|

市場調查報告書

商品編碼

1444542

毫米波技術:市場佔有率分析、產業趨勢與統計、成長預測(2024-2029)Millimeter Wave Technology - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

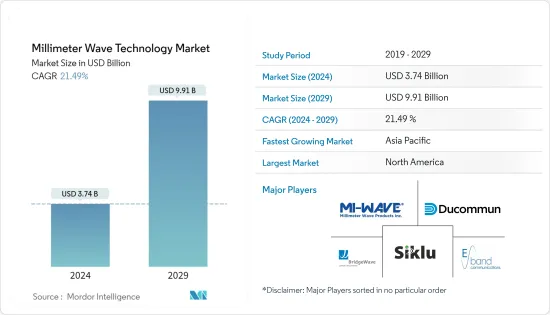

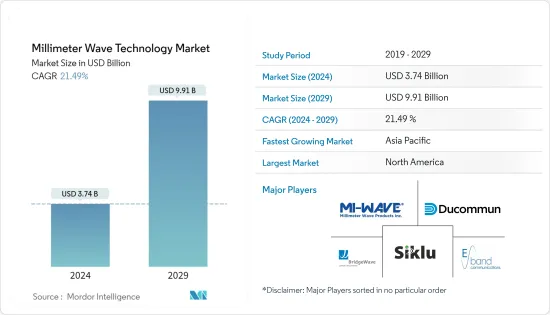

毫米波技術市場規模預計到 2024 年為 37.4 億美元,預計到 2029 年將達到 99.1 億美元,預測期內(2024-2029 年)年複合成長率為 21.49%。

主要亮點

- 該技術可滿足連網家庭、AR/VR 設備、雲端遊戲系統和其他雲端連接設備顯著成長的資料需求。此外,50 GHz 以上的毫米波頻寬可在大而重的資料區塊中提供 20 GHz 以上的額外頻寬,從而實現更高的資料速率。回程傳輸的未來尚不確定,因為一些傳統無線電頻寬(尤其是 26 GHz 和 28 GHz)現在符合 5G 無線電存取的條件。 ETSI 的 mWT ISG 已經對營運商在為 5G 分配毫米波頻寬時是否需要考慮通訊業者繼續營運 3G 和 4G 網路回程傳輸的能力提出了擔憂。

- 研究的市場在先進波束管理、更高峰值速率、多用戶 MIMO、更高有效等向性輻射功率 (EIRP)、更低噪音係數和去程傳輸共用不斷成長。從長遠來看,新的靈活解決方案預計將增加產能並提高性能,從而增加相容組件的製造成本。 5G 使用更高的運作頻率來提供更快的資料速率。因此,你需要調整和調整它們。 5G 設備的設計人員面臨許多產品開發障礙、價格考量和複雜的連接挑戰。儘管5G已經商用,但由於毫米波成本較高,仍有改進的空間。由於毫米波通訊距離短,需要安裝大型基地台,增加了成本。相容組件製造成本的上升預計將限制預測期內的市場成長。

- 除了 COVID-19 的影響外,對無線連接的需求不斷成長也推動了市場的成長。據 CITA 稱,自 2018 年美國推出 5G 以來,無線服務供應商已在其網路上花費了 1,210 億美元,在無線行業花費了 6,350 億美元。

- 根據 CTIA 的 2022 年無線產業年度調查,美國無線產業 2021 年在網路擴展、增強和營運上花費了 350 億美元。這項投資創下了新紀錄,也是資本支出第四年增加。

- 此外,無線業務的競爭也有助於在通貨膨脹時期保持較低的成本。儘管整體價格上漲,但無線成本卻有所下降,以 10 年趨勢,隨著速度提高 85 倍,無線服務成本下降了 43%。這些因素極大地推動了無線技術和行動裝置的採用,對市場成長率產生了積極影響。 5G 部署方面日益加強的合作預計也將在預測期內提高市場成長率。

毫米波技術市場趨勢

天線和收發器佔據主要市場佔有率

- 高性能毫米波設備需要高效率、薄型天線,以確保可靠且無干擾的通訊。此外,由於波長短,毫米波技術基礎設施需要將大型天線陣列封裝到較小的實體尺寸中,這增加了天線和天線的要求。專為毫米波技術設計的收發器推動市場成長。毫米波技術的高資料傳輸速度在即時遊戲、高品質視訊串流和其他頻寬密集型應用中具有多種用途。這些應用需要天線和收發器來中繼和轉換訊號,從而產生了對微帶線的需求。 -用於毫米波技術的晶片整合喇叭、透鏡、反射器和其他天線。

- 根據 GSMA 最近的一份報告,到 2030 年,5G 部署預計將達到約 10 億個連線。這項技術將支撐未來的行動創新,推動持續採用,並有可能在 2030 年為全球經濟增加近 1 兆美元。報告全文指出: 2023年,5G服務將在非洲和亞洲的30個新市場推出。隨著5G部署的不斷擴大,網路營運商正在加大力度擴展5G固定無線存取(FWA)服務。即使在固定寬頻普及較低且收入不斷成長的市場,5G 成長也預計將高於平均水準。

- 5G 毫米波在 24 GHz 至 40 GHz 範圍內使用,可在最短距離內提供大量頻譜和容量。毫米波技術利用大規模 MIMO 來增加容量並擴大覆蓋範圍。該技術以低延遲的方式提供了 5G 中可用的廣泛細分市場。毫米波頻譜分配擴展到800 MHz頻寬,提升峰值速率處理能力。廣泛的無線營運商減少了傳輸時間間隔並減少了無線介面延遲,從而更容易部署和支援低延遲敏感應用。 5G預計將利用亞太兆赫頻段(100-300GHz)提供10GHz或更高的頻寬,提供100Gbps等級的高速、高容量通訊。通訊業者正在利用其在 5G基地台無線電設備的開發和營運中累積的高頻段知識,推動毫米波技術的發展。一些國家正在為下一波工業 4.0 應用選擇高頻段頻譜分配,以便透過無線連接獲得必要的彈性。

- 例如,Verizon在25個NFL體育場部署了5G毫米波網路,讓球迷可以從不同角度觀看比賽,並在手機上體驗AR遊戲和服務。 Verizon 的低延遲 5G 超寬頻網路允許粉絲購買食物、飲料和商品。愛立信正在改進其 5G 解決方案,透過擴大小區覆蓋範圍來最大限度地發揮高頻寬的優勢。服務供應商希望支援較低頻寬的 5G 上行鏈路和較高頻寬的 5G 下行鏈路,以提供更快的資料速度。整合5G低頻寬和5G高頻寬可將高頻寬覆蓋範圍提高高達10 dB。

- 此外,Verizon 計劃於 2023 年 2 月與無線接取網路設備供應商 Vendor Networks 合作,解決基於毫米波 (mmWave) 的 5G 部署挑戰。 Verana 的整合式存取和回程傳輸平台透過封裝毫米波天線解決了具有挑戰性的基於毫米波 (mmWave) 的 5G 部署。這增加了毫米波技術市場對天線和收發器組件的需求。

- 因此,各種最終用戶應用對高速通訊的需求以及毫米波通訊對相控天線和高性能收發器的需求正在推動天線和收發器組件市場的成長,這是由收購、投資和在此期間毫米波技術市場相關人員之間的合作。

北美佔據主要市場佔有率

- 美國在利用毫米波頻譜進行各種應用方面取得了巨大進展。美國聯邦通訊委員會 (FCC) 等監管機構分配和競標毫米波頻寬以供許可和非許可使用。特別是,FCC 為 5G 和其他無線通訊技術開放了 28 GHz、37 GHz、39 GHz 和 47 GHz 等頻寬的頻譜。

- 此外,5G網路在美國的推出也是毫米波技術採用的推手。此外,總部位於亞利桑那州的網路測試和測量公司Viavi Solutions表示,美國是世界上實施網路存取的城市數量最多的最重要的國家之一。

- 天線和收發器組件因其廣泛的應用(例如 5G基地台、無線回程傳輸系統、固定無線存取 (FWA) 設備和雷達系統)而預計將在美國獲得廣泛關注。此外,嚴重依賴毫米波技術的 5G 網路的推出正在推動對高效能天線和收發器的需求。

- 由於 5G 部署、頻譜可用性、資料需求和 FWA 擴展的整合,美國毫米波技術市場正在經歷強勁成長。這些因素加上企業合作和監管支持,為未來幾年的持續擴張和創新奠定了市場基礎。

- 加拿大在利用毫米波頻譜進行各種應用方面取得了重大進展。加拿大創新、科學和經濟發展 (ISED) 等監管機構負責分配和管理毫米波頻率的許可和非許可用途。 26 GHz、28 GHz、38 GHz 和其他頻寬的頻率是毫米波應用的關鍵資產。

- 此外,日本對利用毫米波頻率實現超快網際網路速度和低延遲的 5G 網路的需求日益成長。例如,根據愛立信的報告,截至2022年11月,預計將有400萬加拿大智慧型手機用戶在未來12至15個月內升級到5G服務。此外,雖然只有三分之一的加拿大 5G 用戶認為自己連接網路的時間超過 50%,但 45% 的用戶表示他們仍然擔心覆蓋範圍。預計這些關鍵問題將集中在毫米波頻譜中引入高頻無線電波以滿足不斷成長的需求。

毫米波技術產業概況

毫米波技術市場由多家在競爭相當激烈的市場空間中獲得關注的公司組成。由於多家公司認為該市場是一個有利可圖的擴張機會,因此在預測期內,公司集中度預計將進一步提高。一些著名的市場參與者包括 Siklu Communication Ltd、E-band Communications LLC (Axxcss Wireless Solutions Inc.)、Bridgewave Communications Inc. (Remec Broadband Wireless International)、Ducommun Incorporated 和 Millimeter Wave Products Inc.。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場洞察

- 市場概況

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 買方議價能力

- 新進入者的威脅

- 競爭公司之間的敵意強度

- 替代產品的威脅

- 評估 COVID-19 對產業的影響

- 廣泛介紹了 GaN 在毫米波應用中的重要性,包括目前推出的產品、近期潛力(基於專利申請)、優勢和基板級開發等。

- 毫米波基板形勢(包括LCP、PI和PTFE等毫米波基板及其對5G基礎設施(包括基地台、電話和周邊設備)的影響)

第5章市場動態

- 市場促進因素

- 基地台無線回程傳輸普及

- 5G演進預計將推動市場

- 市場限制因素

- 需要製造相容零件並增加零件成本

- 技術漏洞導致訊號強度降低

第6章市場區隔

- 依組件類型

- 天線和收發器

- 通訊和網路

- 介面

- 頻率和相關組件

- 影像

- 其他組件

- 按許可模式

- 完全/部分許可

- 未經授權

- 按地區

- 北美洲

- 美國

- 加拿大

- 歐洲

- 英國

- 德國

- 法國

- 其他歐洲國家

- 亞太地區

- 中國

- 日本

- 印度

- 韓國

- 其他亞太地區

- 中東和非洲

- 拉丁美洲

- 北美洲

第7章 競爭形勢

- 公司簡介

- Siklu Communication Ltd

- Bridgewave Communications Inc.(Remec Broadband Wireless International)

- E-band Communications LLC(Axxcss Wireless Solutions Inc.)

- Millimeter Wave Products Inc.

- Ducommun Incorporated

- Eravant(SAGE Millimeter Inc.)

- Keysight Technologies Inc.

- Farran Technology Ltd

- Smiths Interconnect Group Limited

- NEC Corporation

- L3Harris Technologies Inc.

第8章投資分析

第9章市場機會與未來趨勢

The Millimeter Wave Technology Market size is estimated at USD 3.74 billion in 2024, and is expected to reach USD 9.91 billion by 2029, growing at a CAGR of 21.49% during the forecast period (2024-2029).

Key Highlights

- The technology accommodates the massive increase in data demands from connected homes, AR/VR devices, cloud gaming systems, and other cloud-connected devices. Furthermore, mmWave bands above 50 GHz can provide over 20 GHz additional bandwidth in large, heavy chunks, allowing higher data rates. Some traditional wireless bands, notably 26 GHz and 28 GHz, have an uncertain future for backhaul since they are now targeted for 5G radio access. ETSI's mWT ISG already expressed concern regarding the need, while allocating mmWave bands for 5G, to consider operators' ability to continue operating the backhaul for their 3G and 4G networks.

- There is a rise in advanced beam management, higher peak rates, multi-user MIMO, higher effective isotropic radiated power (EIRP), lower noise figure, and fronthaul sharing in the market studied. In the long term, new flexible solutions are expected to add more capacity and boost performance, thereby raising the cost of manufacturing compatible components. 5G uses higher operating frequencies to facilitate faster data rates. Therefore, they must be calibrated and coordinated. Designers of 5G-enabled devices face many product development obstacles, price considerations, and complex connectivity challenges. 5G has already been commercialized, and mmWave still needs to be improved in terms of its high costs. The short range of mmWave requires large base stations to be installed, thus making it expensive. A rise in manufacturing costs for compatible components is anticipated to restrict the market's growth during the forecast period.

- The growing demand for wireless connections, along with the impact of COVID-19, contributes to the growth rate of the market. According to CITA, wireless service providers have spent USD 121 billion on their networks and USD 635 billion on the wireless industry since the introduction of 5G in 2018 in the United States.

- According to the CTIA's 2022 Annual Wireless Sector Survey, the wireless sector in America spent USD 35 billion in 2021 on expanding, enhancing, and operating their networks. The investment set a new record and was the fourth year in which capital expenses increased.

- Moreover, during inflation, competition in the wireless business also contributed to maintaining low costs. Despite an overall rise in pricing, wireless costs decreased, following a 10-year trend in which the cost of wireless services decreased to 43% as speeds increased to 85 times. These factors are significantly boosting the adoption of wireless technology and mobile devices, thereby positively impacting the growth rate of the market. The growing collaborations in deploying 5G are also expected to bolster the market's growth rate during the forecast period.

Millimeter Wave Technology Market Trends

Antennas and Transceivers to Hold Major Market Share

- High-performing millimeter-wave devices require efficient low-profile antennas to ensure reliable and interference-free communications, and due to small wavelength, mmWave technology infrastructure requires large antenna arrays to be packed in miniature physical dimensions, which fuels the requirement of antennas and transceivers designed for the millimeter (mm) wave technology, fueling the market growth. The higher data transfer rate of the mmWave technology has various uses in real-time gaming, high-quality video streaming, and other bandwidth-intensive applications, which require antennas and transceivers for relaying and transforming the signals, creating a demand for Microstrip, On-chip Integrated Horn, Lens, and Reflector, and other antennas for mmWave technology.

- According to a recent GSMA report, 5G adoption is anticipated to reach around a billion connections by 2030. The technology will likely underpin future mobile innovation and boost ongoing deployments, adding almost USD 1 trillion to the global economy in 2030. The report states that throughout 2023, 30 new markets across Africa and Asia will launch 5G services. As 5G adoption continues to scale, network operators are increasing their efforts to expand their 5G fixed wireless access (FWA) offerings. Markets with low fixed broadband penetration and rising incomes will also see faster-than-average 5G growth.

- 5G mmWave are found in the range of 24GHz to 40GHz and deliver large quantities of spectrum and capacity over the shortest distances. Millimeter wave technology utilizes massive MIMO to expand capacity and extend coverage. The technology offers a broad range of segments available for 5G with lower latency. Spectrum allocations for mmWave are extensive, with an 800 MHz band, which delivers improved handling of peak rates. Wide radio carriers enable shorter transmission time intervals and lower radio-interface latency to facilitate introducing and supporting low-latency-sensitive applications. 5G is expected to deliver 100 Gbps-class high-speed, high-capacity communications achieved using the sub-terahertz band (100 to 300 GHz), which can provide a bandwidth of 10 GHz or more. Network operators continue to advance millimeter-wave technological development by leveraging the knowledge of high-frequency bands cultivated through developing and operating radio equipment for 5G base stations. In some countries, high-band spectrum allocations are being chosen for the next wave of Industry 4.0 applications to get the necessary flexibility through wireless connectivity.

- For instance, Verizon deployed 5G mmWave networks in 25 NFL stadiums, where fans watched the action from multiple angles on their handsets and experienced AR games and services. Verizon's low latency 5G Ultra-Wideband network enables fans to buy food, beverages, and merchandise. Ericsson is evolving its 5G solutions to maximize the benefits of the high band by extending cell coverage. Service providers are trying to support the 5G uplink on a low band, with the 5G downlink operating on a high band, thereby providing higher data speeds. Aggregating the 5G low band with the 5G high band can improve high-band coverage by up to 10 dB.

- Additionally, in February 2023, Verizon partnered with the radio access network equipment vendor Verana Networks for its plans to solve challenging millimeter-wave (mmWave)-based 5G deployments by adopting Verizon is tapping upstart radio access network equipment vendor Verana Networks for its plans to solve challenging millimeter-wave (mmWave)-based 5G deployments by Verana's Integrated Access and Backhaul platform packages a mmWave antenna, which would raise the demand for antenna and transceiver components in the market of mm-wave technology.

- Therefore, the need for high-speed communications in various end-user applications and the need for phase antennas and highly capable transceivers for mmWave communication is creating a growth of the antennas and transceiver component market growth, which is supported by the acquisitions, investments, and collaborations among the stakeholders of the millimeter wave technology market during the forecast period.

North America to Hold Major Market Share

- The United States has made significant strides in utilizing the millimeter wave spectrum for various applications. Regulatory bodies like the Federal Communications Commission (FCC) have allocated and auctioned millimeter wave frequency bands for licensed and unlicensed use. Notably, the FCC has opened up spectrum in the 28 GHz, 37 GHz, 39 GHz, and 47 GHz bands, among others, for 5G and other wireless communication technologies.

- In addition, the rollout of 5G networks in the United States has been a driving factor behind the adoption of millimeter wave technology. Moreover, Viavi Solutions, an Arizona-based network test and measurement company, stated that the United States is one of the significant global countries with the most cities adopting network access.

- Antennas and transceiver components are expected to gain significant prominence in the United States owing to the wide range of applications, including 5G base stations, wireless backhaul systems, fixed wireless access (FWA) equipment, and radar systems. Also, the rollout of 5G networks, which heavily rely on millimeter wave technology, has driven the demand for high-performance antennas and transceivers.

- The United States millimeter wave technology market is experiencing robust growth due to the convergence of 5G deployment, spectrum availability, data demand, and FWA expansion. In addition to these factors, corporate collaborations and regulatory support position the market for continued expansion and innovation in the coming years.

- Canada has made substantial strides in leveraging the millimeter wave spectrum for various applications. Regulatory authorities, such as Innovation, Science, and Economic Development Canada (ISED), allocate and control the use of millimeter wave frequencies for licensed and unlicensed purposes. Frequencies in the 26 GHz, 28 GHz, 38 GHz, and other bands are significant assets for millimeter wave applications.

- Moreover, the country's rising need for 5G networks that leverage millimeter wave frequencies to deliver ultra-fast internet speeds and low latency is increasing. For instance, according to Ericsson reports, as of November 2022, in the upcoming 12 to 15 months, four million Canadian smartphone users intend to upgrade to 5G service. Additionally, only a third of Canadian 5G users believe they are connected to the network more than 50% of the time, while 45% of users still stated they have coverage concerns. Such significant concerns are anticipated to focus on deploying high-frequency radio waves in the millimeter wave spectrum to capture the growing demand.

Millimeter Wave Technology Industry Overview

The millimeter wave technology market comprises several players for attention in a fairly contested market space. The firm concentration ratio is expected to grow more during the forecast period because several firms observe this market as a lucrative opportunity to expand. Some of the prominent market players are Siklu Communication Ltd, E-band Communications LLC (Axxcss Wireless Solutions Inc.), Bridgewave Communications Inc. (Remec Broadband Wireless International), Ducommun Incorporated, and Millimeter Wave Products Inc., among others.

- August 2023 - Siklu, a global provider of millimeter wave (mmWave) solutions for Digital City and Gigabit Wireless Access (GWA), announced the availability of its new MultiHaul TG T261 terminal unit. The T261 represents Siklu's fourth addition to the MultiHaul TG family of point-to-multipoint 60 GHz products and is Terragraph (TG) certified. Measuring only 4.3 x 6.2 x 2 in. (10.8 x 15.7 x 5.2 cm), the T261 is easily installed on almost any exterior surface. It is connected to a MultiHaul TG distribution node to serve as an endpoint in a fully-meshed MH TG topology.

- October 2022 - Ducommun announced the opening of its new facility in Guaymas, Mexico. The new facility spans 1,15,000 square feet and has multiple capabilities, including metal bond, VersaCore Composites, cable and harness assembly, and hard metal fabrication. Ducommun's expanded operations in Mexico will allow the company to continue its successful legacy of providing the highest product and process quality while delivering maximum competitive value to its OEM customers.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Threat of New Entrants

- 4.2.4 Intensity of Competitive Rivalry

- 4.2.5 Threat of Substitute Products

- 4.3 Assessment of Impact of COVID-19 on the Industry

- 4.4 Significance of GaN across mmWave Applications (To Include Extensive Coverage on Current Launch, Near-term Potential (Based on Patent Filing), Advantages, and Substrate-level Developments, Among Others.)

- 4.5 mmwave Substrate Landscape (To Include Coverage on mmwave Substrates Such As LCP, PI, and PTFE, Along With Their Impact on 5G Infrastructure, Including Base Stations, Phones, and Peripherals)

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Proliferation of Wireless Backhaul of Base Stations

- 5.1.2 Evolution of 5G is Expected to Drive the Market

- 5.2 Market Restraints

- 5.2.1 Need for Manufacturing of Compatible Components and Rising Cost of Components

- 5.2.2 Technological Vulnerabilities Leading to Reduced Wave Strength

6 MARKET SEGMENTATION

- 6.1 By Type of Component

- 6.1.1 Antennas and Transceiver

- 6.1.2 Communications and Networking

- 6.1.3 Interface

- 6.1.4 Frequency and Related Components

- 6.1.5 Imaging

- 6.1.6 Other Components

- 6.2 By Licensing Model

- 6.2.1 Fully/Partly Licensed

- 6.2.2 Unlicensed

- 6.3 By Geography

- 6.3.1 North America

- 6.3.1.1 United States

- 6.3.1.2 Canada

- 6.3.2 Europe

- 6.3.2.1 United Kingdom

- 6.3.2.2 Germany

- 6.3.2.3 France

- 6.3.2.4 Rest of Europe

- 6.3.3 Asia-Pacific

- 6.3.3.1 China

- 6.3.3.2 Japan

- 6.3.3.3 India

- 6.3.3.4 South Korea

- 6.3.3.5 Rest of Asia-Pacific

- 6.3.4 Middle East and Africa

- 6.3.5 Latin America

- 6.3.1 North America

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Siklu Communication Ltd

- 7.1.2 Bridgewave Communications Inc. (Remec Broadband Wireless International)

- 7.1.3 E-band Communications LLC (Axxcss Wireless Solutions Inc.)

- 7.1.4 Millimeter Wave Products Inc.

- 7.1.5 Ducommun Incorporated

- 7.1.6 Eravant (SAGE Millimeter Inc.)

- 7.1.7 Keysight Technologies Inc.

- 7.1.8 Farran Technology Ltd

- 7.1.9 Smiths Interconnect Group Limited

- 7.1.10 NEC Corporation

- 7.1.11 L3Harris Technologies Inc.