|

市場調查報告書

商品編碼

1438387

空調設備:全球市場佔有率分析、產業趨勢與統計、成長預測(2024-2029)Global Air Conditioner - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

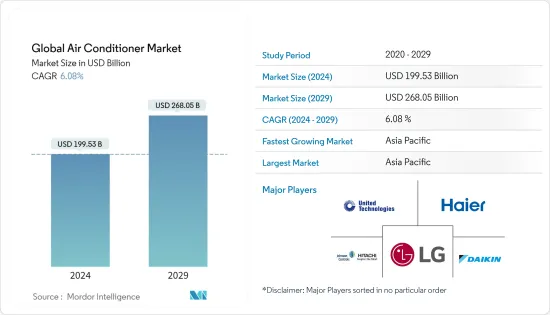

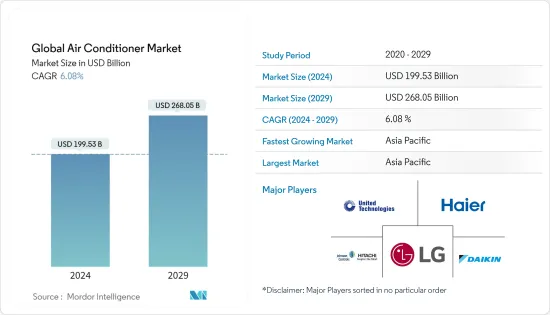

2024年全球空調設備市場規模估計為1995.3億美元,預計到2029年將達到2680.5億美元,在預測期間(2024-2029年)以6.08%的複合年增長率增長。

由於全球溫度和濕度水平迅速上升,以及空調設備作為實用工具而非奢侈品的接受度不斷提高,空調設備 (AC) 行業預計將顯著成長。技術先進的空調(例如採用變頻空調和空氣淨化技術的空調)的出現預計將在預測期內對空調市場產生積極影響。

2020年,新型冠狀病毒感染疾病(COVID-19)的傳播擾亂了市場需求和全球供應鏈。中國是空調設備產品的最大消費國和生產國之一,但基本上透過出口多種二手投入品來滿足眾多國家的需求。生產成品。中國的停產也迫使美國和歐洲的其他空調設備製造商暫時停止成品生產。這擴大了市場供需之間的差距。

暖通空調產業的許多領域,尤其是智慧暖通空調市場,未來幾年的市場規模可能會擴大。可以將傳統遙控空調轉變為智慧型裝置的智慧小工具的日益普及可能是推動智慧空調市場的主要成長動力。雖然由於住宅標準的提高,對房間空調設備的需求正在增加,但由於購物中心、辦公室和工業的建築許可率不斷上升,因此成套空調設備預計將出現溫和成長。

政府有關冷媒的法規迫使製造商開發更節能、更環保的產品。隨著主要冷媒的逐步淘汰,市場出現了許多技術發展。氟氯化碳曾經是最受歡迎的冷媒,但在未來幾年可能會完全被其他冷媒取代。

空調(AC)市場趨勢

由於全球對空調設備的需求不斷增加,市場正在迅速擴大。

根據美國海洋暨大氣美國,2019年7月全球平均氣溫比攝氏20世紀平均氣溫高出約1度。這使其成為有記錄以來最熱的月份。過去的五年是最溫暖的五年。最大的市場是中國,它是全球最大的房間空調 (RAC) 生產國,也是空調需求量最大的市場,達 4,463 萬台。第二大市場是亞洲(不包括日本和中國),市場需求為1782萬台。第三大市場是日本,需求量達1052萬台。北美市場需求量為1559萬台,其次是歐洲691萬台和拉丁美洲683萬台。

亞太地區預計將以最快的速度成長

由於亞太地區基礎設施的快速發展以及人們全部區域生活產品的興趣日益濃厚,空調設備的主要需求來自亞太地區。

在亞太地區,與其他類型的空調相比,PAC(整體式空調)和房間空調(RAC)在市場上佔據主導地位。中國是全球最大的空調系統市場。房間空調設備在中國市場佔據主導地位。日本和印度也是全球空調製造商的重要空調市場。

空調設備(AC)產業概述

競爭形勢分析提供公司收益和績效的詳細策略,包括財務資訊、依部門和地區分類的收入明細、風險分析、關鍵事實、公司概況、業務策略、關鍵產品供應、行銷和分銷策略提供分析、新產品事態發展和最近的新聞。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場動態

- 市場概況

- 市場促進因素

- 市場限制因素

- 波特五力分析

- 價值鏈分析

- 全球空調設備市場的技術創新與最新趨勢

- 新型冠狀病毒感染疾病對市場的影響

第5章市場區隔

- 依產品類型

- 窗戶

- 分離和多分體

- 整體式空調 (PAC)

- 可變冷媒流量 (VRF)

- 其他(冷卻器和可攜式)

- 依最終用戶

- 住宅

- 商業的

- 依分銷管道

- 多品牌商店

- 奢侈品店

- 在線的

- 其他管道

- 依地區

- 北美洲

- 歐洲

- 亞太地區

- 南美洲

- 中東和非洲

第6章 競爭形勢

- 市場集中度概況

- 公司簡介

- Daikin Industries Ltd

- Gree Electrical Appliances Inc.

- Emerson Electric Company

- Midea Group Co. Ltd

- Hitachi-Johnson Controls Air Conditioning Inc.

- Carrier

- LG Electronics Inc.

- Panasonic Corporation

- Toshiba Corporation

- Haier Group Corporation

- Electrolux

- Whirlpool

- Robert Bosch*

第7章市場機會與未來趨勢

第8章 免責聲明

The Global Air Conditioner Market size is estimated at USD 199.53 billion in 2024, and is expected to reach USD 268.05 billion by 2029, growing at a CAGR of 6.08% during the forecast period (2024-2029).

The air conditioning (AC) industry is expected to witness huge growth due to the soaring temperature and humidity levels across the world, along with the rising acceptance of air conditioners as utility products rather than luxury products. The emergence of technologically advanced air conditioners, such as air conditioners with inverters and air purification technologies, is further anticipated to positively influence the air conditioner market through the forecast period.

The spread of COVID-19 disrupted the market demand and global supply chain in 2020. China is one of the largest consumers and producers of air conditioner products, but it also caters to a wide range of countries by exporting several input supplies that are essentially used to produce finished goods. The shutdown of production in China has forced other air conditioner manufacturers based in the United States and Europe to temporarily hold the production of finished goods. This led to an increase in the supply and demand gap in the market.

Numerous segments within the air conditioner industry may increase in market size in the coming years, especially the market for smart air conditioners. The rising popularity of smart gadgets that can convert conventional remote-controlled air conditioners into smart devices is likely to be the primary growth driver, leading the smart air conditioner market. Improvement in housing standards is fueling the demand for room air conditioners, while packaged air conditioners are estimated to grow at a moderate rate with rising permit rates for the construction of malls, offices, and industries.

Government regulations on refrigerants are forcing manufacturers to develop energy-efficient and eco-friendly products. There have been many technological developments observed in the market due to the phasing out of key refrigerants. Once the most preferred refrigerants, CFCs, are likely to be completely replaced by other refrigerants in the next few years.

Air Conditioner (AC) Market Trends

The Growing Demand for Air Conditioners Globally is Surging the Market

The planet's average temperature in July 2019 was about 1°C above the 20th-century average, according to NOAA, the United States (US) National Oceanic and Atmospheric Administration. This makes it the warmest month on record. The last five years have been the five warmest. The largest market was China, the world's single-largest producer of room air conditioners (RAC), and the greatest demand in terms of the number of ACs, with 44.63 million units. The second-largest market was Asia, excluding Japan and China, with a market demand of 17.82 million units. The third-largest market was Japan, whose demand reached 10.52 million units. North America got a market demand of 15.59 million units, followed by Europe with 6.91 million units and Latin America with 6.83 million units.

The Asia-Pacific Region is Anticipated to Grow at the Fastest Rate

The major demand for air conditioners is from Asia-Pacific due to rapid infrastructure development and the rising inclination of people toward lifestyle products across the region.

In the Asia-Pacific region, compared to other types of air conditioners, PAC (packaged air conditioners) and room air conditioners (RAC) dominate the market. China is the largest market for air conditioner systems in the world. In China, room air conditioners dominate the market. Japan and India are other important air conditioning markets for global air conditioning manufacturers.

Air Conditioner (AC) Industry Overview

The competitive landscape analysis provides a detailed strategic analysis of the company's business and performance, such as financial information, revenue breakup by segment and by geography, risk analysis, key facts, company overview, business strategy, key product offerings, marketing and distribution strategies, new product development, and recent news. A few major players include Haier Group Corporation, Daikin Industries Ltd, Hitachi-Johnson Controls Air Conditioning Inc., LG Electronics Inc., and United Technologies Corporation.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.3 Market Restraints

- 4.4 Porters Five Forces Analysis

- 4.5 Value Chain Analysis

- 4.6 Technological Innovations and Recent Trends in the Global Air Conditioner Market

- 4.7 Impact of COVID- 19 on the Market

5 MARKET SEGMENTATION

- 5.1 By Product Type

- 5.1.1 Window

- 5.1.2 Split and Multi Split

- 5.1.3 Packaged Air Conditioner (PAC)

- 5.1.4 Variable Refrigerant Flow (VRF)

- 5.1.5 Others (Chillers and Portables)

- 5.2 By End User

- 5.2.1 Residential

- 5.2.2 Commercial

- 5.3 By Distribution Channel

- 5.3.1 Multi-brand Stores

- 5.3.2 Exclusive Stores

- 5.3.3 Online

- 5.3.4 Other Channels

- 5.4 Geography

- 5.4.1 North America

- 5.4.2 Europe

- 5.4.3 Asia-Pacific

- 5.4.4 South America

- 5.4.5 Middle-East and Africa

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration Overview

- 6.2 Company Profiles

- 6.2.1 Daikin Industries Ltd

- 6.2.2 Gree Electrical Appliances Inc.

- 6.2.3 Emerson Electric Company

- 6.2.4 Midea Group Co. Ltd

- 6.2.5 Hitachi-Johnson Controls Air Conditioning Inc.

- 6.2.6 Carrier

- 6.2.7 LG Electronics Inc.

- 6.2.8 Panasonic Corporation

- 6.2.9 Toshiba Corporation

- 6.2.10 Haier Group Corporation

- 6.2.11 Electrolux

- 6.2.12 Whirlpool

- 6.2.13 Robert Bosch*