|

市場調查報告書

商品編碼

1444558

公共事業曳引機:市場佔有率分析、產業趨勢與統計、成長預測(2024-2029)Utility Tractor - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

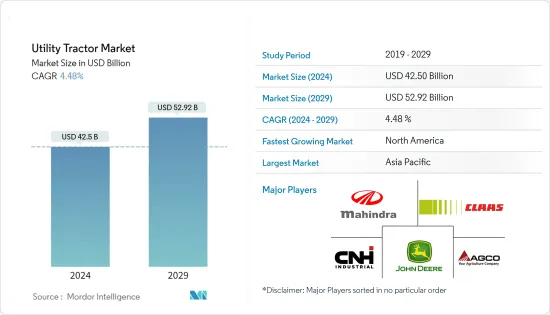

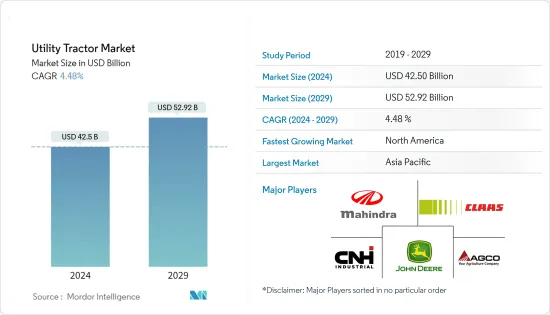

公共事業曳引機市場規模預計到 2024 年為 425 億美元,預計到 2029 年將達到 529.2 億美元,在預測期內(2024-2029 年)年複合成長率為 4.48%。

主要亮點

- 公共事業曳引機設計用於執行各種任務,例如前置裝載機作業、整地和運輸。這種類型的曳引機用於農業任務,例如犁地和牽引重物。由於糧食需求的增加和農業機械化的普及,全世界農業機械的使用正在增加。公共事業曳引機幫助農民輕鬆進行耕作過程。

- 公共事業曳引機由 35 馬力到 100 馬力的部分組成,包括許多用於中小型農業作業的緊湊型公共事業曳引機。小農擴大採用緊湊型公共事業曳引機(40HP 至 70HP),因為它們比普通農用曳引機小得多且便宜得多。儘管成本低廉,但緊湊型曳引機可協助農民利用後鏟和前端裝載機等農業設備執行更多任務,從而節省人事費用。儘管堅硬的土壤條件是大型(41-50馬力)曳引機需求增加的主要原因,但它們在基礎設施和建築等非農業部門的使用不斷增加,也促進了大型曳引機需求的增加類別。因此,公共事業曳引機行業將在未來幾年內成長。

- 公共事業曳引機可用於裝載和挖掘,並配備重要的前部或後部附件,例如前端裝載機和後鏟。儘管如此,它也可用於景觀美化、播種、種植乾草和除雪,使其成為全球該領域的市場領導者。 2019年印度農業機械化水準為40.0%-45.0%。該國約 80.0% 的小農和邊緣農戶擁有的土地不到 5 公頃,減緩了農業機械的普及。印度農業部門對動物和人力的使用顯著下降。其中許多由曳引機和柴油引擎等石化燃料驅動的車輛提供動力。這導致了從傳統農業流程向機械化農業流程的轉變。

- 儘管與中國、巴西等其他新興國家相比,印度的機械化程度較低,但絕對處於成長階段。為了提高機械化水平,印度政府正在透過對各種設備提供補貼並支持透過前端代理商批量採購來推動“平衡農業機械化”,預計在預測期內這一數字將繼續增加,公共事業市場預計將走強。

公共事業曳引機市場趨勢

人們對農業機械化的興趣日益濃厚

- 精密農業和擴大採用農業技術來提高產量,正在增加世界各地少耕土地對多功能曳引機的需求。農業培訓計畫的增加,促進農業機械的大規模使用,也正在提振曳引機產業。此外,一些開發中國家的政府正在提供補貼和財政援助,以支持關鍵農業流程的自動化。

- 此外,各種技術進步導致預先安裝 GPS 和遠端資訊處理系統的現代曳引機出現。全球農用曳引機市場預計將受到自動曳引機日益普及以及可用於農業目的的遠端監控無線連接的廣泛普及的推動。

- 現代農業,農業機械化對農民增收至關重要。然而,中國作物生產中機械的使用效率低。中國農業大學在北京進行的一項研究顯示,2020年全國作物種植和收穫機械化率達71%。

- 小麥、稻米、玉米播種、收穫總合機械化率分別超過95%、85%、90%。為了加速農業機械化進程,中國政府鼓勵農民使用機械,包括對購買機械、使用機械給予財政補貼,對向個體農民提供機械的合作社給予支持,我們推出了一系列政策。

- 亞太地區的農民也在尋找具有客製化功能的公共事業曳引機,以滿足他們的高效農業需求。因此,為了滿足消費者的需求,國內外許多農機製造商紛紛開發出技術先進、能夠適應各種農業應用的新型公共事業曳引機,以拉動未來市場的成長。

- 2022年,約翰迪爾美國為農民推出了Gtaor公共事業曳引機。 AutoTrac 輔助轉向系統可在車輛穿過田地時保持一致、可重複的精確度和效率,進而提高操作員的工作效率。 AutoTrac 讓農民能夠保持警惕並專注於機器設定和控制各種田間條件。農民使用公共事業曳引機進行採樣、散佈,並用精確的網格分類田地。

亞太地區主導市場

- 儘管印度擁有豐富的廉價勞動力,但對糧食的需求仍在增加,農業機械化(特別是曳引機)的採用也增加。中國也是如此,農業機械化也有類似的趨勢。印度和中國的農民對機械化越來越感興趣,原因有幾個。原因之一是人口成長和都市化導致對糧食的需求不斷增加,從而需要提高農業生產力。另一個原因是人事費用上升使得機械投資更具成本效益。

- 印度北部地區,尤其是旁遮普邦、北方邦和哈里亞納邦,多用途曳引機在該國的普及較高。在印度,根據印度政府《農業宏觀管理計畫》機械化部分,為促進農業機械化提供補貼,其中包括購買35馬力以下曳引機最高3萬盧比,其中包括成本的25%。 -起飛(PTO)馬力。在印度,自訂就業服務使小農受益,並且出現了新一代企業家,他們為小土地所有者的利益而操作多功能曳引機。這些因素將導致預測期內該地區的市場成長。

- 中國農業機械化水準提高的趨勢是農業投資的增加和政府對農業機械化的推動。農業機械化投資正在創造亞太地區對多功能曳引機的需求。國家統計局資料顯示,2019年我國曳引機產量61.77萬台。大中型曳引機逐漸被小型曳引機取代。

- 截至2019年終,我國農用曳引機保有量2,224萬台,其中大中型曳引機444萬台。中國也推出了「中國製造2025」計劃,重點以高階機械生產農用曳引機等90%的農業機械,到2020年將佔中國細分市場三分之一的佔有率。支持國產曳引機,促進國內農用曳引機市場發展。

- 多用途曳引機用於農業生產,馬恆達 (Mahindra & Mahindra) 和約翰迪爾 (John Deere) 等國內領先公司借助其產品為該地區的農業實踐做出了重大貢獻。促進未來幾年的市場成長。在新興國家,由於農民可支配收入低、人事費用高,對35馬力至100馬力的曳引機的需求不斷增加。由於農田面積較小,農民更喜歡為農業目的量身訂製的小型緊湊型/公共事業曳引機。此外,小型曳引機減少燃料消費量有助於增強小型和邊緣農民的能力。

公共事業曳引機產業概況

公共事業曳引機市場高度整合,少數廠商佔大部分市場佔有率。 Deere & Company、CNH Industrial、AGCO Corporation、CLAAS KGaA mbH、Mahindra & Mahindra Corporation 是該市場的主要企業。新產品發布、合作夥伴關係和收購是全球領先公司採用的關鍵策略。除了創新和擴張之外,研發投資和新產品系列的開發可能是未來幾年的關鍵策略。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場動態

- 市場概況

- 市場促進因素

- 市場限制因素

- 波特五力分析

- 新進入者的威脅

- 買方議價能力

- 供應商的議價能力

- 替代產品的威脅

- 競爭公司之間敵對的強度

第5章市場區隔

- 地區

- 北美洲

- 美國

- 加拿大

- 北美其他地區

- 歐洲

- 德國

- 英國

- 法國

- 西班牙

- 義大利

- 其他歐洲國家

- 亞太地區

- 中國

- 日本

- 印度

- 其他亞太地區

- 世界其他地區

- 巴西

- 南非

- 其他

- 北美洲

第6章 競爭形勢

- 最採用的策略

- 市場佔有率分析

- 公司簡介

- Deere and Company

- CNH Global NV

- AGCO Corporation

- CLAAS KGaA mbH

- Mahindra and Mahindra Corporation

- Kubota Corporation

- Escorts Group

- Tractors and Farm Equipment Limited(TAFE)

- Kuhn Group

- Yanmar Company Limited

第7章市場機會與未來趨勢

The Utility Tractor Market size is estimated at USD 42.5 billion in 2024, and is expected to reach USD 52.92 billion by 2029, growing at a CAGR of 4.48% during the forecast period (2024-2029).

Key Highlights

- Utility tractor is designed for various tasks such as front loader work, soil cultivation, and transportation. This type of tractor is used for farming operations such as plowing and pulling heavy implements. Globally the use of machinery in agriculture is increasing due to increased demand for food and higher penetration of farm mechanization. Utility tractors help the farmer carry out the agriculture process with ease.

- The utility tractors comprise a range of 35 HP to 100 HP segments, including many compact and utility-type tractors meant for small- to mid-sized farming tasks. Small-scale farmers are increasingly adopting compact utility tractors (40HP-70HP) as they are much smaller than the average agricultural tractors and priced much lower. Despite the low-cost, compact tractors can help farmers perform many tasks with the help of farm equipment, such as backhoes and front-end loaders, and save labor wage expenses. Although a key reason for the increasing demand for larger (41-50 HP) tractors is the hard soil condition, increased use in non-agricultural segments, such as infrastructure and construction fields, has also contributed to the increase in demand in this category, which will boost the utility tractors industry to grow in the coming years.

- Utility tractors can work with significant front or rear attachments, like front-end loaders and backhoes, for loading and digging. Still, they can also be used for landscaping, seeding, hay cultivation, and snow removal, which drives the market for this segment globally. The farm mechanization level in India was recorded at 40.0%-45.0% in 2019. The penetration of farm equipment is slow, as almost 80.0% of small and marginal farmers own less than five hectares of land in the country. The agriculture sector in India has witnessed a substantial decline in the use of animal and human power in the agriculture sector. Many of these are driven by fossil fuel-operated vehicles, such as tractors and diesel engines. This has shifted from the traditional agriculture process to a more mechanized one.

- Though the level of mechanization in India is lower than in other developing countries, like China and Brazil, it is certainly in a growing phase. To increase the mechanization level, the Indian government has been promoting 'Balanced Farm Mechanization' by providing subsidies on various equipment and supporting bulk buying through front-end agencies, which is expected to strengthen the utility tractors market during the forecast period.

Utility Tractor Market Trends

Growing Preference For Farm Mechanization

- Precision farming and the increasing adoption of farm technology to boost production are driving up demand for utility tractors in minimum arable landholdings across the globe. The growing number of farm training programs promoting the use of agricultural machinery on a wide scale is also driving the tractor industry. Moreover, governments in several developing nations are providing subsidies and financial aid to help automate key agricultural processes.

- Furthermore, modern tractors with pre-installed GPS and telematics systems have emerged due to different technical breakthroughs. The global agriculture tractor market is likely to be driven by the rising popularity of automated tractors and the widespread use of wireless connectivity for remote monitoring, which can be used for agriculture purposes.

- Agricultural mechanization is essential to increase farmers' income in modern agriculture. However, the use of machinery for crop production in China is inefficient. According to a study conducted by China Agricultural University (CAU), Beijing, in 2020, the national crop planting and harvesting mechanization rate reached 71%.

- The total mechanization rate of planting and harvesting exceeded 95%, 85%, and 90% for wheat, rice, and maize, respectively. To accelerate agricultural mechanization, the Chinese government issued a series of policies to encourage farmers to use machinery, including financial subsidies for machine purchases and machine operations and support for cooperatives to provide machinery for individual farmers.

- Farmers in the Asia-Pacific region also seek utility tractors with tailored features to fulfill their needs for effective farming. So, to meet consumer demand, many international and domestic agriculture machinery manufacturers are developing new technologically advanced utility tractors which can handle various farming applications to push the market to grow in the future.

- In 2022, John Deere US launched Gtaor Utility Tractor for Farmers. The AutoTrac-assisted steering system increases operator productivity by maintaining consistent, repeatable accuracy and efficiency as the vehicle moves across the field. With AutoTrac engaged, farmers can remain alert and focused on controlling machine settings and varying field conditions. Farmers use the utility tractor for precise grid sampling, spraying, and field boundary creation.

Asia-Pacific Dominates the Market

- Despite abundant and cheap labor in India, there has been a growing demand for food, which has led to an increase in the adoption of farm mechanization, particularly in the form of tractors. This is also true for China, where there has been a similar trend toward mechanization in agriculture. For several reasons, farmers in India and China are increasingly turning to mechanization. One reason is the growing demand for food due to population growth and urbanization, which has led to a need for increased productivity in agriculture. Another reason is the rising cost of labor, which has made it more cost-effective to invest in machinery.

- The penetration of utility tractors in the country is higher in North India, particularly in Punjab, Uttar Pradesh, and Haryana. In India, under the mechanization component of the Macro-Management of Agriculture Scheme, by the Indian government, there is a provision of subsidy to promote agricultural mechanization, including 25% of the cost limited to INR 30,000 for buying tractors of up to 35 Power-take-off (PTO) HP. In India, custom hiring services have benefitted smaller farmers, and a new breed of entrepreneurs who operate utility tractors for the benefit of small landholders has emerged. These factors will lead the market to grow in the region during the forecasting period.

- The trend behind the increase in farm mechanization in China has been increased agricultural investments and the government's push toward farm mechanization. The investments in farm mechanization create the demand for utility tractors in the Asia Pacific. According to data from the National Bureau of Statistics of China, China produced 617,700 tractors in 2019. Large and medium-sized tractors gradually replaced small tractors.

- By the end of 2019, China boasted of 22.24 million agricultural tractors, including 4.44 million large- and medium-sized tractors. China has also introduced the 'Made in China 2025' scheme, which focuses on producing 90% of its agricultural equipment with high-end machines, like agricultural tractors, holding a one-third share of their segments by 2020. This, in turn, boosts indigenously produced tractors and propels the country's agricultural tractor market.

- Utility Tractors are being used for the agricultural process, and major players in the country are contributing to it, such as Mahindra & Mahindra and John Deere, with the help of their products, are contributing a lot to the agricultural practices carried out in the region to increase the market growth in the coming years. In developing countries, the demand for 35HP - 100HP tractors is high due to the low disposable income of farmers and high labor costs. Farmers prefer small and customized compact/utility tractors for agricultural purposes due to small farmland sizes. Moreover, lesser fuel consumption by small tractors helps to empower small and marginal farmers.

Utility Tractor Industry Overview

The utility tractors market is highly consolidated, with few players cornering most of the market share. Deere & Company, CNH Industrial, AGCO Corporation, CLAAS KGaA mbH, and Mahindra & Mahindra Corporation are major players in this market. New product launches, partnerships, and acquisitions are the major strategies the leading global companies adopt. Along with innovations and expansions, investments in R&D and developing novel product portfolios will likely be crucial strategies in the coming years.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.3 Market Restraints

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Threat of New Entrants

- 4.4.2 Bargaining Power of Buyers/Consumers

- 4.4.3 Bargaining Power of Suppliers

- 4.4.4 Threat of Substitute Products

- 4.4.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Geography

- 5.1.1 North America

- 5.1.1.1 United States

- 5.1.1.2 Canada

- 5.1.1.3 Rest of North America

- 5.1.2 Europe

- 5.1.2.1 Germany

- 5.1.2.2 United Kingdom

- 5.1.2.3 France

- 5.1.2.4 Spain

- 5.1.2.5 Italy

- 5.1.2.6 Rest of Europe

- 5.1.3 Asia-Pacific

- 5.1.3.1 China

- 5.1.3.2 Japan

- 5.1.3.3 India

- 5.1.3.4 Rest of Asia-Pacific

- 5.1.4 Rest of the World

- 5.1.4.1 Brazil

- 5.1.4.2 South Africa

- 5.1.4.3 Other Countries

- 5.1.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Most Adopted Strategies

- 6.2 Market Share Analysis

- 6.3 Company Profiles

- 6.3.1 Deere and Company

- 6.3.2 CNH Global NV

- 6.3.3 AGCO Corporation

- 6.3.4 CLAAS KGaA mbH

- 6.3.5 Mahindra and Mahindra Corporation

- 6.3.6 Kubota Corporation

- 6.3.7 Escorts Group

- 6.3.8 Tractors and Farm Equipment Limited (TAFE)

- 6.3.9 Kuhn Group

- 6.3.10 Yanmar Company Limited