|

市場調查報告書

商品編碼

1413690

全球光刻材料市場分析(2023-2024年)Lithography Materials Market Report (a Critical Materials Report) 2023-2024 |

||||||

本報告分析了用於半導體裝置製造的光刻材料的全球市場和供應鏈,並提供了主要供應商的資訊、材料供應鏈中的問題和趨勢、供應商的市場份額估計和預測以及按材料細分市場的細分。向您提供諸如預測之類的資訊。

有關光刻材料市場最新動態和報告亮點的專題新聞稿:

目錄

第一章執行摘要

第二章 研究範圍、目的與研究方法

第三章 半導體產業市場現況與展望

- 世界經濟

- 連結半導體產業與全球經濟

- 半導體銷售額成長率

- 台灣月度銷售趨勢

- 2023年高度不確定性-半導體收入成長預計將放緩至負值

- 晶片銷售趨勢:按電子設備細分市場

- 手機

- PC 出貨量

- 伺服器/IT市場

- 半導體製造業的成長與擴張

- 鑄造廠擴建公告:概述

- 透過在世界各地擴大鑄造廠來加速成長

- 資本支出趨勢

- 技術路線圖

- 代工投資評估

- 政策和貿易趨勢及影響

- 半導體材料概述

- 晶片生產進度可能受到材料產能限制

- 減少物流問題

- Techcet晶圓開始預測至2027年

- Techcet材料預測

第四章光阻部分

- 市場宏觀趨勢

- 光阻營收預測

- EUV光阻:市場概況

- ARF (193)/ARFI (193 Immersion):市場概覽

- KRF (248NM) 光阻:市場概況

- G線/I線:市場概況

- 光阻市場佔有率

- 光阻供應商反思

- 光阻供應商

- 光阻技術的發展趨勢

- 圖案化技術的趨勢

- 製造層:按光刻曝光類型

- 3D NAND技術趨勢(光刻製程的增加)

- 光阻技術的趨勢(平台的變化)

- 圖案趨勢

- 主要材料(宏觀)技術趨勢(圖案材料顯著變化)

- 按地區劃分的趨勢

- 區域趨勢:材料公司的擴張,概述

- 環境、健康與安全問題

- 光阻段評估

第五章 配套延伸市場

- 配套市場狀況

- 配套市場預測

- 輔助(EBR(邊珠去除)、顯影劑、預濕、沖洗)數量預測

- 輔助(EBR/Prewett)獲利預測

- 輔助(EBR/預濕)數量預測

- 輔助(負顯影劑/沖洗劑)利潤預測

- 輔助(負顯影劑/沖洗劑)數量預測

- 輔助(積極的開發商)利潤預測

- 預測輔助(正顯影劑)數量

- 主要擴展供應商

- 選擇擴展輔助供應商

- 延伸預測

- 外延(底塗)獲利預測

- 延伸(底塗)數量預測

- 擴展部分的收入預測(SI底部抗反射塗層)

- 擴展數量預測(SI 底部減反射塗層)

- 延伸(KRF底部抗反射塗層)營收預測

- 延伸(KRF底部增透膜)數量預測

- 延伸(旋塗碳底抗反射塗層)營收預測

- 延伸(旋塗碳底抗反射塗層)用量預測

- 延伸(ARF底部抗反射塗層)營收預測

- 延伸部分(ARF底部抗反射塗層)數量預測

- 輔助延伸技術

- 新製程帶來的材料變化(193NM 浸入式 EUV)

- 發展歷程

- 溶劑的影響:從正性光阻到負性光阻的轉變

- 附屬情況(光阻以外的製造商)

- 輔助擴展材料的評估

- 分析師評級(輔助)

- 分析師評級(擴展)

第六章 供應鏈的 "新" 進入者

- 供應鏈的 "新" 進入者:LAM RESEARCH

- "新" 供應鏈進入者:DONGJIN SEMICHEM(韓國)

- 供應鏈擴張:中國

- 下游供應鏈:中斷

- 供應鏈價格趨勢

- 更多關於供應鏈的思考

- 參考

第七章 供應商簡介

- Avantor

- AllresistGesellschaftfürchemische

- BASF

- BrewerScience

- Chang Chun Petrochemical

- DongjinChemical

- ...20多家其他公司

This report covers the Photolithography materials market and supply chain for those materials used in semiconductor device fabrication. The report contains data and analysis from TECHCET's database and Sr. Analyst experience, as well as that developed from primary and secondary market research. This Critical Materials Report™ (CMR) provides focused information for supply-chain managers, process integration and R&D directors, as well as business development managers, and financial analysts. The report covers information about key suppliers, issues/trends in the material supply chain, estimates on supplier market share, and forecast for the material segments.

This report comes with 3 Quarterly Updates featuring updated market information and forecasting from the report analyst.

TABLE OF CONTENTS

1. EXECUTIVE SUMMARY

- 1.1. MARKET TRENDS IMPACTING LITHOGRAPHY

- 1.2. TECHNICAL TRENDS IMPACTING LITHOGRAPHY

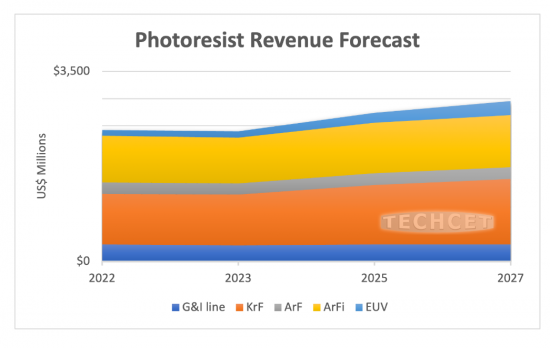

- 1.3. PHOTORESIST REVENUE 5-YEAR FORECAST

- 1.3.1. ANCILLARY AND EXTENSION REVENUE 5-YEAR FORECAST

- 1.4. YEAR 2022 IN REVIEW-2022 LITHOGRAPHY TRENDS/ LESSONS

- 1.5. MARKET TRENDS IMPACTING LITHOGRAPHY MATERIALS OUTLOOK

- 1.6. COMPETITIVE LANDSCAPE

- 1.7. EHS ISSUES/CONCERNS n 0 PFAS

- 1.8. ANALYST ASSESSMENT

- 1.8.1. ANALYST TECHNOLOGY UPDATE

2. SCOPE, PURPOSE AND METHODOLOGY

- 2.1. PURPOSE

- 2.2. METHODOLOGY

- 2.3. OVERVIEW OF OTHER TECHCET CMR™ REPORTS

3. SEMICONDUCTOR INDUSTRY MARKET STATUS & OUTLOOK

- 3.1. WORLDWIDE ECONOMY

- 3.1.1. SEMICONDUCTOR INDUSTRIES TIES TO THE GLOBAL ECONOMY

- 3.1.2. SEMICONDUCTOR SALES GROWTH

- 3.1.3. TAIWAN MONTHLY SALES TRENDS

- 3.1.4. UNCERTAINTY ABOUNDS ESPECIALLY FOR 2023-SLOWER TO NEGATIVE SEMICONDUCTOR REVENUE GROWTH EXPECTED

- 3.2. CHIPS SALES BY ELECTRONIC GOODS SEGMENT

- 3.2.1. SMARTPHONES

- 3.2.2. PC UNIT SHIPMENTS

- 3.2.2.1. ELECTRIC VEHICLE (EV) MARKET TRENDS

- 3.2.2.2. INCREASE IN SEMICONDUCTOR CONTENT FOR AUTOS

- 3.2.3. SERVERS / IT MARKET

- 3.3. SEMICONDUCTOR FABRICATION GROWTH & EXPANSION

- 3.3.1. FAB EXPANSION ANNOUNCEMENT SUMMARY

- 3.3.1.1. NEW FABS IN THE US

- 3.3.2. WW FAB EXPANSION DRIVING GROWTH

- 3.3.3. EQUIPMENT SPENDING TRENDS

- 3.3.4. TECHNOLOGY ROADMAPS

- 3.3.5. FAB INVESTMENT ASSESSMENT

- 3.3.1. FAB EXPANSION ANNOUNCEMENT SUMMARY

- 3.4. POLICY & TRADE TRENDS AND IMPACT

- 3.5. SEMICONDUCTOR MATERIALS OVERVIEW

- 3.5.1. COULD MATERIALS CAPACITY LIMIT CHIP PRODUCTION SCHEDULES?

- 3.5.2. LOGISTICS ISSUES EASED DOWN

- 3.5.3. TECHCET WAFER STARTS FORECAST THROUGH 2027

- 3.5.4. TECHCET'S MATERIAL FORECAST

4. PHOTORESIST SEGMENT

- 4.1. MARKET MACRO TRENDS

- 4.2. PHOTORESIST REVENUE FORECAST

- 4.2.1. EUV PHOTORESIST-MARKET OVERVIEW

- 4.2.2. ARF (193) & ARFI (193 IMMERSION)-MARKET OVERVIEW

- 4.2.3. KRF (248NM) PHOTORESIST-MARKET OVERVIEW

- 4.2.4. G & I LINE-MARKET OVERVIEW

- 4.3. PHOTORESIST MARKET SHARES

- 4.3.1. PHOTORESIST SUPPLIER REFLECTION

- 4.3.2. SUPPLIERS PHOTORESIST

- 4.3.2.1. DUPONT SUPPLY CAPACITY AND DEMAND, INVESTMENTS

- 4.3.2.2. DONGJIN SUPPLY CAPACITY AND DEMAND, INVESTMENTS

- 4.3.2.3. FUJIFILM SUPPLY CAPACITY AND DEMAND, INVESTMENTS

- 4.3.2.4. JSR SUPPLY CAPACITY AND DEMAND, INVESTMENTS

- 4.3.2.5. MERCK KGAA, EMD ELECTRONICS SUPPLY CAPACITY AND DEMAND, INVESTMENTS

- 4.3.2.6. (SHIN-ETSU) SUPPLY CAPACITY AND DEMAND, INVESTMENTS

- 4.3.2.7. SUMITOMO SUPPLY CAPACITY AND DEMAND, INVESTMENTS

- 4.3.2.8. TOK SUPPLY CAPACITY AND DEMAND, INVESTMENTS

- 4.3.2.9. SUB-TIER SUPPLY-CHAIN "NEW" ENTRANTS

- 4.3.2.10. SUB-TIER SUPPLY-CHAIN CHINESE PRODUCERS

- 4.4. PHOTORESIST TECHNOLOGY TRENDS

- 4.4.1. PATTERNING TECHNOLOGY TRENDS

- 4.4.2. PRODUCTION LAYERS BY LITHOGRAPHIC EXPOSURE TYPE

- 4.4.3. 3DNAND TECHNOLOGY TRENDS (INCREASING LITHOGRAPHY STEPS)

- 4.4.4. PHOTORESIST TECHNOLOGY TRENDS (PLATFORM TRANSITIONS)

- 4.4.4.1. THE EVOLUTION (A LITHO MATERIALS PERSPECTIVE): POLYMER PLATFORM TRANSITION AS WELL AS A DEVELOPER TRANSITION @ EUV

- 4.4.5. PATTERNING TRENDS

- 4.4.5.1. PATTERNING TECHNOLOGY TRENDS

- 4.4.5.2. DYNAMIC SELF ASSEMBLY PROCESS

- 4.4.6. KEY MATERIAL (MACRO)TECHNOLOGY TRENDS (PATTERNING MATERIAL TRANSITIONS TO WATCH)

- 4.5. REGIONAL TRENDS

- 4.5.1. REGIONAL TRENDS-MATERIAL COMPANY EXPANSIONS SUMMARY

- 4.6. EHS ISSUES

- 4.7. ASSESSMENT OF PHOTORESIST SEGMENT

5. ANCILLARY AND EXTENSIONS MARKET SEGMENT

- 5.1. MARKET LANDSCAPE FOR ANCILLARIES

- 5.2. ANCILLARY FORECASTS

- 5.2.1. ANCILLARIES (EBR, DEVELOPERS, PREWETS AND RINSES) VOLUMES FORECAST

- 5.2.2. ANCILLARIES (EDGE BEAD REMOVAL AND PREWET) REVENUE FORECAST

- 5.2.3. ANCILLARIES (EDGE BEAD REMOVAL AND PREWET) VOLUMES FORECAST

- 5.2.4. ANCILLARIES (NEGATIVE TONE RESIST DEVELOPER AND RINSE) REVENUES FORECAST

- 5.2.5. ANCILLARIES (NEGATIVE TONE RESIST DEVELOPER AND RINSE) VOLUMES FORECAST

- 5.2.6. ANCILLARIES (POSITIVE TONE RESIST DEVELOPER) REVENUE FORECAST

- 5.2.7. ANCILLARIES (POSITIVE TONE RESIST DEVELOPER) VOLUMES FORECAST

- 5.3. KEY SUPPLIERS OF EXTENSION MATERIALS

- 5.3.1. SELECT EXTENSION AND ANCILLARY SUPPLIERS

- 5.4. EXTENSION MATERIALS FORECASTS

- 5.4.1. EXTENSIONS (BOTTOM COATINGS) REVENUE FORECAST

- 5.4.2. EXTENSIONS (BOTTOM COATINGS) VOLUMES FORECAST

- 5.4.3. EXTENSIONS (SI BOTTOM ANTIREFLECTIVE COATINGS) REVENUE FORECAST

- 5.4.4. EXTENSIONS (SI BOTTOM ANTIREFLECTIVE COATINGS) VOLUMES FORECAST

- 5.4.5. EXTENSIONS (KRF BOTTOM ANTIREFLECTIVE COATINGS) REVENUE FORECAST

- 5.4.6. EXTENSIONS (KRF BOTTOM ANTIREFLECTIVE COATINGS) VOLUMES FORECAST

- 5.4.7. EXTENSIONS SPIN-ON CARBON BOTTOM ANTIREFLECTIVE COATING REVENUE FORECAST

- 5.4.8. EXTENSIONS SPIN-ON CARBON BOTTOM ANTIREFLECTIVE COATING VOLUMES FORECAST

- 5.4.9. EXTENSIONS (ARF BOTTOM ANTIREFLECTIVE COATINGS) REVENUE FORECAST

- 5.4.10. EXTENSIONS (ARF BOTTOM ANTIREFLECTIVE COATINGS) VOLUMES FORECAST

- 5.5. ANCILLARY AND EXTENSION MATERIALS TECHNOLOGIES

- 5.5.1. MATERIAL CHANGES DRIVEN BY NEW PROCESSES (193NM IMMERSION TO EUV)

- 5.5.2. THE DEVELOPER TRANSITION

- 5.5.3. SOLVENT IMPACT: TRANSITION FROM POSITIVE PHOTORESIST TO NEGATIVE PHOTORESIST

- 5.6. ANCILLARY SUPPLY LANDSCAPE (NON-PHOTORESIST MAKERS)

- 5.7. ANCILLARY AND EXTENSION MATERIALS ASSESSMENT

- 5.7.1. ANALYST ASSESSMENT (ANCILLARIES)

- 5.7.2. ANALYST ASSESSMENT (EXTENSIONS)

6. SUPPLY-CHAIN "NEW" ENTRANTS

- 6.1. SUPPLY-CHAIN "NEW" ENTRANTS-LAM RESEARCH

- 6.2. SUPPLY-CHAIN "NEW" ENTRANTS-S. KOREA-DONGJIN SEMICHEM

- 6.2.1. SUPPLY CHAIN EXPANSIONS-CHINA

- 6.3. SUB-TIER SUPPLY-CHAIN: DISRUPTIONS

- 6.4. SUPPLY-CHAIN PRICING TRENDS

- 6.5. SUPPLY-CHAIN OTHER THOUGHTS

- 6.6. REFERENCES

7. SUPPLIER PROFILES

- Avantor

- AllresistGesellschaftfürchemische

- BASF

- BrewerScience

- Chang Chun Petrochemical

- DongjinChemical

- ...and 20+ more

LIST OF FIGURES

- FIGURE 1: PHOTORESIST REVENUE FORECAST

- FIGURE 2: TOTAL ANCILLARY AND EXTENSION REVENUE FORECAST

- FIGURE 3: BOTTOM ANTI-REFLECTIVE COATINGS (BARCS) HOW THEY WORK, EXAMPLE

- FIGURE 4: 2022 MARKET SHARE ESTIMATES OF TOP 3 PHOTORESIST COMPANIES

- FIGURE 5: ASML EUV SYSTEM BEAM PATH NXE: 3400B

- FIGURE 6: GLOBAL ECONOMY AND THE ELECTRONICS SUPPLY CHAIN (2022)

- FIGURE 7: WORLDWIDE SEMICONDUCTOR SALES

- FIGURE 8: TECHCET'S TAIWAN SEMICONDUCTOR INDUSTRY INDEX (TTSI)*

- FIGURE 9: 2023 SEMICONDUCTOR INDUSTRY REVENUE GROWTH FORECASTS

- FIGURE 10: 2022 SEMICONDUCTOR CHIP APPLICATIONS

- FIGURE 11: MOBILE PHONE SHIPMENTS WW ESTIMATES

- FIGURE 12: WORLDWIDE PC AND TABLET FORECAST

- FIGURE 13: ELECTRIFICATION TREND BY WORLD REGION

- FIGURE 14: SEMICONDUCTOR AUTOMOTIVE PRODUCTION

- FIGURE 15: TSMC PHOENIX INVESTMENT ESTIMATED WILL BE US $40 B

- FIGURE 16: CHIP EXPANSIONS 2022-2027 US$366 B

- FIGURE 17: SEMICONDUCTOR CHIP MANUFACTURING REGIONS OF THE WORLD

- FIGURE 18: GLOBAL TOTAL EQUIPMENT SPENDING BY SEGMENT (US$ B)

- FIGURE 19: OVERVIEW OF DEVICE TECHNOLOGY ROADMAP

- FIGURE 20: INTEL OHIO PLANT SITE FEB. 2023 AND ARTIST RENDERING (ON BOTTOM)

- FIGURE 21: EUROPE CHIP EXPANSION UPSIDE

- FIGURE 22: PORT OF LA

- FIGURE 23: TECHCET WAFER START FORECAST BY NODE SEGMENTS**

- FIGURE 24: GLOBAL SEMICONDUCTOR MATERIALS OUTLOOK

- FIGURE 25: PHOTORESIST REVENUE FORECAST

- FIGURE 26: EUV PHOTORESIST REVENUE FORECAST (US$ MILLIONS)

- FIGURE 27: EUV PHOTORESIST VOLUME FORECAST

- FIGURE 28: ARF PHOTORESIST REVENUE FORECAST

- FIGURE 29: ARF PHOTORESIST VOLUME FORECAST

- FIGURE 30: KRF PHOTORESIST REVENUE FORECAST

- FIGURE 31: KRF (248NM) PHOTORESIST VOLUME FORECAST

- FIGURE 32: G&I PHOTORESIST REVENUE FORECAST

- FIGURE 33: G&I PHOTORESIST VOLUME FORECAST

- FIGURE 34: 2022 PHOTORESIST MARKET SHARES ESTIMATES (% OF WW REVENUES)

- FIGURE 35: GENERAL SCHEMATIC OF LITHO EXPOSURES BY DEVICE TYPE

- FIGURE 36: EXAMPLE OF 3D NAND SCALING BY STACKS/TIERS

- FIGURE 37: SCANNER TECHNOLOGY TRENDS ARF TO EUV

- FIGURE 38: EVOLUTION OF PHOTORESIST CHEMISTRY

- FIGURE 39: NANO IMPRINT LITHOGRAPHY:

- FIGURE 40: CONVENTIONAL AND SELECTIVE DIRECTED SELF-ASSEMBLY

- FIGURE 41: ANCILLARY REVENUES FORECAST

- FIGURE 42: ANCILLARY VOLUME FORECAST

- FIGURE 43: EBR AND PREWET REVENUE FORECAST

- FIGURE 44: EBR AND PREWET VOLUME FORECAST

- FIGURE 45: NTD CHEMICALS REVENUE FORECAST

- FIGURE 46: NTD CHEMICALS VOLUME FORECAST

- FIGURE 47: POSITIVE TONE DEVELOPER REVENUES FORECAST (US$M)

- FIGURE 48: PTD VOLUME FORECAST (KILOLITERS/YR)

- FIGURE 49: EXTENSION MATERIALS REVENUE FORECAST

- FIGURE 50: EXTENSION VOLUME FORECAST

- FIGURE 51: SI BARC REVENUE FORECAST (US$M)

- FIGURE 52: SI BARC VOLUME FORECAST

- FIGURE 53: KRF BARAC REVENUE FORECAST

- FIGURE 54: KRF BARC VOLUME FORECAST

- FIGURE 55: SOC REVENUE FORECAST

- FIGURE 56: SOC VOLUME FORECAST

- FIGURE 57: ARF BARC REVENUE FORECAST

- FIGURE 58: ARF BARC VOLUMES/YEAR FORECAST

- FIGURE 59: DEVELOPER TRANSITION

- FIGURE 60: SOLVENT IMPACT FOR POSITIVE VS. NEGATIVE PHOTORESIST

- FIGURE 61: LAM RESEARCH DRY RESIST

LIST OF TABLES

- TABLE 1: GLOBAL GDP AND SEMICONDUCTOR REVENUES*

- TABLE 2: IMF ECONOMIC OUTLOOK*

- TABLE 3: DATA CENTER SYSTEMS AND COMMUNICATION SERVICES MARKET SPENDING 2022

- TABLE 4: REGIONAL SEMICONDUCTOR TRENDS

- TABLE 5: REGIONAL LITHOGRAPHY MATERIALS SUPPLIER EXPANSION SUMMARY

- TABLE 6: SOLVENT SUPPLIERS

- TABLE 7: KEY SUPPLIERS OF EXTENSION MATERIALS

- TABLE 8: ANCILLARY SUPPLIER LANDSCAPE

![光刻材料市場:趨勢、機遇、競爭分析 [2023-2028]](/sample/img/cover/42/1277618.png)