|

市場調查報告書

商品編碼

1438373

安全資訊與事件管理 - 市場佔有率分析、產業趨勢與統計、成長預測(2024 年 - 2029 年)Security Information and Event Management - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

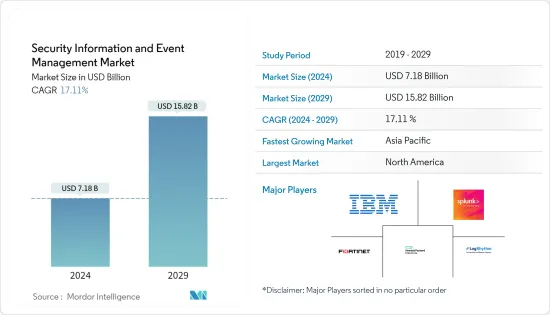

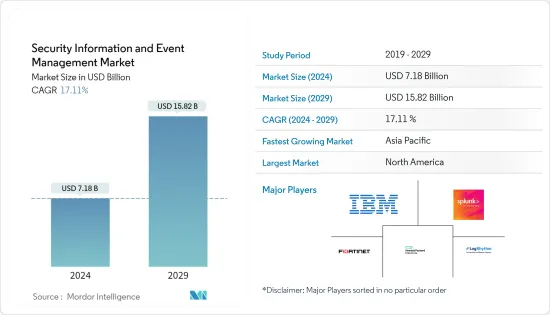

安全資訊和事件管理市場規模預計到 2024 年為 71.8 億美元,預計到 2029 年將達到 158.2 億美元,在預測期內(2024-2029 年)CAGR為 17.11%。

安全資訊和事件管理是基於對組織 IT 網路應用程式和基礎架構中產生的安全警報的即時分析。

主要亮點

- 預計未來幾年,各行業的網路攻擊和安全漏洞風險將不斷增加,銀行和醫療保健公司的關鍵資訊被盜取的可能性很高。主要公司正在採用安全資訊和事件管理解決方案來應對這些課題。由於政府組織可以存取其國家的金融資料,由於多項監管合規性而導致的安全問題增加等因素也有助於市場的成長。

- 與需要軟硬體整合的本地部署相比,基於雲端的 SIEM 解決方案可以節省大量前期成本和 IT 支出,從而導致 IT 支出增加。基於雲端的解決方案佔據了很大的市場佔有率,並且正在推動全球市場的發展。

- 隨著威脅情勢的複雜性增加和使用網路的人數增加,市場預計將在動態變化的環境中快速成長。 BYOD 的日益普及、網路犯罪的持續威脅、SIEM 解決方案的複雜性以及高昂的擁有成本也是市場成長的原因。

- 缺乏對安全措施的認知對市場的成長構成了課題。然而,政府在資料安全領域的措施預計將緩解未來的課題。安全資訊和事件管理軟體的高部署成本和可擴展性等重要因素預計將阻礙預測期內市場的成長。

- 由於 COVID-19 的爆發,針對快速部署的新型遠端存取和遠端辦公基礎設施的攻擊在各個地區有所增加。世界各地的組織積極應對網路威脅,網路威脅在疫情期間激增。因此,網路彈性,指的是一個部門或組織準備、回應和從網路攻擊中恢復的能力,在當前情況下已成為絕對必要性,而不僅僅是一種選擇,這正在逐漸推動疫情後的市場。

安全資訊和事件管理市場趨勢

BFSI 預計將出現顯著成長

- SIEM 解決方案用於保護銀行免受因安全漏洞造成的詐欺。它們為 ATM 網路提供了寶貴的可視性。銀行和金融服務是內部和外部詐欺活動最關鍵的行業,與其他行業相比,打破了所有違規記錄。註冊詐欺審查員協會 (ACFE) 在其報告中審查了來自 125 個國家的 2,504 起內部詐欺案件,這些案件造成了 36 億美元的損失。 ACFE 評估的大多數內部詐欺案件(佔總數的 15.4%)發生在銀行和金融服務部門。 BFSI 領域日益成長的詐欺趨勢正在推動市場發展,因為組織正在其流程中實施 SIEM 軟體來檢測安全漏洞。

- 例如,俄羅斯重要的金融機構烏拉爾FD銀行與Jet Infosystems合作,建立了基於HP ArcSight的安全資訊和事件管理系統。該銀行獲得了可靠、便捷的工具來及時識別和調查資訊安全漏洞。這將事件回應和調查的周轉時間縮短了 80%。

- 根據 IBM 安全情報部落格上的一篇文章,SIEM 工具從 ATM 端點接收日誌、控制網路伺服器並採用關聯規則來幫助安全分析師監控事物,例如網路條目、軟體完整性和防毒來源。這有助於隨時提供 ATM 網路安全狀況的全面概覽。

- 由於金融機構在全球營運中優先考慮安全合規性,因此對安全資訊和事件管理 (SIEM) 的需求更大。例如,在美國,銀行實施了 SIEM 平台以實現 FFIEC 合規性,以保護組織免受漏洞、駭客、網路犯罪和其他網路安全風險的影響。

- 公司正在為 BFSI 開發專門設計的解決方案,並與他們合作提供解決方案。 Adlumin Inc.推出了專門針對金融機構的SIEM解決方案。 Alumni 是美國銀行家協會的會員,一直致力於改善金融機構保護敏感資料和智慧財產權的方式,同時實現合規目標。

北美將佔據最大市場佔有率

- 北美地區預計將佔據重要的市場佔有率,這主要是由於先進技術的廣泛採用。該地區的最終用戶行業對先進安全系統的需求不斷增加,這積極推動了市場的成長。

- 技術的發展促使該地區複雜的威脅和網路攻擊的發展。組織對其專用網路的安全漏洞也變得非常謹慎,這可能會導致巨大的損失。這種安全性問題增加了 SIEM 解決方案的部署,以有效應對持續的安全漏洞。

- 支付卡產業資料安全標準 (PCI DSS) 合規性最初推動了 SIEM 在大型企業中的採用。與支付和銀行業相關的資料外洩在美國非常突出,這反過來又會增加 SIEM 等先進安全服務的採用。此外,隨著區塊鏈技術的日益普及,許多組織正在採用 SIEM 解決方案,特別是在 BFSI 領域。這一因素正在推動該國市場的成長。許多公司正在開發基於區塊鏈的 SIEM 解決方案。

- SIEM 使組織能夠最大限度地減少安全預算。該地區的組織始終需要創新和先進的技術。 SIEM 不僅幫助他們偵測和管理即時威脅和違規行為,還使他們能夠快速分析大量資訊。由於技術的發展,該地區的 SIEM 供應商正在開發先進的超現代解決方案。

- 根據 Deccan Herald 報導,IT 科技巨頭 Wipro 已投資美國網路安全公司 Vectra Networks 和詐欺防制公司 Emailage Corporation,建立網路防禦平台。 Wipro也向應用程式安全公司Denim Group投資了883萬美元。

安全資訊和事件管理產業概述

安全資訊和事件管理市場整合。它由市場上的主要參與者主導。一些主要的市場參與者包括 IBM Corporation、Splunk Inc.、Fortinet Inc.、Hewlett Packard Enterprise Company 和 LogRhythm, Inc.。各種正在進行的收購和創新正在推動市場的成長。此外,SIEM 供應商正在與不同的最終用戶公司建立合作夥伴關係並開發客製化解決方案以增加其市場佔有率。

2022 年 10 月,Exabeam 提供了全球網路安全解決方案,並開發了用於進階安全營運的 New-Scale SIEM。 Exabeam 宣布日本三菱日聯銀行 (MUFG Bank of Japan) 已在其全國金融集團站點和辦事處實施了 Exabeam Fusion SIEM。為了提供整個 IT 基礎架構中典型活動的基線並立即識別可能是網路安全威脅或攻擊跡象的異常情況,MUFG 銀行選擇了 Exabeam Fusion SIEM。

2022 年 10 月,LogRhythm 推出了名為 Axon 的新雲端原生安全營運平台,該平台是 LogRhythm SIEM、NDR 和 UEBA 的升級版本。在 Axon 的幫助下,安全團隊可以輕鬆直覺地獲得跨雲端和本地日誌來源的無縫可見性,為其安全程序奠定基礎。

2022 年 7 月,下一代 SIEM 開發商 Securonix Inc. 與 Redington 在中東和非洲的託管安全服務品牌 DigiGlass 宣布簽署戰略託管安全服務提供者 (MSSP) 協議。根據合約條件,DigiGlass 已獲準使用 Securonix 下一代 SIEM 平台為該地區的客戶提供託管服務。

額外的好處:

- Excel 格式的市場估算 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章:簡介

- 研究成果和假設

- 研究範圍

第 2 章:研究方法

第 3 章:執行摘要

第 4 章:市場洞察

- 市場概況

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 買家/消費者的議價能力

- 新進入者的威脅

- 替代產品的威脅

- 競爭激烈程度

第 5 章:市場動態

- 市場促進因素

- 安全問題日益嚴重

- BYOD 的採用率不斷提高

- 市場限制

- 部署和可擴充性成本高

第 6 章:市場區隔

- 依部署

- 本地部署

- 雲

- 依組織類型

- 中小企業 (SME)

- 大型企業

- 依最終用戶產業

- 零售

- BFSI

- 製造業

- 政府

- 衛生保健

- 其他最終用戶產業

- 地理

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 歐洲其他地區

- 亞太

- 中國

- 日本

- 印度

- 亞太其他地區

- 拉丁美洲

- 巴西

- 阿根廷

- 拉丁美洲其他地區

- 中東和非洲

- 阿拉伯聯合大公國

- 沙烏地阿拉伯

- 中東和非洲其他地區

- 北美洲

第 7 章:競爭格局

- 公司簡介

- IBM Corporation

- Splunk Inc.

- Fortinet Inc.

- LogRhythm Inc.

- McAfee LLC

- Micro Focus International PLC

- RSA Security LLC (Dell Technologies)

- Rapid7 Inc.

- Exabeam Inc.

- Securonix Inc.

- AlienVault Inc.

- Hewlett Packard Enterprise Company

第 8 章:投資分析

第 9 章:市場機會與未來趨勢

The Security Information and Event Management Market size is estimated at USD 7.18 billion in 2024, and is expected to reach USD 15.82 billion by 2029, growing at a CAGR of 17.11% during the forecast period (2024-2029).

Security information and event management are based on real-time analysis of security alerts, which are generated in organizations' IT network applications and infrastructure.

Key Highlights

- Increasing risks of cyber-attacks and security breaches across various industries and high chances of critical information being extracted from banks and healthcare companies are anticipated in the coming years. Major companies are adopting security information and event management solutions to deal with these challenges. Factors such as the rise in security concerns due to several regulatory compliances, as government organizations have access to their country's financial data, are also aiding the market's growth.

- The cloud-based SIEM solutions save a lot of upfront costs and IT expenses compared to on-premise deployments that require hardware and software integration, leading to an increase in IT spending. The cloud-based solutions account for a significant share of the market, and it is driving the market around the world.

- With the growth in complexity of the threat landscape and an increase in the number of people using the internet, the market is expected to grow rapidly in a dynamically changing environment. The growing adoption of BYOD, the constant threat of cybercrime, the complexity of SIEM solutions, and the high cost of ownership are also responsible for the market's growth.

- The lack of awareness about security measures challenges the market's growth. However, government initiatives in the data security space are expected to mitigate the challenge in the future. Significant factors, such as the high cost of deployment and scalability of security information and event management software, are expected to hinder the market's growth over the forecast period.

- Due to the outbreak of COVID-19, attacks against the new and rapidly deployed remote access and teleworking infrastructure increased across various regions. Organizations around the world responded proactively toward cyber threats, which witnessed a spike during the pandemic. Hence, cyber resilience, which refers to a sector or organization's ability to prepare for, respond to, and recover from cyberattacks, has become an absolute necessity rather than a mere option in the current scenario, and this is driving the market gradually after the pandemic.

Security Information and Event Management Market Trends

BFSI Expected to Witness Significant Growth

- SIEM solutions are used to protect banks against fraud due to security breaches. They offer invaluable visibility into ATM networks. Banking and financial services are the most critical sectors for internal and external fraudulent activities, breaking all the breach records compared to other industries. The Association of Certified Fraud Examiners (ACFE) examined 2,504 instances of internal fraud from 125 countries that resulted in losses of USD 3.6 billion in its report. The majority of internal fraud instances evaluated by the ACFE, 15.4% of the total, were in the banking and financial services sector. This increasing trend of fraud in the BFSI sector is driving the market because organizations are implementing SIEM software in their processes to detect security breaches.

- For instance, an important financial institution in Russia, Ural FD Bank, along with Jet Infosystems, established a security information and event management system based on HP ArcSight. The bank acquired a reliable and convenient instrument to identify and investigate information security breaches promptly. This reduced the turnaround time for incident response and investigation by 80%.

- According to a post on IBM's Security Intelligence Blog, SIEM tools receive logs from ATM endpoints, control network servers, and employ correlation rules to help security analysts monitor things, such as entries into the network, software integrity, and antivirus feeds. This helps to deliver a comprehensive overview of the ATM network security posture at any moment.

- Security Information and Event Management (SIEM) is in greater demand because financial institutions prioritize security compliance in their operations around the world. For instance, in the United States, banks implemented SIEM platforms for FFIEC compliance to protect organizations from vulnerabilities, hackers, cybercriminals, and other cybersecurity risks.

- Companies are developing specifically designed solutions for BFSIs and partnering with them to provide the solutions. Adlumin Inc. introduced SIEM solutions specifically for financial institutions. Alumni, a member affiliate of the American Bankers Association, has been working to improve the way financial institutions protect sensitive data and intellectual property while accomplishing their compliance goals.

North America to Hold the Largest Market Share

- The North American region is expected to hold a significant market share, primarily due to the high adoption of advanced technologies. There is an increasing need for advanced security systems among the end-user industries in the region, which positively boosts the market's growth.

- The technological evolution has led to the evolution of sophisticated threats and cyber-attacks in this region. Organizations are also becoming very cautious regarding security breaches in their private networks, which may lead to huge losses. This security concern has increased the deployment of SIEM solutions for efficiently dealing with constant security breaches.

- Payment Card Industry Data Security Standard (PCI DSS) compliance originally drove SIEM adoption in large enterprises. Data breaches related to payment and the banking sector have been prominent in the United States, which, in turn, is set to increase the adoption of advanced security services, such as SIEM. Additionally, many organizations are adopting SIEM solutions with the increasing adoption of blockchain technology, especially in the BFSI sector. This factor is fuelling the market's growth in the country. Many companies are developing blockchain-based SIEM solutions.

- SIEM enables organizations to minimize their security budget. Organizations in the region always demand innovative and advanced technologies. SIEM not only helps them to detect and manage real-time threats and breaches but also enables them to analyze a large amount of information quickly. SIEM providers in this region are developing advanced and ultramodern solutions due to technological growth.

- According to Deccan Herald, IT Technological giant Wipro, has invested in US-based cybersecurity company Vectra Networks and fraud prevention firm Emailage Corporation to establish a cyber defense platform. Wipro also invested USD 8.83 million in application security company Denim Group.

Security Information and Event Management Industry Overview

The security information and event management market is consolidated. It is dominated by the major players present in the market. Some major market players are IBM Corporation, Splunk Inc., Fortinet Inc., Hewlett Packard Enterprise Company, and LogRhythm, Inc. The various ongoing acquisitions and innovations are leading to the market's growth. In addition, SIEM providers are forming partnerships with different end-user companies and developing customized solutions to increase their market share.

In October 2022, Exabeam offered worldwide cybersecurity solutions and developed the New-Scale SIEM for advanced security operations. Exabeam announced that MUFG Bank of Japan had implemented Exabeam Fusion SIEM throughout its nationwide financial group sites and offices. To provide a baseline of typical activity throughout its IT infrastructure and immediately identify anomalies that could be signs of a cybersecurity threat or attack, MUFG Bank selected Exabeam Fusion SIEM.

In October 2022, LogRhythm launched a new Cloud-Native Security Operations Platform called Axon, which has been introduced as an upgrade to LogRhythm SIEM, NDR, and UEBA. With the help of Axon, security teams could easily and intuitively obtain seamless visibility across cloud and on-premises log sources, laying the groundwork for their security procedures.

In July 2022, a strategic Managed Security Services Provider (MSSP) agreement between Securonix Inc., a developer in Next-Gen SIEM, and DigiGlass, a managed security services brand of Redington in the middle east and Africa, was announced. According to the contract conditions, DigiGlass has been permitted to offer managed services for customers all around the region using the Securonix Next-Gen SIEM platform.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Deliverables and Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers/Consumers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Growth in Security Concerns

- 5.1.2 Increasing Adoption of BYOD

- 5.2 Market Restraints

- 5.2.1 High Cost of Deployment and Scalability

6 MARKET SEGMENTATION

- 6.1 By Deployment

- 6.1.1 On-premise

- 6.1.2 Cloud

- 6.2 By Organisation Type

- 6.2.1 Small and Medium Enterprises (SMEs)

- 6.2.2 Large Enterprises

- 6.3 By End-user Industry

- 6.3.1 Retail

- 6.3.2 BFSI

- 6.3.3 Manufacturing

- 6.3.4 Government

- 6.3.5 Healthcare

- 6.3.6 Other End-user Industries

- 6.4 Geography

- 6.4.1 North America

- 6.4.1.1 United States

- 6.4.1.2 Canada

- 6.4.2 Europe

- 6.4.2.1 Germany

- 6.4.2.2 United Kingdom

- 6.4.2.3 France

- 6.4.2.4 Rest of Europe

- 6.4.3 Asia-Pacific

- 6.4.3.1 China

- 6.4.3.2 Japan

- 6.4.3.3 India

- 6.4.3.4 Rest of Asia-Pacific

- 6.4.4 Latin America

- 6.4.4.1 Brazil

- 6.4.4.2 Argentina

- 6.4.4.3 Rest of Latin America

- 6.4.5 Middle East and Africa

- 6.4.5.1 United Arab Emirates

- 6.4.5.2 Saudi Arabia

- 6.4.5.3 Rest of Middle East and Africa

- 6.4.1 North America

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 IBM Corporation

- 7.1.2 Splunk Inc.

- 7.1.3 Fortinet Inc.

- 7.1.4 LogRhythm Inc.

- 7.1.5 McAfee LLC

- 7.1.6 Micro Focus International PLC

- 7.1.7 RSA Security LLC (Dell Technologies)

- 7.1.8 Rapid7 Inc.

- 7.1.9 Exabeam Inc.

- 7.1.10 Securonix Inc.

- 7.1.11 AlienVault Inc.

- 7.1.12 Hewlett Packard Enterprise Company