|

市場調查報告書

商品編碼

1437963

電動車電源逆變器:市場佔有率分析、產業趨勢與統計、成長預測(2024-2029)Electric Vehicle Power Inverter - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

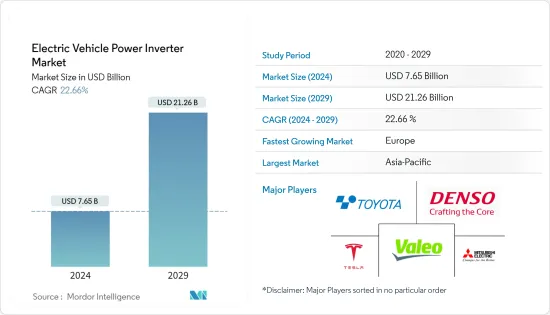

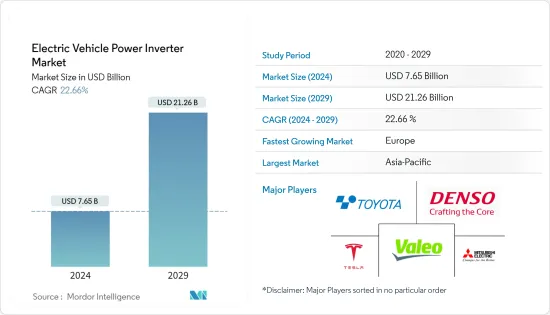

2024 年電動汽車電源逆變器市場規模估計為 76.5 億美元,預計到 2029 年將達到 212.6 億美元,在預測期間(2024-2029 年)以 22.66% 的複合年增長率增長。

此次疫情幾乎影響了全球所有產業。但由於每年電動車的持續需求和銷售等因素,電動車電源逆變器市場需求成長顯著。例如,儘管受到疫情影響,亞太、歐洲等地區各國小客車等電動車銷售仍呈現正成長。然而,汽車產業在2021年電動車產量顯著成長,這可能會增加預測期內對功率逆變器的需求。

從中期來看,隨著政府鼓勵汽車製造商和客戶製造和部署電動車,他們正在向電動車計劃投入大量資金,這為電動車電源逆變器製造商提供了機會。隨著電動車需求的增加,電動車所用零件(例如電源逆變器)的銷售量預計也會增加。

隨著世界各地排放氣體標準變得更加嚴格,汽車製造商逐漸將生產從傳統引擎汽車轉向混合動力汽車和電動車。此外,各國政府也推出了針對電動車購買者降低車輛稅、獎金和保險費等激勵措施,以支持電動車銷售的成長。此外,歐洲、北美和亞太地區(尤其是日本和中國)充電站設施的增加進一步支持了電動車銷售的成長。

除了電動車公告之外,多家製造商還提高了 2025 年以後展望的標準。超過 10 家主要OEM已宣布 2030 年及以後的電動目標。重要的是,一些OEM正計劃重新配置其產品線,僅生產電動車。例如,通用汽車在 2021 年第一季宣布,計劃到 2025 年將電動和自動駕駛汽車的支出增加到 200 億美元。該公司計劃在 2023 年推出 20 款新電動車型,目標是銷售超過一輛汽車。預測期內,美國和中國每年普及擁有 100 萬輛電動車。

電動車電源逆變器市場趨勢

擴大電動車銷量

電動車已成為汽車產業的重要組成部分,為實現能源效率以及減少污染物和其他溫室氣體的排放提供了途徑。日益成長的環境問題和有利的政府措施是推動市場成長的一些主要因素。

2021年全球純電動車銷量為350萬輛,較2020年銷量大幅成長。加速引進搭乘用電動車(EV)並逐步淘汰配備內燃機的傳統汽車的運動正在引起世界各地的關注。平均燃油價格的上漲反映了這樣一個事實:歐洲的新電動車註冊比例高於世界其他地區。因此,燃料價格上漲預計將促使電動車的大規模採用和全球業務的激增。

政府增加對全球充電基礎設施發展的投資可能會促進電動車的銷售。例如,

- 2022年10月,德國政府投資63億歐元(61億美元)增加全國充電站數量。

- 2022年9月,日本租賃公司Orix宣布將在全國安裝電動車充電站。該公司計劃與 Ubiden 合作,到 2025 年建造約 50,000 個充電站。

此外,與電池相關的高成本需要提高車輛性能以及逆變器和其他電力電子設備。例如,

雖然客戶偏好向電動車的轉變是未來脫碳的明顯徵兆,對充電站也至關重要,但電動車的普及將取決於消費行為、基礎設施和特定區域叢集等各種屬性。隨著電動車銷量的增加,充電站的需求也會隨之增加。市場上的知名企業專注於準確診斷消費者情緒,並透過在全國範圍內提供快速充電技術來應對消費者情緒。

雖然這一變化並未導致內燃機汽車銷量下滑,但它為現在和未來的電動汽車創造了一個充滿希望的市場。 上述趨勢導致一些汽車製造商增加了對電動汽車和電源逆變器等相關零部件的研發支出,而另一些汽車製造商則開始專注於新產品的發佈以獲得市場佔有率,最終提振了市場需求。

亞太地區引領電動車電源逆變器市場

亞太地區引領電動車電源逆變器市場,其次是歐洲和北美。中國電動車銷量快速成長。儘管由於 COVID-19感染疾病導致半導體供不應求導致全球汽車銷量放緩,但隨著越來越多的人選擇更清潔的汽車,中國的電動車銷量去年仍然成長了 154%。 2021 年,電動車 (EV) 製造商在中國總合售出 330 萬輛汽車,高於 2020 年的 130 萬輛和 2019 年的 120 萬輛。

印度政府採取了多項措施來促進印度電動車的製造和採用,目的是減少與國際條約相關的排放,並結合快速都市化。隨著印度電動車銷量的增加,汽車製造商正在投資開發新技術並提高產能以滿足需求。例如,

- 2022年5月,豐田集團透露計劃在印度投資480億盧比(6.24億美元)用於製造電動車零件。

- 2022 年 3 月,馬魯蒂鈴木的母公司鈴木馬達宣布投資 1,044 億印度盧比,在印度開發新的電動車和電池工廠。

印度的主要汽車製造商也在進行研發活動,以開發新產品,這些新產品將在預測期內對目標市場的成長產生正面影響。例如,

- 2022年3月,ToyotaKirloskar 馬達宣布推出印度首款氫燃料電池電動車的計劃。這是因為印度最大的新興汽車市場之一尋求加速向清潔交通的轉型。豐田將與政府測試機構國際汽車技術中心合作,研究 Mirai,這是一款針對印度道路和氣候條件量身定做的燃料電池電動車。豐田的 Mirai 汽車將在豐田卡納塔克邦的 Kirloskar 工廠生產。

到2030年,日本希望下一代汽車占新車銷量的50~70%,純電動汽車(BEV)和插電式混合動力汽車(PHEV)佔20~30%,混合動力汽車(HEV)佔20~30%。 佔30~40%。 為此,2021年11月,日本政府為電動汽車撥款總計375億日元(2.9億歐元)。 然而,市場面臨的主要障礙是老化和不良的充電基礎設施。 因此,日本的目標是到 2030 年將全國電動汽車充電站的數量增加到 150,000 個。

幾家大公司已宣佈建立合作夥伴關係,在該國共同開發電動車解決方案。例如,

- SONY集團公司和本田於2022年3月達成策略聯盟,並簽署了合作備忘錄(MOU),表達了建立合資企業的意向,以合作開發和銷售高付加電池。車輛(電動車)。

例如,各種汽車製造商也向其客戶提供家庭充電解決方案以及電動車。

- 2022 年 10 月,ENECHANGE Ltd. 宣佈到 2027 年將在日本安裝 30,000 個電動汽車充電器。 並決定在全國所有 47 個都道府縣的所有 EV 充電器中引入其EV 充電服務。

在預測期內,隨著全球混合動力汽車和電動車銷量的成長趨勢,對電源逆變器的需求預計將同時成長。

電動車電源逆變器產業概況

全球電動車電源逆變器市場由大陸集團、羅伯特博世有限公司、電裝公司和三菱電機公司等少數幾家公司主導。兩家公司都透過開設新的生產工廠和組建合資企業來擴大業務,以獲得超越競爭對手的優勢。例如,

- 2022年11月,大陸集團完成了蒂米甚瓦拉電子元件工廠的第三次擴建。該公司將投資4000萬歐元用於製造業務,提高其在全國生產電動車零件的能力。

- 2021 年 10 月,羅伯特·博世推出了新型商用車專用馬達和逆變器。這款 230電動與博世先進的 SiC 逆變馬達相結合,可減少能量損失並增加商用車的續航里程。

- 2021年5月,羅伯特·博世與保時捷和柏林弗勞恩霍夫可靠性與微整合研究所(Fraunhofer IZM)合作,透過增強車輛電源逆變器的性能來提高電動車(EV)的性能,宣布了一個旨在增加續航里程的新計劃。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 調查先決條件

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場動態

- 市場促進因素

- 市場限制因素

- 產業吸引力-波特五力分析

- 新進入者的威脅

- 買方議價能力

- 供應商的議價能力

- 替代產品的威脅

- 競爭公司之間的敵意強度

第5章市場區隔(以金額為準的市場規模)

- 依推進類型

- 混合車

- 插電式混合電動車

- 電池電動車

- 燃料電池電動車

- 依車型

- 小客車

- 商用車

- 依地區

- 北美洲

- 美國

- 加拿大

- 北美其他地區

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 其他歐洲國家

- 亞太地區

- 中國

- 日本

- 印度

- 韓國

- 其他亞太地區

- 世界其他地區

- 南美洲

- 中東和非洲

- 北美洲

第6章 競爭形勢

- 供應商市場佔有率

- 公司簡介

- Vitesco Technologies

- Robert Bosch GmbH

- DENSO Corporation

- Toyota Industries Corporation

- Hitachi Astemo Ltd

- Meidensha Corporation

- Aptiv PLC(Borgwarner Inc.)

- Mitsubishi Electric Corporation

- Marelli Corporation

- Valeo Group

- Lear Corporation

- Infineon Technologies AG

- Eaton Corporation

第7章市場機會與未來趨勢

The Electric Vehicle Power Inverter Market size is estimated at USD 7.65 billion in 2024, and is expected to reach USD 21.26 billion by 2029, growing at a CAGR of 22.66% during the forecast period (2024-2029).

The pandemic has affected almost every industry around the globe; however, the demand for the electric vehicle power inverter market is growing significantly, owing to factors, such as the continuous demand and sales of electric vehicles every year. For instance, despite the pandemic, the sales of electric vehicles, such as passenger cars, have shown positive growth in various countries in the regions, such as Asia-Pacific and Europe. However, The automotive industry witnessed significant growth in terms of electric vehicle production in 2021, which is likely to increase the demand for power inverters during the forecast period.

Over the medium term, governments in various countries are spending heavily on electric mobility projects, which are going to provide an opportunity for electric vehicle power inverter manufacturers, as governments are encouraging automobile manufacturers and customers to produce and adopt electric vehicles. The rise in the demand for electric vehicles is also expected to increase the sales of the components used in electric vehicles, such as power inverters.

With growing stringent emission standards across the globe, automakers are gradually shifting their production from conventional engine vehicles to hybrid and electric vehicles. In addition, governments have initiated incentives, such as a cut down in vehicle tax, bonus payments, and premiums, for buyers of electric vehicles in the respective countries to support electric vehicle sales growth. Also, the increasing charging station facilities in the regions, especially in Europe, North America, and Asia-Pacific, particularly in Japan and China, have further supported the growing electric vehicle sales.

Several manufacturers have raised the bar to go beyond the announcements related to electric vehicles with an outlook beyond 2025. More than ten of the largest OEMs have declared electrification targets for 2030 and beyond. Significantly, some OEMs plan to reconfigure their product lines to produce only electric vehicles. For instance, in the first trimester of 2021, General Motors announced its plans to raise its spending on electric and autonomous vehicles to USD 20 billion by 2025. The company is expected to launch 20 new electric models by 2023 and aims to sell more than 1 million electric cars a year in the United States and China over the forecast period.

EV Power Inverter Market Trends

Growing Sales of Electric Vehicles

Electric vehicles have become an integral part of the automotive industry, and they represent a pathway toward achieving energy efficiency, along with reduced emissions of pollutants and other greenhouse gases. The increasing environmental concerns, coupled with favorable government initiatives, are some of the major factors driving the market growth.

Global battery electric vehicle sales were marked at 3.5 million units in 2021, which was significantly higher compared to sales figures in 2020. The movement to accelerate the adoption of light-duty passenger electric cars (EVs) and phase out traditional vehicles with internal combustion engines is gaining traction around the world. The increase in average fuel prices reflects the fact that Europe has a higher share of new electric car registrations than other parts of the world. Hence, mass adoption of electric vehicles, owing to rising fuel prices, is expected to proliferate business globally.

Rising government investment in the development of charging infrastructure across the globe is likely to promote the sale of electric vehicles. For instance,

- In October 2022, the German government invested Euro 6.3 Billion (USD 6.1 Billion) to increase the number of charging stations across the country.

- In September 2022, Japanese leasing company Orix announced the installation of electric vehicle charging stations across the country. The company will build around 50,000 charging stations by 2025 in partnership with Ubiden.

Moreover, the high cost associated with batteries has necessitated the improvement of inverters and other power electronics, along with improving the performance of vehicles. For instance,

Shifting customer preference towards electric vehicles is an evident sign for future decarbonization and simultaneously decisive for charging stations, although penetration of EVs is subjected to various attributes, including consumer behavior, infrastructure, and certain regional clusters. An increase in electric vehicle sales will proportionally fuel the demand for charging stations. Prominent players in the market have diagnosed the pinpoint of consumer sentiment and thus are focusing on catering to it by offering fast-charging technologies across the country.

Though change has not resulted in a slump in IC engine vehicle sales, it created a promising market for electric vehicles in the present and future. The above trend has propelled some of the automakers to increase their expenditure on R&D in electric vehicles and associated components, like power inverters, while others have started focusing on launching new products to capture the market share, eventually pushing the demand in the market.

Asia-Pacific is leading the Electric Vehicle Power Inverter Market

Asia-Pacific is leading the electric vehicle power inverter market, followed by Europe and North America, respectively. The sale of electric vehicles in China is growing at a rapid pace. Despite a global downturn in auto sales due to a shortage of semiconductor supply caused by COVID-19 pandemic, electric vehicle sales in China increased by 154 percent last year, as more people chose cleaner vehicles. Electric vehicle (EV) manufacturers sold a total of 3.3 million units in China in 2021, up from 1.3 million in 2020 and 1.2 million in 2019.

The government of India has undertaken multiple initiatives to promote the manufacturing and adoption of electric vehicles in India to reduce emissions pertaining to international conventions and develop e-mobility in the wake of rapid urbanization. With the increasing sales of electric vehicles in India, automakers are investing in the development of new technologies and increasing their production capacities to accommodate the demand. For instance,

- In May 2022, Toyota Group revealed plans to invest INR 48 billion (USD 624 million) in India to manufacture electric vehicle components.

- In March 2022, Suzuki Motor, the parent company of Maruti Suzuki, announced that it will spend INR 10,440 crore in India to develop a new electric car and battery facility.

Key automakers in India are also working on research and development activities to develop new products which would positively impact the target market growth during the forecast period. For instance,

- In March 2022, Toyota Kirloskar Motor unveiled a project to introduce India's first hydrogen-powered fuel cell electric car as one of the biggest emerging car markets looks to expedite its transition to clean transport. Toyota will work with the government's testing agency International Centre for Automotive Technology, to study the fuel cell electric car Mirai for Indian roads and climatic conditions. The Toyota Mirai car shall be manufactured at Toyota's Kirloskar Plant in Karnataka.

By 2030, Japan wants next-generation vehicles to account for 50-70 percent of new vehicle sales, with battery electric vehicles (BEVs) and plug-in hybrid electric vehicles (PHEVs) accounting for 20-30 percent and hybrid electric vehicles (HEVs) accounting for 30-40 percent. To achieve that, in November 2021, The Japanese government earmarked a total of JPY 37.5 billion (EUR 290 million) for e-mobility. However, the primary hindrance the market is facing is the aged and poor charging infrastructure. Hence, Japan is aiming to increase the number of EV charging stations nationwide to 150,000 by 2030.

Several major players announced partnerships to co-develop EV solutions in the country. For instance,

- In March 2022, Sony Group Corporation and Honda Motor Co., Ltd have agreed to forging a strategic collaboration and have signed a memorandum of understanding (MOU) outlining their intention to form a joint venture to collaborate on the development and distribution of high-value-added battery electric vehicles (EVs).

Various automakers are also providing home charging solutions to their customers along with electric vehicles, for instance.

- In October 2022, ENECHANGE Ltd announced the installation of 30,000 EV chargers in Japan by 2027. All EV chargers 47 prefectures in Japan have decided to introduce our EV charging service.

The demand for power inverters is expected to grow simultaneously with the growing trend of hybrid and electric vehicle sales around the world during the forecast period.

EV Power Inverter Industry Overview

The global electric vehicle power inverter market is dominated by a few players such as Continental AG, Robert Bosch GmbH, DENSO Corporation, and Mitsubishi Electric Corporation. The companies are expanding their business by opening new production plants and making joint ventures so that they can have an edge over their competitors. For instance,

- In November 2022, Continental AG completed the construction of the third expansion of the electronic components factory in Timisoara. The company invested Euro 40 Million for the manufacturing operation facility which will enhance the production capacity of electric vehicle components across the country.

- In October 2021, Robert Bosch debuted a new CV-specific electric motor and inverter. This 230 e-motor can be paired with Bosch's advanced Sic inverter to cut down on energy losses and increase the driving range of commercial vehicles.

- In May 2021, Robert Bosch, in association with Porsche and Fraunhofer Institute for Reliability and Micro integration (Fraunhofer IZM) in Berlin, announced a new project aimed at increasing the range of electric vehicles (EVs) by enhancing the performance of power inverters in vehicles.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Drivers

- 4.2 Market Restraints

- 4.3 Industry Attractiveness - Porter's Five Force Analysis

- 4.3.1 Threat of New Entrants

- 4.3.2 Bargaining Power of Buyers/Consumers

- 4.3.3 Bargaining Power of Suppliers

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION (Market Size in Value - USD Million)

- 5.1 By Propulsion Type

- 5.1.1 Hybrid Electric Vehicles

- 5.1.2 Plug-in Hybrid Electric Vehicle

- 5.1.3 Battery Electric Vehicle

- 5.1.4 Fuel Cell Electric Vehicle

- 5.2 By Vehicle Type

- 5.2.1 Passenger Cars

- 5.2.2 Commercial Vehicles

- 5.3 Geography

- 5.3.1 North America

- 5.3.1.1 United States

- 5.3.1.2 Canada

- 5.3.1.3 Rest of North America

- 5.3.2 Europe

- 5.3.2.1 Germany

- 5.3.2.2 United Kingdom

- 5.3.2.3 France

- 5.3.2.4 Italy

- 5.3.2.5 Rest of Europe

- 5.3.3 Asia-Pacific

- 5.3.3.1 China

- 5.3.3.2 Japan

- 5.3.3.3 India

- 5.3.3.4 South Korea

- 5.3.3.5 Rest of Asia-Pacific

- 5.3.4 Rest of the World

- 5.3.4.1 South America

- 5.3.4.2 Middle East and Africa

- 5.3.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Vendor Market Share

- 6.2 Company Profiles*

- 6.2.1 Vitesco Technologies

- 6.2.2 Robert Bosch GmbH

- 6.2.3 DENSO Corporation

- 6.2.4 Toyota Industries Corporation

- 6.2.5 Hitachi Astemo Ltd

- 6.2.6 Meidensha Corporation

- 6.2.7 Aptiv PLC (Borgwarner Inc.)

- 6.2.8 Mitsubishi Electric Corporation

- 6.2.9 Marelli Corporation

- 6.2.10 Valeo Group

- 6.2.11 Lear Corporation

- 6.2.12 Infineon Technologies AG

- 6.2.13 Eaton Corporation