|

市場調查報告書

商品編碼

1438332

露營車 - 市場佔有率分析、產業趨勢與統計、成長預測(2024 - 2029)Recreational Vehicle - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

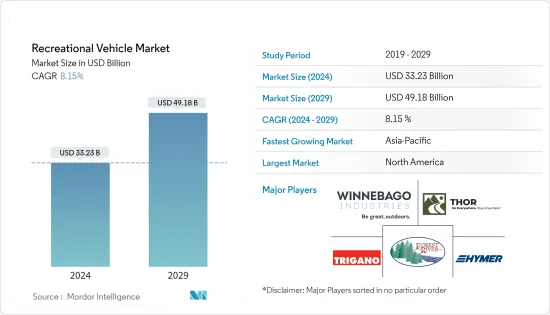

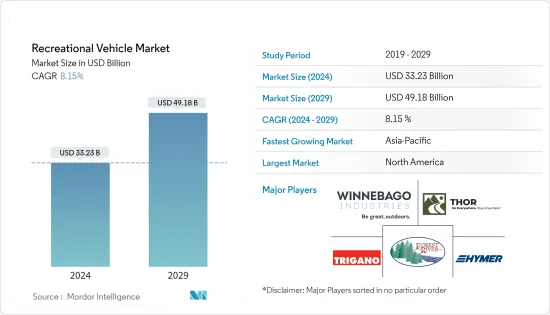

露營車市場規模預計到 2024 年為 332.3 億美元,預計到 2029 年將達到 491.8 億美元,在預測期內(2024-2029 年)CAGR為 8.15%。

COVID-19 危機極大地影響了世界各地的旅遊業。這使得2020年上半年露營車市場的銷售脫軌了幾個月。然而,市場復甦緩慢以及消費者更喜歡住在大篷車而不是酒店,可以刺激市場在預測期內的成長。新興經濟體租賃服務的大幅成長預計也將在短期內推動市場成為焦點。

活躍露營者數量的不斷增加正在推動對露營車的需求。露營車的商業用途正在增加。點對點租賃服務的成長預計將提高千禧世代的受歡迎程度,他們擴大尋求租賃服務。此外,作為遠離工作生活的公路旅行需求的不斷成長可能會促進市場成長。封鎖後,全球休閒車的使用量顯著成長,尤其是在北美和歐洲。

北美可能主導市場。此外,在區域休閒公園和露營地數量迅速成長的推動下,它可能會在預測期內擴大。美國境內有超過 13,000 個私營露營地和 1,600 個公共露營地,個人可以使用露營車體驗露營活動。

由於休閒活動的日益普及,全球休閒車市場預計將快速成長,特別是在北美和歐洲。預計亞太地區在預測期內將顯著成長。由於這些車輛提供了可靠且個人化的出行方式,因此在新冠肺炎 (COVID-19) 疫情期間被認為是最安全的出行選擇。

露營車 (RV) 市場趨勢

露營車區隔市場可望引領市場

露營車市場預計在預測期內複合CAGR最高。該國露營地數量的增加表明人們越來越偏愛露營車休閒旅行。此外,在美國、德國等國家也被廣泛使用,不僅用於度假旅行,還用於尾隨、帶寵物旅行、商務以及戶外運動和其他休閒活動的首選交通方式。

儘管發生了大流行,但過去五年中露營車的新註冊數量仍比大篷車的數量大幅增加。例如,2019 年,德國登記了約 55,000 輛新露營車,2020 年增加到超過 78,000 輛。2021 年露營車數量持續成長,該國登記了超過 82,000 輛露營車。相反,2020 年和 2021 年新註冊的大篷車數量下降了 13%。

在露營車中,C 型露營車比 A 型或 B 型露營車具有更好的燃油效率。它們通常被稱為迷你露營車,以縮小版和較低的價格提供大型露營車的便利設施。這些露營車的價格從大約 40,000 美元到 200,000 美元不等。此外,製造商正在添加多個滑出裝置以增加居住空間,並正在設計具有更大底盤版本的各種平面圖。

預計 A 類機動車輛將繼續在收入中佔據主導地位,到 2021 年將佔全球休閒車市場佔有率的約 50%。線上租賃網站和應用程式的成長進一步簡化了租賃流程,刺激了精通技術的需求千禧世代人口。

北美在 2021 年的商業銷售中也佔據主導地位,並且很可能在預測期內佔據主導地位。美國是世界上最大的商用露營車市場,其中租賃機構主要佔據主導地位。

北美將見證顯著成長

北美休閒車市場是全球最大的。露營車在美國人中非常受歡迎,超過 11% 的家庭擁有它。美國有超過 100 萬個家庭全職居住在露營車。它允許旅行成本降低 20-60%,這推動了露營車在千禧世代中的流行。露營車市場為美國經濟貢獻了 1,140 億美元,僱用了超過 60 萬名員工。

未來幾年,美國將推動北美休閒車市場的收入成長。加拿大休閒車市場在未來幾年也可能呈現顯著成長。預計到預測期結束時,它將佔據北美休閒車市場 10% 以上的佔有率。

另一方面,到2024年底,美國可能會佔據該區域市場80%以上的佔有率。就CAGR而言,加拿大在北美休閒車市場比美國更有利可圖。然而,由於個人可支配收入水準的不斷提高和稅收的放鬆,美國是一個更具吸引力的市場。

例如,與2020年相比,2021年美國露營車出貨量激增。2021年露營車出貨量超過60萬輛,比2020年增加近30%。

擁有多種設施(包括釣魚、激流漂流和健行)的露營地的激增以及自然風景,提供了巨大的市場機會。豪華露營車度假村提供專門的體育設施,包括高爾夫球場、網球場、健康水療中心和美食餐廳,這對市場收入有正面影響。

露營車 (RV) 產業概覽

全球市場的主要參與者包括 Thor Industries、Forest River Inc.、Winnebago Industries、Trigano SA 和 Hymer GmbH & Co. KG。其他重要參與者包括 Airstream、Crossroads RV、Highland Ridge、Skyline Corporation、DRV Luxury Suites、Cruiser RV、Dutchmen RV、Fleetwood Corporation、Grand Design RV、Kropf Industries、GMC Motorhome、Keystone RV 和 Pleasure-Way Industries。

露營車市場競爭激烈,存在多家銷售產品的製造商,這些製造商透過產品功能直接競爭。在該地區營運的公司正在採用併購策略以及夥伴關係和協作來增加其市場佔有率。例如,

- 2022 年 1 月,福特和 Erwin Hymer Group (EHG) 宣布了一項框架協議,將基於 Ford Transit 和 Ford Transit Custom 提供可供客戶使用的休閒車和露營車。

- 2021年12月,阿波羅旅遊休閒與旅遊控股有限公司宣布兩家實體合併。此次合併將使 Apollo Tourism & Leisure 股東擁有合併後集團 25% 的股份。這將擴大阿波羅的全球休閒車網路,包括休閒車的服務、銷售、租賃和製造。

額外的好處:

- Excel 格式的市場估算 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章:簡介

- 研究假設

- 研究範圍

第 2 章:研究方法

第 3 章:執行摘要

第 4 章:市場動態

- 市場促進因素

- 市場限制

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 消費者的議價能力

- 新進入者的威脅

- 替代產品的威脅

- 競爭激烈程度

第 5 章:市場區隔

- 依類型

- 牽引式露營車

- 旅行拖車

- 第五輪拖車

- 折疊露營拖車

- 卡車露營車

- 露營車

- A型

- B型

- C型

- 牽引式露營車

- 依應用

- 國內的

- 商業的

- 依地理

- 北美洲

- 美國

- 加拿大

- 北美其他地區

- 歐洲

- 英國

- 德國

- 法國

- 西班牙

- 歐洲其他地區

- 亞太

- 中國

- 印度

- 日本

- 韓國

- 亞太地區其他地區

- 世界其他地區

- 南美洲

- 中東和非洲

- 北美洲

第 6 章:競爭格局

- 供應商市佔率

- 公司簡介

- Thor Industries Inc.

- Forest River Inc.

- Winnebago Industries Inc.

- REV Group

- NeXus RV

- Tiffin Motorhomes Inc.

- Triple E Recreational Vehicles

- Dethleffs GmbH & Co. KG

- Burstner GmbH & Co. KG

- The Swift Group

- Rapido Motorhomes

第 7 章:市場機會與未來趨勢

The Recreational Vehicle Market size is estimated at USD 33.23 billion in 2024, and is expected to reach USD 49.18 billion by 2029, growing at a CAGR of 8.15% during the forecast period (2024-2029).

The COVID-19 crisis tremendously affected the tourism industry across the world. This derailed the sales of recreational vehicles in the market for a few months in the first half of the year 2020. However, the market's slow recovery and consumers' preference to stay in caravans than hotels can stimulate the market's growth during the forecast period. The high proliferation of rental services in emerging economies is also expected to drive the market in focus for the short term.

The growing number of active campers is contributing to the demand for RVs. The commercial usage of RVs is on the rise. Growth in peer-to-peer rental services is expected to increase popularity among millennials, which are increasingly seeking rental services. Furthermore, the increasing demand for road trips as a getaway from work-life may boost the market growth. The post-lockdown has witnessed significant growth in the use of recreational vehicles across the globe, especially in North America and Europe.

North America is likely to dominate the market. Moreover, it may expand during the forecast period, propelled by a rapidly growing number of regional recreational parks and camping grounds. More than 13,000 privately-owned and 1,600 public campgrounds within the United States enable individuals to experience camping activities with their recreational vehicles.

Because of the increase in the popularity of recreational activities, the global recreational vehicle market is expected to witness rapid growth, especially in North America and Europe. The Asia-Pacific region is expected to witness significant growth during the forecast period. As these vehicles provide a reliable and personal way to travel, it is considered the safest travel alternative because of the COVID-19 pandemic.

Recreational Vehicle (RV) Market Trends

Motorhomes Segment Expected to Lead the Market

The motorhomes segment of the market is anticipated to register the highest CAGR during the forecast period. The increase in the number of campgrounds in the country illustrates the increasing preference for recreational travel with motorhomes. Additionally, they are widely used in the countries like the United States and Germany, not only for vacation traveling but also for tailgating, traveling with pets, business, and as a preferred mode of transportation for outdoor sports and other leisure activities.

Despite the pandemic, Motorhomes have witnessed a significant rise in the number of new registrations over Caravans over the past five years. For instance, in 2019, in Germany, about 55,000 units of new motorhomes were registered, which increased to more than 78,000 units in 2020. The growing number of motorhomes continued in 2021, too, as over 82,000 units were registered in the country. On the contrary, verses 2020 and 2021 saw a 13% dip in new registrations of caravans.

Among the motorhomes, the Type C motorhomes provide better fuel efficiency than the type A or B motorhomes. They are often referred to as mini-motorhomes, which provide the amenities of a larger motorhome in a scaled-down version and at a lower price. The price of these motorhomes ranges from approximately USD 40,000 and goes up to USD 200,000. Moreover, manufacturers are adding multiple slide-outs to increase the living space and are designing a large variety of floor plans with larger chassis versions.

Type A motorized vehicles are expected to continue to dominate in revenue, contributing approximately 50% of the global recreational vehicle market share in 2021. The growth in online rental websites and applications has further eased the renting process, boosting the demand in the tech-savvy millennial population.

North America also dominated the commercial sales in 2021, which will likely dominate during the forecast period. The United States is the largest commercial RV market in the world, which rental agencies primarily dominate.

North America to Witness Significant Growth

The North American recreational vehicle market is the largest across the globe. RV is highly popular among Americans, and over 11% of households own it. Over 1 million households in the United States live full-time in RVs. It allows traveling at 20-60% less cost, which drives the popularity of RV among millennials. The recreational vehicle market contributes an overall USD 114 billion to the US economy, employing over 600,000 people.

Over the next few years, the United States will drive revenue growth in the North American recreational vehicles market. The Canadian recreational vehicles market may also exhibit significant growth in the years to come. It is expected to hold more than a 10% share of the North American recreational vehicles market until the end of the forecast period.

On the other hand, the United States will likely occupy more than 80% of this regional market until the end of 2024. In terms of CAGR, Canada is more lucrative than the United States in the North American recreational vehicles market. However, the United States is a more attractive market, owing to growing personal disposable income levels and tax relaxation.

For instance, the United States witnessed a surge in the shipments of recreational vehicles in 2021 when compared to 2020. In 2021, more than 600,000 units of shipments of recreational vehicles were observed, which is nearly 30% higher than the figures in 2020.

The proliferation of campgrounds with multiple facilities, including fishing, white water rafting, and hiking, along with natural scenic landscapes, provides robust market opportunities. Luxury RV resorts offer specialized sports facilities, including golf courses, tennis courts, health spas, and gourmet restaurants, which positively influence the market revenue.

Recreational Vehicle (RV) Industry Overview

Key players operating in the global market include Thor Industries, Forest River Inc., Winnebago Industries, Trigano SA, and Hymer GmbH & Co. KG. Other significant players include Airstream, Crossroads RV, Highland Ridge, Skyline Corporation, DRV Luxury Suites, Cruiser RV, Dutchmen RV, Fleetwood Corporation, Grand Design RV, Kropf Industries, GMC Motorhome, Keystone RV, and Pleasure-Way Industries.

The Recreational Vehicle Market is intensely competitive with the presence of several manufacturers selling products that compete directly through product features. Companies operating in the are adopting merger & acquisition strategies coupled with partnerships and collaborations to increase their market share. For instance,

- In January 2022, Ford and Erwin Hymer Group (EHG) announced a framework agreement to deliver customer-ready recreational vehicles and motorhomes based on Ford Transit and Ford Transit Custom.

- In December 2021, Apollo Tourism & Leisure and Tourism Holdings Limited announced the merger of the two entities. The merger will result in Apollo Tourism & Leisure shareholders owning 25% of the combined group. This will expand Apollo's global recreational vehicle networks that include RVs' service, sales, rental, and manufacturing.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Drivers

- 4.2 Market Restraints

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Consumers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 By Type

- 5.1.1 Towable RVs

- 5.1.1.1 Travel Trailers

- 5.1.1.2 Fifth Wheel Trailers

- 5.1.1.3 Folding Camp Trailers

- 5.1.1.4 Truck Campers

- 5.1.2 Motorhomes

- 5.1.2.1 Type A

- 5.1.2.2 Type B

- 5.1.2.3 Type C

- 5.1.1 Towable RVs

- 5.2 By Application

- 5.2.1 Domestic

- 5.2.2 Commercial

- 5.3 By Geography

- 5.3.1 North America

- 5.3.1.1 United states

- 5.3.1.2 Canada

- 5.3.1.3 Rest of North America

- 5.3.2 Europe

- 5.3.2.1 United Kingdom

- 5.3.2.2 Germany

- 5.3.2.3 France

- 5.3.2.4 Spain

- 5.3.2.5 Rest of Europe

- 5.3.3 Asia-Pacific

- 5.3.3.1 China

- 5.3.3.2 India

- 5.3.3.3 Japan

- 5.3.3.4 South Korea

- 5.3.3.5 Rest of Asia Pacific

- 5.3.4 Rest of the World

- 5.3.4.1 South America

- 5.3.4.2 Middle-East and Africa

- 5.3.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Vendor Market Share

- 6.2 Company Profiles*

- 6.2.1 Thor Industries Inc.

- 6.2.2 Forest River Inc.

- 6.2.3 Winnebago Industries Inc.

- 6.2.4 REV Group

- 6.2.5 NeXus RV

- 6.2.6 Tiffin Motorhomes Inc.

- 6.2.7 Triple E Recreational Vehicles

- 6.2.8 Dethleffs GmbH & Co. KG

- 6.2.9 Burstner GmbH & Co. KG

- 6.2.10 The Swift Group

- 6.2.11 Rapido Motorhomes