|

市場調查報告書

商品編碼

1439884

電動Scooter和電動機車:市場佔有率分析、行業趨勢和統計、成長預測(2024-2029)Electric Scooter and Motorcycle - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

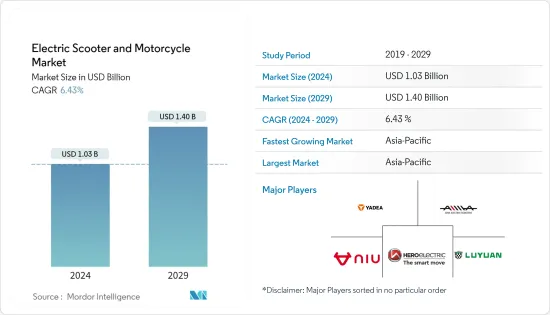

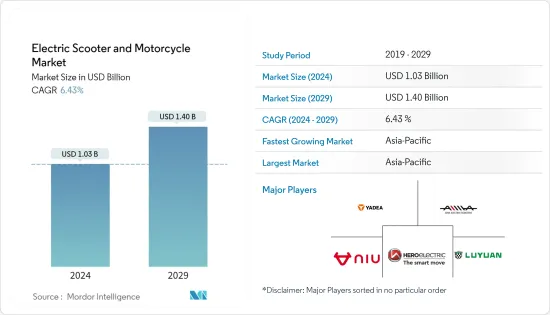

電動Scooter和電動機車市場規模預計到 2024 年為 10.3 億美元,預計到 2029 年將達到 14 億美元,在預測期內(2024-2029 年)成長 6.43%,年複合成長率為

COVID-19感染疾病對電動Scooter和電動機車市場產生了負面影響。全球封鎖法規已停止了新車的生產和銷售,包括電動Scooter和摩托車。

供應鏈中斷也導致無法獲得製造Scooter和摩托車各種零件所需的原料,從而導致生產延誤。然而,隨著全球清潔旅遊趨勢日益明顯,市場對 COVID-19感染疾病後的經濟復甦抱持希望。此外,汽車產量下降和勞動力短缺也對市場產生了重大影響。隨著COVID-19感染人數有限的國家的汽車銷量穩步成長,隨著汽車製造商恢復營運,市場可能會在預測市場期間復甦。此外,製造商正在實施緊急時應對計畫,以減少未來業務的不確定性,以保持與汽車行業關鍵領域客戶的連續性。

從長遠來看,市場成長主要是由於對永續交通的需求不斷增加。日益成長的環境問題和有利的政府措施是推動市場成長的一些主要因素。能源成本上升和新興節能技術之間的競爭預計也將推動市場成長。

由於人們對電動車環境效益的認知不斷提高以及全部區域汽油和柴油價格的上漲,預計亞太地區將主導市場。此外,與電動車相關的政府措施預計將在預測期內進一步增加區域需求。

預計市場也將受到主要企業產能擴張和Start-Ups資金籌措的推動。例如

主要亮點

- 2022 年 11 月:Hero Electric 宣布將投資 260 億印度盧比(3.12 億美元),到 2026 年將電動二輪車產能擴大到每年 400 萬輛,其中包括在拉賈斯坦邦建立製造工廠。

- 2022 年 10 月:總部位於班加羅爾的印度電動二輪車製造商 Ather Energy 宣佈在 Caladium Investments主導的一輪投資中籌集了 5,000 萬美元。 Herald Square Ventures 也參與了本輪投資。

電動Scooter和電動機車的市場趨勢

電動Scooter領域預計將佔據主要市場佔有率

與電動機車Scooter相比,電動滑板車的初始成本較低,市場上的型號也更多,為買家提供了更多選擇並增加了銷售量。電動Scooter作為電動和通勤車輛的吸引力正在推動Scooter普及。因此,一些新興企業開始將數百輛「按分鐘出租」的Scooter引入大都會圈。

多個試驗計畫已啟動,逐步引入電動Scooter,以減少城市車輛排放。電動Scooter的普及也鼓勵了傳統兩輪車製造商進入市場。印度正在成為一個利潤豐厚的電動Scooter市場。因此,多家印度兩輪車製造商正準備在這一領域推出自己的車型。例如,

- 2022 年 11 月:Vegh Automobiles 推出印度首款高速電動ScooterVEGH S60。該Scooter將由 60V 平台上的 60kW 電池供電,旨在滿足印度政府發布的 AIS 56 修正案。Scooter充飽電需3-4小時,最高時速可達60-70公里/小時。

- 2022 年 11 月:Ola Electric 推出印度最便宜的電動ScooterOla S1 Air,售價 79,999 盧比(約 1,000 美元)。這款Scooter採用不同的輪圈設計、整合式後座扶手和後面板底部的黑色飾面。這款Scooter有五種零售顏色:黑色、珊瑚色、液體銀、瓷白色和新薄荷色。

電動Scooter市場也受到許多微型行動公司和電子商務巨頭宣布的投資的推動,這些公司和電子商務巨頭更喜歡使用電動車進行最後一英里的交付,以減少碳排放。例如

- 2022 年 11 月:亞馬遜印度公司與 TVS 馬達簽署合作備忘錄 (MoU),計劃到 2025 年推出 1,000 輛電動二輪車和電動三輪車,用於印度的最後一英里配送業務。

- 2022 年 4 月:愛沙尼亞微型出行、叫車和食品配送公司 Bolt 投資 1.5 億歐元,以擴大其電動Scooter電動持有改善整體客戶體驗。宣布將投資超過 1.515 億美元。這項投資將使 Bolt 的電動自行車和Scooter數量擴大到 23 萬輛,遍布歐洲 250 多個城市。

- 2022 年 1 月:總部位於倫敦的電動Scooter共享公司 Dot 籌集了 7000 萬美元,用於投資擴大其電動Scooter持有,將其網路擴展到新城市,並開始提供新服務。

歐盟成員國、印度和中國政府宣布分別在 2035 年和 2040 年禁止銷售內燃機兩輪車,有助於增加這些地區的電動Scooter銷售量。

因此,預計上述因素的綜合作用將確保未來五年電動Scooter在電動Scooter和電動機車市場的主導地位。

預計亞太地區將在預測期內引領市場

預計亞太地區將在預測期內引領市場。中國、印度、韓國和日本是該區域市場的主要經濟體,預計將影響整個市場。這些國家看到越來越多的新興企業以及成熟的傳統製造商進入市場。

2021年,台灣推出高達900-1,000美元的補貼,用於購買新的電動機車/Scooter。由於實施這些計劃,到 2021 年,該國銷售的Scooter總數為 809,000 輛,其中 94,000 輛是電動Scooter。 2021年電動Scooter佔台灣Scooter市場總量的11.9%。 2021年,Gogoro Inc.在台灣銷售了約79,000輛電動Scooter。台灣政府的目標是到 2035 年台灣新車銷量的 70% 是電動Scooter。

2022年10月,印尼也宣布,到2025年將有200萬輛電動二輪車上路。

印度是最大的兩輪車市場之一,許多新興企業透過推出新車型或擴展現有車型和現有基礎設施來展現自己的存在。例如,

- 2022 年 10 月:印度電動ScooterStart-UpsKLB Komaki Pvt. Ltd. 在印度推出了第七款高速ScooterVenice Eco electric。該Scooter由磷酸鋰鐵供電,據稱可降低火災風險,並配有帶導航功能的 TFT 儀表叢集。

多家電動機車和電動Scooter公司正在推出最新產品,並與全球公司建立策略合作夥伴關係,以吸引更多客戶並獲得市場佔有率。例如,

- 2022 年 10 月:BMW Motorrad 在印尼推出 BMW CE04電動Scooter,售價 3 億印尼幣(19,500 美元)。

- 2022 年 10 月:印尼煤炭開採公司 PT TBS Energy Utama 和科技公司 PT GoJek Tokopedia推出了一家名為 Electrum 的合資企業,在印尼製造和銷售兩個電動輪圈以及電動二輪車電池更換服務。

由於上述趨勢和發展,預計市場在預測期內將以健康的速度成長。

電動Scooter和電動機車產業概況

電動Scooter和電動機車市場高度分散,有多家本地公司和許多新興企業進入市場。市場的主要企業包括浙江綠源電動車、英雄電動有限公司、浙江亞德馬達和小牛電動股份有限公司。傳統公司正在擴大在這個以前由新興企業主導的新市場的影響力。傳統企業透過推出新產品進入市場。例如,

- 2022 年 11 月:比亞喬集團旗下品牌 Aprilia 在米蘭馬達展 Supermoto 組別中展示首款電動機車「Electrica」。

- 2022 年 11 月:川崎宣佈在 2022 年 EICMA 上透過其 Z 和 Ninja 產品工廠推出兩款新的全球電動機車。這款自行車配備 3.0 kWh 可拆卸雙電池裝置,預計將於 2023 年投入商用。

- 2022 年 11 月:比亞喬集團推出 Piaggio 1電動Scooter的 2023 年更新版 Piaggio 1 Active。這款Scooter配備了3千瓦時的電池,最高行駛速度為60公里/小時。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章 簡介

- 調查先決條件

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場動態

- 市場促進因素

- 市場限制因素

- 產業吸引力-波特五力分析

- 新進入者的威脅

- 買方議價能力

- 供應商的議價能力

- 替代產品的威脅

- 競爭公司之間的敵意強度

第5章市場區隔

- 按車型

- 電動Scooter

- 電動機車

- 依電池類型

- 鋰離子

- 密閉式鉛酸電池

- 按地區

- 北美洲

- 美國

- 加拿大

- 北美其他地區

- 歐洲

- 德國

- 英國

- 法國

- 其他歐洲國家

- 亞太地區

- 印度

- 中國

- 日本

- 韓國

- 其他亞太地區

- 世界其他地區

- 南美洲

- 中東和非洲

- 北美洲

第6章 競爭形勢

- 供應商市場佔有率

- 公司簡介

- Zero Motorcycles Inc.

- Hero Electric Vehicles Pvt. Ltd

- Vmoto Limited

- AIMA Technology Group Co. Ltd

- Dongguan Tailing Electric Vehicle Co. Ltd

- Piaggio &C. SpA

- Ather Energy Pvt. Ltd

- Energica Motor Company

- Honda Motor Co. Ltd

- Gogoro Inc.

- NIU International

第7章市場機會與未來趨勢

The Electric Scooter and Motorcycle Market size is estimated at USD 1.03 billion in 2024, and is expected to reach USD 1.40 billion by 2029, growing at a CAGR of 6.43% during the forecast period (2024-2029).

The COVID-19 pandemic had a negative impact on the electric scooter and motorcycle market. The global lockdown restrictions halted the production and sales of new vehicles, including electric scooters and motorcycles.

Also, due to disruptions in the supply chain, the raw materials required to produce different parts of the scooters and motorcycles were unavailable, causing production delays. However, with the growing inclination toward cleaner mobility worldwide, the market is looking forward to an economic revival post the COVID-19 pandemic. Furthermore, the fall in automotive production and lack of labor significantly impacted the market. As automotive manufacturers have resumed operations due to steadily rising automobile sales in countries with a limited number of COVID-19 cases, the market is likely to recover during the forecast market. In addition, the manufacturers are implementing contingency plans to mitigate future business uncertainties to retain continuity with clients in the critical sectors of the automobile industry.

Over the long term, the market growth is primarily due to the growing need for sustainable transportation. Increasing environmental concerns and favorable government initiatives are some of the major factors driving the market's growth. Rising energy costs and competition among emerging energy-efficient technologies are also expected to fuel the market's growth.

The Asia-Pacific region is expected to dominate the market owing to growing awareness about the environmental benefits of electric vehicles and increasing petrol and diesel prices across the region. Moreover, government initiatives related to e-mobility are expected to further increase regional demand during the forecast period.

The market is also anticipated to be driven by capacity expansions by key players and startup fundraising. For instance

Key Highlights

- November, 2022 : Hero Electric Ltd. announced to invest INR 2600 crore (USD 312 million) to expand its production capacity to 4 million electric two-wheelers per annum by 2026, which includes setting up a manufacturing facility in the state of Rajasthan in India.

- October, 2022 : Bengaluru-based Indian electric two-wheeler manufacturer Ather Energy announced that it had raised USD 50 million in an investment round led by Caladium Investments. The investment round also included participation from Herald Square Ventures.

Electric Scooter & Motorcycle Market Trends

E-scooter Segment Expected to Occupy Major Market Share

E-scooters witness higher sales than e-motorcycles due to lower upfront costs and the availability of more models in the market, which provide ample options for buyers. The allure of the e-scooter, both as a toy and as a potential vehicle for commuting, is driving its adoption. Thus, several startups are beginning to flood major metropolitan areas with hundreds of 'rent by minute' scooters.

Several pilot programs have been initiated to introduce e-scooters in a phased manner to reduce vehicle emissions in cities. The popularity of e-scooters is also encouraging conventional two-wheeler manufacturers to enter the market. India is emerging as a lucrative market for e-scooters. Hence, several Indian two-wheeler manufacturers are gearing up to launch their models in the segment. For instance,

- November 2022: Vegh Automobiles launched VEGH S60, their first high-speed electric scooter in India. The scooter will have a battery of 3 kW on a 60V platform designed to meet AIS 56 amendments issued by the Government of India. The scooter will take between 3 to 4 hours to charge fully and reach top speeds between 60 to 70 km/hr.

- November 2022: Ola Electric launched their cheapest electric scooter Ola S1 Air for INR 79999 (~ USD 1000) in India. The scooter features a different wheel design, a single-piece pillion grabrail, and a black finish to the lower part of the rear panel. The scooter is available for retail in five colors: Black, Coral Glam, Liquid Silver, Porcelain White, and Neo Mint.

The market for electric scooters is also being driven by the investments announced by many micromobility companies and E-commerce giants who prefer electric vehicles for their last-mile deliveries to reduce their carbon footprint. For instance

- November 2022: Amazon India signed a Memorandum of Understanding (MoU) with TVS Motor Co. to induct 1000 electric two and three-wheelers by 2025 for last-mile delivery operations in India.

- April 2022: Estonian micro-mobility services, ride-hailing, and food delivery services company Bolt announced investing more than EUR 150 million (USD 151.5 million) for the expansion of its e-bikes and electric scooter fleet and to enhance the overall customer experience. This investment will see Bolt's fleet expand to 230000 e-bikes and scooters across more than 250 cities in Europe.

- January 2022: London-based electric scooter-sharing company Dott raised USD 70 million, which it will invest in the fleet expansion of electric scooters, expanding its network to new cities, and start offering new services.

The announcements by the governments of EU member states, India, and China to ban the sales of IC engine two-wheelers by 2035 and 2040, respectively, contribute to the growing sales of electric scooters in these geographies.

Thus the confluence of the above-mentioned factors is projected to ensure the dominance of electric scooters in the electric scooter and motorcycle market over the next five years.

Asia-Pacific Region Expected to Lead the Market During the Forecast Period

Asia-Pacific is anticipated to lead the market over the forecast period. China, India, South Korea, and Japan are the major economies in the regional market, which are expected to influence the overall market. These countries are witnessing the entry of an increasing number of startups and well-established and conventional manufacturers in the market.

In 2021, Taiwan began subsidizing up to USD 900-1000 for purchasing new electric motorcycles/scooters. Owing to the implementation of such plans, in 2021, 94000 units of scooters out of the total 809000 scooters sold in the country were electric. Electric scooters commanded 11.9% of the total scooter market in Taiwan in 2021. In 2021 Gogoro Inc. sold about 79000 electric scooters in Taiwan. The Government of Taiwan aims to have 70% of new scooter sales in Taiwan to be electric by 2035.

In October 2022, Indonesia also announced it will put 2 million electric two-wheelers on the road by 2025.

India, one of the largest two-wheeler markets, is witnessing the entry of many new startups, which are marking their presence by launching new models and expanding current models and existing infrastructure. For instance,

- October, 2022: Indian electric scooter startup KLB Komaki Pvt. Ltd. launched its seventh high-speed scooter Venice Eco electric, in India. The scooter has a Lithium Ferro Phosphate battery which is claimed to reduce fire risks, and features a TFT instrument cluster with navigation capabilities.

Several electric motorcycle and scooter companies are launching the latest products and entering strategic partnerships with global players to attract more customers and gain market share. For instance,

- October, 2022: In Indonesia, BMW Motorrad launched the BMW CE04 electric scooter at IDR 300 million (USD 19500).

- October, 2022: Indonesian coal miner PT TBS Energi Utama and technology company PT GoJek Tokopedia launched a joint venture named Electrum to manufacture and sell two electric wheels and battery swapping services for electric two-wheelers in Indonesia.

With the aforementioned trends and developments, the market is expected to grow at a healthy rate during the forecast period.

Electric Scooter & Motorcycle Industry Overview

The electric scooter and motorcycle market is highly fragmented and has several local players, with many new startups entering the market. Some of the major players in the market are Zhejiang Luyuan Electric Vehicle Co. Ltd, Hero Electric Ltd, Zhejiang Yadea Motorcycle Co. Ltd, and NIU Tecnologies Inc. Conventional companies are expanding their presence in this new market, which startups earlier dominated. Conventional companies are entering the market by introducing new products. For instance,

- November 2022: Piaggio Group-owned brand Aprilia launched its first electric bike, Electrica, in the supermoto class at the Milan Motorcycle show.

- November 2022: Kawasaki announced to launch of two new global electric bikes at EICMA 2022 under its Z and Ninja product facilities. The bikes will feature a 3.0 kWh removable dual-battery setup and will be launched commercially in 2023.

- November 2022: Piaggio Group launched the updated 2023 version of the Piaggio 1 electric scooter named Piaggio 1 Active. The scooter is equipped with a 3 kWh battery and can travel up to a top speed of 60 km/hr.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Drivers

- 4.2 Market Restraints

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Threat of New Entrants

- 4.3.2 Bargaining Power of Buyers/Consumers

- 4.3.3 Bargaining Power of Suppliers

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 By Vehicle Type

- 5.1.1 E-scooters

- 5.1.2 E-motorcycles

- 5.2 By Battery Type

- 5.2.1 Lithium-ion

- 5.2.2 Sealed Lead-acid

- 5.3 By Geography

- 5.3.1 North America

- 5.3.1.1 US

- 5.3.1.2 Canada

- 5.3.1.3 Rest of North America

- 5.3.2 Europe

- 5.3.2.1 Germany

- 5.3.2.2 UK

- 5.3.2.3 France

- 5.3.2.4 Rest of Europe

- 5.3.3 Asia-Pacific

- 5.3.3.1 India

- 5.3.3.2 China

- 5.3.3.3 Japan

- 5.3.3.4 South Korea

- 5.3.3.5 Rest of Asia-Pacific

- 5.3.4 Rest of the World

- 5.3.4.1 South America

- 5.3.4.2 Middle East and Africa

- 5.3.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Vendor Market Share

- 6.2 Company Profiles*

- 6.2.1 Zero Motorcycles Inc.

- 6.2.2 Hero Electric Vehicles Pvt. Ltd

- 6.2.3 Vmoto Limited

- 6.2.4 AIMA Technology Group Co. Ltd

- 6.2.5 Dongguan Tailing Electric Vehicle Co. Ltd

- 6.2.6 Piaggio & C. SpA

- 6.2.7 Ather Energy Pvt. Ltd

- 6.2.8 Energica Motor Company

- 6.2.9 Honda Motor Co. Ltd

- 6.2.10 Gogoro Inc.

- 6.2.11 NIU International