|

市場調查報告書

商品編碼

1430591

Polyethylene Naphthalate:市場佔有率分析、產業趨勢、成長預測(2024-2029)Polyethylene Naphthalate - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

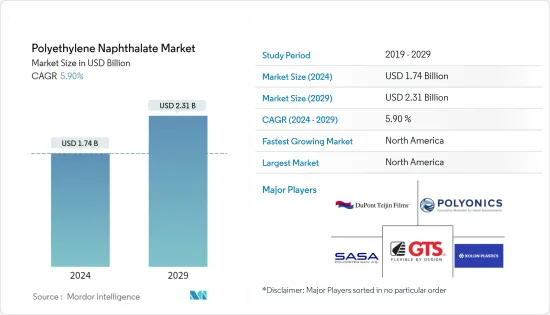

Polyethylene Naphthalate市場規模預計2024年為17.4億美元,預計2029年將達到23.1億美元,在預測期內(2024-2029年)複合年成長率預計為5.90%。

2020 年,由於新冠肺炎 (COVID-19) 疫情的爆發,市場受到了負面影響,導致全球範圍內的國家封鎖、製造活動和供應鏈中斷以及生產停頓。然而,到了2021年,情況開始好轉,市場恢復了成長軌跡。

主要亮點

- 推動市場的主要因素是包裝應用需求的增加和電子產業需求的增加。

- 另一方面,高昂的製造成本阻礙因素了市場的成長。

- Polyethylene Naphthalate在太陽能電池保護中的廣泛應用預計將為市場成長提供各種有利可圖的機會。

- 從應用來看,Polyethylene Naphthalate產業因其高耐用性以及耐化學品和溶劑性而有望主導市場。

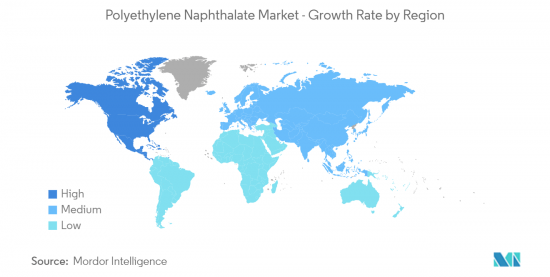

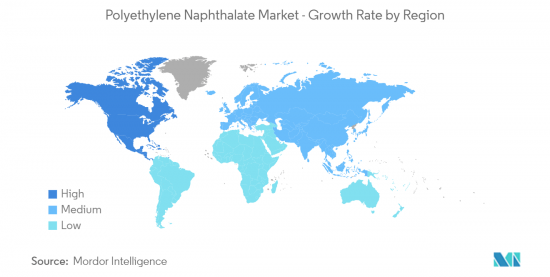

- 北美地區主導全球市場,美國、加拿大和墨西哥等國家的消費量最高。

Polyethylene Naphthalate市場趨勢

包裝產業的需求不斷增加

- Polyethylene Naphthalate是由2,6二羧酸和乙二醇所製得的聚酯。它具有優異的性能,如高耐化學品和溶劑性、高機械強度和優異的閃爍性能。

- 包裝應用中Polyethylene Naphthalate的需求不斷增加,因為其高剛性模量(楊氏模量)賦予了該材料優異的抗收縮性和優異的阻隔功能。

- 此外,Polyethylene Naphthalate對氧氣和水蒸氣的滲透性較低,可抑制容器內部的氧化,非常適合食品保存目的,因此用於食品包裝應用。

- 此外,Polyethylene Naphthalate可以減少包裝所需的層數,從而簡化包裝並降低整體包裝成本。

- 據印度包裝工業協會(PIAI)稱,預計印度包裝行業在預測期內將以22%的成長率成長。此外,到2025年,印度包裝市場預計將達到2,048.1億美元。

- 軟包裝用於南美洲、非洲和亞太地區低收入國家的食品包裝應用。隨著經濟的持續擴張和食品和飲料行業的加速發展,軟包裝在新興國家越來越受歡迎,需求也越來越大。

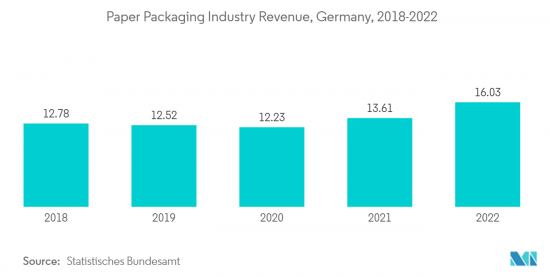

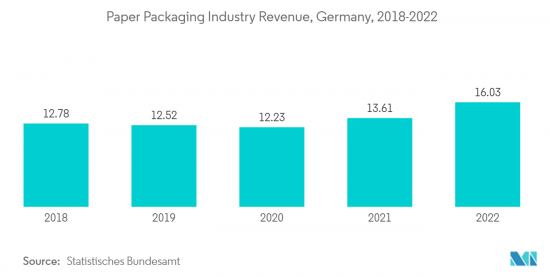

- 在德國,由於各終端用戶產業對非化石包裝的需求不斷增加,紙包裝產業在 2022 年大幅成長。

- 由於上述因素,預計聚Polyethylene Naphthalate市場在預測期內將快速成長。

北美市場佔據主導地位

- 預計北美地區將在預測期內主導聚Polyethylene Naphthalate市場。由於包裝和電子等關鍵最終用戶行業的需求不斷成長,美國和加拿大等國家對聚萘Polyethylene Naphthalate的需求正在增加。

- 由於其高機械和熱性能,Polyethylene Naphthalate以薄膜和粒料的形式廣泛用於電子元件的製造,這增加了該地區對聚萘二Polyethylene Naphthalate的需求。

- 此外,電動車的日益普及以及Polyethylene Naphthalate在高性能和硬橡膠輪胎生產中的使用增加也可能會提振該地區的市場。

- 此外,生產防碎和輕質啤酒和果汁瓶對聚萘二Polyethylene Naphthalate的需求不斷成長,預計將進一步推動該地區聚乙烯市場的成長。

- 美國食品藥物管理局(FDA)已核准聚Polyethylene Naphthalate等可回收塑膠產品用於食品包裝,這可能會在預測期內刺激該地區的市場。

- IEA 表示,聯邦政府的目標是到 2030 年,美國新小客車和輕型卡車銷量的 50% 是電動車 (EV)。此外,根據國際清潔交通理事會的數據,到 2020 年,加州政府將要求到 2035 年在加州銷售的所有新車和小客車均為零排放車輛,包括純電動車和插電式混合動力車。已發布行政命令,強制要求這。

- 在北美地區企業發展的主要公司包括 Polionics 和杜邦帝人薄膜公司。

- 上述因素和政府支持正在推動預測期內聚Polyethylene Naphthalate需求的增加。

Polyethylene Naphthalate產業概況

Polyethylene Naphthalate市場高度整合,主要企業佔據重要佔有率。市場主要企業包括(排名不分先後)杜邦帝人薄膜、SASA Polyester Sanayi AS、KOLON PLASTIC INC.、GTSFlexible Ltd. 和 Polyonics。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第1章簡介

- 調查先決條件

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場動態

- 促進因素

- 包裝應用需求增加

- 電子產業需求增加

- 其他司機

- 抑制因素

- 製造成本高

- 其他阻礙因素

- 價值鏈分析

- 波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭程度

第5章市場區隔(以金額為準的市場規模)

- 應用

- 飲料裝瓶

- 包裝

- 電子產品

- 橡膠輪胎

- 其他

- 地區

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 其他亞太地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 義大利

- 法國

- 其他歐洲國家

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地區

- 中東/非洲

- 沙烏地阿拉伯

- 南非

- 其他中東和非洲

- 亞太地區

第6章 競爭形勢

- 併購、合資、聯盟、協議

- 市場佔有率(%)**/排名分析

- 主要企業策略

- 公司簡介

- Dupont Teijin Films

- EPC Group

- GTS Flexible Ltd.

- KOLON PLASTIC INC.

- Polyonics

- PPI Adhesive Products(CE)sro

- SASA Polyester Sanayi AS

第7章 市場機會及未來趨勢

- 擴大太陽能電池保護應用

- 其他機會

The Polyethylene Naphthalate Market size is estimated at USD 1.74 billion in 2024, and is expected to reach USD 2.31 billion by 2029, growing at a CAGR of 5.90% during the forecast period (2024-2029).

Due to the COVID-19 outbreak, nationwide lockdowns around the world, disruption in manufacturing activities and supply chains, and production halts negatively impacted the market in 2020. However, the conditions started recovering in 2021, thereby restoring the growth trajectory of the market.

Key Highlights

- Major factors driving the market studied are rising demand in packaging applications and increasing demand in the electronics industry.

- On the flip side, high manufacturing costs are the major restraint that hinders the growth of the market.

- The growing application of polyethylene naphthalate in solar cell protection is expected to offer various lucrative opportunities for the growth of the market.

- By application, the packaging segment is expected to dominate the polyethylene naphthalate market owing to its high durability and resistance to chemicals & solvents.

- North America region dominated the market across the globe with the largest consumption from countries such as United States, Canada and Mexico.

Polyethylene Naphthalate Market Trends

Increasing Demand from Packaging Segment

- Polyethylene naphthalate is a polyester that is derived from 2,6 dicarboxylic acid and ethylene glycol. It has superior properties like high resistance to chemicals & solvents, high mechanical strength, and excellent scintillation properties.

- The demand for polyethylene naphthalate in packaging applications is increasing owing to its high stiffness modulus (Young's modulus) which is responsible for better-shrinking resistance of the material and superior barrier capabilities.

- Additionally, polyethylene naphthalate is used for food packaging applications as it is less permeable to oxygen and water vapor, thus reducing the oxidation effects in containers, making it ideal for food preservation purposes.

- Furthermore, polyethylene naphthalate reduces the number of layers required for packaging, which enables simplification in packaging and also reduces overall packaging costs.

- According to the Packaging Industry Association of India (PIAI), the Indian packaging industry is expected to grow at a rate of 22% during the forecast period. Moreover, the Indian packaging market is expected to reach USD 204.81 billion by 2025.

- Flexible packaging is used in food packaging applications in low-income countries in South America, Africa, and Asia-Pacific. The popularity and demand for flexible packaging are rising in emerging economies, and the demand is supported by continued economic expansion and an acceleration in the food and beverage industry.

- In Germany, the paper packaging industry grew significantly in 2022 because of increasing demand for non fossil based packaging for different end user industries.

- Owing to all the above-mentioned factors for polyethylene naphthalate, its market is expected to grow rapidly over the forecast period.

North America Region to Dominate the Market

- North America region is expected to dominate the market for polyethylene naphthalate during the forecast period. In countries like the United States and Canada owing to the growing demand from major end-user industries like packaging and electronics, the demand for polyethylene naphthalate has been increasing in the region.

- Polyethylene naphthalate is widely used in films and pellet forms to manufacture electronic parts owing to its high mechanical and thermal properties, due to which the demand for polyethylene naphthalate is increasing in the region.

- Additionally, with the increasing trend of electric vehicles and the growing use of polyethylene naphthalate in making high-performance and rigid rubber tires is likely to boost its market in the region.

- Furthermore, the rising demand for polyethylene naphthalate in making shatterproof and lightweight beer and juice bottles is likely to further support the polyethylene market growth in the region.

- The United States Food and Drug Administration (FDA) has approved the use of recyclable plastic products like polyethylene naphthalate in food packaging which is likely to stimulate its market in the region during the forecast period.

- According to the IEA, in the United States, the federal aim is for electric vehicles (EVs) to make up 50% of new passenger cars and light trucks sold by 2030. Moreover, as per the International Council on Clean Transportation, in 2020, the California Government has announced an executive order which directs the state to require that, by 2035, all new cars and passenger trucks sold in California be zero-emission vehicles, which includes BEV and PHEV, and others.

- Some of the major companies operating in North America region are - Polyonics and Dupont Teijin Films.

- The aforementioned factors, coupled with government support, are contributing to the increasing demand for polyethylene naphthalate during the forecast period.

Polyethylene Naphthalate Industry Overview

The polyethylene naphthalate market is highly consolidated with top players accounting for a major share of the market. Major companies in the market include Dupont Teijin Films, SASA Polyester Sanayi A.S., KOLON PLASTIC INC., GTS Flexible Ltd., and Polyonics among others (not in any particular order).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Rising Demand in Packaging Applications

- 4.1.2 Increasing Demand in Electronics Industry

- 4.1.3 Other Driver

- 4.2 Restraints

- 4.2.1 High Manufacturing Cost

- 4.2.2 Other Restraints

- 4.3 Industry Value Chain Analysis

- 4.4 Porters Five Force Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Consumers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Value)

- 5.1 Application

- 5.1.1 Beverage Bottling

- 5.1.2 Packaging

- 5.1.3 Electronics

- 5.1.4 Rubber Tires

- 5.1.5 Others

- 5.2 Geography

- 5.2.1 Asia-Pacific

- 5.2.1.1 China

- 5.2.1.2 India

- 5.2.1.3 Japan

- 5.2.1.4 South Korea

- 5.2.1.5 Rest of Asia-Pacific

- 5.2.2 North America

- 5.2.2.1 United States

- 5.2.2.2 Canada

- 5.2.2.3 Mexico

- 5.2.3 Europe

- 5.2.3.1 Germany

- 5.2.3.2 United Kingdom

- 5.2.3.3 Italy

- 5.2.3.4 France

- 5.2.3.5 Rest of Europe

- 5.2.4 South America

- 5.2.4.1 Brazil

- 5.2.4.2 Argentina

- 5.2.4.3 Rest of South America

- 5.2.5 Middle-East and Africa

- 5.2.5.1 Saudi Arabia

- 5.2.5.2 South Africa

- 5.2.5.3 Rest of Middle East and Africa

- 5.2.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share (%)**/ Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 Dupont Teijin Films

- 6.4.2 EPC Group

- 6.4.3 GTS Flexible Ltd.

- 6.4.4 KOLON PLASTIC INC.

- 6.4.5 Polyonics

- 6.4.6 PPI Adhesive Products (C.E.) s.r.o.

- 6.4.7 SASA Polyester Sanayi A.S.

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Growing Application in Solar Cell Protection

- 7.2 Other Opportunities