|

市場調查報告書

商品編碼

1438453

超大規模資料中心:市場佔有率分析、產業趨勢與統計、成長預測(2024-2029)Hyperscale Datacenter - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

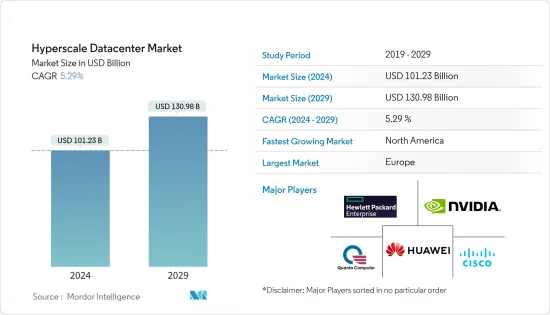

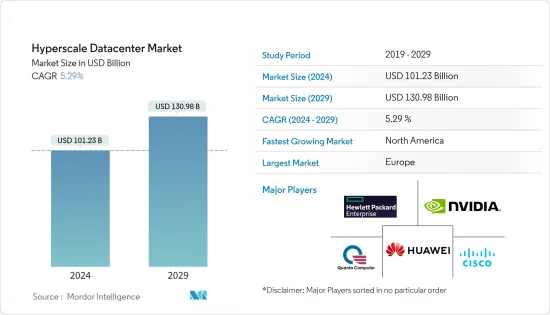

超大規模資料中心市場規模預計到 2024 年為 1,012.3 億美元,預計到 2029 年將達到 1,309.8 億美元,在預測期內(2024-2029 年)成長 5.29%。年複合成長率為

近年來,由於服務高階應用程式的運算和儲存需求不斷增加,超大規模資料中心變得極其強大。業務關鍵型應用程式不斷增加,導致資料中心變得更加複雜。 Web、電子商務、社交媒體、巨量資料、運算、線上遊戲託管和 Hadoop 的日益普及增加了對基礎設施的需求,以提高應用程式速度、能源效率和伺服器密度。

主要亮點

- 直到最近,資料仍被認為是新興經濟的基礎。幾乎所有企業都在使用比以往更多的資料,未來可能會消耗更多的資料。這種快速增加的資料產生需要在某個地方儲存和存取。根據思科系統公司的數據,全球 IP資料流量從 2016 年的每月 96,054 Petabyte成長到 2018 年的每月 150,910 Petabyte,去年達到每月 278,108 Petabyte。

- 此外,透過網路上提供的應用程式和服務繞過傳統的分發方法,對 OTT 應用程式的需求Over-the-Top成長。Over-the-Top服務中提供的服務與媒體和通訊產業高度相關,可以低成本獲取,有助於大量資料成長,並正在推動市場發展。

- 此外,作為數位轉型策略的一部分,物聯網、雲端、巨量資料和分析在多個企業中的迅速採用也增加了資料中心的壓力,全球超大規模資料中心導致了資料中心的成長。

- 提供大規模雲端服務、電子商務、先進醫藥研究、石油和天然氣、航太、證券交易所等的公司正在投資必要的網路基礎設施。然而,現有的新一代防火牆(NGFW)仍需要滿足超大規模架構的大規模和效能需求,這使得採購滿足這些需求的安全解決方案成為一項挑戰。

- 最近的 COVID-19感染疾病使資料中心需求兩極化,超大規模公司和雲端平台的強勁採購。相較之下,許多企業用戶的支出已經放緩。受疫情影響的租賃活動集中在主要雲端市場。大流行後,由於數位化的採用增加以及公司轉向混合和遠端工作模式,市場正在快速成長。

超大規模資料中心市場趨勢

對雲端運算和其他高效能技術不斷成長的需求推動了市場

- 技術應用的不斷成長和消費者對雲端的趨勢正在迅速增加對雲端基礎的解決方案的需求。該技術允許用戶從遠端位置存取資料。企業越來越意識到將資料遷移到雲端以節省成本和資源的重要性,而不是建置和維護本地基礎設施,這增加了對雲端基礎的解決方案的需求。

- 由於這些優勢,大型和小型企業擴大採用雲端基礎的解決方案。在接下來的幾年裡,雲端運算和虛擬將允許您透過對軟體進行分區來節省設定成本,這最終將減少硬體的使用。

- 世界各地的企業和政府機構正在從測試環境轉向將更多業務關鍵型工作負載和運算實例放置在雲端。同樣,對於消費者來說,雲端服務可以讓他們輕鬆地從任何地方、在多個裝置上存取內容和服務。

- 印尼對資料儲存和託管服務的需求預計將大幅增加。雅加達的兩個資料中心將滿足客戶的需求,特別是雲端服務供應商和金融業,他們需要靈活的設施設計來幫助實現其業務目標。今年 4 月,領先的IT基礎設施和服務公司之一 NTT Ltd推出了印尼最大的資料中心(位於雅加達的第三個資料中心),以支援東南亞不斷成長的數位經濟,我們擴大了超大規模資料中心的覆蓋範圍。

- 企業使用雲端運算最常見的方式之一是透過許多主要的全球技術公司提供的眾多「即服務」替代方案。這些服務使企業能夠存取運算能力、軟體和其他與雲端相關的操作,而無需本地基礎設施。據 Flexera Software 稱,截至今年 3 月,46% 的受訪者已經在 Amazon Web Services 上運行關鍵工作負載。

德國預計將佔據主要市場佔有率

- 全球大流行期間電子交易、系統和數位資訊的激增導致歐洲數位流量大幅增加。新公司的迅速崛起,加上人口的不斷成長,將增加對超大規模資料中心的需求。

- 近年來,由於超大規模資料中心的大力發展以及GDPR的實施,德國資料中心市場顯著成長,帶動了德國的投資和區域雲端網路發展。

- 雲端使用和投資的增加促使該國許多公司改善德國的雲端基礎設施,從而推動了市場的成長。例如,Google於2021年8月宣布,2030年將投資10億歐元,加強對可再生能源的利用,並在德國開發雲端運算基礎設施。

- 今年 6 月,Vantage資料中心宣佈在柏林和華沙的兩個待開發區園區開始營運。這些新站點是 Vantage 20 億美元歐洲擴張的一部分,在兩個超大規模資料中心業者企業和雲端供應商歡迎的市場提供資料中心園區。

- 此外,今年2月,美國和歐洲超大規模資料中心開發商和營運商Cloud HQ在奧芬巴赫建造了一座112兆瓦、120萬平方英尺(108,000平方公尺)的超大規模資料中心園區。 ,毗鄰德國法蘭克福東南部的城市。 CloudHQ 的法蘭克福資料中心園區總投資達 11 億歐元(11.5 億美元),建成後將成為德國最大的超大規模資料中心之一。

超大規模資料中心產業概述

超大規模資料中心市場適度分散,包括跨國企業和中小企業。此外,超大規模資料中心應用於各行業,為供應商提供成長機會。市場參與者正在採取合作夥伴關係和收購等策略來增強其產品供應並獲得永續的競爭優勢。

2022 年 10 月,微軟公司計劃在浦那開發一個大型超大規模資料中心,作為其在印度多城市資料中心策略的一部分。作為開發的一部分,該公司透過與 Finolex Industries 簽訂的長期租賃協議,以約 32.9 億盧比(4,020 萬美元)的價格收購了該市 Pimpri-Wagere 地區的一塊 25 英畝的土地。該計劃是在該地點開發資料中心。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場洞察

- 市場概況

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 競爭公司之間的敵意強度

- 替代產品的威脅

- 產業價值鏈分析

- 技術簡介

- 評估新型冠狀病毒感染疾病(COVID-19)對市場的影響

第5章市場動態

- 市場促進因素

- 對雲端運算和其他高效能技術的需求不斷成長

- 市場挑戰

- 資料中心安全挑戰

- 能源消耗過多、產能規劃效率低下

- 市場機會

第6章市場區隔

- 按最終用戶

- 公司

- 主機代管提供者

- 按國家/地區

- 美國

- 加拿大

- 中國

- 日本

- 澳洲

- 英國

- 德國

- 其他

第7章 競爭形勢

- 公司簡介

- Hewlett Packard Enterprise Co

- Cisco Systems Inc.

- Huawei Technologies Co.

- Nvidia Corporation

- Quanta Computer Inc.

- IBM Corporation

- Amazon Web Services Inc.

- Microsoft Corporation

- Alibaba Group

- Alphabet Inc.

- Facebook Inc.

第8章投資分析

第9章市場的未來

The Hyperscale Datacenter Market size is estimated at USD 101.23 billion in 2024, and is expected to reach USD 130.98 billion by 2029, growing at a CAGR of 5.29% during the forecast period (2024-2029).

Hyperscale data centers have become highly powerful in recent years due to the increased computing and storage requirements to serve high-end applications. Business-critical apps are increasing, resulting in greater data center complexity. With the rising popularity of the web, e-commerce, social media, big data, computing, online gaming hosting, and Hadoop, the infrastructure needs to improve application speed, energy efficiency, and server density are increasing.

Key Highlights

- In the recent past, data was considered the foundation of an emerging economy. Almost all enterprises use more data than before and will probably consume even more data in the future. This rapidly increasing data generation must be stored and accessed from somewhere. According to Cisco Systems, the global IP data traffic increased from 96,054 petabytes per month in 2016 to 150,910 petabytes per month in 2018, and it reached 278,108 petabytes per month last year.

- Moreover, the rising demand for over-the-top (OTT) applications through an app or service that can be availed over the internet bypass traditional distribution practices. Services available for over-the-top services are significantly related to the media and communication sector, which can be accessed at a lower cost and contributes to massive data growth, thereby driving the market.

- Furthermore, owing to the rapidly increasing adoption of IoT, cloud, and Big Data, analytics across multiple enterprises as a part of their digital transformation strategy, the burden on the data centers is also increasing, leading to growth in the hyperscale data centers globally.

- Enterprises that offer large cloud services, e-commerce, advanced research of pharmaceuticals, oil and gas, aerospace, stock exchange, and others have invested in the network infrastructure they require. However, sourcing security solutions to meet these needs presents a challenge since existing next-generation firewalls (NGFWs) still need to meet the massive scale and performance needs of hyperscale architectures.

- With the recent outbreak of COVID-19 worldwide, the demand for the data center is bifurcated with strong buying by hyperscale companies and cloud platforms. In contrast, there was a slowdown in spending by many enterprise users. Pandemic-driven leasing activity was concentrated in significant cloud markets. After the pandemic, the market is growing rapidly with the increased adoption of digitization and enterprises moving toward hybrid and remote working models.

Hyperscale Data Center Market Trends

Growing Demand for Cloud Computing and Other Hight Performance Technologies Driving the Market

- The demand for cloud-based solutions is surging, owing to the growing application of technology and consumer propensity towards the cloud. This technology allows the user to access the data from remote locations. The increasing realization among companies about the importance of saving money and resources by moving their data to the cloud rather than building and maintaining on-premise infrastructure is driving the demand for cloud-based solutions.

- Owing to these benefits, large enterprises and SMEs are increasingly adopting cloud-based solutions. Over the next few years, cloud computing and virtualization will be able to save the setup cost of software by dividing it, ultimately leading to decreasing the use of hardware.

- Enterprises and government organizations worldwide are moving from test environments to placing more work-critical workloads and compute instances into the cloud. Similarly, for consumers, cloud services offer anywhere and easy access to content and services on multiple devices.

- The demand for data storage and managed hosting services is expected to increase dramatically across Indonesia. Jakarta's two Data Centers will accommodate clients' needs, particularly cloud service providers and the financial industry, which require flexible facility designs to help them achieve their business objectives. In April this year, NTT Ltd, one of the leading IT infrastructure and services companies, expanded its hyperscale data center footprint by launching the largest data center in Indonesia (Jakarta's third data center) to support the growing digital economy in Southeast Asia.

- One of the most common methods for businesses to use cloud computing is to use the numerous "as-a-service" alternatives provided by many major global technology corporations. These services give businesses access to computing power, software, and other cloud-related operations without the need for on-premises infrastructure. According to Flexera Software, as of March this year, 46% of respondents are already running significant workloads on Amazon Web Services.

Germany is Expected to Hold Major Market Share

- European digital traffic increased tremendously due to the surge in electronic transactions, systems, and digital information during the global pandemic. When paired with the rapid rise of new firms and the ever-increasing population, this boosts demand for hyperscale data centers.

- Over the past few years, the German data center market has grown notably with the rise in the development of hyperscale data centers, and owing to the implementation of GDPR, which has been driving investments and the regional cloud network development in Germany.

- The growing usage of the cloud and investments encourage many players in the country to improve cloud infrastructure in Germany, which drives the market's growth. For instance, in August 2021, Google announced it would invest EUR 1 billion by 2030 to enhance renewable energy use and develop its cloud computing infrastructure in Germany.

- In June this year, Vantage data centers announced the start of operations at two greenfield campuses in Berlin and Warsaw. The new sites are part of Vantage's USD 2 billion European expansion to offer hyperscalers and cloud providers with data center campuses in two sought-after markets.

- Moreover, in February this year, A 112-megawatt, 1.2 million sqft (108k sqm), hyper-scale data center campus is being built by Cloud HQ, a hyper-scale data center developer and operator in the US and Europe, in Offenbach, Germany, a city that borders Frankfurt to the southeast. With a total investment of EUR 1.1 billion (USD 1.15 billion), CloudHQ's Frankfurt data center campus will be one of Germany's biggest hyperscale data centers once fully constructed.

Hyperscale Data Center Industry Overview

The hyperscale data center market is moderately fragmented, with the presence of both global players and small and medium-sized enterprises. Moreover, hyperscale data centers are used in various industries to provide vendors with growth opportunities. Players in the market are adopting strategies, such as partnerships and acquisitions to enhance their product offerings and gain sustainable competitive advantage.

October 2022, Microsoft Corporation plans to develop a large hyperscale data center in Pune as part of its multi-city data center strategy in India. As a part of the development, the company acquired a 25-acre land parcel in the Pimpri-Waghere locality of the city through an agreement with Finolex Industries to transfer the long-term lease for approximately INR 329 crore (USD 40.2 million), and it is planning to develop the data center on this plot.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Force Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Consumers

- 4.2.3 Threat of New Entrants

- 4.2.4 Intensity of Competitive Rivalry

- 4.2.5 Threat of Substitute Products

- 4.3 Industry Value Chain Analysis

- 4.4 Technology Snapshot

- 4.5 Assessment of the Impact of COVID-19 on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Growing Demand for Cloud Computing and Other High Performance Technologies

- 5.2 Market Challenges

- 5.2.1 Data Center Security Challenges

- 5.2.2 Excessive Energy Consumption and Inefficient Capacity Planning

- 5.3 Market Opportunities

6 MARKET SEGMENTATION

- 6.1 By End User

- 6.1.1 Enterprises

- 6.1.2 Colocation Providers

- 6.2 By Country

- 6.2.1 United States

- 6.2.2 Canada

- 6.2.3 China

- 6.2.4 Japan

- 6.2.5 Australia

- 6.2.6 United Kingdom

- 6.2.7 Germany

- 6.2.8 Other Countries

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles*

- 7.1.1 Hewlett Packard Enterprise Co

- 7.1.2 Cisco Systems Inc.

- 7.1.3 Huawei Technologies Co.

- 7.1.4 Nvidia Corporation

- 7.1.5 Quanta Computer Inc.

- 7.1.6 IBM Corporation

- 7.1.7 Amazon Web Services Inc.

- 7.1.8 Microsoft Corporation

- 7.1.9 Alibaba Group

- 7.1.10 Alphabet Inc.

- 7.1.11 Facebook Inc.