|

市場調查報告書

商品編碼

1445405

邊緣運算:市場佔有率分析、產業趨勢與統計、成長預測(2024-2029)Edge Computing - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

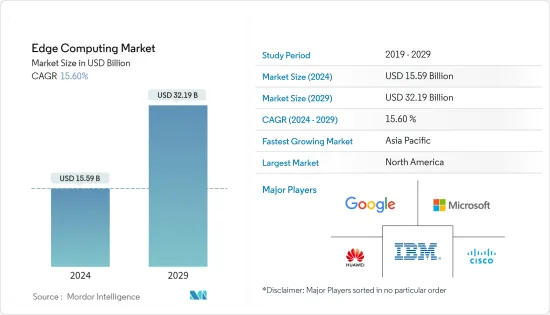

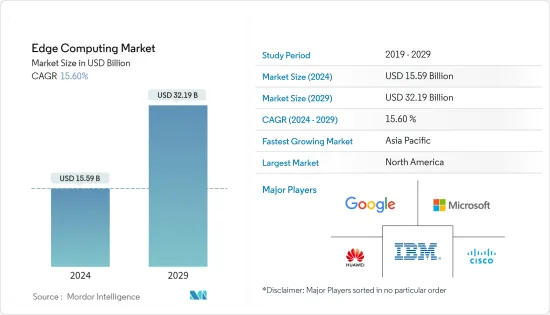

邊緣運算市場規模預計2024年為155.9億美元,預計到2029年將達到321.9億美元,在預測期內(2024-2029年)將成長15.60%,以年複合成長率成長。

5G 營運將進一步推動物聯網的日益普及,這將主要推動所研究市場的成長。很大一部分工業物聯網服務供應商和聚合商提供支援 5G 的網路產品,並預計在未來幾年採用邊緣運算來處理大量資料。

主要亮點

- 在所研究的市場中非常活躍的主要企業包括思科、HPE、戴爾和華為。我們開發適合工業現場惡劣工作條件及使用環境的邊緣運算產品,如電磁波對抗、防塵、防爆、防振、耐電流/耐壓等。這些公司正在邊緣運算市場做出巨大努力,透過合作夥伴關係和頻繁的產品開發來創造下一個重大事物。

- 邊緣運算由 OpenFog Consortium 等舉措主導,該組織由思科、英特爾、微軟和 Dell EMC 等受調查市場的供應商以及普林斯頓大學和普渡大學等學術機構領導。該聯盟旨在開發用於霧運算和邊緣運算部署的參考架構。

- 2022 年 1 月,Verizon 和 AWS 合作,利用行動邊緣運算將美國大都會圈的覆蓋範圍擴大了 30%,新增夏洛特、底特律、洛杉磯和明尼阿波利斯。這種組合最大限度地減少了從平台上託管的應用程式連接到最終用戶設備所需的延遲和網路躍點。

- 邊緣運算市場由大型供應商主導,這些供應商在調查市場中佔有重要佔有率,並正在激烈競爭以在各個區域市場獲得立足點。因此,供應商正在參與多個合作夥伴關係和聯盟,以獲得市場佔有率和技術力。

- 例如,2022 年 4 月,Ball 延長了與 AWS 的合約。此次合作旨在加拿大推出第一個使用 AWS Wavelength 的公共多接取邊緣運算(MEC)。 5G網路預計將為邊緣運算市場帶來新的成長機會。

- COVID-19感染疾病對 5G 和多接取邊緣運算(MEC) 部署產生了積極影響,因為企業將服務速度和低延遲作為關鍵差異化因素來製定策略。網路和運算的更緊密整合以支援下一代應用程式是前進的方向。

邊緣運算市場趨勢

通訊業預計年複合成長率顯著成長

- 電訊是全球市場發展最快的產業之一。目前,產業正在升級普及,為向5G過渡做準備,加上5G在全球的快速普及,推動了通訊產業邊緣運算資源的投資。

- 邊緣運算即將透過 5G 和物聯網顯著重塑通訊網路。此外,對雲端的依賴、對網路連接的依賴以及物聯網的巨大成長和潛力是將通訊推向邊緣的一些關鍵因素。通訊業者不僅可以利用邊緣來增強其核心連接業務並減少客戶的延遲,還可以引入邊緣資料管理等新服務。

- 此外,隨著 5G 技術變得更加規範並成為主流,相容 5G 的設備數量預計會增加,從而引發一些容量問題。雖然毫米波頻寬確保了與頻寬和 4G頻寬的區別,但用戶數量的增加可能會產生對邊緣運算資源的額外需求。例如,根據GSMA行動智庫的資料,5G全球市場普及預計將從2020年的3%增加到2030年的64%。

- 5G、物聯網和邊緣運算的結合將為通訊服務供應商及其客戶帶來變革。在通訊服務供應商增強用戶體驗以及啟用和支援新經營模式的需求的推動下,邊緣運算技術已成為通訊業的主要投資領域。通訊服務供應商正在投資邊緣運算技術,以滿足不斷成長的需求。

- 由於全球市場的這種潛在需求,出現了幾種開放原始碼架構。開放網路基金會、Akraino Edge Stack計劃和其他組織的努力預計將加速該領域邊緣運算的需求。

亞太地區預估年複合成長率最高

- 中國在5G和邊緣運算方面有著良好的開端。監控文化可以為科技進化設定方向。 Meta、蘋果、Netflix 和谷歌等西方公司透過制定使用個人資料定位廣告的標準,塑造了世界數位經濟。阿里巴巴、百度、華為和中興通訊等中國公司正在透過邊緣運算塑造監控技術的未來方向。中國的這些努力是對需求的回應。因此,這個國家在該地區的佔有率是最高的。

- GSMA 調查顯示,約 90% 的中國行動生態系統相關人員認為邊緣運算是 5G 時代的關鍵商機。該國的邊緣運算部署旨在滿足智慧港口、園區和工廠的需求。隨著 5G 網路在未來幾年的擴展,體育賽事、遊戲和自動駕駛等邊緣運算用例將成為可能。

- IIJ 在 Shirai資料中心園區 (Shirai DCC) 內引進了 MDC。 MDC 最初由澳洲製造商 Zella DC 在日本推出。它配備了資料中心所需的功能,如冷卻設備、不斷電系統(UPS)、環境感測器、監視錄影機以及遠端控制電子鎖等實體安全。

- 作為數位印度舉措的一部分,印度政府計劃在該國推廣物聯網。政府已撥款 700 億盧比用於開發 100 個由物聯網設備驅動的智慧城市。政府的目標是控制交通、高效使用水和電力,並使用物聯網感測器收集醫療保健和其他服務的資料。

- 2022 年 2 月,Reliance Jio 在印度各地的 50 多個設施的雲端原生 5G 網路上啟用了邊緣運算。該電信業者已經完成了印度「1000強城市」的5G計劃,並成立了專門團隊專注於該國「5G部署的專用解決方案」。 Jio、Airtel 和 Vodafone Idea 目前正在使用實驗性 5G頻譜在自己的設備中以及與企業合作夥伴一起試點創新的 5G 用例。

- 此外,2022 年 3 月,塔塔諮詢服務公司宣布推出一套由 Microsoft Azure 私有行動邊緣運算(私有 MEC)提供支援的企業 5G 邊緣解決方案。預計此類發展將在預測期內增加亞太地區對邊緣運算的需求。

邊緣運算產業概況

邊緣運算市場本質上是分散且競爭激烈的。目前,該市場由戴爾、微軟、亞馬遜和谷歌等雲端基礎聯網供應商主導。像 GE 這樣的公司擁有為航太和製造業等多個行業提供邊緣運算解決方案的專業知識,並且在市場上佔據重要地位。收購、與產業相關人員建立合作關係以及推出新產品/服務是供應商的主要競爭策略。市場的最新發展包括:

- 2022 年 4 月 - 戴爾科技集團擴展了其邊緣解決方案,以幫助零售商更快地創造更多價值,並利用零售商店產生的資料提供增強的客戶體驗。

- 2022年3月-華為與Du簽署了多接取邊緣運算(MEC)聯合創新合作備忘錄(MoU)。兩家公司計劃在中東研究、檢驗和複製面向 MEC 的應用程式。這些公司旨在支持全球數位經濟的發展,並加速中東的數位轉型。

- 2022 年 3 月 - FogHorn 與 IBM 合作,提供安全、開放的下一代混合雲端平台,該平台具有先進的封閉回路型系統控制功能和邊緣驅動的人工智慧 (AI)。透過整合邊緣和雲端功能,FogHorn 和 IBM 計劃幫助客戶快速處理、部署、分析、儲存和訓練從邊緣到雲端的關鍵資料,為業務流程提供支援。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場洞察

- 市場概況

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 買方議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭公司之間的敵意強度

- 產業價值鏈分析

- 評估 COVID-19 對市場的影響

第5章市場動態

- 市場促進因素

- 法律行業對自動化的需求不斷增加,訴訟數量不斷增加

- 律師事務所在訴訟程序中更多地使用人工智慧

- 市場限制因素

- 敏感和合法資料的資料資料問題

第6章市場區隔

- 按成分

- 硬體

- 軟體

- 服務

- 按最終用戶

- 金融及銀行業

- 零售

- 醫療保健和生命科學

- 產業

- 能源和公共

- 電訊

- 其他最終用戶

- 按地區

- 北美洲

- 美國

- 加拿大

- 歐洲

- 英國

- 德國

- 法國

- 其他歐洲國家

- 亞太地區

- 中國

- 日本

- 澳洲

- 其他亞太地區

- 拉丁美洲

- 墨西哥

- 巴西

- 其他拉丁美洲

- 中東和非洲

- 阿拉伯聯合大公國

- 沙烏地阿拉伯

- 其他中東和非洲

- 北美洲

第7章 競爭形勢

- 公司簡介

- Microsoft Corporation

- Google LLC(Alphabet Inc.)

- IBM Corporation

- Huawei Technologies Co. Limited

- Cisco Systems Inc.

- Hewlett Packard Enterprise Company

- Juniper Networks Inc.

- Dell Technologies Inc.

- Capgemini Engineering(Capgemini)

- EdgeIQ(MachineShop Inc.)

- ADLINK Technology Inc.

- General Electric Company

- Amazon Web Services Inc.

第8章投資分析

第9章市場的未來

The Edge Computing Market size is estimated at USD 15.59 billion in 2024, and is expected to reach USD 32.19 billion by 2029, growing at a CAGR of 15.60% during the forecast period (2024-2029).

The increasing adoption of IoT is augmented by 5G operations, primarily driving the growth of the market studied. A significant share of industrial IoT service providers and aggregators are offering 5G capable network offerings that are expected to adopt edge computing over the coming years for handling the sheer amount of data.

Key Highlights

- The key players that are significantly active in the market studied include cisco, HPE, Dell, and Huawei. They have been developing edge computing products that adapt to harsh working conditions and operating environments at industrial sites, such as anti-electromagnetic interference, anti-dust, anti-explosion, anti-vibration, and anti-current/voltage fluctuations. These companies are making significant efforts in the edge computing market to create the next big thing by engaging in partnerships and making frequent product developments.

- Edge computing is being led by initiatives like OpenFog Consortium, an organization headed by vendors in the market studied, including Cisco, Intel, Microsoft, and Dell EMC, as well as academic institutions like Princeton University and Purdue University. The consortium aims at developing reference architectures for fog and edge computing deployments.

- In January 2022, Verizon and AWS partnered to expand to 30% more metro area locations in the United States with mobile edge computing with the addition of Charlotte, Detroit, Los Angeles, and Minneapolis. The combination minimizes the latency and network hops required to connect from an application hosted on the platform to the end user's device.

- The edge computing market is dominated by major vendors that cover a significant share of the market studied, and they are intensely competing to gain a foothold in different regional markets. Owing to this, vendors are involved in several partnerships and alliances to gain market presence and technological capabilities.

- For instance, In April 2022, Ball extended its agreement with AWS. This collaboration aims to launch the first public multi-access edge computing (MEC) with AWS Wavelength in Canada. 5G network is expected to bring new growth opportunities to the edge computing market.

- The COVID-19 pandemic positively affects the 5G and multi-access edge computing (MEC) deployments as businesses strategize service speed and low latency as key differentiators. The tight integration of network and compute to support next-generation apps is the way forward.

Edge Computing Market Trends

Telecommunication Sector is Expected to Grow at A significant CAGR

- Telecommunications is one of the fastest evolving industries in the global market. The industry is currently in the process of upgrading its infrastructure to prepare for the 5G transition coupled with the booming 5G penetration across the world, is driving the telecom sector to invest in edge computing resources.

- Edge computing is poised to significantly reshape telecom networks, driven by 5G and the IoT. Additionally, the dependence on the cloud, the reliance on internet connectivity, and the enormous growth and potential of the IoT are some of the critical factors driving telecoms toward the edge. Telecom operators can use edge both to boost their core connectivity business and reduce latency for their own customers, as well as to introduce new services such as data management at the edge.

- Further, as 5G technologies become more regulated and go mainstream, 5G-compliant devices are expected to grow, leading to several capacity issues. Although the mm-wave bands ensure that they are highly differentiated from the 3G or 4G bands, the increased number of subscriptions is likely to create demand for additional computing resources at the edge.For instance, according to the data from GSMA Intelligence, the 5G market penetration worldwide is expected to increase from 3% in 2020 to 64% in 2030.

- The combination of 5G, IoT, and edge computing would be transformational for both communication service providers and their customers. Edge computing technology has become the major area of investment in the telecom industry, driven by CSPs' need to enhance user experiences and enable and support new business models. CSPs are investing in edge computing technology to meet the growing demand.

- Owing to such potential demand in the global market, several open-source architectures are emerging. Initiatives by The Open Networking Foundation, Akraino Edge Stack project, and others, are expected to accelerate the demand for edge computing in the sector.

Asia Pacific is Expected to Grow at a Highest CAGR

- China has made a good start in terms of 5G and the edge; a surveillance culture could set the course for the evolution of technology. Western companies such as Meta, Apple, Netflix, and Google have shaped the global digital economy by establishing standards for using personal data to target ads. Chinese companies such as Alibaba, Baidu, Huawei, and ZTE are shaping the future direction of edge computing-backed surveillance technology. Such initiatives in China cater to the demand; thus, the country has the highest share in the region.

- According to a survey by GSMA, approximately 90% of mobile ecosystem players in China recognized edge computing as a significant revenue opportunity in the 5G era. The country's edge computing deployments are designed to meet smart ports, campuses, and factories' requirements. As the 5G networks scale over the next few years, edge computing use cases, such as sporting events, gaming, and autonomous driving, will be possible.

- IIJ deployed MDC on the premises of Shiroi Data Center Campus (Shiroi DCC). The MDC, from Australian manufacturer Zella DC, was the first to be installed in Japan. It is equipped with the functions a data center needs, including a cooling unit, an uninterruptible power supply (UPS), environmental sensors, security cameras, and physical security, including a remote-controlled electronic lock.

- As part of the Digital India initiative, the Government of India planned to give IoT a push in the country. The government has allocated INR 7,000-crore funds to develop 100 smart cities powered by IoT devices. The government intends to control traffic, efficiently use water and power, and collect data using IoT sensors for healthcare and other services.

- In February 2022, Reliance Jio enabled edge computing on its cloud-native 5G network at more than 50 facilities across India. The telco has completed 5G planning for the "top 1,000 cities" across India, and dedicated teams have been formed to focus on "dedicated solutions for 5G deployment" in the country. Jio, Airtel, and Vodafone Idea are currently piloting innovative 5G use cases with their equipment and enterprise partners using the trial 5G spectrum.

- Moreover, in March 2022, Tata Consultancy Services announced the launch of an enterprise 5G edge solution suite with Microsoft Azure Private Mobile Edge Computing (Private MEC). Such developments are poised to grow the demand for edge computing in the Asia Pacific region over the forecast period.

Edge Computing Industry Overview

The edge computing market is fragmented and competitive in nature. Currently, the market is dominated by cloud-based IoT vendors, such as Dell, Microsoft, Amazon, and Google. Companies like GE, which have the expertise of delivering edge computing solutions across different industries, including aerospace or manufacturing, also have significant market positions. Acquisitions, partnerships with industry participants, and new product/service rollouts have been the vendors' key competitive strategies. Some of the recent developments in the market are:

- April 2022 - Dell Technologies expanded its edge solutions to help retailers quickly generate more value and deliver enhanced customer experiences from data generated in retail locations.

- March 2022 - Huawei and Du signed a memorandum of understanding (MoU) for joint innovation on multiaccess edge computing (MEC). The two companies would research, verify, and replicate MEC-oriented applications in the Middle East. The companies also aim to accelerate digital transformation in the Middle East, along with supporting the development of the global digital economy.

- March 2022 - FogHorn collaborated with IBM to provide a secure and open next-generation hybrid cloud platform with advanced, closed-loop system control capabilities and edge-powered artificial intelligence (AI). By bringing together edge and cloud capabilities, FogHorn and IBM plan to help customers rapidly process, deploy, analyze, store, and train critical data from the edge to the cloud and enhance their business processes.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitutes

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Value Chain Analysis

- 4.4 Assessment of the Impact of COVID-19 on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Growing Demand For Automation And Increasing Number Of Litigations In The Legal Industry

- 5.1.2 Growth In The Utilization Of Ai By Legal Companies To Complete Legal Cases

- 5.2 Market Restraints

- 5.2.1 Data Privacy Concerns Of The Confidential And Legal Data

6 MARKET SEGMENTATION

- 6.1 By Component

- 6.1.1 Hardware

- 6.1.2 Software

- 6.1.3 Services

- 6.2 By End-user

- 6.2.1 Financial and Banking Industry

- 6.2.2 Retail

- 6.2.3 Healthcare and Life Sciences

- 6.2.4 Industrial

- 6.2.5 Energy and Utilities

- 6.2.6 Telecommunications

- 6.2.7 Other End-users

- 6.3 By Geography

- 6.3.1 North America

- 6.3.1.1 United States

- 6.3.1.2 Canada

- 6.3.2 Europe

- 6.3.2.1 United Kingdom

- 6.3.2.2 Germany

- 6.3.2.3 France

- 6.3.2.4 Rest of Europe

- 6.3.3 Asia Pacific

- 6.3.3.1 China

- 6.3.3.2 Japan

- 6.3.3.3 Australia

- 6.3.3.4 Rest of Asia Pacific

- 6.3.4 Latin America

- 6.3.4.1 Mexico

- 6.3.4.2 Brazil

- 6.3.4.3 Rest of Latin America

- 6.3.5 Middle East and Africa

- 6.3.5.1 United Arab Emirates

- 6.3.5.2 Saudi Arabia

- 6.3.5.3 Rest of Middle East and Africa

- 6.3.1 North America

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Microsoft Corporation

- 7.1.2 Google LLC (Alphabet Inc.)

- 7.1.3 IBM Corporation

- 7.1.4 Huawei Technologies Co. Limited

- 7.1.5 Cisco Systems Inc.

- 7.1.6 Hewlett Packard Enterprise Company

- 7.1.7 Juniper Networks Inc.

- 7.1.8 Dell Technologies Inc.

- 7.1.9 Capgemini Engineering (Capgemini)

- 7.1.10 EdgeIQ (MachineShop Inc.)

- 7.1.11 ADLINK Technology Inc.

- 7.1.12 General Electric Company

- 7.1.13 Amazon Web Services Inc.