|

市場調查報告書

商品編碼

1250855

美國廚房家具市場The Kitchen Furniture Market in the United States |

||||||

按出廠價計算,2022 年美國廚房家具市場價值約為 206 億美元,同比增長 12%。 預計將在 2023 年下降,並在 2024/2025 年再次增長。

美國長期以來一直是世界上最大的廚房家具進口國,到 2022 年將進口價值 30 億美元的廚房家具。 越南、加拿大和馬來西亞是美國市場廚房家具的主要供應商。 此外,從意大利和德國的進口額約為 2 億美元。 高端市場按價值約佔30%,通過廚房專賣店的分銷份額也相近27%。 超過50%的市場被60家大公司佔據。

在這份報告中,我們研究分析了美國廚房家具市場、供需、廚房家具的交易趨勢和預測、8個地區和6個價格區間的銷售數據、主要公司的市場份額、公司概況和市場營銷策略、分佈分析等。

亮點

內容

介紹

基礎數據

- 廚房家具的生產、出口、進口和消費的價值和數量

- 按價格區間細分的廚房家具市場數量、數量和平均價格

活動趨勢和預測

- 廚房家具的生產、出口、進口和消費(2016-2022 年估計數據)

- 廚房家具市場的預計增長率:價值、數量、平均價格(2021-2022 年預計數據和 2023-2025 年預測)

國際貿易

- 廚房家具的進出口值:按國家/地區、目的地/原產地(2017-2022 年)

- 主要家用電器(冰箱/冰櫃、炊具、抽油煙機、洗碗機、洗衣機/乾衣機)的進出口值(2017-2022 年)

供應結構

- 定制庫存櫃

- 廚房家具供應明細:按櫥櫃類型(定制、半定制、庫存)

- 樣式、材料和顏色

- 廚房家具供應明細:按風格(傳統、過渡/現代、當代)

- 廚房家具供應明細:按櫃門材料

- 檯面

- 廚房家具供應明細:按檯面材料

- 製造基地

- 位置:按州

- 就業和成本

- 主要樣本公司的員工人數(2016 年、2018 年、2020 年、2022 年)

- 家用電器、炊具、照明

分佈

- 區域銷售

- 預計消費:按州分類

- 分銷渠道

- 樣本公司按分銷渠道劃分的廚具銷售估計細目

- 改革

- 設計中心、承包商、室內設計師

- 廚房改造流程及付款方式

衝突

- 主要公司:在美國製造和銷售廚房家具

- 美國 60 家主要公司的廚房家具產量和市場份額

- 美國 60 家主要公司的廚房家具銷售額和市場份額

- 主要樣本公司的廚房家具銷售額和市場份額:按價格區間(低端、中低端、中端、中高端、高端、豪華)

- 主要公司:按地區劃分的銷售額

- 樣本主要公司的廚房家具銷售額和市場份額:按地區(新英格蘭、中東、五大湖、平原、東南部、西南、落基山脈、西海岸)

需求決定因素

- 建築活動的特徵、宏觀經濟指標和人口統計數據

美國廚房家具店 (2000) 聯繫人

美國市場主要廚房家具公司聯繫方式

The report "The Kitchen Furniture Market in the United States", now in its eighth edition, offers a comprehensive analysis of the kitchen furniture sector in the US, providing trends and forecasts of supply, demand and trade of kitchen furniture, sales data and market shares of leading players by eight geographic regions and six price ranges, company profiles, marketing strategies and distribution analysis.

The study has been processed using the following data sources:

- Information collected on approximately 100 manufacturers and suppliers of kitchen furniture and components operating in the US. The information was gathered either through active participation (direct replies to an interview or completion of a questionnaire) or through company balance sheets, figures and estimates.

- Analysis of CSIL databases for kitchen furniture in the United States and worldwide.

- Official economic statistics and international trade data.

- General documentation relating to the kitchen industry is available both online and offline.

The analysis of the US kitchen furniture imports and exports is provided by country and by geographical area of destination/origin, for the period 2017-2022.

The kitchen furniture production in the United States is broken down by type of cabinet, style, cabinet door material, and countertop material for a sample of companies.

The analysis of kitchen furniture distribution in the US market covers the following channels: Kitchen specialists, Home improvement, Builders, Contract, and Furniture stores/chains. An Excel directory of around 2,000 kitchen furniture stores in the US (specialists, chains, distributors) is delivered together with this report.

An overview of the construction and real estate market, as well as figures on population and disposable income in the United States, are also included.

The chapter on the competitive system analyses the main manufacturers and distributors active in the US kitchen furniture market, providing short company profiles, data on kitchen furniture sales by price range and geographic region, and market shares.

The United States has been divided into the following regions:

- New England: Connecticut, Maine, Massachusetts, New Hampshire, Rhode Island, Vermont

- Mideast: Delaware, District of Columbia, Maryland, New Jersey, New York, Pennsylvania

- Great Lakes: Illinois, Indiana, Michigan, Ohio, Wisconsin

- Plains: Iowa, Kansas, Minnesota, Missouri, Nebraska, North Dakota, South Dakota

- Southeast: Alabama, Arkansas, Florida, Georgia, Kentucky, Louisiana, Mississippi, North Carolina, South Carolina, Tennessee, Virginia, West Virginia

- Southwest: Arizona, New Mexico, Oklahoma, Texas

- Rocky Mountain: Colorado, Idaho, Montana, Utah, Wyoming

- West Coast: Alaska, California, Hawaii, Nevada, Oregon, Washington

SELECTED COMPANIES

Among US Kitchen Furniture Market Top Players: Adornus, American Woodmark, AyA Kitchens and Baths, Barbosa Cabinets, Bellmont Cabinet, Bernier Cabinetry, Boffi, Bridgewood Cabinetry, Cabinetworks Group, Candlelight Cabinetry, Canyon Creek Cabinet, Covered Bridge Cabinetry, Crystal Cabinet, Dakota Kitchen & Bath, DeWils, Dura Supreme, Fabuwood Cabinetry, Haas Cabinet, Haecker, Holiday Kitchens, Home Depot, Huntwood Industries, Ikea, Innocraft Cabinetry, Kent Moore Cabinets, Kitchen Cabinet Distributors, Kith Kitchens, Kountry Kraft Kitchens, Kountry Wood Products, LaFata Cabinets, Lanz Cabinets, Leedo Cabinetry, Legacy Cabinets, Lowe's, Marsh Furniture, MasterBrand Cabinets, Nations Cabinetry, Nobilia, Plain & Fancy, QCCI Quality Custom Cabinetry, Rutt HandCrafted Cabinetry, Scavolini, Showplace Wood Products, Signature Custom Cabinetry, StarMark Cabinetry, Tru Cabinetry, Wellborn Cabinet, WF Cabinetry, Wolf Home Products, Woodharbor, Woodmont Cabinetry, Wren Kitchens USA, WW Wood Products

Highlights:

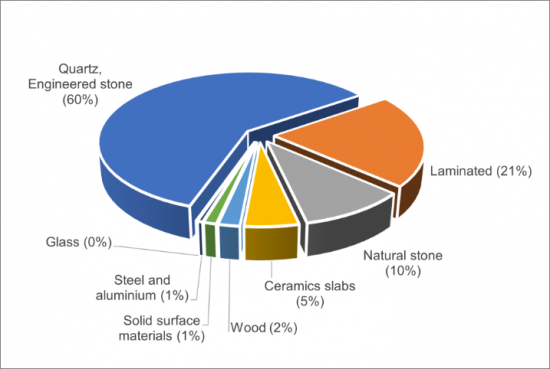

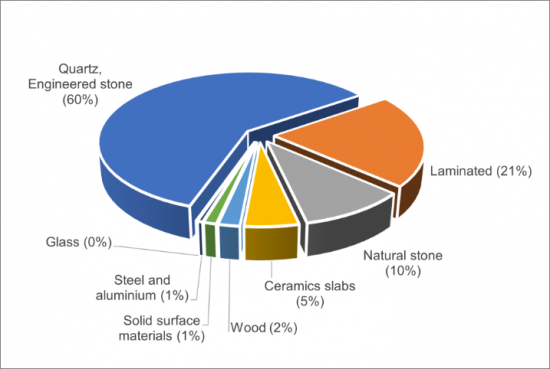

USA: Kitchen furniture supply by worktop material

According to CSIL the US kitchen furniture market in 2022 is worth around 20.6 billion USD at factory prices, with a 12% growth in value on the previous year. The market is expected to decrease in 2023, and growing again in 2024 and 2025.

The United States is by far the leading importer of kitchen furniture worldwide for a long time, importing US$ 3 billion worth of kitchen furniture in 2022. Vietnam, Canada and Malaysia are the main suppliers of kitchen furniture to the American market. Around 200 million USD of imports from Italy and Germany.

The upper-end market accounts for around 30% in value (700 thousand kitchens, on a total of over 8 million units). Similar (27%) share of distribution through kitchen specialists. The top 60 players hold more than 50% of the market. Sales data, market shares and short company profiles are given for 6 price ranges and 8 geographic regions.

A directory of around 2,000 kitchen furniture stores in the US is provided given in Excel annex, together with the report.

TABLE OF CONTENTS

INTRODUCTION

- Research Tools, Terminology and methodological notes

BASIC DATA

- United States. Kitchen furniture production, exports, imports and consumption, in value and volume

- United States. Kitchen furniture market breakdown by price ranges, in value and volume and average price

ACTIVITY TREND AND FORECAST

- United States. Kitchen furniture production, exports, imports and consumption, 2016-2022 estimated data

- United States. Kitchen furniture. Estimated percentage growth of the market: values, volumes and average prices. Estimated data 2021-2022 and forecast 2023-2025

INTERNATIONAL TRADE

- United States. Exports and imports of kitchen furniture by country and by geographical area of destination/origin, 2017-2022

- United States. Exports and imports of major appliances (Refrigerators and freezers, Cooking appliances, Hoods, Dishwashers, Clothes washers and driers), 2017-2022

SUPPLY STRUCTURE

- Custom and stock cabinets

- United States. Breakdown of kitchen furniture supply by type of cabinet: custom, semi-custom, stock

- Styles, materials and colours

- United States. Breakdown of kitchen furniture supply by style: traditional, transitional/modern, contemporary

- United States. Breakdown of kitchen furniture supply by cabinet door material

- Countertops

- United States. Breakdown of kitchen furniture supply by worktop material

- Manufacturing presence

- United States. Kitchen furniture. Establishments by State

- United States. Kitchen furniture. Employment and costs

- United States. Number of employees for a sample of leading companies, 2016, 2018, 2020, 2022

- Appliances, Cookware, Lighting

DISTRIBUTION

- Regional sales

- United States. Kitchen furniture. Estimated consumption by State

- Distribution channels

- United States. Estimated breakdown of Kitchens sales by distribution channel in a sample of companies

- Home Improvement

- Design centers, contractors, interior decorators

- Kitchen Remodelling process and Payment options

COMPETITION

- Top players. Kitchen furniture production and sales in the US

- United States. Kitchen furniture production and market shares of 60 among the leading US companies

- Kitchen furniture sales in the US and market shares of 60 among the leading companies

- United States. Kitchen furniture sales and market share in a sample of leading companies by price range (Low end, Middle-low, Middle end, Middle-upper, Upper-end, luxury)

- Top players. Geographical sales

- United States. Kitchen furniture sales and market share in a sample of leading companies by geographic region (New England, Mid East, Great Lakes, Plains, South East, South West, Rocky Mountain, West Coast)

DEMAND DETERMINANTS

- Construction activity, Macroeconomic indicators, Demographics features

DIRECTORY OF 2000 US KITCHEN FURNITURE STORES

- An Excel directory of around 2,000 kitchen furniture stores in the US (specialists, chains, distributors) is delivered together with this report