|

市場調查報告書

商品編碼

1444382

食品服務包裝 - 市場佔有率分析、產業趨勢與統計、成長預測(2024 - 2029)Food Service Packaging - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

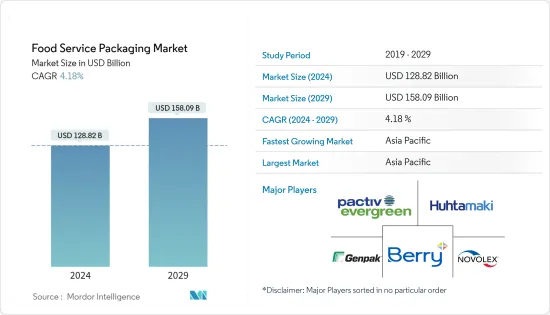

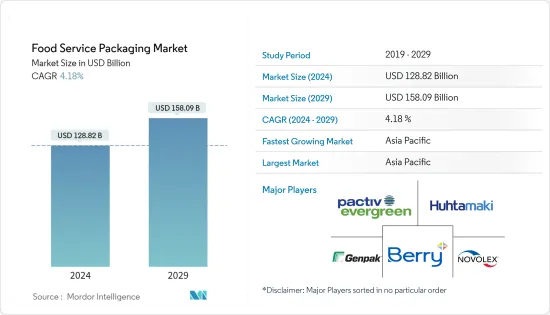

2024年,食品服務包裝市場規模預估為1,288.2億美元,預估至2029年將達到1,580.9億美元,在預測期間(2024-2029年)CAGR為4.18%。

主要亮點

- 過去幾年,線上訂餐和餐廳配送增加了 20% 以上。隨著線上食品配送系統的日益普及,對永續食品服務包裝市場的需求和使用不斷增加,促使製造商選擇永續包裝解決方案。

- 澳洲的咖啡館和餐廳不斷成長,使食品服務包裝市場受益。根據澳洲統計局的數據,截至 2022 會計年度末,澳洲各地有超過 5.19 萬家咖啡館和餐廳開業。與 2017 年相比,澳洲營運的咖啡館和餐廳數量超過 41,500 家。隨著咖啡館和餐廳數量的增加,對食品服務包裝的需求也隨之增加。咖啡館和餐廳經常提供外帶食物和飲料,因此需要紙袋或塑膠容器等包裝。隨著更多咖啡館和餐廳的開業,對零售袋的需求可能會增加。

- Hinojosa 的使命是協助企業在食品業推廣更環保的消費習慣,並從策略上使其更容易將永續性納入競爭優勢。食品服務是對塑膠包裝需求最大的產業之一,2021 年包裝預製食品的塑膠使用量成長了 33% 以上。2023 年 3 月,Hinojosa 包裝集團推出了一系列新的食品服務包裝產品,提供一系列採用可安全接觸食品的印刷方法的解決方案。容器完全由可回收紙製成,並且可生物分解,這使其在其他包裝中脫穎而出。

- 然而,永續包裝的開發成本高且具課題性。許多企業需要更多資源,並且需要投資研發以更好地包裝其資產負債表。此外,必須考慮簡化包裝可能節省的成本。使用永續包裝的成本高於傳統包裝。這是由於所涉及的材料及其採購(包括原始的和二手的)以及不太成熟的供應鏈、製造流程和較低的規模經濟。

- COVID-19 大流行對食品服務包裝行業造成了長期影響。為了適應這種新常態,包括包裝在內的各個行業的公司都採用了新技術和營運方法。隨著人們健康意識的增強,新鮮食品包裝的需求增加。消費者偏好包裝食品以避免細菌、微生物和病原體引起的疾病,而不是從街頭小販那裡購買,預計將推動市場成長。

食品服務包裝市場趨勢

速食店(QSR)佔最大佔有率

- 快餐店 (QSR) 提供低成本食品選擇,並專注於服務速度。最少的餐桌服務和對自助服務的重視使該群體有別於傳統餐廳。速食店中使用的大多數一次性塑膠食品服務產品包括硬質聚苯乙烯(PS)、發泡聚苯乙烯(EPS)、聚丙烯(PP)、聚對苯二甲酸乙二醇酯(PET)和聚乳酸(PLA)。

- 在聚苯乙烯泡沫塑膠杯和包裝、塑膠蓋、紙板架、基因改造蔬菜和無機肉類中,該行業可能更加環保。然而,隨著環保服務對客戶越來越有吸引力,許多公司正在轉向對環境危害較小的綠色選擇。

- 對行動飲食趨勢的需求不斷成長以及食品支出的增加也支持了對 QSR 的需求,最終推動了對食品服務包裝的需求。根據達美樂比薩的數據,美國的速食業(QSR)在過去幾十年中逐年成長,其消費支出高峰在 2022 年超過 3,200 億美元。由於 COVID-19 大流行,2020 年顯著下降。

- 一些以其「有機」選擇而聞名的快餐店正在採用更環保的替代品來減少碳足跡。例如,2022 年 6 月,肯德基印度公司推出了“KFConscious”,作為欽奈最永續的餐廳進行行銷,因為該店旨在使用環保材料。肯德基印度公司也宣布計劃在 2022 年底前在全國再開設 20 家門市。此類情況正在推動快餐業對永續食品服務包裝的需求。

- 2022 年 4 月,英國漢堡王成為英國第一家為其漢堡和配菜嘗試一系列可重複使用和可回收的新包裝的快餐公司。這次試點發布是與全球重複利用平台 Loop 合作創建的,並見證了這家快餐連鎖店嘗試了有史以來第一個可重複使用的漢堡蛤殼。這些情況正在推動食品服務包裝中對永續方法的需求。

亞太地區佔最大市場佔有率

- 亞太地區由人口稠密的國家和中國、印度等新興經濟體組成。食品服務的需求正在快速成長,永續包裝的採用勢頭強勁,預計將在預測期內達到最高水平。

- 塑膠一直是包裝產業的重要組成部分,構成了消費者便利文化的基礎。由於其性價比,瓦楞紙板、玻璃、金屬等傳統包裝材料在食品服務和食品工業的眾多應用中已被塑膠所取代。然而,塑膠在方便使用的同時也使其不可分解,並且永久存在於環境中,僅在印度就造成了 43% 的污染。 2022 年 2 月,可堆肥食品伺服器具品牌 CHUK 加入快速商業公司 Blinkit,成為其永續發展合作夥伴。 Blinkit將CHUK的產品在10分鐘內送達終端消費者,並拉近了終端消費者與CHUK之間的距離。此次合作幫助 CHUK 實現了在 2022-23 會計年度向平台上的最終消費者提供 1000 千萬件商品的目標

- 日本人均包裝材料消費量較高,該國的食品與包裝產業有著密切的關係。日本食品製造商以使用高科技包裝技術和包裝設計的獨創性而聞名。這種對包裝創新的關注促使了日本開發出有吸引力且高效的包裝解決方案。

- 近年來,印度的包裝產業也在經歷成長。許多製造單元、環保材料的引入以及對研發的日益重視帶來了有吸引力的創新包裝產品。印度也推行「印度製造」等舉措,旨在促進本地製造和生產。

- 有了這些舉措和因素,印度的包裝行業預計將受益於投資的增加和技術的進步。以較低的成本提供本地製造的產品可以使印度包裝業在國內和國際市場上具有競爭力。對環保材料的關注也符合全球永續發展趨勢。

- 此外,據業內人士稱,食品服務包裝製造商正在青睞軟包裝,因為它具有視覺吸引力、成本效益高且持久耐用。據 IBEF 稱,印度食品和雜貨市場是全球第六大市場,零售額佔銷售額的 70%。印度食品加工業佔全國整體食品市場的32%,在產量、消費、出口和預期成長方面排名第六。

食品服務包裝產業概述

食品服務包裝市場是分散的,因為許多參與者透過他們的產品進入市場。憑藉創新和需求,市場對新參與者俱有吸引力。

2022年3月,Pactiv Evergreen Inc.透過其全資子公司Evergreen Packaging International LLC完成了向Elopak ASA附屬公司收購Naturepak Beverage Packaging 50%的投資。 Naturepak Beverage Packaging 的製造工廠位於摩洛哥和沙烏地阿拉伯,為中東和非洲地區的客戶提供服務。

2022 年 1 月,Huhtamaki 宣布收購其波蘭合資公司 Huhtamaki Smith Anderson Sp. 的全部所有權。來自 Smith Anderson Group Ltd SA 的 z oo。該公司在東歐位於波蘭 Czeladz 的 Huhtamaki 工廠生產和銷售食品服務紙袋。

額外的好處:

- Excel 格式的市場估算 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章:簡介

- 研究假設和市場定義

- 研究範圍

第 2 章:研究方法

第 3 章:執行摘要

第 4 章:市場動態

- 市場概況

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 買家的議價能力

- 新進入者的威脅

- 替代產品的威脅

- 競爭激烈程度

- 產業生態系統分析

- COVID-19 對餐飲服務包裝市場的影響

- 疫情對市場需求的影響

- 可重複使用與一次性需求

- 餐飲服務法規及其對需求的影響

- 回收和便利需求的影響

第 5 章:市場動態

- 市場促進因素

- 主要市場對簡便食品的需求持續成長

- 由於強調永續性,供應商越來越關注再生塑膠

- 市場課題

- 環境壓力和聚合物價格的不確定性推動軟包裝積極穩定成長

- 市場機會

第 6 章:市場區隔

- 依產品類型

- 瓦楞紙箱和紙箱

- 塑膠瓶

- 托盤、盤子、食品容器和碗

- 杯子和蓋子

- 蛤殼式

- 其他產品類型

- 依最終用戶產業

- 快速反應

- 全方位服務餐廳

- 制度性

- 招待(店內飲食、咖啡和小吃等)

- 其他最終用戶產業

- 依地理

- 北美洲

- 美國

- 加拿大

- 歐洲

- 英國

- 德國

- 法國

- 義大利

- 西班牙

- 歐洲其他地區

- 亞太

- 中國

- 日本

- 印度

- 澳洲

- 亞太其他地區

- 拉丁美洲

- 巴西

- 阿根廷

- 墨西哥

- 拉丁美洲其他地區

- 中東和非洲

- 沙烏地阿拉伯

- 南非

- 埃及

- 中東和非洲其他地區

- 北美洲

第 7 章:競爭格局

- 公司簡介

- Pactiv Evergreen Inc.

- Dart Container Corporation

- Amhil North America

- Genpak LLC

- Huhtamaki Oyj

- Berry Global Inc.

- Novolex Holdings LLC

- Sabert Corporation

- Silgan Plastic Food Container

- B&R Plastics Inc.

- Graphic Packaging International Inc

- Amcor PLC

- Sonoco Products Company

第 8 章:市場的未來

The Food Service Packaging Market size is estimated at USD 128.82 billion in 2024, and is expected to reach USD 158.09 billion by 2029, growing at a CAGR of 4.18% during the forecast period (2024-2029).

Key Highlights

- Over the last few years, online food ordering and restaurant delivery have grown more than 20%. With the increasing adoption of the online food delivery system, the demand and use of the sustainable food service packaging market are rising, causing manufacturers to opt for sustainable packaging solutions.

- The cafes and restaurants in Australia are growing, benefiting the food service packaging market. Over 51.9 thousand cafes and restaurants were open across Australia as of the end of the fiscal year 2022, according to the Australian Bureau of Statistics. Australia has more cafes and restaurants operating than in 2017 when there were over 41.5 thousand establishments. The demand for food service packaging rises as the number of cafes and restaurants rises. Food and drink to go are frequently offered by cafes and restaurants, necessitating packaging like paper bags or plastic containers. The demand for retail bags can rise as more cafes and restaurants open.

- Hinojosa's mission is to assist companies in promoting more environmentally friendly consumption habits in the food sector and to strategically make it easier to include sustainability as a competitive advantage. Food service was one of the industries with the most significant demand for plastic for packaging, where plastic usage to package prepared foods climbed by more than 33% in 2021. In March 2023, Hinojosa Packaging Group launched a new line of food service packaging products that offers a range of solutions using printing methods safe for contact with food. This container is constructed entirely of recyclable paper and is biodegradable, which makes it stand out from other packaging.

- However, sustainable packaging can be expensive and challenging to develop. Many businesses need more resources, and it would require investing in R&D for better packaging on their balance sheets. Further, the potential cost savings from streamlined packaging must be considered. The cost of using sustainable packaging is higher than conventional packaging. This is due to the materials involved and their sourcing (both virgin and used) and the less-established supply chains, manufacturing processes, and lower economies of scale.

- The COVID-19 pandemic left long-term effects on the food service packaging sector. To adjust to this new normal, companies in every industry, including packaging, embraced new technologies and methods of operation. Demand for fresh food packaging increased as people became more health-conscious. Consumer preference for packaged food to avoid diseases caused by bacteria, microorganisms, and pathogens, rather than buying it from a street vendor, is expected to fuel market growth.

Food Service Packaging Market Trends

Quick-service Restaurants (QSR) to Hold the Largest Share

- Quick-service restaurants (QSRs) offer low-cost food options, focusing on the speed of service. The minimal table service and emphasis on self-service make this group different from traditional restaurants. Most of the single-use plastic food service products used in QSRs include rigid polystyrene (PS), expanded polystyrene (EPS), polypropylene (PP), polyethylene terephthalate (PET), and polylactic acid (PLA).

- The industry could be more environmentally friendly among the Styrofoam cups and packages, plastic lids, cardboard holders, genetically modified vegetables, and inorganic meat. However, as eco-friendly services become more appealing to customers, many companies are moving to greener options that are less environmentally harmful.

- The growing demand for on-the-go eating trends and increased spending on food have also supported the demand for QSR, eventually boosting the need for food service packaging. According to Domino's Pizza, The quick service restaurant sector (QSR) in the United States has seen year-over-year growth in the past decades, with its peak consumer spending exceeding USD 320 billion in 2022. Although, Consumer spending in this sector saw a notable decline in 2020 owing to COVID-19 Pandemic.

- Some quick-service restaurants, known for their 'organic' options, are adapting to more environmentally friendly alternatives to reduce their carbon footprint. For instance, in June 2022, KFC India unveiled 'KFConscious,' marketed as the most sustainable restaurant in Chennai, as the outlet aims to use environment-friendly materials. KFC India has also announced plans to open 20 more outlets nationwide by the end of 2022. Such instances are driving the demand for sustainable foodservice packaging in QSRs.

- In April 2022, Burger King UK became the first quick-service restaurant corporation in the UK to trial a new range of reusable and returnable packaging for its burgers and sides. The pilot launch was created in partnership with the global reuse platform Loop and witnessed the fast-food chain try out the first-ever reusable burger clamshells. Such instances are driving the demand for sustainable methods in food service packaging.

Asia-Pacific Accounts for the Largest Market Share

- The Asia-Pacific region comprises densely populated countries and emerging economies like China and India. The demand for food services is rapidly growing, and the adoption of sustainable packaging is gaining momentum and is expected to be the highest during the forecasted period.

- Plastic has been an essential part of the packaging industry that forms the foundation of the consumer convenience culture. Owing to their cost-to-performance ratio, traditional packaging materials, such as corrugated paper boards, glass, metals, etc., have been substituted by plastics in food service and numerous applications in the food industry. However, the qualities that make plastic convenient to use also make it non-degradable and have an everlasting presence in the environment, contributing to 43% of pollution in India alone. In February 2022, CHUK, a compostable food service ware brand, joined quick commerce firm Blinkit as its sustainability partner. Blinkitdelivers CHUK's products to end-consumers within 10 minutes, bridging the gap between end consumers and CHUK. The partnership helped CHUK aim to serve one crore pieces to the end-consumers on the platform in FY 2022-23

- Japan has a high per capita consumption of packaging materials, and there is a close relationship between the food and packaging industries in the country. Japanese food manufacturers are known for using high-tech packaging techniques and their tendency toward ingenuity in packaging designs. This focus on packaging innovation has led to the development of attractive and efficient packaging solutions in Japan.

- The packaging industry in India is also experiencing growth in recent years. The introduction of many manufacturing units, eco-friendly materials, and increased emphasis on research and development has resulted in attractive and innovative packaging products. India has also promoted initiatives like "Make In India," aiming to boost local manufacturing and production.

- With these initiatives and factors in place, the packaging industry in India is expected to benefit from increased investment and technological advancements. The availability of locally manufactured products at a lower cost can make the Indian packaging industry competitive in domestic and international markets. The focus on eco-friendly materials also aligns with global sustainability trends.

- Further, according to industry insiders, food service packaging manufacturers are gravitating towards flexible packaging as it is visually appealing, cost-effective, and long-lasting. According to IBEF, the Indian food and grocery market is the sixth-largest globally, with retail accounting for 70% of sales. The Indian food processing industry accounted for 32% of the country's overall food market, ranking sixth in production, consumption, export, and expected growth.

Food Service Packaging Industry Overview

The Food Service Packaging Market is fragmented, as many players have a presence in the market through their offerings. With innovations and demand, the market is attractive for new players.

In March 2022, Pactiv Evergreen Inc. completed the acquisition of its 50% investment in Naturepak Beverage Packaging Co. Ltd. to Elopak ASA affiliates through its wholly-owned subsidiary, Evergreen Packaging International LLC. Naturepak Beverage Packaging Co. Ltd, manufacturing facilities in Morocco and Saudi Arabia, serves customers in the Middle East and African regions.

In January 2022, Huhtamaki announced that it acquired full ownership of its Polish joint venture company Huhtamaki Smith Anderson Sp. z o.o. from Smith Anderson Group Ltd SA. The company manufactured and sold food service paper bags in Eastern Europe at Huhtamaki's facility in Czeladz, Poland.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Ecosystem Analysis

- 4.4 Impact of COVID-19 on the Foodservice Packaging Market

- 4.4.1 Market Demand Impact Due To The Pandemic

- 4.4.2 Reusable vs Single-use Demand

- 4.4.3 Foodservice Regulations and Their Impact on Demand

- 4.4.4 Impact of Recycling And Convenience On Demand

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Growing Demand For Convenience Food Continues In Major Markets

- 5.1.2 Increasing Vendor Focus On Recycled Plastic Due To Emphasis On Sustainability

- 5.2 Market Challenges

- 5.2.1 Positive And Steady Growth Of Flexible Packaging Due To Environmental Pressure And Uncertainty In Polymer Prices

- 5.3 Market Opportunities

6 MARKET SEGMENTATION

- 6.1 By Product Type

- 6.1.1 Corrugated Boxes And Cartons

- 6.1.2 Plastic Bottles

- 6.1.3 Trays, Plates, Food Containers, And Bowls

- 6.1.4 Cups And Lids

- 6.1.5 Clamshells

- 6.1.6 Other Product Types

- 6.2 By End-user Industries

- 6.2.1 QSR

- 6.2.2 Full-service Restaurants

- 6.2.3 Institutional

- 6.2.4 Hospitality (Dine-ins, Coffee & Snack, Etc.)

- 6.2.5 Other End-user Industries

- 6.3 By Geography

- 6.3.1 North America

- 6.3.1.1 United States

- 6.3.1.2 Canada

- 6.3.2 Europe

- 6.3.2.1 United Kingdom

- 6.3.2.2 Germany

- 6.3.2.3 France

- 6.3.2.4 Italy

- 6.3.2.5 Spain

- 6.3.2.6 Rest of Europe

- 6.3.3 Asia-Pacific

- 6.3.3.1 China

- 6.3.3.2 Japan

- 6.3.3.3 India

- 6.3.3.4 Australia

- 6.3.3.5 Rest of Asia-Pacific

- 6.3.4 Latin America

- 6.3.4.1 Brazil

- 6.3.4.2 Argentina

- 6.3.4.3 Mexico

- 6.3.4.4 Rest of Latin America

- 6.3.5 Middle East and Africa

- 6.3.5.1 Saudi Arabia

- 6.3.5.2 South Africa

- 6.3.5.3 Egypt

- 6.3.5.4 Rest of Middle East and Africa

- 6.3.1 North America

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Pactiv Evergreen Inc.

- 7.1.2 Dart Container Corporation

- 7.1.3 Amhil North America

- 7.1.4 Genpak LLC

- 7.1.5 Huhtamaki Oyj

- 7.1.6 Berry Global Inc.

- 7.1.7 Novolex Holdings LLC

- 7.1.8 Sabert Corporation

- 7.1.9 Silgan Plastic Food Container

- 7.1.10 B&R Plastics Inc.

- 7.1.11 Graphic Packaging International Inc

- 7.1.12 Amcor PLC

- 7.1.13 Sonoco Products Company