|

市場調查報告書

商品編碼

1441624

半導體產業 - 市場佔有率分析、產業趨勢與統計、成長預測(2024 - 2029)Semiconductor Industry - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

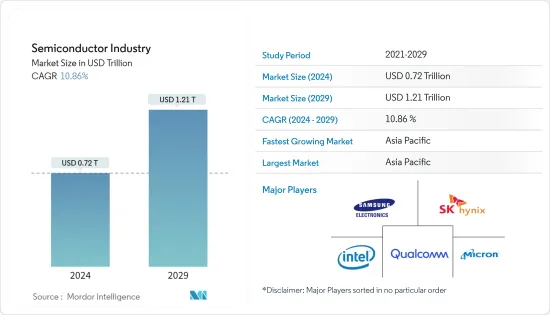

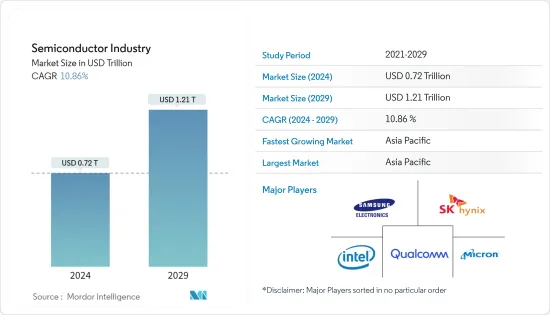

半導體產業預計將從 2024 年的 0.72 兆美元成長到 2029 年的 1.21 兆美元,預測期內(2024-2029 年)CAGR為 10.86%。

主要亮點

- 隨著半導體成為當代技術的基本組成部分,半導體產業正在經歷迅速擴張。這個行業的進步和突破,直接影響著後續的所有技術。

- 半導體裝置是以半導體材料為基礎的電子元件。這種材料可用於生產電晶體、二極體和積體電路 (IC) 中的其他基本功能單元。這些設備的特點是既不能很好地導電,也不能充當有效的絕緣體。半導體裝置的優點包括其經濟性、可靠性和緊湊的尺寸。在過去的幾十年裡,這些設備在各種電子產品生產中的使用越來越受歡迎,預計在未來幾年將繼續保持成長勢頭。

- 半導體產業預計在可預見的未來將出現強勁成長,因為它滿足了人工智慧 (AI)、自動駕駛、物聯網和 5G 等新興技術對半導體材料不斷成長的需求。這種成長是由主要參與者之間的激烈競爭以及對研發 (R&D) 的持續投資所推動的。因此,供應商不斷被推動創新並在市場上獲得競爭優勢。

- 由於企業廣泛採用電氣化和自動化,對半導體設備的市場需求預計將增加。電動車正在引領永續未來的運動,其中電子和半導體是關鍵零件。全球各國政府都為其交通部門的電氣化製定了雄心勃勃的目標,促使領先的汽車製造商在電動車研發方面進行大量投資。半導體正在成為電動車的中央處理單元,使它們能夠提供最佳性能。因此,電動車投資的不斷成長預計將刺激半導體市場的需求。

- 半導體行業需要更多熟練工人。到 2030 年,可能需要增加超過 100 萬名技術工人才能滿足該行業的需求。此外,半導體產業的特徵是交貨時間長和資本投資高。製造能力的限制和需求的變化導致供應鏈短缺。預計這些因素將課題市場的成長。

- 由於 COVID-19,該行業發生了重大變化,影響了客戶行為、業務收入和公司營運。此外,疫情也暴露了供應方面以前未被注意到的風險,可能導致重要零件的短缺。因此,半導體企業正在積極重組供應鏈以增強彈性,而這些調整可能會在後疫情時代持續下去。

半導體市場趨勢

分立半導體將在半導體裝置領域佔據重要市場佔有率

- 對高能源和高能效設備的需求不斷成長,無線和攜帶式電子產品的日益普及,加上由於向電氣化的轉變而在汽車行業中使用這些設備的增加,是推動成長的一些關鍵因素該段的。

- 分立半導體的重要趨勢之一是高效率的電源管理。新的系統架構正在提高交流-直流電源適配器的效率,同時減少尺寸和組件數量。乙太網路供電 (PoE) 的新標準允許更高的功率傳輸,從而支援新型設備的開發,例如互聯照明。

- MOSFET在電信領域一直扮演著重要的角色,因為開關電源是功率MOSFET最普遍的應用,它也常用於MOS射頻功率放大器,使行動網路從類比轉向數位。根據愛立信的數據,2022年第一季5G用戶數增加了7,000萬,達到約6.2億。到2022年底,這一數字預計將達到10億。這些原因將刺激對功率半導體的需求,從而增加對MOSFET的需求,並促使電信領域的多項突破。

- 此外,各種分立半導體對IGBT的需求不斷成長,並廣泛應用於低功率轉換器。汽車、其他馬達驅動和再生能源系統中用於功率轉換的最受歡迎的半導體開關是分離式 IGBT。主要驅動力還在於絕緣柵雙極電晶體 (IGBT) 裝置在汽車、消費性電子、工業、IT 和通訊、醫療保健、航空航太和國防等各個領域的使用不斷增加。

- 大多數分立 IGBT 應用包括逆變器、空調和洗衣機等各種消費品、開關模式電源 (SMPS)(個人電腦、焊接設備以及微波爐、電鍋、電磁爐等感應加熱設備中使用的組件)。爐灶等用於軟開關和頻閃控制。對 UPS、功率調節器、空調等消費性電子設備的需求不斷成長,這些電子設備使用分離式 IGBT 類型進行低電流應用,這被認為推動了分離式 IGBT 市場的成長。人們發現分立式 IGBT 在消費品中具有最低的功率損耗,預計這將成為影響該區隔市場市場成長的關鍵因素。

製造將在半導體材料領域佔據重要市場佔有率

- 半導體製造材料是消費性電子、高階資料中心、汽車應用、醫療設備、物聯網設備、電力電子等領域先進微電子的重要組成部分。該部門涵蓋製程化學品、光掩模、電子氣體、光阻輔助材料、濺鍍靶材、矽和其他材料等材料。

- 推動半導體製造材料需求的主要因素之一是數位整合 IC 在電氣、電子、汽車和電信行業中的使用不斷增加。此外,由於半導體在太陽能電池板、風力和水輪機驅動器和泵浦以及能量轉換中的保護電路中的廣泛應用,預計能源領域投資的增加也將對該領域的成長做出積極貢獻。確保效率和最小的功率損耗。例如,根據IEA的預測,2022年全球能源投資將成長8%,達到2.4兆美元。此外,根據 IRENA 的數據,再生能源支出預計將穩定成長,從而提振市場。

- 雖然多種材料都可以表現出半導體特性,但某些材料由於其特定的特性而更常用於電子設備的製造。兩種最受歡迎的半導體材料是矽和砷化鎵。矽是應用最廣泛的半導體材料,主要是因為其儲量豐富、成本低廉且在高溫下性能相對穩定。矽的電導率約為1000S/m。此外,矽擁有完善的製造基礎設施,使其成為製造商有吸引力的選擇。然而,矽確實有一些缺點,例如與其他材料相比電子遷移率較低,這可能會限制高速元件的性能。

- 砷化鎵是另一種流行的半導體材料,因其較高的電子遷移率和直接能隙而受到重視。這些特性使其非常適合光電應用,例如雷射和太陽能電池。然而,砷化鎵比矽更昂貴且儲量更少,這可能限制其廣泛採用。砷化鎵的另一個缺點是它本質上是一種半絕緣體,而不是電導率為 0.000001 S/m 的半導體。

- 除了矽和砷化鎵之外,研究人員也不斷探索具有前景半導體特性的新材料。這些材料包括氮化鋁、碳奈米管和許多其他有潛力徹底改變產業的材料。隨著對這些新興材料的了解不斷加深,它們可能會在未來的半導體製造中發揮越來越重要的作用。

- 此外,由於低成本方法和半導體領域內部效率的應用,預計製程化學品市場將穩定成長。半導體加工化學品的消耗是由已安裝製造能力的成長和新技術消耗的昂貴化學品以及加工的矽晶圓表面積所推動的。

半導體產業概況

半導體產業的主要參與者包括英特爾公司、三星電子、高通、美光科技公司和SK海力士公司,有助於其半整合性質。市場參與者正在積極利用合作夥伴關係和收購等策略來增強其產品組合併確保持久的競爭優勢。

2023 年 10 月,美光透過推出 16Gb DDR5 記憶體顯著擴展了其 1BETA 製程節點技術。這款新產品以高達 7,200 MT/s 的速度對系統內功能進行了嚴格測試和驗證,現已交付給美光的資料中心和 PC 客戶。美光基於 1BETA 的 DDR5 記憶體將先進的高 k CMOS 裝置技術、4 相時脈系統和時脈同步 1 相結合,效能大幅提升高達 50%,單位效能提升 33%。與上一代相比。

2023 年 9 月,英特爾代工服務 (IFS) 與著名模擬半導體解決方案供應商 Tower Semiconductor 宣布合作。英特爾將擴大其代工服務和 300 毫米製造能力,以協助 Tower 滿足其全球客戶的需求。作為協議的一部分,Tower 將利用英特爾位於新墨西哥州的先進製造工廠來滿足其營運需求。

額外的好處:

- Excel 格式的市場估算 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章:簡介

- 研究假設和市場定義

- 研究範圍

第 2 章:研究方法

第 3 章:執行摘要

第 4 章:市場洞察

- 市場概況

- 科技趨勢

- 產業價值鏈/供應鏈分析

- COVID-19、宏觀經濟趨勢和地緣政治情勢的影響

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 買家的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭激烈程度

第 5 章:市場動態

- 市場促進因素

- 消費性電子設備需求的成長推動製造業前景

- 人工智慧、物聯網和互聯設備在各個行業中的激增

- 半導體在汽車領域的應用不斷增加

- 5G部署增加,5G智慧型手機需求上升

- 市場課題/限制

- 供應鏈中斷導致半導體晶片短缺

- 技術的動態本質要求製造設備發生一些變化

- 垂直整合是OSAT廠商最關心的問題之一

第 6 章:市場區隔

- 依下半導體裝置

- 分離式半導體

- 光電

- 感應器

- 積體電路

- 依下半導體設備

- 前端裝置

- 後端設備

- 依半導體材料

- 製造

- 包裝

- 以半導體代工市場分類

- 依外包半導體組裝測試服務 (OSAT) 市場分類

第 7 章:競爭格局

- 公司簡介

- Intel Corporation

- Samsung Electronics Co. Ltd

- Qualcomm Incorporated

- Micron Technology Inc.

- SK Hynix Inc.

- Texas Instruments Incorporated

- Broadcom Inc.

- Mediatek Inc.

- Applied Materials Inc.

- ASML Holding NV

- Tokyo Electron Limited

- Lam Research Corporation

- KLA Corporation

- Advantest Corporation

- Screen Holdings Co. Ltd

- Teradyne Inc.

- BASF SE

- LG Chem Ltd

- Indium Corporation

- Resonac Holding Corporation

- Kyocera Corporation

- Henkel AG & Co. KGaA

- Sumitomo Chemical Co. Ltd

- Dow Chemical Co. (Dow Inc.)

- Taiwan Semiconductor Manufacturing Company (TSMC) Limited

- Samsung Foundry (Samsung Electronics Co. Ltd)

- United Microelectronics Corporation (UMC)

- GlobalFoundries Inc.

- Semiconductor Manufacturing International Corporation (SMIC)

- Hua Hong Semiconductor Limited

- Powerchip Technology Corporation

- ASE Technology Holding Co.Ltd

- Amkor Technology Inc.

- Jiangsu Changjiang Electronics Technology Co. Ltd

- Powertech Technology Inc.

- Tongfu Microelectronics Co. Ltd

- Tianshui Huatian Technology Co. Ltd

- King Yuan Electronics Co. Ltd

- 供應商市佔率

- 供應商市場佔有率 - 半導體元件市場

- 供應商市場佔有率 - 半導體設備市場

- 供應商市場佔有率 - 半導體代工市場

- 供應商市場佔有率 - OSAT 市場

第 8 章:投資分析

第 9 章:市場的未來前景

The Semiconductor Industry is expected to grow from USD 0.72 trillion in 2024 to USD 1.21 trillion by 2029, at a CAGR of 10.86% during the forecast period (2024-2029).

Key Highlights

- The semiconductor sector is experiencing a swift expansion as semiconductors are becoming the fundamental components of contemporary technology. The progress and breakthroughs in this industry are directly influencing all subsequent technologies.

- Semiconductor devices are electronic components that use semiconducting material as their foundation. This material produces transistors, diodes, and other fundamental functional units found in integrated circuits (ICs). These devices are characterized by their ability to neither conduct electricity well nor act as effective insulators. The benefits of semiconductor devices encompass their affordability, dependability, and compact size. Over the past few decades, the utilization of these devices in the production of diverse electronics has surged in popularity, and it is projected to continue gaining momentum in the forthcoming years.

- The semiconductor industry is projected to experience strong growth in the foreseeable future as it caters to the rising need for semiconductor materials in emerging technologies like artificial intelligence (AI), autonomous driving, the Internet of Things, and 5G. This growth is fueled by intense competition among key players and consistent investment in research and development (R&D). As a result, vendors are constantly driven to innovate and gain a competitive advantage in the market.

- The market demand for semiconductor devices is projected to rise due to businesses' widespread adoption of electrification and autonomy. Electric vehicles are spearheading the movement toward a sustainable future, with electronics and semiconductors serving as crucial components. Governments across the globe are setting ambitious goals for the electrification of their transportation sectors, prompting leading automakers to make substantial investments in electric vehicle research and development. Semiconductors are emerging as the central processing units of EVs, empowering them to deliver optimal performance. Consequently, the growing investments in electric vehicles are anticipated to fuel the demand for the semiconductor market.

- The semiconductor industry needs more skilled workers. By the year 2030, more than one million additional skilled workers are likely to be needed to meet the industry's demand. Further, the semiconductor industry is characterized by long lead times and high capital investments. Manufacturing capacity constraints and changes in demand have led to shortages in the supply chain. These factors are expected to challenge the market's growth.

- The sector has undergone substantial changes due to COVID-19, impacting customer behavior, business revenues, and corporate operations. Additionally, the pandemic has revealed previously unnoticed risks on the supply side, potentially resulting in shortages of essential parts and components. Consequently, semiconductor companies are proactively restructuring their supply chains to enhance resilience, and these adjustments may persist in the post-pandemic era.

Semiconductor Market Trends

Discrete Semiconductors to Hold Significant Market Share in the Semiconductor Devices Segment

- The rising demand for high-energy and power-efficient devices, the increasing prevalence of wireless and portable electronic products, coupled with the increased use of these devices in the automotive industry due to the shift towards electrification are some of the key factors driving the growth of the segment.

- One of the significant trends in discrete semiconductors is efficient power management. New system architectures are improving the efficiency of AC-DC power adapters while simultaneously reducing the size and component count. New standards for Power-over-Ethernet (PoE) allow higher power transfer, which enables the development of new classes of devices, like connected lighting.

- MOSFET has always played an important part in the telecom sector, as switching power supply is the most prevalent application for power MOSFETs, which are also commonly utilized for MOS RF power amplifiers, allowing mobile networks to move from analog to digital. According to Ericsson, the number of 5G subscriptions increased by 70 million during the first quarter of 2022, reaching about 620 million. By the end of 2022, the number is predicted to reach 1 billion. Such reasons will spur the demand for power semiconductors, which will increase the demand for MOSFETs and lead to several breakthroughs in the telecom sector.

- Further, the demand for IGBT among various discrete semiconductors has been gaining traction and is widely used in low-power converters. The most popular semiconductor switches for power conversion in automotive, other motor drives, and renewable energy systems are discrete IGBTs. The main driving force is also the growing use of Insulated Gate Bipolar Transistor (IGBT) devices across a variety of sectors, including automotive, consumer electronics, industrial, IT and communications, healthcare, aerospace and defense, and others.

- The majority of discrete IGBT applications include inverters, various consumer goods like air conditioners and washing machines, switching-mode power supplies (SMPS), which are components used in personal computers, welding equipment, and induction heating devices like microwaves, electric cookers, induction stoves, etc. for soft switching and strobe flash control. The increasing demand for consumer electronic appliances like UPSs, power conditioners, air conditioners, etc., which use discrete IGBT types for lower-current applications, is credited with driving the growth of the discrete IGBT market. Discrete IGBTs have been found to have the lowest power losses in consumer goods, which is anticipated to be a key factor influencing the segment's growth in the market.

Fabrication to Hold Significant Market Share in Semiconductor Materials Segment

- Semiconductor fabrication materials form a crucial building block for the advanced microelectronics found in consumer electronics, high-end data centers, automotive applications, medical devices, IoT devices, power electronics, and more. The segment covers materials like process chemicals, photomasks, electronic gases, photoresist ancillaries, sputtering targets, silicon, and other materials.

- One of the primary factors driving the demand for semiconductor fabrication materials is the increasing use of digitally integrated ICs in the electrical, electronics, automotive, and telecommunication industries. Additionally, the rising investments in the energy sector are also expected to contribute positively to the growth of this segment, owing to the widespread application of semiconductors in solar panels, drives, and pumps in wind and water turbines, and protection circuits in energy conversion to ensure efficiency and minimal power loss. For instance, as per IEA, global energy investment will increase by 8% in 2022 to reach USD 2.4 trillion. Furthermore, according to IRENA, the spending on renewable energy is expected to grow steadily, boosting the market.

- While a wide range of materials can exhibit semiconductor properties, some materials are more commonly used in the fabrication of electronic devices due to their specific characteristics. Two of the most prevalent semiconductor materials are silicon and gallium arsenide. Silicon is the most widely used semiconductor material, primarily due to its abundance, low cost, and relatively stable properties at high temperatures. The electric conductivity of silicon is around 1000 S/m. Additionally, silicon has a well-established fabrication infrastructure, making it an attractive choice for manufacturers. However, silicon does have some drawbacks, such as lower electron mobility compared to other materials, which can limit the performance of high-speed devices.

- Gallium arsenide is another popular semiconductor material, valued for its higher electron mobility and direct bandgap. These properties make it well-suited for optoelectronic applications, such as lasers and solar cells. However, gallium arsenide is more expensive and less abundant than silicon, which can limit its widespread adoption. Another drawback of gallium arsenide is that it exists intrinsically as a semi-insulator rather than a semiconductor with an electrical conductivity of 0.000001 S/m.

- Aside from silicon and gallium arsenide, researchers are continually exploring new materials with promising semiconductor properties. These materials include aluminum nitride, carbon nanotubes, and many other materials that have the potential to revolutionize the industry. As the understanding of these emerging materials grows, they will likely play an increasingly important role in the future of semiconductor fabrication.

- Moreover, the market for process chemicals is expected to grow steadily due to the low-cost method and the applications for internal efficiency in the semiconductor sector. The consumption of semiconductor process chemicals is fueled by growth in installed fabrication capacity and expensive chemicals consumed by new technology, as well as processed silicon wafer surface area.

Semiconductor Industry Overview

The semiconductor industry features major players like Intel Corporation, Samsung Electronics Co. Ltd, Qualcomm Incorporated, Micron Technology Inc., and SK Hynix Inc., contributing to its semi-consolidated nature. Market participants are actively leveraging strategies such as partnerships and acquisitions to bolster their product portfolios and secure enduring competitive advantages.

In October 2023, Micron significantly expanded its 1β process node technology by introducing the 16Gb DDR5 memory. Rigorously tested and validated for in-system functionality at speeds of up to 7,200 MT/s, this new product is now being shipped to Micron's data center and PC clientele. The incorporation of advanced high-k CMOS device technology, a 4-phase clocking system, and clock-sync 1 in Micron's 1β-based DDR5 memory yield a substantial performance enhancement of up to 50%, accompanied by a 33% improvement in performance per watt compared to the prior generation.

September 2023 witnessed Intel Foundry Services (IFS) and Tower Semiconductor, a notable provider of analog semiconductor solutions, announcing a collaboration. Intel will extend its foundry services and 300mm manufacturing capacity to assist Tower in catering to its global clientele. Tower, as part of the agreement, will leverage Intel's advanced manufacturing facility in New Mexico to fulfill its operational needs.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Technological Trends

- 4.3 Industry Value Chain/Supply Chain Analysis

- 4.4 Impact of COVID-19, Macro Economic Trends, and Geopolitical Scenarios

- 4.5 Industry Attractiveness - Porter's Five Forces Analysis

- 4.5.1 Bargaining Power of Suppliers

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Threat of New Entrants

- 4.5.4 Threat of Substitutes

- 4.5.5 Intensity of Competitive Rivalry

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing Needs of Consumer Electronic Devices Boosting the Manufacturing Prospects

- 5.1.2 Proliferation of AI, IoT, and Connected Devices Across Industry Verticals

- 5.1.3 Increased Applications of Semiconductors in Automotive

- 5.1.4 Increased Deployment of 5G and Rising Demand for 5G Smartphones

- 5.2 Market Challenges/Restraints

- 5.2.1 Supply Chain Disruptions Resulting in Semiconductor Chip Shortage

- 5.2.2 Dynamic Nature of Technologies Requires Several Changes in Manufacturing Equipment

- 5.2.3 Vertical Integration is One of the Significant Concerns of OSAT Players

6 MARKET SEGMENTATION

- 6.1 By Semiconductor Devices

- 6.1.1 Discrete Semiconductors

- 6.1.2 Optoelectronics

- 6.1.3 Sensors

- 6.1.4 Integrated Circuits

- 6.2 By Semiconductor Equipment

- 6.2.1 Front-end Equipment

- 6.2.2 Back-end Equipment

- 6.3 By Semiconductors Materials

- 6.3.1 Fabrication

- 6.3.2 Pacakging

- 6.4 By Semiconductor Foundry Market

- 6.5 By Outsourced Semiconductor Assembly Test Services (OSAT) Market

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles*

- 7.1.1 Intel Corporation

- 7.1.2 Samsung Electronics Co. Ltd

- 7.1.3 Qualcomm Incorporated

- 7.1.4 Micron Technology Inc.

- 7.1.5 SK Hynix Inc.

- 7.1.6 Texas Instruments Incorporated

- 7.1.7 Broadcom Inc.

- 7.1.8 Mediatek Inc.

- 7.1.9 Applied Materials Inc.

- 7.1.10 ASML Holding NV

- 7.1.11 Tokyo Electron Limited

- 7.1.12 Lam Research Corporation

- 7.1.13 KLA Corporation

- 7.1.14 Advantest Corporation

- 7.1.15 Screen Holdings Co. Ltd

- 7.1.16 Teradyne Inc.

- 7.1.17 BASF SE

- 7.1.18 LG Chem Ltd

- 7.1.19 Indium Corporation

- 7.1.20 Resonac Holding Corporation

- 7.1.21 Kyocera Corporation

- 7.1.22 Henkel AG & Co. KGaA

- 7.1.23 Sumitomo Chemical Co. Ltd

- 7.1.24 Dow Chemical Co. (Dow Inc.)

- 7.1.25 Taiwan Semiconductor Manufacturing Company (TSMC) Limited

- 7.1.26 Samsung Foundry (Samsung Electronics Co. Ltd)

- 7.1.27 United Microelectronics Corporation (UMC)

- 7.1.28 GlobalFoundries Inc.

- 7.1.29 Semiconductor Manufacturing International Corporation (SMIC)

- 7.1.30 Hua Hong Semiconductor Limited

- 7.1.31 Powerchip Technology Corporation

- 7.1.32 ASE Technology Holding Co.Ltd

- 7.1.33 Amkor Technology Inc.

- 7.1.34 Jiangsu Changjiang Electronics Technology Co. Ltd

- 7.1.35 Powertech Technology Inc.

- 7.1.36 Tongfu Microelectronics Co. Ltd

- 7.1.37 Tianshui Huatian Technology Co. Ltd

- 7.1.38 King Yuan Electronics Co. Ltd

- 7.2 Vendor Market Share

- 7.2.1 Vendor Market Share - Semiconductor Devices Market

- 7.2.2 Vendor Market Share - Semiconductor Equipment Market

- 7.2.3 Vendor Market Share - Semiconductor Foundry Market

- 7.2.4 Vendor Market Share - OSAT Market