|

市場調查報告書

商品編碼

1444021

農業酵素 - 市場佔有率分析、產業趨勢與統計、成長預測(2024 - 2029)Agricultural Enzymes - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

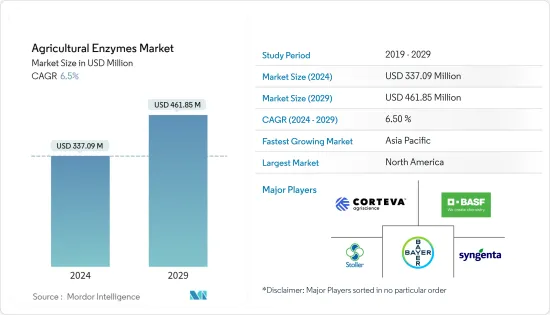

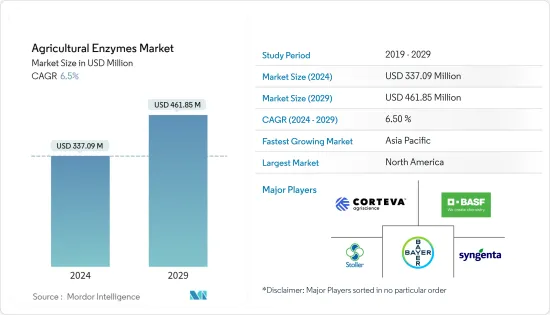

2024年農業酵素市場規模估計為3.3709億美元,預計到2029年將達到4.6185億美元,在預測期內(2024-2029年)CAGR為6.5%。

主要亮點

- 農業酵素已在農業領域廣為接受。推動農業酵素市場的因素是對有機食品的需求不斷成長、生物農產品的日益採用以及主要參與者增加的研發和市場策略。

- 此外,由於人口的快速成長、農業技術的發展以及對無化學產品的需求不斷增加,全球對食品安全的需求不斷增加,也支持了市場的成長。此外,人們對農業生物製品的偏好增加、有機農業的顯著成長以及有限耕地產量的提高是影響全球食品安全需求上升的其他因素。因此,農業酵素產業預計在預測期內將錄得顯著成長。

- 消費者越來越傾向於消費有機食品,這使得農民轉向使用不含化學物質/安全的農藥。根據有機貿易協會統計,2021年美國有機食品銷售額成長8.3%,佔12.8%,2020年則為4.5%。

農業酵素市場趨勢

對有機食品不斷成長的需求

全球對有機食品的需求不斷成長,以及人們對農藥不安全特性的認知不斷增強,增加了對農業酵素的需求。有機農業酵素可以生產經過認證的、高品質的、受控的和安全的食品。因此,它們提供了很高的經濟和環境效益,並維持了健康的生態系統。

此外,農業酵素市場成長的關鍵因素之一是由於全球生化中毒病例不斷增加而引起的健康問題日益嚴重。農藥使用量的增加使食品中殘留農藥,給人們帶來了嚴重的問題。例如,根據聯合國糧農組織的數據,2020年美國是全球最大的農藥消費國,消費量約40.78萬噸。巴西則位居第二,消費量為 37.72 萬噸。

消費者越來越意識到食品中化學農藥的存在所造成的毒性作用。食品中化學農藥的毒性可能導致荷爾蒙失調、癌症和先天性殘疾。消費者對農場種植的蔬菜中農藥和化肥的使用不斷增加的認知不斷提高,促使有機食品的採用範圍擴大。

酵素具有在低濃度、低溫、溫和 pH 值和最少用水量下發揮作用的特性。由於可生物分解,它們是有機和永續農業的流行選擇。 2021年,由於農業酵素等天然生物製品的使用增加,該國有機食品銷售額成長約2%,達到575億美元。相較之下,2020年成長率為12.8%,2019年成長率為4.6%。此外,2021年有機蔬果銷售額成長約4.5%,達到超過210億美元,佔整個區隔市場的15%佔有率。預計這些因素將在預測期內推動農業酵素市場的發展。

北美在農業酵素消費中佔有最大佔有率

北美是全球農業酵素的主要消費者之一。美國是北美農業酵素製劑的主要市場之一。該國在農業領域採用現代技術方面進展迅速。化學投入成本的不斷增加、對土壤和環境的不利影響以及人們對平衡植物營養的認知不斷提高,正在推動該國對農業酶的市場需求。

2022 年 8 月,美國農業部 (USDA) 啟動了一項耗資 3 億美元的新有機轉型計畫。據稱,該計劃將採取具體步驟建立下一代有機生產商並加強有機供應鏈。此類計劃預計將擴大生物基投入的使用,從而擴大該國的市場。

加拿大傾向於生物農業,以提高作物早期生長階段的生產力和品質。鑑於農業用地面積的增加、農業部門投資的改善和政府的支持,加拿大農業酵素市場的需求正在增加。 2020 年,由於疫情在生長季節實施的封鎖,加拿大有機產業遭受了干擾,在全球造成了干擾。儘管有障礙,有機種植面積仍增加了 19%,達到超過 350 萬英畝或近 150 萬公頃。

農業酵素產業概況

農用酵素製劑市場較為集中,主要廠商佔大部分佔有率。拜耳作物科學、巴斯夫SE、Corteva Agriscience、Stoller USA Inc.和先正達股份公司是所研究市場的主要參與者。這些公司正在採取各種策略活動,例如產品創新、擴張、合作以及併購。參與者正在與其他公司合作,在合作研究的同時在市場上建立強大的影響力。

額外的好處:

- Excel 格式的市場估算 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章:簡介

- 研究假設和市場定義

- 研究範圍

第 2 章:研究方法

第 3 章:執行摘要

第 4 章:市場動態

- 市場概況

- 市場促進因素

- 市場限制

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 買家的議價能力

- 新進入者的威脅

- 替代產品的威脅

- 競爭激烈程度

第 5 章:市場區隔

- 依酶類型

- 磷酸酶

- 脫氫酶

- 脲酶

- 蛋白酶

- 其他酵素類型

- 依應用

- 作物保護

- 生育能力

- 植物生長調節

- 依作物類型

- 穀物和穀物

- 油料種子和豆類

- 水果和蔬菜

- 其他作物類型

- 依地理

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 北美其他地區

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 西班牙

- 俄羅斯

- 歐洲其他地區

- 亞太

- 中國

- 日本

- 印度

- 澳洲

- 亞太其他地區

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地區

- 中東和非洲

- 南非

- 中東和非洲其他地區

- 北美洲

第 6 章:競爭格局

- 最常用的策略

- 市佔率分析

- 公司簡介

- BASF SE

- Bayer Cropscience AG

- Syngenta AG

- American Vanguard Corporation

- Bioworks Inc.

- Corteva Agrisciences

- Stoller USA Inc.

- Elemental Enzymes

第 7 章:市場機會與未來趨勢

The Agricultural Enzymes Market size is estimated at USD 337.09 million in 2024, and is expected to reach USD 461.85 million by 2029, growing at a CAGR of 6.5% during the forecast period (2024-2029).

Key Highlights

- Agricultural enzymes have gained extensive acceptance in the farming sector. The factors driving the agriculture enzyme market are the growing demand for organic food, increasing adoption of biological agricultural products, and increased R&D and market strategies by key players.

- In addition, the global rise in the need for food safety due to the rapid increase in population, developments in farming technologies, and the increasing demand for chemical-free products are also supporting the market's growth. Furthermore, the increased inclination toward agro-biologicals, significant growth in organic farming, and the rise in the production yield from limited arable land are other factors that affect the global rise in the need for food safety. Thus, the agricultural enzyme industry is expected to record significant gains during the forecast period.

- The increasing consumer inclination toward consuming organic foods is making farmers switch to chemical-free/safe pesticide usage. According to the Organic Trade Association, the sales growth of organic foods in the United States increased by 8.3% in 2021, accounting for 12.8% compared to 2020, which was 4.5%.

Agricultural Enzymes Market Trends

Growing Demand for Organic Food

The rising demand for organic food worldwide, along with the growing awareness about the unsafe properties of pesticides, has increased the demand for agricultural enzymes. Organic agricultural enzymes enable the production of certified, high-quality, controlled, and safe food. Therefore, they provide high economic and environment-friendly benefits and preserve a healthy ecosystem.

Furthermore, one of the critical aspects of the growth in the agricultural enzyme market is the increasing health concerns due to a growing number of biochemical poisoning cases worldwide. The expanding usage of pesticides leaves food products with their residues, causing severe problems among people. For instance, according to FAO, in 2020, the United States was the largest pesticide-consuming country worldwide, with approximately 407.8 thousand metric tons. Brazil trailed in second, with 377.2 thousand tons consumed.

Consumers are becoming more conscious of the toxic effects caused by the presence of chemical pesticides in food products. The toxicity of chemical pesticides in food commodities can cause hormone disruptions, cancer, and congenital disabilities. The rising consumers' knowledge about the growing use of pesticides and fertilizers in farm-grown vegetables has led to the expanded adoption of organic food products.

Enzymes have features that allow them to work in low concentrations, low temperatures, mild pH, and minimal water usage. Since biodegradable, they are a popular option in organic and sustainable farming. In 2021, owing to the increased use of natural biological products, such as agricultural enzymes, the country's organic food sales grew by about 2% to reach USD 57.5 billion. This compares to a 12.8% growth rate in 2020 and a 4.6% increase in 2019. Also, organic vegetables and fruit sales increased by about 4.5% in 2021 to reach more than USD 21 billion, making up a 15% share of the entire segment. Such factors are expected to drive the agricultural enzymes market over the forecast period.

North America Holds the Largest Share in Agriculture Enzymes Consumption

North America is one of the primary consumers of agricultural enzymes globally. The United States is one of the major markets for agricultural enzymes in North America. The country is highly evolved in adopting modern technologies in the agriculture sector. The increasing cost of chemical inputs, their adverse effect on soil mass and the environment, and the increasing awareness regarding balanced plant nutrition are driving the market demand for agricultural enzymes in this country.

In August 2022, the United States Department of Agriculture (USDA) launched its new USD 300 million Organic Transition Initiative. The program is claimed to take concrete steps to build the next generation of organic producers and strengthen organic supply chains. Such programs are expected to expand the use of bio-based inputs, subsequently expanding the market in the country.

Canada is inclining toward bio-based agriculture to strengthen crop productivity and quality at an early growth stage. The Canadian agricultural enzymes market is growing in demand generation, given the increase in agricultural land size, improved agricultural sector investment, and government support. The Canadian organic sector witnessed disruptions in 2020 with the pandemic-imposed lockdown during the growing season, causing worldwide disruptions. Despite the obstacles, organic acreage increased by 19% to more than 3.5 million acres or almost 1.5 million hectares.

Agricultural Enzymes Industry Overview

The agricultural enzymes market is relatively consolidated, with major players occupying the majority of the share. Bayer CropScience, BASF SE, Corteva Agriscience, Stoller USA Inc., and Syngenta AG are the key players in the market studied. The companies are adopting various strategic activities, such as product innovation, expansion, partnership, and mergers & acquisitions. The players are partnering with other companies to build a strong presence in the market while researching collaboratively.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope Of The Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.3 Market Restraints

- 4.4 Industry Attractiveness - Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products

- 4.4.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 By Enzyme Type

- 5.1.1 Phosphatases

- 5.1.2 Dehydrogenases

- 5.1.3 Ureases

- 5.1.4 Proteases

- 5.1.5 Other Enzyme Types

- 5.2 By Application

- 5.2.1 Crop Protection

- 5.2.2 Fertility

- 5.2.3 Plant Growth Regulation

- 5.3 By Crop Type

- 5.3.1 Grains and Cereals

- 5.3.2 Oil Seeds and Pulses

- 5.3.3 Fruits and Vegetables

- 5.3.4 Other Crop Types

- 5.4 By Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.1.3 Mexico

- 5.4.1.4 Rest of North America

- 5.4.2 Europe

- 5.4.2.1 Germany

- 5.4.2.2 United Kingdom

- 5.4.2.3 France

- 5.4.2.4 Italy

- 5.4.2.5 Spain

- 5.4.2.6 Russia

- 5.4.2.7 Rest of Europe

- 5.4.3 Asia-Pacific

- 5.4.3.1 China

- 5.4.3.2 Japan

- 5.4.3.3 India

- 5.4.3.4 Australia

- 5.4.3.5 Rest of Asia-Pacific

- 5.4.4 South America

- 5.4.4.1 Brazil

- 5.4.4.2 Argentina

- 5.4.4.3 Rest of South America

- 5.4.5 Middle East & Africa

- 5.4.5.1 South Africa

- 5.4.5.2 Rest of Middle East & Africa

- 5.4.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Most Adopted Strategies

- 6.2 Market Share Analysis

- 6.3 Company Profiles

- 6.3.1 BASF SE

- 6.3.2 Bayer Cropscience AG

- 6.3.3 Syngenta AG

- 6.3.4 American Vanguard Corporation

- 6.3.5 Bioworks Inc.

- 6.3.6 Corteva Agrisciences

- 6.3.7 Stoller USA Inc.

- 6.3.8 Elemental Enzymes