|

市場調查報告書

商品編碼

1444000

生物防治 - 市場佔有率分析、產業趨勢與統計、成長預測(2024 - 2029)Biological Control - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

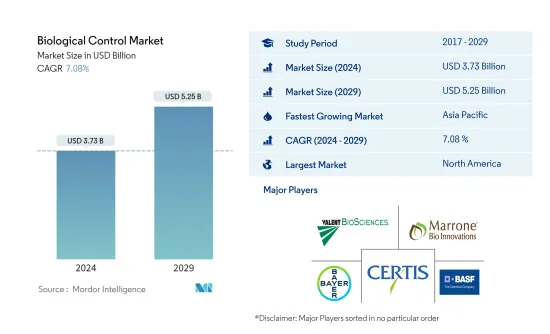

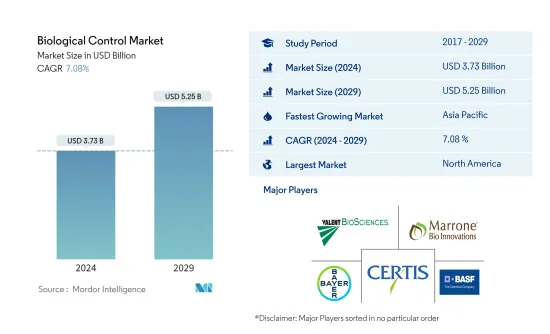

生物防治市場規模預計到 2024 年為 37.3 億美元,預計到 2029 年將達到 52.5 億美元,在預測期內(2024-2029 年)CAGR為 7.08%。

主要亮點

- 生物防治方法對環境友好,與合成農業化學品相比對人體沒有有害影響,並且在整個季節都有效,因此使其成為害蟲防治的理想選擇。民眾對合成農藥對人體危害的日益關注,加上對農業合成化學品的監管不斷加強,以及隨後世界各地對此類化學品的禁令,將推動來年的生物防治市場。

- 由於生物防治的成本比農藥低,因此越來越受歡迎,這促進了市場的擴大。對它的需求日益成長,因為它可以透過減少對環境的排放來取代化學製劑,從而減少土壤和水污染。此外,有機種植面積的增加、監管的寬鬆以及對糧食安全的需求不斷增加是推動生物製品銷售的主要市場驅動力。然而,產品的自壽命較短和農民的認知度較低可能會限制市場的成長。

- 美國等已開發國家正在採用生物防治,主要是土壤處理,以提高作物早期生產力和活力。農藥成本的上升反過來又促使生物防治產品的大量使用。

- 市場仍處於初級階段。正在加強研發合作、夥伴關係和其他活動,以開發和擴大生物控制市場,隨著消費者偏好轉向有機食品,該市場預計將成長。例如,2021年3月,拜耳公司推出了Vynyty柑橘,這是一種基於生物和費洛蒙的作物保護產品,用於控制柑橘農場的害蟲。該產品目前在西班牙使用,並可供其他地中海國家的柑橘和其他作物種植者使用。

生物防治市場趨勢

增加有機農業

有機農業代表了食品工業中一個獨特的、快速成長的部分。世界各地的有機農業面積正在迅速成長。根據FiBL統計,2019年全球有機種植面積為7,200萬公頃,成長4.1%,2020年達7,490萬公頃。

此外,有機農業採用生物防治作為處理害蟲的方法,而不是使用合成作物保護化學品,因此市場上生物防治的成長與有機農業的成長成正比。

此外,世界各國政府正在努力促進有機農業的發展,這促使他們做出立法改革,以在未來幾年促進有機農業的發展。例如,2021 年,歐盟通過了新立法,為有機農業產業建立有效的法律架構。這項立法加上消費者對有機產品的興趣增加,將在預測期內推動生物防治市場的成長。同樣,生物防治產品領域的創新,加上消費者對合成農藥負面影響的認知不斷增強,預計很快就會提高生物防治產品的採用率。

北美主導生物防治市場

北美在生物防治市場佔據主導地位。在北美,由於可用耕地充足,美國擁有最大的市場,約佔北美市場的一半。對有機標籤產品的日益關注和對微生物農藥效率的認知推動了該地區的市場。美國農業部門高度發展,最近一直在適應自然和有機的農業方式。因此,生物防治產品的消費呈成長趨勢。化學投入成本的增加、對土壤和環境的不利影響以及對平衡植物營養的認知不斷提高是推動該國市場需求的主要因素。

影響北美市場採用生物防治的主要因素之一是傳統產品因註冊或產品性能問題而流失。研究是許多重要公司關注的主要領域,包括 FMC Corporation、Corteva Agriscience 和 Marrone Bio Innovations。例如,2021 年,美國 Botanical Solution Inc. (BSI) 和先正達達成協議,將 BSI 的首款產品 BotriStop 在秘魯和墨西哥商業化。 BotriStop 被配製為生物殺菌劑,可有效控制藍莓、葡萄藤和蔬菜中的灰葡萄孢。兩家公司將瞄準秘魯和墨西哥市場的新鮮食品生產需求。

此外,加拿大對生物防治產品的需求主要是由傳統農業、近期管理農藥化妝品使用的市和省法律的變化以及低風險害蟲防治產品的立法和隨後的推廣推動的。農藥成本的上漲也促使了生物防治產品的大量使用。

生物防治產業概況

生物防治市場是一個分散的市場,市場上存在著各種小型和區域性參與者。市場上一些著名的參與者包括 Certis、BASF SE、Marrone Bio Innovations Inc.、Bayer CropScience AG 和 Valent Biosciences。市場主要參與者主要採取不同的策略,例如合作夥伴關係、向新領域拓展業務以及併購,以獲得市場據點並為整體市場帶來更多收入佔有率。

額外的好處:

- Excel 格式的市場估算 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章:簡介

- 研究假設和市場定義

- 研究範圍

第 2 章:研究方法

第 3 章:執行摘要

第 4 章:市場動態

- 市場概況

- 市場促進因素

- 市場限制

- 波特五力分析

- 新進入者的威脅

- 買家的議價能力

- 供應商的議價能力

- 替代產品的威脅

- 競爭激烈程度

第 5 章:市場區隔

- 類型

- 微生物

- 細菌

- 病毒

- 菌類

- 微生物

- 寄生蜂

- 掠奪者

- 昆蟲病原線蟲

- 微生物

- 目標害蟲

- 節肢動物

- 雜草

- 微生物

- 應用

- 種子處理

- 在現場

- 豐收後

- 作物應用

- 穀物和穀物

- 油籽和豆類

- 水果和蔬菜

- 其他作物應用

- 地理

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 北美其他地區

- 歐洲

- 德國

- 英國

- 法國

- 西班牙

- 義大利

- 俄羅斯

- 歐洲其他地區

- 亞太地區

- 中國

- 日本

- 印度

- 澳洲

- 亞太地區其他地區

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地區

- 世界其他地區

- 南非

- 其他國家

- 北美洲

第 6 章:競爭格局

- 最常用的策略

- 市佔率分析

- 公司簡介

- BASF SE

- Bayer CropScience

- Corteva Agriscience

- UPL Ltd.

- Syngenta Ag

- Koppert BV

- Brettyoung (Lallemand)

- Certis USA LLC

- Chr. Hansen

- Marrone Bio Innovations

- Symbiota

- Precision Laboratories LLC

- Verdesian Life Sciences LLC

- Valent Biosciences Corporation (Sumitomo Chemical Company Limited)

- IsAgro

第 7 章:市場機會與未來趨勢

The Biological Control Market size is estimated at USD 3.73 billion in 2024, and is expected to reach USD 5.25 billion by 2029, growing at a CAGR of 7.08% during the forecast period (2024-2029).

Key Highlights

- Biological Control methods are environmentally friendly, have no harmful effects on humans compared to synthetic agrochemicals, and are effective throughout the season, therefore making them ideal for pest control. Rising public concern about synthetic pesticide hazards to the human body coupled with growing regulations on synthetic chemicals in farming and subsequent bans on such chemicals across the world drives the biological control market during the coming year.

- Due to their lower cost than pesticides, biological controls are becoming more popular, which is fostering the expansion of the market. The need for it is growing daily because it can replace chemical agents by reducing emissions into the environment, which in turn leads to less soil and water pollution. Further, the increasing area under organic cultivation, less stringent regulations, and increasing need for food security are the major market drivers that are boosting the sales of biologicals. However, the less self-life of the product and low awareness among the farmers are likely to restrain the market growth.

- The developed country like United States is adopting biological control, mainly in case of soil treatment, to strengthen the crop productivity and vigor at an early stage. The rising cost of pesticides, which has, in turn, led to high usage of biological control products.

- The market is still in its initial stages. Increased R&D collaborations, partnerships, and other activities are underway to develop and expand the biological control market, which is expected to grow as consumer preferences shift toward organic food products. For instance, in march 2021, Bayer AG introduced Vynyty citrus, a crop protection product based on biological and pheromones to control pests on citrus farms. The product is currently being used in Spain and is available to growers of citrus and other crops in other Mediterranean countries.

Biological Control Market Trends

Increasing Organic Farming

Organic farming represents a unique, fast-growing segment of the food industry. The area under organic farming is rapidly growing across the world. According to FiBL statistics, the area under organic cultivation across the world was 72.0 million hectares in 2019, which increased by 4.1% and reached 74.9 million hectares in 2020.

Furthermore, Organic Farming incorporates the use of biological controls as a method to deal with pests rather than using Synthetic Crop Protection Chemicals, therefore Biological Control growth in the market is directly proportional to the increasing organic farming.

Additionally, governments around the world are making efforts for the growth of organic farming and this has led them to make legislative changes that shall boost organic farming in coming years. For instance, in 2021, the EU passed new legislation for an effective legal framework for the organic farming industry. This legislation coupled with increased consumer interest in organic products will drive the growth of the biological controls market during the forecast period. Similarly, innovations in the area of biological control products, coupled with a growing consumer awareness about the negative impact of synthetic pesticides, are expected to boost the adoption rate of biological controls shortly.

North America Dominates the Biological Control Market

North America dominates the biological control market. In North America, the United States holds the largest market, with around half of the North American market, owing to the plenty of available arable lands. Rising concerns over organic labeled products and awareness of microbial pesticides efficiency have driven the market in the region. The United States, with its highly evolved agricultural sector, has been adapting to the natural and organic way of farming lately. Therefore, biological control product consumption is a growing trend there. The increasing cost of chemical inputs, their adverse effect on soil mass and the environment, and the increasing awareness regarding balanced plant nutrition are the major factors driving the market demand in the country.

One of the main factors influencing the North American market adoption of biological control is the loss of conventional products due to registration or product performance concerns. Research is a major area of concentration for many important companies, including FMC Corporation, Corteva Agriscience, and Marrone Bio Innovations. For instance, in 2021, Botanical Solution Inc. (BSI), US, and Syngenta reached an agreement to commercialize BSI's first product, BotriStop, in Peru and Mexico. BotriStop was formulated as a biofungicides to effectively control Botrytis cinerea in blueberries, vines, and vegetables. The companies would target the fresh food production demand in Peruvian and Mexican markets.

Furthermore, the demand for biological control products in Canada is largely driven by conventional agriculture, recent changes to municipal and provincial laws governing the cosmetic use of pesticides, and legislation and ensuing promotion for lower-risk pest control products. The rise in the cost of pesticides also has, in turn, led to the high usage of biological control products.

Biological Control Industry Overview

The biological control market is a fragmented market with the presence of various small and regional players operating in the market. Some of the notable players in the market include Certis, BASF SE, Marrone Bio Innovations Inc., Bayer CropScience AG, and Valent Biosciences. The major players in the market are mainly focusing on adopting different strategies, such as partnerships, expanding operations into new areas, and mergers and acquisitions in order to obtain a stronghold in the market and to bring more revenue share to the overall market.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.3 Market Restraints

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Threat of New Entrants

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Bargaining Power of Suppliers

- 4.4.4 Threat of Substitute Products

- 4.4.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Type

- 5.1.1 Microbials

- 5.1.1.1 Bacteria

- 5.1.1.2 Viruses

- 5.1.1.3 Fungi

- 5.1.2 Macrobials

- 5.1.2.1 Parasitoids

- 5.1.2.2 Predators

- 5.1.3 Entomopathogenic Nematodes

- 5.1.1 Microbials

- 5.2 Target Pest

- 5.2.1 Arthropods

- 5.2.2 Weeds

- 5.2.3 Microorganisms

- 5.3 Application

- 5.3.1 Seed Treatment

- 5.3.2 On-field

- 5.3.3 Post Harvest

- 5.4 Crop Application

- 5.4.1 Grains and Cereals

- 5.4.2 Oilseeds and Pulses

- 5.4.3 Fruits and Vegetables

- 5.4.4 Other Crop Applications

- 5.5 Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.1.4 Rest of North America

- 5.5.2 Europe

- 5.5.2.1 Germany

- 5.5.2.2 United Kingdom

- 5.5.2.3 France

- 5.5.2.4 Spain

- 5.5.2.5 Italy

- 5.5.2.6 Russia

- 5.5.2.7 Rest of Europe

- 5.5.3 Asia Pacific

- 5.5.3.1 China

- 5.5.3.2 Japan

- 5.5.3.3 India

- 5.5.3.4 Australia

- 5.5.3.5 Rest of Asia Pacific

- 5.5.4 South America

- 5.5.4.1 Brazil

- 5.5.4.2 Argentina

- 5.5.4.3 Rest of South America

- 5.5.5 Rest of the World

- 5.5.5.1 South Africa

- 5.5.5.2 Other Countries

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Most Adopted Strategies

- 6.2 Market Share Analysis

- 6.3 Company Profiles

- 6.3.1 BASF SE

- 6.3.2 Bayer CropScience

- 6.3.3 Corteva Agriscience

- 6.3.4 UPL Ltd.

- 6.3.5 Syngenta Ag

- 6.3.6 Koppert BV

- 6.3.7 Brettyoung (Lallemand)

- 6.3.8 Certis USA LLC

- 6.3.9 Chr. Hansen

- 6.3.10 Marrone Bio Innovations

- 6.3.11 Symbiota

- 6.3.12 Precision Laboratories LLC

- 6.3.13 Verdesian Life Sciences LLC

- 6.3.14 Valent Biosciences Corporation (Sumitomo Chemical Company Limited)

- 6.3.15 IsAgro