|

市場調查報告書

商品編碼

1440407

記憶體 - 市場佔有率分析、產業趨勢與統計、成長預測(2024 - 2029 年)Memory - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

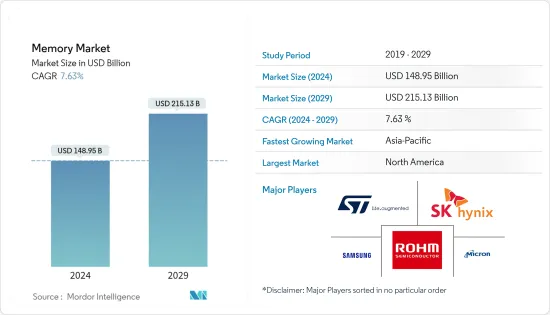

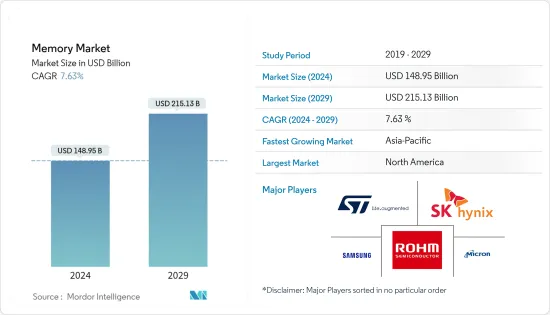

2024年記憶體市場規模預估為1,489.5億美元,預估至2029年將達2,151.3億美元,預測期(2024-2029年)CAGR為7.63%。

全球範圍內的 COVID-19 大流行嚴重擾亂了 2020 年初期市場研究的供應鏈和生產。對於製造單位來說,這種影響更為嚴重。由於勞動力短缺,亞太地區許多封裝、組裝和測試工廠減少甚至暫停營運。這給依賴半導體的最終用戶公司造成了瓶頸。最近,中國與 COVID-19 相關的封鎖再次擾亂了全球記憶體市場供應鏈。 2021 年 12 月,全球最大的兩家記憶體晶片生產商三星電子和美光科技警告稱,中國西安市嚴格的 COVID-19 限制和封鎖可能會擾亂他們在該地區的晶片製造基地。美光科技表示,封鎖可能會導致資料中心廣泛使用的 DRAM 記憶體晶片的供應延遲。

記憶體市場正在快速成長,半導體逐漸成為大多數現代技術的基本建構模組。該市場的創新和進步對所有下游技術產生直接影響。

美國國家有線和電信協會預計,2020 年連網設備數量將達到 501 億台左右。每個物聯網或工業物聯網設備都包含複雜的半導體儲存晶片,可讓設備遠端連接。此外,隨著物聯網即將大幅成長,預計也會影響記憶體市場的成長。

到 2025 年,市場將受益於汽車產業、連接、通訊和資料中心的持續發展和創新。用於安全導航、資訊娛樂和汽車的電子元件消耗的成長進一步促進了市場的成長。

半導體記憶體產品廣泛應用於電子設備,例如智慧型手機、平板顯示器、LED 電視以及民用航空和軍事系統。內存產業也可能受益於生物辨識能力的進步。對智慧型手機和穿戴式裝置等技術先進產品的需求不斷成長,也加速了所研究市場的成長。

此外,一些供應商正在投資這項技術以獲得優勢。例如,2022 年 4 月,提供先進設計和驗證解決方案的領先科技公司是德科技宣布 SK 海力士選擇是德科技的整合週邊組件來互連快速 (PCIe) 5.0 測試平台,以加速記憶體的開發用於設計能夠管理大量資料並支援高資料速度的先進產品的半導體。

記憶體市場趨勢

消費品預計將佔據重要的市場佔有率

新興的記憶體技術增強了記憶體的潛力,能夠以比流行消費性電子產品(包括數位相機、手機、筆記型電腦等)所使用的昂貴矽晶片更低的成本儲存更多資料。

全球半導體代工廠台灣聯電 (UMC) 正在提供基於 28 奈米 CMOS 製造製程的嵌入式非揮發性 STT-MRAM 模組,這將使客戶能夠整合低延遲、超高性能和低功耗的嵌入式 MRAM 記憶體塊進入MCU 和SoC,針對物聯網、穿戴式裝置和消費性電子領域。

該領域的技術進步正在推動所研究市場的需求。 Nantero 等公司開發了稱為 NRAM 的高密度非揮發性記憶體,其速度快得令人難以置信,可以在很小的空間內提供大量存儲,並且功耗非常低。借助 Nantero 的 NRAM,消費性電子產品供應商可以開發被認為具有未來感的新型消費性設備。隨著這些發展,非揮發性記憶體的採用預計將會成長。

該行業新興的儲存技術主要由穿戴式和連接裝置驅動,預計在預測期內將以更快的速度成長。思科系統公司估計,到 2022 年,全球連網穿戴裝置的數量將達到 11.05 億台。

由於數位相機、智慧型手機、遊戲設備等其他消費性電子設備的有效記憶體需求,對這些記憶體技術的需求預計將進一步上升。愛立信估計,到 2022 年,智慧型手機出貨量可能達到 15.744 億部。

美洲佔最大的市場佔有率

快速變化的技術和跨行業的高資料生成正在為該國創造更高效的處理系統的需求。隨著行動和低功耗設備以及高階資料中心和大型片上快取的出現,出現了另一個高優先需求:非揮發性、高密度和低能耗記憶體。

在儲存半導體製造技術方面,美國近年來在DRAM和3D-NAND方面重新獲得了競爭力,美國企業正在全面擁抱EUV(極紫外光)。

根據美國能源部統計,美國約有300萬個資料中心。資料中心已成為新的計算單元。 DPU(資料處理單元)是安全和現代加速資料中心的基本要素,其中 GPU、CPU 和 DPU 能夠組合成一個完全可編程的運算單元。 Nvidia 估計資料管理消耗了資料中心高達 30% 的中央處理核心。對資料中心不斷成長的需求也推動了對記憶體組件的需求。目前,北美的大型資料中心專案推動了對DRAM等記憶體的強勁需求。

此外,預計5G將能夠在短時間內傳輸大量電信資料,這也意味著設備需要更多的儲存空間。這將增加 NAND 快閃記憶體的採用。

美國是工廠自動化和工業控制的主要市場。 FRAM 提供快速隨機存取、高讀寫耐久性和低功耗。在工廠自動化中,業界標準架構、介面、功能和封裝可以實現簡單的嵌入式解決方案,從而消除昂貴的系統重新設計。

記憶體產業概況

由於多家供應商向國內和國際市場提供內存,內存市場競爭非常激烈。市場似乎適度分散,重要供應商採取併購和策略合作夥伴關係等策略,以擴大其影響力並保持市場競爭力。該市場的主要參與者包括三星電子、美光科技、SK 海力士和羅姆等。市場的一些最新發展是:

2021 年 10 月 - 美國記憶體製造商美光科技 (Micron Technology) 將在未來十年內在全球投資超過 1500 億美元用於先進記憶體製造、研究和開發,包括潛在的美國晶圓廠擴建。

2021 年 12 月 - 美光科技宣布擴大與聯華電子公司的業務關係,為美光科技提供確保未來移動、汽車和關鍵客戶供應的機會。

額外的好處:

- Excel 格式的市場估算 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章:簡介

- 研究假設和市場定義

- 研究範圍

第 2 章:研究方法

第 3 章:執行摘要

第 4 章:市場洞察

- 市場概況

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 買家的議價能力

- 新進入者的威脅

- 替代產品的威脅

- 競爭激烈程度

- 技術簡介

- COVID-19 對市場的影響

第 5 章:市場動態

- 市場促進因素

- 5G 和物聯網設備的滲透率不斷上升

- 資料中心不斷成長的記憶體需求

- 消費性電子和汽車產業的需求不斷成長

- 市場課題

- 疫情與中美貿易戰帶來的短期供應鏈課題

第 6 章:市場區隔

- 依類型

- 動態隨機存取記憶體

- 靜態隨機記憶體

- 或非快閃記憶體

- 快閃記憶體

- 只讀記憶體和EPROM

- 其他

- 依應用

- 消費性產品

- 個人電腦/筆記型電腦

- 智慧型手機/平板電腦

- 資料中心

- 汽車

- 其他應用

- 依地理

- 美洲

- 歐洲

- 中國

- 日本

- 亞太

第 7 章:競爭格局

- 公司簡介

- Samsung Electronics Co. Ltd

- Micron Technology Inc.

- SK Hynix Inc.

- ROHM Co. Ltd.

- STMicroelectronics NV

- Maxim Integrated Products Inc.

- IBM Corporation

- Cypress Semiconductor Corporation

- Intel Corporation

- Nvidia Corporation

- Kioxia Corporation

- Vendor Ranking

第 8 章:投資分析

第 9 章:市場的未來

The Memory Market size is estimated at USD 148.95 billion in 2024, and is expected to reach USD 215.13 billion by 2029, growing at a CAGR of 7.63% during the forecast period (2024-2029).

The COVID-19 pandemic across the globe significantly disrupted the supply chain and production of the market studies in the initial phase of 2020. For fabrication units, this impact was more severe. Owing to the labor shortages, many of the package, assembly, and testing plants in the Asia Pacific region reduced and even suspended operations. This created a bottleneck for end-user companies that depend on semiconductors. More recently, COVID-19-related lockdowns in China again disrupted the Global Memory Market supply chain. In December 2021, Samsung Electronics and Micron Technology, two of the world's largest memory chip producers, warned that strict COVID-19 curbs and lockdowns in the Chinese city of Xian might disrupt their chip manufacturing bases in the area. According to Micron Technology, the lockdowns could cause delays in the supply of DRAM memory chips, widely used in data centers.

The memory market is witnessing rapid growth, with semiconductors emerging as the basic building blocks of most modern technologies. The innovations and advancements in this market are resulting in a direct impact on all downstream technologies.

The National Cable and Telecommunications Association projected that the number of connected devices in 2020 will be around 50.1 billion. Every IoT or IIoTdevice contains sophisticated semiconductor memory chips that permit devices to achieve remote connectivity. Moreover, as the IoT is poised to grow significantly, it is expected to impact the growth of the memory market as well.

By 2025, the market is set to experience significant benefits from the ongoing development and innovation in the automotive industry, connectivity, communications, and data centers. The rise in the consumption of electronic components used in the navigation of safety, infotainment, and automobiles further contributes to the market's growth.

Semiconductor memory products are used extensively across electronic devices, such as smartphones, flat-screen monitors, LED TVs, and civil aerospace and military systems. The memory industry is also likely to benefit from progress in biometrics capabilities. The growing demand for smartphones and technologically advanced products, such as wearable gadgets, etc., is also accelerating the growth of the market studied.

Further, several vendors are investing in this technology to gain an advantage. For instance, in April 2022, Keysight Technologies, Inc., a leading technology company that provides advanced design and validation solutions, announced that SK Hynix selected Keysight's integrated peripheral component to interconnect express (PCIe) 5.0 test platforms for speeding up the development of memory semiconductors used for designing advanced products capable of managing huge data and supporting high data speeds and.

Memory Market Trends

Consumer Products is Expected to Hold Significant Market Share

The emerging memory technologies have enhanced the potential of memory by allowing the storage of more data at a lesser cost than the expensive-to-build silicon chips used by popular consumer electronic gadgets, including digital cameras, cell phones, notebooks, etc.

Taiwan's United Microelectronics Corporation (UMC), a global semiconductor foundry, is providing embedded non-volatile STT-MRAM blocks based on a 28nm CMOS manufacturing process, which will enable customers to integrate low latency, very high performance, and low power embedded MRAM memory blocks into MCUs and SoCs, targeting the Internet of Things, wearable, and the consumer electronics sector.

The technological advancements in the field are driving the demand for the market studied. Companies like Nanterohave developed high-density non-volatile memory called NRAM, which is incredibly fast, offer huge amounts of storage in a small space, and consumes very little power. With Nantero'sNRAM, consumer electronics vendors can develop new consumer devices that are considered to be futuristic. With such developments, the adoption of non-volatile memory is expected to grow.

The emerging memory technologies in the sector are mainly driven by wearable and connected devices that are expected to grow at a faster pace during the forecast period. Cisco Systems estimates that the number of connected wearable devices worldwide could reach 1,105 million units by 2022.

The demand for these memory technologies is further expected to rise owing to the effective memory requirement for other consumer electronics devices such as digital cameras, smartphones, gaming devices, etc. Ericsson estimates that the shipment of smartphone units could reach 1574.4 million by 2022.

The Americas Account for the Largest Market Share

Rapidly changing technologies and high data generation across industries are creating a need for more efficient processing systems in the country. With the advent of mobile and low-power devices, as well as high-end data centers and large on-chip caches, another high-priority demand has emerged: non-volatile, dense, and low-energy-consuming memories.

In memory semiconductor manufacturing technology, the United States has regained its competitiveness in DRAM and 3D-NAND in the last few years, and US companies are fully embracing EUV (Extreme Ultraviolet).

According to the US Department of Energy, there are about 3 million data centers in the United States. The data center has become the new unit of computing. DPUs (Data Processing Units) are the essential elements of secure and modern accelerated data centers in which GPUs, CPUs, and DPUs are able to combine into a single computing unit that is fully programmable. Nvidia estimates that data management drains up to 30% of the central processing cores in data centers. The increasing demand for data centers is also boosting the demand for memory components. Currently, large data center projects in North America have contributed to the strong demand for memory, such as DRAM.

Furthermore, It is expected that 5G will enable the transmission of a huge amount of telecommunications data in a short time, which also means devices would need more storage. This would increase the adoption of NAND flash.

The US is a major market for factory automation and industrial control. FRAM offers fast random access, high read and write endurance, and low power consumption. In factory automation, the industry-standard architecture, interface, features, and packages can enable a simple drop-in solution that can eliminate the costly re-designs of the system.

Memory Industry Overview

The Memory Market is highly competitive owing to multiple vendors providing memory to the domestic and international markets. The market appears to be moderately fragmented, with the significant vendors adopting strategies for mergers and acquisitions and strategic partnerships, among others, to expand their reach and stay competitive in the market. Some major players in the market are Samsung Electronics Co. Ltd, Micron Technology Inc., SK Hynix Inc., and ROHM Co. Ltd., among others. Some of the recent developments in the market are:

October 2021 - Micron Technology, a US-based memory manufacturer, will invest more than USD 150 billion worldwide over the next decade in advanced memory manufacturing, research, and development, including potential United States-based fab expansion.

December 2021 - Micron Technology announced an expansion of its business relationship with United Microelectronics Corporation, providing Micron the opportunities to secure supply for mobile, automotive, and critical customers into the future.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHT

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Technology Snapshot

- 4.4 Impact of COVID-19 on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Rising Penetration of 5G and IoT Devices

- 5.1.2 Growing Memory Requirement in Data Centers

- 5.1.3 Rising Demand from Consumer Electronics and Automotive Sectors

- 5.2 Market Challenges

- 5.2.1 Short term supply chain challenges due to the pandemic scenario and the US-China Trade war scenario

6 MARKET SEGMENTATION

- 6.1 By Type

- 6.1.1 DRAM

- 6.1.2 SRAM

- 6.1.3 NOR Flash

- 6.1.4 NAND Flash

- 6.1.5 ROM & EPROM

- 6.1.6 Others

- 6.2 By Application

- 6.2.1 Consumer Products

- 6.2.2 PC/Laptop

- 6.2.3 Smartphone/Tablet

- 6.2.4 Data Center

- 6.2.5 Automotive

- 6.2.6 Other Applications

- 6.3 By Geography

- 6.3.1 Americas

- 6.3.2 Europe

- 6.3.3 China

- 6.3.4 Japan

- 6.3.5 Asia-Pacific

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Samsung Electronics Co. Ltd

- 7.1.2 Micron Technology Inc.

- 7.1.3 SK Hynix Inc.

- 7.1.4 ROHM Co. Ltd.

- 7.1.5 STMicroelectronics NV

- 7.1.6 Maxim Integrated Products Inc.

- 7.1.7 IBM Corporation

- 7.1.8 Cypress Semiconductor Corporation

- 7.1.9 Intel Corporation

- 7.1.10 Nvidia Corporation

- 7.1.11 Kioxia Corporation

- 7.2 Vendor Ranking