|

市場調查報告書

商品編碼

1444964

3PL:全球市場佔有率分析、產業趨勢與統計、成長預測(2024-2029)Global 3PL - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

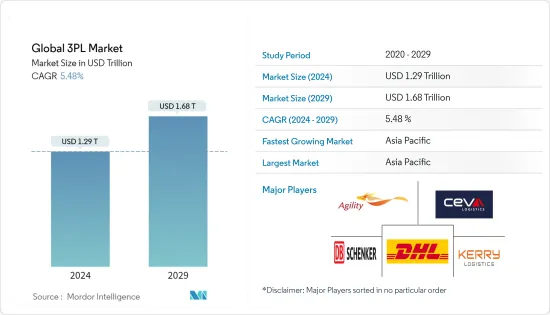

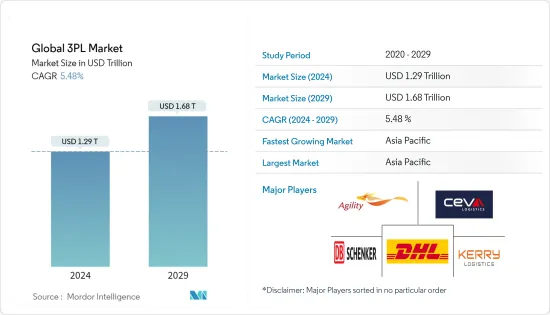

預計2024年全球3PL市場規模為1.29兆美元,預計2029年將達到1.68兆美元,在預測期(2024-2029年)成長5.48%,年複合成長率預計為

該市場由市場參與者提供的訂單履行服務以及端到端取貨和送貨服務驅動。此外,市場是由先進技術推動的,這是企業在市場中成長的前沿因素。

主要亮點

- 近年來,物流業發生了日新月異的變化。 2020 年開始並加速的趨勢持續到 2021 年和 2022 年,宅配的需求不斷增加,消費者的期望也比以往任何時候都要高。同時,2022 年也帶來了一系列挑戰,包括通貨膨脹、經濟不穩定和持續的供應鏈中斷。儘管 2022 年會出現重大干擾,但許多大趨勢仍然(並將繼續)有增無減。例如,亞馬遜透過大力投資內部物流能力來增強其主導地位。

- 托運人現在希望做出更多資料驅動的決策。因此,3PL 公司必須為需要分析專業知識的客戶做好準備。根據最近的一項研究,94% 的承運商認為分析對於確保完整、按時的訂單履行和包裹可見性是必要的。 3PL 必須越來越注重在其業務中產生更多分析見解,例如透過建立資料科學能力和團隊,為客戶和內部團隊提供有用的見解。強大的資料和清晰的策略可幫助第三方物流提供者為托運人提供整個供應鏈中改進的可追溯性和端到端可見性。除了收集更多資料外,公司還必須優先考慮網路安全並制定資料保護計劃。

- 最後一哩交付的重要性對於物流服務供應商來說是眾所周知的。然而,許多人並不知道最後一哩路業務將在未來幾年改變遊戲規則。最後一哩交付已取代價格和產品,成為消費者購買決策的關鍵差異化因素。最後一哩交付對於留住和獲取新客戶至關重要。簡而言之,最後一公里業務決定了企業的成敗。多年來,這一直是物流領域最重要的趨勢之一,並且沒有任何放緩的跡象。越來越多的 3PL 公司正在努力透過將履約中心設在市中心等交通便利的地點來縮短最後一英里的配送距離。

- 客戶維繫是競爭激烈的市場中最困難的挑戰之一,導致公司採取提高揀貨效率、智慧庫存管理和更快補貨最暢銷商品的措施。高速資料和強大的網路連接正在改變供應鏈和物流領域。當今的倉庫管理系統 (WMS) 具有強大的運算能力、大量的資料儲存能力,並且能夠連接到其他重要應用程式,例如企業資源規劃 (ERP) 和客戶關係管理 (CRM)。追蹤出貨已經不夠了。公司需要最佳化流程的每一步,從原料到生產線、行銷以及將產品交付給最終客戶。

第三方物流(3PL)市場趨勢

電子商務銷售成長推動市場

在履約方面,每個托運人都有一組要努力實現的績效指標或關鍵績效指標 (KPI)。在當今快節奏的履約環境中,實現這些目標可能很困難,特別是如果履約不是托運人的核心能力的話。認知到這一點,第三方物流(3PL) 產業正在加緊努力,為更廣泛的客戶提供更廣泛的服務組合。過去,即使是線上銷售服飾的小型企業也認知到將部分或全部履約業務外包給值得信賴的第三方的價值。電子商務的蓬勃發展促使更多公司考慮 3PL 選擇。

電子商務托運人正在努力滿足不斷變化的客戶期望,並解決供應鏈中斷、勞動力限制、運輸問題、通貨膨脹和其他挑戰,這些挑戰已成為當今商業環境中的“新常態”,越來越依賴3PL提供者。因此,3PL 為托運人提供了戰略位置、更多的空間來容納更高的庫存量,以及更廣泛的運輸選擇。隨著去年退貨量的增加,電子商務運輸公司正在尋求與 3PL 合作,後者可以協助客戶完成退貨流程。全通路物流服務的需求也很高,自動化是電子商務履約流程的關鍵組成部分。

主要 3PL 擁有多種電子商務業務,包括喬達、DHL、Ryder 和京東物流(亞洲)等。較小的供應商也紛紛效仿,現在也提供電子商務履約。在大多數情況下,這些 3PL 的電子商務履約業務與傳統的企業對企業 (B2B) 倉儲業務分開。相信未來將需要更多的3PL來付加供應鏈最後一哩路的價值。將大型、笨重的產品從最終配送點運送到客戶所在地仍然是一項重大挑戰。將家具、健身器材和其他大型物品送到客戶家門口需要特殊計劃,特別是在需要快速交貨時。

對先進技術的投資有可能降低全球端到端物流成本

在競爭激烈且不斷成長的市場中,2020 年至 2022 年的過去兩年讓美國明白,我們需要既彈性又敏捷。預計 2021 年線上零售將出現前所未有的成長,尤其是直接面對消費者的服務。主要重點在於提供全通路服務,讓顧客無論通路如何都能享受統一的購物體驗。這可以在店內、線上、行動裝置或社交媒體上完成。客戶現在期望更無縫的體驗、更低的價格、更快的運輸以及對永續性的關注。最嚴峻的挑戰之一是食品雜貨和服裝行業的巨大需求,其中一日送達已成為常態。 2021年,全球運輸能力短缺,送貨司機供應有限。

快速商務已在食品雜貨、製藥和電子商務等行業中採用。公司和品牌正在以數位平台取代傳統的經營模式和分銷管道,以利用現有的技術進步並改善交付服務。該市場的典型特徵是交貨時間少於 20 分鐘。訂單的尺寸、金額和重量通常較小,可以輕鬆地透過兩輪車、無人機或小型車輛運輸。同時,3PL 已經成長為供應鏈網路中的重要相關利益者。隨著對資源驅動型履約服務的需求增加,包括改進交付管理軟體、徹底最佳化物流以及增加都市區小型倉庫的使用,對 3PL 的依賴只會增加。

隨著全球運輸量的增加,特別是由於電子商務的快速發展,供應公司正在尋求創新、經濟高效且高效的最後一哩交付方法。因此,無人駕駛汽車、送貨機器人和無人機等最尖端科技得到了投資和測試。亞馬遜的 Aurora(自動駕駛技術)就是一個典型的例子。

第三方物流(3PL)產業概況

第三方物流(3PL) 市場分散且競爭激烈,多家大公司與中小型企業進行策略合作,以利用區域物流能力。據觀察,主要企業向新地區擴張並擴大其公司的地理範圍。新的競爭對手正在透過客製化的特定產業服務進入 3PL 市場。主要參與者包括 Agility、CEVA Logistics、DB Schenker 和 DHL。 3PL 參與者表現出與其他參與者合作的意願,以降低成本並利用相互競爭優勢。此外,技術的實施也有助於降低營運成本並提高效率。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場洞察與動態

- 市場概況

- 物流領域技術發展

- 電子商務業務洞察

- CEP、最後一公里配送、低溫運輸物流等其他細分市場的需求

- 倉儲市場的整體趨勢

- 市場動態

- 促進因素

- 抑制因素

- 機會

- 產業吸引力-波特五力分析

- 新進入者的威脅

- 買方議價能力

- 供應商的議價能力

- 替代產品的威脅

- 競爭公司之間的敵意強度

- COVID-19 對市場的影響

第5章市場區隔

- 按服務

- 國內運輸管理

- 國際運輸管理

- 付加倉儲配送

- 按最終用戶

- 車

- 能源

- 製造業

- 生命科學與醫療保健

- 零售技術

- 其他最終用戶

- 按地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地區

- 亞太地區

- 印度

- 中國

- 新加坡

- 日本

- 韓國

- 越南

- 澳洲

- 其他亞太地區

- 中東/非洲

- 南非

- 阿拉伯聯合大公國

- 沙烏地阿拉伯

- 埃及

- 其他中東/非洲

- 歐洲

- 德國

- 西班牙

- 法國

- 俄羅斯

- 英國

- 其他歐洲國家

- 北美洲

第6章 競爭形勢

- 公司簡介

- Agility Logistics

- Ceva Logistics

- DB Schenker

- DHL

- Nippon Express

- Yusen Logistics

- Kerry Logistics

- CH Robinson

- AmeriCold Logistics

- FedEx Corporation

- Kuehne+Nagel Inc.

- MAERSK

- DSV

- Panalpina

- Geodis

第7章 市場的未來

第8章附錄

The Global 3PL Market size is estimated at USD 1.29 trillion in 2024, and is expected to reach USD 1.68 trillion by 2029, growing at a CAGR of 5.48% during the forecast period (2024-2029).

The market is driven by the order fulfillment services and end-to-end pickup and delivery services provided by the players in the market. Furthermore, the market is driven by advanced technology, which is a cutting-edge factor for players to grow in the market.

Key Highlights

- The logistics industry has undergone several rapid changes in recent years. The trends that began and accelerated in 2020 continued in 2021 and 2022, with increased demand for home delivery and higher consumer expectations than ever before. At the same time, 2022 presented its own set of challenges in terms of inflation, economic volatility, and ongoing supply chain disruptions. Despite the major disruptions of 2022, there are still many major trends that have continued (and will continue) unabated. Amazon, for example, increased its dominance by heavily investing in its in-house logistics capabilities.

- Nowadays, shippers want to make more data-driven decisions. As a result, 3PL firms must brace themselves for clients who expect analytics expertise. According to one recent study, 94% of shippers believe analytics are required to ensure complete and on-time order fulfillment and package visibility. 3PLs will increasingly need to focus on generating more analytical insights across their operations, for example, by establishing data science capabilities and teams to provide useful insights to their clients and internal teams. Strong data and clear strategies will assist third-party logistics providers in providing shippers with improved traceability and end-to-end visibility across the supply chain. Aside from collecting more data, businesses must prioritize cybersecurity and have data protection plans in place.

- The importance of last-mile delivery is well-known to logistics service providers. However, many people are unaware that final mile operations will be a game changer in the coming years. Last-mile deliveries have already dethroned price and product as key differentiators in shopper purchasing decisions. Last-mile delivery is critical for both retaining and acquiring new customers. Simply put, last-mile operations can make or break a company. This has been one of the most important logistics trends for several years, and it shows no signs of abating. More 3PL companies are working to reduce last-mile delivery distances by locating fulfillment hubs in more accessible locations, such as urban centers.

- Customer retention is one of the most difficult challenges in a highly competitive market, driving businesses to embrace greater picking efficiency, smart inventory management, and rapid replenishment of hot-selling items. The supply chain and logistics domains are being transformed by fast data and strong network connectivity. Warehouse management systems (WMS) of today have extensive computing power, large amounts of data storage, and the ability to connect to other critical applications such as enterprise resource planning (ERP) and customer relationship management (CRM). It is no longer enough to simply track shipments; businesses must optimize every step of the process, from raw materials to the production line, marketing, and delivery of the product to the end customer.

Third Party Logistics (3PL) Market Trends

Growth in E-commerce Sales Driving the Market

On the fulfillment front, all shippers have a set of performance metrics or key performance indicators (KPIs) to work toward. In today's fast-paced fulfillment environment, meeting these targets can be difficult, especially if fulfillment is not a core competency for the shipper. Knowing this, the third-party logistics (3PL) industry has stepped up its game, offering a broader portfolio of services to a broader range of customers. Once the domain of extremely high-volume operations, even small businesses selling clothing online recognize the value of outsourcing some or all of their fulfillment operations to a reputable third party. The e-commerce boom has prompted more businesses to investigate 3PL options.

E-commerce shippers are increasingly turning to 3PL providers to help them meet changing customer expectations and deal with supply chain disruption, labor constraints, transportation issues, inflation, and other challenges that have become the "new normal" in today's operating environment. As a result, 3PLs are offering shippers strategic locations, more space to accommodate higher inventory volumes, and a wider range of delivery options. As the volume of returns has increased in the last year, e-commerce shippers want to work with 3PLs that can help customers with the returns process. Omni-channel logistics services are also in high demand, with automation serving as a critical component of e-commerce fulfillment processes.

The larger 3PLs have multiple e-commerce operations, such as Geodis, DHL, Ryder, and JD Logistics (in Asia), to name a few of the larger players. Smaller providers have followed suit and now offer e-commerce fulfillment as well. In most cases, these 3PLs have e-commerce fulfillment operations separate from their traditional business-to-business (B2B) warehousing operations. More 3PLs will be needed in the future to add value in the last mile of the supply chain, where getting large and bulky items from the final point of distribution to the customer's location remains a major challenge. Getting furniture, fitness equipment, and other large items to customers' doors requires extra planning, especially if they require quick delivery.

Investment in Advanced Technology Could Reduce Cost of End-to-end Logistics Globally

In a competitive and growing market, the last two years, 2020-22, have taught us that we must be both flexible and agile. In 2021, unprecedented growth in online retail was expected, particularly in direct-to-consumer services. The provision of omnichannel services, in which customers enjoy a unified shopping experience regardless of channel, is a major focus. This could be done in-store, online, on mobile, or through social media. Customers now expect a more seamless experience, lower prices, faster shipping, and a greater emphasis on sustainability. One of the most difficult challenges has been the extraordinary demand in the grocery and apparel segments, where one-day deliveries or less are becoming the norm. There was a global shortage of transport capacity and a limited supply of delivery drivers in 2021.

Quick commerce is being adopted by industries such as grocery, pharmaceuticals, and e-commerce. Companies and brands are replacing traditional business models and distribution channels with digital platforms to improve their delivery services by leveraging available technological advancements. This market is typically distinguished by delivery times of less than 20 minutes. The order size, value, and weight are typically small(er) and easily transported via two-wheelers, drones, or small vehicles. The 3PL, on the other hand, has already grown to become an important stakeholder in the supply chain network. With the growing demand for resource-backed fulfillment services, such as improved delivery management software, acute logistics optimization, and increased use of smaller warehouses in urban areas, reliance on 3PLs will only increase.

With delivery volumes increasing all over the world, particularly due to the rapid growth of eCommerce, supply firms are looking for innovative, cost-effective, and efficient approaches to last-mile delivery. This has resulted in investments and trials of cutting-edge technology such as driverless cars, delivery bots, and drones. Aurora (self-driving technology) from Amazon is a prime example.

Third Party Logistics (3PL) Industry Overview

The Third-Party Logistics (3PL) Market is fragmented and highly competitive, with several large companies strategically forming alliances with mid-sized or small-sized companies to leverage their regional capabilities in logistics. Major regional players have been observed to venture into new regions, allowing the companies to improve their geographic reach. New competitors are entering the 3PL market with customized and industry-specific services. Some major players include Agility, CEVA Logistics, DB Schenker, and DHL. The 3PL players have been showing a willingness to partner with other players to reduce cost and leverage on mutual competitive advantage. Additionally, technology adoption has also helped reduce operational costs and improve efficiency.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS AND DYNAMICS

- 4.1 Market Overview

- 4.2 Technological Developments in the Logistics Sector

- 4.3 Insights into E-commerce Business

- 4.4 Demand From Other Segments, such as CEP, Last Mile Delivery, Cold Chain Logistics, etc.

- 4.5 General Trends in the Warehousing Market

- 4.6 Market Dynamics

- 4.6.1 Drivers

- 4.6.2 Restraints

- 4.6.3 Opportunities

- 4.7 Industry Attractiveness- Porter's Five Forces Analysis

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers/Consumers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitute Products

- 4.7.5 Intensity of Competitive Rivalry

- 4.8 Impact of COVID-19 on the Market

5 MARKET SEGMENTATION

- 5.1 By Service

- 5.1.1 Domestic Transportation Management

- 5.1.2 International Transportation Management

- 5.1.3 Value-added Warehousing and Distribution

- 5.2 By End User

- 5.2.1 Automobile

- 5.2.2 Energy

- 5.2.3 Manufacturing

- 5.2.4 Life Science and Healthcare

- 5.2.5 Retail Technology

- 5.2.6 Other End Users

- 5.3 By Geography

- 5.3.1 North America

- 5.3.1.1 United States

- 5.3.1.2 Canada

- 5.3.1.3 Mexico

- 5.3.2 South America

- 5.3.2.1 Brazil

- 5.3.2.2 Argentina

- 5.3.2.3 Rest of South America

- 5.3.3 Asia-Pacific

- 5.3.3.1 India

- 5.3.3.2 China

- 5.3.3.3 Singapore

- 5.3.3.4 Japan

- 5.3.3.5 South Korea

- 5.3.3.6 Vietnam

- 5.3.3.7 Australia

- 5.3.3.8 Rest of Asia-Pacific

- 5.3.4 Middle-East and Africa

- 5.3.4.1 South Africa

- 5.3.4.2 United Arab Emirates

- 5.3.4.3 Saudi Arabia

- 5.3.4.4 Egypt

- 5.3.4.5 Rest of Middle-East and Africa

- 5.3.5 Europe

- 5.3.5.1 Germany

- 5.3.5.2 Spain

- 5.3.5.3 France

- 5.3.5.4 Russia

- 5.3.5.5 United Kingdom

- 5.3.5.6 Rest of Europe

- 5.3.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Overview (Market Concentration and Major Players)

- 6.2 Company Profiles

- 6.2.1 Agility Logistics

- 6.2.2 Ceva Logistics

- 6.2.3 DB Schenker

- 6.2.4 DHL

- 6.2.5 Nippon Express

- 6.2.6 Yusen Logistics

- 6.2.7 Kerry Logistics

- 6.2.8 CH Robinson

- 6.2.9 AmeriCold Logistics

- 6.2.10 FedEx Corporation

- 6.2.11 Kuehne+Nagel Inc.

- 6.2.12 MAERSK

- 6.2.13 DSV

- 6.2.14 Panalpina

- 6.2.15 Geodis*