|

市場調查報告書

商品編碼

1444435

全球網路自動化市場:市場佔有率分析、產業趨勢/統計、成長預測(2024-2029)Network Automation - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

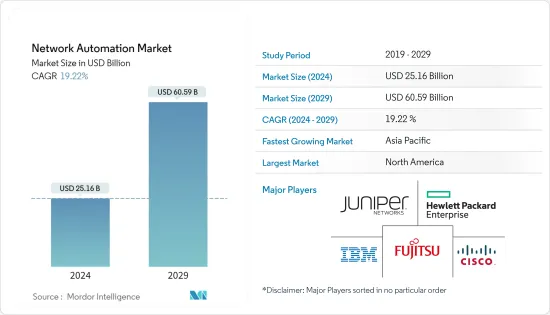

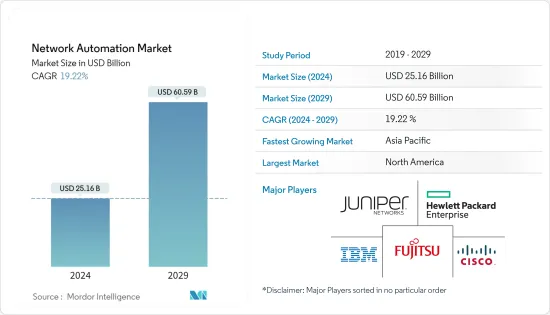

全球網路自動化市場規模預計在 2024 年將達到 251.6 億美元,並在 2024-2029 年預測期內以 19.22% 的年複合成長率成長,到 2029 年將達到 605.9 億美元。

公營和私人公司以及政府機構強制員工在家工作(WFH),這給網路技術帶來了不可預見的壓力,並增加了網路流量,造成了全球範圍內蔓延的頻寬和安全問題。正在引領中國的網路自動化市場。

主要亮點

- 隨著越來越多的用戶、裝置和應用程式依賴企業網路來實現與各種端點的關鍵連接,企業網路面臨壓力。組織對新的網路架構和先進的管理工具越來越感興趣,這些工具利用機器學習和人工智慧來創建自動駕駛或自主網路。這些進步也顯著改變了企業依賴合作夥伴和供應商服務的方式。

- 網路自動化最重要的好處之一是降低營運成本。透過使用自動化且協調的基礎架構消除繁瑣的手動流程,您不僅可以擴展網路的功能,還可以更快地實現投資回報。

- 自動化還可以減少錯誤並提高彈性。除了自動化手動任務和最大限度地減少網路錯誤之外,許多解決方案還可以在無需干涉的情況下自動回應網路錯誤,從而提高業務彈性並確保員工在需要時始終可以存取應用程式和資料。提高網路自動化水平有助於降低複雜性,對於企業跟上數位世界的步伐至關重要。

- 限制市場成長的主要因素之一是某些公司擔心自動化解決方案可能會忽略安全問題或施加許多網路限制。此外,實施自動化系統和解決方案需要組織聘請專家或培訓其目前的網路團隊,最終增加開展業務的成本。

- 在 COVID-19感染疾病期間,自動化在維持 IT 營運方面發揮關鍵作用。根據 4 月 22 日 Verizon 網路報告,該公司網路的資料量與感染疾病 19 之前的水平相比增加了 19%。儘管資料使用仍在增加,但人們使用網路的方式的變化是穩定的。 Verizon 預計其用戶將繼續保持高水準。

網路自動化市場趨勢

虛擬網路領域預計將佔據主要市場佔有率

- 網路功能虛擬(NFV) 和軟體定義網路 (SDN) 抽象化了新網路功能的實現,並將它們與硬體基礎設施和相關拓撲約束解耦。這使得通訊網路可程式設計,從而更加靈活和敏捷。

- SDN和NFV都被視為通訊服務供應商轉型的關鍵使能技術,提供了滿足市場需求的低成本手段。推動該市場的主要最終用戶是需要減少資本支出、提高效率和提供新服務的通訊業者。 NFV 始終透過虛擬在 DPI、防火牆、負載平衡器和會話邊界控制器 (SBC) 等專用設備上執行的網路服務來補充 SDN。這允許這些服務在單一電腦池上運行。減少硬體並節省資本支出和營運支出。

- 網路虛擬和自動化在遇到意外使用高峰的環境中非常有用。自動化網路可以透過自動將網路流量重新導向到網路影響較小區域的伺服器來處理這些峰值。

- 企業開始將其虛擬環境擴展到簡單的虛擬伺服器部署之外。我們目前正在為動態工作負載和私有雲端基礎架構實施虛擬災害復原和虛擬支援。在這個過程中,他們遇到了物理和邏輯網路前所未有的變化速度和複雜性的增加。

- 多個開放原始碼計劃致力於透過虛擬建立網路自動化標準。例如,歐洲電訊標準協會 (ETSI) 的 NFV 管理和編配(MANO) 行業規範組 (ISG) 重點關注雲端基礎的資料中心中網路資源的管理和編配。這些標準可實現 SDN 和 NFV 平台之間更好、更有效率的通訊。

- Microsoft 的 Azure 虛擬網路 (VNet) 是 Azure 專用網路的基本建置區塊。 VNet 允許不同類型的 Azure 資源(例如 Azure 虛擬機器 (VM))安全地相互通訊、與 Internet 和本機網路通訊。 VNet 與資料中心中運行的傳統網路相當,但為 Azure 基礎架構帶來了額外的好處,例如規模、可用性和隔離。

歐洲佔主要市場佔有率

- 由於歐洲地區的快速擴張以及 Microfocus International PLC、諾基亞通訊、愛立信和 Entity Network Management 等市場參與者的存在,歐洲地區在網路自動化領域佔據了主要佔有率。

- 在歐洲,軟體定義網路(SDN)和網路功能虛擬(NFV)技術的採用日益增加。這些因素正在迅速改變大型企業建立廣域網路以滿足其不斷成長的網路需求的方式。此外,在組織中部署多種技術會增加其IT基礎設施的複雜性,從而進一步增加對網路自動化解決方案的需求。

- 5G技術將進一步增加技術和網路架構的複雜性。通訊服務供應商越來越需要智慧管理系統來處理數量迅速增加的實體和虛擬網路事件,這些事件可能會給網路營運中心帶來巨大壓力。思科與 Telefonica 合作實施網路自動化,以簡化西班牙服務供應商的業務,為 5G 時代做好準備。這個新的自動化網路由思科的 Crosswork 網路自動化套件提供支持,可以為 Telefonica 提供更好的營運洞察力和網路健康狀況。

- 此外,三星電子和沃達豐英國也宣布推出英國首個 5G Open RAN 站點,目前正在處理活躍的客戶流量。位於英國巴斯的站點是沃達豐在歐洲第一個可擴展的開放式 RAN 網路設計,另外還有 2,500 多個站點。兩家公司完成了由三星 5G虛擬無線接取網路(vRAN) 提供支援的 5G 即時視訊對話,以紀念首次站點部署。這是英國於 2022 年 1 月首次徵集商用 5G Open RAN。

網路自動化產業概況

網路自動化市場正逐漸成為一個碎片化的市場。各個最終用戶行業的雲端趨勢和不斷成長的網路流量預計很快就會顯著成長。為了在網路自動化形勢保持立足點,當前市場領導的競爭策略非常強大,主要是透過收購各種新興企業和解決方案供應商來推動的。該市場的主要企業是思科系統公司、瞻博網路公司和IBM公司。

2022年12月,T-Mobile和思科宣布推出彈性的分散式全球雲端原生融合核心閘道。 Un-Carrier已將所有5G和4G流量遷移到新的雲端原生核心閘道。這使我們的客戶在頻寬和延遲方面的效能提高了 10% 以上。 T-Mobile 可透過全自動融合核心閘道簡化跨雲端、邊緣和資料中心的網路任務,從而顯著減少營運生命週期管理。

2022 年 1 月,慧與與日本電訊供應商 OPTAGE 合作,後者選擇 HPE 5G 核心堆疊作為其本地 5G 網路測試台。 OPTAGE已經測試了本地5G網路的可行性,以滿足各種最終用戶商業客戶的需求。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場動態

- 市場概況

- 工業吸引力 - 波特五力分析

- 新進入者的威脅

- 買方議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭公司之間的敵意強度

- 產業價值鏈分析

- 技術簡介

- 評估 COVID-19 對市場的影響

- 市場促進因素

- 資料中心網路需求不斷成長

- 連網型設備的成長趨勢

- 市場限制因素

- 各行各業都缺乏熟練的專業人員。

第5章市場區隔

- 網路類型

- 身體的

- 虛擬的

- 混合

- 解決方案類型

- 網路自動化工具

- SD-WAN/網路虛擬

- 意圖式網路

- 服務類型

- 管理服務

- 專業服務

- 介紹

- 雲

- 本地

- 混合

- 最終用戶產業

- 資訊科技/通訊

- 製造業

- 能源/公共事業

- 銀行/金融服務

- 教育

- 其他最終用戶產業

- 地區

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 中東/非洲

第6章 競爭形勢

- 公司簡介

- Cisco Systems Inc.

- Juniper Networks Inc.

- IBM Corporation

- Hewlett Packard Enterprise Development LP

- SolarWinds Inc.

- Network Automation Inc.

- Micro Focus International PLC

- NetBrain Technologies Inc.

- Arista Networks Inc.

- Extreme Networks Inc.

- BMC Software Inc.

- Fujitsu Limited

- VMware Inc.+Saltstack

- Nuage Networks(NOKIA CORPORATION)

- Forward Networks Inc.

- AppViewX Inc.

第7章 投資分析

第8章市場的未來

The Network Automation Market size is estimated at USD 25.16 billion in 2024, and is expected to reach USD 60.59 billion by 2029, growing at a CAGR of 19.22% during the forecast period (2024-2029).

Public and private companies and government entities are requiring employees to work from home (WFH), putting an unforeseen strain on networking technologies and causing bandwidth and security concerns because of increased internet traffic, which is driving the Network Automation Market across the globe.

Key Highlights

- Enterprise networks are under pressure, with more users, devices, and applications relying on the network for essential connectivity to a broad range of endpoints. Organizations are increasingly interested in new network architectures and advanced management tools that leverage machine learning and artificial intelligence to create self-driving or autonomous networks. These advancements are also significantly changing the way enterprises rely on services from their partners and vendors.

- One of the most significant benefits of network automation is a lower operational expense. By eliminating tedious and manual processes through automated and orchestrated infrastructures, one not only extends the network's capabilities but also achieves a faster ROI.

- Automation also reduces errors and builds resiliency. In addition to automating manual tasks to minimize network errors, many solutions automatically respond to network errors without intervention, enhancing business resiliency and ensuring employees have access to the applications and data they need whenever they need it. Increased network automation levels help reduce complexity and are essential for businesses to keep up in the digital world.

- One of the main factors constraining the market's growth is certain firms' concern that automated solutions can overlook security issues or impose many network restrictions. Additionally, implementing automated systems or solutions forces an organization to hire professionals or train its current network teams, ultimately raising costs for the business.

- Automation plays an essential role in maintaining IT operations during the COVID-19 pandemic. According to the Verizon Network Report, April 22, the overall data volume across its networks increased by 19% compared to pre-COVID levels. While data usage remains elevated, the changes in how people use the network have stabilized. Verizon expects the user to continue at sustained higher levels in the future.

Network Automation Market Trends

The Virtual Network Segment is Expected to Hold a Major Market Share

- Network functions virtualization (NFV) and Software-defined networking (SDN) abstract the implementation of new network functions and decouple them from the hardware infrastructure and associated topological constraints, thus, making communications networks programmable and, as a result, much more flexible and agile.

- SDN and NFV are together seen as key technologies enabling the transformation of communication service providers to provide a lower-cost means to address market demands. The primary end users driving this market are telecom operators who need to achieve CAPEX reduction, improve efficiency, and offer new services. NFV has constantly been complementing SDN by virtualizing network services that run in dedicated appliances, such as deep packet inspection (DPI), firewalls, load balancers, and session border controllers (SBCs), so that these services can run on a single pool of computer hardware, yielding CAPEX and OPEX savings.

- Network virtualization and automation are beneficial for environments that experience unexpected usage surges. The automated network can accommodate these surges by automatically redirecting network traffic to servers in less impacted areas of the network.

- Companies are resuming to scale their virtualized environments past simple virtual server deployment. They are now deploying virtual disaster recovery and virtual support for dynamic workloads and private cloud infrastructure. In doing so, they encounter unprecedented rates of change and growing complexity in the physical and logical network.

- Several open-source projects are dedicated to establishing network automation standards through virtualization. For instance, the European Telecommunications Standards Institute (ETSI) Industry Specification Group (ISG) for NFV Management and Orchestration (MANO) is focused on the management and orchestration of network resources in cloud-based data centers. These standards will enable better and more efficient communication between SDN and NFV platforms.

- Microsoft's Azure Virtual Network (VNet) is the fundamental building block for Azure's private network. VNet permits many types of Azure resources, such as Azure Virtual Machines (VM), to interact with each other securely, the internet, and on-premises networks. VNet is comparable to a traditional network that would work in the data center but brings additional benefits to Azure's infrastructure, such as scale, availability, and isolation.

Europe to Account for a Significant Market Share

- The European region holds a significant share in network automation due to the rapid expansion of the area and the presence of market players such as Microfocus International PLC, Nokia Communications, Ericsson, and Entuity Network Management.

- In Europe, the adoption of software-defined networking (SDN) and network function virtualization (NFV) technologies is increasing daily. These factors rapidly change how large enterprises build their wide area networks to meet these growing network requirements. Also, deploying several technologies in organizations is increasing the complexity of the IT infrastructure in these organizations, further increasing the demand for network automation solutions.

- 5G technology adds layers of technical and network architecture complexities. CSPs increasingly demand intelligent management systems to deal with the fast-increasing number of physical and virtual network events that may place heavy workloads on network operation centers. Cisco collaborated with Telefonica to implement network automation to simplify the service provider's operations in Spain in preparation for the 5G era. With this newly automated network powered by Cisco's Crosswork Network Automation suite, Telefonica may be able to provide improved operational insight and network health.

- In addition, Samsung Electronics and Vodafone UK announced the launch of the UK's first 5G Open RAN site, which is now handling active customer traffic. In Bath, the UK, this site is the first of Vodafone's scalable Open RAN network design in Europe, with over 2,500 more locations. The firms completed a 5G live video conversation utilizing Samsung's 5G virtualized Radio Access Network (vRAN) to commemorate the deployment of their first site, which was the UK's first call on a commercial 5G Open RAN in January 2022.

Network Automation Industry Overview

The network automation market is slowly turning into a fragmented market. It is expected to witness a robust increase shortly, strongly driven by cloud trends and growing network traffic across various end-user industries. To maintain their foothold in the network automation landscape, the competitive strategy has been quite strong from the current market leaders, mainly driven by their acquisitions of various startups and solution vendors. Key players in the market are Cisco System Inc., Juniper Networks Inc., and IBM Corporation.

In December 2022, T-Mobile and Cisco announced introducing the highly flexible and distributed global cloud-native converged core gateway. The Un-carrier migrated all of its 5G and 4G traffic to the newly cloud-native core gateway, which immediately improved customer performance by more than 10% in both bandwidth and latency. T-Mobile can dramatically decrease operational life cycle management by using a fully automated convergent core gateway to streamline network tasks throughout the cloud, edge, and data centers.

In January 2022, Hewlett Packard Enterprise partnered with OPTAGE, a Japanese telecommunications provider that selected HPE 5G Core Stack for its testbed Local 5G network. OPTAGE has tested the viability of Local 5G networks to meet the business customer demands of various end-users.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Threat of New Entrants

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Bargaining Power of Suppliers

- 4.2.4 Threat of Substitutes

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Value Chain Analysis

- 4.4 Technology Snapshot

- 4.5 Assessment of the Impact of COVID-19 on the Market

- 4.6 Market Drivers

- 4.6.1 Increasing Demand for Data Center Network

- 4.6.2 Rising Trend of Connected Devices

- 4.7 Market Restraints

- 4.7.1 Lack of Skilled Professional Across Industries

5 MARKET SEGMENTATION

- 5.1 Network Type

- 5.1.1 Physical

- 5.1.2 Virtual

- 5.1.3 Hybrid

- 5.2 Solution Type

- 5.2.1 Network Automation Tools

- 5.2.2 SD-WAN and Network Virtualization

- 5.2.3 Intent-based Networking

- 5.3 Service Type

- 5.3.1 Managed Service

- 5.3.2 Professional Service

- 5.4 Deployment

- 5.4.1 Cloud

- 5.4.2 On-premise

- 5.4.3 Hybrid

- 5.5 End-user Industry

- 5.5.1 IT and Telecom

- 5.5.2 Manufacturing

- 5.5.3 Energy and Utility

- 5.5.4 Banking and Financial Services

- 5.5.5 Education

- 5.5.6 Other End-user Industries

- 5.6 Geography

- 5.6.1 North America

- 5.6.2 Europe

- 5.6.3 Asia-Pacific

- 5.6.4 Latin America

- 5.6.5 Middle-East and Africa

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 Cisco Systems Inc.

- 6.1.2 Juniper Networks Inc.

- 6.1.3 IBM Corporation

- 6.1.4 Hewlett Packard Enterprise Development LP

- 6.1.5 SolarWinds Inc.

- 6.1.6 Network Automation Inc.

- 6.1.7 Micro Focus International PLC

- 6.1.8 NetBrain Technologies Inc.

- 6.1.9 Arista Networks Inc.

- 6.1.10 Extreme Networks Inc.

- 6.1.11 BMC Software Inc.

- 6.1.12 Fujitsu Limited

- 6.1.13 VMware Inc. + Saltstack

- 6.1.14 Nuage Networks (NOKIA CORPORATION)

- 6.1.15 Forward Networks Inc.

- 6.1.16 AppViewX Inc.