛研究和開發的成本變得明顯更高,而且盈利和回報率更低。

抗輻射電子市場趨勢

預測期內空間應用引領市場

人造衛星有多種應用,包括通訊、定位服務和地球觀測。自 1957 年人造衛星發射以來,天基任務經歷了巨大的成長。衛星已發展成為民用和國防部門科學研究的首選。對衛星不斷成長的需求促使衛星製造商採用具有成本效益的方法來大規模生產衛星。

越來越多的太空應用正在推動用於各種任務的抗輻射和抗輻射電子設備的創新,包括訊號處理、數位轉換、電源管理控制和固體資料儲存。革命性的技術進步促進了電子產品的小型化,並推動了智慧材料的發明。因此,衛星的尺寸和品質會隨著時間的推移而減小,這對製造商來說是有利的。在涉及小型衛星的計劃機會的推動下,許多航太巨頭也在這一領域進行投資。例如,2023 年 9 月,Efficient Power Conversion Corporation (EPC) 推出了用於高可靠性和太空應用的氮化鎵 GaN場效電晶體。 DCDC 電源轉換器、馬達驅動器、雷射雷達、深探針和空間離子推進器等應用都受益於這些設備的性能和快速部署。它特別適用於低地球軌道(LEO)、地球同步軌道 (GEO) 和航空電子系統。由於輻射屏蔽是空間電子產品的關鍵設計元素,因此此類發展預計將推動對抗輻射電子產品的需求。

預計北美地區在預測期內將產生最高的需求

由於技術創新和大量最終用戶(主要在美國)的存在,預計北美將在預測期內主導抗輻射電子市場。美國是基於衛星的遠端檢測和通訊系統的狂熱用戶,推動了北美對抗輻射電子產品的需求。此外,該地區是多家知名電子製造公司的所在地,擁有強大的研發和製造基礎設施,為該地區引人注目的市場的持續成長做出了貢獻。美國是航太和國防應用領域的領導者,網路中心戰技術的快速採用預計將在預測期內增強該特色市場的成長前景。

電子產業的輻射耐受特性概述

抗輻射電子市場適度分散。抗輻射電子市場的主要企業包括 Analog Devices、 資料 Devices、Microchip Technology、Renesas Electronics 和 IBM。電子製造業競爭激烈,隨著全球戰場環境的演變和應用的多樣化,企業必須根據最終用戶不斷變化的需求調整產品系列。該市場也受到旨在增強現役軍事資產能力的升級合約分散的顯著影響。為了贏得長期合約並增加市場佔有率,參與者正在大力投資於複雜產品的研發。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 調查先決條件

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場動態

- 市場概況

- 市場促進因素

- 市場抑制因素

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 買家/消費者的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭公司之間敵對關係的強度

第5章市場區隔

- 目的

- 宇宙

- 航太/國防

- 核能發電廠

- 成分

- 微處理器

- FPGA

- 記憶

- 感應器

- 地區

- 北美洲

- 美國

- 加拿大

- 歐洲

- 英國

- 法國

- 德國

- 義大利

- 俄羅斯

- 其他歐洲國家

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 其他亞太地區

- 拉丁美洲

- 巴西

- 墨西哥

- 其他拉丁美洲

- 中東/非洲

- 阿拉伯聯合大公國

- 沙烏地阿拉伯

- 埃及

- 南非

- 其他中東/非洲

- 北美洲

第6章競爭形勢

- 供應商市場佔有率

- 公司簡介

- Analog Devices, Inc.

- BAE Systems plc

- Cobham Limited

- Data Device Corporation

- Honeywell International Inc.

- IBM Corporation

- Infineon Technologies AG

- Microchip Technology Inc.

- Micropac Industries, Inc.

- Renesas Electronics Corporation

- Solid State Devices, Inc.

- STMicroelectronics International NV

- Texas Instruments(TI)

- Advanced Micro Devices, Inc.

- General Dynamics Corporation

第7章 市場機會及未來趨勢

The Radiation-Hardened Electronics Market is valued at USD 1.81 billion in 2024 and is expected to reach USD 2.18 billion by 2029, registering a CAGR of 3.87% during the forecast period.

Radiation-hardened electronics are used for Intelligence, surveillance, and reconnaissance (ISR) systems, as they are built to survive extreme radiation exposures. The rise in demand for security measures such as monitoring, information collection, and border control is going to fuel the demand for radiation-hardened electronics. In the challenging situation of high radiation levels, radiation-hardened materials require proper power management. Any damage to electronics might lead to safety hazards. Thus, these facilities require reliable radiation-hardened power management systems.

Increased dependence on satellite navigation and other satellite-based applications increased the number of satellite launches and other space missions undertaken on a global level. It is expected to create a demand surge for radiation-hardened electronics to ensure the proper functioning of embedded systems onboard the satellites.

The demand for high-performance semiconductors for real-time imaging, 5G/6G communication in defense and space markets, and high radiation-tolerant electronics for nuclear fusion and SMRs is hindered because of limited availability and performance restrictions. While there are major growth drivers in this area, the availability of parts is scarce and thus poses a challenge for the sector.

However, designing a radiation-hardened electronic test bed is a complex procedure, as the simulation of the space-based working environment requires consideration of several unforeseen factors to test for performance and reliability. With the advancement of technology and the proliferation of applications of radiation-hardened electronics, the cost of conducting extensive R&D for emerging applications is significantly higher and fails to ensure profitability and returns.

Radiation Hardened Electronics Market Trends

Space Application to Lead the Market in The Forecast Period

Satellites are used for a plethora of applications, such as communications, positioning services, and Earth observation. Since the launch of Sputnik in 1957, space-based missions witnessed tremendous growth. It is evident through the construction of the International Space Station and the launch of more than 8,100 space objects, including dozens of exploration missions to every corner of the Solar System. Satellites evolved as the preferential choice for conducting scientific research by the commercial and defense sectors. The increasing demand for satellites encouraged satellite manufacturers to inculcate cost-effective approaches for large-scale production of satellites.

Innovation in radiation-tolerant and radiation-hardened electronics for a variety of tasks ranging from signal processing, digital conversion, power management controls, and solid-state data storage is driven by the increasing number of space applications. Revolutionary technological advancements facilitated the miniaturization of electronics, which pushed the invention of smart materials. It, in turn, reduces the satellite size and mass over time for manufacturers. Driven by the opportunities in the projects involving small satellites, many aerospace giants are also investing in this sector. For instance, in September 2023, Efficient Power Conversion Corporation, EPC, introduced gallium nitride GaN field effect transistors for high reliability and space applications. DCDC power converters, motor drives, lidars, deep probes, and ion thrusters for space applications are applications that benefit from the performance and rapid deployment of these devices. They are particularly suited to Earth orbit satellites with a Low Earth Orbit (LEO), Geosynchronous Earth Orbit (GEO), and Avionics systems. Such developments are anticipated to drive the demand for radiation-hardened electronics, as radiation shielding is a critical design aspect for electronic components for space-based applications.

The North America Region is Expected to Generate the Highest Demand During the Forecast Period

North America is anticipated to dominate the radiation-hardened electronics market during the forecast period, fostered by technological innovations and the presence of a large number of end users, particularly in the US. The US is an avid user of satellite-based telemetry and communication systems, driving the demand for radiation-hardened electronics in North America. An existing robust R&D and manufacturing infrastructure, marked by the presence of several prominent electronics manufacturing companies in the region, also contributed to the persistent growth of the market in focus witnessed in the region. The US is a frontrunner in aerospace and defense applications, and the rapid adoption of network-centric warfare techniques is anticipated to bolster the growth prospects of the market in focus during the forecast period. For instance, the US Air Force awarded a USD 222.6 million contract to General Dynamics Mission Systems for secure and radiation-hardened communications systems. As per the contract, General Dynamics will deliver high-altitude electromagnetic pulse and radiation-hardened general area alerting, ultra-high frequency line-of-sight communications to aircraft.

Radiation Hardened Electronics Industry Overview

Radiation-Hardened Electronics market is moderately fragmented. The prominent players in the radiation-hardened electronics market are Analog Devices, Inc., Data Device Corporation, Microchip Technology Inc., Renesas Electronics Corporation, and IBM Corporation, among others. The electronics manufacturing industry is highly competitive, and with the evolving global battlefield environment and diversification of applications, companies must align their product portfolios to the evolving requirements of end users. The market is also significantly influenced by the dispersion of upgrade contracts to enhance the capabilities of the current fleet of active military assets. In order to gain long-term contracts and enhance their market share, players are investing significantly in the R&D of sophisticated product offerings.

Furthermore, continuous R&D is fostering technological advancements in platforms and associated products and solutions of the active players in the radiation-hardened electronics market. For instance, in April 2023, Coherent Logix offered a HyperX line of radiation-hardened software-defined microprocessors. HyperX's space processors are fully programmable software-defined platforms for video imaging, AI, communications, and adaptive processing on the satellite with Software Defined Networking or Active Cyber Security. Coherent Logix's latest offering is HyperX: Midnight system-on-chip (SoC) processor for space applications.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.3 Market Restraints

- 4.4 Industry Attractiveness - Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers/Consumers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products

- 4.4.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Application

- 5.1.1 Space

- 5.1.2 Aerospace and Defense

- 5.1.3 Nuclear Power Plants

- 5.2 Component

- 5.2.1 Microprocessor

- 5.2.2 FPGA

- 5.2.3 Memory

- 5.2.4 Sensors

- 5.3 Geography

- 5.3.1 North America

- 5.3.1.1 United States

- 5.3.1.2 Canada

- 5.3.2 Europe

- 5.3.2.1 United Kingdom

- 5.3.2.2 France

- 5.3.2.3 Germany

- 5.3.2.4 Italy

- 5.3.2.5 Russia

- 5.3.2.6 Rest of Europe

- 5.3.3 Asia-Pacific

- 5.3.3.1 China

- 5.3.3.2 India

- 5.3.3.3 Japan

- 5.3.3.4 South Korea

- 5.3.3.5 Rest of Asia-Pacific

- 5.3.4 Latin America

- 5.3.4.1 Brazil

- 5.3.4.2 Mexico

- 5.3.4.3 Rest of Latin America

- 5.3.5 Middle-East and Africa

- 5.3.5.1 United Arab Emirates

- 5.3.5.2 Saudi Arabia

- 5.3.5.3 Egypt

- 5.3.5.4 South Africa

- 5.3.5.5 Rest of Middle-East and Africa

- 5.3.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Vendor Market Share

- 6.2 Company Profiles

- 6.2.1 Analog Devices, Inc.

- 6.2.2 BAE Systems plc

- 6.2.3 Cobham Limited

- 6.2.4 Data Device Corporation

- 6.2.5 Honeywell International Inc.

- 6.2.6 IBM Corporation

- 6.2.7 Infineon Technologies AG

- 6.2.8 Microchip Technology Inc.

- 6.2.9 Micropac Industries, Inc.

- 6.2.10 Renesas Electronics Corporation

- 6.2.11 Solid State Devices, Inc.

- 6.2.12 STMicroelectronics International N.V.

- 6.2.13 Texas Instruments (TI)

- 6.2.14 Advanced Micro Devices, Inc.

- 6.2.15 General Dynamics Corporation