|

市場調查報告書

商品編碼

1444215

行動虛擬網路營運商 (MVNO) - 市場佔有率分析、產業趨勢與統計、成長預測(2024 - 2029 年)Mobile Virtual Network Operator (MVNO) - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

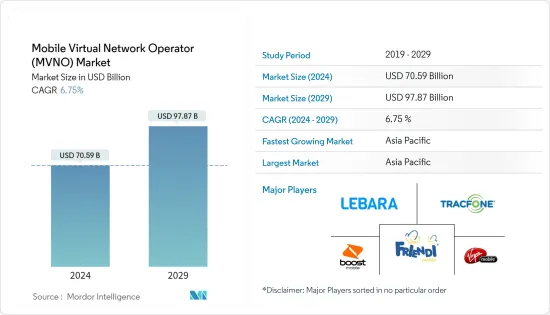

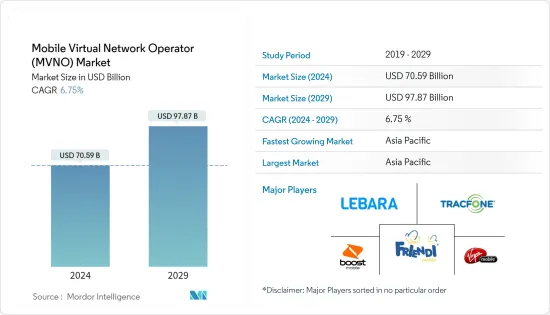

2024年行動虛擬網路營運商市場規模預計為705.9億美元,預計到2029年將達到978.7億美元,在預測期內(2024-2029年)CAGR為6.75%。

e-Sim、人工智慧、機器學習和邊緣運算等新技術推動因素正在為 MVNO 創造新的機會。

主要亮點

- 行動裝置的日益普及正在推動市場的成長。 GSMA預測,到2021年底,已有53億人訂閱了行動服務,佔全球人口的67%。現在,在不斷成長的市場中,大多數人都擁有手機,這意味著未來的成長將來自年輕人首次購買手機訂閱。未來五年,預計將新增 4 億行動用戶,其中大部分來自亞太地區和撒哈拉以南非洲地區,用戶總數將達到 57 億(佔全球用戶總數的 70%)人口)。

- 此外,到2021 年,行動技術和服務創造了4.5 兆美元的經濟增加價值,即全球GDP 的5%。預計到2025 年,這一價值將增加一倍以上,達到約5 兆美元,因為各國受益於行動技術和服務帶來的更高的生產力和效率。行動服務的使用日益增多。

- 根據 GSMA 的數據,到 2025 年,印度將成為全球第二大智慧型手機市場,安裝設備數量約 10 億台。預計到 2025 年將擁有 9.2 億獨立行動用戶,其中 8,800 萬個 5G 連線。

- 此外,市場上的領先公司正在建立合作夥伴關係,在不同市場提供其創新產品,以獲得更多的市場佔有率。例如,2022 年 6 月,Plan.com 透過與 BT Wholesale 的行動虛擬網路營運商 (MVNO) 協議,在其連接平台上推出了第二個行動網路。該公司擁有透過 my.plan 為英國各地企業提供創新連接和生產力解決方案的專業知識。與 BT Wholesale 的交易為客戶提供了選擇、靈活性和訪問第二個行動網路的機會,以利用 EE 的連接性。

- 預計雲端、機器對機器 (M2M) 交易和行動貨幣等服務數量的增加將進一步增加預測期內對行動虛擬網路營運商的需求。

- 零售 MVNO 訂閱可以為用戶提供雜貨折扣和會員卡福利,或者可以幫助零售商更好地瞄準其客戶群。零售 MVNO 的一個例子是 Asda Supermarket 的 Asda Mobile。

- 2022 年 6 月,Reach Mobile 宣布延長了與美國 5G 領導者 T-Mobile 的戰略性交鑰匙批發即服務 (WaaS) 協議,T-Mobile 擁有最出色、最快、最可靠的全國 5G 網路。兩家公司將使用 ReachNEXT,這是一個軟體即服務 (SaaS) 平台,可加速和簡化企業將基於網路的服務推向市場的方式。 T-Mobile 批發客戶可以利用 ReachNEXT,這是一個以前所未有的簡單性和速度啟動和營運 MVNO、固定無線接入、故障轉移網際網路和物聯網等用例的一站式商店,可能覆蓋數百萬家庭。該公告還延長了一項多年的 MVNO 協議,透過該協議,T-Mobile 將繼續為 Reach Mobile 的全國用戶提供網路服務。

- COVID-19 大流行加速了對彈性工作方式的需求,並進一步推動了可增強工作與生活平衡的通訊服務的採用。此外,在全球大流行期間,電信監管機構推遲了 5G 頻譜拍賣計劃。這場大流行迫使世界各地的電信業者測試其網路彈性並重新審視其計劃投資,尤其是在 5G 技術方面。

行動虛擬網路營運商 (MVNO) 市場趨勢

消費領域預計將佔據重要市場佔有率

- 這是 MVNO 中主要且最受關注的部分。新興經濟體中單一行動用戶數量的成長和行動普及率的提高是推動該領域成長的主要因素。

- 市場上的知名企業在全球範圍內以具有競爭力的成本提供無線服務。例如,2022 年 7 月,Boost Mobile 推出了 Connected Car,這是一種價格靈活的行動網路交鑰匙解決方案。透過 Boost,任何人都可以在自己的車上使用 Wi-Fi。連接消費性汽車中的多台平板電腦、電腦和手機,並隨身攜帶。在長途旅行中,他們現在可以串流自己喜歡的節目和電影、上網以及收聽自己喜歡的播客和歌曲,而無需使用手機的資料套餐。連網汽車計劃用戶可以獲得遠端 Wi-Fi 熱點和 5GB 4G LTE資料的行動存取。

- 此外,2022 年 8 月,Verizon 宣布大學生現在可以以低至 20 美元的每月價格獲得 Fios,這是一種閃電般快速的光纖網路,並提供 AutoPay 和特定的 5G 行動套餐。由於大學和機構繼續為學生提供虛擬講座選擇 - 並且一些學生承認為了學期論文熬夜到凌晨 - 可靠且負擔得起的家庭網際網路應該不成問題。

- 傳統上,B2C 或消費者區隔市場在創新和定價方面優於 B2B 區隔市場。對一組設備進行計費和管理比簡單的消費者服務困難得多。由於便利性和利潤率,虛擬網路營運商更喜歡投資消費領域。

- e-SIM 的日益普及預計也將擴大該區隔市場的範圍。 e-SIM 具有 GSMA 創建的遠端配置標準,為 MVNO 供應商提供了簡單性和靈活性。

亞太地區預計將佔據主要市場佔有率

- 亞太地區佔據了重要的市場佔有率,因為該地區在採用 5G 技術、互聯行動裝置和智慧型手機普及率等方面始終處於領先地位。

- 由於該地區電信業的快速成長和廣泛的客戶群,亞太地區是一個重要的智慧型手機市場。此外,該地區在無線網路服務上的支出也在增加。印度、日本、澳洲、新加坡和韓國等國家正在擴大對國內電信市場成長的投資,這可能會提振整個地區的 MVNO 市場需求。

- 在工業和資訊化部 (MIIT) 發起公眾諮詢後,中國移動市場計劃向 MVNO 開放商業牌照,就政府允許包括外資公司在內的商業 MVNO 牌照的提議徵求行業意見和反饋。

- 手機基地台數量持續增加,5G網路建置穩定推進。中國網路協會副會長黃成清表示,到2021年12月,中國手機基地台數量將達到996萬個,手機用戶數量也快速成長。到2021年,中國整體手機用戶規模達到16.43億,其中5G手機用戶達3.55億。這些趨勢預計將在預測期內增加中國行動虛擬網路營運商的收入。

- 印度和印尼等發展中國家的需求增加,隨著地方政府推動數位和行動經濟,智慧型手機擴大進入農村地區,這可能會推動對入門級智慧型手機的需求。例如,印度政府的數位印度計劃是一項旗艦計劃,旨在將印度轉變為數位化社會。

- 例如,2021 年 7 月,Vivo 通訊技術公司透過 Vivo Y72 增加了在印度的 5G 服務。 Y72 的售價為 20,990 印度盧比,憑藉其強大的功能和同類產品中明顯獨特的設計,提供卓越的智慧型手機體驗。手機擁有8GB+4GB可擴充RAM,多工時不會卡頓。

- 中國政府也一直在推動5G產業的發展,並青睞華為和中興等本國公司,這些公司為該技術提供了必要的設備。此外,根據 GSMA 的數據,到 2025 年,5G 連線數將達到 8.07 億。預計到 2025 年,中國將成為全球 5G 連線數最多的國家。

行動虛擬網路營運商 (MVNO) 產業概覽

MVNO 市場競爭激烈,主要是因為存在多個參與者。市場正在走向碎片化,主要參與者採取服務創新和策略合作夥伴關係等策略來擴大客戶群並保持市場競爭力。一些主要參與者包括 Lebara Group BV、TracFone Wireless Inc. 和 FRiENDi Mobile。本公司參與向訂戶提供銷售服務、客戶服務和行動服務。

2022 年 7 月,PeP 收購了 Simapka,以擴大波蘭的金融和行動服務。此次收購將有助於開發一個生態系統,其中 POS 提供的各種附加服務將支持支付。主要目標是確保整個歐洲的零售店透過 Simapka 行動應用程式解決方案從穩定的數位化支付中受益。

2022 年 5 月,Cricket Wireless LLC 宣布與南方校際體育會議 (SIAC) 合作。這項為期三年的協議使 Cricket 能夠為所有歷史黑人學院/大學 (HBCU) 成員學校的 SIAC 球迷提供獨特的體驗。

2021 年 12 月,Lycamobile 與威爾斯政府合作,在整個春季和夏季實現遠距學習。威爾斯的數位排斥學生在返回學校時和整個學年剩餘時間都可以使用行動數據提升計劃。此舉旨在幫助確保兒童能夠存取網路資源,並且在充滿課題的時期不會錯過重要的學習和發展。

額外的好處:

- Excel 格式的市場估算 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章:簡介

- 研究假設和市場定義

- 研究範圍

第 2 章:研究方法

第 3 章:執行摘要

第 4 章:市場動態

- 市場概況

- 產業吸引力-波特五力分析

- 新進入者的威脅

- 買家的議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭激烈程度

- 產業價值鏈分析

- 市場促進因素

- 行動網路用戶的增加和行動裝置的不斷普及

- 對高效蜂窩網路的需求不斷成長

- 市場課題

- COVID-19 對產業影響的評估

第 5 章:市場區隔

- 部署

- 雲

- 本地部署

- 運作模式

- 經銷商

- 服務經營者

- 完整的行動虛擬網路營運商

- 其他操作模式

- 訂閱者

- 企業

- 消費者

- 應用

- 折扣

- 蜂窩M2M

- 商業

- 媒體和娛樂

- 移民

- 零售

- 漫遊

- 電信

- 地理

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 西班牙

- 歐洲其他地區

- 亞太

- 中國

- 日本

- 印度

- 韓國

- 亞太其他地區

- 拉丁美洲

- 巴西

- 阿根廷

- 哥倫比亞

- 墨西哥

- 拉丁美洲其他地區

- 中東和非洲

- 阿拉伯聯合大公國

- 沙烏地阿拉伯

- 南非

- 中東和非洲其他地區

- 北美洲

第 6 章:競爭格局

- 公司簡介

- Lebara Group BV

- TracFone Wireless Inc.

- FRiENDi Mobile

- Boost Mobile LLC (T-Mobile)

- Virgin Mobile USA Inc.

- Tesco Mobile Limited (Tesco PLC)

- Cricket Wireless LLC (AT&T Inc.)

- Lycamobile UK Limited

- PosteMobile SpA

- 1&1 Drillisch AG

- Airvoice Wireless LLC

- ASDA Mobile

- Giffgaff Ltd

- Kajeet Inc. (Arterra Mobility)

- Truphone GmbH

- Voiceworks GmbH

- Asahi Net Inc.

第 7 章:投資分析

第 8 章:市場機會與未來趨勢

The Mobile Virtual Network Operator Market size is estimated at USD 70.59 billion in 2024, and is expected to reach USD 97.87 billion by 2029, growing at a CAGR of 6.75% during the forecast period (2024-2029).

New Technology enablers, like e-Sim, AI, ML, and edge computing, are creating new opportunities for MVNOs.

Key Highlights

- The growing penetration of mobile devices is driving the market's growth. GSMA predicted that by the end of 2021, 5.3 billion individuals had subscribed to mobile services, accounting for 67% of the global population. Most people now own a mobile phone in increasing markets, implying that future growth will come from younger populations taking out their first mobile subscription. Over the next five years, an additional 400 million new mobile users are anticipated to be added, most of whom will be from the Asia-Pacific and Sub-Saharan Africa, bringing the total number of subscribers to 5.7 billion (70% of the global population).

- Furthermore, mobile technology and services generated USD 4.5 trillion in economic value added, or 5% of global GDP in 2021. This value is expected to more than double by 2025, reaching approximately USD 5 trillion, as countries benefit from higher productivity and efficiency brought about by the growing use of mobile services.

- As per GSMA, India is on its way to becoming the second-largest smartphone market globally by 2025, with around 1 billion installed devices. It is expected to have 920 million unique mobile subscribers by 2025, including 88 million 5G connections.

- Further, the leading companies in the market are indulging in partnerships to offer their innovative products in different markets to gain more market presence. For instance, in June 2022, Plan.com launched its second mobile network on its connectivity platform via its Mobile Virtual Network Operator (MVNO) agreement with BT Wholesale. The company has expertise in providing innovative connectivity and productivity solutions to businesses across the United Kingdom through my.plan. The deal with BT Wholesale gives customers a choice, flexibility, and access to a second mobile network to take advantage of EE's connectivity.

- The increasing number of services such as cloud, Machine to Machine (M2M) transactions, and mobile money are further expected to augment demand for mobile virtual network operators over the forecast period.

- Retail MVNO subscriptions may provide users with grocery discounts and loyalty card perks or may help the retailer better target its customer base. An example of a retail MVNO is Asda Supermarket's Asda Mobile.

- In June 2022, Reach Mobile announced that it had extended its strategic, turnkey Wholesale-as-a-Service (WaaS) agreement with T-Mobile, America's 5G leader, with the most prominent, fastest, and most reliable nationwide 5G network. The companies would use ReachNEXT, a Software-as-a-Service (SaaS) platform that accelerates and streamlines how businesses bring network-based services to market. T-Mobile wholesale customers can utilize ReachNEXT, a one-stop shop for launching and operating use cases such as MVNO, Fixed Wireless Access, Failover Internet, and IOT, with unprecedented simplicity and speed, potentially reaching millions of homes. The announcement also extends a multi-year MVNO agreement through which T-Mobile would continue to serve as the network for Reach Mobile's nationwide subscribers.

- The COVID-19 pandemic accelerated the demand for agile and flexible work styles and further pushed the adoption of communication services that enhance work-life balance. Moreover, telecom regulators had postponed their plans for a 5G spectrum auction amid the global pandemic. The pandemic forced telecom operators worldwide to test their network resiliency and revisit their planned investments, especially in 5G technology.

Mobile Virtual Network Operator (MVNO) Market Trends

Consumer Segment is Expected to Hold a Significant Market Share

- This is the primary and the most focused segment among MVNOs. The growing number of single mobile subscribers and the increasing mobile penetration in emerging economies are the major factors fuelling the segment's growth.

- The market's prominent players provide wireless services at competitive costs worldwide. For instance, in July 2022, Boost Mobile introduced Connected Car, a turnkey solution for mobile internet at flexible prices. With Boost, anyone can get Wi-Fi in their automobile. Connect multiple tablets, computers, and phones in the consumer car and take them everywhere. During long road journeys, they can now stream their favorite shows and movies, surf the web and listen to their favorite podcasts and songs without using their cell phone's data plan. The Connected Car plan users get a remote Wi-Fi hotspot and mobile access to 5GB of 4G LTE data.

- Moreover, in August 2022, Verizon announced that college students may now get Fios, a lightning-fast fiber optic network, for as little as USD 20 per month with AutoPay and specific 5G mobile plans. As colleges and institutions continue to provide students with virtual options for lectures - and some students admit to staying up until the wee hours of the morning on term papers - reliable and affordable home internet should not be an issue.

- Traditionally, B2C or consumer segment dominated over the B2B segment regarding innovation and pricing. Billing and managing a fleet of devices is much more difficult than simple consumer service. Due to convenience and profit margins, MVNOs prefer investing in the consumer segment.

- The growing adoption of e-SIM is also expected to expand the scope of the segment. The e-SIM, with the remote provisioning standards created by the GSMA, provides simplicity and flexibility to MVNOs' vendors.

Asia-Pacific is Expected to Hold a Major Market Share

- The Asia-Pacific area accounts for a significant market share, as the region has always remained at the forefront in adopting technological advancements like 5G technology, connected mobile devices, and smartphone penetration, amongst others.

- The Asia-Pacific is a significant smartphone market, owing to the region's rapidly increasing telecom sector and extensive client base. Furthermore, the region is spending more on wireless network services. Countries like India, Japan, Australia, Singapore, and South Korea are expanding their investments in the growth of their domestic telecom markets, which are likely to boost the MVNO market demand across the region.

- China's mobile market has planned to open up to commercial licenses for MVNOs after the Ministry of Industry and Information and Technology (MIIT) launched a public consultation seeking industry input and feedback on the government's proposal to allow commercial MVNO licenses, including foreign-invested firms.

- The number of mobile phone base stations has continued to increase, and the construction of 5G networks has made steady progress. According to Huang Chengqing, vice president of the Internet Society of China, China will have 9.96 million mobile phone base stations by December 2021, and the number of mobile phone users is also rapidly increasing. By 2021, China's overall mobile phone user population reached 1.643 billion, with 355 million using 5G phones. These trends are expected to boost the revenues of MVNOs in China during the forecast period.

- The increased demand from developing countries, such as India and Indonesia, where smartphones are increasingly accessing rural regions as local governments push for digital and mobile economies, is likely to drive demand for smartphones at entry-level price points. For example, the Government of India's Digital India program is a flagship program aiming to transform the country into a digitally enabled society.

- For instance, in July 2021, with the Vivo Y72, Vivo Communication Technology Co. Ltd increased its 5G offering in India. At INR 20,990, the Y72 provides a superior smartphone experience with its powerful features and a visibly unique design in its category. The phone has 8GB+4GB extendable RAM, which keeps it from choking while multitasking.

- The Chinese government has also been pushing the development of its 5G industry, favoring its own companies, such as Huawei and ZTE, which make equipment necessary for the technology to work. Moreover, according to GSMA, there will be 807 million 5G connections by 2025. China is expected to account for the most significant number of 5G connections globally in 2025.

Mobile Virtual Network Operator (MVNO) Industry Overview

The MVNO market is highly competitive, primarily due to the presence of multiple players. The market is leading toward fragmentation, with the major players adopting strategies like service innovation and strategic partnerships to expand their client base and stay competitive in the market. Some major players include Lebara Group BV, TracFone Wireless Inc., and FRiENDi Mobile. Companies are involved in providing sales service, customer service, and mobile service to subscribers.

In July 2022, PeP acquired Simapka to expand financial and mobile services in Poland. This acquisition would aid in developing an ecosystem wherein the payments would be bolstered by a variety of additional services provided by POS. The major objective is to ensure that retail outlets throughout Europe gain benefit from the steady digitization of payments through the solutions of Simapka's mobile application.

In May 2022, Cricket Wireless LLC announced a collaboration with the Southern Intercollegiate Athletic Conference (SIAC). This three-year agreement allows Cricket to provide unique experiences to SIAC fans at all Historically Black Colleges/Universities (HBCUs) member schools.

In December 2021, Lycamobile partnered with the Welsh Government to enable remote learning throughout the spring and summer. The Mobile Data Uplift Scheme was available to digitally excluded students in Wales as they returned to school and throughout the rest of the school year. This aimed to help guarantee that children had access to internet resources and did not miss out on crucial learning and development during a challenging time.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Threat of New Entrants

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Bargaining Power of Suppliers

- 4.2.4 Threat of Substitutes

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Value Chain Analysis

- 4.4 Market Drivers

- 4.4.1 Increasing Mobile Network Subscribers and the Growing Penetration of Mobile Devices

- 4.4.2 Rising Demand for Efficient Cellular Networks

- 4.5 Market Challenges

- 4.6 Assessment of the Impact of COVID-19 on the Industry

5 MARKET SEGMENTATION

- 5.1 Deployment

- 5.1.1 Cloud

- 5.1.2 On-premise

- 5.2 Operational Mode

- 5.2.1 Reseller

- 5.2.2 Service Operator

- 5.2.3 Full MVNO

- 5.2.4 Other Operational Modes

- 5.3 Subsciber

- 5.3.1 Enterprise

- 5.3.2 Consumer

- 5.4 Application

- 5.4.1 Discount

- 5.4.2 Cellular M2M

- 5.4.3 Business

- 5.4.4 Media and Entertainment

- 5.4.5 Migrant

- 5.4.6 Retail

- 5.4.7 Roaming

- 5.4.8 Telecom

- 5.5 Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.2 Europe

- 5.5.2.1 Germany

- 5.5.2.2 United Kingdom

- 5.5.2.3 France

- 5.5.2.4 Italy

- 5.5.2.5 Spain

- 5.5.2.6 Rest of Europe

- 5.5.3 Asia-Pacific

- 5.5.3.1 China

- 5.5.3.2 Japan

- 5.5.3.3 India

- 5.5.3.4 South Korea

- 5.5.3.5 Rest of Asia-Pacific

- 5.5.4 Latin America

- 5.5.4.1 Brazil

- 5.5.4.2 Argentina

- 5.5.4.3 Columbia

- 5.5.4.4 Mexico

- 5.5.4.5 Rest of Latin America

- 5.5.5 Middle East and Africa

- 5.5.5.1 United Arab Emirates

- 5.5.5.2 Saudi Arabia

- 5.5.5.3 South Africa

- 5.5.5.4 Rest of Middle East and Africa

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 Lebara Group BV

- 6.1.2 TracFone Wireless Inc.

- 6.1.3 FRiENDi Mobile

- 6.1.4 Boost Mobile LLC (T-Mobile)

- 6.1.5 Virgin Mobile USA Inc.

- 6.1.6 Tesco Mobile Limited (Tesco PLC)

- 6.1.7 Cricket Wireless LLC (AT&T Inc.)

- 6.1.8 Lycamobile UK Limited

- 6.1.9 PosteMobile SpA

- 6.1.10 1&1 Drillisch AG

- 6.1.11 Airvoice Wireless LLC

- 6.1.12 ASDA Mobile

- 6.1.13 Giffgaff Ltd

- 6.1.14 Kajeet Inc. (Arterra Mobility)

- 6.1.15 Truphone GmbH

- 6.1.16 Voiceworks GmbH

- 6.1.17 Asahi Net Inc.