|

市場調查報告書

商品編碼

1444483

超級資料中心:市場佔有率分析、產業趨勢與統計、成長預測(2024-2029)Mega Data Center - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

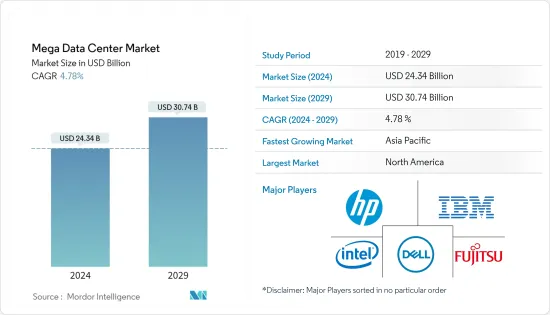

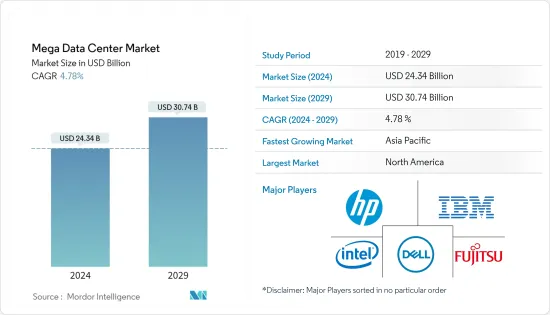

超級資料中心市場規模預計到 2024 年為 243.4 億美元,預計到 2029 年將達到 307.4 億美元,預測期內(2024-2029 年)年複合成長率為 4.78%

主要亮點

- 多年來,虛擬一直在推動資料中心產業的發展。公司正試圖透過將 IT 營運集中在更少、利用率更高的機器上來減少基礎設施。這個過程整體為資料中心創造了更廣闊的視野。經營多個資料中心的公司可能會選擇將其設施集中到幾個大型實施中,以降低複雜性和成本。

- 透過減少建立的超級資料中心的數量(取決於其位置),公司可以享受特定的區域優勢,例如稅收優惠、較低的能源價格、氣候和替代能源的可用性。事實確實如此。因此,超級資料中心的出現是為了最小化成本和最大化利潤。

- 選擇軟體主導、行業相關且設置良好的超級資料中心的好處是,與現在相比,IT 管理成本更低,並且可以在本地存取大量網際網路和工業網際網路資料。這是可能的。資料中心速度和頻寬。這項功能可能會增加全球的 IT 支出,因為早期採用者有很大機會投資新的 IT 技術,以降低整體成本並增加業務收益。

- 雲端和主機代管服務數量的增加、相關的成本效益以及規模經濟的增加等因素正在推動超級資料中心市場的發展。 Microsoft、Google、Amazon Web Services (AWS) 和 Facebook資料中心自成一類。透過到每個節點的多條途徑,創建一個完全自動化、自我修復、網路附加的巨資料結構,該結構以光纖速度運行,以創建一個超級資料中心必須正常運轉。

- 然而,較高的初始投資和較低的資源可用性是對該市場構成挑戰的一些因素。儘管存在這些挑戰,許多組織已經實施或開始實施超級資料中心。

超級資料中心市場趨勢

銀行和金融領域對資料中心的需求不斷成長

- 銀行和金融部門是資料產生最多的部門之一,對資料中心調節營運成本的需求是主要驅動力。金融和銀行組織使用資料中心來儲存客戶記錄、員工管理、交易以及遠端銀行業務、銀行業務和自助查詢等電子銀行業務服務,但它們需要資料中心才能發揮作用。

- 資料中心作為基礎設施被認為是金融的未來。許多金融機構正在建立具有大型網路、儲存和伺服器容量的私有雲端系統,以支援零售金融中心、ATM 和活躍線上帳戶。

- 儘管許多銀行都擁有自己的資料中心,但據觀察,由於銀行利潤的波動,這種趨勢正在改變。維護資料中心也很麻煩,因為它需要適當的冷卻、安全和電力設備,導致 IT、房地產和營運成本。在預測期內,這可能對 BFSI 產業構成挑戰。

亞太地區需求不斷成長推動市場

- 中國各地對高密度、冗餘設施不斷成長的需求正在推動中國資料中心設計和開發的變化。中國每100人就有50個網路用戶,發展空間很大。連接生態系統還包括 73 個主機代管資料中心、52 個雲端服務供應商和 0 個網路結構。

- 然而,在中國,電力、空間和IP傳輸都是有代價的,凸顯了資料中心維護的困難。同樣,在印度,數位經濟對GDP的貢獻率為9.5%。數位經濟包括255.18億美元的固定電話合約和10110.54億美元的行動電話契約,顯示資料中心的發展空間巨大。

- 此外,由於監管和安全原因,印度的許多組織,尤其是 BFSI 部門,不允許將資料託管在國外的資料中心。因此,資料中心供應商正在印度建立本地資料中心,這表明印度龐大的資料中心設施正在成長。

超級資料中心產業概況

超級資料中心市場由於初始投資高、資源可用性低而高度集中,為該市場帶來了挑戰。該市場的主要企業包括思科系統公司、戴爾軟體公司、富士通有限公司和惠普企業。市場的最新發展包括:

2022 年 9 月,微軟在卡達推出了新的資料中心區域,成為該國第一家提供企業級服務的超大規模雲端供應商。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 調查先決條件和定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場動態

- 市場概況

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 買方議價能力

- 新進入者的威脅

- 替代產品的威脅

- 競爭公司之間的敵意強度

- 市場促進因素與阻礙因素簡介

- 市場促進因素

- 資料中心整合需求不斷成長

- 銀行和金融領域對資料中心的需求不斷成長

- 市場限制因素

- 投資及安裝成本高

- 技術簡介

第5章市場區隔

- 按解決方案

- 貯存

- 聯網

- 伺服器

- 安全

- 其他解決方案

- 按最終用戶

- BFSI

- 通訊和資訊技術

- 政府

- 媒體與娛樂

- 其他最終用戶

- 地區

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 中東和非洲

第6章 競爭形勢

- 公司簡介

- Cisco Systems Inc.

- Dell Software Inc.

- Fujitsu Ltd

- Hewlett-Packard Enterprise

- IBM Corporation

- Intel Corporation

- Juniper Networks Inc.

- Verizon Wireless

第7章 投資分析

第8章市場機會及未來趨勢

The Mega Data Center Market size is estimated at USD 24.34 billion in 2024, and is expected to reach USD 30.74 billion by 2029, growing at a CAGR of 4.78% during the forecast period (2024-2029).

Key Highlights

- Virtualization has driven the data center industry over the years. Companies have sought to reduce infrastructure by focusing IT operations on fewer, more highly utilized machines. This process has led to a wider view of data centers in general. Companies operating multiple data centers can choose to focus their facilities on fewer and larger implementations to decrease complexity and costs.

- Implementing fewer mega data centers, depending on their locations, can allow a company to enjoy advantages of certain local benefits, such as tax incentives, low energy prices, climate, or availability of alternative energy sources. Thus, mega data centers result from attempts to minimize cost and maximize profit.

- The merits of choosing a software-led, industry-relevant, and adequately set-up mega data center are lower costs of IT management compared to the present, as well as the ability to access a vast amount of internet and industrial Internet data at local data center speed and bandwidth. This capability is likely to spur IT spending worldwide, as early adopters will have substantial opportunities to invest in new IT techniques to reduce overall business costs and increase revenues.

- Factors including increasing cloud and colocation services, associated cost benefits, and improved economies of scale drive the market for mega data centers. Microsoft, Google, Amazon Web Services (AWS), and Facebook data centers are in a class by themselves. They have to function fully automatic, self-healing, networked mega data centers that operate at fiber optic speeds to make a fabric that can access any node in any particular data center, as there are multiple pathways to every node.

- However, higher initial investments and low resource availability are some factors presenting challenges to this market. Despite such challenges, various organizations have already adopted or are initiating the adoption of mega data centers.

Mega Data Center Market Trends

Rising Demand of Data Centers in Banking and Finance Sectors

- The banking and finance sector is one of the largest generators of data, and the need for a data center to regulate the cost of operations is a primary driver. Finance and banking structures use data centers to store customer records, employee management, transactions, and electronic banking services, such as remote banking, telebanking, and self-inquiry, which need data centers to function.

- Data centers, as infrastructure, are believed to be the future of finance. Many institutions have created private cloud systems to accommodate massive network, storage, and server capacities to support their retail financial centers, ATMs, and active online accounts.

- Many banks maintain their own data centers, but it has been observed that the trend is changing due to fluctuations in the banks' profits. Also, maintaining a data center is cumbersome, owing to the cost drain on IT, real estate, and operations, as it requires proper cooling, security, and power facilities. This can act as a challenge for the BFSI industry during the forecast period.

Growing Demand from Asia-Pacific to Drive the Market

- The growing demand for high-density, redundant facilities throughout China is precipitating a shift in the design and development of the country's data centers. China has 50 internet users per 100 population, indicating scope for a lot of development, and the connectivity ecosystem comprises 73 colocation data centers, 52 cloud service providers, and 0 network fabrics.

- However, power, space, and IP transit all cost more in China, emphasizing the difficulties in maintaining a data center. Similarly, in India, the digital economy contributes 9.5% of the GDP. The digital economy includes USD 25,518 million fixed-line telephone subscriptions and 1,011.054 million mobile telephone subscriptions, indicating a lot of scope for the development of data centers.

- Moreover, owing to regulatory and security reasons, a number of organizations in India, especially from the BFSI sector, are not allowed to host their data in a data center that is out of the country. As a result, the data center providers are setting up local data centers in India, indicating the growing mega data center facilities in India.

Mega Data Center Industry Overview

The mega data center market is highly concentrated due to higher initial investments and low availability of resources, which present challenges to this market. Some of the key players in the market are Cisco Systems Inc., Dell Software Inc., Fujitsu Ltd, and Hewlett-Packard Enterprise. Some recent developments in the market include:

In September 2022, Microsoft launched its new data center region in Qatar, becoming the first hyper-scale cloud provider to offer enterprise-grade services in the nation.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions & Definitions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers/Consumers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Introduction to Market Drivers and Restraints

- 4.4 Market Drivers

- 4.4.1 Increasing Demand for Data Center Consolidation

- 4.4.2 Rising Demand of Data Centers in Banking and Finance Sectors

- 4.5 Market Restraints

- 4.5.1 High Investment and Installation Costs

- 4.6 Technology Snapshot

5 MARKET SEGMENTATION

- 5.1 By Solution

- 5.1.1 Storage

- 5.1.2 Networking

- 5.1.3 Server

- 5.1.4 Security

- 5.1.5 Other Solutions

- 5.2 By End-user

- 5.2.1 BFSI

- 5.2.2 Telecom and IT

- 5.2.3 Government

- 5.2.4 Media and Entertainment

- 5.2.5 Other End-users

- 5.3 Geography

- 5.3.1 North America

- 5.3.2 Europe

- 5.3.3 Asia-Pacific

- 5.3.4 Latin America

- 5.3.5 Middle East & Africa

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 Cisco Systems Inc.

- 6.1.2 Dell Software Inc.

- 6.1.3 Fujitsu Ltd

- 6.1.4 Hewlett-Packard Enterprise

- 6.1.5 IBM Corporation

- 6.1.6 Intel Corporation

- 6.1.7 Juniper Networks Inc.

- 6.1.8 Verizon Wireless