|

市場調查報告書

商品編碼

1440438

碳泡沫:市場佔有率分析、產業趨勢與統計、成長預測(2024-2029)Carbon Foam - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

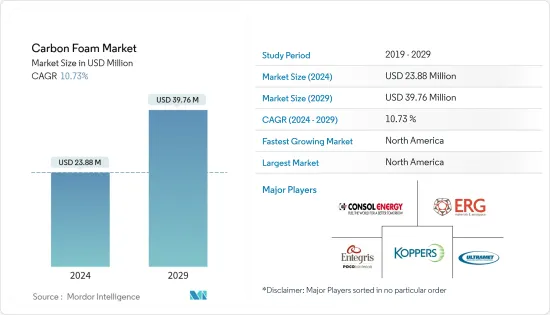

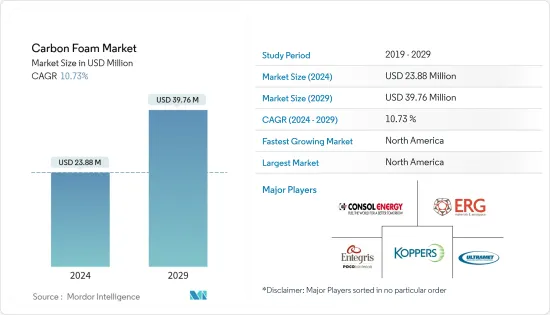

碳泡沫市場規模預計到 2024 年為 2,388 萬美元,預計到 2029 年將達到 3,976 萬美元,在預測期內(2024-2029 年)年複合成長率為 10.73%。

由於供應鍊和市場中斷,COVID-19 對 2020 年的市場產生了重大影響。疫情期間,許多負責生產碳泡沫的工廠關閉。然而,市場正在迅速成長,並已達到疫情前的水平。

主要亮點

- 短期內,碳泡沫在航太和國防工業的使用不斷增加將是推動市場需求的關鍵因素。

- 碳泡沫製造過程的高成本阻礙了市場的成長。

- 對低成本碳泡沫開發的日益關注可能會在未來幾年創造市場機會。

- 北美地區預計將主導市場,並且在預測期內也可能出現最高的年複合成長率。

碳泡棉市場趨勢

擴大在航太和國防工業中使用

- 碳泡沫可用於製造各種航太和國防應用的工程材料,包括航太工具、耐火結構產品、吸能結構、防爆系統和高溫結構。廣泛用於飛機和火箭的隔熱。

- 可用於 EMI 屏蔽和雷達吸收應用的熱保護系統和結構面板。它還可用於隱形技術,這是即將推出的第五代飛機的重要方面。

- 由於其重量輕、強度大和優良的熱性能,也用於惡劣環境下的火箭噴嘴系統。固體火箭馬達透過燃燒固體推進劑產生熱氣體並通過噴嘴排放產生推力。

- 石墨碳泡沫可以防禦爆炸性能量、定向能量武器和電磁脈衝威脅。

- 2022年2月,中國動態研究發展中心測試了一種碳泡沫基塗層,以提高高超音速武器的性能。我們發現,基於碳泡沫的塗層可以將衝擊波衝擊減少 20% 以上,並顯著提高動態穩定性。他也表示,碳泡沫作為未來高超音速飛行的塗層材料具有巨大潛力。

- 2021年10月,美國複合材料協會認可了空軍研究中心進行的部分研究成果。該實驗室開發了碳泡沫技術和相關材料,用於關鍵系統和複合工具,例如波音 787 夢幻飛機以及空軍和 NASA 衛星。

- 根據波音《2022-2041 年商業展望》,到 2041 年,全球新飛機交付總量預計將達到 41,170 架。由於如此巨大的預期交付,預計在預測期內全球對碳泡沫的需求將會增加。

- 此外,根據斯德哥爾摩國際和平研究所(SIPRI)的數據,去年全球軍費總額較2020年成長0.7%,達到21,130億美元。此外,2021年最大的五個支出國是美國、中國、印度、英國和俄羅斯,佔支出的62%。因此,軍事和國防費用的增加預計將支持國防應用對碳泡沫的需求。

美國將征服北美地區

- 北美地區預計將主導市場。美國是該地區最大、最強大的經濟體之一。

- 2021 年 7 月,美國農業部林業局林業產品研究所和Ligsteel LLC 的科學家與Domtar Inc. 合作,從木質素中提取了高價值的碳,木質素是一種在植物細胞壁中發現的物質,可以使碳泡沫變硬。木質素價格低廉且來源廣泛,紙漿和造紙工業每年生產 7,000 萬噸。

- 美國是僅次於中國的第二大電動車市場。從電動車銷量來看,去年國內插電式電動車保有量約65.69萬輛,較2020年成長約100%。

- IEA 表示,聯邦政府的目標是到 2030 年電動車 (EV) 占美國新小客車和輕型卡車銷量的 50%。此外,根據國際清潔交通理事會的數據,2020年,加州政府宣布一項州強制令,要求到2035年在加州銷售的所有新車和搭乘用均為零排放車輛,包括純電動車和插電式混合動力汽車。也宣布了一項行政命令授權

- 此外,根據美國聯邦航空管理局(FAA)的數據,該國與前一年同期比較民航機數量為5,882架,年減22.9%。預計到 2041 年,商業船隊將增至 8,756 艘船舶,年複合成長率為 2%。預計這將增加航太多種應用的市場需求。

碳泡沫產業概況

目前,碳泡沫市場本質上是整合的,主要企業佔據了調查市場的大部分佔有率。該市場的主要參與者包括(排名不分先後)CONSOL Energy Inc.、Entegris、Koppers Inc.、Ultramet 和 ERG Aerospace。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章 簡介

- 調查先決條件

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場動態

- 促進因素

- 擴大在航太和國防工業中使用

- 抑制因素

- 泡沫碳製造製程高成本

- 產業價值鏈分析

- 波特五力分析

- 供應商的議價能力

- 買方議價能力

- 新進入者的威脅

- 替代產品和服務的威脅

- 競爭程度

第5章市場區隔(以金額為準的市場規模)

- 類型

- 石墨

- 非石墨

- 最終用戶產業

- 航太和國防

- 建築與建造

- 車

- 電

- 產業

- 其他最終用戶產業

- 地區

- 亞太地區

- 中國

- 印度

- 日本

- 其他亞太地區

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 其他歐洲國家

- 世界其他地區

- 亞太地區

第6章 競爭形勢

- 併購、合資、合作與協議

- 市場排名分析

- 主要企業採取的策略

- 公司簡介

- American Elements

- Carbon-Core Corporation

- CONSOL Energy Inc.

- ERG Aerospace

- Firefly International Energy

- Koppers Inc.

- Entegris Inc.

- Ultramet

- Xiamen Zopin New Material Limited

第7章市場機會與未來趨勢

- 低成本碳泡沫的開發

- 其他機會

The Carbon Foam Market size is estimated at USD 23.88 million in 2024, and is expected to reach USD 39.76 million by 2029, growing at a CAGR of 10.73% during the forecast period (2024-2029).

COVID-19 highly impacted the market in 2020 because of supply chain and market disruption. During the pandemic, many factories responsible for carbon foam production were shut down. However, the market is growing rapidly and has reached pre-pandemic levels.

Key Highlights

- Over the short term, increasing usage of carbon foam in the aerospace and defense industry is a key factor driving market demand.

- The high cost of the production process of carbon foam is hindering the market's growth.

- Increasing focus on developing low-cost carbon foam will likely create opportunities for the market in the coming years.

- The North American region is expected to dominate the market and is also likely to witness the highest CAGR during the forecast period.

Carbon Foam Market Trends

Increasing Usage in the Aerospace and Defense Industry

- Carbon foam can be used to manufacture engineering material for various aerospace and defense applications, including aerospace tooling, fireproof structural products, energy-absorbing structures, blast protection systems, and hot structures. It is widely used to insulate aircraft and rockets.

- It can be used in thermal protection systems and structural panels for EMI shielding and radar-absorbing applications. It can also be used for stealth technology, an essential aspect of the upcoming fifth-generation aircraft.

- Due to its lightweight nature, strength, and excellent thermal properties, it is also used in rocket nozzle systems, even in harsh environments. Solid rocket motors generate their thrust by burning a solid propellant to generate hot gases, which are exhausted through a nozzle.

- Graphitic carbon foam can protect against blast energy, directed energy weapons, and electromagnetic pulse threats.

- In February 2022, the China Aerodynamics Research and Development Centre tested carbon foam-based coatings on hypersonic weapons to enhance their performance. It found that carbon foam-based coatings could reduce the impact of shock waves by more than 20% and dramatically improve aerodynamic stability. It also mentioned that carbon foam has great application potential as a coating material for future hypersonic flight.

- In October 2021, the American Society for Composites acknowledged some of the research work done by the Air Force Research Laboratory. The laboratory developed carbon foam technology and related materials and applied significant systems, such as those in the Boeing 787 Dreamliner and Air Force and NASA satellites, and composite tooling.

- According to the Boeing Commercial Outlook 2022-2041, the total global deliveries of new airplanes are estimated to be 41,170 by 2041. Due to such huge expected deliveries, the demand for carbon foam is expected to rise globally during the forecast period.

- Furthermore, according to the Stockholm International Peace Research Institute (SIPRI), the total global military expenditure increased by 0.7% to USD 2,113 billion last year compared to 2020. Moreover, the five largest spenders in 2021 were the United States, China, India, the United Kingdom, and Russia, accounting for 62% of expenditure. As a result, rising military and defense spending is expected to support the demand for carbon foam for defense applications.

United States to Dominate the North American Region

- The North American region is expected to dominate the market. The United States is one of the region's largest and most powerful economies.

- In July 2021, scientists from the USDA Forest Service's Forest Products Lab and Ligsteel LLC collaborated with Domtar Inc. to produce high-value carbon foam from lignin, a material found in plant cell walls that makes carbon foam hard. Lignin is inexpensive and widely available, with the pulp and paper industry producing 70 million tons per year.

- The United States is the second-largest market for electric vehicles after China. According to the EV volumes, the country's total plug-in electrical vehicles accounted for around 656,900 units last year, registering a growth rate of ~100% compared to 2020.

- According to the IEA, in the United States, the federal aim is for electric vehicles (EVs) to make up 50% of new passenger cars and light trucks sold by 2030. Moreover, as per the International Council on Clean Transportation, in 2020, the California Government announced an executive order which directs the state to require that, by 2035, all new cars and passenger trucks sold in California be zero-emission vehicles, including BEV and PHEV.

- Moreover, according to the Federal Aviation Administration (FAA), the number of aircraft in the country's commercial fleet accounted for 5,882 in 2020, witnessing a decline rate of 22.9% compared to the previous year. The commercial fleet is forecasted to increase to 8,756 in 2041, with an average annual growth rate of 2% per year. This is expected to increase the market demand from multiple applications in the aerospace industry.

Carbon Foam Industry Overview

The carbon foam market is currently consolidated in nature, where the top players hold the majority share of the market studied. Some of the major players in the market include CONSOL Energy Inc., Entegris, Koppers Inc., Ultramet, and ERG Aerospace (not in any particular order).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Increasing Usage in the Aerospace and Defense Industry

- 4.2 Restraints

- 4.2.1 The High Cost of the Production Process of Carbon Foam

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Value)

- 5.1 Type

- 5.1.1 Graphitic

- 5.1.2 Non-graphitic

- 5.2 End-user Industry

- 5.2.1 Aerospace and Defense

- 5.2.2 Building and Construction

- 5.2.3 Automotive

- 5.2.4 Electrical

- 5.2.5 Industrial

- 5.2.6 Other End-user Industries

- 5.3 Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 Rest of Europe

- 5.3.4 Rest of the World

- 5.3.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 American Elements

- 6.4.2 Carbon-Core Corporation

- 6.4.3 CONSOL Energy Inc.

- 6.4.4 ERG Aerospace

- 6.4.5 Firefly International Energy

- 6.4.6 Koppers Inc.

- 6.4.7 Entegris Inc.

- 6.4.8 Ultramet

- 6.4.9 Xiamen Zopin New Material Limited

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Development of Low-cost Carbon Foam

- 7.2 Other Opportunities