|

市場調查報告書

商品編碼

1441451

汽車車體套件:市場佔有率分析、產業趨勢與統計、成長預測(2024-2029)Car Body Kit - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

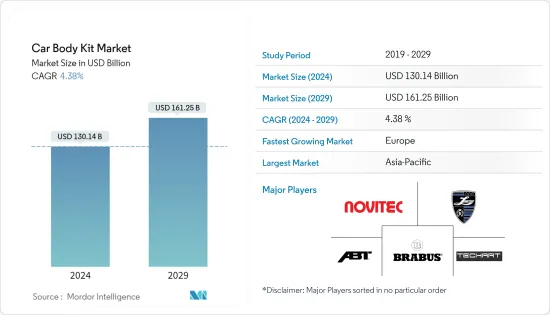

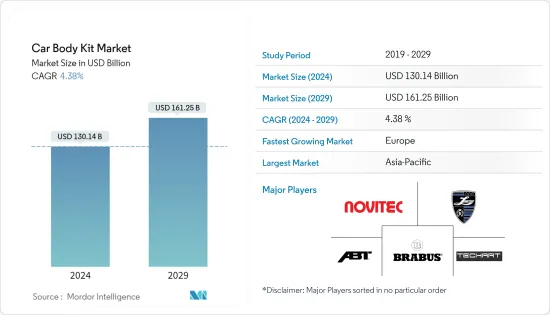

汽車車體套件市場規模預計到 2024 年為 1,301.4 億美元,預計到 2029 年將達到 1,612.5 億美元,預測期內(2024-2029 年)複合年成長率為 4.38%。

冠狀病毒感染疾病(COVID-19)大流行在預測期內襲擊了市場,汽車經銷商和服務中心關閉,供應鏈中斷導致市場需求減少。此外,2020年市場也受到OEM在主要全部區域暫停生產活動的影響,但自2021年限制解除以來,市場一直處於復甦趨勢。

消費者越來越傾向於享受愉快的駕駛體驗,加上年輕人對汽車的定製越來越多,被認為是預測期內市場增長的主要驅動力。 也就是說,今天幾乎每個人都在努力將自己與他人區分開來。 車主用他們的汽車來表達他們的個性,使他們的汽車獨一無二、更舒適,並在其他人中脫穎而出。

而且,汽車愛好者以及高級運動和賽車用戶正在積極參與透過空氣動力學套件、保險桿調校等提高市場的整體性能,預計未來幾年市場需求將進一步擴大。此外,由於擾流板和保險桿損壞而經常發生的事故也增加了市場對車身套件的需求。

然而,這些車輛的高安裝成本和低轉售價值預計將成為主要限制因素。一些主要國家政府實施的嚴格監管對市場成長產生了負面影響。例如,在 2019 年的一項判決中,印度最高法院裁定,對車輛進行與製造商原始規格(如登記證書上所述)不同的改裝是非法的。這意味著買家將無法在汽車上安裝更寬的輪胎、更大的合金、售後排氣裝置,甚至喇叭。

電動的趨勢以及消費者對在車身套件的製造過程中使用輕質材料的日益偏好預計將為市場上的參與者提供顯著的機會。碳纖維是一種有吸引力的選擇,因為它專注於類似賽道的特性,例如在長時間高速行駛過程中遇到的強大力量時具有卓越的強度和耐用性。

Novitec Group、Maxton design、TECHART Automobiledesign GmbH 等是市場上一些知名的參與者。

汽車車體套件市場趨勢

預計汽車車體套件銷售增加,市場需求增加

車身套件可用於多種用途,但最常見的用途是改善車輛的外觀。許多人選擇在他們的汽車上添加車身套件,使其看起來更具攻擊性或運動感。您也可以使用車身套件來改變汽車的形狀,使其看起來更寬或更低。

近年來,重複利用客戶舊車的趨勢日益明顯,許多車主都專注於改變他們看待汽車的方式,以保持汽車的吸引力,這就是為什麼汽車車體在預測期內預計這將推動對該套件的需求。例如,隨著OEM以賦予其獨特外觀的趨勢越來越受歡迎,預計主要原始設備製造商在預測期內提案新小客車將鼓勵車身套件製造商。例如,2022年1月,Skoda汽車發布了新款斯柯達Enyaq 小轎車 iV的官方設計草圖,其車頂線平緩,車尾邊緣Sharp Corporation,側裙與車身同色。新款Enyaq Coupe iV是首款以大眾汽車集團模組化電動套件(MEB)為基礎的全電動車款系列。車頂從 B 柱處輕輕向後傾斜,並與後擋板無縫結合。車尾造型採用大寫字母 ŠKODA 字樣,位於Sharp Corporation的撕裂邊緣下方,並配有該品牌標誌性的 C 形尾燈。 Enyaq Coupe iV 的前部配有令人印象深刻的斯柯達大格柵和扁平、Sharp Corporation切割的大燈,強調了汽車的寬度。

此外,2021 年 2 月,豐田在印度對Fortuna拉皮了中期更新,推出了多項外觀更新、新的內部功能,甚至還進行了一些機械升級。豐田也在印度推出了新的 Legend 版本Fortuna。豐田發表的Legend車身套件可安裝在拉皮和拉皮前車型。常規的Fortuna頭燈被帶有整合式 LED 日行燈和全 LED 頭燈的 Legend 裝置所取代,呈現出獨特的外觀。動態方向燈位於保險桿底部,霧燈位於保險桿上方。

市場的這種發展,加上政府以稅收政策、法規、積極銷售車身套件元件等形式的支援措施,正在鼓勵一些車身套件製造商專注於各種增長戰略,例如推出新產品、擴張和銷售。 例如,2022 年 7 月,伏爾加宣佈擴大了 2022 車型年的 LADA Granta 裝飾級別範圍,並恢復了交叉版的生產。 該車配備了可靠且經濟的高扭矩發動機(90馬力)和手動變速箱。 懸架通過增加 16 毫米進行了現代化改造,輪廓高度又增加了 7 毫米輪胎。 車身由耐用塑膠製成的功能性車身套件保護,即使在輕微的越野條件下也能保護搪瓷免受損壞。

汽車製造商正在關注車輛內複雜部件的基本架構,尤其是關鍵部件,因此,普通汽車比消費者以前提供的汽車要堅固得多。老舊汽車數量的增加表明消費者願意用現代的車身取代舊的、粗獷的外觀。例如,

據信,即使在主要新興國家,一輛汽車的平均行駛里程也能非常平穩地達到30萬至35萬公里左右。例如,印度幾乎所有汽車的保固期通常都在 1,00,000 公里左右。毫不誇張地說,如果您延長維護和保養時間,您的汽車的使用壽命可能會延長一倍。如果您保養好您的汽車並使其至少在前 5-7 年內保持原始狀態,它的性能就有可能遠遠超出上述限制。

因此,考慮到各種案例和積極發展的分析,可以看出,在全球需求上升的情況下,車身套件市場的需求預計將得到車身套件製造商和OEM的貢獻的支持。

亞太地區引領市場

隨著經濟從COVID-19感染疾病逐漸復甦,消費者對豪華車的需求不斷增加。大多數主要奢侈品牌都將中國視為成長率最快的市場。中國是世界上最大的汽車市場,但對德國豪華汽車品牌來說尤其重要。德國豪華汽車製造商梅賽德斯-奔馳、寶馬和奧迪去年均創下了銷售紀錄,儘管該行業近年來面臨低迷。賓士和奧迪分別較去年與前一年同期比較下降6.6%和1.8%,而寶馬等其他汽車製造商則較去年與前一年同期比較增加6.5%。

中國汽車流通協會資料顯示,2021與前一年同期比較%。這也標誌著由於中國整體汽車市場的下行壓力,豪華品牌連續第三年成長。由於對豪華車的需求不斷成長,中國汽車市場仍然具有巨大的潛力。自2020年以來,豪華車廠商銷售量正成長,年輕人對豪華車的需求明顯增加。汽車製造商瞄準的是 Z 世代消費者,他們更容易接受新的車身套件、了解市場趨勢並重視獨特的個性。因此,製造商專注於為車輛提供多種功能。這種趨勢也出現在大眾市場領域。

該國的豪華汽車市場由梅賽德斯-奔馳、奧迪和寶馬等歐洲汽車製造商主導。 2021年,美國豪華車銷量超過400萬輛,其中賓士總合售出758,863輛,BMW共售出815,691輛,奧迪共售出701,289輛。 BMW已成為該國的領先品牌,月均銷量超過65,000輛(包括輕型車的銷量)。

近年來,車身套件在汽車製造商和愛好者中越來越受歡迎。這種修改為用戶提供了改進的性能和美觀性,從而增加了功率和扭矩。汽車性能套件可以添加設計元素並提供各種附加特性,而無需更改或安裝組件或零件。

目前,只有超高階豪華汽車品牌進口到該國,但由於這些品牌完全從美國境外的工廠進口,因此它們可以受益於較低的進口關稅。一些廠商已經推出了市場上最暢銷汽車的特別版。例如,2022年2月,東風小康推出了新款風神逸軒MAX暗夜邊緣版,其車身套件包括前擾流板和唇緣、保險桿方面小翼、前輪胎後小翼、側裙和前部小翼。做過。這些特徵的例子包括後輪的形狀以及遠遠超出後門的前後擋泥板。

汽車車體套件產業概況

汽車車體套件市場由 NovitecGroup、Maxton design 和 TECHART Automobiledesign GmbH 等主要公司區隔。重點區域產品投放和併購是企業維持和提高市場競爭力的重要策略。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 調查先決條件

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場動態

- 市場促進因素

- 市場限制因素

- 波特五力分析

- 新進入者的威脅

- 買方議價能力

- 供應商的議價能力

- 替代產品的威脅

- 競爭公司之間的敵意強度

第5章市場區隔(市場規模(金額))

- 身材

- 掀背車

- 轎車

- 運動型多用途車(SUV)

- 多用途汽車(MPV)

- 車身套件材料

- 玻璃纖維

- ABS塑膠

- 聚氨酯

- 碳纖維

- 複合材料

- 車身套件組件

- 全身套件

- 前後保險桿套件

- 劇透

- 其他部件(唇套件、前格柵、調音罩等)

- 地區

- 北美洲

- 美國

- 加拿大

- 北美其他地區

- 歐洲

- 德國

- 英國

- 義大利

- 法國

- 其他歐洲國家

- 亞太地區

- 印度

- 中國

- 日本

- 韓國

- 其他亞太地區

- 世界其他地區

- 南美洲

- 中東

- 北美洲

第6章 競爭形勢

- 供應商市場佔有率

- 公司簡介

- Modsters Automotive

- Auto Starke Private Limited

- TECHART Automobildesign GmbH

- Maxton Design

- Novitec Group

- LARTE Design

- BRABUS GMBH

- Mansory Design &Holding GmbH

- ABT SportsLine GmBH

- Motoren Mayer Technik GmbH

- AC Schnitzer

第7章市場機會與未來趨勢

The Car Body Kit Market size is estimated at USD 130.14 billion in 2024, and is expected to reach USD 161.25 billion by 2029, growing at a CAGR of 4.38% during the forecast period (2024-2029).

The COVID-19 pandemic hurt the market during the forecast period, as the shutdown of car dealerships and service centers coupled with supply chain disruptions resulted in a decline in demand in the market. Further, the market is also affected by the halt in manufacturing activities of OEMs across major regions by OEMs during 2020. However, the market has been recovering since restrictions were lifted in 2021.

The increasing consumer inclination towards an entertaining driving experience, coupled with rising vehicle customization among the young population, are considered primary driving factors for the market growth during the forecast period, i.e., nowadays, most people try to make themselves different from others. Car owners express their individuality using their vehicles, making them unique, more comfortable, and noticeable among other cars.

In addition, the active participation of car enthusiasts and users of premium sports and racing cars in enhancing the overall performance of the market through aerodynamic kits, bumper tuning, etc., is expected to further augment the demand in the market in the coming years. Furthermore, normal accidents with spoilers and bumper damages contribute to the demand for body kits in the market.

However, the high cost of installation and the decrease in the resale value of these cars are expected to act as major restraints. The stringent regulations imposed by governments across some major countries hurt the growth of the market. For instance, According to the 2019 judgment, the Supreme Court of India ruled that any modification of the vehicle that varies with the manufacturer's original specification (as noted in the Registration Certificate) is illegal. It indicates that buyers cannot even install wider tires, bigger alloys, aftermarket exhausts, or horns in their cars.

The trend of electrification and the growing preference of consumers for using lightweight materials in the manufacturing process of body kits are expected to offer notable opportunities for the players operating in the market. Carbon fiber is one of the attractive options as it focuses on features like racetracks, such as extraordinary strength and durability against intense forces put upon it when traveling at speed for protracted periods.

Novitec Group, Maxton design, TECHART Automobildesign GmbH, and Others are some of the prominent players in the market.

Car Body Kit Market Trends

Increasing Launches of Car Body Kits Anticipated to Enhance Demand in the Market

Body kits can be used for a variety of purposes, but the most common use is to improve the appearance of the vehicle. Many people choose to add body kits because they make the car look more aggressive or sporty. Body kits can also be used to change the shape of the car, making it look wider or lower.

Over the recent years, Customer's inclination to reuse their old cars has been rising, and many car owners are focusing on changing their vehicle outlook to keep them appealing, which is expected to drive the demand for car body kits during the forecast period. For instance, As the trend of car modification is growing in popularity in order to give passenger cars a unique appearance, key OEMs offering new car model launches are anticipated to encourage body kit manufacturers during the forecast period. For instance, in January 2022, Skoda Auto revealed the official design sketches of the new Skoda Enyaq Coupe iV with a gently sloping roofline, the rear with a sharp tear-off edge, and side skirts in the body color. The new Enyaq Coupe iV is the first all-electric model series based on the Volkswagen Group's Modular Electrification Toolkit (MEB). The roof slopes gently from the B-pillar towards the rear and merges seamlessly with the tailgate. The rear styling is dominated by Skoda lettering in block capitals below a sharp tear-off edge and the brand's signature C-shaped rear lights. The front of the Enyaq Coupe iV is characterized by the large and striking Skoda grille and flat, sharply cut front headlights that accentuate the width of the vehicle.

Also, in February 2021, Toyota facelifted the Fortuner in India with a mid-life update, introducing a slew of exterior cosmetic updates, new features on the inside, and even some mechanical upgrades. Toyota also introduced a new Legender variant of the Fortuner in India. The Toyota-launched Legender body kit can be installed on both facelift and pre-facelift models. The headlights on the regular Fortuner will be replaced with Legender's unit, which comes with unique-looking integrated LED DRLs and all LED headlamps. The dynamic turn indicators are placed on the lower part of the bumper, and the fog lamps are placed on the bumper.

Such developments in the market, coupled with supportive government measures in the form of taxation policies, regulations, active sales of body kit components, etc., are encouraging several body kit manufacturers to focus on various growth strategies such as launching new products, expansion, mergers & acquisitions, etc. For instance, in July 2022, AvtoVAZ announced that it has expanded the range of LADA Granta trim levels for the 2022 model year and resumed production of Cross versions. The car is equipped with a reliable, economical, and high-torque engine (90 hp) and a manual transmission. Including 16 mm gave a modernized suspension, and another 7 mm added tires with an increased profile height. The body is protected by a functional body kit made of durable plastic, which protects the enamel from damage in light off-road conditions.

Automakers focus on basic architecture to complex components in the vehicle, especially the significant components, resulting in an average car quite sturdier than the cars consumers were offered before, indicating that rising older cars encourage consumers to replace the older, sturdier look with the latest body kit components. For example,

An average car is believed to last quite smoothly until it covers around 3,00,000 km - 3,50,000 km, even in major developing countries. For example, almost every car in India typically has a warranty of around 1,00,000 km. With extended maintenance and services, it would be safe to say that the car could probably double up its life. A car can pull off more than the mentioned limit if taken care of and kept in a spick and span state in at least 5-7 of its initial years.

Thus, considering the analysis of varied instances and positive developments, it is understood that the demand for the body kits market is anticipated to be supported by the contribution of body kit manufacturers and OEMs in the wake of growing global demand.

Asia-Pacific is Leading the Market

As the economy slowly recovers from the COVID-19 pandemic, consumer demand for premium cars has increased. Most major luxury brands see China as the fastest-growing market in terms of growth rate. China is the largest auto market globally but is disproportionately important to German premium car brands. The German luxury car manufacturers Mercedes-Benz, BMW, and Audi all posted record sales last year despite the industry facing a decline in the past years. Mercedes-Benz and Audi reported a year-on-year decrease of 6.6% and 1.8%, respectively, while other carmakers like BMW reported a year-on-year increase of 6.5%.

According to data from the China Automobile Dealers Association, China's luxury vehicle sales in the first 11 months of 2021 exceeded 2 million units, with a year-on-year increase of over 5%. This also marked the third consecutive year for luxury brands to register growth in the wake of downward pressure in China's overall automotive market. The Chinese auto market continues to have great potential due to the higher rise in demand for premium cars. Luxury carmakers have posted positive sales growth since 2020, with a significant increase in demand for luxury cars among young people. The carmakers target Gen Z consumers as they are more receptive to new body kits, aware of market trends, and focus on a stand-out personality. Owing to this, manufacturers are focusing more on providing different features in their vehicles. The trend can be seen in the mass market segment as well.

The country's luxury car market is led by European automakers, namely Mercedes-Benz, Audi, and BMW. In 2021, more than 4 million luxury vehicles were sold across the country, of which Mercedes-Benz sold a total of 758,863 vehicles, BMW sold 815,691 vehicles, and Audi sold 701,289 vehicles. BMW became the leading brand in the country, with an average monthly sales volume of more than 65,000 units (including the sales of Mini cars).

In recent years, these body kits have gained popularity, particularly among automakers and enthusiasts. The modifications allow users with enhanced performance and aesthetics resulting in increased power and torque. Performance kits in cars can provide a variety of additional characteristics without the need to modify or install any components or parts rather than just adding design elements.

Currently, only ultra-premium luxury auto brands are imported into the country, which may benefit from lower import tariffs, as these brands are fully imported from non-US factories. Several players are launching special editions of their best-selling cars in the market. For instance, in February 2022: DFSK launched the new Aeolus Yixuan MAX Dark Night Edge Edition with a body kit with a front spoiler and lip, winglets on the sides of the bumpers, winglets behind the front tires, side skirts, winglets at the front of the rear wheel, and expanded front and rear fenders that extend well beyond the back door are some examples of these features.

Car Body Kit Industry Overview

The car body kit market is fragmented, as major players such as NovitecGroup, Maxton design, TECHART Automobildesign GmbH, and Others. Product launches in key geographies and mergers and acquisitions are the key strategies adopted by the players to maintain and improve their competitive position in the market. For instance,

- April, 2022, Novitec launched a carbon fiber body kit set for Ferrari 458 Speciale. The body kits include an Air-intake louver side window, cover for taillights, front spoiler lip, flaps for front air-guide, trunk-lid side panels (set) with double-fins, and others

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Drivers

- 4.2 Market Restraints

- 4.3 Porters 5 Force Analysis

- 4.3.1 Threat of New Entrants

- 4.3.2 Bargaining Power of Buyers/Consumers

- 4.3.3 Bargaining Power of Suppliers

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION ( Market Size in USD Billion)

- 5.1 Body Style

- 5.1.1 Hatchbacks

- 5.1.2 Sedans

- 5.1.3 Sports Utility Vehicles (SUVs)

- 5.1.4 Multi-Purpose Vehicles (MPVs)

- 5.2 Body Kit Material

- 5.2.1 Fiberglass

- 5.2.2 ABS Plastic

- 5.2.3 Polyurethane

- 5.2.4 Carbon Fibre

- 5.2.5 Composites

- 5.3 Body Kit Component

- 5.3.1 Full-body Kits

- 5.3.2 Front and Rear Bumper Kits

- 5.3.3 Spoilers

- 5.3.4 Other Components (Lip Kit, Front Grille, Tuning Hoods, etc.)

- 5.4 Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.1.3 Rest of North America

- 5.4.2 Europe

- 5.4.2.1 Germany

- 5.4.2.2 United Kingdom

- 5.4.2.3 Italy

- 5.4.2.4 France

- 5.4.2.5 Rest of Europe

- 5.4.3 Asia Pacific

- 5.4.3.1 India

- 5.4.3.2 China

- 5.4.3.3 Japan

- 5.4.3.4 South Korea

- 5.4.3.5 Rest of Asia-Pacific

- 5.4.4 Rest of the World

- 5.4.4.1 South America

- 5.4.4.2 Middle East

- 5.4.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Vendor Market Share

- 6.2 Company Profiles

- 6.2.1 Modsters Automotive

- 6.2.2 Auto Starke Private Limited

- 6.2.3 TECHART Automobildesign GmbH

- 6.2.4 Maxton Design

- 6.2.5 Novitec Group

- 6.2.6 LARTE Design

- 6.2.7 BRABUS GMBH

- 6.2.8 Mansory Design & Holding GmbH

- 6.2.9 ABT SportsLine GmBH

- 6.2.10 Motoren Mayer Technik GmbH

- 6.2.11 AC Schnitzer