|

市場調查報告書

商品編碼

1444838

工業級尿素 - 市場佔有率分析、產業趨勢與統計、成長預測(2024 - 2029)Industrial Grade Urea - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

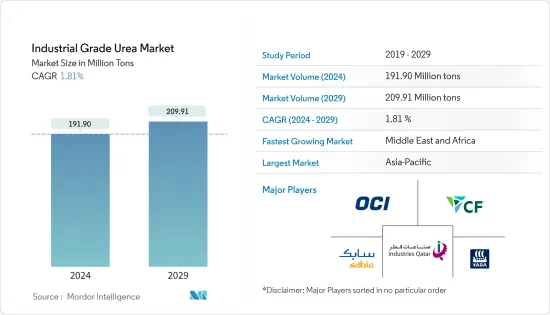

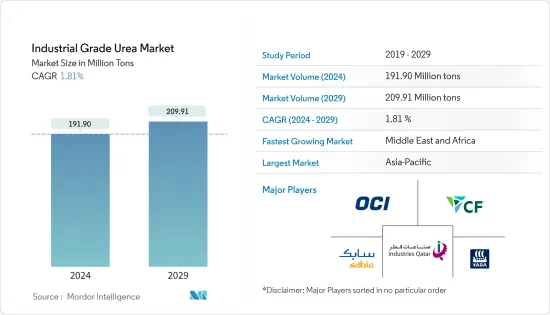

預計2024年工業級尿素市場規模為1.919億噸,預計到2029年將達到2.0991億噸,在預測期內(2024-2029年)CAGR為1.81%。

考慮到 COVID-19 大流行的情況,一些國家被迫進入封鎖狀態,這促使人們最大限度地減少私人車輛的使用。此外,汽車製造廠暫時停產,導致尿素催化劑的消耗量下降。然而,市場於 2021 年復甦。預計未來幾年將大幅成長。

主要亮點

- 短期內,工業級尿素的高適用性、汽車產業需求的增加以及化肥領域使用量的增加預計將推動市場成長。

- 關鍵地區尿素的濫用和價格波動可能會阻礙市場成長。

- 在環保建築中使用工業級尿素可能在未來幾年為市場創造機會。

- 預計亞太地區將主導市場。然而,中東和非洲在預測期內的CAGR可能最高。

尿素市場趨勢

農業領域將主導市場

- 尿素 (NH2)2CO 是一種無色有機化合物,稱為尿素。它極易溶於水,pKa 接近零。全球90%以上的尿素產量用作氮釋放肥料。尿素是常用固體氮肥中氮含量最高的(46.7%)。因此,單位氮養分的運輸成本最低。

- 在土壤中,它水解回氨和二氧化碳。細菌將土壤中的氨氧化成植物可以吸收的硝酸鹽。尿素也用於許多多組分固體肥料配方中。尿素極易溶於水,因此非常適合用於肥料溶液(與硝酸銨:UAN 結合),例如「葉面肥」肥料。對於肥料使用,顆粒是首選,因為它們的粒徑分佈較窄,有利於機械施用。

- 氮肥是提高作物產量和獲利能力的可行方法,特別是在非黑鈣土地區和潮濕地區。氮肥專門用作農作物的補充劑,主要用於農業收割。

- 根據世界銀行的數據,2021年農林漁業總產值為4.17兆美元,而前一年為3.72兆美元。

- 目前亞太地區嚴重依賴氮肥。然而,氮肥的使用、營養管理不善、土壤肥力下降、缺乏補充投入以及行銷和分配系統薄弱是亞太農業部門面臨的一些問題。無論如何,未來幾年對氮肥的需求仍可能主導該地區的化肥市場,這可能會繼續推動尿素市場的消費。

- 此外,農業是全球主要的生計來源。印度和美國等國家的農業部門正在實現積極成長。因此,預計在預測期內對氨的需求將推動市場。

- 22會計年度,印度政府為農民設定了創紀錄的糧食產量增加2%的目標,糧食產量達到3,0731萬噸。 21會計年度產量為3.0334億噸,目標為3.01億噸。因此,這些因素預計將增加對化肥的需求,並推動市場研究。

- 此外,2021年美國農業年度出口水準創歷史新高。美國商務部公佈的2021年貿易資料顯示,美國農產品和食品向全球出口總額達1770億美元,較2020年高出20%。18%,主要是由於全球需求增強導致價格上漲和數量增加。

- 拉丁美洲和加勒比地區的農業部門近年來出現了顯著成長。根據經濟合作暨發展組織 (OECD) 和聯合國糧食及農業組織 (FAO) 的數據,農業和漁業產量預計在預測期內將增加 17%。預計這一成長的 53% 左右將來自農作物產量的增加。

亞太地區將主導市場

- 亞太地區的市佔率最高,其次是北美。

- 隨著人口的增加,印度和中國等國家的農業正在發展。這增加了氮肥的消耗,從而推動了市場。

- 除了農業以外,隨著化工、汽車、醫療等產業的進步,消費也不斷增加。

- 由於人們越來越擔心電價和糧食產量飆升,這可能會加劇全球價格衝擊和糧食通膨,中國當局對化肥出口商設置了新的障礙。

- 中國是全球最大的脲醛樹脂生產國之一。脲醛樹脂在建築中用作膠合板、塑合板和其他木製品的黏合劑。

- 根據國家統計局數據,2021年,糧食總產量68,290萬噸,比上年的6.5億噸增加2%。玉米種植面積比去年增加5%,產量增加4.6%。為了提高生產力以跟上不斷減少的耕地面積而擴大使用化肥預計將推動該國的市場。

- 2022年7月至2022年9月,中國出口尿素84.9萬噸,高於2022年第一季及2022年第二季的30.3萬噸及42.1萬噸。

- 根據OICA統計,中國擁有全球最重要的汽車生產基地,2021年汽車總產量為2,608萬輛,比去年的2,523萬輛成長3%。

- 2021年,印度化肥零售在4月至7月比去年四個月下降了12.4%。所有主要營養素的銷量均有所下降,其中尿素降幅最大,達 12.8%。

- 據印度肥料協會稱,2020-21年度肥料產品總產量為4,349萬噸,比2019-20年度成長1.7%。 2020-21年,尿素產量為2460萬噸,NP/NPK複合肥料產量為932萬噸,過磷酸鈣產量為492萬噸,分別比2019-21年成長0.6%、7.6%和15.8%。20.然而,同期磷酸二銨產量卻大幅下降17.1%,為377萬噸。

- 此外,印度是世界上最大的汽車生產國之一。根據OICA的數據,2021年該國汽車產量為440萬輛,比去年同期的338萬輛成長30%。

尿素產業概況

工業級尿素市場較為分散,許多企業在該行業營運,但在全球產能中所佔佔有率較小。該市場的一些主要參與者包括卡達工業公司、SABIC、OCI NV、Yara 和 CF Industries Holdings Inc. 等。

額外的好處:

- Excel 格式的市場估算 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章:簡介

- 研究假設

- 研究範圍

第 2 章:研究方法

第 3 章:執行摘要

第 4 章:市場動態

- 促進要素

- 工業級尿素的高適用性

- 汽車產業的需求不斷成長

- 增加化肥領域的使用

- 限制

- 重點地區亂用尿素

- 價格波動

- 產業價值鏈分析

- 波特五力分析

- 供應商的議價能力

- 消費者的議價能力

- 新進入者的威脅

- 替代產品和服務的威脅

- 競爭程度

- 原料分析

- 技術簡介

- 生產流程

- 專利分析

- 進出口趨勢

- 監理政策分析

第 5 章:市場區隔(市場規模依數量計算)

- 年級

- 肥料

- 餵食

- 技術的

- 最終用戶產業

- 農業

- 化學

- 汽車

- 醫療的

- 其他最終用戶產業

- 地理

- 亞太

- 中國

- 印度

- 日本

- 韓國

- 東協國家

- 亞太其他地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 法國

- 英國

- 義大利

- 歐洲其他地區

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地區

- 中東和非洲

- 沙烏地阿拉伯

- 南非

- 中東和非洲其他地區

- 亞太

第 6 章:競爭格局

- 合併、收購、合資、合作和協議

- 市佔率(%)分析

- 領先企業採取的策略

- 公司簡介

- Acron

- BASF SE

- CF Industries Holdings Inc.

- China National Petroleum Corporation

- Chambal Fertilisers & Chemicals Ltd

- EuroChem Group

- IFFCO

- Industries Qatar

- Koch Fertilizer LLC

- Notore Chemical Industries PLC

- Nutrien Ltd

- OCI

- Paradeep Phosphates Ltd

- Petrobras

- PT Pupuk Kalimantan Timur (PKT)

- SABIC

- The Chemical Company

- URALCHEM JSC

- Yara

- NATIONAL FERTILIZERS LIMITED

第 7 章:市場機會與未來趨勢

- 工業級尿素在環保建築的應用

The Industrial Grade Urea Market size is estimated at 191.90 Million tons in 2024, and is expected to reach 209.91 Million tons by 2029, growing at a CAGR of 1.81% during the forecast period (2024-2029).

Considering the COVID-19 pandemic situation, several countries were forced to go into lockdown, which led people to minimize the usage of personal vehicles. Additionally, automotive manufacturing plants were on a temporary halt, thus leading to a decline in the consumption of urea-based catalysts. However, the market recovered in 2021. It is expected to grow at a significant rate during the coming years.

Key Highlights

- Over the short term, the high applicability of technical grade urea, increasing demand from the automotive sector, and increasing usage in the fertilizer segment are expected to drive market growth.

- The indiscriminate use of urea in critical regions and fluctuation in prices are likely to hinder the market growth.

- The use of industrial grade urea in eco-friendly construction is likely to create opportunities for the market in the coming years.

- The Asia-Pacific region is expected to dominate the market. However, the Middle East and Africa is likely to witness the highest CAGR during the forecast period.

Urea Market Trends

Agriculture Segment to Dominate the Market

- Urea (NH2)2CO is a colorless organic chemical compound known as carbamide. It is highly soluble in water and has a pKa close to zero. More than 90% of the world's urea production is used as a nitrogen-release fertilizer. Urea has the highest nitrogen content of all solid nitrogenous fertilizers in common use (46.7%). Therefore, it has the lowest transportation costs per unit of nitrogen nutrients.

- In the soil, it hydrolyses back to ammonia and carbon dioxide. Bacteria oxidize the ammonia in the soil to nitrate, which the plants can absorb. Urea is also used in many multi-component solid fertilizer formulations. Urea is highly soluble in water, therefore, very suitable for use in fertilizer solutions (in combination with ammonium nitrate: UAN), e.g., in 'foliar feed' fertilizers. For fertilizer use, granules are preferred because of their narrower particle size distribution, an advantage for mechanical application.

- Nitrogen fertilizers are viable methods for expanding crop yield and profitability, particularly in the non-chernozem zone and moist areas. Nitrogen fertilizers are specially used as supplements for crops and are primarily utilized in the agriculture industry for harvesting.

- According to the World Bank, the total value of the agriculture, forestry, and fishing industries accounted for USD 4.17 trillion in 2021, compared to USD 3.72 trillion in the previous year.

- The Asia-Pacific region holds heavy reliance on nitrogenous fertilizers at present. However, the use of nitrogenous fertilizers, poor nutrition management, declining soil fertility, lack of complementary inputs, and weak marketing and distribution systems are some of the concerns in the Asia-Pacific agriculture sector. Regardless, the demand for nitrogenous fertilizer is still likely to dominate the fertilizer market in the region over the next few years, which is likely to continue driving the consumption of the urea market.

- Furthermore, agriculture is the primary source of livelihood across the globe. Countries such as India and the United States, among others, are witnessing positive growth in the agriculture sector. Hence, the demand for ammonia is expected to drive the market during the forecast period.

- For FY22, the Indian government has set a record target for farmers to raise food grain production by 2%, with 307.31 million tons of food grains. In FY21, production was recorded at 303.34 million tons against a target of 301 million tons. Thus, these factors are expected to increase the demand for fertilizers, driving the market studied.

- In addition, the American agricultural industry witnessed the highest annual export levels ever recorded in 2021. The 2021 trade data published by the Department of Commerce shows that exports of US farm and food products to the world totaled USD 177 billion, topping the 2020 total by 18%, driven by higher prices and larger quantities as global demand strengthens.

- The agriculture sector in Latin America and the Caribbean witnessed significant growth in the recent past. According to the Organization for Economic Co-operation and Development (OECD) and the Food and Agriculture Organization of the United Nations (FAO), agricultural and fisheries production is expected to grow by 17% during the forecast period. Around 53% of this growth is expected to come from an increase in crop production.

Asia-Pacific Region to Dominate the Market

- The Asia-Pacific region accounts for the highest market share, followed by North America.

- With the increase in population, developments in the agriculture industries are taking place in countries like India and China. This increases the consumption of nitrogen fertilizers, thereby driving the market.

- Apart from the agriculture industry, consumption is also increasing with the advancements in the chemical, automobile, and medical industries.

- Chinese authorities are imposing new hurdles for fertilizer exporters among growing concerns over surging power prices and food production, which could worsen a global price shock and food inflation.

- China is one of the largest producers of urea-formaldehyde resin in the world. The urea-formaldehyde resins are used in construction as adhesives for bonding plywood, particleboard, and other wood products.

- According to the National Bureau of Statistics, in 2021, grain production totaled 682.9 million tons, up from 650 million tons last year, registering an increase of 2%. Corn acreage rose 5 percent from last year, and output rose 4.6 percent. The growing use of fertilizers to increase productivity to keep up with the declining cultivated area is expected to drive the market in the country.

- China exported 849,000 tons of urea from July 2022 to September 2022, up from 303,000 tons and 421,000 tons during Q1 2022 and Q2 2022, respectively.

- According to the OICA, China has the world's most significant automotive production base, with a total vehicle production of 26.08 million units in 2021, registering an increase of 3% compared to 25.23 million units produced last year.

- In 2021, retail sales of fertilizers in India had fallen 12.4% in April-July over the four months of last year. All major nutrients have posted lower sales, and urea observed the highest decline of 12.8%.

- According to the Fertilizer Association of India, the production of total fertilizer products stood at 43.49 million MT during 2020-21, showing an increase of 1.7% over 2019-20. The production of urea stood at 24.60 million MT, NP/ NPK complex fertilizers at 9.32 million MT, and SSP at 4.92 million MT during 2020-21, recording an increase of 0.6%, 7.6%, and 15.8%, respectively, over 2019-20. However, production of DAP at 3.77 million MT witnessed a sharp decline of 17.1% during the same period.

- Furthermore, India is among the largest producer of automobiles in the world. According to OICA, the automotive production in the country stood at 4.4 million units in 2021, registering an increase of 30% compared to 3.38 million units produced in the same period last year.

Urea Industry Overview

The industrial grade urea market is fragmented, where many players, holding a small share in the global production capacity, have been operating in the industry. Some of the major players in the market include Industries Qatar, SABIC, OCI NV, Yara, and CF Industries Holdings Inc., among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 High Applicability of Technical Grade Urea

- 4.1.2 Increasing Demand from the Automotive Sector

- 4.1.3 Increasing Usage in the Fertilizers Segment

- 4.2 Restraints

- 4.2.1 Indiscriminate Use of Urea in Key Regions

- 4.2.2 Fluctuation in the Prices

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Consumers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

- 4.5 Feedstock Analysis

- 4.6 Technological Snapshot

- 4.6.1 Production Process

- 4.6.2 Patent Analysis

- 4.7 Import-Export Trends

- 4.8 Regulatory Policy Analysis

5 MARKET SEGMENTATION (Market Size in Volume)

- 5.1 Grade

- 5.1.1 Fertilizer

- 5.1.2 Feed

- 5.1.3 Technical

- 5.2 End-user Industry

- 5.2.1 Agriculture

- 5.2.2 Chemical

- 5.2.3 Automotive

- 5.2.4 Medical

- 5.2.5 Other End-user Industries

- 5.3 Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 ASEAN Countries

- 5.3.1.6 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 France

- 5.3.3.3 United Kingdom

- 5.3.3.4 Italy

- 5.3.3.5 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle-East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 South Africa

- 5.3.5.3 Rest of Middle-East and Africa

- 5.3.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers, Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share (%) Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 Acron

- 6.4.2 BASF SE

- 6.4.3 CF Industries Holdings Inc.

- 6.4.4 China National Petroleum Corporation

- 6.4.5 Chambal Fertilisers & Chemicals Ltd

- 6.4.6 EuroChem Group

- 6.4.7 IFFCO

- 6.4.8 Industries Qatar

- 6.4.9 Koch Fertilizer LLC

- 6.4.10 Notore Chemical Industries PLC

- 6.4.11 Nutrien Ltd

- 6.4.12 OCI

- 6.4.13 Paradeep Phosphates Ltd

- 6.4.14 Petrobras

- 6.4.15 PT Pupuk Kalimantan Timur (PKT)

- 6.4.16 SABIC

- 6.4.17 The Chemical Company

- 6.4.18 URALCHEM JSC

- 6.4.19 Yara

- 6.4.20 NATIONAL FERTILIZERS LIMITED

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Use of Industrial Grade Urea in Eco-friendly Construction