|

市場調查報告書

商品編碼

1439870

聚乙烯亞胺:市場佔有率分析、產業趨勢與統計、成長預測(2024-2029)Polyethyleneimine - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

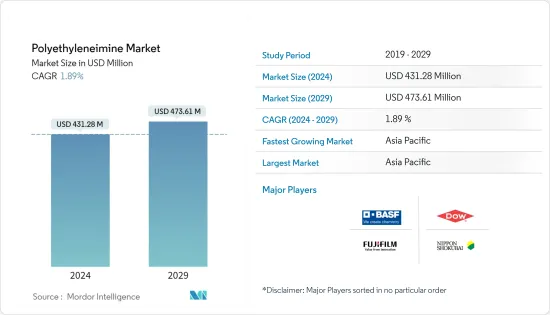

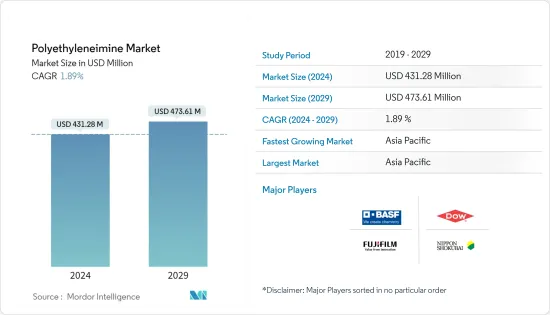

預計2024年聚乙烯亞胺市場規模為4.3128億美元,預計到2029年將達到4.7361億美元,預測期內(2024-2029年)複合年成長率為1.89%。

COVID-19感染疾病對市場的影響是負面的。然而,市場已達到疫情前的水平,預計在預測期內將穩定成長。

主要亮點

- 推動市場的主要因素是清潔劑和水處理化學品應用的需求不斷增加,以及對黏劑和密封劑應用的需求不斷增加。

- 另一方面,嚴格的環境法規正在阻礙市場的成長。

- 聚乙烯亞胺奈米二氧化矽複合材料的發展以及個人護理和化妝品行業的快速發展等因素預計將為市場提供各種成長機會。

- 亞太地區主導全球市場,最大的消費來自中國和印度。

聚乙烯亞胺市場趨勢

黏劑和密封劑產業主導市場

- 聚乙烯亞胺 (PEI) 廣泛用於黏劑和密封劑應用。在黏劑行業的層壓板中用作黏合促進劑。它也用於包裝薄膜的水性底漆。

- 聚乙烯亞胺在包裝工業中用作擠壓塗布的底漆已有一段時間了。它特別用於將聚乙烯粘合到紙張和其他纖維素基材上。在實踐中,使用稀釋的水或水和酒精的溶液塗布。

- 包裝產業是全球最大的黏劑消費產業。由於主要在食品和飲料行業對包裝應用的強勁需求,預計這一趨勢將在預測期內持續下去。

- 黏劑是包裝行業最常用的黏合機制之一。聚乙烯亞胺黏劑主要用於冷凍食品的包裝。這一因素增加了包裝行業對黏劑的需求並擴大了研究市場。

- 據S&P Global稱,2021會計年度印度國內黏劑和密封劑市場價值將達到134-1360億盧比(約1.81-18.3億美元)。印度黏劑和密封劑市場分為兩個部分。工業部門迎合包裝、鞋類、油漆和汽車等 B2B 行業。零售業面向家具/木製品、建築、藝術和工藝品以及電器配件等行業。

- 黏劑在電子工業中有多種應用,包括三防膠、端子電極保護以及表面黏著型元件的黏合。電子產業是印度成長最快的產業之一,根據電子和資訊技術部的數據,截至2021 會計年度,市場規模為4.95 兆盧比至5 兆盧比(約669.5 億盧比)(約676.2 億美元) 。

- 基於上述因素,黏劑和密封劑領域可能在預測期內主導市場。

亞太地區主導市場

- 由於聚乙烯亞胺在清潔劑、黏劑、水處理化學品、化妝品和紙張等應用中的大量使用,預計亞太地區將在預測期內主導聚乙烯亞胺市場。

- 聚乙烯亞胺在紙漿生產中用作濕強劑。中國、印度和東南亞不斷成長的造紙和紙漿工業可能會繼續推動所研究的市場。

- 中國是油墨生產成長最快的國家之一。該國的油墨產業以國際油墨製造商和國內公司為主,例如與中國領先的跨國油墨供應商之一T&K TOKA合資的杭州TOKA油墨,以及與東洋油墨合資的天津東洋油墨,可謂魚龍混雜。 DIC、 SAKATA INX CORPORATION、Siegwerk、Flint Group、Huber Group 等主要油墨公司也在中國設有製造工廠。葉氏化工旗下的紫荊花油墨化工有限公司是國內最大的油墨製造商。

- 消費者習慣的改變和對家庭衛生日益關注正在推動中國對清潔劑和工業清洗產品的需求。 COVID-19感染疾病顯著增加了中國市場對清潔劑和工業清洗產品的需求。 2020 年,清潔劑和清洗產品的銷售收益成長了 10 倍。 2021年,銷售額成長400-500%。

- 肥皂製造是印度日常消費品產業最古老的產業之一,佔消費品產業的 50% 以上。最新資料顯示,全國約有500萬家肥皂零售店,其中375萬家在農村地區經營。

- 印度和丹麥最近在哥本哈根舉行的 2022 年世界水大會暨展覽會上聯合發布了一份關於「印度都市污水情勢」的白皮書。 2021年印度城市中心的廢水產生量為72,368 MLD,但已安裝的廢水處理能力僅31,841 MLD。根據去年宣布的政府 Swachh Bharat Mission 2.0 (SBM 2.0),政府正在努力提高廢水處理能力。預計這將為水處理領域創造對聚乙烯亞胺的巨大需求。

- 由於印度黏劑行業的成長潛力,製造商正在投資該行業。因此,由於新工廠和管道的產能擴張,預計該國聚乙烯亞胺的需求將增加。例如,2021年12月,西卡宣布計劃在印度普納開設高品質黏劑和密封劑的新技術中心和製造工廠。

- 因此,這些因素預計將有助於亞太地區主導整個市場。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 調查先決條件

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場動態

- 促進因素

- 對清潔劑和水處理化學品應用的需求增加

- 增加在黏劑和密封劑應用中的使用

- 抑制因素

- 嚴格的環境法規

- 其他限制

- 產業價值鏈分析

- 波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代產品和服務的威脅

- 競爭程度

第5章市場區隔(市場規模:收益)

- 類型

- 線性

- 分支

- 目的

- 清潔劑

- 黏劑和密封劑

- 水處理化學品

- 化妝品

- 紙

- 塗料、油墨、染料

- 其他用途

- 地區

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 其他亞太地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 義大利

- 法國

- 其他歐洲國家

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地區

- 中東和非洲

- 沙烏地阿拉伯

- 南非

- 中東和非洲其他地區

- 亞太地區

第6章 競爭形勢

- 市場排名分析

- 主要企業採取的策略

- 公司簡介

- BASF SE

- Dow

- FUJIFILM Wako Pure Chemical Corporation

- Gongbike New Material Technology(Shanghai)Co. Ltd

- NIPPON SHOKUBAI Co. Ltd

- Polysciences, Inc.

- SERVA Electrophoresis GmbH

- Shanghai Holdenchem Co.

- WUHAN BRIGHT CHEMICAL Co. Ltd

第7章市場機會與未來趨勢

- 聚乙烯亞胺/奈米二氧化矽複合材料的研發

- 快速擴張的個人護理和化妝品行業

The Polyethyleneimine Market size is estimated at USD 431.28 million in 2024, and is expected to reach USD 473.61 million by 2029, growing at a CAGR of 1.89% during the forecast period (2024-2029).

The impact of COVID-19 on the market was negative. However, the market has reached pre-pandemic levels and is expected to grow steadily during the forecast period.

Key Highlights

- The major factors driving the market are the increasing demand from applications in detergents and water treatment chemicals and the growing usage in adhesives and sealants.

- On the flip side, stringent environmental regulations are hindering the growth of the market.

- Factors such as the development of polyethyleneimine-nano silica composites and the rapidly expanding personal care and cosmetics industry are expected to offer various growth opportunities for the market.

- Asia-Pacific dominates the market worldwide, with the largest consumption coming from China and India.

Polyethyleneimine Market Trends

Adhesives and Sealants Segment to Dominate the Market

- Polyethyleneimine (PEI) is used for a wide range of adhesive and sealant applications. It is used for laminations in the adhesives industry as an adhesion promoter. It is also used in water-based primers for packaging films.

- Polyethyleneimine has been used for some time as an extrusion coating primer in the packaging industry. It has particularly found use in bonding polyethylene to paper and other cellulosic substrates. In practice, it is applied with diluted water or water-alcohol solutions.

- The packaging industry is the largest consumer of adhesives globally. This trend is estimated to continue during the forecast period, primarily due to the robust demand for packaging applications in the food and beverage sector.

- Adhesives are one of the most common bonding mechanisms used in the packaging industry. Polyethyleneimine-based adhesives are used majorly in the packaging of frozen food products. This factor boosts the demand for adhesives in the packaging industry, thus driving the market studied.

- According to S&P Global, India's domestic adhesives and sealants market is INR 134-136 billion (~USD 1.81-1.83 billion) in fiscal year 2021. Indian adhesives and sealant market is divided into two segment. The industrial segment caters to B2B industries such as packaging, footwear, paints, automotive, etc. The retail segment caters to industries such as furniture/woodwork, building construction, arts and craft, electrical fittings, etc.

- The electronics industry uses adhesives for various applications, including conformal coatings, protecting terminal electrodes, bonding of surface mount devices, among many others. The electronics industry is one of the fastest-growing industries in India and, as per the Ministry of Electronics and IT, the market size of the industry is INR 4,950-5,000 billion (~ USD 66.95-67.62 billion) as of fiscal 2021.

- Based on the above-mentioned factors, the adhesive and sealants segment is likely to dominate the market during the forecast period.

Asia-Pacific to Dominate the Market

- Asia-Pacific is expected to dominate the market for polyethyleneimine during the forecast period, as polyethyleneimine is strongly used in applications, such as detergents, adhesives, water treatment chemicals, cosmetics, and paper, in the region.

- Polyethyleneimine is used as a wet strengthening agent in pulp and paper manufacturing. The growing paper and pulp industry in China, India, and Southeast Asia may continue to act as a driver for the market studied.

- China is one of the fastest-growing countries in terms of ink production. The country's ink industry is a mix of international ink manufacturers and domestic players, including Hangzhou TOKA Ink, a JV with T&K Toka, and Tianjin Toyo Ink Co. Ltd, a JV with Toyo Ink, which are the leading multi-national ink suppliers in China. DIC, Sakata INX, Siegwerk, Flint Group, Hubergroup, and other major ink companies also have manufacturing plants in China. The Bauhinia Variegata Ink & Chemicals, a subsidiary of Yip's Chemical, is the largest domestic ink producer in the country.

- The detergents and industrial cleaning agents are gaining demand in China due to changing consumer habits and growing attention toward hygiene at home. Due to the COVID-19 pandemic, the Chinese market witnessed a huge rise in demand for detergent and industrial cleaning agents. The sales revenue for detergents and cleaning agents witnessed a ten-fold growth in 2020. In 2021, the sales grew by 400-500%.

- Soap manufacturing is one of the oldest industries operating in the FMCG sector in India, accounting for more than 50% of the consumer goods sector. As per recent data, there are approximately five million retail outlets selling soaps in the country, of which 3.75 million operate in rural areas.

- India and Denmark together launched a whitepaper recently on 'Urban Wastewater Scenario in India' at World Water Congress and Exhibition 2022 in Copenhagen. In 2021 India's sewage generation was 72,368 MLD in urban centres, whereas the installed sewage treatment capacity was only 31,841 MLD. The government is trying to increase the sewage treatment capacity under the government Swachh Bharat Mission 2.0 (SBM 2.0), which was announced last year. This is expected to create a huge demand for polyethyleneimine in water treatment.

- The manufacturers have been investing in the Indian adhesives industry due to its growth potential. Thus, new plants and capacity expansions in the pipeline are projected to increase the demand for polyethyleneimine in the country. For instance, in December 2021, Sika announced its plans to open a new technology center and manufacturing plant for high-quality adhesives and sealants in Pune, India.

- Thus, such factors are expected to help the Asia-Pacific region dominate the overall market.

Polyethyleneimine Industry Overview

The polyethyleneimine market is highly consolidated with the presence of international and domestic players. The major companies (in no particular order) include BASF SE, Nippon Shokubai Co. Ltd, Dow, and FUJIFILM Wako Pure Chemical Corporation.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Dynamics

- 4.1 Drivers

- 4.1.1 Increasing Demand from Applications in Detergents and Water Treatment Chemicals

- 4.1.2 Growing Usage in Adhesive and Sealant Applications

- 4.2 Restraints

- 4.2.1 Stringent Environment Regulations

- 4.2.2 Other Restraints

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Consumers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 Market Segmentation (Market Size in Revenue)

- 5.1 Type

- 5.1.1 Linear

- 5.1.2 Branched

- 5.2 Application

- 5.2.1 Detergents

- 5.2.2 Adhesives and Sealants

- 5.2.3 Water Treatment Chemicals

- 5.2.4 Cosmetics

- 5.2.5 Paper

- 5.2.6 Coatings, Inks, and Dyes

- 5.2.7 Other Applications

- 5.3 Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 Italy

- 5.3.3.4 France

- 5.3.3.5 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle-East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 South Africa

- 5.3.5.3 Rest of Middle-East and Africa

- 5.3.1 Asia-Pacific

6 Competitive Landscape

- 6.1 Market Ranking Analysis

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 BASF SE

- 6.3.2 Dow

- 6.3.3 FUJIFILM Wako Pure Chemical Corporation

- 6.3.4 Gongbike New Material Technology (Shanghai) Co. Ltd

- 6.3.5 NIPPON SHOKUBAI Co. Ltd

- 6.3.6 Polysciences, Inc.

- 6.3.7 SERVA Electrophoresis GmbH

- 6.3.8 Shanghai Holdenchem Co.

- 6.3.9 WUHAN BRIGHT CHEMICAL Co. Ltd

7 Market Opportunities and Future Trends

- 7.1 Development of Polyethyleneimine-nano Silica Composites

- 7.2 Rapidly Expanding Personal Care and Cosmetics Industry