|

市場調查報告書

商品編碼

1445452

電線和電纜 - 市場佔有率分析、行業趨勢與統計、成長預測(2024 - 2029)Wire And Cable - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

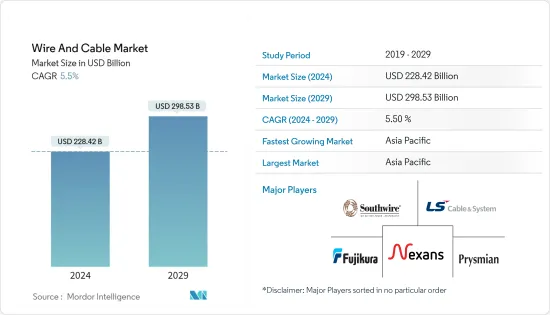

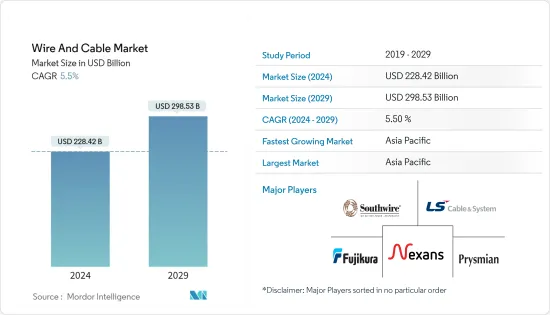

電線電纜市場規模估計到2024年為 2,284.2 億美元,預計到2029年將達到 2985.3 億美元,在預測期內(2024-2029年)CAGR為 5.5%。

再生能源產量的不斷成長、智慧電網技術儲備的增加以及全球政府升級配電和輸電系統的舉措是市場激增的原因。在過去幾年中,內容和雲端供應商試圖吸引更多客戶並提供頻寬密集型服務,提高海底基礎設施的普及度。海底電纜的使用壽命預計為25年。

主要亮點

- 電纜製造公司也大幅提高耐火電纜的生產能力,以滿足建築產品不斷成長的需求。耐火電纜目的是限制火焰的蔓延。他們有一張表來確定釋放的煙霧和其他有毒氣體。此類電線專為商業建築以及大型住宅和製造單位的佈線而設計。提供耐火電纜的主要廠商包括 Nexans、TPC Wire & Cable Corp.、Prysmian Group、Cavicel、Cleveland Cable 等。

- 2022年 7月,由於雲端服務供應商渴望更快的網路連接,美國通訊基礎設施供應商推出了連接英國和歐洲大陸的 Zeus 海底路線。海底電纜幾乎所有網路資料流量都傳輸。許多科技公司,包括Alphabet旗下的Google和Meta,也都投資興建海底電纜。使用電信連接器,可以透過電子或電氣方式長距離傳輸大量資料。它們可以在傳輸資料和提供電話服務的電信電纜的末端看到。對連接和網路存取的需求不斷成長,積極推動了市場的成長。對更高的網際網路速度和更好的連接的日益成長的需求最終需要強大而高效的電纜連接,而光纖技術可以滿足這一需求。連接器有助於保護光纖,並積極促進市場成長。

- 5G網路應用迅速發展,IT連接器系統發揮非常重要的作用。由於訊號頻率、資料速率、封裝密度和訊號完整性要求越來越高,對高性能和高品質板對板連接解決方案的需求也在不斷成長。

- 發展中國家對連接的需求不斷成長,為電纜生產商帶來了巨大的商業前景。然而,安裝光纖電纜等因素給市場成長帶來了一些營運困難。

- COVID-19 大流行對所研究的市場產生了顯著影響,一些部署電線和電纜的最終用戶行業面臨一些困難。 COVID-19 在美國和歐洲的傳播迫使電信監管機構推遲 5G 頻譜拍賣。例如,在葡萄牙,沃達豐、NOS和MEO必須等待700 MHz、1800 MHz、900 MHz、2.6 GHz、2.1 GHz和3.6 GHz等各個頻段的頻率權。

電線電纜市場趨勢

光纖電纜見證重大成長

- 光纖電纜跨越本地電話之間的長距離,並為網路系統提供骨幹。其他系統使用者包括有線電視服務、辦公大樓、大學校園、工廠和電力公司。光纖電纜的傳輸距離為 984.2 英尺至 24.8 英里,最大傳輸距離為 9,328 英里。光纖電纜不易受到干擾。

- 支持全球 5G 部署的政府計劃推動了市場成長。例如,歐盟委員會很早就認知到5G網路的重要性,並建立了公私合作夥伴關係來開發和研究5G技術。因此,歐盟委員會宣布提供超過 7 億英鎊的公共資金,透過 Horizon2020 計畫支持整個歐洲的 5G 部署。

- 在工業4.0中,光纖網路透過高速M2M/M2S網路實現傳統產業電信網路、工業資料通訊和即時監控的升級。因此,光纜製造商致力於提高產量,以滿足全球市場對光纖到府(FTTH)寬頻和電力 5G 服務不斷成長的需求。

- 據 GSMA 表示,預計2030年,海灣合作理事會(GCC)國家巴林、科威特、阿曼、卡達、沙烏地阿拉伯和阿拉伯聯合大公國的 5G 採用率將成為全球最高的地區。 在過去幾年中,雲端和內容供應商試圖吸引更多用戶並提供可靠的頻寬密集服務,提高海底基礎設施的普及度。

- 根據 Telegeography 通報,截至2023年,全球已有近 140 萬公里海底電纜投入使用。這些電纜用於短距離和長距離資料傳輸。例如,連接愛爾蘭和英國的海底CeltixConnect電纜全長131公里。亞美門戶使用了20,000公里長的海底電纜。海底電纜的成長趨勢吸引了投資者並推動了光纖網路的發展。

亞太地區將主導市場

- 亞太地區去年佔有最大的市場佔有率,由於各地區的發展,預計在預測期內CAGR最高。例如,根據中國國家統計局的資料,2023年4月中國電信業業務量約為1,540億元人民幣(21.63兆美元),較上年同期成長18%。電信業務量的成長將推動電信業者建立新的電信塔,推動對所研究市場的需求。

- 中國對再生能源的發展推動該地區太陽能板的建設,這將相應地推動所研究的市場。例如,2022年12月,中國三峽新能源在內蒙古庫布其沙漠擬建的16吉瓦大型計畫的第一期1吉瓦計畫開始興建。這座巨大的設施竣工後,將擁有 8 吉瓦的太陽能、4 吉瓦的風能和 4 吉瓦的煤炭產能。

- 日本不斷成長的能源需求和智慧電網的實施是推動市場擴張的主要動力。許多行業對持續供電的需求不斷成長,擴大了不同地點的發電、配電和輸電範圍,導致低壓電纜的使用更多。

- 由於政府的全民住房計劃和新住宅大樓的建設,印度低壓電纜市場預計將在短期內顯著成長。低壓架空線路通常使用玻璃或陶瓷絕緣體上的裸導線或架空捆綁電纜系統來連接住宅或小型商業客戶和公用設施。

- 其他幾個亞洲國家大力投資,透過海底電纜網路加強連接,促進市場的成長。

電線電纜產業概況

電線電纜市場競爭非常激烈。市場上一些重要的參與者包括 Nexans、LS Cable & System Limited、Prysmian SpA、Southwire Company LLC、Fujikura Limited、Furukawa Electric、Leoni、Belden Incorporated、TE Connectivity、Wilms Group 等。這些公司透過建立多個合作夥伴關係和投資推出新產品來增加市場佔有率,在預測期內贏得競爭優勢。

2023年 5月,Nexans旗下 LibanCables 在其 NahrIbrahim 工業工廠啟動了 600kW 峰值太陽能發電系統的擴建,採用首個 500kW 貨櫃電池解決方案,峰值總輸出功率達到 1.2 MW 。該專案將六台發電機中的兩台更換為光伏板,使 LibanCables 每年減少溫室氣體排放量 1,500 噸,相當於 750 輛汽車的重量。

2023年 4月,負責瑞士輸電網的國家公司 Swissgrid 與Nexans合作,沿著日內瓦-科因特林機場南側埋設超高壓(VHV)架空電線。以地下電纜取代架空電纜將騰出大片土地用於大日內瓦地區的城市開發。

附加優惠:

- Excel 格式的市場估算(ME)表

- 3 個月的分析師支持

目錄

第1章 簡介

- 研究假設和市場定義

- 研究範圍

第2章 研究方法

第3章 執行摘要

第4章 市場洞察

- 市場概況

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 買家的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭激烈程度

- 主要宏觀經濟趨勢影響的評估

第5章 市場動態

- 市場促進因素

- 建築業需求不斷成長

- 智慧電網基礎設施的持續部署

- 電信業的採用率不斷提高

- 市場挑戰

- 安裝成本高且相關的複雜性

- 原物料價格波動

第6章 市場細分

- 按電纜類型

- 低壓能源

- 電源線

- 光纖電纜

- 訊號和控制電纜

- 其他電纜類型

- 依最終用戶垂直領域

- 建築(住宅和商業)

- 電信(資訊科技與電信)

- 電力基礎設施(能源與電力、汽車)

- 其他最終用戶垂直領域

- 按地理

- 北美洲

- 美國

- 加拿大

- 歐洲

- 英國

- 德國

- 法國

- 歐洲其他地區

- 亞太

- 中國

- 日本

- 印度

- 亞太其他地區

- 拉丁美洲

- 中東和非洲

- 北美洲

第7章 競爭格局

- 公司簡介

- Nexans

- Cable & System Limited

- Prysmian SpA

- Southwire Company LLC

- Fujikura Limited

- Furukawa Electric Co., Ltd

- Leoni AG

- Belden Incorporated

- TE Connectivity

- British Cables Company(Wilms Group)

- TELE-FONIKA Kable SA

- Amphenol Corporation

- NKT A/S

- CommScope Holding Company, Inc.

- Corning Incorporated

- Waskonig & Walter

- Shanghai Shenghua Group

- Hengton Optic-Electric

第8章 投資分析

第9章 市場的未來

The Wire And Cable Market size is estimated at USD 228.42 billion in 2024, and is expected to reach USD 298.53 billion by 2029, growing at a CAGR of 5.5% during the forecast period (2024-2029).

The growing renewable energy production, increasing reserves in smart grid technology, and government initiatives globally for upgrading distribution and transmission systems are responsible for market proliferation. In the past few years, content and cloud providers have attempted to attract more customers and offer bandwidth-intensive services, increasing submarine infrastructure popularity. The lifespan of a submarine cable is expected to be 25 years.

Key Highlights

- Cable manufacturing companies are also significantly increasing fire-resistant cable production capacities to keep pace with the increasing need for construction products. Fire-resistant cables are designed to limit the propagation of flames. They have a sheet to determine the smoke and other toxic gases released. Such wires are designed for commercial buildings and wiring in large residential and manufacturing units. The major players offering fire-resistant cables include Nexans, TPC Wire & Cable Corp., Prysmian Group, Cavicel, Cleveland Cable, and others.

- In July 2022, US communications infrastructure provider launched the Zeus subsea route connecting the United Kingdom and continental Europe as cloud service providers desire faster internet connection. Undersea cables transmit almost all internet data traffic. Numerous technology companies, including Alphabet's Google and Meta, have also invested in building subsea cables. Using telecom connectors, extensive data can be transmitted over long distances via electronic or electrical means. They could be seen at the end of telecom cables that transmit data and offer telephony services. Growing demand for connectivity and internet access positively drives the market's growth. The growing need for higher internet speed and better connectivity eventually requires robust and efficient cable connectivity, which fiber optic technology fulfills. The connectors help protect optic fiber, positively boosting the market's growth.

- 5G network applications are rapidly gaining momentum, and IT connector systems play a crucial role. Due to ever-higher signal frequencies, data rates, packing density, and signal integrity requirements, the need for high-performance and high-quality board-to-board connection solutions is also growing.

- The growing demand for connectivity in developing nations for cable producers presents significant business prospects. Yet factors such as installing fiber optic cables provide several operational difficulties for market growth.

- The COVID-19 pandemic had a remarkable impact on the market studied, with several end-user industries that deploy wire and cables facing several difficulties. The spread of COVID-19 across the United States and Europe has forced telecom regulators to postpone 5G spectrum auctions. For instance, in Portugal, Vodafone, NOS, and MEO had to wait for frequency rights in various frequency bands such as 700 MHz, 1800 MHz, 900 MHz, 2.6 GHz, 2.1 GHz, and 3.6 GHz bands.

Wires and Cables Market Trends

Fiber Optic Cable to Witness Major Growth

- Fiber-optic cable spans long distances between local phones and provides the backbone for network systems. Other system users include cable television services, office buildings, university campuses, industrial plants, and electric utility companies. Fiber cables travel between 984.2 feet and 24.8 miles, while the maximum transmission distance is 9,328. Fiber optic cables are less susceptible to interference.

- The government programs to support 5G deployment across the globe drive market growth. For instance, the European Commission recognized the importance of the 5G network early and established a public-private partnership to develop and research 5G technology. As a result, the European Commission announced public funding of over GBP 700 million to support 5G deployment across Europe through the Horizon 2020 Program.

- In Industry 4.0, the fiber optic cable network enables the upgrade of telecom networks, industrial data communication, and real-time monitoring in traditional industries with high-speed M2M/M2S networks. Thus, manufacturers of optical fiber cable focus on improving production to keep up with the growing demand for fiber-to-the-home (FTTH) broadband and power 5G services in the global market.

- According to GSMA, the Gulf Cooperation Council (GCC) states of Bahrain, Kuwait, Oman, Qatar, Saudi Arabia, and the United Arab Emirates are forecast to have the highest 5G adoption rates of any region worldwide in 2030. In the past few years, cloud and content providers have attempted to attract more users and offer reliable bandwidth-intensive services, increasing submarine infrastructure popularity.

- According to Telegeography, as of 2023, nearly 1.4 million km of submarine cable are in service worldwide. These cables are used for short and long-range data transmission. For instance, the submarine CeltixConnect cable connecting Ireland and the United Kingdom is 131 km. A 20,000 km long submarine cable is used in the Asia America Gateway. The growing trend of submarine cables attracts investors and fuels the optic fiber network.

Asia Pacific to Dominate the Market

- Asia-Pacific held the largest market share in the previous year and is expected to register the highest CAGR over the forecast period due to various regional developments. For instance, according to the National Bureau of Statistics of China, the Chinese telecommunications industry's business volume was roughly CNY 154 billion (USD 21.63 trillion) in April 2023, an 18% rise over the same period the previous year. The rise in telecom business volume would push telecom players to establish new telecom towers, driving the demand for the studied market.

- China's development toward renewable energy is pushing the construction of solar panels in the region, which would proportionately drive the market studied. For instance, in December 2022, China's Three Gorges New Energy began construction on the first 1 GW phase of a proposed 16 GW mega-project in Inner Mongolia's Kubuqi Desert. The gigantic facility, when completed, would feature 8 GW of solar, 4 GW of wind, and 4 GW of improved coal capacity.

- Rising energy demand and implementing smart grid networks in Japan are the primary drivers driving market expansion. The increasing demand for continuous power supply in many industries has expanded power generation, distribution, and transmission across various locations, resulting in greater use of LV cables.

- India's low-voltage cable market is expected to see significant growth shortly due to the government's Housing For All plan and the construction of new residential buildings. Low voltage overhead lines, which may use bare conductors carried on glass or ceramic insulators or an aerial bundled cable system, are often used to connect a residential or small commercial customer and the utility.

- Several other Asian countries are investing heavily to strengthen connectivity through undersea cable networks, thus boosting the market's growth.

Wires and Cables Industry Overview

The Wire and Cable Market is very competitive. Some of the significant players in the market are Nexans, LS Cable & System Limited, Prysmian S.p.A, Southwire Company LLC, Fujikura Limited, Furukawa Electric Co., Ltd, Leoni, Belden Incorporated, TE Connectivity, Wilms Group, among others. The companies are increasing the market share by forming multiple partnerships and investing in introducing new products, earning a competitive edge during the forecast period.

In May 2023, LibanCables, a Nexans company, launched the extension of its 600kW peak solar power system at its NahrIbrahim industrial facility, leading to a total output power of 1.2 MW at peak with a first-of-its-kind 500kW containerized battery solution. The project will allow LibanCables to reduce greenhouse gas emissions by 1,500 tons per year, equivalent to the weight of 750 cars, by replacing two of its six electric generators with photovoltaic panels.

In April 2023, Swissgrid, the national company in charge of Switzerland's electricity transmission grid, partnered with Nexans to bury the Very High Voltage (VHV) overhead power lines along the southern side of the Geneva-Cointrin airport. Replacing the overhead cables with underground cables will free up large tracts of land destined for urban development in the greater Geneva area.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitutes

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 An Assessment of the Impact of Key Macroeconomic Trends

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Rising Demand from the Construction Sector

- 5.1.2 Ongoing Deployment of Smart Grid Infrastructure

- 5.1.3 Growing Adoption in the Telecommunications Industry

- 5.2 Market Challenges

- 5.2.1 High Cost of Installation and Associated Complexities

- 5.2.2 Fluctuating Raw Material Prices

6 MARKET SEGMENTATION

- 6.1 By Cable Type

- 6.1.1 Low Voltage Energy

- 6.1.2 Power Cable

- 6.1.3 Fiber Optic Cable

- 6.1.4 Signal and Control Cable

- 6.1.5 Other Cable Types

- 6.2 By End-user Vertical

- 6.2.1 Construction (Residential & Commercial)

- 6.2.2 Telecommunications (IT & Telecom)

- 6.2.3 Power Infrastructure (Energy & Power, Automotive)

- 6.2.4 Others End-user Verticals

- 6.3 By Geography

- 6.3.1 North America

- 6.3.1.1 United States

- 6.3.1.2 Canada

- 6.3.2 Europe

- 6.3.2.1 United Kingdom

- 6.3.2.2 Germany

- 6.3.2.3 France

- 6.3.2.4 Rest of Europe

- 6.3.3 Asia-Pacific

- 6.3.3.1 China

- 6.3.3.2 Japan

- 6.3.3.3 India

- 6.3.3.4 Rest of Asia-Pacific

- 6.3.4 Latin America

- 6.3.5 Middle East and Africa

- 6.3.1 North America

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Nexans

- 7.1.2 Cable & System Limited

- 7.1.3 Prysmian S.p.A

- 7.1.4 Southwire Company LLC

- 7.1.5 Fujikura Limited

- 7.1.6 Furukawa Electric Co., Ltd

- 7.1.7 Leoni AG

- 7.1.8 Belden Incorporated

- 7.1.9 TE Connectivity

- 7.1.10 British Cables Company (Wilms Group)

- 7.1.11 TELE-FONIKA Kable S.A.

- 7.1.12 Amphenol Corporation

- 7.1.13 NKT A/S

- 7.1.14 CommScope Holding Company, Inc.

- 7.1.15 Corning Incorporated

- 7.1.16 Waskonig & Walter

- 7.1.17 Shanghai Shenghua Group

- 7.1.18 Hengton Optic-Electric