|

市場調查報告書

商品編碼

1444077

農業助劑:市場佔有率分析、產業趨勢與統計、成長預測(2024-2029)Agricultural Adjuvants - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

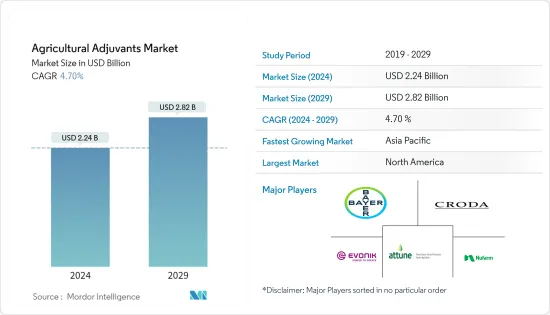

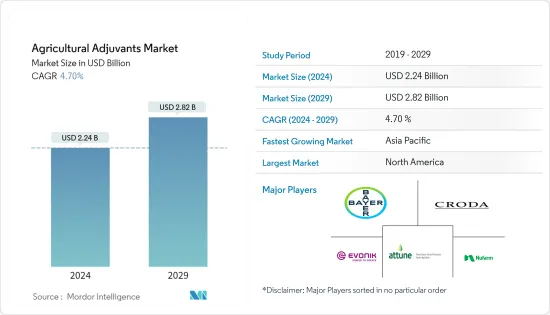

2024年農業助劑市場規模估計為22.4億美元,預計到2029年將達到28.2億美元,在預測期間(2024-2029年)以4.70%的複合年增長率增長。

主要亮點

- 近年來,由於已開發國家農業生產中對永續害蟲管理的需求不斷增加,農業助劑市場經歷了顯著成長。此外,提高農業生產力以滿足全球糧食需求的需求促使作物保護化學品的使用增加,這推動了農業助劑市場的發展。人們越來越重視提高作物保護化學品在不同氣候條件下的有效性,從而增加了對其中使用的助劑進行創新的需求。

- 在全球範圍內,包括北美、歐洲和亞太地區在內的多個地區對基因改造作物的暴露和應用實施了嚴格的規定。該地區基因改造作物產量低是農業助劑使用方便的重要因素。大規模採用基改作物會減少佐劑的使用。種植基改作物的農民選擇經過基因改造的耐除草劑種子,以解決必須使用化學藥劑的問題,從而消除了對助劑的需求。因此,這些地區對基改作物生產的嚴格監管極大地促進了助劑的成長。

- 此外,消費者對環保農業助劑的偏好增加以及生物來源製品助劑的使用增加等因素也促進了市場的成長。

農用助劑市場趨勢

糧食需求增加與耕地減少推動市場發展

世界人口正在呈指數級成長。每天有近 20 萬人增加世界的糧食需求。根據美國人口分類,世界人口在過去 100 年幾乎翻了兩番,預計到 2050 年將達到 92 億。因此,養活不斷成長的人口已成為對世界的威脅。

此外,在過去 40 年裡,世界因侵蝕和污染而失去了大量耕地,這可能對全球糧食需求造成可怕的後果。持續耕田和大量使用化學肥料正在導致世界各地的土壤劣化。侵蝕發生的速度比土壤形成的速度快100倍。在不破壞生態系統變化的情況下,僅 2.5 公分的表土就需要大約 500 年的時間才能形成。

此外,各種作物害蟲每年造成全球作物損失的 10-16%。因此,作物保護是農民為滿足世界糧食需求而採取的重要策略。在作物上結合使用助劑和農藥是一項經過驗證的技術,可以增加全球糧食產量。根據世界銀行公佈的資料庫,全球整體人均耕地面積從2017年的0.19公頃減少到2020年的0.18公頃。因此,世界各地的農民都在明智地使用助劑方面得到政府的支持。

北美市場佔據主導地位

北美佔據了農用助劑市場佔有率。這是先進作物保護技術的最大市場之一。當玉米、大豆等農作物大面積種植時,會消耗大量的農藥,也意味著使用大量的助劑。此外,作物保護科學實踐意識的提高也促使農民使用助劑的比例提高。

該地區的主要佔有率被認為是由於人口快速成長、耕地持續減少以及對標準品質食品的需求增加等重要因素造成的。此外,農業勞動力短缺、農業實踐的變化、人們對農業環境影響的認知不斷增強以及對永續生產系統的興趣日益濃厚等因素預計將進一步支持北美市場的成長。

此外,有關改進和高效佐劑解決方案的持續研發活動也有望擴大市場成長範圍。政府為永續農業實踐所採取的政策支持助劑的消費,這是推動該地區所研究市場成長的另一個重要因素。

農用助劑產業概況

農助劑市場整合,本土企業佔最大佔有率。市場主要企業正專注於推出新產品,以滿足更廣泛的消費者群體並擴大其在市場上的影響力。投資於廉價且有效產品的研發是市場領導採取的另一個策略。市場主要企業包括 Nufarm、Bayer Cropscience、Croda International PLC、Evonik Industries AG、Attune Agriculture 等。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場動態

- 市場概況

- 市場促進因素

- 市場限制因素

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 買方議價能力

- 新進入者的威脅

- 替代產品的威脅

- 競爭公司之間的敵對關係

第5章市場區隔

- 依類型

- 活化劑

- 有用

- 依用途

- 除草劑

- 殺蟲劑

- 殺菌劑

- 其他

- 依地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 北美其他地區

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 俄羅斯

- 其他歐洲國家

- 亞太地區

- 中國

- 日本

- 印度

- 澳洲

- 其他亞太地區

- 南美洲

- 阿根廷

- 巴西

- 南美洲其他地區

- 非洲

- 南非

- 其他非洲

- 北美洲

第6章 競爭形勢

- 市場佔有率分析

- 最採用的策略

- 公司簡介

- Adjuvant Plus Inc.

- Akzonobel NV

- Brandt Consolidated Inc.

- Croda International PLC

- Evonik Industries AG

- Garrco Products Inc.

- Helena Chemical Company

- Huntsman Corp.

- Interagro(UK)Ltd

- Lamberti SPA

- Momentive Performance Materials Inc.

- Nufarm

- Solvay

- Wilbur-Ellis Company

第7章市場機會與未來趨勢

The Agricultural Adjuvants Market size is estimated at USD 2.24 billion in 2024, and is expected to reach USD 2.82 billion by 2029, growing at a CAGR of 4.70% during the forecast period (2024-2029).

Key Highlights

- The agricultural adjuvants market has witnessed substantial growth in recent years owing to the growing need for sustainable pest management in agricultural operations in developed countries. Further, the need for improved agricultural productivity to meet the global food demand has imposed the increased use of crop protection chemicals, which is, in turn, driving the market for agricultural adjuvants. Increased emphasis on the improved effectiveness of crop protection chemicals in varied climatic conditions is necessitating the need for innovations in terms of the adjuvants used in them.

- Globally, several regions, including North America, Europe, and the Asia-Pacific, have imposed strict regulations on the exposure and application of genetically modified crops. The lesser production of GMO crops in this region is a crucial factor contributing to the convenient use of adjuvants in agriculture. With genetically modified crops being adopted on a large scale, the use of adjuvants would have been reduced. The farmers cultivating the GMO crops choose herbicide-resistant seeds that have been genetically modified to tackle issues for which chemicals had to be applied, thus, cutting off the requirement for adjuvants. Therefore, stringent regulations for GMO crop production in these regions have largely contributed to the growth of adjuvants.

- In addition, the factors such as growing consumer preference for environment-friendly agricultural adjuvants and increasing use of adjuvants for biological products are contributing to the market's growth.

Agricultural Adjuvants Market Trends

Growing Food Demand and Decrease in Arable Land Driving the Market

The global population is increasing exponentially. Nearly 200,000 people are getting added to the world food demand daily. According to the United States population division, the world's human population has increased nearly fourfold in the past 100 years, and it is projected to reach 9.2 billion by 2050. Thus, supplying food to the growing population has become a global threat.

Furthermore, in the past 40 years, the world has lost a major portion of its arable land due to erosion or pollution, with potentially disastrous consequences for the global demand for food. The continual plowing of fields, combined with the heavy use of fertilizers, has degraded soils worldwide. Erosion occurs at a pace of up to 100 times greater than the rate of soil formation. It takes around 500 years for just 2.5 cm of topsoil to be created amid unimpeded ecological changes.

Moreover, various crop pests cause 10-16% of global crop losses annually. So, to meet the global food demand, crop protection is the key strategy farmers adopt. The use of adjuvants alongside pesticides over crops is a proven technology for increasing global food production. As per a database published by the World Bank, the area per capita for arable land declined globally from 0.19 hectares in 2017 to 0.18 hectares in 2020. Accordingly, farmers across the globe are being supported by the respective governments for the judicious use of adjuvants.

North America Dominates the Market

North America accounts for the majority of agriculture adjuvants market share. It is one of the largest markets for advanced crop protection technologies. With large acreages under crops such as corn and soybean, which consume large quantities of crop protection chemicals, the usage of adjuvants is higher. Furthermore, the usage of adjuvants is also high at the farmer level due to greater awareness of the scientific practices of crop protection.

The major share of this region is attributed to crucial factors, such as a rapidly growing population, continuous reduction in the arable land, and increased demand for standard-quality food. Moreover, the factors such as shortages of agricultural labor, changing agricultural practices, growing recognition of the environmental impact of agriculture, and growing interest in sustainable production systems are further expected to support the market growth in North America.

In addition, ongoing research & development activities on improved and efficient adjuvant solutions are also anticipated to widen the scope for market growth. The government policies adopted for sustainable agricultural practices support the consumption of adjuvants, which is an additional key factor driving the growth of the studied market in the region.

Agricultural Adjuvants Industry Overview

The market for agricultural adjuvants is consolidated, with local players occupying the maximum share. Key players in the market are focusing on new product launches to cater to a broader consumer base and expand their market presence. Investments in research and development of cheap and effective products is another strategy adopted by market leaders. Some of the major players in the market are Nufarm, Bayer Cropscience, Croda International PLC, Evonik Industries AG, and Attune Agriculture.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope Of The Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.3 Market Restraints

- 4.4 Industry Attractiveness - Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products

- 4.4.5 Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 By Type

- 5.1.1 Activator Adjuvants

- 5.1.1.1 Surfactants

- 5.1.1.2 Oil Adjuvants

- 5.1.2 Utility Adjuvants

- 5.1.1 Activator Adjuvants

- 5.2 By Application

- 5.2.1 Herbicide Adjuvants

- 5.2.2 Insecticide Adjuvants

- 5.2.3 Fungicide Adjuvants

- 5.2.4 Other Applications

- 5.3 By Geography

- 5.3.1 North America

- 5.3.1.1 United States

- 5.3.1.2 Canada

- 5.3.1.3 Mexico

- 5.3.1.4 Rest of North America

- 5.3.2 Europe

- 5.3.2.1 Germany

- 5.3.2.2 United Kingdom

- 5.3.2.3 France

- 5.3.2.4 Italy

- 5.3.2.5 Russia

- 5.3.2.6 Rest of Europe

- 5.3.3 Asia-Pacific

- 5.3.3.1 China

- 5.3.3.2 Japan

- 5.3.3.3 India

- 5.3.3.4 Australia

- 5.3.3.5 Rest of Asia-Pacific

- 5.3.4 South America

- 5.3.4.1 Argentina

- 5.3.4.2 Brazil

- 5.3.4.3 Rest of South America

- 5.3.5 Africa

- 5.3.5.1 South Africa

- 5.3.5.2 Rest of Africa

- 5.3.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Share Analysis

- 6.2 Most Adopted Strategies

- 6.3 Company Profiles

- 6.3.1 Adjuvant Plus Inc.

- 6.3.2 Akzonobel NV

- 6.3.3 Brandt Consolidated Inc.

- 6.3.4 Croda International PLC

- 6.3.5 Evonik Industries AG

- 6.3.6 Garrco Products Inc.

- 6.3.7 Helena Chemical Company

- 6.3.8 Huntsman Corp.

- 6.3.9 Interagro (UK) Ltd

- 6.3.10 Lamberti SPA

- 6.3.11 Momentive Performance Materials Inc.

- 6.3.12 Nufarm

- 6.3.13 Solvay

- 6.3.14 Wilbur-Ellis Company