|

市場調查報告書

商品編碼

1444886

基於位置的服務 - 市場佔有率分析、產業趨勢與統計、成長預測(2024 - 2029)Location-based Services - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

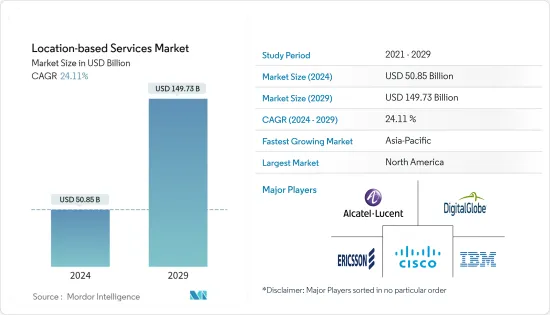

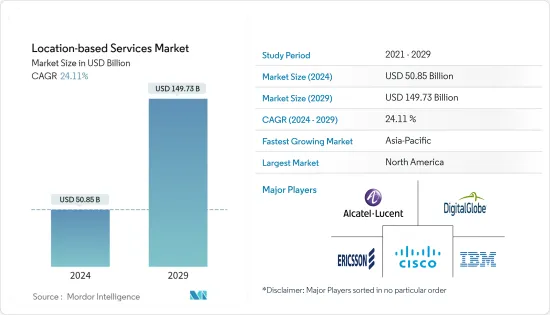

基於位置的服務市場規模預計到2024年將達到508.5億美元,預計到2029年將達到1497.3億美元,在預測期內(2024-2029年)CAGR為24.11%。

智慧型手機使用的激增正在推動基於位置的服務市場。

主要亮點

- 基於位置的服務(LBS)在過去幾年中蓬勃發展。它擴大被用來定位某個地區的朋友、定位最近的餐廳或向附近的購物者做廣告廣告。 LBS 使用戶能夠存取有關其周圍環境的相關最新資訊,並允許企業更新客戶的訂單資訊。所有這些LBS應用程式都提供了動態的使用者體驗,為企業與客戶的互動提供了便捷的方法。

- 發展最快的定位方法是基於行動定位和基於衛星的GPS。隨著全球小區識別 (CGICTA) 和增強觀測時間差 (E-OTD) 等更廣泛的方法的應用,實際精度在 50-1000 m 範圍內。這些技術為最終用戶提供了基於特定應用程式位置識別所需的準確性的機會。

- 可以透過使用 E-OTD、觀測到達時間差 (OTDOA)、無線輔助 GNSS (A-GNSS) 以及將 A-GNSS 與其他標準技術結合的混合技術來確定位置。使用追蹤車輛移動的基於位置的服務,可以為通勤者和服務尋求者提供更好的位置和準確的即時推測到達時間。預計這將獲得重要的市場基礎,再加上世界各國在智慧城市計畫中努力實現平穩交通目標的巨大努力。預計這些發展將在預測期內創造更多機會,特別是在拉丁美洲和亞太市場。

- 此外,隨著對 3D 地圖應用程式與智慧型手機整合的持續大量投資,諾基亞、三星和其他 OEM 等市場參與者正在進入該市場。亞馬遜公司和微軟公司等線上網路服務供應商也開始在其平台上提供 3D 地圖。例如,Parrot 是一家為手機提供無線設備的知名廠商,該公司將其消費級無人機定位於 3D 建模、測繪和農業用途。預計這些情況將在預測期內推動新興經濟體的市場需求。

- 基於位置的服務目前面臨來自政府有關消費者隱私的政策和法規的巨大風險。大多數軟體開發商都開始意識到日益成長的國際隱私法和行業自律規範對其使用進行管理。 今年11 月,谷歌同意支付約3.92 億美元,與40 個州達成和解,指控該公司透過個人資訊追蹤人們。關閉位置追蹤後的設備。

- 此外,COVID-19 對基於位置的服務市場的影響也不盡相同。這主要是因為疫情對使用這些服務的產業產生了不同的影響。總體而言,儘管市場的強勁復甦將在預測期內推動基於位置的服務的需求,但市場仍受到了負面影響。

基於位置的服務 (LBS) 市場趨勢

快消品及電商產業可望大幅成長

- 過去十年,電子商務機構呈現不斷成長的趨勢。行動應用程式因其個性化功能而取得了更大的成功。它們更易於使用,並在品牌和客戶之間形成直接聯繫,從而實現高水準的消費者參與。

- 行動應用程式幫助電子商務商店分析當前市場和消費者行為,從而製定更好的行銷策略。基於使用者位置的電子商務服務已成為現代資訊服務中特別重要的組成部分。在這些使用者密集型應用程式中,服務品質非常重要,設計方法越來越依賴軟體標準來實現品質。

- 電子商務應用程式為居住在特定位置的客戶提供量身定做的優惠。這些優惠以個人化通知的形式傳遞給客戶,這比通用推播通知更有效。

- 換句話說,市場依靠人工智慧來識別那裡受歡迎的地點和產品。資料設定完畢後,賣家可以支付一次性費用,將庫存運送到最終地點。

- RTLS 包括廣泛的定位技術,從藍牙信標和被動射頻識別 (RFID) 到保持資產和後端流程持續通訊的大型系統。許多倉庫所有者選擇混合使用基於位置的技術以最具成本效益的方式滿足他們的需求。

全球電子商務行業的成長以及對高效定位服務的需求正在推動市場成長。例如,根據商務部人口普查局的數據,今年第二季美國零售電商銷售額為2,573億美元,較第一季成長2.7%。此外,據IBEF稱,印度電子商務市場預計將從2017年的385億美元蓬勃發展到2026年的2,000億美元。

亞太地區預計將佔據重要佔有率

- 中國不僅是區域內的LBS主要市場,也是全球範圍內的主要市場,因為中國在基礎設施建設和技術能力方面的投資顯著成長,再加上網際網路和移動普及率,使中國在該地區處於突出地位。以及全球市場。

- 第五十次中國網際網路絡發展狀況統計報告顯示,截至去年6月,中國網民規模達10.51億,網路普及率達74.4%,相對於全國人口規模而言,這是一個龐大的數字。基於位置的服務在該國應該有很多機會,因為很多人可以上網,而且越來越多的人正在使用智慧型手機。

- 此外,日本是主要汽車工業的發源地之一,也是重要的出口國。日本汽車出口額達127.1億美元,汽車相關就業人數達552萬人(根據日本汽車工業協會的數據),汽車工業是日本經濟的核心產業部門之一。

- 隨著汽車工業的不斷發展,日本擁有完善的導航基礎設施,並專注於自動駕駛汽車的技術和基礎設施建設。該國正在利用自動駕駛車輛實施 3D 地圖,並透過具有人工智慧助理的汽車導航系統提供災難資訊。

- 印度的社群媒體滲透率正在顯著成長。 WhatsApp 是印度最常用的應用程式,滲透率達 81.2%,其次是 Instagram、Facebook、Telegram 和 Twitter。此外,各大社群媒體企業也越來越注重國內,以增加活躍用戶。

- 這些趨勢顯示了該國 LBS 市場成長的巨大潛力,並鼓勵各個供應商將該服務納入其產品組合中。例如,去年8月,IT服務巨頭Wipro Ltd宣布與HERE Technologies合作,為能源和公用事業、製造、運輸和物流、電信和汽車行業的客戶提供基於位置的服務。

- 同樣,去年 10 月,領先的計程車聚合商和電動汽車製造商 Ola 宣布收購地理空間服務提供商 GeoSpoc,以幫助開發更準確的地圖、整合多式聯運選項並部署即時地圖。衛星圖像可獲取道路品質以提高安全性。

基於位置的服務 (LBS) 產業概述

基於位置的服務市場需要更具凝聚力。持續的研究和技術進步預計將成為市場的主要趨勢。這些公司正在採取各種策略來擴大客戶群並擴大市場佔有率。主要策略涉及長期合作夥伴關係或併購。

2022 年 11 月,VeriDaaS Corporation 宣布收購加拿大地理情報公司 4DM。 4DM 透過諮詢專案和以服務為基礎的工作,讓政府、非政府組織和私營部門組織參與智慧交通解決方案、環境健康、基於位置的服務和風險評估應用領域。

2022 年 3 月,Aruba Networks 宣布改進其邊緣服務平台 (ESP),提供新的管理功能和基於位置的服務的開發,以幫助企業抓住邊緣和物聯網機會。該公司還推出了內建 GPS 接收器和 Open Locate 的自定位室內存取點 (AP),用於從存取點向裝置共用位置資訊。

額外的好處:

- Excel 格式的市場估算 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章:簡介

- 研究假設和市場定義

- 研究範圍

第 2 章:研究方法

第 3 章:執行摘要

第 4 章:市場洞察

- 市場概況

- 產業吸引力-波特五力分析

- 買家的議價能力

- 供應商的議價能力

- 新進入者的威脅

- 替代產品的威脅

- 競爭激烈程度

- 產業價值鏈分析

- COVID-19 對產業影響的評估

第 5 章:市場動態

- 市場促進因素

- 對基於地理的行銷的需求不斷成長

- 室內服務 BLE 和 UWB 的出現推動了技術進步

- 由於社交媒體和基於位置的應用程式的高滲透率,LBS 的新興用例

- 市場課題

- 隱私/安全和監管限制之間的權衡

第 6 章:市場區隔

- 依地點

- 室內的

- 戶外的

- 依服務類型

- 專業的

- 管理

- 依最終用戶產業

- 快消品及電商

- 零售

- 衛生保健

- 資訊科技和電信

- 運輸

- 油和氣

- 其他最終用戶產業

- 地理

- 北美洲

- 美國

- 加拿大

- 歐洲

- 英國

- 德國

- 法國

- 歐洲其他地區

- 亞太

- 中國

- 日本

- 印度

- 亞太地區其他地區

- 世界其他地區

- 北美洲

第 7 章:競爭格局

- 公司簡介

- ALE International

- IBM Corporation

- Cisco Systems Inc.

- Ericsson Inc.

- DigitalGlobe Inc.(Maxar Technologies )

- Creativity Software Ltd.

- IndoorAtlas Ltd

- Esri Technologies Ltd

- GL Communications Inc.

- Google LLC

- HERE Global BV

- HPE Aruba Inc.

- Teldio Corporation

- HID Global (Assa Abloy AB)

- Sewio Networks

- Ubiquicom

- Zebra Technologies Corporation

第 8 章:投資分析

第 9 章:市場的未來

The Location-based Services Market size is estimated at USD 50.85 billion in 2024, and is expected to reach USD 149.73 billion by 2029, growing at a CAGR of 24.11% during the forecast period (2024-2029).

The proliferation of smartphone usage is driving the location-based services market.

Key Highlights

- Location-based services (LBS) have emerged significantly during the past few years. It is increasingly being used to locate friends in an area, locate the nearest restaurant, or advertise deals to shoppers nearby. LBS gives users access to relevant and up-to-date information about their surroundings and allows businesses to update their customers regarding their orders. All these LBS applications offer a dynamic user experience, providing a convenient method for the interaction of business enterprises with customers.

- The fastest-developing positioning methods are based on mobile positioning and satellite-based GPS. With more widespread methods, like global cell identity (CGICTA) and enhanced observed time difference (E-OTD), the practical precision falls in the range of 50-1000 m. These technologies provide end-users with opportunities based on the accuracy required for specific application location identification.

- Location can be determined by using E-OTD, observed timed difference of arrival (OTDOA), wireless-assisted GNSS (A-GNSS), and hybrid technologies, which combine A-GNSS with other standard technologies. Better location and accurate, speculated arrival times in real-time can be offered to commuters and service seekers using location-based services that track vehicular movement. This is expected to gain a significant market base, coupled with the countries' significant efforts worldwide in trying to achieve smooth transportation goals as a part of their smart city projects. These developments are expected to create increased opportunities, particularly in the Latin American and Asia-Pacific markets, over the forecast period.

- Furthermore, with the significant ongoing investments for the integration of 3D mapping applications with smartphones, market players, such as Nokia, Samsung, and other OEMs, are entering this market. Online web service providers, such as Amazon Inc. and Microsoft Corp., have also started offering 3D maps on their platforms. For instance, Parrot, a prominent player providing wireless devices for mobile phones, has positioned its consumer drones for 3D modeling, mapping, and agricultural uses. These instances are expected to drive market demand across emerging economies during the forecast period.

- Location-based services currently face tremendous risks from government policies and regulations on consumer privacy. Most software developers are becoming aware of the growing international privacy laws and industry self-regulation codes that govern its use.In November this year, Google agreed to pay around $392 million in a settlement with 40 states over allegations that the company tracked people through their devices after location tracking had been turned off.

- Also, the effects of COVID-19 on the location-based services market were not all the same. This was mostly because the pandemic had different effects on the industries that used the services. Overall, the market was impacted negatively, although a solid recovery is set to drive the demand for location-based services over the forecast period.

Location Based Services (LBS) Market Trends

FMCG and E-Commerce Sector Expected to Witness Significant Growth

- There has been an increasing trend in e-commerce establishments in the past decade. Mobile apps have enjoyed greater success due to their personalization features. They are easier to use and form a direct link between the brands and customers, thus enabling high levels of consumer engagement.

- Mobile apps help e-commerce stores analyze the current market and consumer behavior, resulting in better marketing strategies. E-commerce services based on user location have emerged as an especially important segment of modern information services.In these user-intensive applications, quality of service is important, and design methods are increasingly relying on software standards to achieve quality.

- E-commerce applications provide tailored offers to customers that reside in specific locations. These offers are delivered to customers in the form of personalized notifications, which are more effective than general-purpose push notifications.

- In other words, marketplaces rely on artificial intelligence to identify locations and products that are popular there. Once the data is set up, sellers can pay a one-time cost to have their stock shipped to the final location.

- RTLS includes a wide range of location technologies, from Bluetooth beacons and passive radio frequency identification (RFID) to large-scale systems that keep assets and back-end processes in constant communication.Many warehouse owners choose to use a mix of location-based technologies to meet their needs in the most cost-effective way.

The growth in the e-commerce industry and the need for efficient location-based services worldwide are driving market growth. For instance, U.S. retail e-commerce sales for the second quarter of this year were USD 257.3 billion, up 2.7% from the first quarter of this year, according to the Census Bureau of the Department of Commerce. Moreover, according to IBEF, the Indian e-commerce market is expected to flourish from USD 38.5 billion in 2017 to USD 200 billion by 2026.

Asia Pacific Region is Expected to Occupy Significant Share

- China is not only a major market for LBS in the regional space but also globally, owing to its significant growth in investments toward building infrastructure and technological capabilities, combined with internet and mobile penetration, which have placed the country in a prominent position in the region as well as in the global market.

- According to the 50th China Statistical Report on Internet Development, the number of internet users totalled 1,051 million, and the internet penetration rate reached 74.4% in the country as of June last year, which is huge considering the population of the country. Location-based services should have a lot of opportunities in the country because so many people have access to the internet and more people are getting smartphones.

- Moreover, Japan is home to one of the major automotive industries and a prominent exporter. With motor vehicle exports in value terms amounting to USD 12.71 billion and auto-related employment in Japan totalling 5.52 million people (as per the Japan Automobile Manufacturer Association), the automotive industry is one of the Japanese economy's core industrial sectors.

- With such a growing automotive industry, Japan has a well-built navigation infrastructure and focuses on building technology and infrastructure for autonomous vehicles. The country is implementing 3D maps with self-driving vehicles and offering disaster information via car navigation systems, which have an AI-based assistant.

- India's social media penetration is growing significantly. WhatsApp is the most used app in India, with 81.2% penetration, followed by Instagram, Facebook, Telegram, and Twitter. Besides, various major social media enterprises are increasingly focusing on the country to increase their active users.

- Such trends show the excellent potential for the growth of the LBS market in the country and encourage various vendors to include the service in their portfolios. For example, in August of last year, IT services behemoth Wipro Ltd announced a collaboration with HERE Technologies to provide location-based services to customers in the energy and utilities, manufacturing, transportation and logistics, telecom, and automotive industries.

- Similarly, in October last year, Ola, a leading cab aggregator and e-vehicle maker, announced that it had acquired GeoSpoc, a geospatial service provider, to help develop more accurate mapping, incorporate multi-modal transportation options, and deploy real-time satellite imagery to access road quality for increased safety.

Location Based Services (LBS) Industry Overview

The location-based services market needs to be more cohesive. Ongoing research and technological advancements are expected to be the key trends in the market. The companies are adopting various strategies to expand their customer base and mark their presence in the market. The primary strategies involve long-term partnerships or mergers and acquisitions.

In November 2022, VeriDaaS Corporation announced the acquisition of 4DM, a geo-intelligence company based in Canada. 4DM engages governments, NGOs, and private sector organizations in the areas of intelligent transportation solutions, environmental health, location-based services, and risk assessment applications through consulting projects and service-based work.

In March 2022, Aruba Networks announced the advancement of its Edge Services Platform (ESP) with new management capabilities and development in location-based services to help enterprises go after edge and IoT opportunities. The company also unveiled self-locating indoor access points (APs) with built-in GPS receivers and Open Locate for sharing location information from an access point to a device.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Buyers

- 4.2.2 Bargaining Power of Suppliers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Value Chain Analysis

- 4.4 Assessment of Impact of COVID-19 on the Industry

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Growing Demand for Geo-based Marketing

- 5.1.2 Technological Advancements Aided by Emergence of BLE and UWB for Indoor Services

- 5.1.3 Emerging Use-cases for LBS due to High Penetration of Social Media and Location-based App Adoption

- 5.2 Market Challenges

- 5.2.1 Trade-offs between privacy/security and regulatory constraints

6 MARKET SEGMENTATION

- 6.1 By Location

- 6.1.1 Indoor

- 6.1.2 Outdoor

- 6.2 By Service Type

- 6.2.1 Professional

- 6.2.2 Managed

- 6.3 By End-user Industry

- 6.3.1 FMCG and E-commerce

- 6.3.2 Retail

- 6.3.3 Healthcare

- 6.3.4 IT and Telecom

- 6.3.5 Transportation

- 6.3.6 Oil and Gas

- 6.3.7 Other End-user Industries

- 6.4 Geography

- 6.4.1 North America

- 6.4.1.1 United States

- 6.4.1.2 Canada

- 6.4.2 Europe

- 6.4.2.1 United Kingdom

- 6.4.2.2 Germany

- 6.4.2.3 France

- 6.4.2.4 Rest of Europe

- 6.4.3 Asia-Pacific

- 6.4.3.1 China

- 6.4.3.2 Japan

- 6.4.3.3 India

- 6.4.3.4 Rest of Asia Pacific

- 6.4.4 Rest of the World

- 6.4.1 North America

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 ALE International

- 7.1.2 IBM Corporation

- 7.1.3 Cisco Systems Inc.

- 7.1.4 Ericsson Inc.

- 7.1.5 DigitalGlobe Inc.(Maxar Technologies )

- 7.1.6 Creativity Software Ltd.

- 7.1.7 IndoorAtlas Ltd

- 7.1.8 Esri Technologies Ltd

- 7.1.9 GL Communications Inc.

- 7.1.10 Google LLC

- 7.1.11 HERE Global BV

- 7.1.12 HPE Aruba Inc.

- 7.1.13 Teldio Corporation

- 7.1.14 HID Global (Assa Abloy AB)

- 7.1.15 Sewio Networks

- 7.1.16 Ubiquicom

- 7.1.17 Zebra Technologies Corporation