|

市場調查報告書

商品編碼

1444070

能源產業巨量資料分析:市場佔有率分析、產業趨勢與統計、成長預測(2024-2029)Big Data Analytics In Energy Sector - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

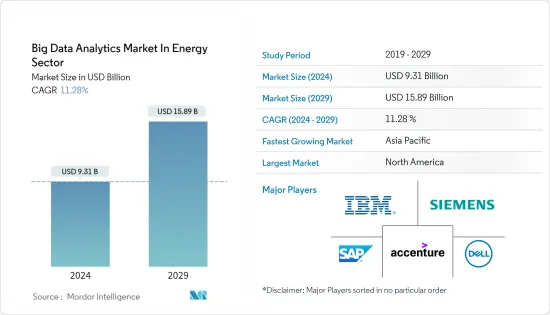

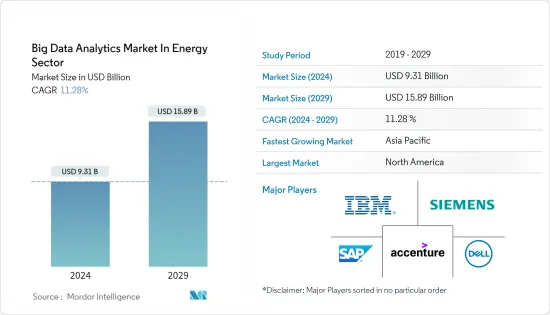

能源產業巨量資料分析市場預計將從 2024 年的 93.1 億美元成長到 2029 年的 158.9 億美元,預測期(2024-2029 年)年複合成長率為 11.28%。

巨量資料分析在能源領域降低能源消費量和提高能源效率方面發揮重要作用,導致產業對分析的需求不斷增加。

主要亮點

- 石化燃料的稀缺導致人們越來越依賴太陽能、波浪渦輪機和風力發電機等替代能源,消費量迅速增加。因此,使用先進的大資料庫分析工具來了解這些能源來源的行為和適應變得至關重要。油價波動導致能源相關計劃的高支出,並創造了對巨量資料分析的需求。因此,對優質資訊的需求不斷增加,這可能會增加市場成長和盈利。

- 能源產業面臨許多挑戰,包括預測生產需求、提高效率、負載平衡和最佳化以及最佳化營運流程。雖然英國石油公司和哈里伯頓等許多大公司已經實施了資料分析,但小型和資料匱乏的公司仍有很大潛力達到新的高度。巨量資料分析提供一致的、資料支援的輸出,有助於避免停機和供應鏈中斷。

- 一些服務供應商共同提供有效的分析服務。 2022 年 9 月,斯倫貝謝和 Cognite 宣佈建立策略合作夥伴關係,將斯倫貝謝的地下企業資料解決方案與 Cognite 的開放式工業 DataOps 平台 Cognite Data Fusion 整合。這項合作關係將使客戶能夠將油井、油藏和設施的資料整合到開放平台中,利用內建人工智慧和先進的分析工具來最佳化生產、降低成本並減少營運空間。它將是這樣的。

- 然而,最近爆發的COVID-19清楚地表明,不確定性對決策流程和市場產生負面影響。隨著市場參與企業開始接收有關情況的即時訊息,能源市場開始放緩。在這種場景下使用巨量資料可以將資訊放大到各個相關人員,防止恐慌,確保市場穩定和供應安全。

- 此外,人們對智慧電錶優勢的認知不斷提高,以及對替代能源的投資增加,正在推動 COVID-19 大流行後的市場擴張。此外,石油價格波動、石化燃料枯竭以及電力傳輸效率和可靠性提高等新趨勢也推動了能源領域對巨量資料分析的需求。此次疫情也凸顯出缺乏訓練有素、具備專業知識的勞動力,這限制了該產業的擴張。

能源產業巨量資料分析市場趨勢

智慧電錶推動市場成長

- 巨量資料分析的智慧計量包括電網營運、資源規劃、現場服務、客戶體驗和法規遵循等組件。它有助於透過產生的資料增強需求和預測,這可能會推動市場成長。

- 此外,智慧電錶巨量資料分析有助於預測能源消耗。這在管理供需和減少能源浪費方面發揮關鍵作用。根據英國商業、能源和工業戰略部(BEIS)2022年3月發布的報告,近期總合安裝了380萬個智慧電錶,與前一年同期比較增加了7%。此外,根據官方決議,哥倫比亞政府希望在 2030 年為 75% 的家庭安裝智慧電錶。

- 此外,大量的智慧電錶部署會產生大量資料。例如,如果智慧電錶每30分鐘記錄一次資料,那麼2000萬隻智慧電錶在短短一年內產生的記錄數將是3.51011筆。此外,智慧電錶資料(消費量、故障、斷電、價格資訊等)的多樣性和性質產生異質多源資料。這樣,智慧電錶資料就具備了巨量資料量大、異質性高等特性。此外,智慧電錶資料必須快速處理和分析,以便於即時分析。根據能源效率研究所的數據,2022 年美國將安裝 1.24 億個智慧電錶,比前一年略有增加。

- 此外,需要脫碳和去中心化的公共產業可以透過添加地理資訊系統 (GIS)、CIS 和天氣資料等其他資訊來源,從計量資料中受益。 AWS 快速入門在 AWS 雲端上部署智慧電錶資料分析 (MDA) 平台。該平台幫助公用事業公司利用能源消耗資料的價值,同時消除麻煩。該平台還使公用事業公司能夠提供新服務,例如負載預測、透過主動通知更深入地與客戶參與、配電資產的預測性維護以及線路品質分析。

- 根據業務環境,各個作業系統可以將資料傳送到平台以獲得可操作的見解。例如,根據AWS報告,Kalkitech是AWS精選技術合作夥伴,提供電錶通訊解決方案,包括用於抄表應用程式的通訊協定堆疊、大型電錶模擬器和電錶測試工具。該公司根據監管機構的要求提供這些工具,並提供智慧電錶作為雲端基礎的服務。

- MDA平台每天可批次處理高達250TB的抄表資料。它還處理遲到的資料,並為各種消費端點資料準備,例如資料倉庫 (Amazon Redshift)、機器學習管道 (Amazon SageMaker) 或 API,從而允許將資料傳送到第三方應用程式。 。

- 新興國家正在能源領域大力投資,由先進巨量資料技術驅動的智慧電錶普及在未來幾年將更加普及。此外,Ameren 還與密蘇裡州監管機構制定了一項策略,擴大其智慧型能源計畫 (SEP),到 2025 年安裝 120 萬個智慧電錶,並最近購買了兩個總合700 MW 的風電場。我提案。

亞太地區市場成長顯著

- 該地區對所研究市場的成長做出了重大貢獻。該地區的巨量資料分析市場正在穩步成長,這主要是由於包括中國和印度在內的多個國家擴大採用物聯網和智慧技術,以及智慧城市等各種政府舉措,這一點已得到證實。在能源領域。根據電力部國家智慧電網任務近期發布的資料,截至2022年1月,印度各邦智慧電網總配額1,116萬台中,已安裝373萬台。 EESL 的目標是取代 250 億個傳統設備。印度正在透過智慧電錶國家計畫 (SMNP) 將電錶與智慧電錶連接起來,以減少 AT&C 損失。

- 在亞太地區,由於中國人口眾多,智慧電錶和創新電網系統的適應率不斷提高,中國有望成為能源和公共產業領域巨量資料分析的重要國家。根據彭博社報道,2022年5月,中國政府報告稱,2022年前四個月在太陽能和風能計劃等清潔能源計劃上投資約43億美元,高於2021年同期金額。與同期投資相比約204 %。有前景的投資預計將吸引一代人的智慧電錶和相關計劃,進一步吸引該國多個最終用戶的消費,並推動對巨量資料分析的需求,以充分利用資源。

- 此外,該地區的發電業也有大量活動。與全球趨勢一致,該產業積極推出綠色發電解決方案,特別是在印度、中國、日本和新加坡等國家。

- 在日本,電力公司已開始實施國家電網重組計劃,這將需要對輸配電設備和基礎設施進行投資。鑑於核能發電廠除役,日本政府加大了對可再生能源的關注。政府的目標是到2030年25-35%的電力來自可再生能源。

- 同時,根據Utility Bidder稱,新加坡比其他國家都更依賴石化燃料,正在利用先進的計量系統加速向清潔能源的過渡。根據《Smart Energy International》發表的報告,新加坡最近僅安裝了 50 萬個智慧電錶,計劃到 2024 年達到 140 萬個。

- 市場上的各個參與者正在擴大其產品範圍,並利用印度城市發展的需求。例如,ABB 印度公司於 2022 年 2 月針對數位面板電錶市場推出了最新系列的電力測量和電力監控電錶,2017 年至 2023 年全球年複合成長率為 6%。透過此次推出,除了現有的單一網路分析儀和多功能儀表之外,ABB 印度還提供了廣泛的產品組合,以滿足醫療保健、基礎設施、飯店和餐飲等行業的面板儀表市場需求。

能源領域巨量資料分析的產業概述

能源產業巨量資料分析市場整合,大型企業佔市場佔有率。缺乏熟練的勞動力(具有分析技能和專業知識)、隱私問題日益嚴重以及資料外洩等因素使得新進入者難以進入市場。市場滲透率的提高和新技術投資能力的增強預計將加劇競爭對手之間的敵意。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章 簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

- 調查系統

- 二次調查

- 初步調查

- 對資料進行三角測量並產生見解

第3章執行摘要

第4章市場動態

- 市場概況

- 市場促進因素

- 海量資料湧入

- 原油價格波動

- 市場限制因素

- 缺乏技術純熟勞工

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 買方議價能力

- 新進入者的威脅

- 替代產品的威脅

- 競爭公司之間的敵意強度

- 評估 COVID-19 對產業的影響

第5章市場區隔

- 按用途

- 電網營運

- 智慧電錶

- 資產和員工管理

- 按地區

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 中東和非洲

第6章 競爭形勢

- 公司簡介

- IBM Corporation

- Siemens AG

- SAP SE

- Dell Technologies Inc.

- Accenture PLC

- Infosys Limited

- Intel Corporation

- Microsoft Corporation

- Palantir Technologies Inc.

- Enel X Srl

第7章 投資分析

第8章市場的未來

The Big Data Analytics Market In Energy is expected to grow from USD 9.31 billion in 2024 to USD 15.89 billion by 2029, at a CAGR of 11.28% during the forecast period (2024-2029).

Big Data analytics plays a crucial role in reducing energy consumption and improving energy efficiency in the energy sector, thus boosting the demand for analytics in the industry.

Key Highlights

- The scarcity of fossil fuels is increasing the dependency on alternate energy sources, such as solar, wave, and wind turbines, where consumption is rising rapidly. Thus, it has become imperative to use advanced big data-based analytical tools to understand the behavior or adaption of these energy sources. The volatility in oil prices leads to high expenditure on energy-related projects, creating demand for big data analytics. Thus, the need for quality information is increasing, which may boost the market's growth and profitability.

- The energy sector faces many problems like predicting production demand, enhancing efficiency, optimizing load distribution and optimization, and optimizing operational processes. Many large corporates like BP and Halliburton have adopted data analytics, while there is a high scope for small companies with lesser data to achieve new heights. Big data analytics helps deliver consistent and data-backed outputs to avoid downtime or supply chain disruption.

- Some service providers collaborate to deliver effective analytics services. In September 2022, Schlumberger and Cognite announced entering a strategic partnership to integrate Schlumberger's Enterprise Data Solution for subsurface with Cognite's open industrial DataOps platform, Cognite Data Fusion. The partnership would allow customers to integrate data from wells, reservoirs, and facilities in a single, open platform and leverage embedded AI and advanced analytics tools to optimize production, reduce costs and decrease operational footprint.

- However, the recent COVID-19 outbreak revealed the negative impacts of uncertainty on decision-making processes and markets. When market participants started receiving real-time information about the situation, the energy markets began to ease. Big Data can be used in such scenarios to amplify information to various stakeholders to prevent panic and ensure market stability and security of supply.

- Also, after the COVID-19 pandemic, the growing awareness of the benefits of smart metering and increased investment in alternative energy sources are driving market expansion. Furthermore, the volatility of oil prices, the depletion of fossil fuels, and emerging trends for improved efficiency and dependability in power transmission contribute to the demand for Big Data analysis in the energy sector. The pandemic also highlighted the shortage of trained labor with domain-specific knowledge limiting industry expansion.

Big Data Analytics in Energy Sector Market Trends

Smart Metering to Fuel Market Growth

- Smart metering in Big Data analytics contains components such as grid operations, resource planning, field services, customer experience, and regulatory compliances. It helps enhance demand and forecast through the data generated, which will likely boost market growth.

- Furthermore, Big Data analytics in smart metering assists in predicting energy consumption, which plays a vital role in managing demand and supply and mitigates the waste of energy. According to the UK Department of Business, Energy and Industrial Strategy (BEIS) report published in March 2022, a total of 3.8 million smart meters were installed recently, with a 7% increase from the previous year. In addition, in Colombia, the government desires to have 75% of households with smart meters til 2030, according to an official resolution.

- Further, the large number of smart meters deployed can generate tremendous data. For example, if an intelligent meter records data every half hour, the number of records generated by twenty million intelligent meters is 3.51011 over just one year. Further, the diversity and nature of smart meter data (e.g., consumption, fault, outage, and price information) results in heterogeneous multi-source data. Thus, smart meter data has the characteristics of big data, such as large volumes and high heterogeneity. In addition, intelligent meter data must be quickly processed and analyzed to facilitate real-time analysis. According to the Institute for Electric Efficiency, 124 million smart meters installed in 2022 in the United States, a slightly increased from the previous year.

- Moreover, utilities that require decarbonization and decentralization can benefit from metering data by adding other information sources like geographic information systems (GIS), CIS, and weather data. AWS Quick Start deploys the Smart Meter Data Analytics (MDA) platform on AWS Cloud. This platform helps the utilities tap the value of energy consumption data while removing heavy lifting. The platform also allows utilities to provide new services such as load prediction, deeper customer engagement through proactive notifications, predictive maintenance on distribution assets, and circuit quality analytics.

- Depending on the business context, the individual operating systems can send data to the platform and get actionable insights. For example, According to a report by AWS, Kalkitech is an AWS Select Technology Partner, providing meter communication solutions such as a protocol stack for meter reading applications, a large-scale meter simulator, and a meter test tool. The company offers these tools per the regulatory bodies, providing smart metering as a cloud-based service.

- The MDA platform can process up to 250TB of meter reads daily in batches. It also handles late-arriving data and prepares data for different consumption endpoints like a data warehouse (Amazon Redshift), a machine learning pipeline (Amazon SageMaker), or APIs to make the data consumable for third-party applications.

- Developing countries are hugely investing in the energy sector, which is expected to boost smart metering with advanced Big Data techniques in the coming years. Additionally, Ameren proposed expanding its Smart Energy Plan (SEP) with Missouri regulators, laying out a strategy to install 1.2 million smart meters by 2025 and purchasing two wind farms totaling 700 MW recently.

Asia Pacific\sto Experience Significant Market Growth

- The region is contributing significantly to the studied market growth. Primarily due to the factors, such as the increasing adoption of IoT and smart technologies and various government initiatives, such as smart cities, across multiple countries, including China and India, affirm the region as the favorably-growing region in the Big Data analytics market in the energy sector. According to the recent data released by the National Smart Grid Mission, Ministry of Power, out of the total allocated quantity of 11.16 million smart meters, 3.73 million were installed across various states in India as of January 2022. EESL aimed to replace 25 crore conventional meters with smart meters in India through the Smart Meters National Program (SMNP) to reduce AT&C losses.

- In the Asia-Pacific, China is expected to be a significant country in Big Data analytics in the energy and utility sector due to its immense population and rising rate of adaptation of smart metering and innovative grid systems. According to Bloomberg, in May 2022, the Chinese government reported having invested around USD 4.3 Billion in clean power projects like solar and wind projects in the first fourth months of 2022, about 204% compared to the investment in the same period in 2021. Such promising investments will attract smart metering and related projects at the generation level and for further consumption to several end-users in the country, propelling the demand for big data analytics for the best utilization of the resources.

- Additionally, there has been significant high activity in the region's power generation sector. Similar to the global trend, there has been immense activity in the industry to adopt greener power generation solutions, especially in countries like India, China, Japan, and Singapore.

- In Japan, electrical utilities have begun implementing a nationalized grid restructuring program, which would necessitate investment in T&D equipment and infrastructure. Given the country's decommissioning of nuclear power plants, the Japanese government is increasing its focus on renewable energy. The government is working towards generating 25-35% of power from renewable sources by 2030.

- At the same time, according to Utility Bidder, Singapore, which relies on fossil fuels more than any other country, is leveraging advanced metering to speed up the shift to clean energy resources. According to a report published in Smart Energy International, Singapore has only installed 500,000 smart meters recently and plans to reach the 1.4 million mark by 2024.

- Various players in the market are increasing their product range and scope to capitalize on the demand in the Indian urban development landscape. For instance, in February 2022, ABB India launched the latest series of electrical measuring and power monitoring meters for the digital panel meter market, registering a CAGR of 6% between 2017-2023 globally. With this introduction, ABB India offerings a broad portfolio in addition to the existing range of single network analyzers and multifunction meters catering to the Panel Meter market across industries such as healthcare, infrastructure, hospitality, and F&B, to name a few.

Big Data Analytics in Energy Sector Industry Overview

The Big Data analytics market in the energy sector is consolidated, with major players dominating the market share. Due to factors a lack of skilled workforce (with analytical skills and expertise), rising privacy concerns, and data breaches, new players are finding it difficult to enter the market. The competitive rivalry is anticipated to be high due to higher market penetration and the ability to invest in new technologies.

In February 2022, cQuant.io, an energy analytics company, partnered with Microsoft to scale its cQuant energy analytics solution, enabling customers to decrease their greenhouse gas emissions with reliable renewable energy purchases.

In February 2022, IBM and SAP strengthened their partnership to help clients move workloads from SAP Solutions to the cloud. IBM announced teaming with SAP to provide technology and consulting expertise, making it easier for clients to embrace a hybrid cloud strategy and move mission-critical workloads from SAP Solutions to the cloud for regulated and non-regulated enterprises.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

- 2.1 Research Framework

- 2.2 Secondary Research

- 2.3 Primary Research

- 2.4 Data Triangulation and Insight Generation

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Enormous Influx of Data

- 4.2.2 Volatility in the Oil Prices

- 4.3 Market Restraints

- 4.3.1 Lack of Skilled Labor

- 4.4 Industry Attractiveness - Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products

- 4.4.5 Intensity of Competitive Rivalry

- 4.5 Assessment of the Impact of COVID-19 on the Industry

5 MARKET SEGMENTATION

- 5.1 By Application

- 5.1.1 Grid Operations

- 5.1.2 Smart Metering

- 5.1.3 Asset and Workforce Management

- 5.2 By Geography

- 5.2.1 North America

- 5.2.2 Europe

- 5.2.3 Asia-Pacific

- 5.2.4 Latin America

- 5.2.5 Middle-East and Africa

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 IBM Corporation

- 6.1.2 Siemens AG

- 6.1.3 SAP SE

- 6.1.4 Dell Technologies Inc.

- 6.1.5 Accenture PLC

- 6.1.6 Infosys Limited

- 6.1.7 Intel Corporation

- 6.1.8 Microsoft Corporation

- 6.1.9 Palantir Technologies Inc.

- 6.1.10 Enel X S.r.l.