|

市場調查報告書

商品編碼

1429469

製造業巨量資料分析:市場佔有率分析、產業趨勢與統計、成長預測(2024-2029)Big Data Analytics In Manufacturing - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

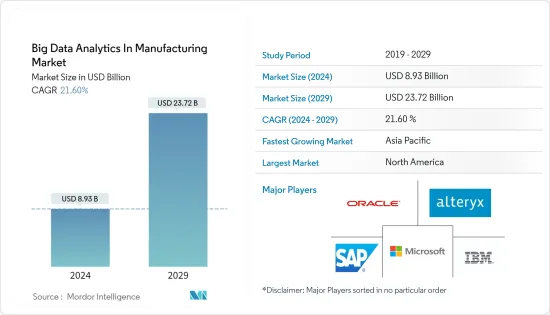

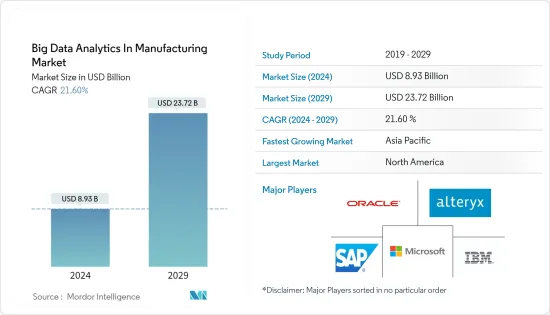

製造業巨量資料分析市場規模預計到2024年為89.3億美元,預計到2029年將達到237.2億美元,預測期內(2024-2029年)複合年成長率為21.60%,預計還會成長。

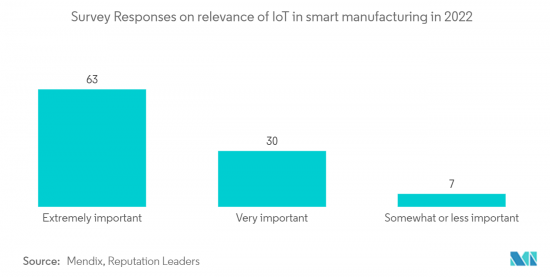

製造業擴大採用人工智慧 (AI) 技術來高效處理複雜的工作流程。到 2030 年,全球物聯網、製造市場預計將達到 1.5 兆美元,影響整個產品生命週期和及時交貨,導致意外停機、缺陷和安全問題。明智的決策對於製造商預防至關重要智慧型文件處理 (IDP) 等人工智慧解決方案可以透過將非結構化和半結構化資訊即時轉換為可用資料,幫助製造商最大限度地減少處理文件的時間。很有幫助。

主要亮點

- 根據麥肯錫的報告,資料主導的企業吸引客戶的可能性高出 23 倍,獲利的可能性高出 19 倍。製造公司可以透過業務的不同領域收集資料並即時視覺化來利用資料分析。例如,透過切換到 Oracle Analytics Cloud,Schneider Electric現在能夠收集、自動分析和處理 90% 的售罄資料。該技術減少了資料採集錯誤,消除了手動資料整合,提高了及時性和準確性。

- 為了解決勞動力管理障礙,製造商必須預見人員配置、日程安排、培訓和生產力方面的挑戰。巨量資料公司提供預測分析解決方案,幫助製造組織安排維護和維修、減少停機時間並提高生產力。例如,BMW使用資料分析解決方案來監控汽車生產過程中的產品品質。安裝在寶馬製造部門的感測器提供的資料可以幫助公司在品質問題成為重大問題之前及早發現它們。

- COVID-19 大流行擾亂了製造業,並使供應鏈和庫存追蹤變得困難。生產領域的這些障礙迫使他們與擁有 RFID 和條碼掃描等技術的巨量資料分析提供者合作。

- 在製造業中採用巨量資料分析的主要障礙是大量資料的可用性,這需要品質過濾過程。來自不同部門的資料必須整合起來並作為一個實體來立即識別和解決問題。透過採用人工智慧技術和資料分析,製造商可以最佳化業務、提高生產力並保持全球競爭力。

製造業巨量資料分析市場趨勢

狀態監測可望顯著成長

- 狀態監測是使用感測器收集資料並監測關鍵運作參數(例如振動、聲音異常、氣流和電流)的過程。預測資料分析解決方案使用這些資料來主動預測機器故障,最終有助於降低維護成本和停機時間。

- Mondas 是一家為能源工廠和建築服務設備製造商提供狀態監控平台的公司。該公司的即時監控功能可以在缺陷發展為重大問題之前檢測到缺陷,有助於降低營運成本。

- 2023 年 2 月,總部位於都柏林的 Hoistech 與 CoreRFID 合作開發了一款基於應用程式的視覺化管理工具,讓使用者可以監控和報告任何資產的狀態。該應用程式使用行動電話的 GPS 自動定位用戶和資產,儀表板提供所有資產績效的清晰概覽。

- 2022年4月,歐姆龍科技推出了K7TM,一款主要應用於汽車和快速消費品產業的加熱設備狀態監測裝置。該裝置可以輕鬆安裝在現有設備上,並且可以檢測機器的異常狀況。其一大特點是在設備運作時可以自動測量加熱器的電阻值,並且可以確定加熱器劣化的趨勢。

- 2022 年 3 月,Guardhat 發布了用於工人狀態監測的工業級解決方案。該應用程式支援即時監控和基於事件的警報,有助於防止因暴露於熱、氣體、輻射和其他危險而造成的傷害甚至死亡。該測試在一家金屬生產工廠進行,該工廠收到警報稱一名工人因溫度超過 102 華氏度而過度勞累,並在工人受傷前對其進行了降溫。

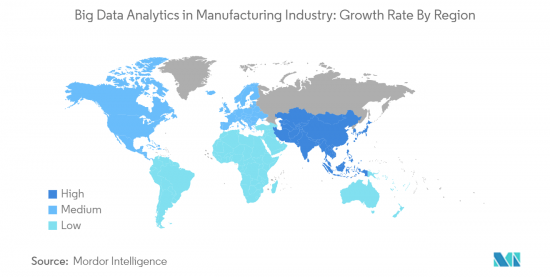

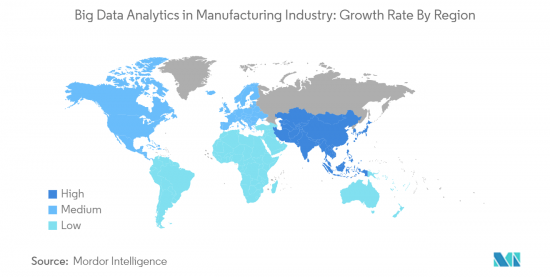

亞太地區成長最快

- 亞洲開發銀行(ADB)發布報告預測,2023年東南亞(SEA)經濟將成長4.7%。製造業為東協地區提供了巨大的成長機會,而物聯網(IoT)技術的採用有可能進一步增強這一成長潛力。

- 亞太地區 (APAC) 地區的多個國家,例如韓國、中國、日本、台灣和新加坡,以其強大的製造業而聞名,特別是在電子設備組裝和半導體元件生產方面。這些國家擴大採用巨量資料分析來改善電子和半導體產業的業務。

- 透過結合物聯網技術的引入和資料分析,將可以即時了解日常業務中的車輛事故、員工缺勤、事故和傷害等各個業務方面。這可以促進平穩運行並提高製造效率。

- 越南領先的數位轉型服務供應商 FPT Software 與日本 IT 公司 SCSK 共同發布了汽車產業OEM(目的地設備製造商)和供應商的全面解決方案。該平台 MaaZ(Monozukuri Adaptive AUTOSAR)旨在提供高效的解決方案,可縮短產品上市時間並降低客戶的總擁有成本。

- 預計2023年東南亞經濟將顯著成長,主要體現在製造業。物聯網技術和資料分析的採用可能會進一步促進該行業的成長。 FPT Software 和 SCSK 等公司透過合作為OEM和供應商提供先進的解決方案,推動汽車產業的創新和效率。

製造業巨量資料分析概述

製造業中分析解決方案和物聯網的採用正在迅速增加,為巨量資料分析供應商創造了新的商機。為了在新參與企業的競爭中生存下來,現有的參與者正在隨著市場的擴大而擴大他們的產品陣容。資料分析可以提供競爭優勢的一個領域是影像分析,幫助製造公司檢測肉眼難以識別的微小裂縫和刮痕等缺陷。

2023 年 2 月,美國國家智慧製造研究所 CESMII 與 SAS 合作,推進整個製造業的高階分析。在智慧工廠部署分析解決方案可以推動數位轉型,提高生產品質和效率,並改善業務決策。 SAS 的領先客戶之一喬治亞 -Pacific 使用 SAS 的雲端原生解決方案將計劃外停機時間減少了 30%,並將整體效率提高了 10%。

2022 年 1 月,印度巴拉特石油公司 (BPCL)推出了“One BPCL”,這是一種將所有業務部門統一在一個共用平台上的技術解決方案。 BPCL 在 Salesforce Sales and Service Cloud 和 Tableau CRM 中實施業務分析,以協助銷售負責人捕獲潛在客戶、監控機會管道並更快地達成交易。透過利用這些先進技術,BPCL 旨在簡化業務並提高整體業務績效。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第1章執行摘要

第2章 市場洞察

- 市場概況

- 產業吸引力-波特五力分析

- 買家/消費者的議價能力

- 供應商的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭公司之間敵對關係的強度

- 產業價值鏈分析

- COVID-19 市場影響評估

第3章市場動態

- 市場促進因素

- 不斷發展的技術、資產和工程導向的價值鏈

- 透過工業 4.0 實現快速工業自動化

- 市場限制因素

- 缺乏意識和安全擔憂

- 市場機會

- 預測分析工具的使用增加

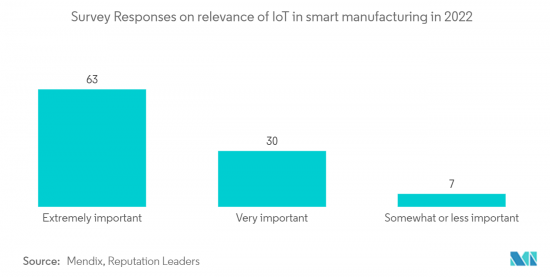

- 工業物聯網 (IIoT) 的採用率不斷提高

第4章市場區隔

- 按最終用戶產業

- 半導體

- 航太

- 車

- 其他最終用戶產業

- 按用途

- 狀態監測

- 品管

- 庫存控制

- 其他用途

- 按地區

- 北美洲

- 美國

- 加拿大

- 歐洲

- 英國

- 德國

- 法國

- 其他歐洲國家

- 亞太地區

- 中國

- 日本

- 印度

- 其他亞太地區

- 拉丁美洲

- 中東/非洲

- 北美洲

第5章競爭形勢

- 公司簡介

- Alteryx Inc.

- IBM Corporation

- Knime AG

- Microsoft Corporation

- MicroStrategy Incorporated

- Oracle Corporation

- RapidMiner Inc.

- SAP SE

- SAS Institute Inc.

- Tibco Software Inc.(Alpine Data)

第6章 投資分析

第7章投資分析市場的未來

The Big Data Analytics In Manufacturing Market size is estimated at USD 8.93 billion in 2024, and is expected to reach USD 23.72 billion by 2029, growing at a CAGR of 21.60% during the forecast period (2024-2029).

The manufacturing industry increasingly adopts artificial intelligence (AI) technologies to handle complex workflows efficiently. With the global IoT, manufacturing market projected to reach USD 1.5 trillion by 2030, informed decision-making is critical for manufacturers as it impacts the entire product life cycle and timely delivery and prevents unplanned outages, defects, or safety issues. AI solutions such as intelligent document processing (IDP) help manufacturers minimize time spent processing documents by turning unstructured and semi-structured information into usable data in real-time.

Key Highlights

- According to a McKinsey report, data-driven businesses are 23 times more likely to attract clients and 19 times more likely to be profitable. Manufacturing companies can leverage data analytics by collecting and visualizing data from various areas of their operations in real-time. Schneider Electric, for example, switched to Oracle Analytics Cloud, which helped collect 90% of its sell-out data and analyze and process it automatically. With this technology, data collection errors were reduced, manual data consolidation was eliminated, and timeliness and accuracy improved.

- To tackle workforce management obstacles, manufacturing organizations must predict staffing, scheduling, training, and productivity challenges. Big data companies provide Predictive Analytics Solutions that help manufacturing organizations schedule maintenance and repairs, reduce downtime, and increase productivity. BMW, for instance, uses a data analytics solution to monitor the quality of its products during the production of cars. The sensors installed in BMW's manufacturing unit provide data that can help recognize quality issues early before they become a major problem.

- The COVID-19 pandemic disrupted the manufacturing industry, making keeping track of the supply chain and inventory challenging. These hurdles in the production sector compelled organizations to collaborate with big data analytic providers for technologies like RFID and barcode scanning, which help track goods in dispatch and location of warehouses by sitting in the manufacturer's premises.

- The major hurdle in adopting big data analytics in the manufacturing industry is the availability of a large amount of data with a need for quality filtering processes. Data from different departments should integrate and work as one entity to identify and resolve problems immediately. By adopting AI technologies and data analytics, the manufacturing industry can optimize operations, increase productivity, and stay competitive globally.

Big Data Analytics In Manufacturing Market Trends

Condition Monitoring is Expected to Register a Significant Growth

- Condition monitoring is a process that involves the use of sensors to collect data and monitor crucial operating parameters such as vibrations, sound anomalies, airflow, and current. This data is then used by predictive data analytics solutions to predict machine failures before they happen, ultimately helping to reduce maintenance costs and downtime.

- Mondas is a company that provides a Condition Monitoring platform for manufacturers of energy plants and building services equipment. Their real-time monitoring functionality helps to lower operating costs by detecting defects before they become major problems.

- In February 2023, Dublin-based Hoistech partnered with CoreRFID to develop an app-based visual management tool that enables users to monitor and report on the condition of any asset. The app automatically geolocates the user and asset using the phone's GPS, while the dashboard provides a clear overview of all asset performance.

- In April 2022, OMRON Technologies launched K7TM, a condition monitoring device for heater equipment used primarily in the automotive and FMCG industries. These devices can be easily attached to existing equipment to detect abnormal machinery conditions. One of the key features of this device is the automatic measuring of the resistance of the heater during equipment operation to identify the deterioration tendency of the heater.

- In March 2022, Guardhat released an industrial-grade solution for worker condition monitoring. The application assists in real-time monitoring and event-based alerts to help prevent injury or even death from exposure to heat, gas, radiation, or any other calamity. The trials were conducted at a metal production facility, where the organization received alerts that workers were getting over-exerted as the temperatures exceeded 102°F and got them cooled off before any injury occurred.

Asia-Pacific to Witness Highest Growth

- The Asian Development Bank (ADB) has released a report forecasting that the Southeast Asian (SEA) economy will grow by 4.7% in 2023. One sector that presents vast opportunities for growth in the ASEAN region is manufacturing, and the adoption of the Internet of Things (IoT) technology can further enhance this growth potential.

- Several countries in the Asia-Pacific (APAC) region, such as South Korea, China, Japan, Taiwan, and Singapore, are known for their strong manufacturing industries, particularly in producing electronics assembly and semiconductor parts. These countries are increasingly adopting big data analytics to improve operations in the electronics and semiconductor industries.

- The implementation of IoT technology, combined with data analysis, can enable real-time insights into various operational aspects, such as vehicle mishaps, employee absences, accidents, and injuries, during daily operations. This can help facilitate smooth operations and enhance efficiency in the manufacturing industry.

- Vietnam's leading digital transformation services provider, FPT Software, and Japanese IT company SCSK have collaborated to launch a comprehensive solution for original equipment manufacturers (OEMs) and suppliers in the automotive industry. The platform, MaaZ (Monozukuri Adaptive AUTOSAR), aims to provide highly efficient solutions that can reduce the product's time to market and lower the total cost of ownership for customers.

- In summary, the Southeast Asian economy is expected to experience significant growth in 2023, particularly in the manufacturing industry. The adoption of IoT technology and data analysis can further enhance growth in this sector. Companies such as FPT Software and SCSK are driving innovation and efficiency in the automotive industry by collaborating to provide advanced solutions to OEMs and suppliers.

Big Data Analytics In Manufacturing Industry Overview

The manufacturing sector has seen a surge in adopting analytics solutions and IoT, presenting new opportunities for big data analytics providers. Existing players expand their product offerings as the market expands to compete with new entrants. One area where data analytics can provide a competitive edge is image analysis, which helps manufacturing companies detect defects such as minute cracks or scratches that are difficult to identify with the human eye.

In February 2023, the United States national institute on Smart Manufacturing, CESMII, partnered with SAS to promote advanced analytics across the manufacturing sector. Deploying analytics solutions in smart factories can drive digital transformation, enhance production quality and efficiency, and improve business decision-making. Georgia-Pacific, one of SAS's earlier clients, has experienced a 30% reduction in unplanned downtime and a 10% improvement in overall efficiency using SAS's cloud-native solution.

In January 2022, India's Bharat Petroleum Corporation Limited (BPCL) launched "One BPCL," a technology solution that unites all its business units under a single shared platform. BPCL deployed Salesforce Sales and Service Cloud and Tableau CRM's business analytics to help its sales officers capture leads, monitor opportunity pipelines, and close deals faster. By leveraging these advanced technologies, BPCL aims to streamline its operations and improve its overall business performance.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 EXECUTIVE SUMMARY

2 MARKET INSIGHTS

- 2.1 Market Overview

- 2.2 Industry Attractiveness - Porter's Five Forces Analysis

- 2.2.1 Bargaining Power of Buyers/Consumers

- 2.2.2 Bargaining Power of Suppliers

- 2.2.3 Threat of New Entrants

- 2.2.4 Threat of Substitute Products

- 2.2.5 Intensity of Competitive Rivalry

- 2.3 Industry Value Chain Analysis

- 2.4 Assessment of the Impact of COVID-19 on the Market

3 MARKET DYNAMICS

- 3.1 Market Drivers

- 3.1.1 Evolving Technology, Asset, and Engineering-oriented Value Chain

- 3.1.2 Rapid Industrial Automation led by Industry 4.0

- 3.2 Market Restraints

- 3.2.1 Lack of Awareness and Security Concerns

- 3.3 Market Opportunities

- 3.3.1 Increasing Use of Predictive Analytics Tools

- 3.3.2 Increasing Adoption of IIoT

4 MARKET SEGMENTATION

- 4.1 By End-user Industry

- 4.1.1 Semiconductor

- 4.1.2 Aerospace

- 4.1.3 Automotive

- 4.1.4 Other End-user Industries

- 4.2 By Application

- 4.2.1 Condition Monitoring

- 4.2.2 Quality Management

- 4.2.3 Inventory Management

- 4.2.4 Other Applications

- 4.3 Geography

- 4.3.1 North America

- 4.3.1.1 United States

- 4.3.1.2 Canada

- 4.3.2 Europe

- 4.3.2.1 United Kingdom

- 4.3.2.2 Germany

- 4.3.2.3 France

- 4.3.2.4 Rest of the Europe

- 4.3.3 Asia-Pacific

- 4.3.3.1 China

- 4.3.3.2 Japan

- 4.3.3.3 India

- 4.3.3.4 Rest of the Asia Pacific

- 4.3.4 Latin America

- 4.3.5 Middle East and Africa

- 4.3.1 North America

5 COMPETITIVE LANDSCAPE

- 5.1 Company Profiles

- 5.1.1 Alteryx Inc.

- 5.1.2 IBM Corporation

- 5.1.3 Knime AG

- 5.1.4 Microsoft Corporation

- 5.1.5 MicroStrategy Incorporated

- 5.1.6 Oracle Corporation

- 5.1.7 RapidMiner Inc.

- 5.1.8 SAP SE

- 5.1.9 SAS Institute Inc.

- 5.1.10 Tibco Software Inc. (Alpine Data)