|

市場調查報告書

商品編碼

1444932

AIOps:市場佔有率分析、產業趨勢與統計、成長預測(2024-2029)AIOps - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

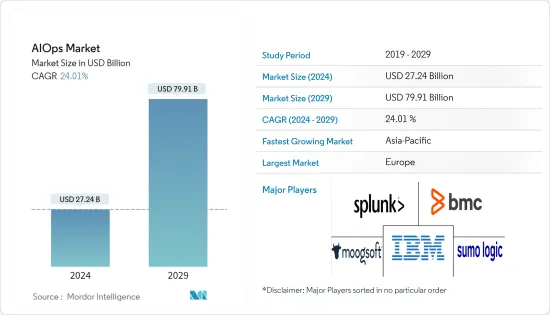

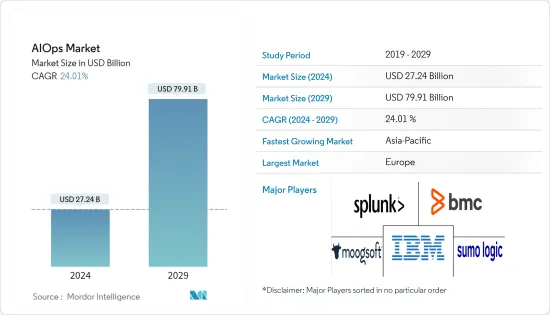

AIOps市場規模預計2024年為272.4億美元,預計到2029年將達到799.1億美元,預測期內(2024-2029年)年複合成長率為24.01%,預計還會成長。

隨著越來越多的人在家工作,公司強制實施的在家工作(WFH) 政策已將資訊安全的重點從企業基礎設施轉移到雲端和虛擬基礎設施。

主要亮點

- DevOps 專業人員受到大量警報、顯著的 IT 雜訊以及跨不同技術傳播的訊號的阻礙。同時,提高企業IT基礎設施效能以及更準確、更快速地管理事件的需求也在不斷成長。

- 隨著企業越來越意識到人工智慧如何應對挑戰和支援 IT 營運,他們正在轉向基於人工智慧的解決方案。此外,由於在家工作的人數增加,AIOps 行業也可能會擴大。根據世界經濟論壇的數據,美國員工在家工作的天數從 2021 年 1 月的每週 1.58 天增加到去年 6 月的每週 2.37 天。

- 此外,隨著設備變得更加智慧,網路變得更加複雜,資料量增加,AIOps 使用量增加。全球對雲端運算的日益廣泛使用也推動了許多操作的自動化。隨著越來越多的公司遷移到雲端,對 AIOps 平台的需求預計將激增。

- IT 營運管理 (ITOM) 產業已經對 SaaS ITOM 的出現做出了反應。事實證明,SaaS 作為 IT 幫助台和基礎設施監控的交付模式是有益的。這些解決方案通常包含來自收購的 SaaS 供應商的日誌管理、網站監控、伺服器監控和雲端管理。然而,缺乏認知是預測期內限制市場成長的關鍵問題之一。

- 由於各公司擴大了在家工作政策,COVID-19 疫情刺激了包括人工智慧在內的下一代技術領域的市場成長。例如,LogMeIn, Inc.(美國)是一家提供雲端和基於 SaaS 的遠端連線和客戶互動服務的供應商,在疫情爆發期間,其所有服務組合的新註冊數量都顯著增加。

- 駭客、網路釣魚、線上身分盜竊、勒索軟體攻擊等網路犯罪呈上升趨勢,造成全球業務中斷和經濟損失,並引起許多企業對資料安全的擔憂。 gov.uk 去年的一項民意調查發現,39% 的英國企業在過去 12 個月內意識到網路攻擊,這與前幾年的研究結果一致。此外,企業內部對自動化技術的接受度不斷提高,即使是小規模的企業,也正在推動基於人工智慧的平台的採用,並有望推動 AIOps 市場的成長。

AIOps市場趨勢

BFSI 預計將持有相當大的佔有率

- 銀行業務涉及員工、客戶和外部機構執行的許多常規和非常規活動以及交易。由於這些活動的複雜性,監控至關重要。提供即時資訊和自動問題解決的 AIOp 預計將在預測期內推動市場成長。 CA Technology 的 AIOps 平台或 CA Digital Experience Insights 使金融公司能夠解決效能、容量和配置問題等複雜的 IT 問題。

- 銀行和其他金融機構專注於確保其產生的資料的安全,主要是在過去幾年發生了許多引人注目的資料外洩事件之後。

- 許多銀行和其他金融機構正在使用 AIOps 來提高效率。例如,印度央行旨在提高其數位商家入職流程的成功率,並簡化新客戶的交易。 QualityKiosk 基於 AIOps 的分析解決方案 AnaBot 透過更好地服務國內和美國交易,使收益增加了 7%,並提高了賣家入職成功率。

- 根據 BAE Systems Applied Intelligence 的數據,近四分之三 (74%) 的美國和英國金融機構的網路犯罪增加。除了明顯的經濟損失外,網路犯罪還可能為企業帶來嚴重的財務後果,包括股價暴跌、聲譽受損和訴訟。 AIOps 可以幫助防範此類犯罪。 AIOps 解決方案提供全天候監控、偵測可疑活動並啟動防禦操作以保護易受影響的系統。

- 此外,將人工智慧整合到金融機構的營運服務中增強了服務台系統內建的功能。因此,它提供了高階管理層所需的監督和關鍵績效指標,以便在營運趨勢對現有產品和流程產生負面影響之前識別營運趨勢。

歐洲將實現巨大成長

- 歐洲AIOps市場成長的主要原因之一是該地區的MSP希望為正在進行大規模數位轉型並需要現代營運解決方案的企業提供全面的服務。

- 該地區的公司採用各種策略來提高競爭力。例如,去年 10 月,英國公司 Micro Focus 宣布 Operations Bridge 被認可為針對 AIOps 平台的「行動研究」(RIA) 供應商評級矩陣TM 研究的領導者。除了獲得這項榮譽之外,Micro Focus 還發布了兩款新的 SaaS 解決方案:Operations Bridge Reports 和 Cloud Observability。

- 此外,人工智慧採用最常見的是 IT/技術 (47%),其次是研發 (36%) 和客戶服務 (24%)。這意味著人工智慧在IT營運領域變得越來越重要。

- 各國政府在日常業務中提高人工智慧意識方面發揮重要作用。透過宣佈人工智慧為關鍵戰略優先事項,一些成員國和歐盟機構正在採取措施推進該地區人工智慧領導地位的雄心壯志。這包括推出專用的國家和歐盟層面的人工智慧戰略文件,促進研究和創新,以及考慮新的監管方法來管理人工智慧的開發和使用。

- 此外,歐盟委員會計劃透過其 Horizon Europe 和 Digital Europe 計劃每年在人工智慧領域投資 10 億歐元(10.7 億美元)。數位十年預計將動員私人產業和成員國的進一步投資,年資本達到 200 億歐元(213.9 億美元),並推動該地區的 AIOps 產業。

- 歐洲最近宣布了一套針對人工智慧開發和使用的嚴格規則和保障措施,試圖對新技術採取道德方法,以獲得相對於中國和美國的競爭優勢。所有「高風險」的人工智慧應用在進入市場前都將接受強制評估。這對於使用 AIOps 和處理敏感資料的醫療保健和 BFSI 部門尤其有利。

AIOps產業概述

Moogsoft Inc.、IBM Corporation、Splunk Inc.、BMC Software Inc.和Sumo Logic Inc.等主要企業的出現加劇了市場參與者之間的競爭。我們不斷創新產品和服務的能力使我們比市場上其他參與者俱有競爭優勢。這些參與者可以透過策略合作夥伴關係、併購以及研發活動獲得更大的市場佔有率。

- 2022 年 11 月:網路智慧供應商 Aprecomm 宣布推出 Aprecomm Virtual Wireless Expert,這是一款適用於鈀登科技 ecCloud 控制器的 AIOps 解決方案。根據新聞稿,鈀登科技 Wi-Fi 6網路基地台的所有用戶都將能夠透過兩家公司聯合部署的釙登科技 Wi-Fi AIOps 解決方案來提高網路效能。

- 2022 年 6 月:HCL Technologies DRYiCE 推出 DRYiCE IntelliOps (IntelliOps),這是解決企業全端 AIOps 和工作流程可觀察性需求的解決方案。企業已大力投資於先進的數位計劃,以實現 IT 環境現代化並滿足消費者對始終線上的數位服務的期望。然而,仍需要克服一些障礙。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場洞察

- 市場概況

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭公司之間的敵意強度

- 評估 COVID-19 對市場的影響

第5章市場動態

- 市場促進因素

- IT 營運中對基於人工智慧的服務的需求不斷成長

- 改善端到端業務應用程式保證和運作

- 市場限制因素

- IT 營運中的變更數量增加

- 市場機會和主要發展

- 小型企業轉向雲端基礎設施

- 各國政府為引進人工智慧而採取的舉措

- 過去兩年發布的 AIOps 工具以及需要考慮的關鍵 AIOps 平台功能

- 在整個應用程式生命週期的各種用例中應用 AIOps

- AIOps 階段和用例的演變

第6章 主要應用形勢

- 根本原因分析

- 網路可用性和最佳化

- 問題分配

- 異常檢測和網路安全

- 改進的儲存管理

第7章市場區隔

- 組織類型

- 中小企業

- 主要企業

- 介紹

- 本地

- 雲/SaaS

- 最終用戶產業

- 媒體與娛樂

- 資訊科技/電信

- 零售

- 衛生保健

- BFSI

- 其他最終用戶產業

- 地區

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 中東/非洲

第8章 主要廠商概況

- Bigpanda Inc.

- BMC Software Inc.

- Broadcom Inc

- Elasticsearch BV

- IBM Corporation

- Logz.Io(Logshero Ltd.)

- Loom Systems Ltd.(Service Now Inc)

- Moogsoft Inc.

- Splunk Inc

- Appdynamics LLC(Cisco Systems Inc)

- Dynatrace LLC

- Extrahop Networks Inc.

- New Relic Inc.

- Resolve Systems LLC

- Stackstate BV

第9章投資分析

第10章市場的未來

The AIOps Market size is estimated at USD 27.24 billion in 2024, and is expected to reach USD 79.91 billion by 2029, growing at a CAGR of 24.01% during the forecast period (2024-2029).

With the increase in the number of people working from home, enterprise-instituted work-from-home (WFH) policies shifted information security focus from enterprise infrastructure to cloud and virtualized infrastructure.

Key Highlights

- DevOps professionals are hampered by large amounts of warnings, substantial IT noise, and signals spread across diverse technologies. Meanwhile, companies need to increase IT infrastructure performance and manage events more precisely and quickly is expanding.

- Enterprises are moving toward AI-based solutions as they become more aware of how AI can handle difficulties and assist operating IT operations. Furthermore, the growing number of individuals working from home will likely increase the AIOps industry. According to the World Economic Forum, the number of days US employees work from home climbed from 1.58 per week in January 2021 to 2.37 in June last year.

- Furthermore, as devices gain intelligence, networks have become more complex, and data volumes have increased, boosting AIOps usage. The growing global use of cloud computing is also pushing the automation of many operations. As more businesses transition to the cloud, the need for AIOps platforms is projected to surge.

- The IT Operations Management (ITOM) industry is already reacting to the emergence of SaaS ITOM. SaaS as a delivery model for IT helpdesks and infrastructure monitoring is proven beneficial. These solutions typically incorporate log management, website monitoring, server monitoring, and cloud management from acquired SaaS vendors. However, lack of awareness is one of the significant concerns restraining market growth during the forecast period.

- Due to the increasing work-from-home policy across companies, the COVID-19 outbreak stimulated market growth in next-generation tech sectors, including artificial intelligence. For example, during the outbreak, LogMeIn, Inc. (US), a provider of cloud and SaaS-based remote connection and customer interaction services, substantially increased the number of new sign-ups across all its service portfolios.

- The rising number of cybercrimes, such as hacking, phishing, online identity theft, and ransomware assaults, which cause business disruptions and financial losses worldwide, generated concerns for many companies about their data security. According to a last year's gov.uk poll, 39% of UK firms recognized a cyber assault in the preceding 12 months, consistent with prior years of the study. Furthermore, the increased acceptance of automation technologies in enterprises, even on a small scale, is driving the deployment of AI-based platforms, which is expected to boost AIOps market growth.

AIOps Market Trends

BFSI is Expected to Hold Significant Share

- Banking operations include many periodic and aperiodic activities and transactions performed by employees, customers, and external agencies. These activities are complex, which makes monitoring essential. AIOps delivering real-time information and automated problem-solving are expected to boost market growth over the forecast period. The AIOps platform from C.A. technologies, i.e., C.A. Digital Experience Insights, enables financial firms to solve complex I.T. problems, including performance, capacity, and configuration issues.

- Banks and other financial institutions focus on ensuring the security of the data they generate, primarily due to the numerous high-profile data breaches over the past few years.

- Many banks and other financial institutions are using AIOps to increase their efficiency. For instance, a central Indian bank intended to increase the success rate of its digital merchants' onboarding process and streamline and simplify transactions for its new clients. By better servicing ON-US & OFF-US transactions, QualityKiosk's AIOps-based analytics solution AnaBot boosted revenue by 7% and enhanced the success percentage of merchant onboarding.

- According to BAE Systems Applied Intelligence, cybercrime increased at about three-fourths (74%) of financial institutions in the U.S. and the United Kingdom. In addition to the recognized financial losses, cybercrime can have severe financial implications for enterprises, including collapsing stock prices, reputational damage, and legal action. AIOps can help in the defense against this crime. AIOps solutions offer round-the-clock monitoring, suspicious activity detection, and defense operation initiation to safeguard susceptible systems.

- Furthermore, the integration of A.I. in operation services across financial institutions enhanced the capabilities built into the service desk systems. It thus provides the oversight and critical performance indicators necessary for the higher management to identify operational trends before adversely impacting the existing products and processes.

Europe to Witness Significant Growth

- One of the primary reasons for the European AIOps market growth is the region's MSPs seeking to offer comprehensive services to enterprises undergoing large-scale digital transformation and requiring modern operations solutions.

- Companies in the region employ various strategies to achieve a competitive edge. For instance, in October last year, Micro Focus, a business with headquarters in the UK, declared that Operations Bridge had been recognized as a Leader in the Research in Action (RIA) Vendor Evaluation MatrixTM study for AIOps Platforms. In addition to receiving this honor, Micro Focus also unveiled Operations Bridge Reports and Cloud Observability, two new SaaS solutions.

- Moreover, the most widely reported adoption of AI (47%) was in the IT/technology function, followed by R&D with 36% and customer service with 24%. It signifies the growing importance given to AI in the IT operations field.

- The government plays a significant role in increasing awareness about artificial intelligence in daily operations. By declaring AI as a major strategic priority, several member states and EU institutions are taking steps to advance the region's ambitions for AI leadership. It includes rolling out devoted national and EU-level AI strategy documents, boosting research and innovation, and exploring new regulatory approaches for managing the development and use of AI.

- Additionally, the European Commission intends to invest EUR 1 billion (USD 1.07 billion) annually in AI through Horizon Europe and Digital Europe programs. Over the digital decade, it will mobilize further investment from the private industry and the Member States to reach an annual capital volume of Euro 20 billion (USD 21.39 billion), predicted to propel the AIOps industry in the region.

- Europe recently released a set of strict rules and safeguards for the development and artificial intelligence use as it tries to make an ethical approach to the new technology to gain a competitive advantage over China and the United States. Before entering the market, all 'high-risk' AI applications will be subject to a compulsory assessment. It will be especially beneficial for the healthcare and BFSI sectors which handle sensitive data using AIOps.

AIOps Industry Overview

The competitive rivalry amongst the players in the market is high owing to the presence of some key players such as Moogsoft Inc., IBM Corporation, Splunk Inc., BMC Software Inc., and Sumo Logic Inc., amongst others. The ability to continually innovate its products and services allowed them to gain a competitive advantage over other players in the market. These players can attain a more significant market footprint through strategic partnerships, mergers & acquisitions, and research and development activities.

- November 2022- Aprecomm, a provider of network intelligence, unveiled their AIOps solution for Edgecore ecCloud controllers, the Aprecomm Virtual Wireless Expert. According to a release, all users of Edgecore Wi-Fi 6 access points can increase network performance due to the Edgecore Wi-Fi AIOps solution that the two firms jointly introduced.

- June 2022- The HCL Technologies DRYiCE introduced DRYiCE IntelliOps (IntelliOps), a solution that addresses an enterprise's full-stack AIOps and workflow observability demands. Businesses have made significant investments in sophisticated digital efforts to modernize their IT environment and strive to meet consumer expectations for constantly available digital services. However, a few obstacles still need to be overcome.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Consumers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitute

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Assessment of the Impact of COVID-19 on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Growing demand for AI-based services in IT operations

- 5.1.2 Increasing end-to-end business application assurance and uptime

- 5.2 Market Restraints

- 5.2.1 Increasing number of changes in IT operations

- 5.3 Market Opportunities and Key Developments

- 5.3.1 SMEs Moving Towards Cloud Infrastructure

- 5.3.2 Government Initiatives For AI Adoption in Various Countries

- 5.4 AIOps Tools Released in Past Two Years and Key AIOps Platform Capabilities To be Considered

- 5.5 Application of AIOps across various Use Cases Over the Life Cycle of an Application

- 5.6 Evolution of AIOps Stages and Use Cases

6 KEY APPLICATION LANDSCAPE

- 6.1 Root Cause Analysis

- 6.2 Network Availability and Optimization

- 6.3 Problem Assignment

- 6.4 Anomaly Detection and Cybersecurity

- 6.5 Improved Storage Management

7 MARKET SEGMENTATION

- 7.1 Organization Type

- 7.1.1 Small and Medium Enterprises

- 7.1.2 Large Enterprise

- 7.2 Deployment

- 7.2.1 On-Premise

- 7.2.2 Cloud/SaaS

- 7.3 End-User Industry

- 7.3.1 Media and Entertainment

- 7.3.2 IT and Telecom

- 7.3.3 Retail

- 7.3.4 Healthcare

- 7.3.5 BFSI

- 7.3.6 Other End-User Industries

- 7.4 Geography

- 7.4.1 North America

- 7.4.2 Europe

- 7.4.3 Asia Pacific

- 7.4.4 Latin America

- 7.4.5 Middle East and Africa

8 KEY VENDOR PROFILES

- 8.1 Bigpanda Inc.

- 8.2 BMC Software Inc.

- 8.3 Broadcom Inc

- 8.4 Elasticsearch B.V

- 8.5 IBM Corporation

- 8.6 Logz.Io (Logshero Ltd.)

- 8.7 Loom Systems Ltd. (Service Now Inc)

- 8.8 Moogsoft Inc.

- 8.9 Splunk Inc

- 8.10 Appdynamics LLC (Cisco Systems Inc)

- 8.11 Dynatrace LLC

- 8.12 Extrahop Networks Inc.

- 8.13 New Relic Inc.

- 8.14 Resolve Systems LLC

- 8.15 Stackstate BV