|

市場調查報告書

商品編碼

1445552

葡萄糖:市場佔有率分析、產業趨勢與統計、成長預測(2024-2029)Glucose (Dextrose) - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

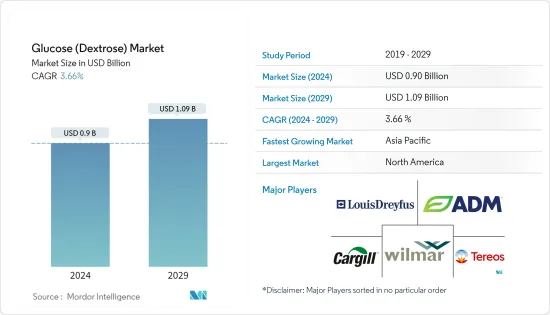

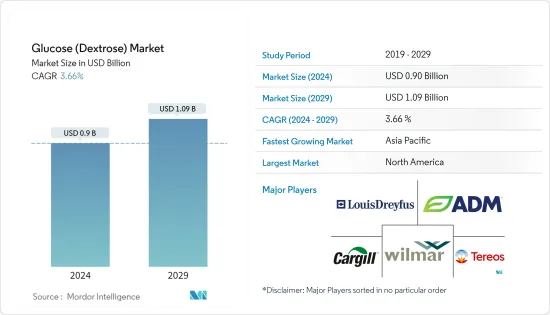

2024年葡萄糖市場規模估計為9億美元,預計2029年將達到10.9億美元,在預測期內(2024-2029年)年複合成長率為3.66%。

葡萄糖通常用作烘焙產品中的甜味劑。由於它的味道與蔗糖相似 60-70%,因此經常出現在烘焙產品、乳製品和糖果零食等加工食品中。葡萄糖也用於糖果零食應用,以帶來(果味)風味、提供輕微的清涼感並平衡甜味。其他應用領域包括飲料、冰淇淋、烹飪和肉類加工以及製藥。在乳基飲料(巧克力或其他口味)中,葡萄糖廣泛與其他砂糖結合以控制整體甜度。

葡萄糖在軟勺式冰淇淋、冰棒、水冰和其他需要透明度和適度甜度的冷凍甜點中非常有用。葡萄糖可以改善冰淇淋的適口性和有利的融化特性。可以在 -18 度C下舀取的冰淇淋受益於葡萄糖降低其冰點的能力。根據美國農業部的數據,2021 年美國人均消費約 21.9 磅冷凍乳製品。

飲食習慣的變化以及使用葡萄糖作為有效甜味劑的零食和甜點的趨勢正在促進葡萄糖在食品和飲料領域的使用。該市場是由糖果零食、烘焙和乳製品等多個行業對即食食品的需求不斷成長所推動的,這些食品具有多種用途的甜味劑,具有額外的健康益處。由於供應鏈問題和全球經濟的快速變化,市場面臨原料價格波動的挑戰,特別是玉米。世界各地的糖業巨頭正在考慮將小麥和熟澱粉作為生產用於烘焙點心、飲料和冰淇淋的高品質葡萄糖漿的永續選擇。潔淨標示解決方案的趨勢日益成長,這為葡萄糖製造商提供了巨大的潛力。公司正在透過技術進步支援的產品創新來升級其產品組合。

葡萄糖市場趨勢

飲料業的應用不斷增加

包括酒精飲料和非酒精飲料在內的飲料產業正在蓬勃發展,各種新公司進入市場,市場競爭加劇。該公司正在開發吸引消費者的創新產品,從而產生了對包括甜味劑在內的更好成分的需求。根據中國國家統計局數據,2022年12月中國無酒精飲品產量總合1,380萬噸,年增4.6%。

葡萄糖可以精確控制由濃縮或果肉水果製成的無酒精飲品中甜味和風味的平衡,具體取決於所使用的特定水果。葡萄糖和高甜度甜味劑適用於多種飲料。此外,在生產低熱量啤酒時,將可發酵葡萄糖快速添加到由麥芽和其他添加劑製成的麥芽汁中,可以增加立即可用於發酵的糖的比例。這會產生具有正常酒精濃度的低熱量啤酒。多達三個發酵階段用於生產高酒精含量的專門食品啤酒。最後的發酵在瓶中用過量的酵母進行。葡萄糖被認為是此類產品的理想甜味劑,因為它易於發酵。葡萄糖的多功能性以及與各種成分的相容性預計將在預測期內推動市場發展。

亞太地區預計將成為成長最快的市場

由於對低熱量食品的需求不斷成長以及玉米粉和小麥澱粉的供應量大且價格實惠,亞太地區預計將成為食品和飲料葡萄糖市場成長最快的地區。該地區的即食食品和製藥行業正在快速成長,增加了葡萄糖(右旋糖)產品的消費量。為了維持健康的生活方式,消費者對含有大量葡萄糖的能量飲料的需求越來越大,這主要推動了中國、澳洲、日本和印度等國家食品和飲料產業的發展。對能量飲料等飲料的需求不斷成長正在推動全部區域的市場。葡萄糖為能量和運動飲料提供了持續能量和耐力所需的易於吸收的碳水化合物。

葡萄糖廣泛應用於整個乳製品產業。葡萄糖有利於延長保存期限並平衡乳製品和發酵甜點的甜度。添加葡萄糖可防止蔗糖結晶,進而增強冰淇淋和冰沙的質地和雪酪。葡萄糖經常與其他砂糖結合使用,以調節乳類飲料(巧克力或其他口味)的整體甜度。根據美國農業部對外農業服務局的數據,2021 年印度加工食品市場的冰淇淋和冷凍甜點銷售額總計 13.2 億美元。因此,亞太全部區域乳製品產業的蓬勃發展正在推動全部區域的市場。

葡萄糖產業概況

葡萄糖(葡萄糖)市場在全球競爭激烈。在該國營運的主要公司,如嘉吉公司、阿徹丹尼爾斯米德蘭公司、Tereos SA、豐益國際有限公司和路易達孚控股公司,透過其產品供應加強了市場。世界上最大的公司擁有廣泛的產品線和地理覆蓋範圍,這給他們帶來了優勢。近年來,具有功能優勢的產品不斷創新已成為市場的重要競爭因素。全球主要公司正在加強研發力度,根據最終用戶產業需求開發利基創新產品。 Tate & Lyle 是研究市場中的知名公司之一,2021 年的研發支出為 4,100 萬歐元,而 Teleos SA 2021-2022 年的研發支出為 1,720 萬歐元。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場動態

- 市場促進因素

- 市場限制因素

- 產業吸引力-波特五力分析

- 新進入者的威脅

- 買方議價能力

- 供應商的議價能力

- 替代產品的威脅

- 競爭公司之間的敵意強度

第5章市場區隔

- 醬

- 小麥

- 玉米

- 其他資訊來源

- 類型

- 食品和飲料

- 麵包店/糖果零食

- 零食和穀物

- 飲料

- 乳製品

- 藥品

- 其他用途

- 食品和飲料

- 地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 北美其他地區

- 歐洲

- 西班牙

- 英國

- 德國

- 法國

- 義大利

- 俄羅斯

- 其他歐洲國家

- 亞太地區

- 中國

- 日本

- 印度

- 澳洲

- 其他亞太地區

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地區

- 中東和非洲

- 南非

- 阿拉伯聯合大公國

- 其他中東和非洲

- 北美洲

第6章 競爭形勢

- 最採用的策略

- 市場佔有率分析

- 公司簡介

- Archer Daniels Midland Company

- Cargill Incorporated

- Ingredion Incorporated

- Roquette Freres

- Tate &Lyle PLC

- Tereos SA

- Sudzucker AG(Agrana Group)

- Louis Dreyfus Holding BV

- International Flavors and Fragrances

- Wilmar International Limited

第7章市場機會與未來趨勢

The Glucose Market size is estimated at USD 0.9 billion in 2024, and is expected to reach USD 1.09 billion by 2029, growing at a CAGR of 3.66% during the forecast period (2024-2029).

Dextrose is often used as a sweetener in baking products. It can be commonly found in processed foods like bakery, dairy products, confectionery, etc., as it tastes 60-70% like sucrose. Dextrose is also used in confectionery applications to bring out their (fruity) flavors, provide a light cooling effect, and balance their sweetness. Some of its other application areas include beverages, ice cream, culinary and meat curing, and pharmaceuticals. In milk-based drinks (chocolate or other flavors), dextrose is widely used to control the overall sweetness in combination with other sugars.

Dextrose is very useful in soft-scoopable ice cream, ice lollies, water ices, and other frozen desserts where a clear, moderate sweetness is sought. Dextrose can enhance ice cream's palatability and favorable melt-down properties. The scoopable ice cream at - 18 °C benefits from glucose's ability to lower the freezing point. According to the US Department of Agriculture, in 2021, an average person consumed about 21.9 pounds of frozen dairy across the United States.

Changes in food habits and an inclination toward snacks and desserts, in which dextrose is used as an effective sweetening agent, are driving the use of dextrose in the food and beverage segment. The market is driven by increasing demand for convenience foods with the versatile application of sweeteners with additional health benefits in several industry segments, such as confectionery, bakery, and dairy products. The market faces challenges in terms of fluctuating prices of raw materials, primarily corn, with issues in the supply chain and rapid changes in the global economy. Sugar giants worldwide view wheat and cook starch as sustainable options to produce high-quality glucose syrups that can be used in baked goods, beverages, and ice creams. There has been a growing trend for a clean-label solution, which offers great potential for glucose (dextrose) manufacturers. Companies are upgrading their portfolio with product innovation supported by technological advancements.

Glucose Market Trends

Increasing Application in the Beverage Sector

The beverage industry, including alcoholic and non-alcoholic beverages, is booming with various new players entering the market, thus making the market more competitive. Players are developing innovative products to attract consumers, creating the need for better ingredients, including sweeteners. According to the National Bureau of Statistics of China, a total of 13.8 million metric ton of soft drinks were produced in China in December 2022, representing a 4.6% rise from the same time the year before.

Dextrose can precisely control the sweetness and flavor balance in soft drinks manufactured from concentrated or pulp fruit depending on the particular fruits utilized. Dextrose and high-intensity sweeteners are compatible for usage in different beverages. Additionally, while manufacturing low-calorie beers, the percentage of sugar instantly available for fermentation is increased by quickly adding fermentable dextrose to the wort made from malt and other adjuncts. This produces a low-calorie beer with a regular alcohol concentration. Up to three fermentation stages are used to create specialty beers with higher alcohol content. Inside the bottle, together with extra yeast, the final fermentation occurs. Dextrose is considered ideal as a sweetener in such products because it can be used for fermentation immediately. The versatility and compatibility of glucose with various ingredients are expected to drive the market during the forecast period.

Asia-Pacific is Expected to Emerge as the Fastest-growing Market

The Asia-Pacific region is projected to be the fastest-growing in the dextrose market for food and beverages due to the rising demand for low-caloric food and the large-scale availability and affordability of corn and wheat starch. The region's rapidly growing convenience food and pharmaceutical industries have led to increased consumption of glucose (dextrose) products. In order to maintain a healthy lifestyle, consumers are increasingly looking for energy drinks that contain a significant amount of glucose, thus driving the food and beverage sector, primarily in countries like China, Australia, Japan, and India. The rise in demand for beverages such as energy drinks has been driving the market across the region. Dextrose delivers readily absorbed carbohydrates necessary for sustained energy and endurance in energy and sports beverages.

Dextrose is widely used across the dairy industry. Dextrose enhances shelf life and is suitable for balancing sweetness in dairy and fermented desserts. Ice cream and sorbet's texture and mouthfeel are enhanced by preventing sucrose recrystallization with the addition of dextrose. Dextrose is frequently used in conjunction with other sugars to regulate the overall sweetness in milk drinks (chocolate or other flavors). According to the USDA Foreign Agricultural Service, ice cream and frozen dessert sales in the Indian packaged foods market totaled USD 1.32 billion in 2021. Hence, the thriving dairy industry across the Asia-Pacific region has been propelling the market Aacross the region.

Glucose Industry Overview

The glucose (dextrose) market is highly competitive at the global level. The major players operating in the country, such as Cargill Incorporated, Archer Daniels Midland Company, Tereos SA, Wilmar International Limited, and Louis Dreyfus Holding BV, have strengthened the market through their product offerings. The major global players have vast product lines and geographical reach, which give them an upper hand. In the recent past, continuous product innovations with functional benefits have been the key competitive factor in the market. Key global players have intensified their R&D efforts to develop niche and innovative products based on the end-user industry's requirements. Tate & Lyle, one of the prominent players in the market studied, spent EUR 41 million on research and development in 2021, whereas Tereos SA spent EUR 17.2 million on R&D during 2021-2022.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Drivers

- 4.2 Market Restraints

- 4.3 Industry Attractiveness - Porter's Five ForceS Analysis

- 4.3.1 Threat of New Entrants

- 4.3.2 Bargaining Power of Buyers/Consumers

- 4.3.3 Bargaining Power of Suppliers

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Source

- 5.1.1 Wheat

- 5.1.2 Corn

- 5.1.3 Other Sources

- 5.2 Type

- 5.2.1 Food and Beverage

- 5.2.1.1 Bakery and Confectionery

- 5.2.1.2 Snacks and Cereals

- 5.2.1.3 Beverages

- 5.2.1.4 Dairy Products

- 5.2.2 Pharmaceuticals

- 5.2.3 Other Applications

- 5.2.1 Food and Beverage

- 5.3 Geography

- 5.3.1 North America

- 5.3.1.1 United States

- 5.3.1.2 Canada

- 5.3.1.3 Mexico

- 5.3.1.4 Rest of North America

- 5.3.2 Europe

- 5.3.2.1 Spain

- 5.3.2.2 United Kingdom

- 5.3.2.3 Germany

- 5.3.2.4 France

- 5.3.2.5 Italy

- 5.3.2.6 Russia

- 5.3.2.7 Rest of Europe

- 5.3.3 Asia-Pacific

- 5.3.3.1 China

- 5.3.3.2 Japan

- 5.3.3.3 India

- 5.3.3.4 Australia

- 5.3.3.5 Rest of Asia-Pacific

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle East and Africa

- 5.3.5.1 South Africa

- 5.3.5.2 United Arab Emirates

- 5.3.5.3 Rest of Middle East and Africa

- 5.3.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Most Adopted Strategies

- 6.2 Market Share Analysis

- 6.3 Company Profiles

- 6.3.1 Archer Daniels Midland Company

- 6.3.2 Cargill Incorporated

- 6.3.3 Ingredion Incorporated

- 6.3.4 Roquette Freres

- 6.3.5 Tate & Lyle PLC

- 6.3.6 Tereos SA

- 6.3.7 Sudzucker AG (Agrana Group)

- 6.3.8 Louis Dreyfus Holding BV

- 6.3.9 International Flavors and Fragrances

- 6.3.10 Wilmar International Limited