|

市場調查報告書

商品編碼

1418774

鋰離子電容器和其他電池超級電容器混合動力(BSH)儲能:市場詳細分析.路線圖.技術詳細分析.製造商評估.下一次成功(2024-2044)Lithium-ion Capacitors and other Battery Supercapacitor Hybrid Storage: Market Forecasts, Roadmaps, Deep Technology Analysis, Manufacturer Appraisal, Next Successes 2024-2044 |

||||||

概述

| 報告統計 | |

|---|---|

| SWOT評估 | 6 |

| 章節架構 | 12 項目 |

| 預測線 | 2024-2044 |

| 主要結論 | 30 項目 |

| 公司 | 116家公司 |

| 新資訊圖 | 107 分 |

| 2023/2024年研究論文回顧 | 153 點 |

鋰離子電容器(LIC)和其他電池超級電容器混合(BSH)儲能現已成為主流,預計將成為一項價值100億美元的業務。

本報告分析了全球LIC和BSH儲能市場的最新情況和未來前景,並概述了技術、當前發展和普及趨勢、未來發展和業務擴展的成果和教訓以及當前和未來的前景。正在調查有前景的應用領域和主要公司的概況。

目錄

第一章執行摘要和結論

第 2 章 電池超級電容器混合動力 (BSH):必要性、工具包和製造方法概述

- 儲能工具包

- 儲能市場

- 技術優化與競爭問題:概述

- LIC、鋰離子電池、超級電容器參數比較(共34項)

- LIC格式與鄰近技術的比較

- 參考

第三章 未來鋰離子電容器設計與競爭力

- 概述

- 設計問題

- 研究管道分析

- 參考

第 4 章其他金屬離子電容器的設計與進展:鉛離子、鎳離子、鉀離子、鈉離子和鋅離子電容器

- 概述

- 鉛離子電容器:歷史、基本原理與研究進展

- 鎳離子電容器:歷史、基本原理與研究進展

- 鉀離子電容器:基本原理、研究管線

- 鈉離子電容器:基本原理、研究管線

- 鋅離子電容器:基本原理、研究管線

第五章 與BSH家電儲能相關的其他新化學品

- 概述

- 理由

- 研究管道

第六章 研究管道分析中所採用的新興材料(2024/2023)

- 概述

- 影響超級電容器關鍵參數的因素推動銷售

- 常用材料選擇

- 改進超級電容器的策略

- 石墨烯在超級電容器及其變體中的重要性

- 對於超級電容器/其他二維及相關材料和研究實例

- 超級電容器電極材料與結構研究(2023)

- 超級電容器電極材料與結構研究(2024)

- 迄今為止的重要案例

- 超級電容器及其變體的電解質

- 一般考慮因素

- 超級電容器及其變體的電解質

- 膜難度等級和使用/建議的材料

- 減少自放電:需求大,但研究很少

第七章BSH家電新興市場:基本趨勢與最佳前景比較-能源、汽車、航太、軍事、電子等

- 市場影響(2024-2044)

- 概述

- 超級電容器變體的相對商業重要性(2024-2044)

- 最有前途的超級電容器系列的市場建議(2024-2044)

- 市場潛力與生產規模不匹配

- 大型設備供給及潛力分析

第八章 能源領域BSH家電新市場

- 概述:悲觀、中間和樂觀前景(2024-2044)

- 熱核能

- 低間歇性併網發電:波浪能、潮流能、風力發電

- 超越電網超級電容器:巨大的新機遇

- 水電

第九章 陸上車輛和船舶的新應用:汽車、巴士、卡車列車、越野車輛(建築、農業、採礦、林業、物料搬運)、船隻、船舶

- 超級電容器在陸地交通的應用:概述

- 雖然道路應用面臨衰退,但越野應用正在蓬勃發展。

- 超級電容器的市場規模及其在陸地車輛中的變體(價值基礎):如何從公路過渡到越野

- 具有大型超級電容器的新興車輛及相關設計

- 再生電車和無軌電車並解決架空電線的間隙

- 用於物料搬運(物流)的超級電容器

- 用於採礦和採石場的大型超級電容器

- 車用大型超級電容器研究

- 用於火車和軌道側面再生的大型超級電容器

- 大型超級電容器在船舶和研究管道中的應用

第十章 6G通訊、電子、小型電力新應用

- 概述

- 小型BSH/超級電容器的應用已顯著擴展。

- 穿戴式裝置、智慧手錶、智慧型手機、筆記型電腦和類似設備中的BSH家電和超級電容器

- 6G通訊:2030年BSH家電的新市場

- 不斷增長的資產追蹤市場

- 用於電池支援/備用電源的超級電容器

- 手持終端BSH和超級電容

- 使用物聯網節點/無線感測器以及 BSH 和超級電容器的能量收集模式

- 用於數據傳輸、鎖定、電磁閥啟動、電子墨水更新和 LED 閃光燈的峰值功率

- 智慧電錶

- 點焊

第十一章 軍事與航空航太新應用

- 概述

- 軍事應用:高度關注電動和電磁武器

- 軍事應用:無人機、通訊設備、雷達、飛機、船舶、坦克、衛星、飛彈、彈藥點火、電磁裝甲

- 航空航太:衛星電動飛機 (MEA) 的增加和其他成長機會

第十二章 BSH(含LIC)、超級電容器、贗電容器、CSH公司評估(共116家公司)

- 指標分析:全部116企業對比

- 116家BSH(含LIC)、超級電容器、贗電容器製造商評估(10項比較,108頁)

Summary

| REPORT STATISTICS | |

|---|---|

| SWOT appraisals: | 6 |

| Chapters: | 12 |

| Forecast lines: | 2024-2044 |

| Key conclusions: | 30 |

| Companies: | 116 |

| New infograms: | 107 |

| 2023/4 research papers reviewed: | 153 |

This new commercially oriented 470-page report finds that lithium-ion capacitors LIC and other battery supercapacitor hybrid BSH energy storage will now become mainstream, headed to being a $10 billion business. It is the most up-to-date, comprehensive report on the subject and it concentrates on the opportunities for value-added materials and device suppliers with much for investors, product and system integrators and others. There is a glossary at the start and terms are explained throughout. Dollars, gaps in the market and benefitting society and lessons from success and failure have precedence over nostalgia and academic obscurity. Nonetheless, a large amount of research and experience from 2023 and 2024 is referenced and interpreted too, so you can dig deeper where you wish.

Pivoting to success

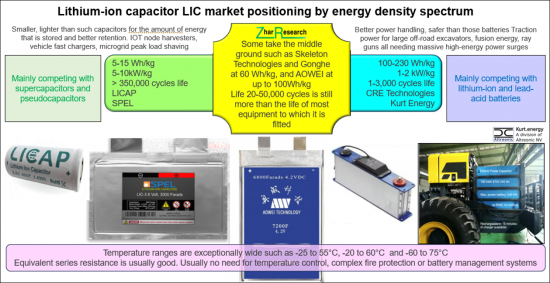

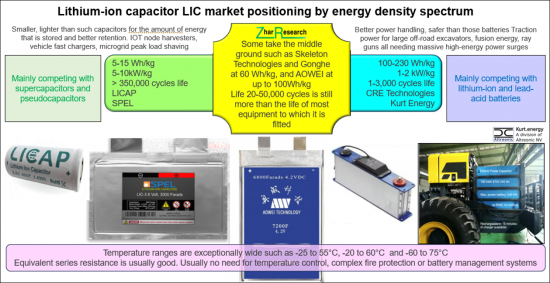

Dr. Peter Harrop, CEO of Zhar Research advises, "After a false start with lead and nickel versions and concentration on tiny versions for electronics with limited demand at the time, the industry has pivoted to add larger lithium-ion ones for electrical engineering. Incoming technologies particularly need these such as fusion power stations, electric trains, in unmanned mining vehicles, heavy vehicle fast chargers and electromagnetic weapons."

He adds, "Latest versions are better than a simple compromise between supercapacitors and lithium-ion batteries. For example, they can last longer than the equipment to which they are fitted and provide more than enough power handling yet minimal end-of-life issues - like supercapacitors. Many can now hold electricity almost as long as a lithium-ion battery can achieve yet have ten times the power density and pulse capability. Versions approaching lithium-ion battery levels of energy density are not flammable and need little or no battery management system or temperature control - huge advantages. The flood of new research covered in the report gives assurance of even better to come such as lower cost and no valuable materials needed for most of them."

The report layout

The Executive Summary and Conclusions is sufficient for those in a hurry. It has all the 30 key conclusions, SWOT appraisals, 42 forecast lines (sub types, by region, by power level, by application and for equipment to which they are fitted 2024-2044. There is a market and technology milestone roadmap 2024-2044, and many new infograms pull it all together, including graphics of the supercapacitor-like and battery-like versions with rationale and pictured examples of success.

The 23-page Introduction starts with the place of battery supercapacitor hybrids in the energy storage toolkit, including BSH replacing batteries in a 2023 e-bike. Learn how energy harvesting and beyond-grid power production create BSH markets and how they are evolving beyond standard formats to widen appeal. The technology is then introduced by comparing BSH internal design to others, how hot topics now include LIB and graphene. Understand BSH voltage, charge retention and ageing issues compared to competition. See BSH competitive position on energy density vs power density and days storage vs rated power return. A table then compared 34 parameters for LIC, Li-ion battery and supercapacitors then you see LIC formats compared with adjacent technologies and further reading.

Covering the technology in depth for each type of emerging BSH begins with Chapter 3. "Future lithium-ion capacitor design and competitive position" (10 pages). Then comes Chapter 4. "Lead-ion, nickel-ion, potassium-ion, sodium-ion, zinc-ion capacitors: design and competitive position" (15 pages) followed by Chapter 5. "Other emerging chemistries for battery-supercapacitor hybrid storage (15 pages)" . Here are BSH using Zeolite Ionic Frameworks ZIF, Metal Organic Frameworks MOF, MXenes and other exotica such as metal alloys and manganese complexes. Where will that all lead? Primarily, these chapters are an appraisal of latest research, including much in 2024. Toxic, flammable, temperature intolerant or short-lived materials, even with good other parameters, will not be acceptable anymore.

Do you want more detail of specifics of the anatomy of a BSH - electrodes, electrolytes and membranes? That requires us to cast the net wider to look at research that is relevant to BSH but not specific to it. That analysis is in Chapter 6. "Emerging materials employed with 2024, 2023 research pipeline analysis" (50 pages) is a much deeper look at the matched active-electrode/ electrolyte and membrane opportunities emerging. The battery electrode is not the emphasis here. There is depth on the many reasons why more adopt graphene yet research in MXenes and metal organics frameworks MOF and actual use of carbon nanotubes is happening. We identify your best opportunities to supply value added materials in future and to create and sell the most successful devices. See the limited research on reducing self-discharge despite the fact that the commercial impact of that would be considerable.

Now come the markets that will earn the big money 2024-2044. Chapter 7 introduces them with "Emerging markets : basic trends and best prospects compared between energy, vehicles, aerospace, military, electronics, other" . It takes only 11 pages because it consists mainly of new infograms, tables and pie charts covering such things as "Market analysis for the six most important applicational sectors" in 6 columns, 5 lines and "Market propositions of the most-promising supercapacitor families 2024-2044" in 6 columns, 3 lines. Another describes largest lithium-ion capacitors offered by 7 manufacturers with 4 parameters and comment.

The market detail then starts with Chapter 8. "Energy sector emerging markets for supercapacitors and their variants" (49 pages), starting with "Overview: poor, modest and strong prospects 2024-2044" and mostly detailing the opportunities in "thermonuclear power" , "less-intermittent grid electricity generation: wave, tidal stream, elevated wind" , beyond-grid power and fast chargers for electric vehicles land and air because all read to the strengths of supercapacitors. See both examples and intentions.

Chapter 9 is 48 pages on "Emerging land vehicle and marine applications: automotive, bus, truck train, off-road construction, agriculture, mining, forestry, material handling, boats, ships" . Chapter 10 at 29 pages is "Emerging applications in 6G Communications, electronics and small electrics" again with compact comparisons and infograms. Chapter 11, "Emerging military and aerospace applications" in 19 pages analysing and comparing key aspects of this rapidly emerging sector demanding all three - CSH, supercapacitor and BSH. For example, electrodynamic and electromagnetic weapons including force field all use supercapacitors and also military hybrid and diesel vehicles because they are not replaced by battery electric as seen on-road because their duty cycles are too demanding. Chapter 12 is 110 pages comparing 116 companies in detail in ten columns plus colour coding and pie charts. The ones making or saying they will make are identified, including which BSH type, and the others are supercapacitor cell and stack makers considering the BSH option.

That is why we suggest that the report, "Lithium-ion capacitors and other battery supercapacitor hybrid storage: detailed markets, roadmaps, deep technology analysis, manufacturer appraisal, next successes 2024-2044" is essential reading for investors, value-added materials suppliers, device manufacturers, product and system integrators with much to interest legislators, researchers, users and other interested parties as well.

Lithium-ion capacitor market positioning by energy density spectrum. Source: Zhar Research report, "Lithium-ion capacitors and other battery supercapacitor hybrid storage: detailed markets, roadmaps, deep technology analysis, manufacturer appraisal, next successes 2024-2044" .

Table of Contents

1. Executive summary and conclusions

- 1.1. Purpose of this report

- 1.2. Methodology of this analysis

- 1.3. Definitions

- 1.4. Energy storage toolkit

- 1.4.1. The basic options

- 1.4.2. BSH have some of superlatives of a supercapacitor combined with those of a battery

- 1.4.3. BSH and in particular LIC create some valuable tipping points

- 1.4.4. The many advantages of lithium-ion capacitors LIC and the energy density choices

- 1.4.5. How strategies for improving supercapacitors will benefit BSH including LIC

- 1.4.6. Prioritisation of active electrode-electrolyte pairings

- 1.5. 12 Primary conclusions: BSH markets including LIC

- 1.6. Infogram: the most impactful market needs

- 1.7. Infogram: relative commercial significance of BSH and pseudocapacitors 2024-2044

- 1.8. Some market propositions and uses of EDLC and BSH including LIC 2024-2044

- 1.9. Technology uses by applicational sector for EDLC vs BSH - examples

- 1.10. Analysis of supply and potential of LIC and EDLC for large devices

- 1.11. 18 primary conclusions: technologies and manufacturers

- 1.12. Infogram: the energy density-power density, life, size and weight compromise

- 1.13. How strategies to require less storage make BSH more adoptable

- 1.14. How research needs redirecting: 5 columns, 7 lines

- 1.17. BSH and EDLC research activity by country and technology 2024

- 1.18. SWOT appraisals and roadmap 2024-2044

- 1.18.1. SWOT appraisal of supercapacitors and BSH

- 1.18.2. SWOT appraisal of LIC and other BSH

- 1.18.3. SWOT appraisal of graphene LIC

- 1.18.4. SWOT appraisal of batteryless storage technologies generally

- 1.19. Roadmap of market-moving BSH events - technologies, industry and markets 2024-2044

- 1.20. Battery supercapacitor hybrids: forecasts by 22 lines 2024-2044

- 1.20.1. Competitors RFB, EDLC, Pseudocapacitor and BSH $ billion 2024-2044 table

- 1.20.2. Competitors RFB, EDLC, Pseudocapacitor and BSH $ billion 2024-2044 graphs with explanation

- 1.20.3. Battery supercapacitor hybrid storage BSH by type: BSH, Non-lithium, LIC, banks $ billion 2024-2044 table and graphs

- 1.20.4. Battery supercapacitor hybrids BSH value market percent by four regions 2024-2044 table and graph

- 1.20.5. Battery supercapacitor hybrids BSH value market percent by five applications 2024-2044: table, graph

- 1.20.6. Battery supercapacitor hybrid BSH value market % by three Wh categories 2024-2044

- 1.20.7. BSH value market % by three electrode morphologies 2024-2044

- 1.20.8. BSH product life years and life of equipment to which it is fitted years 2014-2044

- 1.21. Background forecasts in 22 lines 2024-2044

2. Battery supercapacitor hybrids BSH: introduction to need, toolkit and manufacture

- 2.1. Energy storage toolkit

- 2.1.1. The basic options

- 2.1.2. How BSH will compete with other technologies

- 2.1.3. Electrochemical vs electrostatic storage

- 2.1.4. Examples of competition between capacitor, supercapacitor and battery technologies

- 2.1.5. Supercapacitors and BSH replacing batteries in ebikes

- 2.2. Energy storage market

- 2.2.1. Overview

- 2.2.2. Energy harvesting creates markets for BSH storage

- 2.2.3. The beyond-grid opportunity for large BSH

- 2.2.4. Need for conventional BSH formats but also structural electrics and electronics

- 2.3. Introduction to technology optimisation and technology competition issues

- 2.3.1. Overview

- 2.3.2. BSH internal design compared to others

- 2.3.3. Hot topics include LIB and graphene

- 2.3.4. BSH voltage, charge retention and ageing issues compared to competition

- 2.3.5. BSH competitive position on energy density vs power density

- 2.3.6. Days storage vs rated power return MW for storage technologies

- 2.4. 34 parameters for LIC, Li-ion battery and supercapacitor compared

- 2.5. LIC formats compared with adjacent technologies

- 2.6. Further reading

3. Future lithium-ion capacitor design and competitive position

- 3.1. Overview

- 3.2. Design issues

- 3.3. Analysis of research pipeline

- 3.4. Further reading

4. Other metal-ion capacitors design and progress: Lead-ion, nickel-ion, potassium-ion, sodium-ion, zinc-ion capacitors

- 4.1. Overview

- 4.2. Lead ion capacitors: history, rationale , research pipeline

- 4.3. Nickel-ion capacitors: history, rationale, research pipeline

- 4.4. Potassium-ion capacitors: rationale, research pipeline

- 4.5. Sodium-ion capacitors: rationale, research pipeline

- 4.5. Zinc-ion capacitors: rationale, research pipeline

5. Other emerging chemistries for battery-supercapacitor hybrid storage

- 5.1. Overview

- 5.2. Rationale

- 5.3. Research pipeline

- 5.3.1. Zeolite Ionic Frameworks for BSH

- 5.3.2. MXene and MOFs composites for BSH

- 5.3.2. Metal alloys and manganese compounds in BSH

6. Emerging materials employed with 2024, 2023 research pipeline analysis

- 6.1. Overview

- 6.2. Factors influencing key supercapacitor parameters driving sales

- 6.3. Materials choices in general

- 6.4. Strategies for improving supercapacitors

- 6.4.1. General

- 6.4.2. Prioritisation of active electrode-electrolyte pairings

- 6.5. Significance of graphene in supercapacitors and variants

- 6.5.1. Overview

- 6.5.2. Graphene supercapacitor SWOT appraisal

- 6.5.3. Vertically-aligned graphene for ac and improved cycle life

- 6.5.4. Frequency performance improvement with graphene

- 6.5.5. Graphene textile for supercapacitors and sensors

- 6.5.6. Eleven graphene supercapacitor material and device developers and manufacturers compared in five columns

- 6.6. Other 2D and allied materials for supercapacitors with examples of research

- 6.6.1. MOF and MXene and combinations are the focus

- 6.6.2. Tantalum carbide MXene hybrid as a biocompatible supercapacitor electrodes

- 6.6.3. CNT

- 6.7. Research on supercapacitor electrode materials and structures in 2024

- 6.8. Research on supercapacitor electrode materials and structures in 2023

- 6.9. Important examples from earlier

- 6.10. Electrolytes for supercapacitors and variants

- 6.10.1. General considerations

- 6.10. Electrolytes for supercapacitors and variants

- 6.10.1. General considerations including organic electrolytes

- 6.10.2. Supercapacitor electrolyte choices

- 6.10.3. Focus on aqueous supercapacitor electrolytes

- 6.10.4. Ionic liquid electrolytes in supercapacitor research

- 6.10.5. Focus on solid state, semi-solid-state and flexible electrolytes

- 6.10.6. Hydrogels as electrolytes for semi-solid supercapacitors

- 6.10.7. Supercapacitor concrete and bricks

- 6.11. Membrane difficulty levels and materials used and proposed

- 6.12. Reducing self-discharge: great need, little research

7. Emerging BSH markets : basic trends and best prospects compared between energy, vehicles, aerospace, military, electronics, other

- 7.1. Implications for the market 2024-2044

- 7.2. Overview

- 7.3. Relative commercial significance of supercapacitor variants 2024-2044

- 7.4. Market propositions of the most-promising supercapacitor families 2024-2044

- 7.5. Mismatch between market potential and sizes made

- 7.6. Analysis of supply and potential for large devices

- 7.6.1. Overview

- 7.6.2. Largest lithium-ion capacitors offered by manufacturer with parameters and uses

- 7.6.3. Markets for the largest BSH

- 7.6.4. Market analysis for the six most important applicational sectors

8. Energy sector emerging BSH markets

- 8.1. Overview: poor, modest and strong prospects 2024-2044

- 8.2. Thermonuclear power

- 8.2.1. Overview

- 8.3.2. Applications of supercapacitors in fusion research

- 8.3.3. Other thermonuclear supercapacitors

- 8.3.4. Hybrid supercapacitor banks for thermonuclear power: Tokyo Tokamak

- 8.3.5. Helion USA supercapacitor bank

- 8.3.6. First Light UK supercapacitor bank

- 8.3. Less-intermittent grid electricity generation: wave, tidal stream, elevated wind

- 8.3.1. Supercapacitors in utility energy storage for grids and large UPS

- 8.3.2. 5MW grid measurement supercapacitor

- 8.3.3. Tidal stream power applications

- 8.3.4. Wave power applications

- 8.3.5. Airborne Wind Energy AWE applications

- 8.3.6. Taller wind turbines tapping less-intermittent wind: protection, smoothing

- 8.4. Beyond-grid supercapacitors: large emerging opportunity

- 8.4.1. Overview

- 8.4.2. Beyond-grid buildings, industrial processes, minigrids, microgrids, other

- 8.4.3. Beyond-grid electricity production and management

- 8.4.4. The off-grid megatrend

- 8.4.5. The solar megatrend

- 8.4.6. Hydrogen-supercapacitor rural microgrid Tapah, Malaysia

- 8.4.7. Supercapacitors in other microgrids, solar buildings

- 8.4.8. Fast charging of electric vehicles including buses and autonomous shuttles

- 8.5. Hydro power

9. Emerging land vehicle and marine applications: automotive, bus, truck train, off-road construction, agriculture, mining, forestry, material handling, boats, ships

- 9.1. Overview of supercapacitor use in land transport

- 9.2. On-road applications face decline but off-road vibrant

- 9.3. How the value market for supercapacitors and their variants in land vehicles will move from largely on-road to largely off-road

- 9.4. Emerging vehicle and allied designs with large supercapacitors

- 9.4.1. Industrial vehicles: Rutronik HESS

- 9.4.2. Heavy duty powertrains and active suspension

- 9.5. Tram and trolleybus regeneration and coping with gaps in catenary

- 9.6. Material handling (intralogistics) supercapacitors

- 9.7. Mining and quarrying uses for large supercapacitors

- 9.7.1. Overview and future open pit mine and quarry

- 9.7.2. Mining and quarrying vehicles go electric

- 9.7.3. Supercapacitors for electric mining and construction

- 9.8. Research relevant to large supercapacitors in vehicles

- 9.9. Large supercapacitors for trains and their trackside regeneration

- 9.9.1. Overview

- 9.9.2. Supercapacitor diesel hybrid and hydrogen trains

- 9.9.3. Supercapacitor regeneration for trains on-board and trackside

- 9.9.4. Research pipeline relevant to supercapacitors for trains

- 9.10. Marine use of large supercapacitors and the research pipeline

10. Emerging applications in 6G Communications, electronics and small electrics

- 10.1. Overview

- 10.2. Substantial growing applications for small BSH and supercapacitors

- 10.3. BSH and supercapacitors in wearables, smart watches, smartphones, laptops and similar devices

- 10.3.1. General

- 10.3.2. Wearables needing BSH and supercapacitors

- 10.4. 6G Communications: new BSH market from 2030

- 10.4.1. Overview with needs

- 10.4.2. New needs and 5G inadequacies

- 10.4.3. 6G massive hardware deployment: proliferation but many compromises

- 10.4.4. Objectives of NTTDoCoMo, Huawei, Samsung and others

- 10.4.5. Progress from 1G-6G rollouts 1980-2044

- 10.4.6. 6G underwater and underground

- 10.5. Asset tracking growth market

- 10.6. Battery support and back-up power supercapacitors

- 10.7. Hand-held terminals BSH and supercapacitors

- 10.8. Internet of Things nodes, wireless sensors and their energy harvesting modes with BSH and supercapacitors

- 10.8.1. Overview

- 10.8.2. Sensor inputs and outputs

- 10.8.3. Ten forms of energy harvesting for sensing and power for sensors

- 10.8.4. Supercapacitor transpiration electrokinetic harvesting for battery-free sensor power supply

- 10.9. Peak power for data transmission, locks, solenoid activation, e-ink update, LED flash

- 10.10. Smart meters

- 10.11. Spot welding

11. Emerging military and aerospace applications

- 11.1. Overview

- 11.2. Military applications: electrodynamic and electromagnetic weapons now a strong focus

- 11.2.1. Overview: laser weapons, beam energy weapons, microwave weapons, electromagnetic guns

- 11.2.2. Electrodynamic weapons: coil and rail guns

- 11.2.3. Electromagnetic weapons disabling electronics or acting as ordnance

- 11.2.4. Pulsed linear accelerator weapon

- 11.3. Military applications: unmanned aircraft, communication equipment, radar, plane, ship, tank, satellite, guided missile, munition ignition, electromagnetic armour

- 11.3.1. CSH sales increasing

- 11.3.2. Force Field protection

- 11.3.3. Supercapacitor- diesel hybrid heavy mobility army truck

- 11.3.4. 17 other military applications now emerging

- 11.4. Aerospace: satellites, More Electric Aircraft MEA and other growth opportunities

- 11.4.1. Overview: supercapacitor numbers and variety increase

- 11.4.2. More Electric Aircraft MEA

- 11.4.3. Better capacitors sought for aircraft

12. 116 BSH (including LIC), supercapacitor, pseudocapacitor, CSH companies assessed in 10 columns and 112 pages

- 12.1. Analysis of metrics from the comparison of 116 companies

- 12.2. 116 BSH (including LIC), supercapacitor and pseudocapacitor manufacturers assessed in 10 columns across 108 pages