|

市場調查報告書

商品編碼

1445629

雲端資訊技術服務管理 (ITSM) - 市場佔有率分析、產業趨勢與統計、成長預測(2024 - 2029 年)Cloud Information Technology Service Management (ITSM) - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

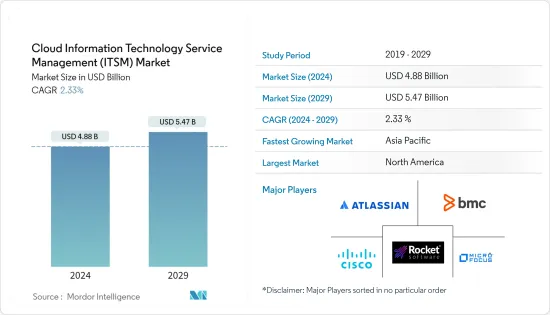

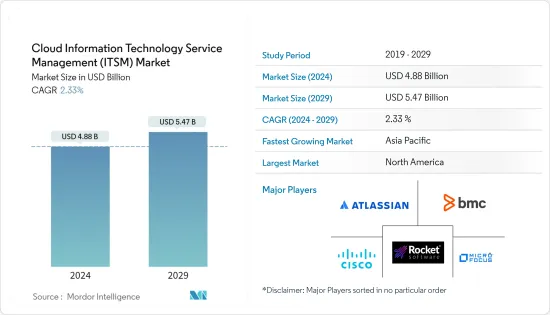

雲端資訊技術服務管理市場規模估計到2024年為48.8億美元,預計到2029年將達到54.7億美元,在預測期內(2024-2029年)CAGR為2.33%。

雲端運算的出現大幅影響了企業的運作方式。雲端解決方案的採用率不斷提高,降低了 IT 基礎設施成本,帶來了營運模式的變化。雲端解決方案的部署使企業能夠致力於核心業務能力。

主要亮點

- 支援各種通用和專業業務應用程式的雲端服務的廣泛可用性推動公司向數位企業的轉型。在使用雲端服務時,服務提供者的資訊科技服務管理(ITSM)流程成為組織的延伸,創造了重要的流程依賴性,必須仔細整合和管理該依賴性,以避免引進時間延遲、不必要的複雜性、安全漏洞和風險。公司的IT運作。

- 新創公司和中小型企業擴大使用基於雲端的應用程式,推動了雲端 IT 服務管理行業的發展。基於雲端的應用程式可協助企業降低 IT 基礎架構運作費用,並提高可擴展性、協作效率、工作流程靈活性、公司穩定性和其他優勢。

- 雲端 ITMS 解決方案和服務與先進人工智慧(AI)平台的整合是雲端 IT 服務管理(ITSM)產業發展趨勢之一。此人工智慧平台使企業能夠實現廣泛的IT和企業管理服務的自動化,同時也提供可擴展的雲端平台。

- 儘管雲端 ITMS 提供了多項優勢,但大多數最終用戶並不知道其可用性。此外,網路攻擊不斷增加的發展中國家對個人資料和企業營運的安全疑慮預計將阻礙市場擴張。

- 由於遠距工作的興起和企業數位轉型的擴大,COVID-19 大流行對市場產生了有益的影響。企業尋找無縫、高效且可從任何位置存取的業務流程。此外,許多企業完成了數位轉型,有些企業決定保持完全遠端或採用數位和辦公室混合模式營運。因此,IT 團隊預計對內部 IT 支援和雲端 ITSM 的需求將急劇上升,推動所研究的市場成長。

- 總體而言,疫情推動了雲端 ITSM 市場的發展,預計疫情過後該市場也將大幅成長,大多數組織將轉向混合工作場所模式。透過部署雲端 ITSM 工具而增強的支援和服務也將仍然是疫情後推動所研究市場的一個重要因素。

雲端資訊技術服務管理(ITSM)市場趨勢

企業向基於雲端的技術的轉變推動了市場

- IT 基礎架構的格局快速改變。各個最終用戶垂直領域的企業都在努力平衡其 IT 基礎設施功能和成本管理。未來的技術採用計畫圍繞著採用新興技術展開,隨著企業希望更換過時的基礎設施,這些技術預計將呈指數級成長。像Google和AWS這樣的公共雲端巨頭需要按需、動態、龐大的可擴展性需求。

- 使用雲端服務的公司只需為臨時使用的資源付費,而不需要購買、編程和維護長期閒置的額外資源和設備。這有助於公司最大限度地減少不產生收入的成本。因此,雲端 ITSM 工具蓬勃發展。

- 基於雲端的 ITSM 解決方案是技術生態系統中最省力的發明之一。透過為海量資料提供安全的空間,雲端 ITSM 服務交付計畫可以節省 IT 基礎設施成本,並節省致力於核心業務策略的時間。

- Hashicorp 表示,到2021年,90%的大型企業已採用多雲端,預計到2023年這一比例將達到 94%。因此,基於雲端的採用的成長對所研究的市場具有巨大的潛力。

- 此外,舊應用程式的雲端遷移將成為未來幾年的另一個ITSM策略趨勢。此 ITSM 解決方案簡化了 IT 營運並有效解決了安全漏洞。根據 Spiceworks Ziff Davis 的2022年 IT 狀況報告,約 44%的企業預計 5G 技術將成為2022年的主要 IT 能力。54%的受訪企業認為物聯網將成為主要的預算促進因素。因此,對於所有這些技術開發,基於雲端的 ITSM 解決方案將見證所研究市場的成長。

- 此外,2022年 5月,ServiceNow 領先的語音支援和雲端聯絡中心解決方案 CLogic 宣布美國最大的全服務特許連鎖餐廳之一的特許經營商和營運商 Denny's 選擇其平台。最新的技術合作夥伴關係將為 Denny 的 IT 技術服務、客戶服務和人力資源營運提供支持,涵蓋 3,000 多名員工和 1,600 多個地點。

北美預計將佔據主要佔有率

- 由於雲端技術的廣泛採用以及該地區最終用戶產業對改善 IT 服務的需求不斷成長,北美是雲端 ITSM 的重要市場。根據 Site24*7 的 IT 管理調查報告,62%的受訪者表示管理簡單性是雲端遷移的首要因素,緊隨其後的是業務連續性(60%)和可擴展性(59%)。

- 此外,2022年3月發布的一份報告以及一項針對900 多名IT 專業人士的名為「混合雲端採用調查」的調查顯示,大多數企業(93%)採用混合雲端和本地解決方案,或在五年內完全遷移到雲端。調查主要在北美和歐洲進行,其中43.8%的受訪者來自北美。因此,向雲端平台的不斷轉變將推動未來幾年對 IT 服務管理解決方案的需求。

- 此外,該地區在雲端 ITSM 供應商方面擁有牢固的立足點,為市場的成長做出了貢獻。其中包括 IBM Corporation、ServiceNow Inc. 和 BMC Software Inc. 等。

- 該地區大量採用 IT 服務解決方案來提高效率並維持組織的生產力。該技術已被 IT 和電信巨頭、BFSI 和政府機構採用。

- 此外,加拿大政府制定了「雲端優先」策略,在啟動資訊技術投資、措施、策略和專案時,將雲端服務確定為主要交付選項並對其進行評估。雲端預計也將使加拿大政府能夠利用私營部門提供者的創新,使其資訊技術更加敏捷。

雲端資訊技術服務管理(ITSM)產業概述

雲端 ITSM(資訊技術服務管理)市場高度分散,主要參與者包括 IBM 公司、BMC Software Inc.、Micro Focus International PLC、Atlassian Inc. 和 ASG Technologies Group, Inc.。市場上的公司包括僅在其ITSM 產品的雲端版本上開發一些新功能,並採用合作夥伴關係、創新和收購等策略來增強其產品供應並獲得永續的競爭優勢。

- 2022年 5月 - IBM 宣布與 Amazon Web Services Inc.(AWS)簽署策略合作協議(SCA),計劃在 AWS 上以軟體即服務(SaaS)的形式提供廣泛的軟體目錄。 IBM 和 AWS 之間的首個此類協議將使客戶能夠快速輕鬆地存取 IBM 軟體,這些軟體涵蓋自動化、資料和人工智慧、安全性和永續發展功能,建置於AWS 上的Red Hat OpenShift Service( ROSA)並運行AWS 上的雲端原生。

- 2022年 5月 - ServiceNow 宣布了幾個重要的解決方案,以改善服務營運管理、低程式碼治理和政府服務。其中包括服務營運工作區:它將服務和營運資料整合到單一體驗中,以提供跨團隊問題的共享可見性;以及 App Engine 管理中心:它整合了低程式碼開發的治理。公共部門數位服務:它改善了政府組織的服務交付。

附加優惠:

- Excel 格式的市場估算(ME)表

- 3 個月的分析師支持

目錄

第1章 簡介

- 研究假設和市場定義

- 研究範圍

第2章 研究方法

第3章 執行摘要

第4章 市場洞察

- 市場概況

- 產業吸引力-波特五力分析

- 新進入者的威脅

- 買家/消費者的議價能力

- 供應商的議價能力

- 替代產品的威脅

- 競爭激烈程度

- COVID-19 對市場影響的評估

第5章 市場動態

- 市場促進因素

- 企業轉向基於雲端的技術

- 整合人工智慧功能使其更加方便用戶使用

- 市場限制

- 儲存資料時對資料所有權、安全性和保密性的擔憂

第6章 市場細分

- 依應用

- 配置管理

- 績效管理

- 網路管理

- 資料庫管理系統

- 其他應用

- 依最終用戶產業

- BFSI

- 資訊科技和電信

- 零售

- 衛生保健

- 其他最終用戶產業(製造、旅遊和飯店、政府和教育)

- 按地理

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 中東和非洲

第7章 競爭格局

- 公司簡介

- IBM Corporation

- BMC Software Inc.

- Micro Focus International PLC

- Atlassian Inc.

- ASG Technologies Group, Inc.

- Citrix Systems Inc.

- Cherwell Software, LLC

- Ivanti Inc.

- Servicenow Inc.

- CA Technologies Inc.

- Axios Systems PLC

- Sunrise Software Ltd.

第8章 投資分析

第9章 市場的未來

The Cloud Information Technology Service Management Market size is estimated at USD 4.88 billion in 2024, and is expected to reach USD 5.47 billion by 2029, growing at a CAGR of 2.33% during the forecast period (2024-2029).

The emergence of cloud computing has significantly impacted the way businesses are being operated. The increasing adoption rate of cloud solutions has brought changes in the operating models by reducing IT infrastructure cost. The deployment of cloud solutions enables enterprises to focus on core business competencies.

Key Highlights

- The broad availability of cloud services to support various generalized and specialized business applications is fuelling companies' transformations into digital enterprises. When utilizing cloud services, the service provider's Information Technology Service Management (ITSM) processes become an extension of an organization creating an essential process dependency that must be carefully integrated and managed to avoid introducing time delays, unnecessary complexity, security vulnerabilities, and risk to the company's IT operation.

- The growing usage of cloud-based applications among startups and small and medium-sized businesses drives the cloud IT service management industry. Cloud-based apps help firms reduce IT infrastructure running expenses and increase scalability, collaboration efficiency, work process flexibility, company stability, and other benefits.

- Integration of cloud ITMS solutions and services with advanced artificial intelligence (AI) platforms is one of the developing cloud IT service management (ITSM) industry trends. The AI platform enables enterprises to automate a wide range of IT and enterprise management services while also providing a scalable cloud platform.

- Although the fact that cloud ITMS provides several benefits, the majority of end users are unaware of its availability. Moreover, security concerns for personal data and corporate operations in developing countries where cyber-attacks are on the increase are projected to hinder market expansion.

- The COVID-19 pandemic had a beneficial impact on the market, owing to the rise in remote working and the expanding digital transformation of enterprises. Businesses are looking for business processes that are seamless, efficient, and accessible from any location. Further, many businesses completed their digital transformation, and some have decided to remain fully remote or operate on a digital and in-office hybrid model. Thus, IT teams can expect a sharp rise in the need for internal IT support and cloud ITSM, thereby boosting the studied market growth.

- Overall, the pandemic has fueled the cloud ITSM market, and the market is also expected to witness prolific growth post-pandemic, with most organizations shifting to a hybrid workplace model. The enhancing support and services from deploying the cloud ITSM tool would also remain a significant factor in boosting the studied market post-pandemic.

Cloud Information Technology Service Management (ITSM) Market Trends

Shift Among Businesses Towards Cloud Based Technologies Drives the Market

- The landscape of IT infrastructure is changing rapidly. Enterprises across various end-user verticals struggle to balance their IT infrastructure functioning and cost management. The future technology adoption plans hover around adopting emerging technologies expected to grow exponentially as businesses look to replace outdated infrastructure. Public cloud giants like Google and AWS require on-demand, dynamic, enormous scalability needs.

- Companies using cloud services are required to pay only for resources they temporarily use instead of purchasing, programming, and maintaining additional resources and equipment that remain idle over long periods. This helps the companies in minimalizing costs that do not generate revenue. Thus, cloud ITSM tools are witnessing prolific growth.

- Cloud-based ITSM solutions are one of the best effort-saving inventions of the technology ecosystem. By providing a safe space for colossal data, a cloud ITSM service delivery plan economizes IT infrastructure costs and saves time to focus on core business strategies.

- According to Hashicorp, 90% of large enterprises have adopted multi-cloud in 2021, and this is expected to reach 94% by 2023. Thus, growth in cloud-based adoption holds prominent potential for the studied market.

- Moreover, cloud migration of legacy applications would be another ITSM strategy trending in the coming years. This ITSM solution streamlines IT operations and effectively addresses security gaps. According to Spiceworks Ziff Davis' 2022 State of the IT report, about 44% of enterprises foresee 5G technology as a major IT capability in 2022. 54% of companies surveyed believe IoT would be a major budget driver. Thus, for all these technology development, cloud-based ITSM solutions would witness growth in the studied market.

- Also, in May 2022, CLogic, the leading voice-enabling and cloud contact center solution for ServiceNow, announced the selection of its platform by Denny's, franchisor and operator of one of America's largest franchised full-service restaurant chains. The latest technology partnership would support Denny's IT Technical Services, Guest Services, and Human Resources operations for its more than 3,000 employees and over 1,600 locations.

North America is Expected to Hold Major Share

- North America is a prominent market for cloud ITSM, owing to the high adoption of cloud technology and the growing need for improving IT services by the end-user industries in the region. According to a survey report on IT Management by Site24*7, 62% of respondents reported ease of management as the top factor in cloud shift, closely followed by business continuity (60%) and scalability (59%).

- Further, a report published in March 2022 with a survey named "A hybrid cloud adoption survey" with 900+ IT professionals suggested that most businesses (93%) are adopting a hybrid cloud and on-premise solutions or migrating fully to the cloud within five years. The survey was majorly done in North America and Europe, where 43.8% of respondents were from North America. Thus, the growing transition toward cloud platforms would drive the demand for IT service management solutions in the coming years.

- Additionally, the region has a strong foothold on the cloud ITSM vendors, contributing to the market's growth. Some include IBM Corporation, ServiceNow Inc., and BMC Software Inc., among others.

- The region is witnessing an influx in the adoption of IT service solutions to increase efficiency and maintain the productivity of organizations. The adoption has been adopted by IT and telecommunication giants, BFSI, and government agencies.

- Furthermore, the government of Canada has a "cloud-first" strategy, whereby cloud services are identified and evaluated as the principal delivery option while initiating information technology investments, initiatives, strategies, and projects. The cloud is also expected to allow the government of Canada to harness the innovation of private-sector providers to make its information technology more agile.

Cloud Information Technology Service Management (ITSM) Industry Overview

The Cloud ITSM (Information Technology Service Management) Market is highly fragmented with the presence of major players like IBM Corporation, BMC Software Inc., Micro Focus International PLC, Atlassian Inc., and ASG Technologies Group, Inc. The companies in the market are making some new features on only the cloud version of their ITSM product, and also adopting strategies such as partnerships, innovations, and acquisitions to enhance their product offerings and gain sustainable competitive advantage.

- May 2022 - IBM announced that it signed a Strategic Collaboration Agreement (SCA) with Amazon Web Services Inc. (AWS), with plans to offer a broad array of its software catalog as Software-as-a-Service (SaaS) on AWS. The first-of-its-kind agreement between IBM and AWS would provide clients with quick and easy access to IBM software that spans automation, data and AI, security, and sustainability capabilities built on Red Hat OpenShift Service on AWS (ROSA) and runs cloud-native on AWS.

- May 2022 - ServiceNow announced several significant solutions to improve service operations management, low-code governance, and government services. These include, Service Operations Workspace: It consolidates service and operations data into a single experience to provide shared visibility into issues across teams, and App Engine Management Center: It consolidates governance for low-code development. Public Sector Digital Service: It improves service delivery for government organizations.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Threat of New Entrants

- 4.2.2 Bargaining Power of Buyers/Consumers

- 4.2.3 Bargaining Power of Suppliers

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Assessment of COVID-19 Impact on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Shift Among Businesses Towards Cloud Based Technologies

- 5.1.2 Integration of AI Enabled Features Making it More User Friendly

- 5.2 Market Restraints

- 5.2.1 Concerns of Data Ownership, Safety and Security in Storing It

6 MARKET SEGMENTATION

- 6.1 By Application

- 6.1.1 Configuration Management

- 6.1.2 Performance Management

- 6.1.3 Network Management

- 6.1.4 Database Management System

- 6.1.5 Other Applications

- 6.2 By End-user Industry

- 6.2.1 BFSI

- 6.2.2 IT and Telecommunication

- 6.2.3 Retail

- 6.2.4 Healthcare

- 6.2.5 Other End-user Industries (Manufacturing, Travel and Hospitality, Government and Education)

- 6.3 By Geography

- 6.3.1 North America

- 6.3.2 Europe

- 6.3.3 Asia Pacific

- 6.3.4 Latin America

- 6.3.5 Middle East and Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles*

- 7.1.1 IBM Corporation

- 7.1.2 BMC Software Inc.

- 7.1.3 Micro Focus International PLC

- 7.1.4 Atlassian Inc.

- 7.1.5 ASG Technologies Group, Inc.

- 7.1.6 Citrix Systems Inc.

- 7.1.7 Cherwell Software, LLC

- 7.1.8 Ivanti Inc.

- 7.1.9 Servicenow Inc.

- 7.1.10 CA Technologies Inc.

- 7.1.11 Axios Systems PLC

- 7.1.12 Sunrise Software Ltd.