|

市場調查報告書

商品編碼

1273315

雲網絡安全市場 - 增長、趨勢和預測 (2023-2028)Cloud Network Security Market - Growth, Trends, and Forecasts (2023 - 2028) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

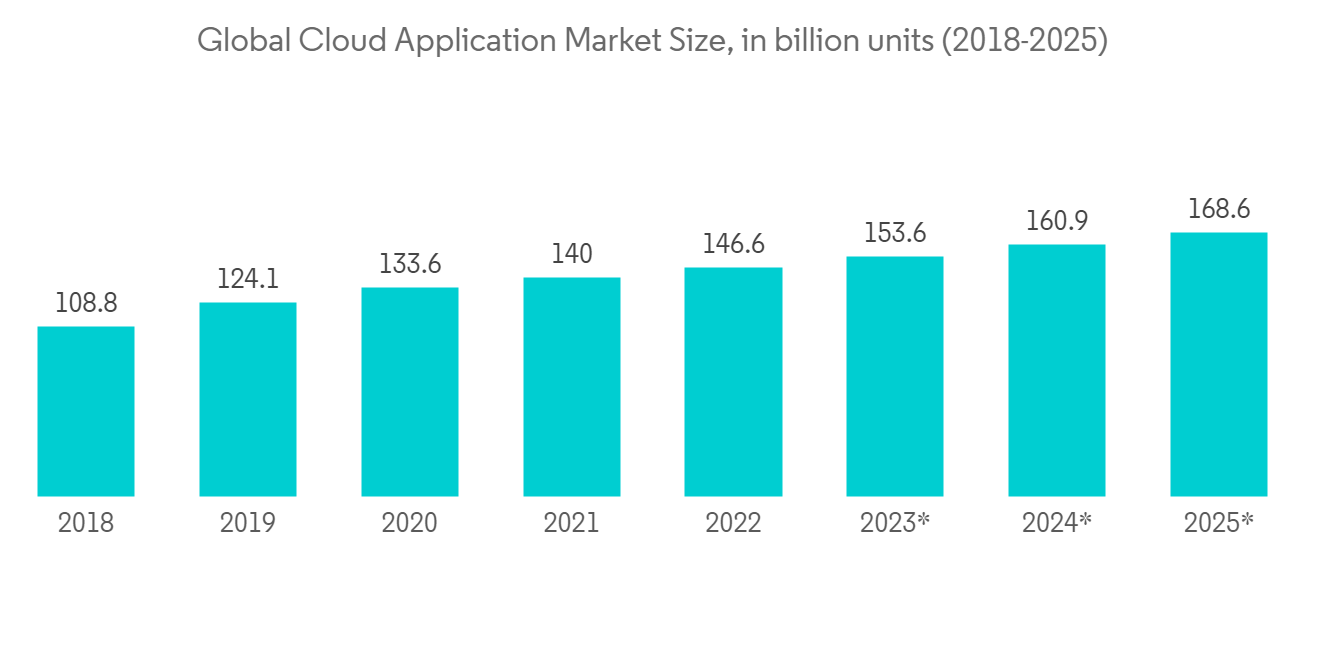

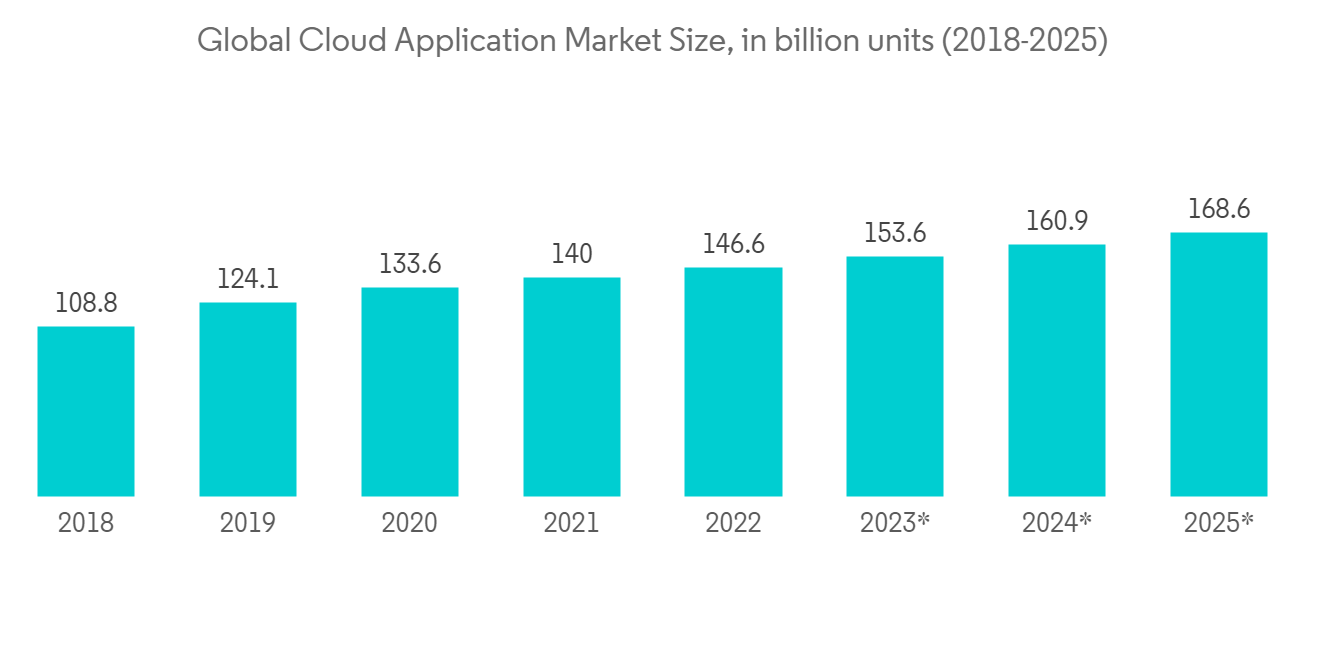

在預測期內,雲網絡安全市場預計將以 18.1% 的複合年增長率增長。

保護免受網絡攻擊對於工業設施來說變得越來越重要。 因此,行業越來越希望從新機器的開發階段到整個生命週期部署雲網絡安全。 雲安全初創公司的進入有望為市場注入更多資金,刺激服務的進步和發展。 COVID-19 期間在家工作的選擇增多導致雲存儲的採用率很高,許多公司繼續效仿。 這種不斷變化的工作環境正在推動對雲安全的需求。

主要亮點

- 這個市場是技術和網絡市場中一些最大參與者的所在地,例如 IBM、思科和英特爾 (Cisco)。 這些公司是基於雲的網絡技術的早期採用者和重要投資者,是市場先驅。 為了保持競爭力和市場地位,這些公司繼續投資於該領域。

- Deloitte 已宣布擴大其全球 Google Cloud 業務,這不僅會提升公司的雲能力,還會為雲專業人士提供培訓和認證。 我們的客戶還受益於幫助他們從雲投資中實現價值。

- CrowdStrike 和 EY 建立了合作夥伴關係,以提供雲安全和可觀察性服務。 該合資企業將為聯合客戶提供 CrowdStrike Cloud Security 和實時可見性來保護他們的雲工作負載,以更好地了解和評估其基礎設施環境中的問題。

- COVID-19 大流行影響了每個組織。 遠程辦公的流行、基於 Web 的會議的增加以及將用戶連接到這些服務的網絡上不斷增加的用戶流量對雲存儲產生了很高的需求,這需要安全和高效的操作。

- 根據數據中心發展預測,55 個地區已經開始建設相當於 410 萬千瓦的設施,這對雲網絡運營商來說,存儲、保存和保護這些數據是一項挑戰。我來了。

雲網絡安全市場趨勢

基於應用的分類和產品將成為雲網絡安全的大需求

- 基於應用程序的分類和產品可用性推動了對基於雲網絡安全的產品的積極市場需求。 組織選擇數據加密和其他可用的方法來保護信息。

- 商業用途的範圍從用於國防的軍事級產品和服務,到用於金融業務的工業級產品和服務,再到公共用途的產品和服務。 一些網絡應用程序需要不間斷的連接,這對業務運營至關重要,而其他網絡應用程序則需要容忍中斷並繼續網絡運營。

- 這些因素決定了產品基於應用程序的實施和利用,從而推動了各自細分市場的發展。 在航空航天和國防領域,通信故障是致命的並且會造成巨大的經濟損失,這推動了對頂級產品的需求。

- 各個領域使用的app數量都在增加,但在金融服務領域,針對性的客戶促銷和產品優惠、銀行預約提醒、實時提醒、賬單提醒、客戶調查等,佔有很大份額因為它以各種方式為客戶服務。

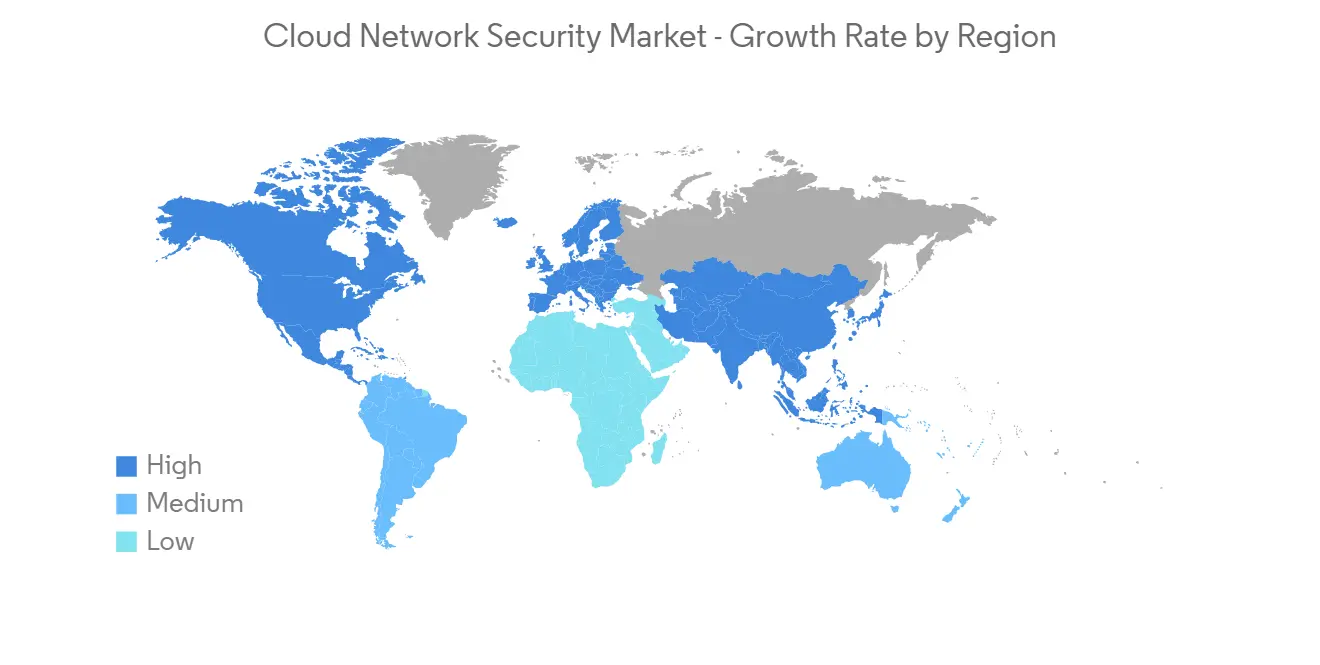

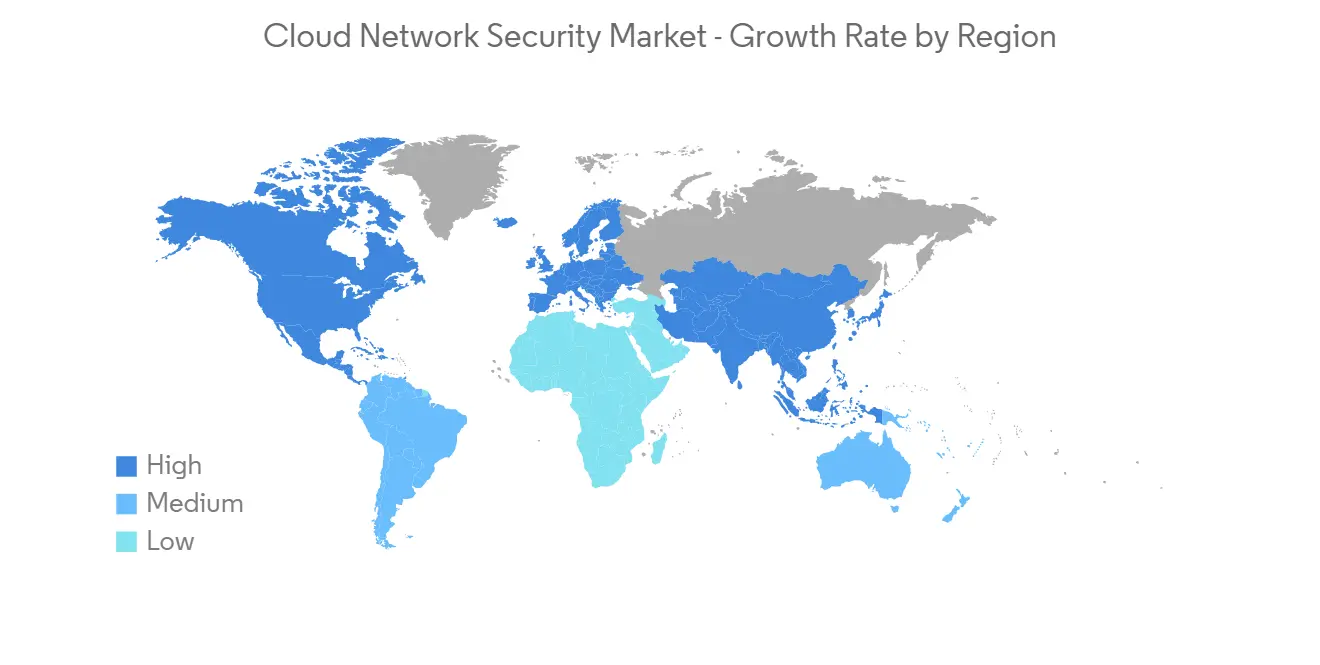

美國占據雲網絡安全市場最大份額

- 美國是全球最大的雲網絡安全消費者。 這可以歸因於大公司的存在、網絡攻擊頻率的增加以及該國託管服務器數量的增加。

- 許多雲安全提供商的總部都設在美國,全球大約 63% 的私營網絡安全公司都位於美國。 大多數公司先在國內試點新服務,然後再向全球推廣。

- 該國對新技術的快速採用和對安全性日益增長的興趣正在推動市場發展。 微軟和亞馬遜等主要雲服務提供商在該國的存在在雲安全市場的增長中發揮著重要作用。

- 與 17 家主要私營部門公司(包括交通、零售和醫療保健)相比,美國聯邦、州和地方政府機構在網絡安全方面排名最後。 但現在該地區的政府正在加強他們的安全規範,以提供更好的雲安全。

- 與其他市場相比,大中型企業的滲透率更高,因此我們預計該細分市場將成為網絡安全解決方案的主要購買者。 隨著中小企業獲得網絡曝光機會,基於雲的解決方案的採用也有望增加。 因此,預計該行業的投資在預測期內也將呈指數增長。

- 此外,該國的其他工業部門(例如製造業、能源和公用事業)已經轉向數字化運營方式,並開始更好地了解其網絡風險,因此它們有望實現顯著增長。有可能性。

雲網絡安全行業簡介

全球雲網絡安全市場高度分散。 多種網絡威脅迫使政府和行業加大對網絡空間的投資。 投資的增加導致許多新進入者進入市場,以更低的價格提供解決方案,從而使市場更具競爭力。 市場上的主要參與者包括 IBM 公司、英特爾公司、趨勢科技公司、思科系統公司、華為技術公司等。 這些參與者不斷提供和升級創新產品以滿足日益增長的市場需求。

2022 年 11 月,思科和紅帽聯手簡化混合雲容器管理。 該合作夥伴關係將使客戶更容易啟動和管理裸機容器化工作負載。

2022 年 11 月,Google Cloud 和印度數據安全委員會 (DSCI) 將聯合發起“Secure with Cloud Initiative”,旨在“神秘化雲安全”和“促進向雲的遷移”。做到了。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

內容

第 1 章目錄

第二章介紹

- 調查假設和市場定義

- 調查範圍

第三章研究方法論

第 4 章執行摘要

第 5 章市場動態

- 市場概覽

- 市場驅動因素

- 在組織中快速採用基於雲的服務

- 網絡攻擊增加

- 由於 BYOD 和 CYOD 的增加,對雲安全的需求增加

- 市場製約因素

- 數據隱私

- 雲存儲的複雜結構

- 行業價值鏈分析

- 行業吸引力 - 波特五力分析

- 新進入者的威脅

- 買方/消費者議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭公司之間的敵對關係

第 6 章市場細分

- 通過申請

- 身份和訪問管理 (IAM)

- 數據丟失防護 (DLP)

- 安全信息和事件管理 (SIEM)

- 按安全類型

- 應用安全

- 數據庫安全

- 網絡安全

- 網絡/電子郵件安全

- 按組織規模

- 大公司

- 中小企業

- 最終用戶

- 醫療保健

- 銀行和金融服務

- 零售和消費者服務

- 製造業

- 運輸/物流

- IT/電信

- 其他最終用戶

- 按地區

- 北美

- 美國

- 加拿大

- 墨西哥

- 其他北美地區

- 歐洲

- 英國

- 法國

- 德國

- 俄羅斯

- 其他歐洲

- 亞太地區

- 中國

- 印度

- 日本

- 澳大利亞和新西蘭

- 其他亞太地區

- 拉丁美洲

- 巴西

- 墨西哥

- 其他拉丁美洲地區

- 中東和非洲

- 阿拉伯聯合酋長國

- 沙特阿拉伯

- 南非

- 其他中東和非洲地區

- 北美

第七章競爭格局

- 供應商市場份額

- 併購

- 公司簡介

- Amazon Web Services

- Microsoft Corp.

- Cisco Systems Inc.

- Palo Alto Networks Inc.

- Trend Micro Inc.

- Fortinet Inc.

- Sangfor Technologies Inc.

- Mcafee

- Huawei Technologies Co. Ltd.

- IBM Corporation

- Intel Corporation

第8章 投資分析

第9章 市場機會與將來動向

The cloud network security market is expected to register a CAGR of 18.1% during the forecast period. Protection against cyberattacks is becoming more critical for industrial establishments. Therefore, industries are now considering implementing cloud network security right at the development stage for new machines and throughout their entire life cycle. The entry of new cloud security start-ups will bring more financial investment to the market, adding to the advancement and development of the service. The adoption rate for cloud storage became high during the COVID-19 period as the work-from-home option emerged significantly, and many companies continue to follow this. These modifications in the work environment are fueling the need for cloud security.

Key Highlights

- The market comprises major players, such as IBM, Cisco, and Intel, who are the leaders in technology and the networking market (Cisco). Being early adopters and significant investors in cloud-based networking technologies, these players are pioneers in the market. To hold on to their competitive edges and positions in the market, these companies have continued to invest in this field.

- Deloitte announced the expansion of its global Google Cloud practice, which will not only advance the company's cloud capabilities but also provide training and certification for cloud professionals. The clients will also benefit by helping them realize value from cloud investments.

- CrowdStrike and EY signed an alliance to deliver cloud security and observability services. This venture will provide joint customers the ability to secure their cloud workloads with CrowdStrike Cloud Security and real-time visibility to better understand and assess issues in their infrastructure environments.

- The COVID-19 pandemic affected every organization. There was a high demand for cloud storage, which required a secure and efficient operation due to the rise in work-from-home adoption, web-based conferences, and rising user traffic on the networks that connected users to these services.

- Forecasts for the development of data centers indicate that construction on 4.1 GW worth of facilities is already underway in 55 regions, posing challenges for cloud network businesses to store, preserve, and secure this data.

Cloud Network Security Market Trends

Application-based Classification and Products to have Significant Demand for Cloud Network Security

- Application-based segmentation and product availability have driven positive demand for cloud network security-based products in the market. Organizations opt for data encryption or other available means to safeguard information.

- Commercial usage varies from the military-grade products and services used in defense to industry-grade products and services for financial businesses to public-use products and services. Some network applications require uninterrupted connectivity vital for the operation of the business, while others require the network to be operated continuously with a tolerance for disruption.

- These factors decide the application-based implementation and usage of the product and drive the market in their respective segments. A failure of communication can be catastrophic and huge in terms of finances in the aviation and defense sectors, driving the demand for top-end products.

- The number of apps used in the various sectors is increasing, while the financial services segment holds the major share as it serves the customer in various ways, like targeted customer promotions and product offers, bank appointment reminders, real-time alerts, bill reminders, and customer surveys.

United States Accounts for the Largest Share in the Cloud Network Security Market

- The United States is the largest consumer of cloud network security in the world. This could be attributed to the presence of large enterprises, the growing frequency of cyberattacks, and the increasing number of hosted servers in the country.

- Many cloud security-providing companies are headquartered in the United States, and the country is home to approximately 63% of the world's privately-owned cybersecurity companies. Most of the companies pilot their new services in the country before launching them globally.

- The rapid adoption of new technology in the country and the growing focus on security are pushing the market forward. The presence of large cloud service providers in the country, such as Microsoft and Amazon, is playing a significant role in the growth of the cloud security market.

- US federal, state, and local government agencies rank last in cybersecurity compared to 17 major private industries, including transportation, retail, and healthcare. Presently, however, the government in this region has tightened the security norms to provide better cloud security.

- With higher penetration levels in medium- and large-scale companies compared to the rest of the market, this segment of the market is expected to be the main buyer of network security solutions. Also, as smaller enterprises access their cyber exposures, growth in the adoption of cloud-based solutions is expected. As a result, investments in this sector are also expected to increase exponentially over the forecast period.

- Moreover, there is huge growth potential in other industry segments in the country, such as manufacturing, energy, and utilities, as they have already migrated to digitally transformed methods of operation and are now beginning to get a better understanding of their cyber exposure.

Cloud Network Security Industry Overview

The global cloud network security market is highly fragmented, as several cyber threats are forcing governments and respective industries to invest more in their cyberspace. Increasing investment is driving many new players that offer solutions at lower prices into the market, which makes the market competitive. Some of the key players in the market are IBM Corporation, Intel Corporation, Trend Micro Inc., Cisco Systems Inc., and Huawei Technologies Co., Ltd. These players are constantly innovating and upgrading their product offerings to cater to increasing market demand.

In November 2022, Cisco and Red Hat joined hands to streamline hybrid-cloud container management. With this partnership customers can more easily turn-up and manage bare-metal containerized workloads.

In November 2022, Google Cloud and the Data Security Council of India (DSCI) together launched the "Secure with Cloud initiative, aimed at "demystifying cloud security" and encouraging cloud migration.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 TOC

2 INTRODUCTION

- 2.1 Study Assumption and Market Definition

- 2.2 Scope of the Study

3 RESEARCH METHODOLOGY

4 EXECUTIVE SUMMARY

5 MARKET DYNAMICS

- 5.1 Market Overview

- 5.2 Market Drivers

- 5.2.1 Rapid adaptation of cloud based services among organisations

- 5.2.2 Increased Cyber Attacks

- 5.2.3 Rising trend of BYOD and CYOD to boost cloud security demand

- 5.3 Market Restraints

- 5.3.1 Data Privacy

- 5.3.2 The Complex Structure of Cloud Storage

- 5.4 Industry Value Chain Analysis

- 5.5 Industry Attractiveness - Porter's Five Forces Analysis

- 5.5.1 Threat of New Entrants

- 5.5.2 Bargaining Power of Buyers/Consumers

- 5.5.3 Bargaining Power of Suppliers

- 5.5.4 Threat of Substitute Products

- 5.5.5 Intensity of Competitive Rivalry

6 MARKET SEGMENTATION

- 6.1 By Application

- 6.1.1 Identity and access management (IAM)

- 6.1.2 Data loss prevention (DLP)

- 6.1.3 Security information and event management (SIEM)

- 6.2 By Security Type

- 6.2.1 Application Security

- 6.2.2 Database Security

- 6.2.3 Network Security

- 6.2.4 Web and e-mail security

- 6.3 By Organisation Size

- 6.3.1 Large Enterprises

- 6.3.2 Small-Medium Enterprises

- 6.4 By End-User

- 6.4.1 Healthcare

- 6.4.2 Banking and Financial Services

- 6.4.3 Retail and Consumer Services

- 6.4.4 Manufacturing

- 6.4.5 Transport and Logistics

- 6.4.6 IT and Telecom

- 6.4.7 Other End-Users

- 6.5 Geography

- 6.5.1 North America

- 6.5.1.1 United States

- 6.5.1.2 Canada

- 6.5.1.3 Mexico

- 6.5.1.4 Rest of North America

- 6.5.2 Europe

- 6.5.2.1 UK

- 6.5.2.2 France

- 6.5.2.3 Germany

- 6.5.2.4 Russia

- 6.5.2.5 Rest of Europe

- 6.5.3 Asia-Pacific

- 6.5.3.1 China

- 6.5.3.2 India

- 6.5.3.3 Japan

- 6.5.3.4 Australia-New Zealand

- 6.5.3.5 Rest of Asia-Pacific

- 6.5.4 Latin America

- 6.5.4.1 Brazil

- 6.5.4.2 Mexico

- 6.5.4.3 Rest of Latin America

- 6.5.5 Middle East & Africa

- 6.5.5.1 United Arab Emirates

- 6.5.5.2 Saudi Arabia

- 6.5.5.3 South Africa

- 6.5.5.4 Rest of Middle East & Africa

- 6.5.1 North America

7 COMPETITIVE LANDSCAPE

- 7.1 Vendor Market Share

- 7.2 Mergers & Acquisitions

- 7.3 Company Profiles

- 7.4 Amazon Web Services

- 7.5 Microsoft Corp.

- 7.6 Cisco Systems Inc.

- 7.7 Palo Alto Networks Inc.

- 7.8 Trend Micro Inc.

- 7.9 Fortinet Inc.

- 7.10 Sangfor Technologies Inc.

- 7.11 Mcafee

- 7.12 Huawei Technologies Co. Ltd.

- 7.13 IBM Corporation

- 7.14 Intel Corporation